CME Clearing: Principles for Financial Market

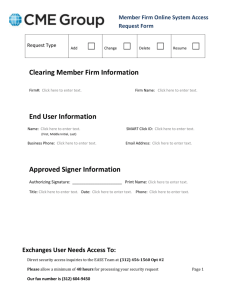

advertisement