Tax Offsets

advertisement

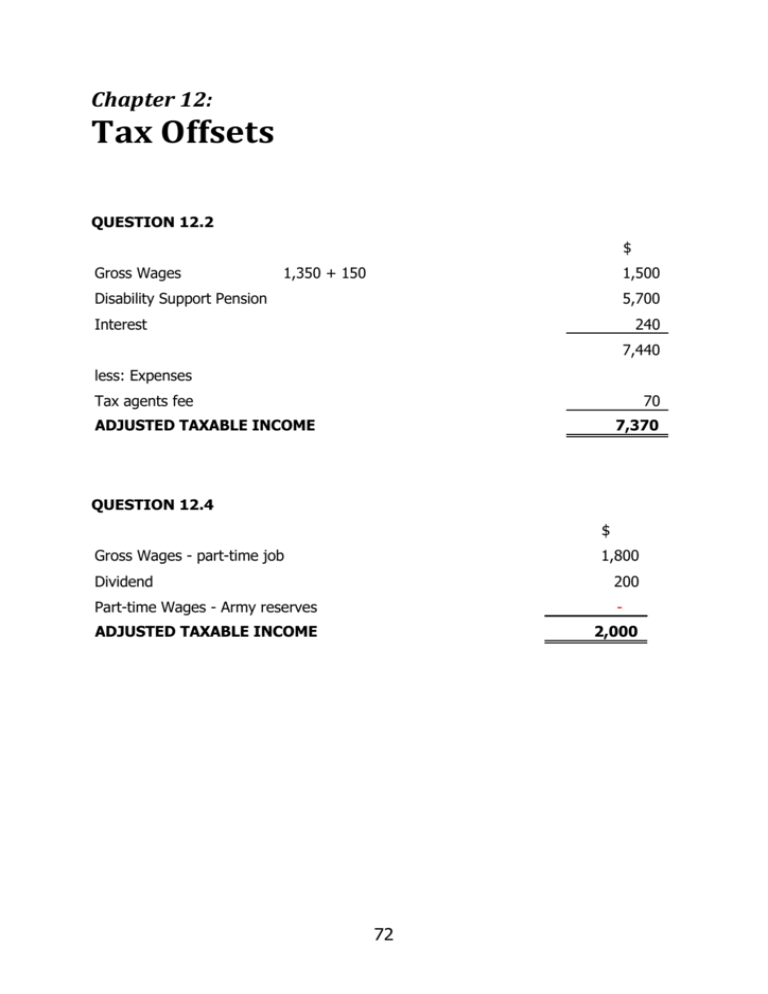

Chapter 12: Tax Offsets QUESTION 12.2 $ Gross Wages 1,350 + 150 1,500 Disability Support Pension 5,700 Interest 240 7,440 less: Expenses Tax agents fee 70 ADJUSTED TAXABLE INCOME 7,370 QUESTION 12.4 $ Gross Wages - part-time job 1,800 Dividend 200 Part-time Wages - Army reserves - ADJUSTED TAXABLE INCOME 2,000 72 QUESTION 12.6 $ ( a ) Eligible for Family Tax Benefit Part B ( b ) Spouse Tax Offset 2,286 - ((2,282-282)/4) 1,786 ( c ) Not eligible for spouse tax offset (taxable income > $150,000) ( d ) Parent Tax Offset 1,676- ((3,200-282)/4) ( e ) Parent Tax Offset 1,676 - ((1,815-282)/4) 947 1,293 QUESTION 12.8 $ ( a ) Zone Tax Offset - Zone A ordinary 338 + (50% x 2,286) 1,481 ( b ) Zone Tax Offset - Zone B ordinary 57 + (20% x 1,676) ( c ) Zone Tax Offset - Zone A special 1,173 + (50% x 1,382*) 1,864 1,173 + (50% x 882*) 1,614 386 * 1,676 - ((1,460-282)/4) = 1382 ( d ) Zone Tax Offset - Zone B special * 2,286 - ((5,900-282)/4) = 882 73 QUESTION 12.10 (a) Payment to doctor in respect of an illness 55 ( b ) No payment made by Samantha - (c) 120 Payment to doctor less: Medicare Refund Received 64 56 ( d ) Payment to doctor 125 less: Medicare Refund Receivable 64 61 (even though refund not received until the following year, the eligible medical expenses is net of amount received or receivable). (e) Only amounts paid are included. This differs from the recognition of refunds and rebates. (f) Not an eligible medical expense as it relates to prevention of illnesses, not treatment of an illness. QUESTION 12.12 ( a ) Payments to pharmacy in respect of illness Medications do not have to be prescribed as long as they are (b) in respect of an illness. Payments for medication must be to a hospital or medical (c) practitioner ( d ) Vitamins need to be prescribed by a medical practitioner. Vitamins prescribed by a medical practitioner are included as (e) eligible medical expenses. Even where prescribed, the vitamins must be purchased from (f) a pharmacy or medical practitioner. 74 $ 520 190 390 QUESTION 12.14 (a) Not treating an illness and not a medically necessary operation, therefore not eligible expenditure. Cosmetic procedures are ineligible. (b) Braces are used to correct teeth state and function. Therefore expenditure is incurred in treating an illness. 5,200 (c) Laser surgery used to correct impaired eyesight. Therefore expenditure is incurred in treating an illness. 3,600 (d) Not treating an illness and not a medically necessary operation, therefore not eligible expenditure. The health fund rebate is therefore ignored also. Not treating an illness and not a medically necessary operation, therefore not ( e ) eligible expenditure. May be entitled to tax offset for provate health insurance. Question 12.16 (a) Yes A spouse is specifically included IRRESPECTIVE of their adjusted taxable income. (b) Yes A child under 21 is included as a dependant. (c) Yes Their domestic and relational circumstances are not relevant. However, the expenditure must be paid by the taxpayer claiming the tax offset. (d) No Only dependants that are resident taxpayers are considered. (e) Yes Mal is still entitled to claim a tax offset in respect of Freda. Yes Kyle is subject to a notional tax offset as a full-time student aged under 25. (f) 75 QUESTION 12.18 $ Doctor's Fees 920 - 425 495 Prescribed medication - pharmacy 330 Non-prescribed medication - pharmacy 95 Chiropractor's fees 210 - 135 Operation 4,780 - 3,190 - 270 75 1,320 2,315 less: Rebate - Medicare Safety Net 175 2,140 Medical Expenses Tax Offset (2,140 - 2,000) x 20% $ 28 QUESTION 12.20 Eligible Medical Expenses $ Robina 120 + (200 - 50) 270 Jed 400 + 600 + 100 1,100 Erica 200 + 300 + 120 620 Tori 70 + 350 + (220 - 40) 600 2,590 LESS: Health Fund Rebates 145 2,445 Medical Expenses Tax Offset (2,445 - 2,000) x 20% $ QUESTION 12.22 Eligible Medical Expenses Carrick $ 1,680 430 + (750 - 80) + 580 Rosielee Natalie 89 3,400 (4,700 - 1,300) 5,080 Medical Expenses Tax Offset (5,080 - 2,000) x 20% 76 $ 616 QUESTION 12.24 Income from working $ Gross Wages 39,000 Clothing Allowance 4,000 Tips 1,200 $ 44,200 Deductions relating to income from working Work Deductions 300 Net Income From Working 43,900 Mature Age Worker Tax Offset $ 500 QUESTION 12.26 Income from working $ Gross Business Income 97,000 Deductions relating to income from working Business Deductions 36,000 Net Income From Working 61,000 Mature Age Worker Tax Offset $ 100 500 - (5% x (61,000 - 53,000)) QUESTION 12.28 $ Uniforms ineligible expense Textbooks School fees 0 300 ineligible expense Internet 0 120 420 Education offset 420 X 50% 210 Roy is not able to claim education expenses for Amy as she is not under taking primary or secondary studies. 77 QUESTION 12.30 Taxpayer Alan $ 2,230 Beth > $48,708 taxable income - Cameron under 65 - not eligible - Darelle 2,230 - (12.5% x (34,000 - 30,685)) 1,816 Elise under 64 - not eligible - QUESTION 12.32 Jack and Liz's average taxable income is $40,000. This is above the cut-out threshold of $39,496. Therefore, neither are eligible for the Senior Australian tax offset, even though Liz has a taxable income below the lower threshold of $26,680. QUESTION 12.34 $ Eligible Medical Expenses Leo 800 - 240 560 Erica 120 + 140 - 60 + 420 - 100 520 Rick 700 - 200 500 Frank 550 - 300 250 Rikki 1,400 - 500 900 Helen 650 - 350 300 3,030 less: Outstanding health insurance rebate 100 2,930 Medical Expenses Tax Offset (2,930 - 2,000) x 20% Private Health Insurance 30% x 3,500 Parent Tax Offset (1,676 x 9/12) - ((4,000 - 282)/4) 328 Mature Age Worker Tax Offset 500 - (5% x (56,000 -53,000)) 350 TOTAL TAX OFFSETS 186 1,050 1,914 78 QUESTION 12.36 $ Gross Pension Gross Wages Dividends Franking Credit TAXABLE INCOME Tax on $31,000 Medicare Levy $ 16,000 10,000 3,500 1,500 31,000 3,750.00 465.00 4,215.00 15% x (31,000 - 6,000)) 1.5% x 31,000 Less: Non Refundable Tax Offsets Low Income Tax Offset 1,500 - 4% x (31,000 - 30,000) Mature Worker Tax Offset Parent Tax Offset Super Tax Offset 15% x 16,000 1,460.00 500.00 1,676.00 2,400.00 3,750.00 465.00 LIMITED TO Less: Refundable Tax Offsets Private Health Insurance Tax Offset PAYG Franking Tax Offset TAX REFUNDABLE 79 600.00 1,500.00 1,500.00 3,600.00 3,135.00