administrative practice letter subject: tax

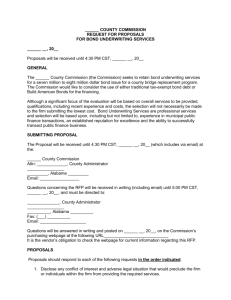

advertisement