SPEEDY (0SP BU) COMPANY OVERVIEW

16-Feb-15

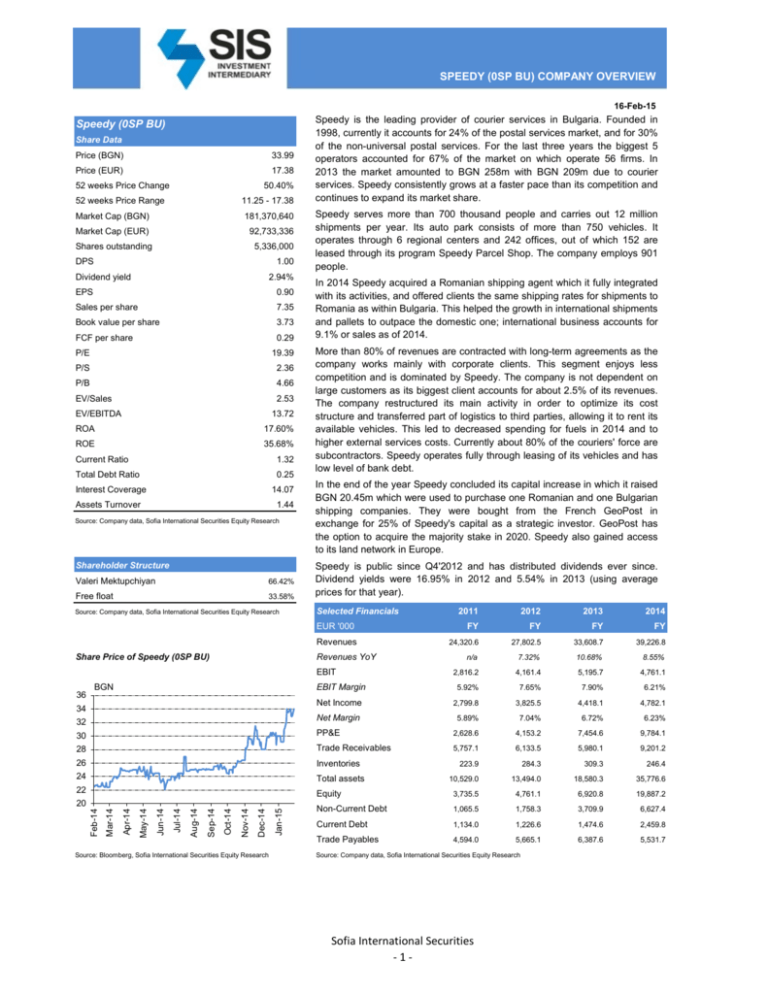

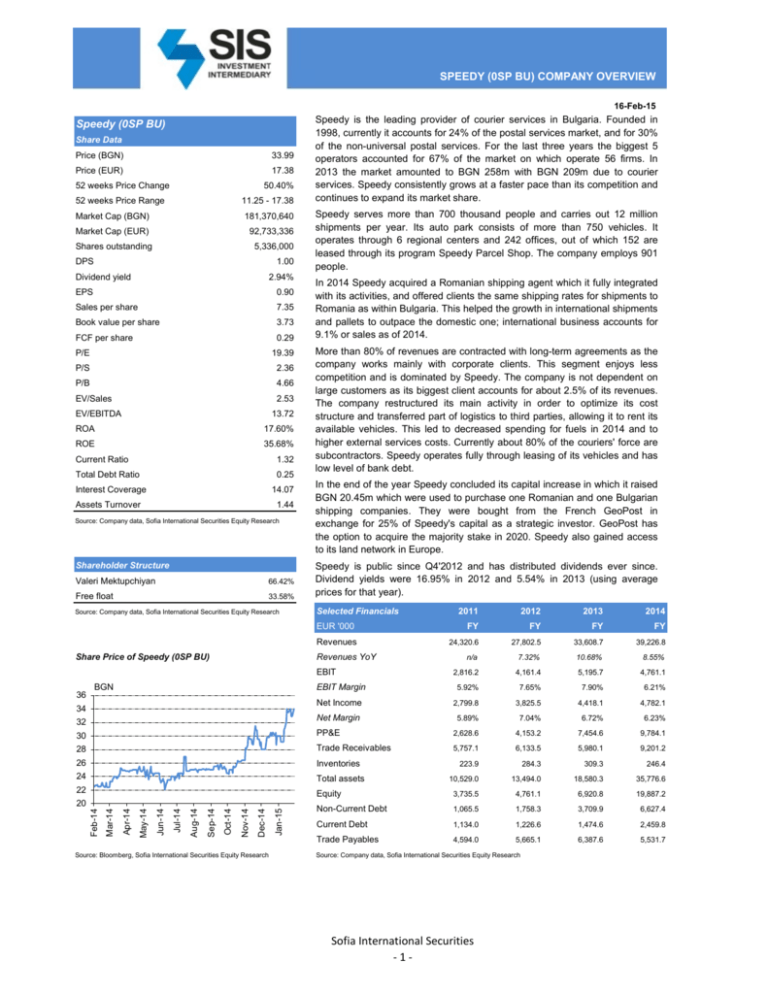

Speedy (0SP BU)

Share Data

Price (BGN)

33.99

Price (EUR)

17.38

52 weeks Price Change

50.40%

52 weeks Price Range

11.25 - 17.38

Market Cap (BGN)

181,370,640

Market Cap (EUR)

92,733,336

Shares outstanding

5,336,000

DPS

1.00

Dividend yield

2.94%

EPS

0.90

Sales per share

7.35

Book value per share

3.73

FCF per share

0.29

P/E

19.39

P/S

2.36

P/B

4.66

EV/Sales

2.53

EV/EBITDA

13.72

ROA

17.60%

ROE

35.68%

Current Ratio

1.32

Total Debt Ratio

0.25

Interest Coverage

14.07

Assets Turnover

1.44

Source: Company data, Sofia International Securities Equity Research

Shareholder Structure

Valeri Mektupchiyan

66.42%

Free float

33.58%

Source: Company data, Sofia International Securities Equity Research

Speedy is the leading provider of courier services in Bulgaria. Founded in

1998, currently it accounts for 24% of the postal services market, and for 30%

of the non-universal postal services. For the last three years the biggest 5

operators accounted for 67% of the market on which operate 56 firms. In

2013 the market amounted to BGN 258m with BGN 209m due to courier

services. Speedy consistently grows at a faster pace than its competition and

continues to expand its market share.

Speedy serves more than 700 thousand people and carries out 12 million

shipments per year. Its auto park consists of more than 750 vehicles. It

operates through 6 regional centers and 242 offices, out of which 152 are

leased through its program Speedy Parcel Shop. The company employs 901

people.

In 2014 Speedy acquired a Romanian shipping agent which it fully integrated

with its activities, and offered clients the same shipping rates for shipments to

Romania as within Bulgaria. This helped the growth in international shipments

and pallets to outpace the domestic one; international business accounts for

9.1% or sales as of 2014.

More than 80% of revenues are contracted with long-term agreements as the

company works mainly with corporate clients. This segment enjoys less

competition and is dominated by Speedy. The company is not dependent on

large customers as its biggest client accounts for about 2.5% of its revenues.

The company restructured its main activity in order to optimize its cost

structure and transferred part of logistics to third parties, allowing it to rent its

available vehicles. This led to decreased spending for fuels in 2014 and to

higher external services costs. Currently about 80% of the couriers' force are

subcontractors. Speedy operates fully through leasing of its vehicles and has

low level of bank debt.

In the end of the year Speedy concluded its capital increase in which it raised

BGN 20.45m which were used to purchase one Romanian and one Bulgarian

shipping companies. They were bought from the French GeoPost in

exchange for 25% of Speedy's capital as a strategic investor. GeoPost has

the option to acquire the majority stake in 2020. Speedy also gained access

to its land network in Europe.

Speedy is public since Q4'2012 and has distributed dividends ever since.

Dividend yields were 16.95% in 2012 and 5.54% in 2013 (using average

prices for that year).

Selected Financials

EUR '000

Revenues

Share Price of Speedy (0SP BU)

Revenues YoY

EBIT

36

BGN

34

2011

2012

2013

FY

FY

FY

2014

FY

24,320.6

27,802.5

33,608.7

39,226.8

n/a

7.32%

10.68%

8.55%

2,816.2

4,161.4

5,195.7

4,761.1

EBIT Margin

5.92%

7.65%

7.90%

6.21%

Net Income

2,799.8

3,825.5

4,418.1

4,782.1

32

Net Margin

5.89%

7.04%

6.72%

6.23%

30

PP&E

2,628.6

4,153.2

7,454.6

9,784.1

28

Trade Receivables

5,757.1

6,133.5

5,980.1

9,201.2

26

Inventories

223.9

284.3

309.3

246.4

24

Total assets

10,529.0

13,494.0

18,580.3

35,776.6

22

Equity

3,735.5

4,761.1

6,920.8

19,887.2

Non-Current Debt

1,065.5

1,758.3

3,709.9

6,627.4

Current Debt

1,134.0

1,226.6

1,474.6

2,459.8

Trade Payables

4,594.0

5,665.1

6,387.6

5,531.7

Source: Bloomberg, Sofia International Securities Equity Research

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

20

Source: Company data, Sofia International Securities Equity Research

Sofia International Securities

-1-

Sales by shipments in Q4'14

Income statement

2011

2012

2013

FY

FY

FY

FY

Revenues

24,320.6

27,802.5

33,608.7

39,226.8

Expenses

-39,307.0

-43,730.0

-52,429.0

-62,573.0

4,223.3

5,443.7

6,802.2

7,233.8

-1,407.1

-1,282.3

-1,606.5

-2,472.6

2,816.2

4,161.4

5,195.7

4,761.1

297.1

96.6

-257.2

552.2

-162.1

-199.4

-428.0

-338.5

3,113.3

4,258.0

4,938.6

5,313.3

-313.4

-432.6

-520.5

-531.2

2,799.8

3,825.5

4,418.1

4,782.1

EUR '000

International

shipments

9%

Others

6%

EBITDA

Depreciation

EBIT

Net financial result

t/o interest expense

EBT

Domestic

shipments

85%

Taxes

Net Income (before minorities)

Minorities

Net Income

Source: Company data, Sofia International Securities Equity Research

Sales vs. EBIT Margin

%

14.97

15.46

12.14

2012

2013

Revenues

18

16

14

12

10

8

6

4

2

0

0.0

0.0

0.0

3,825.5

4,418.1

4,782.1

9,784.1

2,628.6

4,153.2

7,454.6

Intangibles

173.3

193.3

310.9

193.3

Other Non-Current Assets

559.9

571.1

567.0

13,587.1

3,361.7

4,917.6

8,332.5

23,564.4

223.9

284.3

309.3

246.4

5,757.1

6,133.5

5,980.1

9,201.2

Cash & Cash Equivalents

962.3

2,003.8

3,687.9

2,566.2

Other Current Assets

223.9

154.9

270.5

198.4

7,167.3

8,576.4

10,247.8

12,212.2

10,529.0

13,494.0

18,580.3

35,776.6

Equity

3,735.5

4,761.1

6,920.8

19,887.2

Non-Current Debt

1,065.5

1,758.3

3,709.9

6,627.4

0.0

0.0

0.0

0.0

Non-Current Liabilities

1,065.5

1,758.3

3,709.9

6,627.4

Trade Payables

4,594.0

5,665.1

6,387.6

5,531.7

Current Debt

1,134.0

1,226.6

1,474.6

2,459.8

0.0

82.8

87.4

1,270.6

5,728.0

6,974.5

7,949.6

9,262.1

10,529.0

13,494.0

18,580.3

35,776.6

Cashflow from Operations

3,155.2

4,296.4

5,667.7

5,623.7

Cashflow from Investments

-300.6

-235.2

-796.1

-14,025.2

-1,218.9

Non-Current Assets

Inventories

Trade Receivables

Current Assets

Total Assets

2014

EBIT Margin (RS)

Source: Company data, Sofia International Securities Equity Research

Other Non-Current Liabilities

ROE (DuPont Decomposition)

3.2

2.8

2.4

2.0

1.6

1.2

0.8

0.4

0.0

0.0

2,799.8

Balance sheet

PP&E

EUR m

45

40

35

11.58

30

25

20

15

10

5

0

2011

2014

x

%

100

Other Current Liabilities

80

60

Current Liabilities

Total Equity and Liabilites

40

Cash Flow Statement

20

0

2011

2012

2013

2014

t/o Capex

ROE (RS)

Net Profit Margin (RS)

Cashflow from Financing

Assets Turnover

Financial Leverage

Net Cash

Source: Company data, Sofia International Securities Equity Research

-300.6

-235.2

-796.1

-2,722.1

-3,019.7

-3,184.3

7,285.4

132.4

1,041.5

1,687.3

-1,116.2

Source: Company data, Sofia International Securities Equity Research

Sofia International Securities

Nikolay Dimov

Martin Georgiev

Equity Research

Equity Analyst

Executive Director

+359 2 937 98 74

+359 2 937 98 66

dimov@sis.bg

martin.georgiev@sis.bg

Tel: +359 2 988 63 40

Fax: +359 2 937 98 77

E-mail: info@sis.bg; ndimov@bloomberg.net

Sofia International Securities

-2-

Disclaimers and Required Disclosures

The research and the recommendations in this report have been prepared and reviewed by:

Nikolay Dimov

Equity Analyst

dimov@sis.bg

Martin Georgiev

Executive Director

martin.georgiev@sis.bg

The individuals responsible for the preparation of this report certify that they have not received nor will receive compensation in exchange for

expressing specific views or recommendations in this report. Sofia International Securities AD and the individuals responsible for this report accept

no liability whatsever for any losses arising from the use of information or opinions expressed in this report.

Sofia International Securities AD is a member of Bulgarian Stock Exchange (BSE) and the Central Depository of Bulgaria. The company provides

brokerage, investment banking, equity research, portfolio management and other services. Sofia International Securities AD is regulated by the

Financial Supervision Commission of Bulgaria.

Sofia International Securities is not registered as a broker or dealer with the Securities and Exchange Commission or NASD in the United States of

America and the information may be distributed in the US only to individuals who by acceptance hereof confirm that they represent “major

institutional investors” as defined in Regulation 15a-16 of the Securities Exchange Act of 1934.

Any opinions expressed in this report are subject to change without notice and Sofia International Securities is not under any obligation to update or

keep current the information contained herein. Any opinions expressed in this report are only correct as of the stated date of their issue.

This report has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. The report is

published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial

instruments. The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. The report is based

on information obtained from sources believed to be reliable but is not guaranteed as being accurate, nor is it a complete statement or summary of

the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of

their own judgment.

Sofia International Securities does not own shares of the company that is subject of this report. The individuals who are responsible for the

preparation of this report do not own shares of the company that is subject of the report. Sofia International Securities is not a market maker in the

securities that are subject of this report. Sofia International Securities do not provide any corporate finance or other services to the company that is

subject of this report. However, Sofia International Securities may seek to provide such services in the future.

Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income

of any security or related instrument mentioned in this report. Sofia International Securities accepts no liability whatsoever for any loss or damage

of any kind arising out of the use of all or any part of this report. Additional information will be made available upon request.

For more detailed information about the company, please contact our research department.

© 2014-2015. All rights reserved. No part of this report may be reproduced or distributed in any manner without the written permission of Sofia

International Securities.

Sofia International Securities

1113 Sofia

3A Nikolay Haytov Str.

Tel.: + 359 2 988 63 40

Fax: + 359 2 937 98 70

Sofia International Securities

-3-