Best Practices:

REAL ESTATE MANAGEMENT SERVICE

Management Company | Client Relations | Management of the Property | Tenant/Resident Relations

2013

© 2013 Institute of Real Estate Management of the National Association of Realtors®

All rights reserved. This book or any part thereof may not be reproduced, stored in a retrieval system, or transmitted, in

any form or by any means, without the prior written permission of the publisher. Inquiries should be directed to: Best

Practices, Institute of Real Estate Management, 430 North Michigan Avenue, Chicago, Illinois 60611, USA.

This document is designed to provide accurate and authoritative information in regard to the subject matter covered.

Because of changing and varying state and local laws, competent professional advice should be sought prior to use.

This document is distributed with the understanding that IREM is not engaged in rendering legal, accounting, or

any other professional service. If legal advice or other expert assistance is required, the services of a competent

professional should be sought.

IREM encourages diversity. We welcome individuals of all races, genders, creeds, ages, sexual orientations, national

origins, and individuals with disabilities. Our organization strives to provide an equal opportunity environment among

its members, vendors, and staff.

IREM®, the IREM logo, Certified Property Manager®, CPM®, the CPM key logo, Accredited Residential Manager®, ARM®,

the ARM torch logo, Accredited Management Organization®, AMO®, the AMO circle logo, Income/Expense Analysis®,

Expense Analysis®, JPM® and MPSA® are registered marks of the Institute of Real Estate Management.

Printed in the United States of America

ISBN: 1-57203-191-3

IREM Headquarters

430 North Michigan Avenue

Chicago, IL 60611-4090

www.irem.org

Phone

Fax

E-mail

(800) 837-0706

(312) 329-6000

(800) 338-4736

custserv@irem.org

Best Practices: Real Estate Management Service

Contents

Introduction................................................................................................................................ 2

Definitions.................................................................................................................................. 3

Management Company............................................................................................................. 4

Client Relations.......................................................................................................................... 9

Management of the Property.................................................................................................. 12

Tenant/Resident Relations....................................................................................................... 19

Best Practices Checklist........................................................................................................... 21

About the Intitute of Real Estate Management...................................................................... 25

Best Practices: Real Estate Management Service

1.

Definitions

The following definitions have been adopted for purposes of this Best Practices document. They do not necessarily

represent legal terminology or definitions and should not be construed as such.

Client – The term “client” is used here to refer to the owner of the property or owner’s designated agent to

whom management services are provided.

Client directive – The term “client directive” is a written instruction from the client or confirmed in writing

with the client or contained within a contract or management agreement.

Landlord – The term “landlord” is used here to refer to the owner or owner’s designated agent of real estate

that is rented or leased to an individual or business.

Management company – The term “management company” is used here to refer to an organization

operating as a managing agent that provides real estate management services for a fee. This includes property

management companies and property management departments within full-service real estate companies.

Owner – The term “owner” is used here to refer to the individual or entity with legal right of title

to a property.

Tenant – The term “tenant” is used here to refer to a person or entity that pays rent to occupy or gain

possession of real estate.

Best Practices: Real Estate Management Service

3.

1. Management Company

Best Practice 1.1. Company Formation. The management company shall be established in compliance with all

applicable laws and regulations.

Explanation of Best Practice 1.1. Whether the management company is formed as a sole proprietorship, partnership,

corporation, or other legal entity, each of which has its own revenue and tax implications, all legal requirements

should be followed in establishing it. Failure to properly and legally establish and operate the business could

jeopardize the properties and other assets under its care.

Best Practice 1.2. Legal Compliance. The management company and its employees shall conduct business

activities with knowledge of and in compliance with all applicable laws and regulations.

Explanation of Best Practice 1.2. Numerous legal obligations are imposed on management companies. This

includes laws and regulations that affect businesses in general, as well as those that affect real estate companies in

particular. In many jurisdictions, a real estate license is required for third-party management companies that engage in

the lease or management of properties for others.

Best Practice 1.3. Management Company Insurance. The management company shall maintain insurance

coverage that protects the management company, its employees when acting in an official capacity for the company,

and the assets under its fiduciary care.

Explanation of Best Practice 1.3. The business environment requires management companies regardless of size

to protect the interests of the principals and company by sharing certain risks with insurance providers. Clients

must have confidence that the managing agent can withstand losses and continue to do business uninterrupted.

Insurance is needed to protect the company’s property from damage and destruction losses and to protect the

financial interests of the company and client from losses resulting from actions taken by the firm’s ownership or

employees.

Insurance for a management company generally includes, but is not limited to, the following: workers’ compensation

insurance, fidelity and crime insurance, crime coverage insurance, errors and omissions insurance, business

interruption insurance, employment practices liability insurance, employee benefit coverage, disability insurance,

and officers and directors insurance. Additional items that may be insured are: buildings and other structures,

automobiles or other mobile property, machinery and equipment, furniture and fixtures, inventory, records and

valuable documents, money and securities, and intangible property such as trademarks and logos. Finally, a

management company may purchase insurance that protects against libel, slander, discrimination, unlawful and

retaliatory eviction, and invasion of privacy suffered by tenants and their guests.

Best Practice 1.4. Company Emergency Preparedness. Emergency preparedness and emergency response

plans and procedures for the management company shall be developed and, when necessary, followed.

Explanation of Best Practice 1.4. A management company, no matter the size, should be prepared for emergencies

of any kind. Drafting an emergency preparedness and response plan that includes business continuity planning can

help the management company deal more efficiently with emergencies and better protect the lives of employees

as well as ensure the stability of the company’s assets and continuous management of those assets under its care.

An emergency procedures manual provides step-by-step instructions on what everyone in a company should do

in case of an emergency.

4.

Best Practices: Real Estate Management Service

1. Management Company

Best Practice 1.5. Company Policies and Procedures. Written policies and procedures shall be developed and

enforced for all company operations, communicated to and readily accessible by all employees, and reviewed and

updated as needed.

Explanation of Best Practice 1.5 Policies and procedures are designed to guide actions and behaviors in the

workplace. Policies help ensure that workplace behaviors conform to legal requirements and organizational

expectations. Procedures, which are step-by-step lists of activities required to conduct certain tasks, ensure that

routine tasks are carried out in an effective, efficient, and consistent fashion. Together, policies and procedures

are a roadmap for employees and a tool to standardize the way employees handle specific assignments. While

important for all management companies, policies and procedures are especially important when companies have

branch offices and when managed properties have on-site management personnel.

Typically policies and procedures are compiled into an operations manual that covers day-to-day operational

procedures for the company and its personnel. These manuals generally include supporting forms and sample

letters. Whether printed and distributed or provided electronically via a company website, such policies and

procedures must be readily accessible to all employees and their use reinforced.

Best Practice 1.6. Recordkeeping. The management company shall maintain company, property, and client

records in accordance with all applicable regulatory guidelines, contractual obligations, and company policy, and in a

manner that provides for proper and secure records storage, efficient records retrieval, and appropriate destruction

of obsolete records.

Explanation of Best Practice 1.6. Recordkeeping is a key function of a management company. This includes

records pertaining to the company itself, all properties under its management, and all clients that are served.

Recordkeeping protocols are necessary to comply with various laws and to operate the business properly. A

management company’s recordkeeping system should provide for the proper and secure storage, easy and

efficient retrieval, and destruction of obsolete records of the following types of records for the management

company itself, for each property under its management, and for each of the company’s clients:

• Accounting and bookkeeping records

• Bank records

• Contracts and leases

• Corporate records

• Correspondence

• Employee records

• Frequently used forms

• Intellectual property records

• Marketing and advertising records

• Permits and licenses

• Stock records

• Tax records

Best Practice 1.7. Staff Development. The management company shall provide for the professional development,

training, and credentialing of employees in accordance with their roles and responsibilities.

Explanation of Best Practice 1.7. Real estate management is a dynamic business that depends on the expertise

and skills of its employees. Only through ongoing education and training of its staff can a management company

maintain its competitiveness by increasing competency levels and eliminating deficiencies and provide a high level

of professionalism for the staff. Additionally, providing opportunities to acquire education and earn professional

credentials helps employees grow in their jobs and within the industry and encourages loyalty and productivity.

Best Practices: Real Estate Management Service

5.

1. Management Company

Training and development are related but not synonymous. Training typically provides employees with specific

skills or helps correct performance problems, whereas development is an effort to provide employees with abilities

that will be used on a long-term basis to develop enriched and more capable workers throughout the career life

cycle. An employee development program consists of systematic and planned activities designed to provide

employees with the necessary knowledge, skills, and abilities to meet current and future job demands aligned

with the company’s business needs and goals. Employee development activities should be planned for every

employee, regardless of position, throughout the employee’s tenure with the company and designed to support

the company’s goals, increase productivity, decrease or eliminate performance deficiencies, increase employee

commitment, and decrease turnover.

Best Practice 1.8. Job Descriptions. The management company shall have written job descriptions that accurately

represent the duties and responsibilities of each person within the company.

Explanation of Best Practice 1.8. Even if not currently hiring or creating a new position, an employer should have

clear, concise, and accurate job descriptions for all positions. A job description serves both existing and potential or

future employees. Job descriptions provide current employees with clear guidelines about their responsibilities and

keep employees focused on their job. The boundaries delineated by a job description can prevent employees from

encroaching on others’ responsibilities. A job description typically consists of the following elements: identification

information, job summary, job duties and responsibilities, job requirements, and minimum qualifications.

In the recruitment process, a job description gives potential employees comprehensive information about the job

for which they are applying. An accurate and effective job description filters applicants who are being evaluated for

the opening − helping generate a higher-quality pool of applicants. It also serves as a resource to the supervisor

who is filling a position by helping determine the types of selection tools that should be used when hiring.

Additionally, job descriptions provide standards that can be used to judge employee performance. This provides the

foundation for employee compensation programs and for comparing the relative worth of each job’s contributions

to the company’s overall performance.

Best Practice 1.9. Company Ethics. The management company shall have and enforce a written company code

of ethics that defines ethical relationships between the employees of the company and its clients, residents, tenants,

vendors, the public, and other employees.

Explanation of Best Practice 1.9. Real estate management companies have an obligation to adhere to standards

for ethical behavior in their organizations. A code of ethics is essential to provide guidance and standards for all

company employees as relates to conduct of business. This can be accomplished either by developing a code that

is company-specific or by adopting the code of ethics of a professional association such as IREM. The company’s code of ethics should be in writing, distributed to all employees when they start their employment

with the company, and regularly communicated to employees on an ongoing basis. Periodic training about the

code and its application is also encouraged. The examples set by the behavior of managers and executives in a

firm and the training they provide employees will reinforce the company’s ethical commitment.

Best Practice 1.10. Accounting System. The management company shall establish, maintain, and update as

needed an accounting system that supports company operations, is consistent with client directives, and complies with

accepted accounting and financial reporting principles.

Explanation of Best Practice 1.10. The handling of client funds is accomplished through an accounting system

that accommodates both the management company and the properties under its care. Accounting is generally

6.

Best Practices: Real Estate Management Service

1. Management Company

defined as the practice of classifying, recording, and summarizing financial transactions. It is largely concerned

with monitoring the flow of income and expenses in a business, accomplished through categories of debits and

credits. In a further refinement, short-term movements in accounts are monitored through accounts payable and

accounts receivable. Financial accounting is a system of classifying financial transactions that documents the

financial position of a given entity – either the management company or the properties under its management – in

the form of a balance sheet and an income statement.

Client directives with respect to accounting systems can vary widely: Some institutional owners may provide the

management company with an accounting procedures manual that sets forth all of the institution’s requirements;

other clients may have less stringent, though no less important, accounting expectations. Any accounting system

should support both cash and accrual accounting to the extent that client reporting requirements dictate.

An accounting system can be provided through an in-house accounting department, or the accounting function

can be outsourced. In either case, the management company is responsible for that system and its adherence to

all accepted accounting and financial reporting principles.

Best Practice 1.11. Company Budget. The management company shall prepare, and monitor ongoing conformance

with, an annual budget for the company.

Explanation of Best Practice 1.11. A company budget is one of the many tools available for monitoring the

income and expense of the organization and therefore its viability as an entity and for measuring its success as a

business.

Best Practice 1.12. Financial Controls. The management company shall establish and adhere to internal financial

controls for the handling of all company funds and client funds.

Explanation of Best Practice 1.12. Of the many functions of an accounting department, the handling of client funds

is vitally important. Monies belonging to clients are received and paid in the name of the managed property or its

ownership. For this reason, specific policies and procedures are needed for handling receipts and disbursements.

Internal checks and balances reduce the possibility of theft or misappropriation of funds as well as minimize the

potential for accounting errors. Internal financial controls should provide for an internal audit system in which a

supervisor reviews prior transactions for irregularities, an authorization for signing checks and dollar limitations

without a second signature, and other appropriate protocols to safeguard the handling of company and client

funds. In addition, the company shall conduct an independent financial audit or financial review when required by

law or regulation, company policy, or client directives.

Best Practice 1.13. Commingling Funds. The management company shall not commingle the funds of multiple

clients or client funds with company funds. Funds in trust or escrow accounts for multiple clients shall be clearly

designated and accounted for as they apply to each client.

Explanation of Best Practice 1.13. Improper handling of client funds by a third-party management company can be

a violation of laws and regulations and is a violation of IREM’s code of professional ethics. One of the most serious

offenses is that of commingling of funds – the mixing together of two or more clients’ funds or of a client’s funds

with the management company’s funds so that the ownership of the monies is unclear. Although it is possible

to use a master account that contains the funds of several clients which in turn are accounted for separately on

paper, most managers maintain separate bank accounts for individual clients to avoid potential problems. In many

cases, separate accounts are even maintained for individual properties when a client has more than one property

under management by the firm.

Best Practices: Real Estate Management Service

7.

1. Management Company

Best Practice 1.14. Strategic Plan. The company shall develop, maintain, periodically update, and regularly

communicate to its employees a strategic plan for the company.

Explanation of Best Practice 1.14. A company’s strategic plan sets out the goals, objectives, and guidelines for the

organization so that all participants understand their respective roles and the direction of the organization. At its

most comprehensive level, a strategic plan identifies market strategy (the services it will provide and the clients it

will serve), management strategy (the functions to be performed and who will perform them), and financial strategy

(how the business will be capitalized and how it will conduct its business to be profitable and economically viable).

A management company benefits from planning and developing a strategy by focusing resources, precluding

personal agendas, and creating a platform for communicating organizational vision.

A strategic plan is not a static document but should be a working document that can be modified as necessary to

align with changing business environments. It outlines decisions about how the business will be conducted to be

successful and, indeed, defines the nature of the business. In so doing, a strategic plan enables the company to

optimize the firm’s potential by identifying and responding to opportunities. Ultimately, the intent of a strategic

plan is to improve company performance based on measurable, identifiable standards and to serve clients by

helping to ensure a stable, viable business.

Best Practice 1.15. Industry Involvement and Support. The management company shall participate in and

support industry organizations.

Explanation of Best Practice 1.15. Industry organizations and professional associations can provide a management

company and its employees with access to continuing education, industry data and other information, advocacy for

real estate owners as well as managers, and a host of other benefits and services that strengthen the company and

enable it to more effectively serve its clients.

8.

Best Practices: Real Estate Management Service

2. Client Relations

Best Practice 2.1. Client Objectives. The management company shall identify and confirm in writing the client’s

objectives for owning the property.

Explanation of Best Practice 2.1. The purpose of real estate management is to achieve the goals and objectives

of the property’s owner. Not everyone owns real estate for the same reason. Typical goals are periodic income

from cash flow, return on investment through capital growth, capital appreciation, income tax advantage, use

for business, investment control, financing leverage, and pride of ownership – and frequently more than one

of these. Because different goals can suggest different management responses, the client’s goals establish the

parameters for the primary direction for the management of the property. As such, they determine how the

property is managed on a day-to-day basis and how much authority the manager will have in handling fiscal and

other issues.

The management company should insist that clients clearly articulate their objectives and confirm them in

writing. These objectives, in turn, will be reflected in the management agreement, which establishes operating

parameters that allow these goals to be met, and the management plan, which outlines how the goals and

objectives will be achieved.

Best Practice 2.2. Management Agreement. A written management agreement shall be in place that

establishes the business relationship between the management company and the client and defines and explains

the duties, responsibilities, and obligations of each party and the authority of the management company.

Explanation of Best Practice 2.2. To minimize the possibility of misunderstandings and the problems they can

cause, the relationship between the property owner and the management company is documented in writing

in the form of a management agreement. The management agreement is a formal and binding contract

between the management company and the property owner that establishes the manager’s legal authority

over the operation of the property. It identifies the property owner and the management company as parties

to the agreement, establishes the relationship between the owner and the manager for a fixed period, defines

the manager’s authority and compensation for services provided, outlines procedures, specifies limits of the

manager’s authority and actions, states financial and other responsibilities of the property owner, and provides

for termination of the agreement at a time certain or under specific conditions.

Best Practice 2.3. Scope of Authority. The management company shall not act beyond what is specified in the

management agreement without documented client approval.

Explanation of Best Practice 2.3. One of the primary purposes of the management agreement is to spell out the

management company’s scope of authority – the limitations placed upon the management company without

obtaining further approval. The concept of scope of authority for a management company operating as an

agent has specific legal meaning and relates to the performance of duties that are assigned to an agent by a

principal, either expressly or implied.

Best Practice 2.4. Customer Service. The management company shall have a customer service plan for

its clients.

Explanation of Best Practice 2.4. Because serving the client, which is reflected in the level of service to the

property and the degree of attentiveness to the client, is one of the management company’s top priorities,

the company should have a customer service plan that creates the platform for delivery of a high level of

customer service throughout the organization. A thorough plan addresses responding to client requests and

needs in a timely and professional manner, regular contact and communication with the client, client surveys

Best Practices: Real Estate Management Service

9.

2. Client Relations

to determine customer service levels and identify areas of improvement, staff training aimed at providing a

high level of customer service, client communications based on notifying clients of conditions and incidents at

their properties, having the technology infrastructure to meet client needs, and fulfilling the client’s goals and

delivering on expectations.

s agent for the property owner, the management company accepts responsibility for communications with

A

tenants and users of the property. This is a distinctly separate aspect of providing customer service. The quality

of service provided is a reflection on the owner of the property as well as an indication of the management

company’s performance in service to the owner.

Best Practice 2.5. Operating Reports. Accurate and complete financial and operating reports shall be provided

to the client on a regular, timely basis in accordance with the client’s instructions with respect to content, format, and

frequency.

Explanation of Best Practice 2.5. Scheduled reports to the client represent the primary communications link

between the management company and the client. To a large degree, they form the basis for determining

the performance of the property, as well as the client’s assessment of the performance of the management

company. It is management’s responsibility, at the outset, to verify the client’s requirements with respect to

the timing of these reports (typically monthly, although some owners prefer quarterly reports) as well as their

content and the format in which they are to be prepared and delivered − and to submit reports to the client in

accordance with these mutually agreed-upon requirements.

Generally, operating reports will contain both financial and narrative reports which, taken together, present a

clear and accurate description of what of relevance has happened on and around the property and the impact

of these occurrences on property operations. Reports should be prepared consistently from one period to the

next and in a manner that is clear, understandable, and easy to use.

While the scope, depth, and frequency of reports may vary from one client to another and from one type

of property to another, management’s ability to comply with the client’s requirements with respect to

providing timely, accurate, complete, useful, and truthful reporting is critical to the effective delivery of

management services.

Best Practice 2.6. Property Audit. The management company shall recommend that the client perform an annual

review or financial audit of property operations and shall fully cooperate in the conduct of such a financial review or

audit if performed by the client.

Explanation of Best Practice 2.6. The management company is responsible for significant assets. An audit of

property accounts and property operations gives assurance to the client that these assets are being properly

and accurately accounted for and safeguarded. The property owner usually has the right to audit the

accounts of the property at any time, although the owner and manager may agree to a routine audit schedule

and state the schedule in the management agreement. In all cases, the management company should

encourage the client to perform an audit at least once a year and fully support and cooperate in the performance

of the audit.

Best Practice 2.7. Client Property Insurance. The management company shall provide assistance and support to

the client in identifying insurance needs and acquiring and maintaining property and other insurance coverage related

to ownership of the property when requested by the client.

10.

Best Practices: Real Estate Management Service

2. Client Relations

Explanation of Best Practice 2.7. Although responsibility for obtaining insurance coverage typically rests with

the property owner, the management company plays a key role in supporting the owner in obtaining the

appropriate type and level of insurance – generally with respect to loss of income, structural damage, and

liability. The property owner usually gives the management company the responsibility to hold the policies, file

claims, and ensure that premiums are paid.

Best Practice 2.8. Client Property Taxes. The management company shall provide assistance and support to the

client in complying with all property tax obligations and appealing tax levels and assessments when requested by the client.

Explanation of Best Practice 2.8. Although the management company may not be responsible for property

tax matters, clients frequently look to management for assistance in filing appeals and complying with tax

obligations and should be prepared to assist the owner as may be requested.

Best Practice 2.9. Loyalty to Client. The management company shall exercise loyalty to the interests of the client

and shall not engage in any activity which could reasonably be construed as contrary to the best interests of the client

without full disclosure.

Explanation of Best Practice 2.9. The management company may represent any number of clients and some

of the properties may be competing in the same market or may even have some direct relationship to one

another. The management company should make the client aware of the management of competing properties

or competing interests by fully disclosing all such potential conflicts, ideally in writing.

Best Practice 2.10. Disclosure. The management company, as a fiduciary for the client, shall not accept, directly

or indirectly, any rebate, fee, commission, discount, or other benefit, monetary or otherwise, that has not been fully

disclosed to the client.

Explanation of Best Practice 2.10. It is common for suppliers and service providers to seek business from

management companies in their capacity as agents for property owners. Because management companies

represent multiple properties, there is a greater potential for business to the provider with fewer contacts and

effort. As a result providers may see an advantage in discounting their service or product based on volume.

If the benefit is afforded to each property or client, disclosure would not be necessary although it might be

worthwhile to keep clients informed of the benefit to them created by virtue of the agent’s aggregation of

properties under management. However, if the benefit is to the management company, it must be disclosed.

Best Practice 2.11. Client Obligations. The management company shall provide non-financial assistance and

support to the client in complying with the client’s incumbent obligations and responsibilities to other parties when so

requested by the client.

Explanation of Best Practice 2.11. The client may have obligations to other parties, including but not limited to

government and regulatory entities, tenants and residents, and other investors. These obligations may include

or arise from leasehold, contractual, statutory, regulatory, compliance, legal, and reporting requirements. The

client is responsible for fulfilling these obligations but may look to the management company to provide

assistance and support of a non-financial nature in acknowledging and fulfilling these obligations. The

management company should be prepared to assist the owner as may be reasonably requested.

Best Practices: Real Estate Management Service

11.

3. Management of the Property

Best Practice 3.1. Management Plan. The management company shall prepare a management plan for managed

properties in accordance with client directives.

Explanation of Best Practice 3.1. The management plan provides a detailed outline of the management company’s

operation of the property for the next period of time − typically one year, but sometimes for longer periods − to

meet the client’s objectives. Having the plan in writing assures there is no misunderstanding as to the direction

to be taken in managing the property.

The purpose of the management plan is for the management company to look at every facet of the property

and determine the best course of action for the coming period in concurrence with the objectives of ownership.

To this end, it represents a logical, deductive, intensive analysis of all factors related to a property. This typically

includes a regional analysis, neighborhood analysis, property analysis, market analysis, budget and cash flow

projections, analysis of alternatives, followed by recommendations and conclusions.

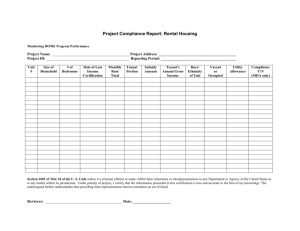

Best Practice 3.2. Property Budget. The management company shall prepare an annual operating budget for the

property, submit it to the client in a timely manner in accordance with the client’s instructions with respect to content

and format, and obtain appropriate approvals as applicable.

Explanation of Best Practice 3.2. A property budget is an itemized projection of income and expenses over

a specific period for that property. A budget serves as a guideline for operating a property and forms the

foundation for the overall management plan. It is used to measure the performance of the property and, by

extension, the performance of the management company and to measure the achievement of the owner’s

financial requirements.

The budget helps the management company minimize variance of the property’s net operating income and

assess the cash position of the property at a given time. The operating budget lists the principal or regular

sources of income and expenses for the property, usually on a monthly basis, and also indicates when the

transactions are expected to occur. The budget can form the basis for making periodic financial operating

reports to the owner as may be required.

Presentation of the budget to the owner offers a natural opportunity to discuss the past performance of

the property and make adjustments to individual budget items as the coming year is contemplated. The

management company can explain how anticipated income and expenses are expected to affect the property’s

performance.

In addition to the annual operating budget, a multi-year capital budget projection should be provided.

Best Practice 3.3. Property Policies and Procedures. The management company shall establish and enforce

written policies and procedures relative to the operation of each managed property, making such policies and

procedures readily accessible to all company and property staff.

Explanation of Best Practice 3.3. Policies and procedures are needed for each managed property. Although

there will be many similarities from one property to the next, each property has unique characteristics and its

policies and procedures should focus on the particular requirements of the property. Moreover, a property’s

policies and procedures may incorporate components from the client’s operations manual or adaptations of

the management company’s policies and procedures modified to be consistent with the client’s requirements.

Usually the differences are in the details because each property has unique features, and the management

company must address them specifically in order for the management of the property to be efficient and costeffective. Finally, policies and procedures should be consistent with current law and reviewed periodically to

ensure compliance with changes in laws or regulations.

12.

Best Practices: Real Estate Management Service

3. Management of the Property

Policies and procedures serve to inform employees of policies, instruct employees in procedures, provide

technical data for reference, and define the scope of the job and relate it to the total organization. Similar to

company policies and procedures, property policies help ensure that workplace behaviors conform to legal

requirements and organizational expectations.

Policies and procedures typically are compiled into an operations manual, often supplemented with sample

forms and letters, and made available to employees in printed format or electronically in a readily accessible

manner.

Best Practice 3.4. Routine Maintenance. The management company shall assess, develop, and implement a plan

for the routine custodial and corrective maintenance of the property consistent with client directives.

Explanation of Best Practice 3.4. Routine maintenance focuses on the day-to-day upkeep of the property

that is essential to ensure that the owner’s asset is maintained at a consistently high level to maintain value,

increase reliability, and reduce premature repair/obsolescence while preserving the property’s appearance and

optimizing the tenant environment.

Routine maintenance plans include the performance of regular routine inspections. Custodial maintenance

generally includes cleaning of building components, common areas, and, in the case of some commercial

properties, tenants’ leased premises. Corrective maintenance represents after-the-fact maintenance in which

a problem needs to be repaired or corrected, often identified during a property inspection or, on occasion,

through tenant requests. Making corrective repairs as soon as possible after a problem is discovered will prevent

further damage to the system or equipment and avert a more costly, more time-consuming repair at a later

time.

Routine, custodial, and corrective maintenance can be done through in-house staff or under a service contract with

an outside vendor.

Best Practice 3.5. Preventive Maintenance. The management company shall assess, develop, and implement a

plan for the preventive maintenance of the property consistent with client directives.

Explanation of Best Practice 3.5. Preventive maintenance is a proactive program of regularly scheduled inspections,

servicing, and repairs designed to prolong the useful life of equipment and other items while helping to avoid

more costly breakdowns. Preventive maintenance is a valuable management practice that can add years to the life

of equipment and sustain a property in good to excellent condition. Preventive maintenance should be scheduled

so that the work can be done in a timely fashion regardless of a building’s other maintenance needs and planned

when equipment is not being used or when use is not at peak capacity.

A preventive maintenance program can play a significant role in risk management. Regularly inspecting and

repairing property assets helps to avoid equipment damage or failure and mishaps or accidents. A preventive

maintenance program will help defer and perhaps eliminate certain emergencies that could endanger peoples’

health and welfare because all systems, equipment, and premises are regularly inspected and kept in good

operating condition.

A preventive maintenance plan typically is based on inventorying and servicing the mechanical, electrical,

plumbing, and other essential components that support the property. Information and instructions provided in

the operating manuals and manufacturer’s warranties for each piece of installed equipment identify the service

to be performed. Records are maintained of maintenance performed, observed problems, corrective actions

taken, and replacements and spot checks by supervisors.

Best Practices: Real Estate Management Service

13.

3. Management of the Property

Best Practice 3.6. Capital Improvements. The management company shall recommend and assist in implementing

capital improvements consistent with client directives.

Explanation of Best Practice 3.6. Every building has a life cycle. Over time, the fixtures, appliances, decor,

and the building itself become obsolete or wear out. Eventually, replacement is needed, and replacing and

renovating parts of a building often entail large outlays of cash and are regarded as capital improvements. A

capital improvement is a betterment to a building or equipment that extends its life or increases its usefulness

or productivity. Examples include change-out of appliances, roof replacement, upgrading the HVAC system,

constructing an addition to the building, alarm installation, and tenant improvements. The cost of a capital

improvement is added to the basis of the asset improved and then depreciated, in contrast to repairs and

maintenance, which are expensed currently.

A sound capital improvement and replacement plan begins with a comprehensive assessment of the condition

of the property. The assessment should include information about the infrastructure, site improvements,

structures, systems, and fixed assets.

Best Practice 3.7. Receipt of Funds. The management company shall receive, deposit, and account for incoming

funds accurately and in a timely manner and in accordance with accepted accounting principles, client directives, and

applicable laws and regulations.

Explanation of Best Practice 3.7. Close management of receivables helps keep a constant and even flow of cash

into a company. Receivables should be collected as quickly as possible and should be deposited in the bank

promptly. At a rental property, whether residential or commercial, close attention to receivables means keeping

track of rent payments, noting late payments, and quickly contacting tenants who have not paid on time.

Best Practice 3.8. Deposit of Funds. The management company shall exert due diligence for the protection of

client’s funds against all foreseeable contingencies, depositing such funds in an escrow, trust, or agency account with

an insured financial institution, or as otherwise required by the client.

Explanation of Best Practice 3.8. Policies and procedures should be established for consistent processing of funds

received. The handling of the funds from receipt to deposit should be managed in such a manner to protect

both the owner and management company from any loss of funds. The management company’s procedures

should provide proper accounting to monitor the timeliness of the receipts and that they are applied to the

correct accounts. The management company must assure that its policies and procedures for deposit of funds

comply with applicable laws and regulations. Management company personnel who handle client’s funds should

be bonded and adequate audit trails should be in place.

Best Practice 3.9. Disbursements. The management company shall disburse and account for outgoing funds and

payables accurately and in a timely manner and in accordance with accepted accounting principles, client directives,

and relevant laws and regulations and with proper approvals.

Explanation of Best Practice 3.9. The management company will establish purchasing policies as a way to monitor

the many expenses it incurs for supplies, services, and materials on behalf of a property. The management

company is charged with paying bills, disbursing of funds, and accounting for all disbursements in an appropriate

manner. To monitor how money flows from a property, it is important to make sure that the invoice itself is

accurate, that the payment is made on time, and that the payment goes to the right company or person. In

most cases purchase orders are used to control and monitor disbursements.

14.

Best Practices: Real Estate Management Service

3. Management of the Property

Best Practice 3.10. Contractor Insurance Requirements. Contractors providing goods or services to managed

property shall be required to meet minimum insurance requirements, and the management company shall develop

and implement a system for the collection of contractor certificates of insurance and compliance with insurance

requirements.

Explanation of Best Practice 3.10. A contractor is a person or a company that is a separate business entity engaged

by the management company to complete a task on or provide services to the property. The management

company should confirm that the contractor has insurance and can demonstrate that the property, the property

owner of record, the owner’s legal representative, and the management company are not exposed to loss from

any negligence on the part of the contractor who provides services to the property.

At a minimum, contractor insurance will provide coverage for persons coming onto a property to perform

work. Many properties have set limits that contractors must meet. The management company should confirm

that vendors are in compliance with all insurance requirements by requesting certificates of insurance from

contractors. The certificate of insurance is a document issued by an insurer that evidences that an insurance

policy exists and identifies the insurer, insurance agency, insured, types of insurance, policy numbers, effective

dates, limits, certificate holder, cancellation procedure, special provisions (e.g., additional insured), and the

name of the representative who authorizes the certificate to be issued.

Best Practice 3.11. Insurance Claims. The management company shall establish and follow a systematic procedure

for reporting loss claims and potential loss claims relating to managed property and for managing the claims process.

Explanation of Best Practice 3.11. Even with all the precautionary measures a management company may take,

incidents will occur that may result in potential losses. Policies and procedures for consistently responding to

potential loss claims at a property ensure that all necessary steps are followed and responses are consistently

applied. The steps in responding to an incident should, at a minimum, include:

• Filing a written incident report, which is an internal report kept on file at the property.

• Reporting to the insurance company, sent immediately for informational purposes in case of future lawsuit.

The time requirement for notification typically is stated in the insurance policy.

• Filing a damage claim where appropriate.

Procedures for documenting and reporting a loss ensure that these steps are followed in a complete and

accurate manner. Reporting a property loss typically includes: name and contact information of insured, name

and contact information of person to be contacted for additional information, date and time of loss, location

of damage, estimated cost of repairs and replacement based on bids received, identification of who will do

the work, original builder of damaged property or original manufacturer of damaged item, date of completion

or purchase date of manufactured item, identification of witnesses or notification of authorities (such as fire

department, police department), detailed description of damage and cause, signature of person filing report,

date of submission, and photos as applicable.

L iability losses require different types of information to be reported on an accident report, particularly if a

person was injured or property was damaged.

Before any losses are experienced, the management company can take steps to facilitate claim adjustments

in the event of losses by creating and maintaining detailed written records of items that are insured and where

appropriate provide photographic records of equipment in place as well as structural and finish elements.

Best Practices: Real Estate Management Service

15.

3. Management of the Property

Best Practice 3.12. Emergency Preparedness. The management company shall establish and, when necessary,

follow emergency preparedness and emergency response plans and procedures for managed properties.

Explanation for Best Practice 3.12. Emergency preparedness and response plans provide for optimum protection

of people and property during and after emergency conditions and minimize the time needed for restoration.

A thorough and well-designed emergency procedures plan enables the property staff to be prepared before a

disaster occurs, in order to minimize and perhaps prevent injuries to people and damage to property.

Every property, regardless of size or function, should have an emergency procedures plan that addresses the

property’s unique needs. The plan should spell out how the property staff will respond to different types of

emergencies, identify and establish a notification process to the proper authorities and interested parties (lease

holders, ownership, insurance companies, local emergency authorities, management company personnel), and

inform tenants of management’s role in an emergency and how tenants should respond.

A comprehensive safety and emergency plan reduces the threat of emergencies through prevention, early

detection, notification, and evacuation and relocation plans. Further risk is reduced through control and

mitigation of recovery operations. Once a plan is in place, it should be maintained and updated periodically

and at least annually, should be communicated frequently and made readily accessible to all affected parties,

and should be supported through employee and tenant training and familiarization programs.

Best Practice 3.13. Property Security. Security policies and procedures for a managed property shall be established

as appropriate, with periodic review conducted for compliance and changing conditions.

Explanation of Best Practice 3.13. Maintaining a reasonably safe environment is not only a risk reduction issue

for the management company, it is an important aspect of the service provided to tenants and others lawfully

on the property. Periodic review of security policies and procedures should occur at least annually or whenever

there are changes at the property.

Best Practice 3.14. Safety. Emergency and life safety equipment and components of a managed property shall be

maintained in proper working condition and in compliance with all applicable codes and regulations.

Explanation of Best Practice 3.14. The management company should prepare and adhere to proper maintenance

procedures, periodic inspection and testing, and documentation for equipment and components designed to

protect tenants and other occupants.

Best Practice 3.15. Environmental and Health Safety and Hazard Control. The management company

shall establish and maintain an environmental and health safety management program. Hazards shall be reported

immediately to the client with a response plan.

Explanation of Best Practice 3.15. Given the long list of potential environmental hazards, every type of property

faces serious and numerous risks. New laws, changes in regulations, and changes on a site suggest that

conducting a thorough review of the risks and liabilities at a site at least once a year is a wise practice.

Best Practice 3.16. Marketing Plan. The management company shall develop and implement a written marketing

plan for each managed property consistent with the client’s objectives.

Explanation of Best Practice 3.16. A marketing plan is designed to effectively attract potential tenants to lease

the current and future vacant space at a property. This includes identification of the most likely tenants for the

16.

Best Practices: Real Estate Management Service

3. Management of the Property

building, the desired tenant mix, the types of tenants that will complement others and guidelines for reaching

them, and a budget to fund the planned advertising and promotional activities. The purpose of the marketing

plan is to shape and focus all marketing and leasing efforts for the property.

Best Practice 3.17. Leasing Policies and Procedures. The management company shall develop and implement

written leasing policies and procedures as appropriate for the property and in accordance with client objectives,

company policy, and applicable laws and regulations.

Explanation of Best Practice 3.17. Leasing policies and procedures are tools to effectively seek potential tenants

for current and future vacant space which enhance the respective tenant mix and value of the property. Whether

leasing functions will be performed by employees of the management company or by independent leasing

agents, it is the responsibility of the management company to establish policies and procedures acceptable to

the client.

Best Practice 3.18. Leasing Plan. The management company shall have a written leasing plan for each managed

property as appropriate for the property and in accordance with client objectives.

Explanation of Best Practice 3.18. A leasing plan is an outline for leasing to and placing occupants in a property.

The information in the leasing plan will depend on the property type and may include items such as unit

rental rates and locations for residential properties, square footage and space plans for office buildings, and

merchandise categories, tenant mix, and tenant placement for retail properties. The leasing plan can be

considered a component of the broader overall marketing plan.

Best Practice 3.19. Rental Rates. The management company shall establish rental rates based on assessment of

the market and client objectives as appropriate for the property,

Explanation of Best Practice 3.19. Rental rates determine a property’s income which in turn determines value.

Rental rates begin with a market analysis that allows management to position the property in the correct market

and evaluate it according to the standards of that market. Establishing rental rates requires assessment of

the desirability of the property, viability of the neighborhood, and overall strength of the market. Base rent is

established at which space can be leased to yield a satisfactory occupancy level without being underpriced.

Best Practice 3.20. Property Staffing. The management company shall provide for the adequate staffing of the

property and supervision of property employees and vendors in accordance with client objectives.

Explanation of Best Practice 3.20. The management company applies human resource planning to ensure that

it has the right number of employees with the right skill sets to deliver the desired level of service to the

property that is being managed. A needs assessment typically forms the basis of determining staffing needs

and ensuring that the appropriate employees will be hired and retained.

Best Practice 3.21. Legal Compliance. The management company shall manage property with knowledge of and

in compliance with all applicable laws and regulations.

Explanation of Best Practice 3.21. The management company is responsible for having a good understanding

of the agencies that have authority over each property under management and gaining knowledge of the laws

Best Practices: Real Estate Management Service

17.

3. Management of the Property

and regulations that apply to the services provided by the company and the properties under the company’s

responsibility. In all aspects of managing the property, legal compliance lessens risks to regulatory actions and

lawsuits. Acting with knowledge of and in compliance with laws and regulations also enhances the reputation

of both the property owner and the management company.

Best Practice 3.22. Sustainability. The property management company shall be knowledgeable about sustainable

alternatives and able to integrate sustainable maintenance and operational practices into to the management of a

property consistent with client directives.

Explanation of Best Practice 3.22. Sustainable real estate management practices can have the effect of reducing

a property’s operating expenses and preserving the value of the asset. Moreover, tenants and residents in

greater numbers are demanding sustainability, and owners and their managers are under increased pressure

to respond. This is supported by experts in sustainable real estate management who suggest that tenant and

resident demand, especially in non-residential real estate, is one of the primary drivers toward sustainability.

The real estate management company shall craft a sensible sustainability strategy for a property consistent with

the client’s directives and make sound management decisions to achieve sustainability goals with respect to

energy efficiency, water efficiency, indoor environmental quality, and waste output and disposal. This strategy

should be updated annually or as may be required.

Best Practice 3.23. Benchmarking. The property management company shall utilize benchmarking as a tool to

assess property performance with the goal of identifying areas of improvement.

Explanation of Best Practice 3.23. Benchmarking is the process of comparing processes and performance

metrics in order to improve one’s own results. It is most frequently used to measure performance based on a

specific metric – for example, operating expense per square foot – that is then compared to others.

Benchmarking typically involves four steps: (1) understanding one’s own processes and internal performance

metrics, (2) identifying the business processes of others that result in superior outcomes – e.g., the best

practices, (3) comparing one’s own processes to those best practices, and (4) taking the steps to close the gap

in performance, typically by doing things better, faster, or more efficiently. Ideally benchmarking is not a onetime exercise but rather becomes an integral component of a continual process improvement strategy

In building operations, benchmarking of energy and utility usage has become especially critical in identifying

under-performing buildings, detecting opportunities for efficiency improvements, and receiving recognition for

superior energy performance via the U.S. Environmental Protection Agency (EPA), Energy Star, Leadership in

Energy and Environmental Design (LEED), and the like.

18.

Best Practices: Real Estate Management Service

4. Tenant/Resident Relations

Best Practice 4.1. Leases/Agreements. The management company shall ensure that a written agreement is in

place for every tenant/resident occupying the property that specifically addresses the responsibilities of both the

landlord and tenant.

Explanation of Best Practice 4.1. In rental properties, a lease, a legal contract between the two parties, defines

the rights and responsibilities of the tenant and the landlord, defined as the owner or the owner’s designated

agent. As such, it protects the tenant’s interests as much as it protects the property owner’s interests. It is

based on the intended use of the space, the common areas, and any special provisions for that usage for the

tenant and regular payments in the form of rent for the owner. It is management’s responsibility to administer

lease agreements and ensure that both parties act consistently with the terms of the lease, which requires the

management company to have on file and regularly review a written lease for each tenant or sub-tenant.

Best Practice 4.2. Tenant/Resident Insurance Requirements. If required by the client, leases shall specify

the responsibilities of the tenant with respect to insurance, including any minimum coverages required, and the

management company shall develop and implement a system for the collection and regular compliance review of

tenants’ certificates of insurance.

Explanation of Best Practice 4.2. Because insurance for the property as a whole does not cover the contents

of tenants’ individually leased spaces, tenants are responsible for carrying insurance for these contents. In the

case of residential leases, tenant insurance policies are readily available. For commercial property, most leases

require tenants to carry enough insurance to cover their inventory and whatever furnishings and equipment they

have in their leased space. The commercial tenant’s insurance coverage should be sufficient both to preserve

the business and to meet the terms of the lease in case of disaster. Commercial tenants are usually required

to carry their own liability insurance, and the lease should obligate them to list the owner of the property and

management company as additional named insureds on insurance policies.

Best Practice 4.3. Tenant/Resident Safety. The management company shall develop, maintain, and enforce

general safety guidelines and awareness to protect tenants/residents and others lawfully on the common areas of the

property.

Explanation of Best Practice 4.3. Safety and security play important roles in managing all aspects of operating a

property and running a property management company. The management company should assess the safety

and security needs of the property and develop, monitor, and implement a safety plan that is communicated to

tenants and others on the property. Included in this assessment should be an accident prevention plan.

Best Practice 4.4. Tenant/Resident and Occupant Customer Service. The management company shall have a

customer service plan for tenants, residents, and others lawfully on the premises.

Explanation of Best Practice 4.4. A property’s most valuable asset is its income stream, and this income stream

comes primarily from the rents paid by tenants. Keeping tenants is easier and less expensive than replacing

tenants. A tenant and occupant customer service plan will vary among property types but generally will include

building operations and practices, frequent communications, accurate and timely tenant billings, timely return

of phone calls and emails, requests handled in a timely and courteous fashion, and personal visits on a regular

basis – and employee training to support all of these protocols. Providing a high level of customer service

to tenants will improve relations, impact turnover, and enhance the ability to attain the client’s goals and

objectives.

Best Practices: Real Estate Management Service

19.

4. Tenant/Resident Relations

Best Practice 4.5. Tenant/Resident Selection. The management company shall develop and adhere to written

policies and procedures on tenant selection that are consistent with client directives, company policy, and in compliance

with applicable laws and regulations.

Explanation of Best Practice 4.5. Selection of tenants for a property requires consistently applied policies and

procedures and constant awareness of laws and regulations that differ among property types. Irrespective of the

property type, by renting to the best qualified applicants at the beginning, many management problems can

be avoided. Once a prospect has filled out an application, feasibility as a tenant must be assessed by qualifying

the potential tenant. Qualifying a residential prospect involves examining household income, references, credit

history, court records for evictions and landlord/tenant civil actions, and conducting criminal background checks.

Qualifying a commercial prospect consists of evaluating the business in a number of areas, such as financial

strength, stability, reputation, and business operations. The management company’s responsibility to the client

in tenant selection is to maximize net operating income and minimize risk.

Best Practice 4.6. Lease Compliance. The management company shall monitor that tenants are in compliance

with lease terms, including but not limited to rent collections, and act accordingly in the event of noncompliance.

Explanation of Best Practice 4.6. The management company is responsible for ensuring the tenants are in

compliance with lease terms and, if not, acting accordingly. When dealing with any type of lease violation,

the management company should always operate within the controlling laws and regulations governing

delinquency, collection, and eviction rights and procedures. The management company must be familiar with

and understand both the laws and regulations and the practices that govern these matters. Failure to ensure

that prospective tenants will adhere to the lease terms will defeat the client’s objectives.

20.

Best Practices: Real Estate Management Service

Best Practices Checklist

Client Relations Best Practices

.1. Client Objectives. The management company shall identify and confirm in writing the client’s

2

objectives for owning the property.

.2. Management Agreement. A written management agreement shall be in place that establishes

2

the business relationship between the management company and the client and defines and explains

the duties, responsibilities, and obligations of each party and the authority of the management

company.

.3 Scope of Authority. The management company shall not act beyond what is specified in the

2

management agreement without documented client approval.

2.4. Customer Service. The management company shall have a customer service plan for its clients.

.5. Operating Reports. Accurate and complete financial and operating reports shall be provided to

2

the client on a regular, timely basis in accordance with the client’s instructions with respect to content,

format, and frequency.

.6. Property Audit. The management company shall recommend that the client perform an annual

2

review or financial audit of the property operations and shall fully cooperate in the conduct of such a

financial review or audit if performed by the client.

.7. Client Property Insurance. The management company shall provide assistance and support to

2

the client in identifying insurance needs and acquiring and maintaining property and other insurance

coverage related to ownership of the property when requested by the client.

.8. Client Property Taxes. The management company shall provide assistance and support to the

2

client in complying with all property tax obligations and appealing tax levels and assessments when

requested by the client.

.9. Loyalty to Client. The management company shall exercise loyalty to the interests of the client

2

and shall not engage in any activity which could reasonably be construed as contrary to the best

interests of the client without full disclosure.

.10. Disclosure. The management company, as a fiduciary for the client, shall not accept, directly or

2

indirectly, any rebate, fee, commission, discount, or other benefit, monetary or otherwise, that has not

been fully disclosed to the client.

.11. Client Obligations. The management company shall provide non-financial assistance and

2

support to the client in complying with the client’s incumbent obligations and responsibilities to other

parties when so requested by the client.

Management of the Property Best Practices

.1 Management Plan. The management company shall prepare a management plan for managed

3

properties in accordance with client directives.

3.2. Property Budget. The management company shall prepare an annual operating budget for

the property, submit it to the client in a timely manner in accordance with the client’s instructions with

respect to content and format, and obtain appropriate approvals as applicable.

22.

.3. Property Policies and Procedures. The management company shall establish and enforce

3

written policies and procedures relative to the operation of each managed property, making such

policies and procedures readily accessible to all company and property staff.

Best Practices: Real Estate Management Service

Best Practices Checklist

3.4. Routine Maintenance. The management company shall assess, develop, and implement a plan for the

routine custodial and corrective maintenance of the property consistent with client directives.

3.6. Capital Improvements. The management company shall recommend and assist in implementing

capital improvements consistent with client directives.

3.8. Deposit of Funds. The management company shall exert due diligence for the protection of client’s

funds against all foreseeable contingencies, depositing such funds in an escrow, trust, or agency account

with an insured financial institution, or as otherwise required by the client.

3.9. Disbursements. The management company shall disburse and account for outgoing funds and

payables accurately and in a timely manner and in accordance with accepted accounting principles, client

directives, and relevant laws and regulations and with proper approvals.

3.11. Insurance Claims. The management company shall establish and follow a systematic procedure for

reporting loss claims and potential loss claims relating to managed property and for managing the claims

process.

.12. Emergency Preparedness. The management company shall establish and, when necessary, follow

3

emergency preparedness and emergency response plans and procedures for managed properties.

.13. Property Security. Security policies and procedures for a managed property shall be established as

3

appropriate, with periodic review conducted for compliance and changing conditions.

3.14. Safety. Emergency and life safety equipment and components of a managed property shall be

maintained in proper working condition and in compliance with all applicable codes and regulations.

3.15. Environmental and Health Safety and Hazard Control. The management company shall establish

and maintain an environmental and health safety management program. Hazards shall be reported

immediately to the client with a response plan.

.16. Marketing Plan. The management company shall develop and implement a written marketing plan

3

for each managed property consistent with the owner’s objectives.

.17. Leasing Policies and Procedures. The management company shall develop and implement written

3

leasing policies and procedures as appropriate for the property and in accordance with client obligations,

company policy, and applicable laws and regulations.

.18. Leasing Plan. The management company shall have a written leasing plan for each managed property

3

as appropriate for the property and in accordance with client directives.

.19. Rental Rates. The management company shall establish rental rates based on assessment of the

3

market and client expectations as appropriate for the property and in accordance with client directives.

.20. Property Staffing. The management company shall provide for the adequate staffing of the property

3

and supervision of property employees and vendors in accordance with client objectives.

.5. Preventive Maintenance. The management company shall assess, develop, and implement a plan for

3

the preventive maintenance of the property consistent with client directives.

.7. Receipt of Funds. The management company shall receive, deposit, and account for incoming funds

3

accurately and in a timely manner and in accordance with accepted accounting principles, client directives,

and applicable laws and regulations.

.10. Contractor Insurance Requirements. Contractors providing goods or services to managed property

3

shall be required to meet minimum insurance requirements, and the management company shall develop

and implement a system for the collection of contractor certificates of insurance and compliance with

insurance requirements.

Best Practices: Real Estate Management Service

23.

Best Practices Checklist

3.21. Legal Compliance. The management company shall manage property with knowledge of and in compliance

with all applicable laws and regulations.

3.22. Sustainability. The property management company shall be knowledgeable about sustainable alternatives

and able to integrate sustainable maintenance and operational practices into to the management of a property

consistent with client directives.

.23. Benchmarking. The property management company shall utilize benchmarking as a tool to assess property

3

performance with the goal of identifying areas of improvement.

Tenant/Resident Relations Best Practices

.1. Leases/Agreements. The management company shall ensure that a written agreement is in place for every

4

tenant/resident occupying the property that specifically addresses the responsibilities of both the landlord and

tenant.

.2. Tenant/Resident Insurance Requirements. If required by the client, leases shall specify the responsibilities of

4

the tenant with respect to insurance, including any minimum coverages required, and the management company

shall develop and implement a system for the collection and regular compliance review of tenants’ certificates of

insurance.

.3. Tenant/Resident Safety. The management company shall develop, maintain, and enforce general safety

4

guidelines and awareness to protect tenants/residents and others lawfully on the common areas of the property.

.4. Tenant/Resident and Occupant Customer Service. The management company shall have a customer

4

service plan for tenants, residents, and others lawfully on the premises.

.5. Tenant/Resident Selection. The management company shall develop and adhere to written policies and

4

procedures on tenant selection that are consistent with client directives, company policy, and in compliance with

applicable laws and regulations.

.6. Lease Compliance. The management company shall monitor that tenants are in compliance with lease

4

terms, including but not limited to rent collections, and act accordingly in the event of noncompliance.

24.

Best Practices: Real Estate Management Service

About the Institute of Real Estate Management

The Institute of Real Estate Management (IREM®) is an international community of real estate managers across all

property types dedicated to ethical business practices and maximizing the value of investment real estate. An affiliate

of the National Association of REALTORS®, IREM has been a trusted source for knowledge, advocacy and networking

for the real estate management community since 1934.

IREM is the only professional real estate management association serving both the multi-family and commercial real

estate sectors and has 80 U.S. chapters, 13 international chapters, and several other partnerships around the globe.

Worldwide membership includes approximately 18,000 individual members and 540 corporate members.