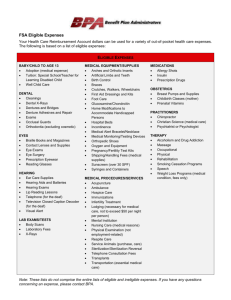

Medical expenses

advertisement

Medical expenses Singles and families may be able to claim a tax tax offset is completely phased out. Nevertheless, you may still be able to claim offset for out-of-pocket disability aids, attendant care or aged care medical expenses incurred during the year. expenses above the relevant claim amount until 1 July 2019, even if these expenses have not been claimed in the prior year. Please note the net medical expenses tax Net Medical Expenses from 1 July 2013 offset is means tested from 1 July 2012 and is Income below MLS Income above MLS being phased out in the 20% of excess above $2,120 10% of excess above $5,000 upcoming financial years. Qualifing for the tax offset Eligible medical expenses The offset applies to medical expenses incurred Not all medical expenses are eligible for the for an individual and their dependants. For the purposes of this offset, dependants include your spouse and children under the age of 21, medical expense tax offset, such as solely cosmetic procedures including beautifying or superficial alteration. Cosmetic procedures for regardless of their income. Full time students under the age of 25 who you maintained are also your dependents if their income is below the legitimate medical needs (e.g. reconstructive surgery) can still be eligible. If there is no Medicare benefit payable in respect of the relevant threshold for the year. cosmetic procedure, the expense is likely to be an ineligible medical expense. In order to qualify for a tax offset, your total medical expenses (after refunds from Medicare Doctors, nurses and pharmacists and/or your private health insurer) must exceed Payments to legally qualified medical practitioners, the relevant threshold. nurses and pharmacists qualify for the tax offset if If your adjusted taxable income is below the pertaining to an illness or operation. Life Medicare levy surcharge (MLS) threshold ($84,000 insurance, medical examinations and vaccinations for singles and $168,000 for couples or families), required for overseas travel are not eligible. you will be eligible to claim a reimbursement of 20% for net medical expenses over $2,120 for the 2013 financial year. Prescribed and non-prescribed medications The cost of medication purchased from a legally qualified chemist qualifies for the medical expense If your adjusted taxable income is above the tax offset if it is purchased for an illness or relevant threshold, you will only be able to claim a operation, even if the medication was not tax offset equivalent to 10% for net medical prescribed by a doctor. Examples include pain expenses incurred in excess of $5,000. relief tablets and cough medicine. Please note, in order to claim the offset in the The tax offset does not apply to chemist-type 2014 income year, you must have had a claim in items, such as those mentioned above, if they are 2013. This applies for each of the subsequent purchased from another retailer such as a years until 1 July 2019 when the medical expense supermarket or health food store. CHARTERED ACCOUNTANTS 20 Albert Street / PO Box 256 Blackburn Victoria 3130 T: 03 9894 2500 F: 03 9894 1622 contact@youraccountant.com.au Published June 2013 www.youraccountant.com.au Therapeutic treatment Therapeutic treatment may qualify for the medical expense tax offset provided that the treatment is administered at the direction of a medical practitioner. Your doctor must first refer you to a specific practitioner in order for the treatment to be eligible. Therapeutic treatment can include physiotherapy, osteopathy, chiropractic treatment and massage, dietetic treatment or speech therapy. Vitamins and health foods In most cases vitamins, health foods and other similar items will not qualify for the tax offset as they are not considered to be pertaining to an illness or operation. To be eligible for the tax offset, vitamins would have to be specifically the payments were made: To an approved aged care provider under the Aged Care Act 1997; and For personal or nursing care, not just for accommodation. A recipient of approved care is a person who has been assessed by an Aged Care Assessment Team (ACAT) as requiring high or low level care. Daily fees are an example of an eligible expense. However, accommodation bonds do not qualify as they are solely for accommodation and not for personal or nursing care. Further, payments to retirement villages do not qualify. Claiming the tax offset prescribed by a medical practitioner for the We have prepared a spreadsheet to assist you in treatment of an illness or condition. summarising your medical expenses. The spreadsheet can be found at: Dental & optical treatment Payments to a dentist for dental services or www.youraccountant.com.au/publications/resources treatment will qualify for the medical expense tax Please note some pharmacists can give you an offset, unless they are solely cosmetic, e.g. teeth annual statement showing all medications charged bleaching. during the year. Payments made to optometrists and eye You can also request an annual statement from specialists are also eligible for the tax offset. This your health insurance provider and from Medicare includes payments for eye tests, prescription which will show receipts presented and benefits glasses and contact lenses. Surgery to correct paid. your vision is also eligible. Surgical appliances The cost of artificial limbs, hearing aids and other assistive aids are eligible medical expenses. Such items can include adhesive plaster and bandages, wheelchairs and crutches. Hospitals, hostels and nursing homes Payments made to hospitals relating to an illness Further information For further information please contact the following staff member: Simon Dinér simon.diner@youraccountant.com.au Call our office on (03) 9894 2500 or operation will qualify for the tax offset, provided the treatment is not solely cosmetic. Liability limited by a scheme approved under Professional Standards Legislation Recipients of approved aged care for permanent or respite care can also claim the tax offset for payments made to residential aged care facilities such as hostels and nursing homes provided that Disclaimer: This publication has been prepared on the basis of information available at the date of preparation. The information is general in nature and is not to be taken as a substitute for specific professional advice. We recommend that our advice be sought on specific issues prior to acting on transactions affected. FocusOn Medical Expenses