Chapter 13 - E-Book

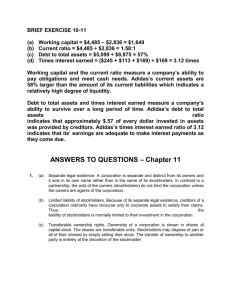

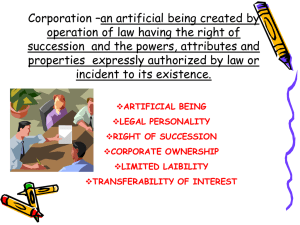

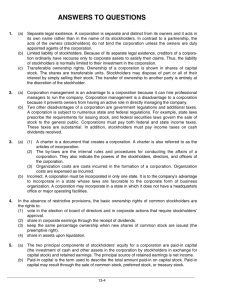

advertisement