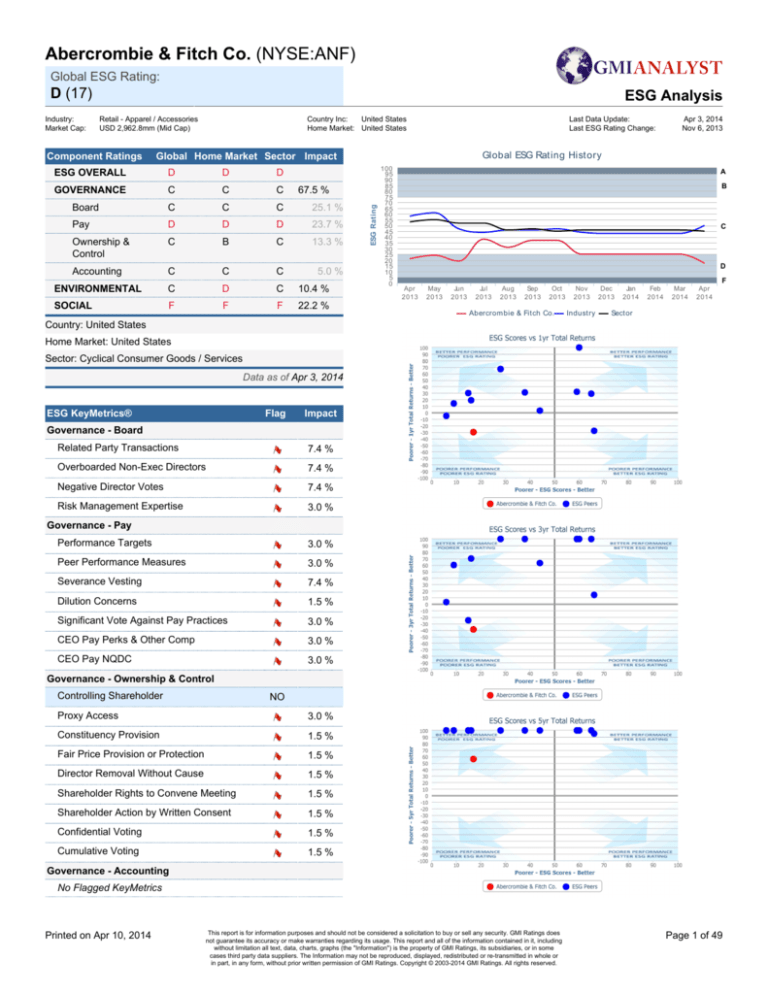

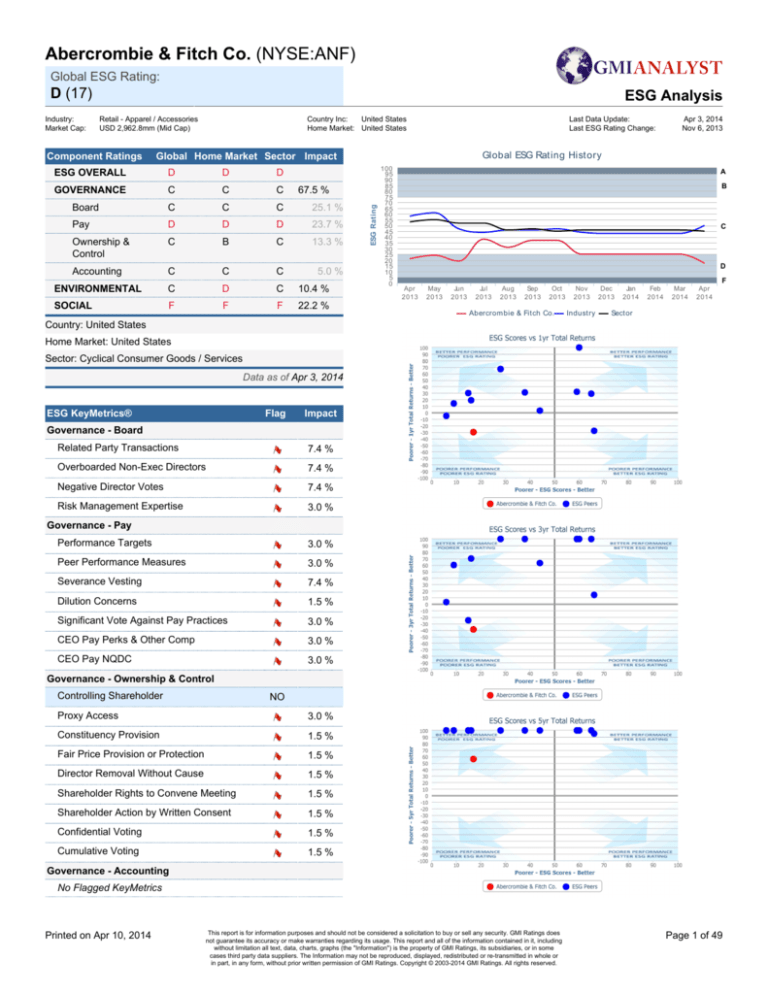

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Component Ratings

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

ESG OVERALL

D

D

D

GOVERNANCE

C

C

C

Board

C

C

C

25.1 %

Pay

D

D

D

23.7 %

Ownership &

Control

C

B

C

13.3 %

Accounting

C

C

C

5.0 %

ENVIRONMENTAL

C

D

C

10.4 %

SOCIAL

F

F

F

22.2 %

Apr 3, 2014

Nov 6, 2013

Global ESG Rating History

Global Home Market Sector Impact

67.5 %

ESG Rating

Industry:

Market Cap:

ESG Analysis

100

95

90

85

80

75

70

65

60

55

50

45

40

35

30

25

20

15

10

5

0

A

B

C

D

F

Apr

2013

May

2013

Jun

2013

Jul

2013

Aug

2013

Sep

2013

Oct

2013

Abercrom bie & Fitch Co.

Nov

2013

Industry

Dec

2013

Jan

2014

Feb

2014

Mar

2014

Apr

2014

Sector

Country: United States

Home Market: United States

Sector: Cyclical Consumer Goods / Services

Data as of Apr 3, 2014

ESG KeyMetrics®

Flag

Impact

Governance - Board

Related Party Transactions

7.4 %

Overboarded Non-Exec Directors

7.4 %

Negative Director Votes

7.4 %

Risk Management Expertise

3.0 %

Governance - Pay

Performance Targets

3.0 %

Peer Performance Measures

3.0 %

Severance Vesting

7.4 %

Dilution Concerns

1.5 %

Significant Vote Against Pay Practices

3.0 %

CEO Pay Perks & Other Comp

3.0 %

CEO Pay NQDC

3.0 %

Governance - Ownership & Control

Controlling Shareholder

NO

Proxy Access

3.0 %

Constituency Provision

1.5 %

Fair Price Provision or Protection

1.5 %

Director Removal Without Cause

1.5 %

Shareholder Rights to Convene Meeting

1.5 %

Shareholder Action by Written Consent

1.5 %

Confidential Voting

1.5 %

Cumulative Voting

1.5 %

Governance - Accounting

No Flagged KeyMetrics

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 1 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

ESG Analysis

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

ESG KeyMetrics®

Flag

Impact

YES

0.0 %

Environmental

High Environmental Impact Company

Environmental Disclosure Change

1.5 %

Water Use Reporting

1.5 %

Waste Production Reporting

1.5 %

Alternative Energy

1.5 %

Impact Reduction Targets

Environmental Management

1.5 %

Environmental Certification

1.5 %

Social

High Social Impact Company

YES

0.0 %

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

ESG Analysis

The ESG profile for Abercrombie & Fitch Co. is characterized by several red flags,

highlighted by concerns related to pay and social impacts. Notable red flags include

KeyMetrics related to combined CEO/Chair, related party transactions, negative

director votes, peer performance measures, significant vote against pay practices,

CEO pay perks, CEO pay pension, strong classified board combination, proxy

access, labor practices, and discriminatory employment practices.

At the company's 2013 annual meeting, four directors received director withhold

votes of approximately 16 percent, indicating a significant level of shareholder

dissent.

ESG RATING ANALYSIS

This company was first assigned an ESG rating on 2/17/2012. A complete history

of its rating as of the first week of each month is shown in the chart above, and also

compared against the average rating for its sector and industry. You can hover over

the indicators on each charted line to show the letter grade rating and percentile

rank as of that date. Our current global ESG rating for Abercrombie & Fitch is an

overall D.

This rating falls into the lower ranges for all the companies we rate, indicating the

presence of significant concerns in one or more areas and the need for further

review and study.

Labor Practices

3.0 %

Discriminatory Employment Practices

3.0 %

Child Labor

3.0 %

Discriminatory Business Practices

3.0 %

Please note that ratings changes in the first part of the year reflect, in part, changes

due to GMI's annual ratings methodology updates and universe expansion.

Political Activity Disclosure

1.5 %

HIGHEST IMPACT KEYMETRICS

Pay Linked to Sustainability

1.5 %

Sustainability Reporting Framework

1.5 %

The following flagged KeyMetrics indicate the most important factors driving our

current ESG rating for Abercrombie & Fitch:

Sustainability Reporting

1.5 %

UN Global Compact

1.5 %

Workplace Safety Auditing

1.5 %

Workplace Safety Reporting

1.5 %

Controversies

No controversies found

Revenue

Share

Involvment

• Related Party Transactions

• Overboarded Non-Exec Directors

• Negative Director Votes

• Severance Vesting

Our ESG concerns at Abercrombie & Fitch are focused primarily on the company's

social impacts.

SOCIAL IMPACTS

Abercrombie & Fitch has been designated High Social Impact on the basis

of its primary operating industry. Social impacts, policies and practices at this

company are under continual review and monitoring, based on a combination

of news reports, legal and regulatory filings, and the company's own reporting

commitments. Ideally the company would have established links between its

incentive pay policies for company executives and the effective management

of its social and environmental impacts, but this is not the case. Abercrombie

& Fitch does not regularly publish a formal sustainability report. It does not

currently report on its sustainability policies and practices via the Global Reporting

Initiative, a commonly used and highly effective standard for such reporting, nor

has it become a voluntary signatory of the UN Global Compact, yet another

commonly employed global standard for achieving and maintaining more effective

sustainability practices. In the area of workplace safety this company has not yet

implemented OHSAS 18001 as its occupational health and safety management

system, nor does it actively disclose its workplace safety record in its annual report

or other reporting vehicle.

CORPORATE GOVERNANCE

EXECUTIVE PAY

CEO pay practices at Abercrombie & Fitch include a number of areas that may

raise concerns for shareholders.

The Abercrombie & Fitch board includes an independent compensation committee,

considered best practice for oversight of executive compensation.

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 2 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

ESG Analysis

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

For the most recently reported period the CEO's base salary was $1,528,846.

Non-equity incentive compensation was $1,731,600. Perquisites and other

miscellaneous compensation totaled $800,538.

One concern is that the board has executed a formal CEO employment agreement,

which may bind the ability of the compensation committee to make compensation

decisions that tie pay to performance.

The board has established a clawback policy regarding its executive incentive

pay, allowing it to recoup payouts that may have been the result of financial

misstatements or otherwise determined to have been undeserved.

We note that shareholder votes on compensation are mandatory in this market,

affording shareholders the ability to review and approve executive pay practices

at this company, which has been shown to have positive effects on executive pay

practices. Shareholders should be aware that more than 10 percent of shares

were voted against the company’s advisory vote on executive compensation ('say

on pay') at the most recent annual meeting. Given generally very high levels

of support for say-on-pay votes in this market (last year, only about 24.3% of

companies in this market received 10 percent or more dissenting votes), this result

indicates a significant level of shareholder discomfort with the company’s executive

compensation practices.

The following flagged KeyMetrics raise concerns regarding the board's ability to

implement and maintain effective incentives for the company's CEO and other top

executives:

• Unvested equity awards partially or fully accelerate upon the CEO’s termination,

characteristic of 90.2% of companies in the home market. Accelerated equity

vesting allows executives to realize pay opportunities without necessarily having

earned them through strong performance.

• The company has not disclosed specific, quantifiable performance target

objectives for the CEO, in contrast to 73.9% of companies in its home market that

have provided such metrics. Disclosure of performance metrics is essential for

investors to assess the rigor of incentive programs.

• The company pays long-term incentives to executives without requiring the

company to perform above the median of its peer group, which is the case for 90.7%

of companies in the Russell 3000 index. Incentive plans that pay for mediocre

performance undermine the linkage between pay and performance.

THE BOARD

The Abercrombie & Fitch board’s policies and practices do not raise significant

concerns at this time regarding its ability to properly oversee management and

represent shareholder interests, but shareholders should note the issues discussed

below.

The Abercrombie & Fitch board currently has an independent majority, which

enables it to more effectively fulfill its critical function of overseeing management

on behalf of shareholders. Additionally, the company has split the roles of CEO

and chair and has named a fully independent chairman, a practice that is

increasingly identified with superior board performance. An independent chairman

is characteristic of 26.9% of companies in the Russell 3000.

Multiple related party transactions and other potential conflicts of interest involving

the company's board or senior managers should be reviewed in greater depth, as

such practices, even when limited to current market rates, raise concerns regarding

potential self-dealing or abuse. We note that related party transactions are flagged

at a majority (50.8%) of companies in United States.

Additionally, we note that a collection of directors with long, coinciding tenure

can sometimes form a subgroup in which collegiality takes precedence over

rigorous oversight of a company’s affairs. In this case, for example, the

compensation decisions approved by this board have met with significant dissent

from shareholders at the most recent annual meeting. Related party transactions

raise additional concerns in this regard. Notably, one or more of the company's

directors have received a negative or withheld shareholder vote in excess of

10% in the company's most recently reported election, indicating a higher than

usual degree of shareholder dissatisfaction with that individual's performance

as a director. Under such circumstances we recommend further research into

that individual's role on the board, their personal background and experience,

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 3 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

ESG Analysis

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

involvement in potentially conflicted related party transactions, or service on

committees involved in problematic practices.

As a positive, the company has a majority standard for director elections, which

enables shareholders to better hold directors accountable in uncontested elections.

There are 12 directors in all and the board met 7 times in the last reported year.

There were also 4 non-executive meetings.

OWNERSHIP & CONTROL

While no significant concerns are raised by the company’s corporate governance

practices, shareholders should be aware of the potential risk factors enumerated

below.

Limits on shareholder rights and management-controlled takeover defense

mechanisms currently in place at Abercrombie & Fitch include:

• Constituency provisions that may be invoked to deter tender offers regarded as

hostile by current management

• Fair price provisions that fail to insure that all shareholders are treated fairly

• Limits on the right of shareholders to convene a special or emergency general

meeting

• Limits on the right of shareholders to take action by written consent

• The absence of confidential voting policies

• The absence of cumulative voting rights

ACCOUNTING AND FINANCIAL REPORTING

The Abercrombie & Fitch board of directors includes a fully independent

audit committee, and at least one member of that committee meets our

standards for financial expertise. The company's independent auditor is

PricewaterhouseCoopers LLP. For the most recently reported fiscal year,

Abercrombie & Fitch paid a total of $2,592,828 in audit and other related fees. This

figure includes $2,587,177 in basic audit fees.

ENVIRONMENTAL IMPACTS

Abercrombie & Fitch has been designated High Environmental Impact on the basis

of its primary operating industry. Environmental impacts, policies and practices at

this company are under continual review and monitoring, based on a combination

of news reports, legal and regulatory filings, and the company's own reporting

commitments.

The identification and use of alternative energy sources is an increasingly important

factor in improving a company's ability to reduce its future environmental impacts

and control future costs. Abercrombie & Fitch has been flagged for its limited

efforts in this area. The company has been flagged for its failure to establish

specific environmental impact reduction targets, a critical practice for any company

operating in a high environmental impact industry that is committed to its own

long-term sustainability. The company has been flagged for its failure to utilize an

environmental management system or to seek ISO 14001 certification for some or

all of its operations.

MATERIAL ESG EVENTS

On March 6, 2014, it was reported that Abercrombie & Fitch would pay $4075.96

to one Assistant Manager for failing to pay proper overtime wages under claims

that arose under the Fair Labor Standards Act.

On September 23, 2013, it was reported that Abercrombie &

Fitch had agreed to make religious accommodations to its policy governing

employees'

appearances as part of a settlement of discrimination lawsuits filed in

California. The lawsuits were filed on behalf of two Muslim women who claimed

the company discriminated against them because they were head scarves. Halla

Banafa sued in 2010 after she was denied a job at an Abercrombie store. Hani

Khan sued in 2011 after she was fired. The women's lawsuits were filed by the

U.S. Equal Employment Opportunity Commission.

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 4 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

ESG Analysis

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

On September 11, 2013, it was reported that a federal judge in California had ruled

Abercrombie & Fitch violated a law when it fired a Muslim woman for wearing a

headscarf. The company fired Umme-Hani Khan after she refused to remove her

headscarf, which she wears when she is in public or around men who are not

immediate family members. The company said she violated the "Look Policy,"

which forbids employees from wearing head wear. The policy is part of a marketing

strategy to convey the Abercrombie brand, the company said. Khan's supervisors

never informed her she was not complying with the policy, and permitted her to

wear her headscarf as long it matched company colors. Khan had been wearing

the headscarf at work for four months before the store's district manager abruptly

terminated her employment. The U.S. Equal Employment Opportunity Commission

sued on Khan's behalf, accusing the company of discriminating against employees

on the basis of religion.

On August 18, 2013, it was reported that a damning report on the Australian fashion

industry shows 93 per cent of brands do not know where their cotton is sourced,

making it likely child labour and exploitation have been involved. Brands Supre,

Abercrombie and Fitch, Rivers, Lacoste and the Specialty Group, which owns

Millers and Katies, were labelled as the worst in the report.

On July 23, 2013, France's official human rights watchdog Defenseur des Droits,

said it was investigating Abercrombie & Fitch Co over concerns the company

discriminates in hiring store staff based on appearance. The rights watchdog, an

official body that investigates suspected discrimination cases, cited in particular a

2006 interview with website salon.com in which Chief Executive Mike Jeffries said

the company hires good-looking people to attract good-looking customers.

On May 20, 2013, Abercrombie & Fitch brand Hollister Co. was found guilty of

discriminating against disabled shoppers because the steps at its store entrances

are not wheelchair-friendly. The company was embroiled in a legal battle for

four years following a slew of complaints from customers. The long-running case

originally grew from complaints filed against two Hollister stores in Colorado by the

Colorado Cross-Disability Coalition. In 2012 the Colorado-focused case grew into

a class-action suit targeting the 248 Hollister stores across the U.S. that feature

imitation porch steps as a main entrance. The U.S. Justice Department has also

weighed in on the discrimination case. It highlighted that the Hollister stores were

built long after the ADA came into play and therefore the entrances violate both

the 'spirit and letter of the law.'

On May 3, 2013, Business Insider reported Abercrombie & Fitch didn’t stock XL

or XXL sizes in women's clothing because they don't want overweight women

wearing their brand. A 2006 interview with Salon, CEO Michael Jeffries said that

his business was built around sex appeal. After the content of the interview was

disseminated through social media, the company faced widespread criticism of its

practices.

On April 17, 2013, Abercrombie and Fitch investigated calls for its clothes to be

taken off the shelves in Germany after tests revealed high levels of cancer-causing

chemical Benzidine. Germany's Plusminus magazine said a series of tests on a

woman's A&F top made in India had "extremely high" levels of the substance, used

in dyes, and said to cause bladder cancer.

On November 25, 2012, Abercrombie & Fitch settled an age-discrimination lawsuit

that raised questions about some of its workplace practices. The lawsuit was

brought against the company by a former pilot in 2010 claiming that he was unfairly

fired and replaced by a younger man. In court documents, the former pilot of

the company's jet detailed, among other examples, a flight manual defining a

mandatory dress code of boxer briefs, jeans below the waist, and a "spritz" of

Abercrombie cologne. No details of the settlement was disclosed.

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 5 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

ESG Analysis

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

300

Total Shareholder Return (as of 12-31-2013)

Values

200

5 Years 3 Years

1 Year

100

0

- 100

5 Year

3 Year

Abercrom bie & Fitch Co.

Industry

1 Year

Abercrombie & Fitch Co.

56.32

-39.99

-30.04

Retail - Apparel / Accessories

215.44

41.70

27.16

S&P 500

226.66

65.58

37.44

S&P 500

ESG KeyMetrics®

The GMI KeyMetrics list includes the ESG metrics (environmental, social and corporate governance) that most effectively summarize our numerical ESG

Scores and letter-grade ESG Ratings. Most are organized into topical components which have also been assigned their own numerical scores, and have

been calculated both as global and home market scores. Red flags ( ) are shown for those metrics that indicate specific areas of concern, the red flags

indicating more material concerns in the context of a specific company's rating. You can mouse over the metric names for a brief description of each item

and the flagging criteria used, and, except for event-driven metrics, click on the name to jump to the page where any additional information is to be found.

The Accounting (AGR) section includes similar information regarding the corporate governance and accounting metrics that comprise the AGR Rating.

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 6 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Business Overview

BUSINESS OVERVIEW

Abercrombie & Fitch Co. (A&F) through its subsidiaries, is a specialty

retailer of casual apparel for men, women and kids. Through stores

and direct-to-consumer operations, the Company is engaged in

selling an array of products including casual sportswear apparel,

including knit and woven shirts, graphic t-shirts, fleece, jeans and

woven pants, shorts, sweaters, outerwear, personal care products,

and accessories for men, women and kids under the Abercrombie

& Fitch, abercrombie kids, and Hollister brands. In addition, the

Company operates stores and direct-to-consumer operations offering

bras, underwear, personal care products, sleepwear and at-home

products for women under the Gilly Hicks brand. The Company

operates in three segments: U.S. Stores, International Stores, and

Direct-to-Consumer. As of February 2, 2013, the Company operated

912 stores in the United States and 139 stores outside of the United

States.

EQUITY COMPOSITION

Class A Common Stock $.01 Par, 04/11, 150M auth., 103,300,000

issd., 16,054,000 shs in Treas @ $725.3M. Insiders control 1.47%.

IPO: 10/96, 8,050,000 shs. @$16 by Goldman, Sachs & Co. 6/99, 2for-1 stock split. 5/98, converted all Class B into Class A. 7/29/95=26

weeks.

STOCK LISTINGS

Primary

Country

Exchange

Ticker

USA

NYSE

ANF

Issue Type

ANALYST FOOTNOTES

FY'00 Q's are restated for acct. change. FY '00-'99 financls are

reclass. FY'01 Q's are reclass. FY'95-'96, '99-'01 Summ. Q's as

reported.

FUNDAMENTAL SUMMARY

Key data relating to the company's fundamental business performance.

Income Statement

Total Revenue

Gross Profit

Total Operating Expense

Operating Income

Net Income Before Taxes

Net Income After Taxes

Net Income Before Extra. Items

Net Income

Income Available to Com Excl ExtraOrd

Income Available to Com Incl ExtraOrd

Diluted Net Income

Normalized Income Before Taxes

Normalized Income After Taxes

Normalized Inc. Avail to Com.

USD 1,033.3 mm

USD 651.0 mm

USD 1,068.7 mm

USD -35.4 mm

USD -37.0 mm

USD -15.6 mm

USD -15.6 mm

USD -15.6 mm

USD -15.6 mm

USD -15.6 mm

USD -15.6 mm

USD -37.0 mm

USD -15.6 mm

USD -15.6 mm

Balance Sheet

Total Current Assets

Total Assets

Total Current Liabilities

Total Debt

Total Liabilities

Total Equity

Total Liabilities & Shareholders' Equity

Total Common Shares Outstanding

USD 1,286.6 mm

USD 2,852.4 mm

USD 603.6 mm

USD 200.4 mm

USD 1,177.4 mm

USD 1,675.0 mm

USD 2,852.4 mm

USD 76.4 mm

FINANCIAL SUMMARY

BRIEF: For the 39 weeks ended 02 November 2013, Abercrombie

& Fitch Co. revenues decreased 7% to $2.82B. Net loss totaled

$11.5M vs. income of $79.8M. Revenues reflect U.S. Stores segment

decrease of 41% to $1.07B, International Stores segment decrease

of 26% to $583.7M, United States segment decrease of 40% to

$1.27B, Europe segment decrease of 27% to $540M, Comp. Store

Sales (%) - Hollister decrease from -0.3 to -15.5%.

ANNUAL MEETING

Date

06/20/2013

Location

Corporate Headquarters

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 7 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Business Overview

CONTACT INFO

Mailing address

6301 Fitch Path

NEW ALBANY, OH 43054 United States

Phone

+1-(614)-2836500

Fax

+1-(302)-6555049

Web Site

http://www.abercrombie.com

Incorporated in

Delaware, United States

Primary Contact

Mr. Ronald A Robers Jr.

1 614 283 6500

Senior Vice President, General Counsel and

Secretary

Investor Relations

Mr. Eric Cerny

1 614 283 6385

Manager, Investor Relations

General Counsel

Ronald A. Robins, Jr.

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 8 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Governance - Board

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Component Ratings

Country Inc:

United States

Home Market: United States

Global Home Market Sector Impact

ESG OVERALL

D

D

D

GOVERNANCE

C

C

C

Board

C

C

C

25.1 %

Pay

D

D

D

C

B

C

Apr 3, 2014

Nov 6, 2013

Company Peers

Company

67.5 %

Last Data Update:

Last ESG Rating Change:

Ticker

Country

Market

1 year

Cap ($mm) TSR

Total

Directors

Board Board

Rating Score

Foot Locker, Inc.

NYSE:FL

USA

6,769.07

32.01

10

B

Urban Outfitters, Inc.

NASD:URBN

USA

5,356.18

-5.74

7

F

4

23.7 %

Kate Spade & Co

NYSE:KATE

USA

4,565.74 157.59

12

C

60

13.3 %

Carter's, Inc.

NYSE:CRI

USA

4,080.01

29.88

10

B

84

DSW Inc.

NYSE:DSW

USA

3,217.63

31.31

11

C

28

Abercrombie & Fitch Co.

NYSE:ANF

USA

2,962.77 -30.04

12

C

51

Ascena Retail Group Inc

NASD:ASNA

USA

2,781.80

14.56

7

D

12

Chico's FAS, Inc.

NYSE:CHS

USA

2,469.50

3.46

8

C

59

American Eagle Outfitters

NYSE:AEO

USA

2,387.91 -28.05

9

C

66

Country: United States

Guess?, Inc.

NYSE:GES

USA

2,364.10

30.11

6

C

46

Home Market: United States

The Men's Wearhouse, Inc.

NYSE:MW

USA

2,297.32

67.05

10

D

20

Sector: Cyclical Consumer Goods / Services

The Buckle, Inc.

NYSE:BKE

USA

2,203.90

19.15

9

D

8

Ownership

Control

&

Accounting

ENVIRONMENTAL

SOCIAL

C

C

C

D

F

F

C

C

F

5.0 %

10.4 %

22.2 %

90

Data as of Apr 3, 2014

Governance - Board KeyMetrics

Flag

Impact

Related Party Transactions

7.4 %

Overboarded Non-Exec Directors

7.4 %

Negative Director Votes

7.4 %

Risk Management Expertise

3.0 %

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 9 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Governance - Board

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

About the Board

Chairman of the Board

Arthur C. Martinez

Chief Executive Officer

Michael S. Jeffries

Lead Director

Craig R. Stapleton

Formal Governance Policy Available?

Yes

Business Ethics Policy Available?

Yes

Full Board Meetings Held Last Year

7

Non-Executive Director Mtgs Held Last Year

4

Classified Board Elections?

No

Director Election Standard?

Majority

Independent Audit Committee?

Yes

Independent Comp Committee?

Yes

Independent Nominating Committee?

Yes

Board Has Outside Majority?

Yes

Total Directors

12

Inside Directors

1

Outside Directors

10

Outside Related Directors

1

Designated Directors

0

Directors Over 70

2

Directors With Over 15yrs Tenure

2

Overboarded Executive Directors

0

Overboarded Non-Executive Directors

1

Female Directors

2

Directors Who Are CEOs of a Rated Company

2

Directors Who Failed Min Attendance

0

Directors Who Hold Minimal Shares in the

Company

0

Flagged Directors

0

Board of Directors

Name

Age

Archie M. Griffin

Arthur C. Martinez

COB

Charles R. Perrin

Craig R. Stapleton

LD

Tenure Boards

Status

Relationship

58

14

1

Active

Outside

73

0

6

Active

Outside

68

0

2

Active

Outside

68

5

3

Active

Outside

Share Held Vote Against % Proxy Votes Year

36,999

11.50%

2011

24,025

16.08%

2013

Elizabeth M. Lee

69

4

1

Active

Outside

7,267

3.04%

2011

James B. Bachmann

70

11

2

Active

Outside

14,915

3.39%

2013

John W. Kessler

77

16

2

Active

Outside Related

14,289

16.69%

2013

Kevin S. Huvane

54

3

1

Active

Outside

4,500

15.97%

2013

Lauren J. Brisky

62

11

1

Active

Outside

23,492

10.13%

2011

1,500

16.01%

2013

1,007,728

4.14%

2013

Michael E. Greenlees

66

3

1

Active

Outside

Michael S. Jeffries

69

18

1

Active

Inside

67

0

3

Active

Outside

CEO

Terry Burman

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 10 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Governance - Board

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Name

Country Inc:

United States

Home Market: United States

Age

Allan A. Tuttle

Tenure Boards

Last Data Update:

Last ESG Rating Change:

Status

Relationship

Apr 3, 2014

Nov 6, 2013

Share Held Vote Against % Proxy Votes Year

3

0

Retired

Outside

8,451

Daniel J. Brestle

67

2

1

Retired

Outside

2,394

3.46%

2008

Edward F. Limato

73

7

0

Retired

Outside

16,971

48.41%

2010

John A. Golden

64

10

0

Retired

Kathryn D. Sullivan Ph.D.

59

3

0

Retired

Outside

54,082

8.57%

2007

Outside

200

Leslie H. Wexner

75

2

1

Retired

Outside Related

Robert A. Rosholt

63

2

1

Retired

Outside

25.87%

2010

Robert S. Singer

61

1

2

Retired

Inside

4,269

Russell M. Gertmenian

61

9

0

Retired

Outside

35,728

12.81%

2005

Sam N. Shahid Jr.

67

7

0

Retired

Outside Related

4,058

Seth R. Johnson

59

6

1

Retired

Inside

56,249

0

1,930

Board Committees

Name

Age

Board Tenure

Committee Status

Relationship

Audit Committee (met 8 time(s) last year)

Name

Age

Board Tenure

Lauren J. Brisky

62

James B. Bachmann

70

Craig R. Stapleton

Michael E. Greenlees

Charles R. Perrin

Committee Status

Relationship

11

X

Outside

11

C

Outside

68

5

X

Outside

66

3

X

Outside

68

0

X

Outside

Compensation Committee (met 6 time(s) last year)

Name

Age

Board Tenure

Committee Status

Relationship

Terry Burman

67

0

X

Outside

Charles R. Perrin

68

0

X

Outside

Craig R. Stapleton

68

5

X

Outside

Kevin S. Huvane

54

3

X

Outside

66

3

C

Outside

Michael E. Greenlees

Executive Committee (met 4 time(s) last year)

Name

Age

Board Tenure

Committee Status

Relationship

Craig R. Stapleton

68

5

X

Outside

John W. Kessler

77

16

C

Outside Related

Michael S. Jeffries

69

18

X

Inside

Nominating and Governance Committee (met 6 time(s) last year)

Name

Age

Board Tenure

Committee Status

Relationship

Craig R. Stapleton

68

5

C

Outside

Terry Burman

67

0

X

Outside

Lauren J. Brisky

62

11

X

Outside

58

14

X

Outside

Archie M. Griffin

Corporate Social Responsibility Committee (met 4 time(s) last year)

Name

Age

Board Tenure

Committee Status

Relationship

John W. Kessler

77

16

X

Outside Related

Archie M. Griffin

58

14

C

Outside

Elizabeth M. Lee

69

4

X

Outside

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 11 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Governance - Board

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Name

Kevin S. Huvane

Age

Board Tenure

Committee Status

Relationship

54

3

X

Outside

Auditor: PricewaterhouseCoopers LLP

Payment Amount

Audit Fees

2,587,177

Audit Related Fees

0

Audit Tax Fees

5,651

Other Audit Fees

0

Total Fees

$ 2,592,828

Last Data Update:

Last ESG Rating Change:

Apr 3, 2014

Nov 6, 2013

Auditor Fees

Other: 0.00 %

Audit Tax : 0.22 %

Audit Related: 0.00 %

Audit: 99.78 %

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 12 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Arthur C. Martinez

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Arthur C. Martinez is Non-Executive Independent Chairman of the Board of Abercrombie & Fitch Co. Mr.

Martinez brings substantial public company board experience and senior executive experience in the retail

industry. Mr. Martinez currently serves on the Board of Directors of American International Group, IAC/Interactive

Corporation, Fifth & Pacific Companies (formerly Liz Claiborne), International Flavors & Fragrances, Inc., where

he is Lead Director, and HSN, Inc., where he is Chairman. In connection with his appointment as a Director

and Non-Executive Chairman of Abercrombie & Fitch, Mr. Martinez has notified the boards of two companies,

of which he currently is a director, that he will not stand for reelection at the next annual meeting. Mr. Martinez

previously served on the Board of PepsiCo, Inc. and was Chairman of the Board of the Federal Reserve Bank of

Chicago. He also served as Chairman and CEO of Sears, Roebuck and Co. and prior to that was Vice Chairman

and a Director of Saks Fifth Avenue. Prior to that, Mr. Martinez served as the Group Chief Executive for the

retail division of B.A.T. Industries/BATUS, Inc., which included Saks Fifth Avenue, Marshall Field’s and other

department stores. Mr. Martinez received a B.S. degree from Polytechnic University of New York University, and

an M.B.A. degree from Harvard Business School.

Non-Executive Chairman of the

Board

Start Date :

Jan 27, 2014

External Directorships

Company

Current

ESG Rating

Current AGR Rating

Title

Dates

IAC/InterActiveCorp (NASD:IACI)

C

Average (60)

Director

- Head of Compensation Committee

- Head of Human Resources

Committee

Sep 15, 2005

- Jun 15, 2014

Kate Spade & Co (NYSE:KATE)

C

Very Aggressive (10)

Director

- Head of Compensation Committee

- Member of Audit Committee

Jan 3, 2001 May 15, 2014

PepsiCo, Inc. (NYSE:PEP)

C

Average (55)

Director

May 15, 1999

- May 2, 2012

Martha Stewart Living Omnimedia, Inc.

(NYSE:MSO)

C

Average (70)

Director

Jun 4, 2003 Jul 27, 2004

Abercrombie & Fitch Co. (NYSE:ANF)

D

Average (75)

Non-Executive Chairman of the

Board

Jan 27, 2014

- Present

American International Group Inc (NYSE:AIG)

C

Average (59)

Director

- Head of Compensation Committee

- Member of Governance Committee

- Member of Nominating Committee

Jun 15, 2009

- Present

International Flavors & Fragrances Inc

(NYSE:IFF)

C

Aggressive (16)

Director

- Member of Audit Committee

- Member of Governance Committee

- Member of Nominating Committee

Jun 30, 2006

- Present

HSN, Inc. (NASD:HSNI)

C

Average (54)

Chairman of the Board

- Head of Governance Committee

- Head of Nominating Committee

- Member of Executive Committee

Aug 15, 2008

- Present

Education

Name

Degree

University of Notre Dame

Juris Doctor

Harvard University

Masters of Business

Administration

Polytechnic University in New York

Bachelor of Science

Printed on Apr 10, 2014

Major

Graduated

Mechanical

Engineering

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 13 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Michael S. Jeffries

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Michael S. Jeffries is Chief Executive Officer, Director of Abercrombie & Fitch Co. Mr. Jeffries has served

as Chairman of the Company since May 1998, and as Chief Executive Officer of the Company since February

1992. From February 1992 until May 1998, Mr. Jeffries held the title of President of the Company.

Chief Executive Officer, Director

Committees :

Executive

Start Date :

Jan 27, 2014

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Printed on Apr 10, 2014

Current

ESG Rating

Current AGR Rating

D

Average (75)

Title

Chief Executive Officer, Director

- Member of Executive Committee

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Dates

Jan 27, 2014

- Present

Page 14 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Jonathan E. Ramsden

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Jonathan E. Ramsden is Chief Financial Officer, Chief Operating Officer of Abercrombie & Fitch Co. From

December 1998 to December 2008, Mr. Ramsden served as Chief Financial Officer and a member of the

Executive Committee of TBWA Worldwide, a large advertising agency network and a division of Omnicom

Group Inc. Prior to becoming Chief Financial Officer of TWBA Worldwide, he served as Controller and Principal

Accounting Officer of Omnicom Group Inc. from June 1996 to December 1998.

Chief Financial Officer, Chief

Operating Officer

Start Date :

Jan 27, 2014

External Directorships

Company

Current

ESG Rating

Current AGR Rating

Omnicom Group Inc. (NYSE:OMC)

C

Aggressive (23)

Abercrombie & Fitch Co. (NYSE:ANF)

D

Average (75)

Printed on Apr 10, 2014

Title

Controller

Chief Financial Officer, Chief

Operating Officer

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Dates

Jun 15, 1996 Jun 15, 1998

Jan 27, 2014

- Present

Page 15 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

James N. Bierbower

Apr 3, 2014

Nov 6, 2013

Title :

Mr. James N. Bierbower is Executive Vice President - Human Resources of Abercrombie & Fitch Co. He joined

Abercrombie & Fitch in 2006 as Vice President - Organizational Development. He was promoted to Senior Vice

President in 2008 and assumed his most current role as Senior Vice President - Human Resources two years

ago. Mr. Bierbower is a graduate of the University of Pennsylvania's Wharton School. Prior to joining A&F, he

held a variety of positions in merchandising, human resources, finance and operations with The May Department

Stores Company.

Executive Vice President - Human

Resources

Start Date :

Feb 26, 2014

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Current

ESG Rating

Current AGR Rating

D

Average (75)

Title

Executive Vice President - Human

Resources

Dates

Feb 26, 2014

- Present

Education

Name

Degree

Major

Graduated

Wharton School of Business at the University of

Pennsylvania

Printed on Apr 10, 2014

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 16 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Diane Chang

Apr 3, 2014

Nov 6, 2013

Title :

Ms. Diane Chang is Executive Vice President - Sourcing of Abercrombie & Fitch Co., since May 2004. Prior

thereto, Ms. Chang held the position of Senior Vice President — Sourcing of A&F from February 2000 to May

2004 and the position of Vice President — Sourcing of A&F from May 1998 to February 2000.

Executive Vice President - Sourcing

Start Date :

May 15, 2004

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Printed on Apr 10, 2014

Current

ESG Rating

Current AGR Rating

Title

Dates

D

Average (75)

Executive Vice President - Sourcing

May 15, 2004

- Present

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 17 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Leslee K. Herro

Apr 3, 2014

Nov 6, 2013

Title :

Ms. Leslee K. Herro is Executive Vice President - Planning and Allocation of Abercrombie & Fitch Co., since May

2004. Prior thereto, Ms. Herro held the position of Senior Vice President — Planning and Allocation of A&F from

February 2000 to May 2004 and the position of Vice President — Planning & Allocation of A&F from February

1994 to February 2000.

Executive Vice President - Planning

and Allocation

Start Date :

May 15, 2004

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Printed on Apr 10, 2014

Current

ESG Rating

Current AGR Rating

D

Average (75)

Title

Executive Vice President - Planning

and Allocation

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Dates

May 15, 2004

- Present

Page 18 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Amy Zehrer

Apr 3, 2014

Nov 6, 2013

Title :

Ms. Amy Zehrer is Executive Vice President - Stores of Abercrombie & Fitch Co. Prior thereto, Ms. Zehrer held

the position of Senior Vice President — Stores of A&F from November 2007 to February 2013 and the position

of Vice President — Stores of A&F from August 2006 to November 2007. Ms. Zehrer has been with A&F since

1992 playing an integral part in evolving the brands and the success of the Company's international expansion.

Executive Vice President - Stores

Start Date :

Feb 26, 2013

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Printed on Apr 10, 2014

Current

ESG Rating

Current AGR Rating

D

Average (75)

Title

Executive Vice President - Stores

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Dates

Feb 26, 2013

- Present

Page 19 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Robert E. Bostrom

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Robert E. Bostrom has been appointed as Senior Vice President, General Counsel, Corporate Secretary of

Abercrombie & Fitch Co., effective January 2014. Mr. Bostrom, who graduated from Boston College Law School in

1980. Mr. Bostrom joins Abercrombie from international law firm Greenberg Traurig, where he served as Co-Chair

of the Financial Regulatory and Compliance Practice, a firm known for quality and innovation and particularly

experienced in the areas of law and business concerns. Prior to that, Mr. Bostrom was Executive Vice President,

General Counsel and Corporate Secretary of The Federal Home Loan Mortgage Corporation, where he played

a pivotal role directing the company's legal strategy during the financial crisis. During his tenure, he was named

one of the most influential in-house counsels in Washington DC by The National Law Journal, and Freddie Mac

was recognized as having one of the country's Best Legal Departments in 2011 by Corporate Counsel magazine.

He has advised boards of directors and committees on corporate governance issues, compliance and enterprise

risk management programs, and crisis management. Earlier in his career, Mr. Bostrom served as Executive Vice

President and General Counsel - Legal and Regulatory of National Westminster Bancorp, which controlled a

large US subsidiary of a major global bank, and ultimately helped structure the sale of the bank for $3.6 billion.

Senior Vice President, General

Counsel, Corporate Secretary

Start Date :

Jan 15, 2014

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Current

ESG Rating

Current AGR Rating

D

Average (75)

Federal Home Loan Mortgage Corp (OTC:FMCC)

Conservative (99)

Title

Dates

Senior Vice President, General

Counsel, Corporate Secretary

Jan 15, 2014

- Present

Executive Vice President, General

Counsel, Corporate Secretary

Feb 1, 2006 Jul 29, 2011

Education

Name

Degree

Boston College

Juris Doctor

Columbia University

Masters

Franklin and Marshall College

Bachelor of Arts

Printed on Apr 10, 2014

Major

Graduated

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 20 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

James B. Bachmann

Apr 3, 2014

Nov 6, 2013

Title :

Mr. James B. Bachmann is Independent Director of Abercrombie & Fitch Co., since July 2003. Mr. Bachmann

retired in 2003 as Managing Partner of the Columbus, Ohio office of Ernst & Young LLP, after serving in various

management and audit engagement partner roles in his 36 years with the firm. Mr. Bachmann also serves as the

lead independent director and Chair of the Audit Committee of Lancaster Colony Corporation, a company which

manufactures and markets food products and for which he has served as a director since 2003.

Director

Committees :

Audit (HEAD)

Start Date :

Jul 11, 2003

External Directorships

Company

Current

ESG Rating

Current AGR Rating

Title

Dates

Lancaster Colony Corp. (NASD:LANC)

C

Average (84)

Director

- Head of Audit Committee

- Member of Executive Committee

Nov 15, 2007

- Present

Abercrombie & Fitch Co. (NYSE:ANF)

D

Average (75)

Director

- Head of Audit Committee

- Member of Compensation

Committee

Jul 11, 2003

- Present

Education

Name

Degree

John Carroll University

Bachelors

Printed on Apr 10, 2014

Major

Graduated

Accounting

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 21 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Lauren J. Brisky

Apr 3, 2014

Nov 6, 2013

Title :

Ms. Lauren J. Brisky is Independent Director of Abercrombie & Fitch Co., since July 2003. Ms. Brisky retired

February 1, 2009 as the Vice Chancellor for Administration and Chief Financial Officer of Vanderbilt University,

after serving 10 years in that capacity. As the Vice Chancellor for Administration and Chief Financial Officer,

she served as the financial liaison for Vanderbilt University’s Audit, Budget and Executive Committees and

was responsible for Vanderbilt University’s financial management as well as administrative infrastructure,

which included such areas as facilities and construction, human resources, information systems and business

operations. She served as Associate Vice Chancellor for Finance of Vanderbilt University from 1988 until her

1999 appointment to Vice Chancellor. Ms. Brisky has also held positions at the University of Pennsylvania,

Cornell University and North Carolina State University. She serves as Chair of the Board of Trustees for Simmons

College, where she has served as a member of the Board since 2000. Ms. Brisky has also served as a member

of the Board of Directors of the Metropolitan Sports Authority of Nashville since 2004.

Director

Committees :

Audit , Governance , Nominating

Start Date :

Jul 11, 2003

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Current

ESG Rating

Current AGR Rating

D

Average (75)

Title

Director

- Member of Audit Committee

- Member of Governance Committee

- Member of Nominating Committee

Dates

Jul 11, 2003

- Present

Education

Name

Degree

Cornell University

Masters of Business

Administration

Simmons College of Kentucky

Bachelor of Arts

Printed on Apr 10, 2014

Major

Graduated

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 22 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Terry Lee Burman

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Terry Lee Burman is Independent Director of Abercrombie & Fitch Co. Mr. Burman brings to the Board

significant experience and expertise in the retail industry. Mr. Burman is currently Chairman of Zale Corporation,

and he serves on the Board of Tuesday Morning Corporation. He previously served on the Boards of Barry’s

Jewelers, Inc., Caesars World, Inc., Unimax Corporation and Yankee Candle Company. Mr. Burman was

previously CEO of Signet Jewelers Ltd. and served on the Signet Board of Directors. Prior to Signet, Mr. Burman

was President and CEO of Barry’s Jewelers, Inc. Mr. Burman received a B.S. from the University of Southern

California.

Director

Committees :

Compensation , Governance ,

Nominating

Start Date :

Jan 27, 2014

External Directorships

Company

Current

ESG Rating

Current AGR Rating

Abercrombie & Fitch Co. (NYSE:ANF)

D

Average (75)

Director

- Member of Compensation

Committee

- Member of Governance Committee

- Member of Nominating Committee

Jan 27, 2014

- Present

Zale Corporation (NYSE:ZLC)

C

Average (38)

Chairman of the Board

May 31, 2013

- Present

Tuesday Morning Corporation (NASD:TUES)

C

Average (57)

Director

- Member of Audit Committee

- Member of Compensation

Committee

- Member of Governance Committee

- Member of Nominating Committee

Feb 4, 2013

- Present

Average (54)

Director

- Member of Audit Committee

- Member of Compensation

Committee

Oct 23, 2007

- Present

Yankee Holding Corp. (AI:B1E33)

Signet Jewelers Ltd. (NYSE:SIG)

C

Aggressive (20)

Title

Chief Executive Officer, Director

Dates

Jun 15, 2000 Jan 29, 2011

Education

Name

Degree

University of Southern California

Bachelor of Science

Printed on Apr 10, 2014

Major

Graduated

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Page 23 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Michael E. Greenlees

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Michael E. Greenlees has been appointed as Independent Director of Abercrombie & Fitch Co., effective

February 15, 2011. Since 2007, Mr. Greenlees has served as Chief Executive Officer of Ebiquity plc, a U.K

based company that provides data-driven insights to the global media and marketing community and is listed

on the London Stock Exchange’s AIM market. Mr. Greenlees was one of the original founding partners of Gold

Greenlees Trott, or The GGT Group plc, an international advertising and marketing group. The GGT Group plc

was listed on the London Stock Exchange in 1986 at which time Mr. Greenlees became Chairman and Chief

Executive Officer, a role he occupied for over 10 years until the company’s sale to Omnicom Group Inc., a holding

company for a number of advertising and marketing services businesses, in 1998. At that time, Mr. Greenlees

joined the Board of Directors of Omnicom Group Inc. and served as President and Chief Executive of TBWA

Worldwide Inc., a subsidiary with offices in nearly 70 countries. In 2001, Mr. Greenlees became Executive Vice

President of Omnicom Group Inc. and served in that role until 2003. From 2004 to 2006, he served as Chief

Executive Officer of FastChannel Network, Inc., a software solutions business targeting the advertising and media

community. Mr. Greenlees has served on the boards of several public companies, including Omnicom Group

Inc., Hewitt Associates Inc., and Ebiquity plc.

Director

Committees :

Compensation (HEAD) , Audit

Start Date :

Feb 15, 2011

External Directorships

Company

Abercrombie & Fitch Co. (NYSE:ANF)

Current

ESG Rating

Current AGR Rating

D

Average (75)

Director

- Head of Compensation Committee

- Member of Audit Committee

Feb 15, 2011

- Present

Average (56)

Chief Executive Officer, Executive

Director

Oct 10, 2007

- Present

Aggressive (23)

Executive Vice President, Director

Mar 15, 2001 May 21, 2002

Ebiquity plc (SEA:EBQ)

Omnicom Group Inc. (NYSE:OMC)

Printed on Apr 10, 2014

C

Title

This report is for information purposes and should not be considered a solicitation to buy or sell any security. GMI Ratings does

not guarantee its accuracy or make warranties regarding its usage. This report and all of the information contained in it, including

without limitation all text, data, charts, graphs (the "Information") is the property of GMI Ratings, its subsidiaries, or in some

cases third party data suppliers. The Information may not be reproduced, displayed, redistributed or re-transmitted in whole or

in part, in any form, without prior written permission of GMI Ratings. Copyright © 2003-2014 GMI Ratings. All rights reserved.

Dates

Page 24 of 49

Abercrombie & Fitch Co. (NYSE:ANF)

Global ESG Rating:

D (17)

Industry:

Market Cap:

Director Bio

Retail - Apparel / Accessories

USD 2,962.8mm (Mid Cap)

Country Inc:

United States

Home Market: United States

Last Data Update:

Last ESG Rating Change:

Archie M. Griffin

Apr 3, 2014

Nov 6, 2013

Title :

Mr. Archie M. Griffin is Independent Director of Abercrombie & Fitch Co., since August 2000. Since July 2010,