Investments

advertisement

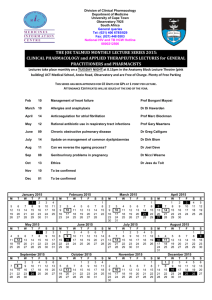

This Session Investments Session 15 – Performance Evaluation Prof. Nuno Fernandes Nfernandes@fcee.ucp.pt Why do we need performance analysis? The risks associated measurement. The importance of benchmarking. Risk-adjusted returns. Stock-picking and market timing. Different tools performance Prof. Nuno Fernandes Averaging Returns r = ∑ t =1 performance analyze portfolio Investments 2005/2006 2 Motivation for Performance Analysis Arithmetic Mean: n to with For example, let us say that you decide to invest in a diversified equity portfolio with average risk. You see that your return was 20%. Is this good or bad? rt n Geometric Mean: 1/ n ⎡n ⎤ r = ⎢∏(1+ rt )⎥ −1 ⎣ t =1 ⎦ Prof. Nuno Fernandes Investments 2005/2006 3 Benchmark Returns The investor has to compare the returns of his/her manager with the returns that would have been obtained had he/she invested in an alternative portfolio with identical risk. Performance must be evaluated on a relative basis; not on absolute basis! Investments 2005/2006 Investments 2005/2006 4 Analyzing Performance Statistics In performance analysis you need to make relevant comparisons. Prof. Nuno Fernandes Prof. Nuno Fernandes 5 Mutual funds with the highest average rate of return might not have the highest rank because… A highly aggressive fund may earn higher returns than a less aggressive fund but the higher returns may not be sufficient to compensate for the extra risk taken Prof. Nuno Fernandes Investments 2005/2006 6 1 The Basic Problems A Fund’s Performance Against Its Peers 60 There are two basic problems with performance analysis: 50 40 9 Even if the mean and variance of returns are assumed to be constant, there is the need to obtain many observations to achieve significant results (skills vs good luck) 9 In the case of active management (as opposed to passively managed funds) shifting parameters and styles could make evaluation quite difficult. Prof. Nuno Fernandes Investments 2005/2006 30 20 10 0 -10 -20 Year1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 5th Percentile 7 Prof. Nuno Fernandes Median 95th Percentile Fund Investments 2005/2006 8 Sharpe Ratio One simple way to investigate the fund’s performance is to consider risk-adjusted returns…remember that the CAPM tells us that the more market risk you take on, the higher should be the return. A widespread measure is the Sharpe ratio: ⎛R − R ⎞ ⎜ P f ⎟⎠ Sharpe = ⎝ σ P Reward to total variability trade-off. Risk Adjusted Measures Prof. Nuno Fernandes Investments 2005/2006 9 Sharpe Ratio Investments 2005/2006 10 The MM-M (M2) Performance Measure ⎛R − R ⎞ ⎜ P f ⎟⎠ Sharpe = ⎝ σ P Prof. Nuno Fernandes Prof. Nuno Fernandes Investments 2005/2006 11 The Modigliani-Modigliani measure, M2 , is a variant of the Sharpe ratio. It focuses on total volatility but the riskadjusted return is, essentially, a differential return relative to the benchmark returns. The measure takes into account the fund’s average return and determines what it would have been if the fund (under investigation) had the same degree of total risk as the market portfolio (for example, Wilshire 5000 or S&P 500 indices). Prof. Nuno Fernandes Investments 2005/2006 12 2 M2 Performance Measure M2 = R P* −R E(R) M2 Performance Measure CML M M The first step is to generate the so-called “adjusted portfolio”, P*. This portfolio is made up of two parts: CAL(P) M2 P P* 9 The managed portfolio, P; and 9 A position in T-Bills in a way that the total volatility of the adjusted portfolio matches the market index’s volatility. Prof. Nuno Fernandes Investments 2005/2006 σ 13 Treynor’s Measure Prof. Nuno Fernandes The Treynor’s measure gives you the excess return per unit of risk. However, unlike the Sharpe Ratio, it uses the systematic risk instead of total risk. Prof. Nuno Fernandes Investments 2005/2006 P 15 Prof. Nuno Fernandes Like Jack Treynor and William Sharpe, Michael Jensen recognized the CAPM’s implications for performance measurement. Alpha is average fund’s return above the predicted return from the CAPM, given the portfolio’s Beta and average market return. Prof. Nuno Fernandes Investments 2005/2006 Investments 2005/2006 16 Appraisal Ratio Appraisal = ⎡ ⎤ = R − ⎢ R + β ⎛⎜ R − R ⎞⎟⎥ P ⎣ f P⎝ M f ⎠⎦ 14 ⎛R − R ⎞ ⎜ P f ⎟⎠ Treynor = ⎝ β P Jensen’s alpha: Jensen = α σ Treynor’s Measure Jensen’s Measure P Investments 2005/2006 ⎛R − R ⎞ ⎜ P f ⎟⎠ Treynor’s measure: Treynor = ⎝ β P σ M 17 αP σ (ε P ) Appraisal Ratio divides the alpha of the portfolio by the nonsystematic risk (from the CAPM equation, where Jensen’s alpha is estimated) Nonsystematic risk could, in theory, be eliminated by diversification Prof. Nuno Fernandes Investments 2005/2006 18 3 About Portfolio Performance Measures To adequately evaluate a portfolio, must analyze both risk and return SHARPE measures risk-premium per unit of total risk TREYNOR measures risk-premium per unit of systematic risk Jensen’s alpha measures risk-adjusted returns for both portfolios and individual assets Prof. Nuno Fernandes Investments 2005/2006 Which Measure Should We Use? To decide on compensation: 9 Use the Jensen measure, which should provide you the amount you are willing to pay the manager To decide on optimal portfolio choices: 9 Use Sharpe ratio if portfolio represents entire investment 19 Use Treynor’s measure for a fund that is just one sub-portfolio out of a large set of passively-managed portfolios Additional tools are available for measuring a manager’s market timing skills Prof. Nuno Fernandes Investments 2005/2006 20 Performance Attribution Decomposing overall performance into components Components are related to specific elements of performance Example components Performance Attribution 9 Broad Allocation 9 Industry 9 Security Choice 9 Up and Down Markets - Timing Prof. Nuno Fernandes Investments 2005/2006 21 Prof. Nuno Fernandes Investments 2005/2006 22 Market Timing A good market timer structures a portfolio to have a relatively high Beta when the market is expected to rise and low Beta when the market is expected to drop. In other words, the market timer wants to do the following strategy: Market Timing 9 Hold a high-Beta portfolio when RM > R f 9 Hold a low-Beta portfolio when RM < R f Prof. Nuno Fernandes Investments 2005/2006 23 Prof. Nuno Fernandes Investments 2005/2006 24 4 Superior Stock Selection Market Timing R −R P f If the fund manager really has good timing abilities (good and accurate forecasts of market movements), then the portfolio will do better than a benchmark portfolio that has a constant Beta (that is equal to the average Beta of the timer’s portfolio). Alpha R −R M f To really “time the market”, the fund manager must change: 9 the average Beta of the risky securities held in the portfolio; or 9 the relative amounts invested in the risk-free asset and the risky assets. Prof. Nuno Fernandes Investments 2005/2006 25 The previous exhibit indicates that the relationship between the portfolio’s excess returns and the market’s excess return was linear. This result suggests that the portfolio’s Beta was, roughly speaking, the same during the entire period under consideration. Investments 2005/2006 26 Superior Market Timing Stock Selection Prof. Nuno Fernandes R −R P f Alpha R −R M f In this case, it appears that the investment manager successfully identified and invested in some underpriced securities (alpha is positive). Prof. Nuno Fernandes Investments 2005/2006 27 Prof. Nuno Fernandes Investments 2005/2006 28 Market Timing The previous exhibit indicates that the relationship between the portfolio’s excess returns and the market’s excess return was not linear. The exhibit suggests that the portfolio consisted of high-Beta securities during periods when the market return was high and low-Beta securities when the market dropped. In this case, it appears that the investment manager successfully identified market timing (alpha is positive). Prof. Nuno Fernandes Investments 2005/2006 Bogey 29 Prof. Nuno Fernandes Investments 2005/2006 30 5 Process of Attributing Performance to Components Process of Attributing Performance to Components Set up a ‘Benchmark’ or ‘Bogey’ portfolio Use indexes for each component Use target weight structure Prof. Nuno Fernandes Investments 2005/2006 31 Calculate the return on the ‘Bogey’ and on the managed portfolio Explain the difference in return based on component weights or selection Summarize the performance differences into appropriate categories Prof. Nuno Fernandes Formula for Attribution rB = n ∑w i =1 r p − rB = n ∑ (w i =1 pi r & rp = Bi Bi ∑w i =1 pi 32 Contributions for Performance n ∑w i =1 pi r pi Contribution for asset allocation n n Investments 2005/2006 r pi − ∑ w Bi rBi = i =1 (wpi - wBi) rBi + Contribution for security selection wpi (rpi - rBi) = Total Contribution from asset class wpirpi -wBirBi r pi − w Bi rBi ) Where B is the bogey portfolio and p is the managed portfolio Prof. Nuno Fernandes Investments 2005/2006 33 Prof. Nuno Fernandes Investments 2005/2006 34 Mutual Funds - Investment Policies Style Analysis Prof. Nuno Fernandes Investments 2005/2006 35 Money Market Fixed Income Equity Balance & Income Asset Allocation Indexed Specialized Sector Prof. Nuno Fernandes Investments 2005/2006 36 6 Style Analysis Analyzing a Portfolio Manager’s Style Based on regression analysis Examines asset allocation for broad groups of stocks More precise than comparing to the broad market Prof. Nuno Fernandes Investments 2005/2006 37 Analyzing a Portfolio Manager’s Style Sharpe (1992) - model to analyze a portfolio manager’s style (i.e., growth vs value, etc.) Uses modest amount of public information about funds Uses price indexes for 12 asset classes as explanatory variables for a mutual fund’s return Prof. Nuno Fernandes Investments 2005/2006 Analyzing a Portfolio Manager’s Style Ri − RF = α i + β i1 ( RI1 − RF ) + β i 2 ( RI 2 − RF ) + ... + β i12 ( RI 12 − RF ) Sample explanatory factors Uses APT framework 9 Soloman Brothers 90-day Treasury bill index The factor loadings are estimates of the weights that a fund invests in the twelve asset categories 9 Lehman Brothers Intermediate-Term Government Bond Index 9 FTA Japan Index 9 Sharpe/BARRA Value Stock Index Same type of analysis could be done using a ‘rolling’ regression Prof. Nuno Fernandes Investments 2005/2006 39 Rolling Style Analysis Prof. Nuno Fernandes Investments 2005/2006 38 Prof. Nuno Fernandes Investments 2005/2006 40 Benefits From Using Quantitative Management Style Analysis 41 Investment holdings are usually not reported publicly until months after they are made—too late for investors to react in a timely manner Mutual funds can report misleading investment goals. It can also provide better forecasts of mutual fund’s risk/return than subjective comments in newspapers, etc. Sharpe’s analysis: 97.3% of returns attributed to style Prof. Nuno Fernandes Investments 2005/2006 42 7 Empirical Evidence Empirical Evidence Prof. Nuno Fernandes Investments 2005/2006 43 Empirical Evidence Prof. Nuno Fernandes Investments 2005/2006 Investments 2005/2006 45 Prof. Nuno Fernandes Investments 2005/2006 9 Not enough to minimize diversifiable risk Basic problems with performance evaluation; The issue of skill against good luck; Mutual funds are usually able to reduce their diversifiable risk Risk-adjusted returns (Sharpe ratio, Treynor’s measure, Jensen measure, appraisal ratio) Investors can maintain their desired risk-class by mutual fund investing Benchmark returns from benchmark portfolios Asset Allocation versus Stock Selection. Most investors should focus on a mutual fund’s fees and favor funds charging smallest fees Investments 2005/2006 46 Learning Experience Average American has only about 7 different stocks Prof. Nuno Fernandes 44 Empirical Evidence The Bottom Line Prof. Nuno Fernandes 47 Prof. Nuno Fernandes Investments 2005/2006 48 8