h The role of the business model in financial statements

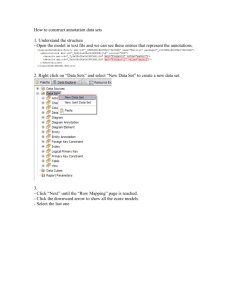

advertisement