Understanding the Emergence of Industrial Networks

advertisement

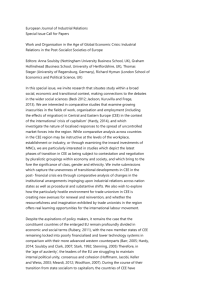

Credits Compiled and written for the project research team by Dr Jen Gristock This policymakers’ and entrepreneurs’ summary of the ESRC project ‘The jen@britishlibrary.net Institute for Prospective Technological Studies (IPTS) Seville Project research team s.radosevic@ssees.ac.uk School of Slavonic and East European Studies (SEES), University College London Dr David Dyker d.a.dyker@sussex.ac.uk Sussex European Institute / Economics, Sussex University. Prof Nick von Tunzelmann g.n.vontunzelmann@sussex.ac.uk SPRU Science and Technology Policy Research, Sussex University Francis McGowan f.mcgowan@sussex.ac.uk Sussex European Institute / International Relations and Politics, Sussex University .net/jen Ms Deniz Eylem Yoruk d.e.yoruk@sussex.ac.uk For more information about Baroness Margaret Sharp School of Slavonic and East European Studies, University College London & SPRU House of Lords, London & Visiting Fellow, SPRU emerging industrial architecture of the wider Europe’ has been compiled, written and edited for the research team by Jen Gristock jen@britishlibrary.net see SISM research at http://pages/britishlibrary the research described within this report please contact the project leader Slavo Radosevic at UCL s.radosevic@ssees.ac.uk and visit the web page www.ssees.ac.uk/esrc.htm March 2003 Dr Slavo Radosevic, Project Coordinator Jose Molero, jmolero@icei.ucm.es Dr Ulrike Hotopp ulrike.hotopp@ cabinet-office.x.gsi.gov.uk Tom O'Connor tpoc@eircom.net CIRCA Group, Dublin Miss Kate Bishop k.bishop@ssees.ac.uk School of Slavonic and East European Studies, University College London Rick Woodward rick@case.com.pl Centre for Social and Economic Analysis (CASE), Warsaw Stefan Dunin-Wasowicz Graduate Institute of International Studies, University of Geneva Centre for Social and Economic Analysis (CASE), Warsaw Michal Gorzynski michalg@case.com.pl Geomina Turlea turlea@fx.ro Prof Cezar Mereuta Matija Rojec matija.rojec@gov.si 2 Instituto Complutense de Estudios Internacionales, Universidad Complutense, Madrid Cabinet Office, UK Institute for World Economy and Romanian Center for Economic Modeling, Bucharest Romanian Center for Economic Modeling, Bucharest Faculty of Social Sciences, University of Ljubljana 1 Introduction The premise behind European integration and enlargement is that by creating a wider Europe it is possible to stimulate and share economic growth and political stability. So far, however, we have seen on average increasing divergence rather than convergence in the wider Europe. Catching up has been restricted to just a few of the restructuring countries of Central and Eastern Europe to date. If Europe as a whole is to enjoy long-term political and economic stability the benefits of enlargement need to be secured across the region as a whole. Tackling this task requires an understanding that growth through effective European integration is dependent upon not only the possession of physical goods and knowledge, nor simply the support of social and institutional processes. Rather, it depends on how well a region’s assets in goods, expertise, networks and institutional support mechanisms fit the broader policy environment of the nation state, 4 the EU, and multinational companies. By adapting industrial and innovation networks at the local and regional levels to the national and international policy environment (and vice versa) a more effective integration into the wider global networks will be possible, providing a sound basis for economic growth and prosperity. But what kinds of policies and business strategies could encourage such close industry and economic integration, in a region that is experiencing economic and industrial change on such a grand scale? This was the question behind the ESRC research project, ‘The emerging industrial architecture of the wider Europe’, undertaken at University College London, SSEES and the University of Sussex, SPRU and SEI, in cooperation with several EU and CEE universities (see page 2 for full details of the project team). The implications of this research for policymakers and business people are the subject of this booklet. 2 Encouraging growth When thinking about ways to encourage economic growth in Central and Eastern Europe, policymakers and academics have generally focused on the removal of barriers to trade, the interdependencies between trade, FDI and growth, and associated spillovers. However, openness by itself does not necessary generate long–term growth. Many countries of central and eastern Europe are highly integrated into the world economy through FDI and trade; but not all have benefited. The elusive mechanisms which translate trade and market integration into investment, technology integration and growth in this region need to be better understood. Economic growth in the countries of Central and Eastern Europe will to a great extent depend on whether these countries and their regions will become loci of innovation activities. Policymakers all over Europe are aware that both the size of the technological gap and available institutional and social infrastructure influence the potential for innovation and hence a country’s potential for productivity and catching-up. What is less well understood, however, is that the extent to which countries can develop capabilities to assimilate, generate and manage technical change and learning is mediated by the nature of the networks that support these activities. Merely having or constructing networks is not enough: it is the extent to which the character of these networks fit with the national and international policy context that is critical. If European Integration is to be effective, if the countries of Central and Eastern Europe are before too long to have the income levels enjoyed elsewhere in Europe, policymakers need to help a multiplicity of local and national networks emerge or redevelop in ways that are compatible with national and international (principally EU) policy goals and market demands. Nor are strong production links sufficient: the innovation networks and knowledge links within these networks also need to become aligned. But how can all of this be done? 5 3 Rethinking integration The term ‘European integration’ refers to a multifaceted process of political decisions and policy formation on the one hand and trade and investment interconnectedness on the other. To understand integration, therefore, we need to understand the complexities of the political and economic (or policy and production) aspects and the interaction between them. Moreover we need to realise that the ways in which these factors operate will depend upon particular country or sectoral conditions. Policy integration needs to be seen in terms of the processes of negotiation and implementation of rules and other policy instruments. It is not enough to look at the formal outputs of governments; how those measures are put into practice and what impact they have also have to be taken into account. Similarly it is not enough to focus on market integration alone. While market integration is required, it does not necessarily lead to the integration of production and technology networks that are necessary for innovation and economic growth. An essential part of the process of integration is therefore the formation and maintenance of production and technology networks. When we speak about the different kinds of integration, we are not just talking about the need to consider production integration and policy integration; we are also speaking of the interrelationships between these two. Creating and sustaining compatible networks is sustaining integration. Case Study 1 uses the example of the Industrial Development Authority in Ireland as a policy vehicle for Irish integration into the EU via foreign direct investment. Case Study 1 - State action and EU integration: Foreign Direct Investment and the Industrial Development Authority in Ireland The role of networks in creating and sustaining growth can be illustrated by considering economic development in Ireland over the last thirty years. Ireland has been a member of the European Union since 1973, but experienced serious financial difficulties in the late 1980s. Such problems were eased by a number of different factors, not least the arrival of a large number of multinational corporations in the region. Arguably the most important factor involved with these changes was the Industrial Development Authority’s (IDA) success in developing networks to attract foreign direct investment. By creating informal and formal networks of people from Government Departments and Ministries, Irish Embassies, the multi-national corporations that were and were not already in Ireland, universities and Institutes of Technology and other state agencies (with their world-wide networks of offices) the IDA was able to create an aligned network of industrial policymakers and multinational corporations that reached into global networks and the global economy. As a result, many Irish companies now have links with multinational corporations (MNCs) and Ireland has become a favoured location for MNCs. More recently policymakers in Ireland have turned their attention to the hitherto neglected indigenous industry in Ireland and its role in the new economy. 6 Figure 1a: Achieving compatibility between policy and industry integration: a simple illustration Policy integration SHALLOW DEEP Industry integration SHALLOW DEEP Figure 1b: Achieving compatibility between policy and industry integration: a more detailed explanation Policy integration ‘Shallow’ policy integration (trade and finance liberalisation; no free movement of labour; some policy co-operation) ‘Deep’ policy integration (autonomous jurisdiction; direct financial instruments; CAP; single currency regime; movement of capital and labour integrated) ‘Shallow’ industry integration (spreading of market linkages through trade and finance flows) compatibility incompatibility the lack of industrial integration leads to considerable economic inequalities and cohesion problems. ‘Deep’ industry integration (a variety of production and technology networks) incompatibility frustration; the lack of political integration leads to tensions and instabilities Industry integration in modes of ‘shallow’ integration; market-mediated interactions compatibility; virtuous circle of policy and network learning through integration and ‘catching-up’ 7 The interaction between policy and production integration can be seen in a variety of ways. At its most basic, policy integration in the form of an agreement to remove economic barriers and coordinate national legislation should translate into production integration in the form of closer economic ties. However the depth of these processes will also affect the nature of their interaction, as demonstrated in Figure 1. The key issue for policymakers is to match the degree of ‘integratedness’ on the two dimensions of industry integration and policy integration. In the development of a wider Europe, long-term objectives will be difficult and perhaps impossible to attain without compatibility at a ‘deep’ level, creating a ‘virtuous circle’ for catching up. As these figures indicate, deep political integration in a shallow industrial integration context, or the converse, produces excessive need for budget transfer and undermines cohesion objectives. Formal policy alignment with the EU (deep policy integration) leaves unresolved the problem of conflicts and gaps in policy implementation. This may have significant effects on patterns of industry integration in some sectors in the future. Case Study 2 - Policy and Production Integration: the Central Eastern European Electricity Industry The interaction between policy and production integration can be illustrated by the case of the development of the Central and Eastern European Electricity Industry. Electricity utilities in CEE are becoming interconnected with the EU in physical, policy and corporate terms: CEE grids have been synchronised with Western power networks since 1996 and continuing mergers and joint ventures have forged relationships between CEE firms and their Western counterparts. At the same time, governments have been adapting pricing and regulatory practices to those applied within member states and aligning themselves with the relevant parts of the EU acquis. But the experience of reform in the Czech, Hungarian and Polish Electricity utilities has indicated that problems have been less to do with the formal alignment of policy and more to do with day-to-day processes, perhaps reflecting more fundamental conflicts in this sector. Measures to encourage Foreign Direct 8 The expectation is that industrial integration between European West and East will generate longterm productivity growth and catching up when firms belong to networks whose character matches their policy environment and where the policy environment is conducive to the development of those networks and the participation of CEE firms within them. Global political economy as well as the EU accession process has shifted CEE states towards a regulatory role, and CEE states will have to learn how to influence industrial development on their territory whilst at the same time complying with the EU regulatory requirements. Interactions are mediated by many different contexts, and to make them effective, these interactions have to be made mutually compatible and supportive. This is what achieving economic growth through network alignment is all about. 9 4 Who creates network alignment? Since the beginnings of transition, discussions of the issues facing CEE countries have focused on markets and institutional changes for market economy. Yet firms and markets are not the only actors involved in the interactions which constitute the co-evolution of political and industrial integration. Compatible, successful enlargement cannot be nurtured by considering firm-level integration on its own. CEE state governments, regional/local governments, multinational corporations (and the way these integrate national markets into their networks), domestic firms, international agencies and other intermediary bodies, EU policy communities and educational organisations all influence the alignment of networks. The more different 10 networks grow to match each other, the deeper and broader the integration between CEE and the EU will be. The intersection between the different networks that are involved in the process of building sectoral capabilities involves a variety of actors and networks, and is firm and territorially specific. Overall, the key questions are: what is triggering complementarity between local, national and global production technology networks? Where such complementarities are not present, what are the obstacles or missing links? There is an overwhelming need to support networks so that these existing stocks of capabilities and infrastructure are developed to be compatible with policy environments and changing market-driven demands. 5 How do networks become aligned? Policymakers are used to the idea of market failure. But in CEE what is more important is network failure. Networks can fail for two reasons: a failure to form networks, or a failure of different networks (global, national and local) to couple or align. The persistence of old networks can often disguise the lack of alignment brought about by the new circumstances arising out of the quest for deep integration, and thus creates network failure in the second sense. Yet some encouraging examples of overcoming network failure and re-creating network alignment do exist, as exemplified by the cases of Videoton (see Case Study 3). Case Study 3 - Achieving network alignment: Videoton and domestic firm success Videoton is the main contracting manufacturing company in the electronics industry in Central Europe. Most of the other ex-socialist electronics companies did not survive. And yet the transformation that led to Videoton’s success took place without any sizeable foreign direct investment, showing that domestically controlled modernisation is indeed possible. The combination of factors responsible for Videoton’s success at the local, national and global level raises the issue of whether it is possible to speak of a Videoton ‘model’ to be replicated. A mixture of entrepreneurship, the actions and strategies of Videoton Holding as a networking agent, interactions with foreign partners, which helped with market access and finance, local initiatives that attracted foreign companies, the prospect of EU entry and proximity to EU markets were all essential contributions to Videoton’s success. The key issue for policymakers is that no one actor could replicate all of the factors associated with Videoton’s success, but by acting in a compatible way, all of these actors helped bring about the network alignment that allowed this innovative company to thrive. The actual policies, strategies, capabilities and infrastructure that are required to correct network failure will vary between actors, sectors and regions. In the CEE food industry, for example, the main problem in Romania seems to lie on the supply side in agriculture, whereas in Poland it is on the demand side in marketing. But by working together to identify and develop market opportunities, strategic policies, capabilities and infrastructure, these actors can help the character of innovation climates and networks to become compatible with changing marketdriven demands. 11 5.1 Drivers for network alignment While network alignment involves all the actors represented in working together, it is unlikely that network failure will be avoided unless a key actor takes the lead organising role. In different contexts, different factors can be identified as the most significant impetus for the integration of innovation networks, the network component or the context around which networks become aligned. Sectoral influences also have a great impact on close cooperation and alignment. In some sectors, foreign buyers act as the architects of network alignment, while in some other sectors foreign manufacturers may play such a key role. Where the impetus for network integration appears to be an organisation or group with a particular strategy, as opposed to a market or set of markets, the organisation is called a network organiser. In the post-socialist era, any actor with the necessary capabilities and resources can be a network organiser. An example is provided in Case Study 4, of Vistula SA in the Polish clothing industry. A user or supplier firm, a bank, a holding company or an industrial group, a foreign trade organisation, an R&D institute, a foreign firm, an intermediary group (for example, the Industrial Development Authority (IDA) in Ireland noted in Case Study 1) or, in some cases, even the national or regional administration could theoretically act in this way. In practice, however, given the current underdevelopment of management capabilities, finance and technology in CEE, for the time being it has been foreign companies that have been the most active network organisers. The research team’s survey of Hungarian and Slovenian companies indicates that large firms acting as network organisers are the key influences on alignment, as these firms have the capabilities and resources to integrate systems of suppliers and mediate the implementation of their strategies throughout the network. Multinationals’ technology transfer activities can be one-sided, but even here the desire to exchange knowledge is important: for example, the Icoa research farms and laboratories in Poland are examples of attempts to bring technological development capabilities to hostcountry environments. 5.2 Thinking about networks at different levels Figure 2 stresses the role of different actors and different levels of interactions in network alignment. On the international level, CEE networks are limited in scope (mainly intra-firm) and are being shaped by the strategies of the multinational corporations. At present only the domestically controlled firms in sectors that 12 require local subcontracting and contacts with multiple foreign buyers which also have good organisational capabilities are well connected. Actors working within different network levels have potentials in terms of their ability to influence the network in different ways: complementarities between different functions of the firm are best enhanced at the firm level, as management through centrally directed change is much less possible at national policy level, for example. MARKET MARKET FIRMS National networks Global networks Local networks EU CEE STATE Figure 2: Representation of network alignment Case Study 4 - The Network organiser: Vistula SA in the Polish Clothing Industry Vistula SA is one of the biggest clothing companies in Poland. Based in Krakow, it has been producing men’s suits since 1945. Since becoming integrated into global production networks, Vistula has learnt quickly, recognizing and keeping pace with the evolution of the global clothing industry and improving its design capabilities, firm structure and distribution channels. In the long term, Vistula aims to move away from garment production and focus instead on the preassembly stage. This involves technical design, grading and pattern marking and on distribution. The company acts as a network organiser by linking foreign partners with those in the domestic market through its own inter-firm production network in Poland. This involves: Becoming integrated into global production networks: networking with West European brand manufacturers, retailers and intermediaries. Acting as a distribution licensee: e.g. in 2001, the purchase of an Italian company’s license to distribute its products in the Polish market through a separate chain of shops. Establishing subsidiary production networks: four of its subsidiaries produce for foreign customers via subcontracts. Integrating small Polish companies into its own production networks: subcontracting its own collections to small Polish companies. Setting up inter-firm production networks with large Polish firms: including production networks with peer companies to produce complementary garments or accessories. 13 6 The role of the multinationals So far we have discussed the critical importance of network alignment in European enlargement, and the key role played by foreign companies, particularly the multinationals, in helping local, national and international networks become aligned around changing marketdriven demands in ways that are compatible with policy environments. There are big national differences in network alignment across CEE countries. These differences reflect (among other things): differences in the multinational corporations’ strategies; different roles of governments in different industries and countries; and different positions of local authorities. Currently international industrial networks in CEE are organised by multinational corporations and the networks’ objectives, depth and scope are shaped by their strategies. They are mainly intrafirm type networks. The networks that are emerging are composed mainly of the parent firm and local subsidiaries, possibly with their subcontractors. However, the presence of foreign firms in a particular network is not enough: domestic firms also need to have the capabilities to engage with foreign strategic partners, suppliers and buyers (and vice versa). Case Studies 5, 6 and 7 exemplify these broader kinds of relationships under the organising leadership of foreign multinational companies. Case Studies 5 and 6 - Multinationals and network alignment: Eridania Beghin Say and Soufflet in CEE food processing The influence of multi-national corporations on integration through network alignment is relatively positive in the agribusiness sector. The multinationals’ strong and strict hierarchical structures and communications systems dominate the development of networks and their biased alignment. For example, the entry of Eridania Beghin Say (EBS) was initially driven by local market seeking. However, once this agribusiness company had acquired new CEE markets, it started to expand in a way that strongly influenced the alignment of regional networks. This has been motivated by search for efficiency savings which led to innovation through the introduction of information technologies and technology transfer in CEE countries. Similarly, when the malt producer Soufflet entered CEE markets it had to overcome quality and quantity problems in the upstream branch of agricultural malt production. Since then it has established a system of cooperation with local farmers with the aim of directly transferring knowledge in various ways from the parent company. Both EBS and Soufflet have strongly influenced the alignment of regional and local networks, acting effectively as network organisers, since both aimed to produce for the domestic market. Whilst the European Bank for Reconstruction and Development (EBRD) and CEE local governments have played a role in network alignment, the strongest influence in both these cases has been their parent companies. However, the availability of parent company R&D and consultancy networks prevents the development and alignment of networks with local intermediate organisations (like research institutes, universities, and the like) in the host countries, whilst encouraging integration into other multinationals’ subsidiary networks in the host countries. 14 Case Study 7 - Retailing and network realignment: Tesco in CEE Tesco is a UK retailer with firm-specific advantages in e-grocery that it carries from the UK retail market into CEE. Location restrictions prompted Tesco to adopt the strategy of taking over local chains in Hungary and Poland and of the US chain KMart in the Czech Republic and Slovakia. After gaining experience in these markets through acquisitions it continued to expand through greenfield investments: i.e. the construction of new hypermarkets in suburbs. In pursuit of market share Tesco has played a significant role in shaping retailing in the CEE through consolidating its shop structure through the hypermarkets. It is also developing the CEE retail market, expediting the introduction of information technology systems and changing attitudes through training programmes for staff in line with its customer service philosophy. In Hungary, Tesco has become involved in the whole supply chain, developing close relationships with Hungarian agricultural producers. Retailing abroad naturally brings about a dependence on - and co-operation with - local suppliers, as companies seek to satisfy local tastes. In Hungary more than 90 per cent of Tesco’s 115,000 products are procured from domestic producers and wholesalers: the remainder being mostly branded electrical and sports goods. These close ties helped prepare the Hungarian agricultural and horticultural industry to be able to compete in the tough European market. Tesco also exports £4m of Hungarian goods each year, mainly wine, onions and paprika. Compliance with safety and hygiene standards has also improved supplier efficiency, safety and product quality in Hungary. From a CEE policy perspective, this means that the foreign firms that have the most potential to help develop a region are those whose strategies fit with capabilities and infrastructure that exist or that can be developed locally, or those who are willing to invest in the development of those capabilities and/or infrastructure. This would allow foreign network presence to become translated into expansion and/or growth. Rather than simply trying to attract foreign direct investment (FDI) from any investor, policies in CEE should aim to be selective by positively discriminating in favour of those investors whose strategies and organisations complement regional advantages. Such selective discrimination takes place today in some instances of privatisation where trade sales to foreign purchasers are premised on particular conditions. However the process is often implicit and takes second place to budgetary considerations. As a result, network alignment appears to be limited and primarily driven by considerations and strategies of the multinational corporations (MNCs). Without the wider and deeper involvement of local CEE firms into MNC networks, there can be little assurance that the presence of multinational companies will help greatly. 15 7 The role of local governments Despite being the least powerful actors in the emerging CEE innovation systems, in some regions and sectors it is the local governments that have made the greatest efforts in relation to their capacities to reconcile their interests with those of the multinational corporations. For example, in competition with several big towns, the government of the Hungarian town Komàrom won the opportunity for a mobile telephone factory to be built on the framework of a capital investment of $115m by Nokia, now owned by Elcoteq. The Komàrom government did this by providing tax exemptions and by undertaking to improve some of the public utilities at its own expense. Other local governments have also worked to attract foreign investors, to help provide land and utilities and to promote training and retraining. For example, in Szekesfehervar, Hungary, the local council helped Philips find and buy a location for a greenfield television and VCR plant, issuing paperwork and permits as quickly as possible. International networks also appear to be emerging around the activities of local CEE firms working with small foreign firms. 16 As these promise more by way of technology and know-how transfer, such small business actions could be a potential route for innovation-led integration in the region. However, if such networks are to become integrated through local, national and international levels, one issue that needs to be addressed is the current underdeveloped and under-resourced nature of local governance systems. Value chains cannot be fully supported just from the national level; they require multilevel governance support from national, regional and EU levels. As Sharp (2003) notes, government capability to integrate policy objectives and actions from the different tiers of government (EU, national, regional) is essential for promoting industrial upgrading through industrial networks. Where local governance is developed (e.g. Poland and Hungary) local authorities are emerging as important players in aligning local and foreign networks, despite limited decentralization and lack of financial autonomy. There is a great deal of room for EU policy actions to strengthen the role of regions in industry integration. 8 The role of national governments This report has described how in some sectors and countries in CEE, a few domestic firms appear to be operating as network organisers, seeding networks with foreign firms and prompting potentially different patterns of industry upgrading. However, they are generally in a relatively poor position with respect to their ability to become network organisers, and so it is not surprising that currently in CEE, the weak point for development via network alignment is the national network. National networks are composed of large and small local firms, their mutual links and their links to infrastructure organisations (e.g. universities, services). But how can CEE states act to nurture these networks? Correcting this ‘network failure’ is a matter of integrating production with technological development, which will not mean reverting to the old S&T systems and their vertical division of labour, but will mean a new demand-driven system where the accumulated stock of human capital is helped to be relevant to the new one. Owing to the WTO trade regime and EU accession, many decision- making prerogatives have been restricted (for example the use of non-tariff barriers and subsidies). CEE states need to learn to act to influence industrial development in new ways, which will have to be done in co-operation with the EU. Rather than trying to make a region attractive to foreign investors in a general sense, policies should aim to develop those parts of a region’s infrastructure and other elements within the national innovation system that complement the business strategies of companies that are moving towards knowledge-based activities. Figure 3 illustrates how CEE policies to support growth and development have changed in the years since transition. First-wave policies emphasised the liberalisation of FDI flows. Second-wave policies were designed around the marketing of locations and investment agency support. Modern (third-wave) policies recognise that focusing on the support of productive systems such as supply/value chains, clusters and industrial districts is more effective than focusing on any one region or company (Sharp 2003). 17 Liberalisation of FDI flows Marketing of locations and investment agency support Supply chain focus – targeting investors in Source: created by Gristock from Radosevic (2003) Figure 3: Changing industrial policy in CEE CEE countries need to learn to adopt and implement second and third generation policies in order to catch up. Examples of thirdwave policies include the National Subcontracting programmes in the Czech Republic and the Hungarian Integrator programme, which aims to integrate domestic firms with foreign firms through supply linkages. In sectors where regulation plays an important role (e.g. energy, telecoms, pharmaceuticals), network alignment is strongly shaped via state regulations. Generally speaking, at the level of firms, industrial networks are influenced by factors such as industry type, and the local and national network context. It is this latter influence, the degree of development of local and national networks, which is generally low in Central and Eastern European 18 countries, and therefore preventing network alignment – and hence integration – in the region. Hence action is needed to support the firms that are involved in multiple networks, and to encourage those with more limited network connections to engage more widely. Network support activities could involve many different kinds of policies that give support to local and international networking and diffusion activities, including the appropriate use of fiscal incentives and financial institutions, including support for domestic small and large firm involvement with foreign company networks. Policies could also be used to remedy significant shortcomings with respect to corporate governance. 9 The role of the EU The impact of the EU integration process on network alignment appears to be greater in production than in policy terms. In market-driven industrial networks, EU demand operates as a strong focal point for new industry networks and generates the necessary coherence for clustering in the region. In terms of policy integration, the process of complying with the EU acquis should transform the orientation of CEE governments, affecting the range of policy options open to them (though, in practice, this impact is likely to be mediated by the capacity of national and subnational governments to implement and comply with those rules and the EU institutions’ willingness to enforce them). EU accession is already reducing the decision-making options of candidate countries in areas like Free Economic Zones (FEZs) (e.g. tax incentives) and state subsidy control. The effects of abolishing export processing or FEZs for the CEE countries may well be negative unless some institutional change and improved attraction for FDI can compensate for this loss. There are elements of EU policy which could be deployed to help network alignment (most notably initiatives under the research, enterprise and recently revived industrial policies), but it remains to be seen whether these are as robust as the regulatory 19 10 Sectors and network alignment A full list of sectors and the current state of affairs in different industries throughout CEE is beyond the scope of this report (see list of publications). But it is important to consider and address sectoral differences in the formation of policy. For example, our research has shown that it is export-oriented markets and subcontracting networks that drive network alignment in the clothing industry. In the food industry on the other hand, it appears that alignment is occurring around local markets and the multinationals’ production and technology networks. This illustrates how policies designed to enhance economic growth through network alignment must be designed differently if they are to work in these different sectors, although the importance of foreign capital and the current weakness of national and local networks are common to all sectors and all parts of CEE. Networks aligning around: Sector Actions/influences encouraging this: Integration into MNC production and technology networks/chains Food, Electronics Capability development, distribution and supply chain upgrading State orientations Electricity Regulatory change Subcontracting networks Clothing Foreign firms - Market access Local firms networking with foreign firms Still very limited except in agri-food sector with local farmers Networking support Figure 4: Sectors and network alignment 20 11 Policy Recommendations 11.1 Advice for those studying growth in CEE In methodological terms, the research has shown just how necessary it is to pursue a variety of disciplinary and methodological approaches to understand the issue of industrial upgrading of regions and countries via industrial networks in the globalised economy. If analysts let any one approach dominate their investigations, be it econometrics or case studies, or exclusively macro or micro, this would seriously impair their understanding of the transformation process in the CEE countries. Non-mainstream approaches do appear deficient, and this project clearly shows the need to pursue complementary research approaches. Although the factors underpinning European enlargement are unique, the approach adopted here - mixing micro-economic and macro-policy variables should also be applicable to mapping regional integration in other parts of the world (e.g. NAFTA, AFTA, APEC, MERCOSUR). 11.2 Advice for foreign businesses Foreign firms have followed a number of different strategies to become successfully aligned in CEE innovation networks. Businesses need to: 1. Understand consumer behaviour. Successful business strategies distinguish between substitutive products (which require consumers to make informed choices between options) e.g. soap versus shower gels, and lifestyle changing products that require consumers to change behaviourally (e.g. mobile phones versus landlines). 2. Adopt sophisticated local marketing strategies. Rather than simply emphasising the low cost, the product is marketed as a choice well made in relation to consumer experiences. 3. Buy a brand. Many companies have used the acquisition of a local brand to gain a foothold into the market, to improve infrastructure or overcome greenfield entry barriers. For example, Procter & Gamble acquired a local dog food brand solely for its production facilities which were retooled to produce a mild baby soap. 4. Redefine products and portfolios. In some cases Western mass market products have been tailored to local tastes and redefined as superior products, as with the case of Magnum ice cream, with the fruit strips that are popular in CEE. Similar actions can be necessary within a portfolio of products. For example, Unilever repositioned Lux as a superior premium brand (Dove Premium) 21 against a local brand it acquired as the low cost player. By careful pricing, such portfolios can be used as effective tactical barriers against entry by potential competitors. 5. Look for the long term. Business strategies which aim to yield a profit in the long run are more successful than those which aim to make quick returns. 6. Use agile organisation structures. The fastchanging environment in CEE requires organisations to have structures that are able to align their innovation structures and manage and respond quickly to change. 11.3 Advice for CEE domestic companies 1. Understand your market. Including both the finance and the technology. 2. Be realistic about what it is possible to achieve on your own and what kinds of partnerships could be instrumental in safeguarding your longterm competitive position and growth. 3. Value membership of MNC networks. This is especially true, the more you are able to operate as a network organiser, i.e. to establish local value chains and link with local intermediary organisations (universities, R&D institutes, chambers of commerce, local governments). 4. Avoid dependence on one foreign partner. Instead, try to maximise 22 synergies from your relationships with several partners. 5. Expand your technology, R&D and other knowledge links for example, through EU programmes as well as various other noncommercial links with foreign firms and associations. 6. Understand and influence the system. In the long term, your competitive position is dependent on the strength of your local and national system of innovation. Working through industrial associations, it is your responsibility to modernise local technological capability as much as you can, including R&D and business services activities. 11.4 Advice for CEE policymakers Domestic firms (large and small) and related national networks (R&D institutes, infrastructure institutions) are ‘the weakest link’ in the development of CEE economies. The interrelationships that exist between political and industrial integration as well as those between the levels of interaction (macro, meso, micro) mean that successful enlargement cannot be nurtured by considering firm-level integration on its own. To succeed, firms do not need to belong to an ‘ideal’ type of network whose character can be prescribed in advance: rather, they need to belong to a network whose character interacts positively with their policy environment, both nationally and internationally. The challenge for CEE state policymakers is therefore to develop policies which aim to identify relevant complementarities between firm and region-specific advantages and disadvantages. Rather than simply trying to attract foreign direct investment (FDI), policies in CEE should aim to be selective by positively discriminating towards those investors whose strategies and organisations complement regional advantages. But what might this mean in practice? The region–specific, sector-specific and even firmspecific nature of network alignment dictates that policy advice cannot take the form of a ‘best practice’ checklist of actions that would be universally appropriate. Strategies need to be conceived in relation to the firm-, sector- and region-specific advantages and disadvantages in different parts of CEE. However, what would be useful to policymakers is a process for identifying these firm and regionspecific advantages and disadvantages. One such possible guide is shown in Figure 5. Also shown in the guide are policy examples and the contexts within which they have proved successful in the past. 23 12 Guide for policymakers 1. Identify firm and region-specific advantages, paying close attention to: -Existing networks, firms, clusters and supply chains Use networks to talk to local and foreign firms about their strategies 2. Identify complementarities, scrutinising the region’s assets in: -capabilities -infrastructure -upstream and downstream resources and skills 3. Identify what is missing Barriers to networking? Capabilities? Infrastructure? Supply issues? Marketing know-how? Efficient administration (public or private?) Appropriability of investments? 4. Use incentives, networking support and regulation to develop complementarities and address missing elements so that the national innovation system complements the business strategies of companies that are moving towards knowledge-based activities providing targeted, well-timed support Source: created by Gristock from project team research reports Figure 5 - Identifying policies for growth through network alignment: a process 24 List of publications All project working papers can be downloaded from the project website www.ssees.ac.uk/esrcwork.htm General 1. Radosevic, Slavo (2003), ‘The emerging industrial architecture of the wider Europe: The co-evolution of industrial and political structures - An overview of the project results’, Project Working Paper No. 29, January 2003 2. Radosevic Slavo (2001), ‘Pan-European industrial networks as factor of convergence or divergence within Europe: Conceptual and empirical issues for research’, in Wallace, H. (Ed.): Whose Europe? Interlocking Dimensions of Integration, Macmillan, London, 2001, pp. 45-67. 3. Radosevic, Slavo, (2001), ‘Integration through industrial networks in the wider Europe: An assessment based on survey of research’, in Koschatzky, K., M. Kulicke and A.Zenker (Eds.): Innovation Networks – Concepts and Challenges in the European Perspective, Physica Verlag, Heidelberg and New York, pp. 153174. 4. Dyker David A. (2000) ‘The dynamic impact on the Central-East European economies of accession to the European Union’, Project Working Paper No. 2, April 2000. Firm case studies 5. Radosevic, Slavo (2001), ‘European integration and complementarities driven network alignment: the case of ABB in Central and Eastern Europe’, Project Working Paper No. 4, June 2001. 6. Yoruk, Deniz Eylem (2002), ‘Industrial integration and growth of firms in transition economies: the case of a French Multinational Company’, Project Working Paper No. 20, March 2002. 7. Yoruk, Deniz Eylem (2002), ‘Growth of a Polish meat company: mergers and acquisitions and the role of strategic investors’, Project Working Paper No. 18, March 2002. 8. Radosevic, Slavo and Deniz Eylem Yoruk (2001), 'Videoton: the Growth of Enterprise through Entrepreneurship and Network Alignment', SSEES Department of Social Sciences Electronic Working Paper in Economics and Business, No. 4, June 2001 http://www.ssees.ac.uk/economic.htm and Project Working Paper No. 18. 9. Radosevic, S., D. Dornisch, D. E. Yoruk (2001), 'The issues of enterprise growth in transition and post-transition period: the case of Polish “Elektrim'”, No. 1, April 2001 (available on the ESRC project site: http://www.ssees.ac.uk/economic.htm) 10. Yoruk, D. E. and S. Radosevic (2000), 'International Expansion and BuyerDriven Commodity Chain: the Case of TESCO', No. 5 , November 2000, (available on the ESRC project site: 25 11. Yoruk, D. E. (2002), ‘Role of network development in the growth of firm: the case of a Romanian bakery company’, Project Working Paper No. 27, July 2002. 12. Yoruk, D. E. (2002), ‘Global production networks, upgrading at the firm level, and the role of network organiser: The case of Polish Vistula’, Project Working Paper No. 28 13. Yoruk, D. E. and N. von Tunzelmann (2001), ‘Role of Multinationals and Network Alignment in East Europe. The case of an Agribusiness Company’, Project Working Paper No. 6, January 2001. 14. D. E. Yoruk (2002), ‘Effective Integration to Global Production Networks: Knowledge Acquisition and Accumulation. The case of Braincof SA in Romania, Forthcoming as Project Working Paper No. 26, July 2002 Corporate strategy perspective 15. Shah, Sangita (2002), Innovation strategies in central Europe: a corporate perspective, Project Working Paper No. 16, March 2002 Industry studies 16. Deniz Eylem Yoruk (2002), ‘Patterns of industrial upgrading in the clothing industry in Poland and Romania’, Project Working Paper No. 19, March 2002. 17. Radosevic, S. (2002), ‘Electronics industry in CEE: the emerging production 26 24. Rojec, Matija and Andreja Jaklic (2002), ‘Integration of Slovenia into EU and global industrial networks: review of existing evidence’, Working Paper No. 14, March 2002. 25. Dunnin-Wasowicz, Stefan, Michal Gorynski and Richard Woodward (2002), ‘Integration of Poland into EU global industrial networks: The evidence and the main challenges’, Working Paper No, 16, 2002. 26. Hamar, Judit (2002), ‘FDI and industrial networks in Hungary’, Working Paper No. 13, March 2002. 27. Dyker, David et al. (2002), ‘East – West networks and their alignment: industrial networks in Hungary and Slovenia’, Project Working Paper No. 10, January 2002. [Forthcoming in Technovation] Trade aspects 28. Hotopp, U., S. Radosevic and K. Bishop (2002), ‘Trade and industrial upgrading in countries of central and eastern Europe: patterns of scale and scope based learning’, Project Working Paper No. 26, Regional aspects 29. Radosevic, Slavo (2002), ‘Regional Innovation Systems in Central and Eastern Europe: Determinants, Organizers and Alignments’, Journal of Technology Transfer, 27, pp. 87-96 (an expanded version is available as the working paper on the project site http://www.ssees.ac.uk/clsr.pdf). Foreign direct investment and employment 30. Mickiewicz, T., S. Radosevic and U. Varblane (2000), 'The Value of Diversity: Foreign Direct Investment and Employment in Central Europe during Economic Recovery', April 2000 (http://www.one-europe.ac.uk/pdf/WP5.PDF), Working Paper 5, ESRC Programme ‘One Europe or Several?’. State and policy issues 31. McGowan, Francis (2002), ‘State Strategy and Regional Integration; the EU and Enlargement’, Project Working Paper No. 22, March 2002. 32. Sharp, Margaret (2003), Industrial Policy and European Integration: lessons for the CEECs from Western European Experience, Project Working Paper No. 30 February 2003. 27 Summary Policymakers all over Europe are aware that both the size of the technological gap and available institutional and social infrastructure influence the potential for innovation and hence a country’s potential for productivity and catching-up. What is less well understood, however, is that the extent to which countries can develop capabilities to assimilate, generate and manage technical change and learning is mediated by the nature of the networks that support these activities. Merely having or constructing networks is not enough: it is the extent to which the character of these networks fit with the national and international policy context that is critical. The project ‘Achieving Growth in a Wider Europe: Understanding the Emergence of Industrial Networks’ found that the key issue for policymakers is the need to help a multiplicity of local and national networks emerge or redevelop in ways that are compatible with national and international (principally EU) policy goals and market demands. Strong production links are not sufficient: the innovation networks and knowledge links within these networks also need to become aligned. Since the beginnings of transition, discussions of the issues facing the countries of Central and Eastern Europe have focused on markets and institutional changes for market economy. Yet firms and markets are not the only actors involved in the interactions which constitute the coevolution of political and industrial integration. Compatible, successful 28 enlargement cannot be nurtured by considering firm-level integration on its own. This report illustrates how CEE state governments, regional/local governments, multinational corporations (and the way these integrate national markets into their networks), domestic firms, intermediary bodies such as international agencies, EU policy communities and educational organisations all influence the alignment of networks. The more these different networks grow to match each other, the deeper and broader the integration between CEE and the EU will be. Overall, the key question is: what is triggering complementarity between local, national and global production technology networks? In different contexts, different factors can be identified as the most significant impetus for the integration of innovation networks, the network component or the context around which networks become aligned. If foreign direct investment and/or