The Trading Profit and Loss Account The Trading Profit and Loss

advertisement

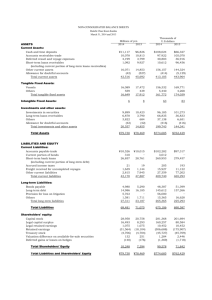

The Trading Profit and Loss Account Account Businesses usually calculate their profit level by creating a Trading Profit and Loss Account (TPL) The TPL is produced because: It is a legal requirement It summarises all the year’s transactions It shows the financial ‘health’ of the business. Can be used to compare trade this year with trade last year © Business Studies Online: Slide 1 The Parts of A T,P&L Account Account The document is made up of 3 sections which must be completed in turn: The Trading Trading Account Account The Thiscalculates calculatesgross gross This profit.It Ittakes takesthe the profit. directcosts costsof of direct productionaway awayfrom from production thesales salesrevenue revenue the The Profit Profit && Loss Loss The Account Account Thistakes takesthe the This expenses(indirect (indirect expenses costs)away awayfrom fromthe the costs) grossprofit profitto to gross calculatenet net profit profit calculate The Appropriation Appropriation The Account Account Thisshows showswhat whatwill will This happento toany anyprofit profit happen thathas hasbeen beenmade. made. It It that usuallyrefers refersto to usually dividendsand andtaxation taxation dividends © Business Studies Online: Slide 2 The Structure of a TP&L Account (1) (1) Need to calculate how much it has cost to make the goods that have been sold Trading Profit and Loss Statement For Lou Pole, year ending 31.08.04 £ £ Value of stock Sales 400,000 owned at the start of the year LESS Cost of sales Opening Stock 100 Value of raw Purchases 100,000 materials 100,100 purchased during the year Less Closing Stock 100 Value of stock left at the end of the year. This will be next year‛s OPENING STOCK Business Name and Date Sales, the money from selling goods 100,000 Gross profit 300,000 Calculated by subtracting cost of sales from sales © Business Studies Online: Slide 3 The Structure of a TP&L Account (2) Expenses listed and a total given £ Gross profit LESS Expenses Salaries Rent Other Total expenses Net profit Corporation Tax Profit after tax Dividends Retained profit Calculated by subtracting dividends. This is the amount of money that will be kept in the business 75,000 25,000 14,000 114,000 £ 300,000 Calculated by subtracting expenses from Gross Profit 186,000 74,400 111,600 5,580 106,020 Calculated by subtracting tax from net profit © Business Studies Online: Slide 4 Different Types of T,P & L Accounts Accounts The T,P & L Accounts of businesses will differ according to their legal structure Companies (Ltds & Plcs) are subject to more legal constraints: The Accounts Of Incorporated Businesses Accounts must be published Accounts usually show figures for 2 years They must show how the profit is being used (Appropriation Account) © Business Studies Online: Slide 5 The Limitations Of T,P & L L The trading, profit & loss account is a historical view of the business It does not tell us what will happen in the future – although it may help to identify trends Businesses may “manipulate” accounts in order to reduce their tax liabilities, or to deter a potential takeover © Business Studies Online: Slide 6 Working Capital Capital Working capital refers to the materials that a business needs in order to make the products that it sells Without working capital a business would be unable to operate It is the working capital that produces profit and as such it is referred to as an investment However, working capital items are NOT intended to be kept by the business © Business Studies Online: Slide 7 How Money Works In Business Business Money constantly goes round a business in a cycle This can be shown as follows: © Business Studies Online: Slide 8 The Speed of the Working Capital Cycle Cycle If the amount of cash at the end of the cycle is bigger than that at the start then a firm will make a profit How much profit depends upon how quickly they can get round this cycle. How quickly it can get round depends on two factors: Speed of The Working Capital Cycle Creditors • People a business owes money to. • They speed up the cycle Debtors • People who owe the business money. • They slow down the cycle. © Business Studies Online: Slide 9 Calculating the Working Capital The working capital of a firm is calculated as follows: Working Capital = Current Assets – Current Liabilities Where: Current Assets = Anything a business owns, which it intends to sell Examples include raw materials, stock, debtors and cash. Current Liabilities = Anything that a business owes, which must be paid within the next 12 months Examples include creditors, overdraft and dividends. This calculation is part of the BALANCE SHEET © Business Studies Online: Slide 10 What is a Balance Sheet? Sheet? A Balance Sheet is a financial statement which shows the ASSETS, LIABILITIES and CAPITAL of a business on a particular date Assets Assets Capital Capital Areitems itemsowned owned Are bythe thebusiness businessor or by owedto tothe the owed business business Isthe themoney money Is investedby bythe the invested ownersor or owners shareholders shareholders Liabilities Liabilities Areamounts amountsowed owed Are bythe thebusiness business by © Business Studies Online: Slide 11 The Key Principle of a Balance Sheet Sheet Businesses can only spend money that they either have, or have borrowed then: All Assets must equal All Liabilities © Business Studies Online: Slide 12 The Structure of a Balance Sheet (1) (1) Business Name and Date Balance Sheet For A.B.Hive LTD as at 31 December 2004 Fixed assets Building Equipment £ Fixed Assets are listed and then added up. Current assets Stock Debtors Cash at bank 30,000 10,000 5,000 45,000 £ 170,000 60,000 230,000 Current Assets are listed and totalled © Business Studies Online: Slide 13 The Structure of a Balance Sheet (2) (2) Current Liabilities listed and totalled Current liabilities Trade creditors £ £ Calculated by current assets – current liabilities 25,000 Net Current Assets 20,000 OR Working Capital Less Long Term Liabilities Mortgage 45,000 Loan 5,000 50,000 Net Assets Calculated by fixed assets + working capital – long term liabilities Long Term liabilities are listed and totalled, then taken away 200,000 © Business Studies Online: Slide 14 The Structure of a Balance Sheet (3) (3) FINANCED BY:­ This section shows where the money in the business has come from. £ Capital and reserves Share capital Profit and loss account 75,000 125,000 Total Capital Employed 200,000 This means that £200,000 has been invested in the business © Business Studies Online: Slide 15 Who Uses A Balance Sheet? Both the balance sheet and the profit and loss account show the ‘health’ of the business All the stakeholders will be interested in the balance sheet, but especially: Shareholders Customers Suppliers Employees When used with the Trading Profit and Loss account it shows how well the business is doing © Business Studies Online: Slide 16 The Limitations Of The Balance Sheet Sheet As soon as it is produced it is out of date Fixed assets may be over­valued if they are depreciated incorrectly Businesses are not required to include “intangible assets” such as brand names. This can understate the value of the company Companies tend not to give a breakdown of the figures – they just quote totals © Business Studies Online: Slide 17 Differences In Accounts Accounts Different types of business produce different types of accounts, due to legal requirements: Unincorporated Businesses Must produce accounts for taxation purposes Incorporated Businesses Must publish accounts Are usually in a simple format Often abbreviated so competitors get limited information T, P & L A/C will not have an Appropriation Account Usually show 2 years figures Some terminology is changed © Business Studies Online: Slide 18 Share Capital Vs Loan Capital Capital There is a big difference between share capital and loan capital: Share Capital Loan Capital The total amount invested in a business by shareholders Note that share capital is NOT the same as Shareholders funds Is medium – long­term finance provided by: Banks Debentures Other lenders © Business Studies Online: Slide 19 Share Capital Vs Shareholders Funds Funds Any profits invested in a business belong to it’s shareholders As such Shareholders funds can be calculated as: Shareholders Funds = Share Capital + Reserves © Business Studies Online: Slide 20