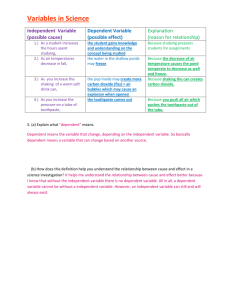

COLGATE-PALMOLIVE (I) LTD

advertisement

COLGATE-PALMOLIVE (I) LTD DISCLAIMER This Presentation and its related publication, release, webcast or communication (together the “Presentation”) is for general information purposes only. This Presentation does not solicit any action by Colgate-Palmolive (India) Limited (the “Company”) based on the material contained herein. Nothing in this Presentation is intended by the Company to be construed as legal, accounting, investment or tax saving advice. This Presentation includes statements that are, or may be deemed to be, “forward‐looking statements”(except for the historical information). These forward-looking statements appear in several places in the Presentation and are based on certain expectations, assumptions, anticipated developments and various other factors which are not limited to, risk and uncertainties regarding fluctuations in market share, earnings, market growth, intense competition and the pricing environment in the market, consumption level, ability to maintain and manage key business stakeholders and external factors having impact on the conduct of the business not limited to inflation, currency fluctuations, climatic changes, political and regulatory environment, Government policies and changes in international oil prices etc. The Company, therefore, in no way assures, represents, warrants, guaranty, undertake, express or imply, given that such statements, views, projections or forecasts are correct or that the objectives of the Company will be achieved as contained in the Presentation. The Company’s actual results of operations, financial condition, stability, liquidity, and the development of the industry / business sector in which the Company operates, may differ materially from those suggested by the forward‐looking statements contained in this Presentation. The Company may alter, amend, modify, revise or make necessary changes in any manner to any such forward looking statements contained herein including but not limited to oral forward looking statements as may be required from time to time on the basis of any subsequent developments, conditions, circumstances, information, events or otherwise. The Company expressly disclaims and does not assume or undertake any obligation to update forward looking statements to reflect the events, developments or circumstances after the date of the Presentation. Neither the Company nor its affiliates or advisors or representatives nor any of its or their parent or subsidiary companies or undertakings or any such person's officers, directors or employees guarantees that such forward‐looking statements and its assumptions, including oral or implied, are error free, lacking omissions, fair, accurate and complete nor does either assume or accept any responsibility for such forward‐looking statements in future or the actual occurrence of such projections or forecast based on such forward-looking statements. This Presentation should not be in any manner whatsoever construed as an approval, acknowledgement, confirmation or acceptance by any statutory or regulatory authority in India including the stock exchanges in India. The material contained in this Presentation is subject to change without notice and past performance and historical trends or information is not indicative of future results. This Presentation is for information purposes only and does not constitute or should not be construed as an offer / invitation for sale or subscription of or solicitation for any securities of the Company. Investors are cautioned to exercise diligence before taking any investment decisions or otherwise and Company assumes no responsibility for any loss or damage suffered due to any decisions made on the basis of this Presentation. INNOVATING to FY 2013-14: A CHALLENGING ENVIRONMENT Inflation (CPI) GDP Growth Consumer Confidence 15.5 9.7 9.49.3 8.9 8.6 8.5 8.3 7.8 7.87.7 7.5 7.3 6.9 6.1 6.3 6.1 5.8 5.35.45.2 4.8 4.7 4.74.8 4.4 131131 129129 127 126 123 121122 121 119119 120118 11.2 9.7 5.6 6.5 5.5 9.5 9.1 8.3 121 115 112 6.5 2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 2013 2013 2013 2013 2014 2014 2013 2013 2012 2012 2011 2011 2010 2010 2009 2009 2008 2008 3.8 Source: Consumer Confidence: Nielsen Global Consumer Confidence Index 4Q13 India, GDP Growth CSO MOSPI, Gr Val YA FY 2013-14: A CHALLENGING ENVIRONMENT 25% 20.0% 20% 18.3% 18.2% 17.7% 16.7% 15% 9.0% 8.8% 10.9% 7.6% 8.4% 9.4% 10% 12.1% 10.8% 3.0% 2.1% 2.5% 8.2% 6.8% 0.3% 5% 9.3% 7.3% 9.3% 9.1% 9.1% 9.3% 9.1% 8.3% 0% Price Led Growth Consumption Growth Value Growth Source: Nielsen FMCG Gr Val YA 6.6% 2.9% 5.3% FY 2013-14: A CHALLENGING ENVIRONMENT High competitive intensity in Oral Care in 2013 Entry of new players Unprecedented aggression from key competitors WE DELIVERED ON OUR GOALS WE DELIVERED ON OUR SALES & PROFIT Net Sales PAT 15% 18% +461 +9% Crs FY 12-13 Vol 9% FY 13-14 8% FY 12-13 FY 13-14 WE EXPANDED OUR MARGINS DESPITE COST INCREASES GROSS MARGIN 60.4% 59.5% FY 12-13 +90 bps FY 13-14 WE EXPANDED OUR CONSUMER FRANCHISE TOOTHPASTE National 54.5 55.9 (+140 bps) 57.1 (+180 bps) Colgate 23.8 13.9 22.8 21.5 Competitor 1 13.5 13.3 Competitor 2 Source: AC Nielsen Retail Audit YTD April 2014 2012 2013 YTD 2014 WE EXPANDED OUR CONSUMER FRANCHISE TOOTHBRUSH National 39.8 41.6 (+180 bps) 42.3 (+100 bps) Colgate 18.8 18.4 18.6 Competitor 1 7.3 7.2 6.4 Competitor 2 Source: AC Nielsen Retail Audit YTD April 2014 2012 2013 YTD 2014 WE CONTINUE TO BE INDIA’S MOST PURCHASED BRAND & GROWING Source: Kantar Worldpanel Report 2013 WE CONTINUE TO BE INDIA’S MOST TRUSTED BRAND # 1 Brand across all sectors 3 Years in a row Source: Economic Times Brand Equity Survey 2013 WE CONTINUE TO LEAD WITH THE PROFESSION Brand Used Most Often by Dentists Brand Recommended Most Often by Dentists 67 75 11 5 CP Competitior 1 Competitior 2 4 1 Competitior 3 CP Competitior 1 Source: Ipsos Dentist Track 2013 9 3 Competitior 2 Competitior 3 RESULTS DRIVEN BY FOCUSED STRATEGY, IMPECCABLE EXECUTION & … INNOVATION INNOVATING TO CREATE NEW SEGMENTS Whitening Gum Health Salt + Lime Tapered Bristles INNOVATING TO DRIVE PREMIUMIZATION PREMIUM VALUE CONTRIBUTION OF PREMIUM PORTFOLIO UP 300 bps IN THE LAST 2 YEARS INNOVATING ACROSS ALL PRICE & BENEFIT SEGMENTS Price Rs.95 70g Rs.84 100g Rs.96 140g Rs.82 150g Rs.80 200g Rs.75 200g Rs.40 175g Rs.10 28g Rs.5 18g Benefits INNOVATING TO DRIVE AWARENESS & PENETRATION 114 MM children contacted INNOVATING TO INCREASE AVAILABILITY 4.6MM • Colgate Available in • 2x Village Coverage in 2013 outlets INNOVATING TO CONNECT WITH THE CONSUMER Colgate – Most Social Company in FMCG Over 2.7MM fans on Colgate India & Maxfresh Facebook pages LEVERAGING MOBILE TO EXPAND REACH 768,000 First LOCATION BASED targeting at the Holy Festival of KUMBH CONSUMERS VISITED COLGATE STALL This unique idea won many awards at India, Asia Pacific and Global level 13.8 Million consumers CONNECTED THROUGH OBD CALLS INNOVATING TO WIN WITH THE SHOPPER 2013 STRATEGY SUMMARY 1. ACCELERATED PENETRATION & DISTRIBUTION 2. CREATED NEW BENEFIT SPACES & DRIVING PREMIUMIZATION 3. CONNECTED WITH CONSUMERS & SHOPPERS IN NEW WAYS TO GROW CONSUMPTION EXPANSION OF FRANCHISE DESPITE A DOWNTURN OUR GOAL : CREATE LONG TERM VALUE FOR OUR SHAREHOLDERS CONTINUE WITH OUR GROWTH STRATEGY 1. ACCELERATE PENETRATION 2. DRIVE PREMIUMIZATION 3. EXPAND CONSUMPTION 4. CREATE NEW BENEFIT SPACES OUR GROWTH PILLARS 1. ACCELERATE PENETRATION PENETRATION: HEADROOM FOR MORE GROWTH 329MM consumers do not use Toothpaste Toothpaste Penetration 100 80 75 78 80 79 87 84 91 61 63 2011 2012 56 60 40 90 38 42 20 46 43 Urban 49 Rural 0 2005 2006 2007 2008 2009 2010 Source: Indian Readership Survey (HHs), IMRB** RURAL: HEADROOM FOR MORE GROWTH Toothpaste Penetration in key Rural States UP 51.9 Bihar 30.1 MP 41.5 Mah 63.1 OUR GROWTH PILLARS 2. DRIVE PREMIUMIZATION PREMIUMIZATION: HEADROOM FOR MORE GROWTH Average Selling Price Per KG of Toothpaste Average Selling Price Per Toothbrush 1477 1118 865 340 4.5X 3.5X 2.5X X 157 104 36 13 12X 8X 3X X Market size DOUBLES if ASP reaches China levels OUR GROWTH PILLARS 3. GROW CONSUMPTION CONSUMPTION: HEADROOM FOR MORE GROWTH 599 Per Capita Consumption (gms) Market size DOUBLES 547 if PCC reaches China levels 374 280 147 OUR GROWTH PILLARS 4. CREATE NEW BENEFIT SPACES, NEW USAGE OCCASIONS, NEW REGIMEN… CONTINUOUS STREAM OF INNOVATIONS 2012 INNOVATIONS MAY JUNE JULY JULY SEP OCT 2013 INNOVATIONS JAN MAR JUL OCT MAY NOV QTR1 2014 INNOVATIONS FIRST EVER TEETH WHITENING TREATMENT WATCH THIS SPACE … WE HAVE MANY MORE BREAKTHROUGH TECHNOLOGIES THIS YEAR SERVICING THE GROWTH TWO NEW STATE-OF-THE-ART FACILITIES 1. Toothpaste facility at Sanand, Gujarat commissioned in March 2014 2. Toothbrush facility at Sricity, Andhra Pradesh to be commissioned in Q4, 2014 WINNING ON THE GROUND WINNING WITH THE SHAREHOLDERS Sales/ Volume Margin Non Variable Overheads Advertising Increasing Operating Profit CONSISTENT DOUBLE DIGIT GROWTH IN QUARTERLY SALES 13.4% 15.8% (Rs. Crores) 14.7% 18.3% 17.7% 20.5% 774 13.9% 896 15.9% 921 884 845 812 763 736 Apr-Jun 2012 Jul-Sept 2012 Oct-Dec 2012 Jan-Mar 2013 Apr-Jun 2013 Jul-Sep 2013 Oct-Dec 2013 Jan-Mar 2014 CONTINUE TO GROW OUR NET SALES CAGR 5 years – 16% 14.9% (Rs. Crores) 17.5% 18.2% 13.2% 15.8% 15.0% 3,545 3,084 2,624 2,221 1,962 1,695 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 CONTINUE TO DRIVE GROSS MARGINS (Rs. Crores) 60.4% 60.7% 60.4% 60.0% 59.5% 2,143 2,000 56.3% 1,834 1,600 1,574 1,349 1,200 1,186 800 954 400 0 2008-09 2009-10 2010-11 2011-12 Gross Margin 2012-13 % Sales Gross Margin expansion despite inflationary environment and currency pressure through driving efficiencies and cost control 2013-14 EBITDA EXPANSION IN 4Q 2013-14 (Rs. Crores) 21.9% 200 22.7% 180 20.8% 22.1% 160 19.6% 19.7% 16.3% 17.0% 140 120 202 100 176 169 162 165 150 80 146 151 Jul-Sep 2013 Oct-Dec 2013 60 40 20 Apr-Jun 2012 Jul-Sept 2012 Oct-Dec 2012 Jan-Mar 2013 Apr-Jun 2013 EBITDA % / Sales Jan-Mar 2014 CONTINUE TO DELIVER ON PROFIT AFTER TAX CAGR 5 years – 13% +9% (Rs. Crores) +11% +11% +46% -5% 540 497 446 423 403 +25% 290 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 CONTINUE TO DELIVER VALUE FOR OUR SHAREHOLDERS EPS – 17% (CAGR 10 yrs) 31.1 17.0 7.9 8.3 10.1 29.6 32.8 36.5 39.7 21.3 11.8 DPS – 16% (CAGR 10 yrs) 20.0 13.0 6.0 7.0 7.5 9.5 15.0 22.0 25.0 28.0 27.0 SHAREHOLDER RETURNS Year Shares Value 1978 IPO - 250 6,250 1994 Rights - 1,280 25,600 2014* Holdings - 14,080 20,190,720 * as on April 30, 2014 Dividend Received (includes Capital reduction) 3,426,219 Compounded return of 27% since the IPO COMMITTED TO WIN WITH INTEGRITY MAINTAINING THE HIGHEST ETHICAL STANDARDS Voted THE MOST ETHICAL Brand LIVING OUR VALUES Water for People Providing Sanitized Drinking water for villages Pratham – Education for under privileged children Care IndiaHelping Girl Child Associated with NTP for supporting HIV affected kids Supporting creative workshops for children CONTINUE TO EXPAND ORAL CARE AGGRESSIVELY Consumer & Community Shopper Consumer insights Educating the shopper Community Initiatives BSBF Changing consumer habits Educating shoppers Educating shoppers Developing the category Penetration driving activity Engaging the shopper Understanding the shopper Global & local expertise Category focused, bigger pie Driving new rituals WELL POISED TO CONTINUE CREATING SHAREHOLDER VALUE Clear Strategic Priorities Strong Innovation Pipeline Focus on Efficiency & Effectiveness Good Governance Leading To Win LET’S TALK