Revenue Recognition under IFRS

advertisement

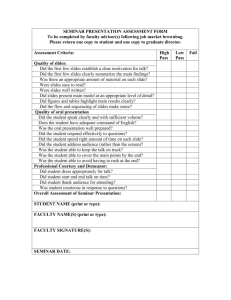

Beratung Revenue Recognition under IFRS IAS 18 Revenue IAS 11 Construction Contracts IFRIC 13 Customer Loyalty Programs © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Schulung Umstellung IAS 18: Agenda Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 1 Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 2 IAS 18: Basic principles Types of revenue-generating transactions Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inflows result in increases in equity, other than increases relating to contributions from equity participants. Classification of revenues under IAS 18: Sale of goods; Rendering of services; Interest, royalties and dividends. For each of these groups IAS 18 specifies under what conditions revenue is to be recognized. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 3 IAS 18: Basic principles Measurement of Revenue “Revenue shall be measured at the fair value of the consideration received or receivable” (IAS 18.9) Revenue is normally in the form of cash or cash equivalents If payment is deferred, fair value of consideration may be less than nominal amount – Transaction constitutes a financing transaction; – Fair value is determined by discounting all future receipts using an imputed rate of interest, using a) prevailing rate of interest for a similar instrument of an issuer with a similar credit rating, or b) a rate that discounts the nominal amount of the instrument to the current cash sales price of the goods or services. Where goods or services are swapped for goods or services which are of a similar nature The exchange is not regarded as a transaction which generates revenue © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 4 IAS 18: Basic principles Identification of the transaction Recognition criteria in IAS18 usually applied separately to each transaction It may be necessary, however, to apply the recognition criteria to the separately identifiable components of a single transaction to reflect substance of transaction – Example: Sales price of a product includes subsequent servicing for a specific period of time Two or more transactions may linked in a way that the commercial effect is that of one transaction and must be accounted for together – Example: An entity sells goods and in a separate contract agrees to repurchase them (thus negating the substantive effect of the transaction) Problem: IAS 18 provides little guidance regarding the accounting for multiple element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 5 IAS 18: Basic principles Revenue recognition on sale of goods Revenue from the sale of goods recognized when: (IAS 18.14) Significant risks and rewards of ownership have been transferred to buyer; Seller retains neither: – continuing managerial involvement normally associated with ownership, or – effective control over goods sold Amount of revenue can be measured reliably; Flow of economic benefits to seller is probable Related costs can be reliably measured. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 6 IAS 18: Basic principles Revenue recognition upon rendering services When the outcome of a service transaction can be estimated reliably, revenue should be based on stage of completion. Reliable estimate requires: (IAS 18.20) Amount of revenue can be measured reliably; Flow of economic benefits to seller is probable; Stage of completion at the balance-sheet date can be measured reliably Costs incurred to date and costs to complete transaction can be measured reliably. When this is fulfilled then the amount of revenue is recognized based on the stage of completion (percentage of completion method) as specified in IAS 11. Exception: When services represent an „indeterminate number of acts“ over a specified period of time, revenue is recognized on a straight-line basis over the period, unless some other method better reflects the stage of completion. (IAS 18.25) – Example: providing an office cleaning service for a specified period of time. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 7 IAS 18: Basic principles Interest, royalties and dividends Revenue arising from the use of others of assets yielding interest, royalties and dividends recognized only if: Flow of economic benefits to entity is probable, and amount of revenue can be measured reliably. Revenue is to be recognized as follows: Interest to be recognized according to the effective interest method. Royalties to be recognized on an accrual basis in accordance with the substance of the agreement. Dividends to be recognized when the shareholder‘s right to receive payment is established. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 8 IAS 18: Basic principles IAS 18: Required disclosures Minimum disclosures include: Accounting policies adopted for revenue recognition, including – Methods adopted to determine the stage of completion of service transactions Amount of each significant category of revenue recognized during the period, including revenue from: a) Sale of goods b) Rendering of services c) Interest d) Royalties e) Dividends, and Amount of revenue arising from exchanges of goods or services included in each significant category of revenue © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 9 Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 10 Influence of US GAAP on the application of revenue recognition rules under IFRS US GAAP rules for revenue recognition are highly detailed and voluminous (approx. 200 different sources of revenue recognition!). IAS 18, however, contains only very general rules As a result, the US GAAP rules are often applied in reporting under IFRS, representing best practice. (Companies reporting und both US GAAP and IFRS generally have identical revenue recognition policies.) Examples of special rules under US-GAAP that are often applied under IFRS include: – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 11 Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 12 Important US GAAP revenue recognition rules: Bill & Hold Transactions „Bill & hold“ transactions refer to sales, where amounts have been invoiced and recognized in revenue, but the related goods sold have not yet been delivered to the buyer and remain with the buyer. Rules represent opinions of the SEC as codified in Staff Accounting Bulletins (SAB‘s) No. 101 and 104. Selected criteria for revenue recognition: Sales contract stating bill & hold treatment should generally be in written form. Seller has no further performance requirements. Product must be complete and ready for shipment. The customer must request bill & hold treatment and must have a „substantial business purpose“ for the bill & hold basis. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 13 Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 14 Important US GAAP revenue recognition rules: Upfront fees Non-refundable cash payments are not necessarily considered to be revenue. Examples: Utility "hook-up„ fees One-time initiation fees for fitness-centre membership Technology "access fees„ Upfront fees are to be deferred and recognized over a period (representing the average life of the customer relationship) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 15 Basic principles of IAS 18 Special rules under US-GAAP (SAB 101/104) that are often applied under IFRS – Bill & Hold transactions – Up-front fee arrangements – Multiple-element arrangements © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 16 Important US GAAP revenue recognition rules: Multiple Element Arrangements (EITF 00-21) Definition – multiple element arrangements: An arrangement containing multiple revenue-generating activities that has been negotiated as a package. A total price for all activities (delivery of goods and services) may have been agreed to. As of the balance-sheet date, certain revenue-generating activities may not yet have been performed. Example: Sale of a software together with services that are required by the customer to use the software. Problem: Identification of the unit or units of accounting that are to be considered in applying revenue recognition rules. (Does the arrangement represent a single unit of accounting, or are there multiple units of accounting to be separately considered. Note: EITF 00-21 governs the identification of accounting units within a multiple-delivery arrangement, but does not specify how revenue for those units is to be recognized. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 17 Multiple-element arrangements Overview A single transaction (contract) is to be accounted for as separate units of accounting if the elements (deliverables) meet the requirements for separation under EITF 00-21 Transaction Unit of accounting 1 © Douglas Nelson 2007 Unit of accounting 2 AGiG Seminar – 8 November 2007 Unit of accounting 3 Revenue Recognition 18 Multiple-element arrangements Example Transaction: Providing an individual customer IT solution (an arrangement might include) Sale of Software Software 1 © Douglas Nelson 2007 Software 2 Providing services (Training, Callcenter, etc.) Providing services (Software Updates) Software 3 AGiG Seminar – 8 November 2007 Revenue Recognition 19 Multiple-element arrangements Separation Question: When is a multiple-element arrangement to separated into components (units of accounting) for purpose of revenue recognition? Answer: A separation into units of accounting is required (reflecting substance over form), if: – the components already delivered under the arrangement have „stand-alone value“ for the customer. „Stand-alone value“ for a component (according to EITF 00-21) exists if it is sold separately by any vendor or the customer could resell the delivered item(s) on a stand-alone basis“ and – There is reliable evidence of the fair value for the components which have not yet been delivered under the arrangement. – The US-GAAP rules under EITF 00-21 are considered to be in conformity with the provisions of IAS 18.13, requiring the identification of transactions © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 20 Multiple-element arrangements Revenue allocation and revenue recognition If the above-mentioned conditions are not all met, the components of the arrangement are to be considered as one unit of accounting for purposes of revenue recognition (no separation). The requirements for recognition of revenue must be applied to the entire arrangement as a single unit of accounting. If the conditions are all met and a separation into more than one unit of accounting is appropriate, then fulfillment of applicable revenue recognition criteria is to be determined separately for the individual units of accounting. The revenue applicable to a unit of accounting is determined using the relative fair value method, as follows: Fair value of individual accounting unit Sum of all individual unit fair values © Douglas Nelson 2007 x Total arrangement price AGiG Seminar – 8 November 2007 Revenue Recognition 21 Multiple-element arrangements Example (1/3) Software 1 Software 2 Software 3 Call Center, Training Performance made as of balance sheet date? Yes Yes No Partially performed Standalone value to customer? Yes Yes Yes Nein Fair value reliably estimable? Yes Yes Yes No (Yes) 50 80 20 (50) Fair value amount 160 Total arrangement price Note: ( ) = Alternative scenario © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 22 Multiple-element arrangements Example (2/3) Revenue recognition in initial example: Revenue recognition could be considered for the delivered Software 1 and 2 and the partially performed services (call center, training) as of the balance-sheet date. However, in the initial example no revenue recognition is permitted through the date of the balance sheet, since the fair value of the contract elements which have not been (completely) performed at the balance-sheet date cannot be reliably established. The revenue recognition for the entire arrangement therefore is deferred until the completion of the call-center and training services. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue Recognition 23 Multiple-element arrangements Example (3/3) Revenue recognition: alternative scenario The contract elements already delivered have standalone value to the customer and there is reliable evidence of fair value for the elements to be completed after the balance-sheet date. – For the software items 1 and 2 (assuming recognition of applicable revenue recognition criteria) revenue is to be recognized. – The revenue amount is determined based on the relative fair value method, as follows: Sum of the individual fair values 200 Total arrangement price for software and services 160 Software 1 and 2 share of total fair value = (50+80)/200 Revenue to be recognized = 65 % x 160 (arrangement price) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 65% 104 Revenue Recognition 24 Beratung IAS 11 Construction contracts © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Schulung Umstellung IAS 11: Agenda Revenue recognition on construction contracts Typical features of construction contracts Construction contracts: Types of contracts and timing of revenue recognition Ability to reliably estimate contract result Construction contracts: Definition of revenues and costs Stage of completion Amounts included in contract costs Combining and segmenting construction projects Balance sheet presentation Example © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 26 Revenue recognition on construction contracts IFRS requires use of percentage of completion („PoC“) method for construction contracts However, certain preconditions must be met for the application of PoC: – Among others, costs still to come must be reasonably estimable (s. slide 5) On a loss contract, entire loss is recognized immediately upon becoming known. If final result of a contract cannot be reasonable estimated: – Revenues are recorded in the amount of contract costs PoC method to be applied when a contract extends over more than one period. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 27 Typical features of construction contracts 1. 1. 2. 2. Completion Completion period period extending extending over over at at least least 22 periods periods Individual Individual construction construction projects projects based based on on customers customers specifications; specifications; no no serial serial production production 3. 3. Normally Normally relatively relatively complex complex production production processes processes Examples: Industrial engineering projects, shipbuilding, real estate construction, construction of satellites, software development, film production © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 28 Construction contracts Types of contracts and timing of revenue recognition Type of contract Treatment under HGB Treatment under IFRS Contracts with „milestone“ agreements, where performance of total contract is broken down into legally separate contractual elements Revenue and profit realization is according to the completed milestones In many cases, similar to HGB (but only if result approximates PoC revenue and profit recognition) Contracts without milestone agreements Revenue and profit realization upon completion of entire contract Revenue and profit realization based on stage of completion = Percentage of Completion Method = Completed Contract Method © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 29 Ability to reliably estimate contract result Ability to reliably estimate contract result requires following: (IAS 11.23) Reliable estimate of total contract revenue Probable flow of economic benefits to entity from contract Reliable estimate at balance-sheet date of costs to complete contract and stage of completion Reliable identification and measurement of contract costs, so that actual costs can be compared with prior estimates. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 30 Construction contracts Definition of revenues and costs Revenues on construction contracts Originally agreed contract sales price +/- Increases and decreases resulting from subsequent contract variations + Claims resulting from, e.g., incorrect information supplied by buyer + Special payments provided by buyer (Incentive payments) e.g. for completion ahead of schedule = Total revenue Cost of sales on construction contracts Direct expense of material + Material overheads + Direct labour + Indirect labour and construction overhead + (Only if specifically included under terms of contract: allocated general & administrative expenses, sales expenses, and research & development expenses) = Total contract costs Generally excluded from contract costs: General, administrative and selling costs and research & development expenses that are not specifically to be reimbursed under the terms of the contract © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 31 Stage of completion The stage of completion to be determined by a method that reliably measures work performed. (IAS 11.30) Examples: Proportion of costs incurred to date to total estimated contract costs („cost to cost“ method) Comparison of performance through the balance-sheet date, compared to total contract performance (for example, direct labour hours) Completion of a physical portion of a total contract Progress payments received from customers do not reflect the work performed! © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 32 Amounts included in contract costs (1/2) Examples of costs directly related to specific contracts: Direct material costs Direct labour costs Normal depreciation on equipment used for the contract Rental costs of machines and equipment Costs of technical support Estimated rework and guarantee costs Examples of attributable overhead costs: Insurance Construction overheads Capitalized interest (optional) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 33 Amounts included in contract costs (2/2) Costs not attributable to contracts: Selling, general and administrative expenses not explicitly reimbursable under the terms of a contract Research and development costs not explicitly reimbursable under the terms of a contract Depreciation on machinery and equipment which is not utilized for a specific contract © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 34 Combining and segmenting construction projects The provisions of IAS 11 are normally applied to individual construction contracts. However, when looking from an economic point of view (substance over form), a different treatment may be required : – Individual components of a contract are to be segmented and separately accounted for when: (IAS 11.8) Separate proposals have be submitted for each asset, Each asset has been subject to separate negotiations, and Costs and revenues of each asset can be identified. – A group of contracts is be combined and treated as a single contract when: (IAS 11.9) The group of contracts is negotiated as a single package, The contracts are so closely interrelated that they are, in effect, part of a single project with an overall profit margin, and The contracts are performed concurrently or in a continuous sequence. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 35 Balance sheet presentation For each contract in progress the amount due to or due from customers is determined as the net amount of: Total costs incurred and recognized profits to date Total advances received. In the balance sheet there is a separate presentation of: Gross amount due from customers as an asset Gross amount due to customers as a liability – This means there is a netting of assets and liabilities at the individual contract level, but the sums of contract net assets and net liabilities are not offset in the balance sheet. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 36 Construction contracts - Example (1/3) Assumptions: To construct a bridge a contract is entered into with a fixed price of 9,000. The total contract costs are estimated at the beginning of the project to be 8,000. The estimated construction period is 3 years. At the end of the first period the estimate of total contract costs is revised to 8,050. In the 2nd period a contract variation is authorized by both parties that will increase contract revenues by 200 and increase contract costs by 150. Actual costs incurred amount to 2,093 in the 1st period, 4,075 in the 2nd period and 2,032 in the 3rd period. In the 2nd period material is purchased which is not processed until the 3rd period. The stage of contract completion is to be determined using the „cost-to-cost“ method. Note: Example from IAS 11, Appendix, (slightly modified) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 37 Construction contracts – Example (2/3) Assumptions: Period 1 1 Original contract price Period 2 Period 3 9.000 9.000 9.000 -- 200 200 3 Total revenue 9.000 9.200 9.200 4 Originally estimated total contract costs 8.000 8.000 8.000 5 Revision in period 1 50 50 50 Revision in period 2 - 150 150 6 Total contract costs 8.050 8.200 8.200 7a Costs incurred to date at period end 2.093 6.168 8.200 7b Thereof actual construction costs 2.093 6.068 8.200 950 1.000 1.000 26 % 74 % 100 % 2 Revision in period 2 8 Estimated gross profit (row 3 - row 6) 9 Percentage of completion (row 7b : row 6) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 38 Construction contracts – Example (3/3) Revenue, cost of revenue and gross profit in the income statement Period 1 Revenue (9.000 x 0,26) 2,340 2,340 Cost of revenue 2,093 2,093 247 247 Revenue (9.200 x 0,74) 6,808 4,468 (=6,808 – 2,340) Cost of revenue 6,068 3,975 (=6,068 – 2,093) 740 493 Revenue 9,200 2,392 (=9,200 x 0,26) Cost of revenue 8,200 2,132 Gross profit 1,000 260 Gross profit Period 2 Gross profit Period 3 © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Construction contracts 39 Beratung IFRIC 13 Customer Loyalty Programs (June 2007) © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Schulung Umstellung IFRIC 13: Agenda Scope of IFRIC 13 Issues Consensus in IFRIC 13 Effective date and transition © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 41 Scope of IFRIC 13 IFRIC 13 Interpretation applies to customer loyalty award credits that: a) An entity grants to its customers as part of a sales transaction (a sale of goods, rendering of services or use by a customer of entity assets); and b) subject to meeting any further qualifying conditions, customers can redeem in the future for free or discounted goods or services. IFRIC 13 addresses only the accounting by the entity granting awards © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 42 Issues Issues addressed in IFRIC 13 are: a) Whether entity’s obligation to provide free or discounted goods or services (“awards”) in future is to be recognised by and measured by: i. Allocating a portion of consideration received from sales transaction to the award credits and deferring the recognition of revenue; or ii. Providing for estimated future costs of supplying awards. b) If consideration is allocated to award credits: i. How much should be allocated to them? ii. When should revenue should be recognised? and iii. If a third party supplies the awards, how should revenue be measured? © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 43 Consensus in IFRIC 13 (1/3) Entity shall account for award credits as a separately identifiable component of sales transaction(s) in which they are granted (“initial sale”). – Fair value of consideration received on initial sale is to be allocated between the award credits and other components of sale. – Consideration allocated to award credits is measured at their fair value (the amount for which the awards could be separately sold). If entity supplies awards itself: – It should recognize consideration allocated to award credits as revenue when award credits are redeemed and entity fulfils its obligations to supply awards. – Amount of revenue recognised based on number of award credits redeemed relative to total number of credits expected to be redeemed. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 44 Consensus in IFRIC 13 (2/3) If a third party supplies awards: Entity must assess whether it is collecting the consideration allocated to the award credits on its own account (as principal) or on behalf of third party (as agent). a) If entity is collecting consideration as agent on behalf of third party, it shall: i. Measure revenue as net amount retained on its own account ((i.e., difference between consideration allocated to the award credits and amount payable to third party for supplying awards); and ii. Recognise this net amount when third party becomes obligated to supply the awards and entitled to receive consideration. © Douglas Nelson 2007 – These events may occur as soon as award credits are granted; – Alternatively, if customer can choose to claim awards from either entity or a third party, the events may occur only when customer chooses to claim awards from third party. AGiG Seminar – 8 November 2007 Customer loyalty programs 45 Consensus in IFRIC 13 (3/3) b) If entity is collecting consideration on its own behalf, it shall: i. Measure revenue as the gross consideration allocated to the award credits and ii. Recognise the revenue when it fulfils its obligations in respect of the rewards If unavoidable costs of meeting obligations to supply awards are expected to exceed consideration received (i.e., consideration allocated to award credits upon initial sale not yet recognized as revenue, plus any additional consideration receivable at time of redemption), this represents an onerous contract. – Liability must be recognized for the excess in accordance with IAS 37. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 46 Effective date and transition IFRIC 13 to be applied for annual periods beginning on or after 1 July 2008. – Earlier application is permitted; – If applied for a period beginning before 1 July 2008, this is to be disclosed. Changes in accounting to be accounted for in accordance with IAS 8. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 47 Beratung SEC Staff Accounting Bulletins (SAB) Nos 101 and 104: Revenue Recognition in Financial Statements And selected significant EITF Issues © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Schulung Umstellung Why Focus on Revenue Recognition? Increasing risk for companies listed in the US High profile accounting failures SEC highly focused on revenue recognition Over 50% of restatements required by SEC result from improper revenue recognition Market valuations as multiple of revenues © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 49 Revenue Recognition Authoritative Literature Has Been Added to Address Misapplications of Basic Concepts 8 FASBs and 1 Technical Bulletin Approx. 30 EITFs and 15 SOPs FASB C o n c e p t St a t e m e n t s N o . 5 a n d 6 SEC guidance (e.g., SAB 101, 104 and AAER 108) © Douglas Nelson 2007 Over 200 sources of US GAAP on revenue recognition! Other: numerous practice bulletins, FASB staff positions and Q&A’s, SAS’s and audit guides AGiG Seminar – 8 November 2007 Revenue recognition 50 EITF 99-19: "Reporting Revenues Gross as a Principal versus Net as an Agent" Indications for “gross” or “net” presentation of revenues – Who has primary responsibility for providing product or service? – Who has inventory risk prior to delivery? – Does seller have pricing discretion? – Who has credit risk? – Does seller have discretion in supplier selection? No individual factor is deciding in determining net or gross reporting of revenues © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 51 Other important "EITF Issues" 00-10: "Accounting for Shipping and Handling Fees and Costs" – Shipping billed to customer must be shown as revenue – No guidance regarding treatment of freight costs – if amounts are material, the handling should be disclosed 00-14: "Accounting for Certain Sales Incentives" – Coupons und rebates are netted from revenues – Free goods provided are considered part of cost of sales and should not be netted from revenues © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 52 SAB 101 "Revenue Recognition in Financial Statements" Published: December 1999 © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 53 Revenue is Recognized When it is... Realized or Realizable Evidence of an arrangement Collectibility and Earned Performance/delivery Fixed or determinable price © Douglas Nelson 2007 Based on SOP 97-2 Criteria AGiG Seminar – 8 November 2007 Revenue recognition 54 Persuasive Evidence of Arrangement Customary business practices: Written Contracts: – Must be signed by BOTH parties prior to recognition of revenue. Other allowable documentation: – Signed customer purchase order; – Online authorization of purchase; – Some oral agreements. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 55 Persuasive Evidence of Arrangement – Consignment Arrangements Title is transferred but: Buyer has the right to return product and – Buyer not obligated to pay at date of sale; – Payment contingent upon resale; – Buyer has no economic substance from seller. Seller has to repurchase the product or goods of which the product is a component – Seller provides non-standard financing; – Seller pays interest costs under 3rd party financing. The product is delivered for demonstration purposes. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 56 Delivery and Performance – FOB Terms and Title Transfer FOB Terms FOB shipping point FOB destination International Issues – Romalpa Provisions Self-Insurance/Other security interests © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 57 Delivery and Performance – Bill & Hold Arrangements AAER No. 108 sets conditions for recognition of revenue in bill and hold transactions. SAB 101 repeats conditions Buyer request for Bill & Hold generally should be in writing Seller must not retain ANY specific performance obligations such that the earnings process is not complete The product must be complete and ready for shipment © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 58 Delivery and Performance – Customer Acceptance Issues Class of Transaction Accounting Demonstration/Evaluation Consignment Seller Specified Criteria FAS 48/FAS 5 Subjective Return Provisions Customer Specified Criteria © Douglas Nelson 2007 FAS 48 FAS 48/FAS 5 AGiG Seminar – 8 November 2007 Revenue recognition 59 Delivery and Performance – Installation Issues Two-Tiered Test Inconsequential/Perfunctory – FAQ Question 3 lists factors to consider – most important is whether FULL amount of fee is due – Accrue costs to complete – Meeting this test will be rare Multiple-Element Arrangement – Follow EITF 00-21 (this was a SAB 104 revision) IfIf neither neither test test can can be be met, met, defer defer revenue revenue until until installation installation isis complete. complete. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 60 Case Study – Installation and Customer Acceptance (1/2) ABC is an equipment manufacturer that entered into a sales contract with a customer to sell and install equipment for $5 million. ABC has experience in the production and successful installation of the equipment. Installation may take up to 60 days. ABC has developed internal specifications for the equipment and has previously demonstrated that the equipment meets those specifications. The contract also includes customer-specified technical and performance criteria regarding speed and quality. Equipment is tested at ABC’s facility prior to shipment. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 61 Case Study – Installation and Customer Acceptance (2/2) Continued Title to the equipment passes to customer upon delivery. ABC has sold the equipment w/o installation for $4.8 million and routinely sells its services separately on a time and materials basis. Based on these rates, installation labor on a stand-alone basis would be approximately $300,000. The cost for installation is approximately $100,000. The installation process is generally completed by ABC but could be performed by others. 100% of the fee is due no later than 90 days after delivery. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 62 Case Study – Questions 1) Is installation inconsequential or perfunctory? 2) Is there objective evidence to separate equipment element from the installation element? 3) Is installation essential to the functionality? 4) Which category of customer acceptance provision does this fall into? © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 63 Delivery and Performance – Up-Front Nonrefundable Fees Nonrefundable cash does not equal revenue Common situations: – Health club initiation fees; – Utility “hookup” or activation fees; – Technology access fees. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 64 Biotechnology Arrangements Typical Arrangements May Include: Up-front fee for “development to date” – Fees will be deferred and amortized if there is continuing involvement in R&D or manufacture/distribution of the product Milestone payments – Recognized upon receipt if achievement represents substantive work and approximates value of achieving that milestone – EITF 91-6 model – Added to deferred revenue and amortized over remaining period of involvement (may not be acceptable because it back-ends revenue significantly) On-going Royalties – Generally recognized as earned © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 65 Other Licensing Issues No Continuing Involvement Start or Street Dates Extensions © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 66 Contract Acquisition and Origination – Scope of SAB 101 Footnote 29 – Incremental direct costs associated with acquiring a revenue-producing contract, unless specifically provided for in authoritative literature, should be accounted for in accordance with – FASB Technical Bulletin 90-1 (paragraph 4), or – FASB Statement 91 (paragraph 5). © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 67 Contract Acquisition and Origination – Scope of SAB 101 Deferral of costs is permitted (not required) Applies only to the deferral of incremental direct costs for which revenue has been deferred (FAQ) Excludes: – Start-up costs (SOP 98-5); – Deferral of costs in accordance with SOP 81-1, SFAS 51 or SFAS 60. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 68 Contract Acquisition and Origination Policy should be disclosed Preferability letters Amortize costs consistent with revenues © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 69 Contract Acquisition and Origination Deferral of costs in excess of deferred revenue is inappropriate, except when there is a contractual arrangement (1996 SEC staff speech) – Recoverability must be evaluated – Evaluation should consider only estimated cash flows during the contractual period – Accounting policy decision © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 70 Contract Acquisition and Origination Costs – FTB 90-1 Costs Costs directly directly related related to to the the acquisition acquisition of of aa contract contract and and would would not not have have been been incurred incurred but but for for the the acquisition acquisition of of that that contract contract © Douglas Nelson 2007 Excluded: Indirect costs Unsuccessful efforts Advertising Included: Commissions Costs meeting definition in SFAS No. 91 AGiG Seminar – 8 November 2007 Revenue recognition 71 Contract Acquisition and Origination Costs – SFAS No. 91 Incremental Incremental direct direct costs costs incurred incurred in in transactions transactions with with independent independent third third parties parties and and certain certain costs costs directly directly related related to to specified specified activities activities performed performed by by the the company company for for the the contract contract © Douglas Nelson 2007 Excluded: Indirect costs Advertising Included: Commissions Preparing and processing documents AGiG Seminar – 8 November 2007 Revenue recognition 72 Comparison of Methods FTB 90-1 Incremental direct costs Expense costs associated with the negotiation of a contract that is not consummated SFAS No. 91 Incremental direct costs Costs incurred with independent third parties Certain costs directly related to specified activities performed by the lender for the contract © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 73 Fixed and Determinable Fees – Refundable Service Fees SEC believes fees should be accounted for as a deposit in accordance with FAS 140 but will allow analogy to FAS 48 in limited situations Common situations: – Commercial lease brokerage fees contingent upon the tenant moving into the facility; – Talent agent whose fee for arranging a celebrity endorsement is cancelable if the celebrity breaches contract with customer; – Insurance agent whose commission is refundable in whole for a 30-day period as required by law and then declining on a pro-rata basis until the customer makes six monthly payments. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 74 Fixed and Determinable Fees – Contingent Fee Arrangements SEC has verified that guidance in Question 8 of SAB 101 is limited to contingent rent scenarios Common situations: – Consulting fees based on cost savings when it is probable that the savings will be achieved; – Investment management fees tied to performance above a market index. © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 75 SAB 101 – Financial Statement Disclosures Expanded disclosures of revenue recognition policies – Each material type of transaction (including barter sales) – For multiple-element transactions, the revenue recognition policy for each element – For equipment sold on an installed basis, the method of accounting for the installation Changes in estimated returns for revenue recognized in accordance with FAS 48 Policy for refundable service fees Policy for contract acquisition and origination costs Certain other disclosures © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Revenue recognition 76 Thank you for your attention! DOUGLAS NELSON Financial Reporting IFRS and US GAAP www.douglasnelson.de © Douglas Nelson 2007 AGiG Seminar – 8 November 2007 Customer loyalty programs 77