2015 Mid-Year Report

advertisement

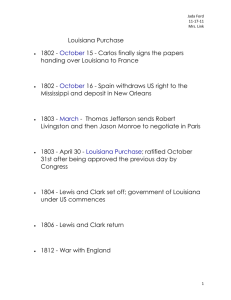

Committee of 100 for Economic Development, Inc. P. O. Box 1546 Baton Rouge, LA 70821 2015 Mid-Year Report Washington, D.C. Briefing January 21-22, 2015 2015 Gubernatorial Forum March 31, 2015 Our Washington DC Briefing has become a signature event of C100 and the Washington Mardi Gras Program. The 2015 Briefing began with the Louisiana Congressional delegation luncheon sponsored by Jones Walker at the U.S. Capitol Visitors’ Center. This year, we produced our Annual Spring Meeting as a Gubernatorial Forum featuring the four announced candidates. Each candidate was allotted 45 minutes to answer prepared questions from C100 policy issues and questions from the audience, This portion of the meeting was for C100 members and guests only with no media permitted. This was followed by presentations from Louisiana natives Charlie Cook, Editor and Publisher of the Cook Political Report, and Ron Faucheux, President of Clarus Research Group and former state legislator and Secretary of Commerce in Louisiana. Both speakers provided expert commentary on the federal and state political climate and upcoming elections. Adams & Reese sponsored another great reception this year to close out the first day of the program. The Congressional Delegation luncheon hosted by Jones Walker is our most popular event allowing C100 members to discuss matters with Congressional leaders and staff. Day Two continued with an excellent lineup of speakers. Former Michigan Governor and President of the national Business Roundtable John Engler discussed topics on which the Business Roundtable has taken positions, such as fiscal stability, pro-growth tax reform, expanded trade, immigration, infrastructure investment, and smart regulation. Governor Engler was followed by Wes Farno with Higher State Standards Partnership discussing Common Core moving forward and Louisiana native Mary Martin with the US Chamber’s Environment, Technology & Regulatory Affairs reporting on the regulatory environment. Roman Buhler with the Madison Coalition was our luncheon speaker presenting their work on restoring a balance of state and federal powers and curbing the authority of federal regulators. Governor John Engler with the Business Roundtable discusses with C100 members matters of national concern for businesses across the US After the candidates’ forum, ExxonMobil sponsored a panel consisting of Louisiana Education Superintendent John White and BESE Board President Chas Roemer moderated by Mark Northcutt of ExxonMobil discussing Common Core State Standards in Louisiana. A second panel was focused on Louisiana’s Fiscal Reform Agenda featuring Dr. James Richardson of LSU’s Public Administration Institute and Scott Drenkard of the Washington DC-based Tax Foundation. This signified the launch of C100’s Fiscal Reform Project through the Committee for a SECURE Louisiana. Superintendent John White, BESE Board President Chas Roemer, and ExxonMobil’s Mark Northcutt stress the importance of staying the course on Common Core Standards. LSU’s Dr. Jim Richardson and Scott Drenkard of the Tax Foundation announce C100’s plan for a Fiscal Reform Study Gulf States Initiative In November of 2014 C100 began gauging the feasibility of revitalizing the Gulf of Mexico States Accord, an association of government and business leaders from the five US and seven Mexican states bordering the Gulf of Mexico. The primary purpose is to develop economic opportunities and business exchange between the states in the areas of maritime, oil & gas, healthcare, coastal management, agriculture, and construction. C100 member firms Pan American Life, Ochsner, Chase Bank, Jones Walker, and the Port of New Orleans sponsored the event. This partnership was further explored in Merida, Yucatan at the invitation of Consul General of Mexico in New Orleans Ramon Gonzales Jameson and Eric Rubio, Chief of Staff for the Governor of Yucatan May 20-22, 2015. Representatives from the US and Mexico in each of the targeted sectors were able to meet and share ideas on business development. Wes Farno provides information on Common Core standards and how Louisiana business leaders can show support for these efforts. Louisiana native Mary Martin with the US Chamber of Commerce addresses issues regarding environmental regulations. Consul General of Mexico in New Orleans Ramon Gonzales Jameson, Mexican Senator for Campeche Jorge Luis Lavalle Maury, and Michael Olivier at the November meeting on the Gulf States Initiative held in New Orleans. A Letter from Our Chairman Fiscal Reform Study The Committee of 100 supports promoting a careful and complete appraisal of the Louisiana tax structure as part of a Fiscal Reform project. To accomplish this C100, through the Committee for a Secure Louisiana, has engaged the Tax Foundation, a national group that has done numerous state tax studies around the country, to provide its insight and analysis to restructuring and improving our tax structure. We have also asked Dr. Jim Richardson to work with us in developing policies and support for major tax provisions to be developed over the next several years. C100 members have contributed $125,500 to date toward the funding of this study. Below is a list of our SECURE contributors. A tremendous thank you goes out to all who have donated, including: Boysie Bollinger David Bondy Elliott Bouillion Sue Brignac Wayne Brown JJ Buquet Vernon Chance Tom Clark George Cummings Randy Ewing Tom Hawkins Trott Hunt Christopher Kinsey Kris Kirkpatrick Mike Madison Norman Morris George Nelson Roger Ogden Darren Olagues Sonia Perez Mike Reitz Lannie Richardson Phillip Rozeman, M.D. Kenny Smith Gray Stream Upcoming Regional Meetings, Oct. - Nov., 2015 C100 will be conducting regional meetings across the state to discuss the findings of our Fiscal Reform Study led by Dr. James Richardson of LSU’s Public Administration Institute and Scott Drenkard of the Tax Foundation. Findings of the study and recommendations for fiscal reform in Louisiana will be presented to C100 members for consideration and input. Remembering Virginia Shehee On July 6, 2015, we said good-bye to C100 founding member and former Chairwoman Virginia Shehee. Mrs. Shehee was a strong, caring, and compassionate business and civic leader, referred to as the “First Lady of Shreveport” and the “Matriarch of Northwest Louisiana”. She served as Louisiana State Senator for District 38 in Caddo and DeSoto parishes from 1976 - 1980. Much of the growth and progress in the Shreveport area can be linked to Virginia Shehee’s support and the active role she took in her community and in encouraging others’ involvement. We encourage you to read through the many articles and comments that have been written to eulogize this amazing woman. She will be greatly missed. Dear C100 Members: As we complete the summer and enter election season, we offer you a report on the scope and status of Committee of 100 activities in support of public policy issues that affect our business environment in Louisiana. The Executive Committee identified workforce development as a primary theme to guide us in this year. Our engagement and coordination with other stakeholders has been consistent with this primary theme. However, the fiscal challenges we are facing as we transition to a new administration led to our support of an assessment of fiscal reform and modernization opportunities that will lead to a more stable and predictable revenue stream for our state to thereby assist post-secondary education and the state as a whole. We presented the initial phase of this during the Gubernatorial Forum. Throughout the summer, we have led a task force comprised of the leadership of PAR, CABL, Louisiana Budget Project, Dr. Jim Richardson, and the Tax Foundation toward the development of a plan to be preliminarily presented and discussed at our Fall meeting, with a full rollout anticipated to occur after the primary and before the runoff election. Additionally, we have continued to support the Gulf States Initiative in conjunction with World Trade Center of New Orleans and the Consul General of Mexico in New Orleans. The next scheduled meeting for this will be on April 20-21, 2016 in Lafayette. Most recently, we were requested to join the Board of Regents Collaborative on Higher Education, along with representatives of PAR, LABI, WIC and OWC and all of the System heads. The purpose of this Collaborative is to work to ensure a cooperative relationship with the leadership of higher education and the business community to face the fiscal and operational challenges that demand our collective attention. Finally, we have participated in a Statewide Policy Coalition, along with LABI, PAR, CABL, GNO, BRAC, One Acadiana, NLEP, LCA, LMOGA, LOGA, and Blueprint which has helped to identify areas of substantive agreement among all stakeholders to present to candidates in the Fall elections. I also invite you to view our website www.C100LA.org to obtain information about our programs, activities, and focus. I think you’ll find the rest of the year with activities of value paving the way for an exciting 2016 that begins with our Washington Briefing on January 20, 2016. Our Fall meeting in Baton Rouge in November will focus on Fiscal Reform and our Program of Work for 2016. Respectfully Tom Clark, Chairman Committee of 100 for Economic Development, Inc. Office Address: 450 Laurel Street, Suite 1830 Baton Rouge, LA 70801 Mailing Address: P. O. Box 1546 Baton Rouge, LA 70821 Office: Fax: (225) 382-3750 (225) 336-5220 Email: olivier@C100LA.org woodworth@C100LA.org www.C100LA.org Website: 2015 Fiscal Reform Guiding Principles The Committee of 100 (C100), through SECURE, is partnering with the LSU Public Administration Institute (Dr. Jim Richardson), PAR, & CABL to produce a study by the Washington D.C.-based Tax Foundation to outline fiscal reform options designed to develop consensus amongst various stake holders while giving legislators and our next governor the tools and ideas they need to develop reform proposals that promote sustained economic growth and attract investment. These reforms are to outline how to eliminate the structural deficit we face each fiscal year and will be directed to the candidates for statewide elected positions, most specifically gubernatorial candidates. Below are the “Guiding Principles” developed by our team and presented to the Tax Foundation on areas that must be addressed by this study. 1. True tax reform will require a long-term commitment given the complications of the tax code and the need (1) to maintain a revenue stream consistent with the spending priorities of the state, (2) to sustain the state’s economic growth, and (3) to promote an equitable distribution of who pays for public services within the state the multiple exemptions, credits, and rebates built into the tax code and the changes made in the 2015 Legislative Session complexities of the state and local tax structure interaction and the need to deal directly with the structural budget problems, both a tax issue and a spending issue 2. Transparency of the distribution of the tax burden on individuals ranging from low income to higher income individuals, households, and families on businesses and business activities relative distribution to tax policy in states with which Louisiana competes 3. Re-examination of the corporate income/franchise tax marginal tax rates definition of tax base - consistent for corporations and state government fluctuations in corporate tax collections over time and use in long-term budgeting use of corporate franchise tax in corporate tax system 4. Re-examination of personal income tax with respect to marginal tax rates tax base impact of various tax alternatives on different income categories 5. State and local sales tax issues regarding the tax base of goods & services and the corresponding rates changes associated with broader base of reductions in other taxes development of common state and local tax base - a long-term issue so as to avoid destabilizing revenue projections of local governments development of common state and local tax administration state and local sales tax laws consistent with Streamlined Sales and Use Tax Agreement 6. Local government responsibility and taxation review of property tax as source of local revenues major tax exemptions (homestead exemption, 10-year industrial tax exemption) inventory tax and implications for state policy property tax variation among parishes property and sales tax base for local governments 7. Observations Fiscal Reform, including reforming the tax structure, will require multiple years to rectify given the structural budget problems Corporate income tax provisions, rates, and tax base need to be reworked. Corporate income tax rate needs to be reduced. Need transparency on who’s going to pay less and who’ll pay more Goal is for the state to do more with revenue collected- “spending” Enhance local government responsibility which includes: Sales tax on distribution of goods & services- enable local governments to increase revenue State and local sales tax administration uniformity Property taxation must be included in any long-term tax reform Single flat rate for PIT will have distributional impact on middle income taxpayers Fiscal reform requires tax code and spending analyses SAVE THE DATES! Upcoming C100 Events Statewide Regional Meetings October - November, 2015 C100 Fall Meeting November, 2015 Washington, D. C. Briefing January 20-21, 2016 Annual Spring Meeting / Legislative Briefing April/May, 2016