Insurers: Rating Methodology - Thought Leadership

advertisement

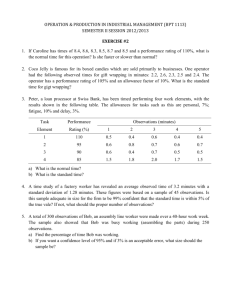

Aon Benfield Analytics Overview of S&P’s Request for Comment: “Insurers: Rating Methodology” July 2012 port Document Title Sub-Title of Report Document Date General Overview On July 9, 2012, Standard & Poor’s (S&P) released a Request for Comment (RFC) that corresponds to their new set of proposed criteria for rating insurance companies. This also includes a document on the anticipated changes to their rating methodology as well as an online tutorial on the new framework and the recommended underlying changes. S&P has set a deadline of September 9, 2012 for comments and responses from the industry before they finalize the new criteria, with the stated goal of implementation in late 2012 or early 2013. Additionally, before implementation S&P plans to issue a report summarizing the comments they have received. S&P has advised that the updated methodology is part of a company-wide criteria revision focused on increased transparency. For reference, S&P went through a similar process for financial institutions in 2011 where they published the final updated criteria on November 9, 2011. S&P subsequently issued a press release stating it reviewed the ratings on the largest financial institutions by applying its new ratings criteria twenty days later. In respect of the proposed insurer update, S&P has stated that based on their testing they expect that the majority of ratings will remain unchanged or move by no more than one notch after implementation, and that any change to the overall distribution of ratings is expected to be modest. This paper summarizes the new model framework that S&P is proposing, compares it against the current methodology, details key aspects with regards to their new criteria, and provides key questions that S&P is looking for feedback on. We intend that this document can be utilized as a general overview and reference on S&P’s proposed methodology. For the full RFC, please go to: http://www.standardandpoors.com/insurancecriteria S&P has cited the following reasons for transitioning to new criteria for rating global insurance companies. Transparency Recently S&P’s sovereign and bank ratings criteria has been enhanced to increase transparency for users. S&P is continuing this focus by updating the global insurance company rating methodology. Specificity Increasing the specificity of the ratings factors and sub-factors. This expands beyond the scope of capital adequacy into all aspects on S&P’s rating framework. Forward Looking Nature Forming a global framework for rating insurance companies that is more forward looking and increases comparability; providing consistent analysis for all global insurers. Centralizing Various Criteria Centralizing the insurance criteria framework in one single criteria document. The proposed framework combines various criteria and will at least partially supersede certain existing criteria. The new S&P framework is based on the analysis of the Business and Financial Risk Profiles of each insurance company. These two main areas are the "anchor" of the new rating framework. S&P is utilizing a matrix view to compare each insurance company’s risk profile, and will implement certain thresholds and caps to determine the final ratings, which will be described in more detail below. The analysis will focus on current year results as well as the upcoming two years of anticipated performance. While a prospective approach is not new for S&P, the proposed criteria more formally introduces a consistent forward looking methodology. Overview of S&P’s RFC: “Insurers: Rating Methodology” 1 The proposed criteria apply to all insurers in the business of life, health, and property / casualty insurance, and reinsurance. The criteria exclude ratings on bond insurers, insurance brokers, insurers that are starting up or are in run-off, and mortgage and title insurers. Additionally, public information (pi) ratings are out of the scope of the RFC. The New S&P Framework can be summarized broadly in the following chart. The proposed criteria determine an operating company’s insurer rating using five key steps: 1. Evaluate Business Risk Profile 2. Evaluate Financial Risk Profile 3. Derive Rating Anchor from combination of 1 and 2 4. Apply Modifiers and Caps 5. Determine Group or Government Support, if any The aim is to clearly and in considerable detail specify the factors and sub-factors of the analysis and to show how they combine into rating outcomes. A key aspect of the rating matrix in the proposed criteria is geared towards enhancing transparency. The criteria provide detailed quantitative and qualitative components of how rating factors (and sub-factors) are measured and integrated within the rating matrix to derive a rating. On the right is our view of where the rating components of S&P’s current rating framework flow into the proposed criteria. New factors in the proposed criteria not explicitly addressed in the current rating criteria include the impact of Industry and Country Risks, analysis of prospective capital adequacy and risk position. S&P’s assessment of ERM and its capital adequacy model are unaffected by the proposed criteria. Aon Benfield Mapping of S&P Rating Criteria: Current vs. Proposed Current Rating Components* Proposed Rating Matrix Industry Risk Operating Performance Business Position Business Risk Profile (Anchor) Operating Performance Investments Capitalization Financial Flexibility Financial Risk Profile (Anchor) Management & Corporate Strategy Enterprise Risk Management ERM - Management (Modifier) Liquidity Liquidity (Cap) * Note: Shown for illustration purposes on a "best fit" basis; Operating Performance is considered a key component of both Business Risk and Financial Risk profiles; Other rating components may also fall into multiple places of the proposed rating matrix Overview of S&P’s RFC: “Insurers: Rating Methodology” 2 Business Risk Profile The Business Risk Profile (BRP) is intended to assess the risk inherent in an insurer’s operations and the potential sustainable returns resulting from these operations. The two main drivers of Business Risk are Insurance Industry Country Risk Assessment and Competitive Position. Insurance Industry Country Risk Assessment (IICRA): This broadly addresses the market and segment risk of an insurer—including the sovereign risk. The IICRA score is a weighted blend of S&P’s analysis of the Country Risk Score and the Industry Risk Score based on a matrix of outcomes provided by S&P. Insurance companies that operate in a single country/sector would be assigned with that country or sector’s IICRA score. A weighted average score based on GPW from respective areas/regions is used for companies that operate in multiple areas or regions. The underlying aspects for determining IICRA are included in the sub-factors below. Country Risk Sub-factors Economic risk Political risk Financial system risk Payment culture and the rule of law Industry Risk Sub-factors Return on capital Product risk Barriers to entry Insurance penetration trend Institutional framework Competitive Position: S&P looks at a company’s operating performance on numerous levels by comparing it to the various industry benchmarks, peer studies and distribution channels. The sub-factors below are assessed using a score of Positive, Neutral, or Negative in each category Operating performance Differentiation of brand or reputation Market share Level of controlled distribution channels Geographic distribution Other diversification Financial Risk Profile The Financial Risk Profile (FRP) is viewed as the consequence of decisions that management makes in the context of its BRP and risk tolerances. The starting point for FRP evaluation is the analysis of capital and earnings. While analyzing capital and earnings is not new for S&P, combining the analysis into one seamless component of their methodology is a change to their current approach. Capital and earnings will be scored on a scale of one to eight, where one is the strongest. Capital and Earnings: Capital and earnings measurers an insurer’s ability to absorb losses by assessing capital adequacy prospectively, and is a function of three sub-factors that are scored: (1) regulatory capital adequacy, (2) capital adequacy based on S&P’s internal model and (3) representativeness of modeling. This summary does not expand on the regulatory capital adequacy as it appears to be a standard item that S&P reviews before an in-depth analysis of capital using their proprietary risk based capital model. Overview of S&P’s RFC: “Insurers: Rating Methodology” 3 To derive the second capital and earnings sub-factor, capital adequacy, S&P proposes to follow four steps: 1. Determine total adjusted capital (TAC) and risk based capital (RBC) requirements at various confidence intervals for the past financial year-end 2. Project the RBC requirement growth or contraction for the next two years. For example, if the RBC requirement was $12.0M at year-end 2011, and S&P expected 5% business growth, the RBC requirement at year-end 2012 would be $12.6M. 3. Score earnings quality as “high” or “low”; based on a number of tests to determine earnings volatility. For example, if S&P’s standard catastrophe charge is greater than annual operating earnings the score cannot be “high”. 4. Calculate prospective TAC generation and TAC. Earnings quality directly impacts S&P’s calculation of prospective TAC. Note that S&P’s capital model is to remain largely unchanged, with some minor adjustments including removal of concentration and size factor adjustments, as S&P feels those risks are now captured elsewhere. The last sub-factor of capital and earnings, called Representativeness of Modeling, determines whether the analysis of prospective capital adequacy has overstated or understated capital and operating performance. This sub-factor can be scored positive, negative or neutral, and S&P states most insurers are likely to be scored neutral under the proposed criteria. Once the capital and earnings score (between one and eight) is determined, it is adjusted by the scores for risk position and financial flexibility to arrive at the final FRP score. Risk Position and Financial Flexibility: Risk position assesses material risks that the capital model does not incorporate, and specific risks that it captures but that could make an insurer’s capital and related financial ratios significantly more or less volatile. Financial flexibility uses qualitative and quantitative measures to estimate the balance between an insurer’s sources and uses of external capital and liquidity over the current and next two years. Both risk position and financial flexibility are scored strong, adequate, less than adequate or weak, and are used to adjust the capital and earnings score between minus one and plus two points to arrive at the overall FRP score. The respective sub-factors used to determine the scoring are: Risk Position Sub-factors Exposure to employee benefits obligations Foreign currency exposure Investment leverage Investment portfolio diversification Additional sources of capital volatility Overview of S&P’s RFC: “Insurers: Rating Methodology” Financial Flexibility Sub-factors Access to sources of external capital and liquidity Financial leverage Fixed-charge coverage 4 Modifiers and Caps After determining the rating “anchor” by combining the BRP score and the FRP score, the proposed criteria establish four additional factors to be evaluated. These modifiers and caps apply cumulatively. A high level review of the four factors is in the below table. Modifiers ERM and Management Score Peer Comparisons Caps Liquidity Score Fixed Charge Coverage Sovereign Ratings and T&C Assessment The proposed criteria combine two existing rating categories into a single score ranging from one to five. The importance of ERM is also scored as high or low depending on the rated entity’s risk profile. The overall score for this rating modifier is a function of the sub-factor scores of ERM, Management and the importance of ERM determinations. It should be noted that the proposed criteria do not introduce any new ERM or Management rating methodology. The rating anchor can be adjusted by up to one notch in either direction to reflect the insurer's relative credit standing among peers, either through a holistic analysis of the eight rating factors (except liquidity) or by identifying below- or aboveaverage vulnerability to event-related risks or sustained, predictable operating and financial outperformance or underperformance. The liquidity analysis, and more specifically the proposed liquidity ratio thresholds, is an enhanced aspect of S&P’s rating methodology. Liquidity is assessed with a score ranging from one to five and is analyzed absolutely (not relative to peers or insurers in the same rating category). Liquidity, when analyzed in this section of the proposed methodology, is a cap to the final rating. Liquidity is a cap instead of a component of BRP or FRP as S&P views weak liquidity can more likely lead to default, but strong liquidity does not enhance an insurer’s overall creditworthiness. This test is another cap to the final rating and provides the following minimum fixed-charge coverage ratios by credit profile level: aaa: 8x; aa: 5x; a: 3x; bbb: 2x; bb: 1.5x. The relevant sovereign ratings and Transfer & Convertibility assessments are usually a cap, unless the insurer meets certain circumstances (described as rare), in which the insurer’s rating could exceed the sovereign by a maximum of two notches. Rating an insurer above the sovereign means that S&P believes the company’s willingness and ability to service debt is superior to the sovereign and that there is measurable probability the insurer will not default if the sovereign does. Overview of S&P’s RFC: “Insurers: Rating Methodology” 5 Evaluate Group or Government Support The final steps consider any group support for subsidiaries or extraordinary governmental support for insurers owned by a government. S&P will assess the status of group members by defining them as either core, highly strategic, strategically important, moderately strategic or nonstrategic. S&P also discusses the process of assigning ICRs to non-operating insurance holding companies, operating holding companies and noninsurance operating companies. S&P Seeking Responses for Specific Questions S&P has listed four questions it is seeking market feedback on its proposed criteria: 1. Do the criteria incorporate the key factors affecting an insurer’s creditworthiness? Do you agree with the main variables for assessing the different factors? If not, what is missing and what is redundant? 2. Are we sufficiently clear and transparent about how we explain the proposed process for assigning ratings, and standard for evaluating and weighting the proposed rating factors? If not, what areas would benefit from greater clarity? 3. Do you agree with the way the proposed insurance industry and country risk assessment (IICRA) score is reached and would affect insurers’ ratings? If not, what alternatives would you propose? 4. Do you agree with the proposed way that liquidity, ERM and management are scored and how they would affect ratings? Aon Benfield’s Rating Agency Advisory Group plans to provide written feedback to S&P in regard of this Request for Comment. Additionally, we can provide assistance in understanding rating agency requirements and potential changes. Should you or your clients have questions, please do not hesitate to contact a member of Aon Benfield’s Rating Agency Advisory Group, including: Overview of S&P’s RFC: “Insurers: Rating Methodology” 6 Contact Information Global Kelly Superczynski Head of Global Rating Agency Advisory Aon Benfield Analytics +1 312 381 5351 kelly.superczynski@aonbenfield.com U.S. Patrick Matthews Head of U.S. Rating Agency Advisory +1 215 751 1591 patrick.matthews@aonbenfield.com EMEA Marc Beckers Head of Aon Benfield Analytics, EMEA +44 (0)20 7086 0394 marc.beckers@aonbenfield.com APAC Rade Musulin COO, Aon Benfield Analytics, APAC +61 2 9650 0428 rade.musulin@aonbenfield.com About Aon Benfield Analytics Aon Benfield Analytics offers clients industry-leading catastrophe management, actuarial, rating agency advisory and risk and capital strategy expertise. Whether working side-by-side with brokers on risk transfer products or engaging on broader analytic and modeling engagements, our 400+ specialists around the world consistently deliver innovation and thought leadership to clients. In placements, we quantify the effectiveness of reinsurance and help structure optimal risk transfer programs. Beyond the placement, we provide solutions for risk and concentration analysis, portfolio optimization, catastrophe modeling, pricing and cost recovery, and economic capital modeling. Aon Benfield Analytics, together with our leading broking teams, helps clients fully consider the capital, income, regulatory and rating agency implications of all risk transfer transactions. About Aon Benfield Aon Benfield, a division of Aon plc (NYSE: AON), is the world’s leading reinsurance intermediary and full-service capital advisor. We empower our clients to better understand, manage and transfer risk through innovative solutions and personalized access to all forms of global reinsurance capital across treaty, facultative and capital markets. As a trusted advocate, we deliver local reach to the world’s markets, an unparalleled investment in innovative analytics, including catastrophe management, actuarial and rating agency advisory. Through our professionals’ expertise and experience, we advise clients in making optimal capital choices that will empower results and improve operational effectiveness for their business. With more than 80 offices in 50 countries, our worldwide client base has access to the broadest portfolio of integrated capital solutions and services. To learn how Aon Benfield helps empower results, please visit aonbenfield.com. Copyright 2012 Aon Benfield Inc. This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The comments in this summary are based upon Aon Benfield's preliminary analysis of publicly available information. The content of this document is made available on an “as is” basis, without warranty of any kind. Aon Benfield disclaims any legal liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Aon Benfield reserves all rights to the content of this document Overview of S&P’s RFC: “Insurers: Rating Methodology” 7