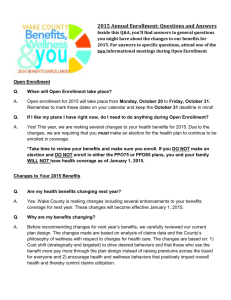

BENEFITS BULLETIN - Cypress-Fairbanks Independent School

advertisement