spirits

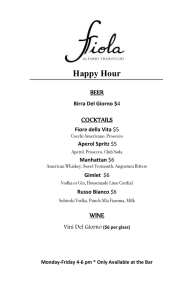

advertisement

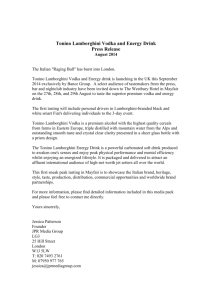

spirits review Ladoga extends its reach Ladoga Group president Veniamin Grabar explains to Helen Windle how the company is expanding Ladoga Group, based in St Petersburg, has established itself as one of the leading spirits producers in Russia. Initially a vodka producer, the company has been expanding and evolving to take advantage of the market opportunities available. It now produces brandy, liqueurs, bitters, vermouth, gin and pre-mixed cocktails, as well as owning two wineries in Spain, a distillery in France and the Fruko-Schulz company in the Czech Republic. The company boasts some impressive statistics for 2012, with spirits production up 14.1% on 2011, to reach 3.3m nine-litre cases in total. The value of the company grew by 10%, reaching RUB9.27bn (US$281m), of which RUB7.35bn (US$223m) was generated from the St Petersburg plant. Ladoga’s largest volume driver is vodka, selling nearly 1m cases in Russia in 2012. While some of its lower-priced brands declined in 2012, the company’s premium selection is looking healthy. Its key brands are the premium vodkas Czar’s Gold and Czar’s Original, which draw inspiration from Peter the Great and royal Russian heritage. Behind Russian Standard, the Czar’s brand range is the second-largest in the premium vodka segment in Russia and saw growth of 27.4% in 2012 versus 2011, according to the IWSR. In the context of the declining Russian vodka market this growth is even more impressive, although the premium-plus vodka segments are faring better than the lower end of the vodka market. Increasing excise tax and a sharp rise in the minimum price of vodka is sacrificing the low-priced market to the black market. Excise tax impact President of Ladoga Group, Veniamin Grabar talks to the IWSR Magazine about the impact of these price increases. “The increase in excise taxes made production of counterfeit alcohol even more profitable, volumes of which, without doubt, will grow by 10-15%. A truck with 20,000 bottles of illegally produced vodka brings $60,000 – this is a serious problem for legal producers of alcohol. Recently, the black market began to raise its head. It’s not a secret that their success is down to low prices, which would be especially attractive to the consumer. Any increase in excises will strike manufacturers of cheap vodka first of all. After raising excise taxes, the cheapest vodka is close to RUB200 ($6), whereas two years ago you could buy vodka for less than RUB100 ($3). In my opinion, such an increase can be characterised as rather 26 September 2013 declining, other spirits categories – and not just imported spirits – are in growth in Russia. Ladoga is driving forward the local liqueurs and bitters categories. Ladoga holds 18-20% of the market of liqueurs and bitters categories in Russia and nearly 95% in St Petersburg. Ladoga’s bitters portfolio grew 26.8% in 2011 and a further 2.3% in 2012, according to the IWSR. Meanwhile, its liqueurs portfolio grew 17.9% in 2011 and 26.1% in 2012. Grabar adds: “Consumption of liqueurs and bitters in Russia is gradually increasing. Recently there has been a tendency, when choosing between vodka and liqueurs, for consumers to opt for the latter. This is primarily due to the fact that consumers who are buying these kinds of products are after the taste, not strength. In addition, during the economic crisis buyers tried to manage their money rationally and chose liqueurs and bitters as a cheaper option and not a lower-quality type of alcohol. If there are no sharp fluctuations in the Russian economy in the next five years, this market will grow steadily.” Czech acquisition Veniamin Grabar, president, Ladoga Group sharp. Consumers of ordinary vodka, who cannot afford their favourite brand, are likely to switch to the use of counterfeit alcohol; manufacturers of cheap vodka will be harmed. “In part, we are protected from the risks associated with the increase in excise. We sell vodka in the premium and super-premium segments. According to our estimates, the increase in excise taxes won’t have huge impact on us. Like many other players in the alcohol market, we made large reserves of alcohol at the end of 2012, before the tax increase.” However, while the vodka market is Imperial Collection Gold is the international version of the firm’s flagship brand Czar’s Gold In 2008 Ladoga Group bought Fruko-Schulz, the Czech spirits producer, for approximately €15m ($20m). The factory currently has three bottling lines and a total capacity of 1.7m nine-litre cases per year. “The acquisition of the Czech plant of Fruko-Sсhulz helped to strengthen our market position in these categories [bitters and liqueurs],” notes Grabar. “Moreover, it didn’t just give us a new market, but also allowed us to touch upon a more than 100year-old tradition of production of bitters, liqueurs and absinthe, which are not manufactured in Russia. We have increased production despite the very strong increase in excise tax in the Czech Republic, as well as having expanded the product line, introduced more modern technology and improved management. The enterprise has not lost either in volume or in revenue; 2012 was the spirits review third year of steady growth in a row. Products from the Czech plant are exported to Russia, China and many European countries.” It has been beneficial for Ladoga to expand its business to involve foreign investment, and imports and exports. This has allowed the company to drive growth when other domestic markets or categories may be falling. Its vodka exports are expanding, with primary focus on Imperial Collection Gold, the export version of Czar’s Gold. Grabar says: “Ladoga shows outstanding potential in growing its flagship vodka brand Imperial Collection. The brand is spreading fast across the globe and the Asian market is the new target for the company. Thanks to its highest quality and historical roots, this vodka has all the grounds to be ranked among the top brands on the premium alcohol market. This unique Russian vodka famous for its golden filtration has been distributed in Russia as Czar’s Gold since 2003. “Following its successful re-launch on foreign markets as Imperial Collection Gold, it has become the iconic Russian super-premium vodka. Due to superb packaging and the finest quality vodka, it is keenly accepted by highend clubs, restaurants and hotel chains in Europe and the Americas. In 2012 Imperial Collection hit the London market with our premium Russian vodka, which has both history behind it and quality inside. The Dorchester, The Langham, Buddha bar, Nobu, Baku and Mari Vanna are just a few of the high-end venues currently offering Imperial Collection to their clients. The Imperial Collection super-premium vodka, served in a Venetian decanter topped with Swarovski crystal, was recognised by the Beverly Hills International Spirits Awards 2012 with a double gold medal. It is packed in a Fabergé Easter Egg box, available in 11 colour combinations and the limited issue of designer gift-sets is to be introduced to our exclusive clientele soon.” Below: spirits from Czech producer Fruko-Schulz, acquired in 2008 The Imperial Collection super-premium vodka, served in a Venetian decanter “A truck with 20,000 bottles of illegally produced vodka brings $60,000 and this is a serious problem for legal producers of alcohol” – Veniamin Grabar, president, Ladoga Group Domestic activity As well as export, Ladoga also imports and distributes products in the domestic market. It has distribution agreements with other major importers within Russia and imports and distributes Black Beast whisky, Lautrec Cognac and a number of other brands, including wines from the New and Old World. Ladoga also exclusively imports the brands from its foreign enterprises – namely FrukoSchulz, Bodegas El Cidacos and Camino Real in Spain, and Favraud Cognac in France. This range of portfolios has helped the company develop its presence in categories such as liqueurs and Cognac as well as tapping into fast-growing categories such as imported wine for the first time. Altogether these imported products earned the company RUB1.06bn ($32m) in 2012. Grabar explains: “Our acquisitions are aimed at products that have never been produced in Russia, but are in demand in the local market. European wine is very much overpriced on the Russian market. In a European restaurant a bottle of good wine is no more than €30 ($40) and a bottle of similar wine in Russia costs from RUB2,000 ($60) up to RUB10,000 ($300). Our secret is that we have excluded the chain of intermediaries from the production – the products of our enterprise in Rioja are 1.5 times cheaper than other producers. Competitors are also forced to reduce prices.” According to the IWSR, Spanish wine consumption in Russia grew by 180,000 cases in 2012 to reach 4m cases overall. The category is forecast to continue this strong growth in 2013. Ladoga is well positioned to enjoy growth in the Russian market. With representation in most categories, it will benefit from the growth of imported wines and spirits, local flavoured spirits and even within the declining vodka category. Although its lowerpriced vodkas may be losing out, the company has key premium offerings, which can drive growth in both value and volume terms. ■ September 2013 27