Qantas Research Report - Sep 2014

advertisement

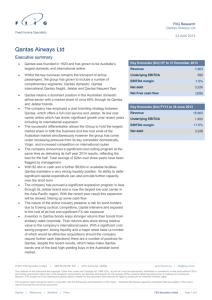

FIIG Research Qantas Airways Ltd 4 September 2014 Qantas Airways Ltd Key financials ($m) Executive summary FY13 Revenue EBITDA Qantas was founded in 1920 and has grown to become Australia’s largest domestic and international airline. Whilst the key business remains the transport of airline passengers, the group has grown to include a number of complementary segments: Qantas Domestic, Qantas International, Qantas Freight, Jetstar and Qantas Loyalty (Frequent Flyer) Qantas retains a dominant position in the Australian domestic airline sector with a market share of circa 65% through its Qantas and Jetstar brands The company has adopted a dual branding strategy between Qantas, which offers a full cost service and Jetstar, its low cost carrier airline which has driven significant growth over recent years including its international expansion The successful differentiation allows Qantas to hold the largest market share in both the business and low cost ends of the Australian market simultaneously however the group has come under increasing pressure from its key competitor domestically, Virgin, and increased competition on international routes The company announced a significant cost cutting program at the same time as delivering its 1H14 results, reflecting the increasingly challenging nature of the airline industry. Total savings of $2bn over three years have been flagged by management With $3.0bn in cash and a further $630m in available facilities Qantas maintains a very strong liquidity position. Its ability to defer significant capital expenditure can also provide further capacity over the short term The company has pursued a significant expansion program in Asia through its Jetstar brand and is now the largest low cost carrier in the Asia-Pacific region. With the recent poor result this expansion will be slowed, freeing up cash flow Qantas was downgraded by the rating agencies to sub-investment grade at the beginning of the year. According to the rating agencies, the downgrade reflected a worse than expected impact on Qantas’ credit profile of a deterioration in the company’s core domestic business Despite the downgrade, Qantas was able to issue the first subinvestment grade bond in the domestic market in May and June, reflecting both the continuing quality of the Qantas name as well as the buoyancy being experienced in credit markets in 2014 Approximately 70% of Qantas’ total debt is senior secured debt. Certain aircraft and engines act as security against related financings The nature of the airline industry presents a risk for bond holders due to it being cyclical, competitive, capital intensive and exposed to the cost of jet fuel and significant foreign currency exposure © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 FY14 FY15e FY16e 15,902 15,352 15,561 16,020 1,990 1,042 1,488 1,882 5 -2,843 -20.0 298.1 3,251 3,455 3,186 2,425 1.6x 3.3x 2.1x 1.3x 1,417 1,069 1,010 1,513 372 0 108 599 NPAT Net Debt Net Debt / EBITDA Operating Cash Flow Free Cash Flow FY15, FY16 based on average Bloomberg broker consensus estimates A$m Operating Performance 25,000 NPAT EBITDA 20,000 15,000 Revenue 15,902.0 15,724.0 11,759.0 15,352.0 12,884.0 10,000 5,000 0 1,827.0 1,617.0 250 112 1,770.0 1,990.0 5 1,042.0 -245 -2843 FY14 -5,000 FY10 FY11 FY12 FY13 Interest Coverage Ratios 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x -1.0x -2.0x 7.5x 7.0x 6.8x 5.3x 3.6x 2.2x 1.7x 2.0x 1.2x EBITDA/Interest Expense EBIT/Interest Expense -1.3x Financial Leverage Total Debt / Total Assets Total Debt / Total Capital 80.0% 70.0% 60.0% 50.0% 40.0% 69% 30.0% 20.0% 10.0% 29% 53% 50% 49% 29% 51% 31% 30% 37% 0.0% FY10 FY11 FY12 FY13 FY14 Source: Bloomberg www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 1 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 Background Qantas was founded in 1920 and has grown to be Australia’s largest domestic and international airline. Whilst the key business remains the transport of airline passengers, the Group has grown to include a number of complementary businesses. The Qantas Group consists of five business segments: Qantas Domestic – where the company is a market leader in both the business and leisure markets through its duel brand strategy (Qantas and Jetstar) with the Qantas premium brand maintaining its dominance in its home territory Qantas International –Qantas’ traditional international business including its new strategic alliance with Emirates Airways Qantas Freight – air freight business including Australia Air Express Jetstar – the largest low cost carrier in the Asia-Pacific with targeted investments in key markets in the world’s fastest growing region Qantas Loyalty (Frequent Flyer) – Australia’s leading customer loyalty program with more than 10 million members Operations At the same time as the release of the 1H14 result, the company announced a three year operational review which would seek to deliver $2bn in cost savings. Drivers of this $2bn cost saving will include: Head count reduction of 1,000 within 12 months (including 300 already announced) CEO and board pay cuts No bonuses for executives and pay freeze Review of suppliers - expect Qantas to take a Woolworths/Coles approach to suppliers Network optimisation - already Qantas has announced reduced services to Darwin, and increases in Adelaide to better align fleet utilisation Other overheads International turnaround The turnaround of the international operations business includes the exiting of unprofitable routes, rationalisation of catering and engineering operations, more efficient capital allocation, reconfiguring the fleet to enhance profitability and building better alliances including the continued strengthening of the Qantas-Emirates alliance. For the 2014 full year, underlying EBIT for Qantas International was a $497m loss (compared to a $246m loss for FY13). A slower global economy has seen considerable passenger seat volume moved to Qantas’ key international routes as has the addition of significant low cost and government backed competitors. This additional passenger seat volume has had the effect of lowering yields across the industry and placing significant negative pressure on pricing. Jetstar The Jetstar brand made an EBIT loss of $116m for FY14 compared to a $138m EBIT gain for the prior comparable period as the international Jetstar business was affected by the same supply/demand dynamics as the Qantas International business. All of Qantas’ business units were also affected negatively by unfavourable movements in fuel pricing and FX. In response, Qantas has slowed its growth program for Jetstar as it realigns its fleet with route demand. Jetstar’s domestic business remains profitable and is the largest low cost carrier in the Australian domestic market. Qantas-Emirates The Qantas-Emirates tie up, a 10 year alliance, has a number of benefits to Qantas and its customers. For its customers, it provides one stop access to 33 European destinations (compared to five previously) and 31 one stop services to the Middle East and Northern Africa (none previously) as well as broader access for its frequent flyer program through a single partner. © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 2 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 For the company, the benefits extend beyond the traditional code sharing model with commissions also available on nontrunk routes as well as providing a significant feeder for Qantas’ domestic business. The development of the alliance also allows Qantas to restructure its Asian business, an area of great potential growth, but also subject to increasing competition. This restructure will include fleet management (ensuring the most efficient aircraft for the route is utilised) and schedule management, with better timing of flights to suit customer requirements rather than designing flight schedules to meet end destination requirements in Europe. Debt Structure Qantas’ debt structure includes both secured and unsecured facilities, using a combination of bank debt and the bond markets to meet its debt funding needs. In addition, Qantas’ recognises its obligations under its aircraft operating leases (which are not recognised on the balance sheet) for the purposes of its own reported gearing calculation. Reported Gearing Ratio $m Adjusted Equity FY14 2,938 Current debt Non-current debt Cash and cash equivalents Other Net on balance sheet debt Operating lease liability Net debt incl. operating leases 1,210 5,273 -3,001 -27 3,455 1,296 4,751 On balance sheet gearing Total gearing ratio 54% 62% FY13 5,717 835 5,245 -2,829 -25 3,226 1,621 4,847 36% 46% Change % -49% 45% 1% 6% 8% 7% -20% -2% 18% 16% Source: Qantas; FIIG Securities The increase in Qantas’ reported gearing ratio from 46% at FY13 to 62% at FY14 above is largely as result of the reduction in balance sheet equity value at FY14, which was due in large part to the $2.6bn write-down in the value of the international fleet. Despite the downgrade of Qantas’ credit rating to sub-investment grade at the beginning of the year, Qantas has been active in the debt capital markets, recently issuing the following $A bonds: On May 12 – A$300 million of 7.75% eight-year notes, at a yield of 400 basis points over the swap rate; and On June 4 - A$400 million of 7.5% seven-year notes, at a yield of 385 basis points over the swap rate Qantas has embarked on a strategy of extending the overall duration of its debt facilities, by cutting the amount of unsecured debt it must repay within three years by 47 percent, paying down A$724 million of bonds and loans earlier this year after raising A$700 million via the nation’s first sub investment grade domestic note sales. With the recent high yield issues, Qantas has rebalanced its debt profile towards the Australian dollar. The figure below reflects Qantas’ unsecured debt profile before and after the extension of the debt maturity profile. © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 3 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 Source: company presentation Following the extension of Qantas’ debt profile, more than half of the company’s debt won’t come due until after 2019, leaving it freer to focus on an operational overhaul aimed at reversing recent losses and a declining market share. With the focus for Qantas being the restructuring of its business over the next couple of years, the recent terming out of their debt profile allows Qantas to ease the pressure of refinancing challenges in the near term whilst credit markets remain buoyant. Approximately 70% of Qantas’ total debt is senior secured debt. Certain aircraft and engines act as security against related financings. Under the terms of certain financing facilities, the underwriters to these agreements have a fixed charge over certain aircraft and engines to the extent that debt has been issued directly to those underwriters. Trading results – Full year to 30 June 2014 Qantas Airways Limited (Qantas) announced a $646m underlying loss and a $2.9bn statutory loss after tax for FY14. The statutory loss includes an impairment charge of $2.6bn, relating to a non-cash write-down of Qantas’ international fleet. In spite of very challenging conditions, Qantas was able to generate positive operating cash flows of $1.1bn in FY14 despite being engaged in a domestic price war with arch rival Virgin Australia. In addition, whilst Virgin has declined to provide any guidance to the market, Qantas has forecast it will return to profitability in 1H15. In addition, management has stated that it is focused on regaining the company’s investment grade credit rating. Following the results announcement, the rating agencies have maintained their negative outlook on Qantas, but have chosen not to downgrade its credit rating further. While the outlook remains negative, S&P has in particular noted there © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 4 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 are early indications that some key drivers are moving in Qantas' favour: revenue yields are expected to improve through more manageable capacity additions in both domestic and international markets, and the improved unit costs provide evidence of progress with Qantas' transformation program A number of industry fundamentals affected Qantas’ performance (which also affected its competitor Virgin, which announced its own loss for FY14) including increased capacity in the domestic market placing pressure on pricing; uncompetitive cost base and work practices; high AUD and fuel costs and a distorted market place (ie: Virgin’s foreign government ownership structure). In response Qantas announced it was accelerating its business transformation including staff cuts of up to 5,000 full time equivalents, adjusting its existing fleet including removal of older, less efficient aircraft and removal of unprofitable routes and a reduction in capital expenditure by delaying new aircraft acquisitions. The company is also exploring/undertaking a number of other options including the sale and lease back of terminal space. Revenue for the full year was 3% down on the prior comparable period as continued competition and increased fleet capacity in the market led to subdued passenger yields for FY14. Summary financials $m Net passenger revenue Net freight revenue Other revenue Total revenue Operating expenses (excl fuel) Fuel Depreciation and amortisation Non-cancellable aircraft operating leases Total expenses Underlying EBIT Net finance costs Underlying profit before tax Items not included in underlying profit Tax Net profit after tax FY14 13,242 955 1,155 15,352 9,354 4,496 1,422 520 15,792 -440 206 -646 -3,330 1,113 -2,863 FY13 13,673 935 1,294 15,902 9,318 4,243 1,450 525 15,536 366 180 186 -175 -9 2 Change % -3% 2% -11% -3% 0% 6% -2% -1% 2% -220% 14% -447% n/a* n/a* n/a* Source: Qantas; FIIG Securities *Percentage changes not meaningful in the context of the relative results Liquidity Qantas maintains a strong liquidity positing with cash of $3.0bn and available facilities of $630m available at the end of the financial year. Further, the company has continued to adopt a proactive approach to refinancing ahead of schedule to maintain this liquid position as well as flexibility in its approach to capital expenditure with a proposed $1.3bn in total reductions in planned capital investment over FY15 and FY16, all of which are positives for credit investors. Net on balance sheet debt for the period increased to $3.46bn up from $3.23bn in the prior comparable period with gearing increasing similarly. The company has publically stated its intention to decrease its level of debt, a process which has been backed by recent actions, in particular the deployment of proceeds from the group’s asset swap with Australia Postal Corp (swapping Australian Posts share of domestic freight company Australia Air Express for Qantas’ share of StarTrack) and the cash benefit from the late delivery of Boeing Dreamliners to reducing debt ($650m). © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 5 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 Strengths Qantas retains a dominant position in the Australian domestic airline sector with a market share of circa 65% across both its Qantas and Jetstar brands. Qantas maintains its dominance in the lucrative business passenger segment and continues to grow its corporate account numbers The company has introduced a dual branding strategy through the differentiation between Qantas, which offers a full cost service and Jetstar, its successful low cost carrier airline which has driven significant growth over recent years including its international expansion. The successful differentiation allows the Group to hold the largest market share in both the business and low cost ends of the Australian market simultaneously With $3.0bn in cash and a further $630m in available facilities Qantas maintains a very strong liquidity position. Its ability to defer significant capital expenditure can also provide further capacity over the short term Despite the recent negative result, Qantas remains an asset rich business, with a number of significant entities and opportunities to reduce debt levels through asset sales available to management In the recent FY14 results announcement, Qantas indicated that it was not intending to sell the profitable Qantas loyalty (frequent flyer) business. Overall, whilst a sale of the frequent flyer business could generate significant cash which could be used to pay down debt, retaining this business within the group is a positive given it provides a stable, quality earnings stream to supplement the underlying airline business Despite the downgrade, Qantas continues to retain significant flexibility in its financial position, funding strategies and fleet plan which has allowed it to continue to raise funds and generate liquidity in the face of changing market conditions. Qantas is the first Australian corporate to issue a sub-investment grade, high-yield bond into the domestic A$ debt capital markets. It was able to successfully raise bonds twice this year in the space of two months. Risks Following the ratings downgrade at the beginning of the year, Qantas is now considered to be a sub-investment grade credit by the rating agencies. In the description of one of the rating agencies, an obligor rated in the corresponding sub-investment grade category faces major ongoing uncertainties and exposure to adverse business, financial, or economic conditions which could lead to the obligor's inadequate capacity to meet its financial commitments Qantas is in the midst of restructuring its business. As such, Qantas is exposed to the execution risks of implementing change on a number of fronts and transitioning its business to profitability The nature of the airline industry presents a risk for bond holders due to it being cyclical, capital intensive, being exposed to ‘force majeure’ events (eg: terrorism) as well as the cost of jet fuel which fluctuates with movements in the underlying commodity. Offsetting this is the long history of Qantas’ operations, its diversity across its two brands as well as the continued ownership of the frequent flyer business (which is separated in a number of its peers) and most importantly its dominant position in its home market The airline industry remains highly competitive with competition increasing both on the company’s domestic and international routes. In particular Qantas’ international business faces strong competition from government backed, or significantly government owned competition. Despite this Qantas has maintained its position in the domestic market and in fact has seen off a long list of domestic competitors. The sector increasingly looks like a duopoly with Virgin and we would expect to see some easing on the domestic competition front (with sporadic outbursts of competitive activity) as both Qantas and Virgin suffered losses over FY14, a position which is unsustainable in the longer term for both competitors. Qantas’ international business has underperformed financially in recent years due in large part to the increase in competition which has come with the deregulation of routes and has been a financial drain on the group as a whole. The company has undertaken a significant process of transformation in this business, delivering more than half the expected $300m in improvements to date. The Group will need to continue to deliver on this transformative program in order to return this division to profitability © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 6 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 Approximately 70% of Qantas’ total debt is secured senior debt, which ranks ahead of Qantas’ unsecured debt in the event of a default and liquidation scenario Conclusion Despite a weak FY14 result, with the general media attention focussing on the large headline losses, there were still a number of positives for Qantas’ bondholders to take away from the FY14 results. Of particular note were the better than expected underlying earnings, an increase in group liquidity of $600m to $3.6bn, positive management comments on market conditions, progress on the cost reduction initiatives and confirmation that Qantas Loyalty (Frequent Flyer) will not be sold. Qantas remains one of the strongest brands in Australia and one of its best known internationally. Notwithstanding the recent poor result the company retains a significant asset base and a market capitalisation (at time of writing) of over $3.3bn which provides comfort for investors in the company’s ability to meet its commitments. © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 7 of 8 FIIG Research Qantas Airways Ltd 4 September 2014 The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. The information has been prepared solely for informational purposes only and does not constitute or form part of any offer for sale or subscription of, or solicitations or any offer to buy or subscribe for, or any invitation to subscribe for or purchase any securities and nothing contained herein shall form the basis of any contract or commitment whatsoever. The information is being furnished to you solely for your information and may not be reproduced or redistributed to any other person. No action has been taken to permit the public distribution of the information in any jurisdiction and the information should not be distributed to any person or entity in any jurisdiction where such distribution would be contrary to applicable law. The information has not been lodged with Australian Securities and Investments Commission or any other authority. The information is intended for distribution only to financial institutions and professional investors whose ordinary business includes the buying or selling of securities in circumstances where disclosure is not required under Chapter 6D.2 or Chapter 7 of the Corporations Act 2001 of Australia (the “Corporations Act”) and only in such other circumstances as may be permitted by applicable law. Any securities that may be offered by the Issuer in, or into, Australia are offered only as an offer that would not require disclosure to investors under Part 6D.2 or 7.9 of the Corporations Act. This information is directed only to persons to whom disclosure is not required under Part 6D.2 or 7.9 of the Corporations Act. The information is a summary only and does not purport to be complete. It does not amount to an express or implied recommendation or a statement of opinion (or a report or either of those things) with respect to any investment in the Issuer nor does it constitute a financial product or financial advice. The information does not take into account the investment objectives, financial situation or needs of any particular investor. FIIG does not provide accounting, tax or legal advice. Prospective investors are required to make their own independent investigation and appraisal of the business and financial condition of the Issuer and the nature of any securities that may be issued by the Issuer. By accepting receipt of the information the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial securities discussed herein. Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the Issuer which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice. No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Any offering of any security or other financial instrument that may be related to the subject matter of this communication will be made pursuant to separate and distinct documentation (“Offering Documents”) and in such case the information will be superseded in its entirety by any such Offering Documents in its final form. In addition, because the information is a summary only, it may not contain all material terms and the information in and of itself should not form the basis for any investment decision. Any decision to purchase securities in the context of a proposed offering of securities, if any, should be made solely on the basis of information contained in the Offering Documents published in relation to such an offering. Neither FIIG nor the Issuer shall have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG or the Issuer be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages. FIIG has been engaged by the Issuer to arrange the issue and sale of the Notes by the company and will receive fees from the issuer of the Notes. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities. FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg. An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified. The FIIG research analyst certifies that all of the views expressed in this document accurately reflects their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. © 2014 FIIG Securities Limited | ABN 68 085 661 632 | AFS Licence No. 224659 www.fiig.com.au | info@fiig.com.au The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced, distributed or provided to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights. Sydney | Melbourne | Brisbane | Perth FIIG Securities Limited | Page 8 of 8