THE UK FAST FOOD INDUSTRY

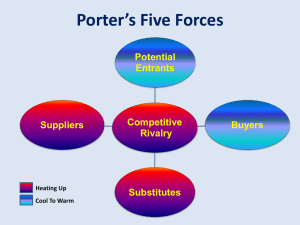

advertisement

THE UK FAST FOOD INDUSTRY GROUP B Why the UK? Easily identifiable Different cultural tastes have a large impact on the global success of multinational chains at national level MAIN TRENDS Growth in 2000 represents an increase of 4% compared to 1999 Growth is forecasted at the same rate in 2001 Predicted steady overall growth rate until 2005 Segments and Main Players Sandwiches: Greggs,Thurstens, Subway Burgers: McDonalds, Burger King Pizza: Pizza Hut Chicken: KFC Fish and Chips Indian or Chinese Takeaway Industry Analysis P.E.S.T Analysis Five Forces Frame Work P.E.S.T. Analysis POLITICAL Health and Safety Guidelines Labelling of GM Foods Animal rights campaigns 1998: BSE P.E.S.T. Analysis ECONOMIC Low set up costs Franchising facilitates set ups Support from major suppliers Growing market Perceived value for money Increasing disposable income P.E.S.T. Analysis SOCIAL Busy lifestyles Healthy Eating and Obesity Increased Vegetarianism Homogeneity Social Activities P.E.S.T. Analysis TECHNOLOGICAL Investment in technological innovations Computer ordering (till system) FIVE FORCES ANALYSIS THREAT OF ENTRANTS Setting Up Product Differentiation FIVE FORCES ANALYSIS THREAT OF SUBSTITUTES Convenience Shops Mid-range restaurants Pre-cooked food Other social activities Health food shops FIVE FORCES ANALYSIS POWER OF SUPPLIERS Farming Industry Worldwide market of suppliers Alliances FIVE FORCES ANALYSIS POWER OF BUYERS Consumers Little brand loyalty FIVE FORCES ANALYSIS COMPETETIVE RIVALRY New entrants likely Price Wars Overall demand is increasing The Future? Strong development in market growth Nutritional products come in strongly Other niche foods – “smaller world”