general problems of smes in the automotive component

advertisement

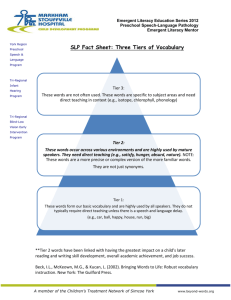

GENERAL PROBLEMS OF SMES IN THE AUTOMOTIVE COMPONENT INDUSTRY - THE PRESENT SITUATION As the market pressure towards vehicle manufacturers augments, they tend to pass on the pressure on their suppliers in terms of price, quality, and services. Nonetheless, there are additional changes in the supply system and structure, which affect the component suppliers. The number of parts, components and systems, which are outsourced by the vehicle manufacturers, is increasing continuously. Generally, this tendency leads to a growing prominence of suppliers in the automotive industry, which will change the relationship between OEMs and suppliers as well as among suppliers themselves. However, not all suppliers will be in the position to take advantage of these opportunities. Within this scenario, there are three main tendencies, which are the most significant for the future viability of the South Eastern European automotive component suppliers, regardless of their size and location: (a) (b) (c) The continuously increasing demand for high quality, The ability to integrate parts and components into comprehensive systems, The growing strength of large 1st tier suppliers. (a) High Quality Nowadays, with larger shares of each vehicle coming from single companies outside the vehicle manufacturer, the risk of poor quality is substantially increasing. Therefore, vehicle manufacturers are looking for original product quality, which would reduce the time-consuming and costly quality checks and rework processes. As a consequence, automotive component suppliers, which work closely with vehicle manufactures, will be assessed continuously and most thoroughly for the quality of their work. Vehicle manufacturers are looking for defects per million parts, which on average must not exceed 150. Furthermore, there is a strong trend towards error free deliveries at all times. In the South Eastern European context, where the average defect rate is often significantly higher, the challenge is not only to reach this target, but also to achieve it in the shortest time possible, given the current developments in the global automotive industry. At the same time, vehicle manufactures do not allow increases in price as compensation for these efforts. On the contrary, many demand yearly price cuts up to 10%. The smaller the supplying company, the more difficult this exercise becomes. Yet, highest quality standards remain the most important prerequisite. (b) Ability to Deliver Integrated Systems Vehicle manufacturers are demanding that their suppliers deliver more complete systems, rather than just parts or components. This trend is based on vehicle manufacturers’ strategies trying to reduce the number of suppliers. The benefits are to be found in the more efficient work and lower costs. However, there are benefits for the suppliers as well, if they would not only deliver or, in some cases, assemble parts and components, but would have the possibility to design, develop and test systems, which would eventually allow them to retain a larger share of the added value to the final product. In order to best fulfil these tasks within an integrated system, the supply industry needs to be structured in such a way that companies can jointly perform the system integration. Ideally, this comprehensive system is based on three distinct roles: - First tier suppliers (system integrators): The first tier of component manufacturers comprises companies, which are capable of supplying integrated systems to the vehicle manufacturer rather than individual components, e.g. dashboards. These suppliers will need to offer not only a broad range of technologies and materials but require also strong research capabilities in order to work closely with the vehicle manufacturers to develop better systems. Tier 1 suppliers are involved in the design, development and testing process of the products/systems they are responsible for. They also need to be financially strong in order to invest continuously into new technologies and manufacturing capacities. The tier 1 suppliers would involve companies that are financially strong, technology-oriented, large players who operate on a global basis, e.g. Delphi Automotive System, Bosch, Visteon, and Magneti Marelli. - Second tier suppliers (direct suppliers): The second tier suppliers include those companies, which supply the first tier manufacturer with finished components. The profile of a second tier auto component company is generally that of a substantially large manufacturer, who, yet, does not have either the financial, or technological recourses or extensive geographical (global) reach in order to supply integrated systems to vehicle manufacturers. - Third tier suppliers (indirect suppliers): Third tier companies include those firms, which supply raw materials and basic parts and components to the second tier automotive component manufacturers. They do not dispose of substantial recourses to develop integrated systems or, at least, completely finished, complex components. Suppliers seek to position themselves as high up as possible in this hierarchy, as a high position allows retaining a higher percentage of the value added within the supply chain. At the same time, a well-maintained position decreases substantially the vulnerability of a company. Within this structure, two areas of concern are important to companies in Southeast Europe: Firstly, the supply chain concept, as described above, is only just beginning to emerge. A number of large international Tier 1 companies are now supplying complete systems and modules to OEMs. Most of the Southeast European component manufacturers would fall under the Tier 2 and 3 categories. As many SME will lose their current direct business with OEMs, a solution for these domestic SMEs is to link up with Tier 1 or large Tier 2 companies (in the case of the smaller tier 3 firms) and to become part of their global supply chains. In order to do so, these SMEs will have to successfully compete among themselves and with international competitors who might be already part of these supply chains. This can only be done if the domestic companies can become internationally competitive. Secondly, in the South Eastern European scenario, over many years, vehicle manufacturers had supported a host of SME component manufacturers in a parentancillary relationship, supported by very strict localization norms. The vehicle manufacturers did most of the “systems development” in-house and the component industry was supplying mainly smaller, individual components and parts. Hence, the component industry in Southeast Europe never got the opportunity of developing true system capabilities. Furthermore, due to the preponderance of SMEs, viable scales were never developed. This led to a fragmentation of capacities and, eventually, lack of domestic, and even more, international competitiveness. Although these conditions have been changing in the last years, the time available to the automotive component industry in Southeast Europe to transform into a globally competitive industry seems very short, as the described systems of suppliers are developing very rapidly throughout all markets and production locations. Unless they become able to change and improve, many SMEs would face the prospect of losing business and, eventually, having to close down. (c) Growing Strength of 1st Tier Suppliers Within this scenario of a consolidated and further structured vehicle and component industry, tier 1 suppliers are gaining more and more strength, as a shrinking supply base, in principle, implies less competition. Further, tier 1 suppliers will be more and more the ultimate know-how partners for designing and developing of components and systems. Therefore, these suppliers will gain a strong position not only vis-à-vis the vehicle manufacturers but, of course, also vis-à-vis the direct and indirect suppliers (tier 2 and 3). Already in many cases, it is not any longer the OEM, which is the important buyer from the small and medium-sized company, but also the tier 1 system supplier. ***