growth team m e m b e r s h i p ™

1

Market Research and Competitive Intelligence Priorities

2013

global survey results

Share this survey on

Twitter and Linkedin

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Co-Sponsor

growth team m e m b e r s h i p ™

2013 survey results

CONTENTS

Market Research and Competitive Intelligence Executive Summary . . . . . . . 3

INTRO

Survey Overview and Distribution of Respondents . . . . . . . . . . . . . . . 4

What is the Growth Team Membership™? . . . . . . . . . . . . . . . . . . . 5

Overarching Challenges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

SECTION

1

SECTION

2

SECTION

3

SECTION

4

SECTION

5

SECTION

6

Key Market Research Challenges . . . . . . . . . . . . . . . . . . . . . . . . 7

Market Research Resource Trends . . . . . . . . . . . . . . . . . . . . . . . 11

Key Competitive Intelligence Challenges . . . . . . . . . . . . . . . . . . . . 17

Competitive Intelligence (CI) Resource Trends . . . . . . . . . . . . . . . . . 21

Special Interest Topic: Supporting Stakeholder Decision‑Making . . . . . . . . 27

Respondent Demographics . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

2

growth team m e m b e r s h i p ™

2013 survey results

Introduction

3

Market Research and Competitive Intelligence (CI) Survey Executive Summary

KEY INTERNAL CHALLENGE

KEY INTERNAL CHALLENGE ROOT CAUSE

Key Market Research

Challenge

Ensuring research insights are actionable and

included in stakeholders’ decision-making

Lack of process reinforcement

SECTION 2:

BUDGETS

RESOURCES

Market Research Resource

Trends

R&D typically has an annual budget of less

than $500,000*

For 2013, budgets and staffing levels will

remain constant

SECTION 3:

KEY INTERNAL CHALLENGE

KEY INTERNAL CHALLENGE ROOT CAUSE

Key Competitive Intelligence

Challenges

Developing, implementing, and monitoring

counter-intelligence tactics

Inadequate skills

SECTION 4:

BUDGETS

RESOURCES

Competitive Intelligence (CI)

Resource Trends

R&D typically has an annual budget of less

than $250,000*

For 2013, budgets and staffing levels will

remain constant

SECTION 1:

SECTION 5:

Supporting Stakeholder

Decision-Making

PRIMARY INTERNAL CLIENT

TOP ACTIVITY TO SUPPORT

SALES

TOP ACTIVITY TO SUPPORT

EXECUTIVE MANAGEMENT

Sales/Business Development

Customer/consumer

research

SWOT analysis

*All monetary values in this report are in US dollars ($USD).

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Introduction

4

Survey Overview and Distribution of Respondents

Survey Purpose

To understand the most

pressing challenges shaping

market research and

competitive intelligence

executives’ 2013 planning

Methodology

Web-based survey platform

Survey Population

Co-Sponsor

Market research and

competitive intelligence

executives at manager level

and above

93

survey

respondents *

Europe

7%

respondents’ roles*

Corporate

44%

Business Unit/Division

17%

Asia-Pacific

Americas

50%

Both Corporate and

Business Unit/Division

39%

14%

Africa

1%

Middle East South Asia

19% 0%

*Percentages do not include respondents who answered “Other” or did not complete the question.

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Introduction

5

What is the Growth Team Membership™?

GTM is a research and consulting program that supports

executives within the functions that report to the CEO

CEO’s Growth Team™

GTM: Creating Client Value

R&D/

Innovation

GTM’s case-based best practices help executives:

Sales

Leadership

Corporate

Strategy

CEO

Marketing

GTM provides best practices, events, and services that enable

executives to address challenges within their companies

Corporate

Development

Market

Research

Market

Research

Investors/

Finance

Speed the design and implementation of

initiatives by not reinventing the wheel

Save money and reduce risk by avoiding

mistakes made by other companies

Accelerate problem-solving with a

cross‑industry perspective

Competitive

Competitive

Intelligence

Intelligence

Improve their functions’ and companies’

performance and productivity

GTMresearch@frost.com

www.gtm.frost.com

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

twitter.com/Frost_GTM

slideshare.net/FrostandSullivan

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Introduction

6

What’s Keeping Market Research and Competitive Intelligence Executives Up at Night in 2013?

Market Research’s Overarching Challenges

Best Practice Solutions from GTM

Ensuring Research Insights are Actionable

Market Research must deliver actionable customer

insights to drive the company’s decision-making.

Learn how BP’s market research function used segment-based

consumer insights to shape companywide marketing initiatives.

Competitive Intelligence’s Overarching Challenges

Capturing Employees’ Competitive Information

Learn how Cintas developed a companywide intelligence

network that incorporated employee insights into the company’s

decision‑making.

Competitive Intelligence needs to harness the

competitive insights of its employees.

Devising Effective Competitive Strategies

Competitive Intelligence executives must continually

assess the company’s unique strengths, identify

high‑growth market opportunities, and analyze

potential responses to competitive threats.

Learn how our Competitive Strategy toolkit helps you perform

internal competency evaluation, market due diligence, and

threat mitigation.

Contact us at GTMResearch@frost.com.

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

7

INTRO

SECTION

1

Key Market Research Challenges

SECTION

2

SECTION

3

SECTION

4

SECTION

5

SECTION

6

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 1

8

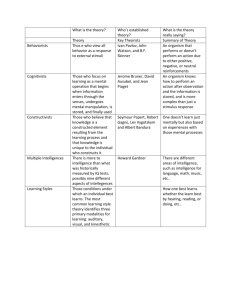

Top Five Key Market Research Challenges

CHALLENGE

1

SURVEY QUESTION:

Ensuring research insights are actionable and

included in stakeholders’ decision‑making

2

Developing an integrated customer and market

insights dashboard to support decision-making

3

Creating an insight generation process that yields

high-quality outputs

4

Integrating global, regional, and local customer/

market information to generate insights

5

Demonstrating the ROI of market research

IN 2011, respondents were

concerned with providing

valuable insights for strategic

decision-makers.

BY 2012, respondents were

focusing on demonstrating

the ROI of market research.

What are the top five functional challenges shaping your market research plans?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 1

9

Respondents’ challenges are attributed to staff and process limitations

Top Five Market Research Challenges

Root Cause of Top Five Market Research Challenges

CHALLENGE

1

Ensuring research insights are

actionable and included in stakeholders’

decision‑making

Process: Lack of enforcement

2

Developing an integrated customer and

market insights dashboard to support

decision-making

Staff: Inadequate headcount

3

Creating an insight generation process that

yields high-quality outputs

Process: Lack of process

4

Integrating global, regional, and local

customer/market information to

generate insights

Staff: Inadequate headcount

Process: Lack of enforcement

5

SURVEY QUESTION:

Demonstrating the ROI of market research

Strategic Alignment: Insufficient support by

senior management

Please indicate the root cause—staff, process, technology/systems, or strategic alignment—of your top five market research challenges.

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 1

10

B-to-B respondents prioritize dashboards and future trends,

while B-to-C respondents focus on portfolio balance and insight quality

Top Five Market Research Challenges (By Business Model)

CHALLENGE

B-to-B

B-to-C

1

Engaging stakeholders to pinpoint their

research needs

Ensuring the research portfolio balance strategic

and tactical projects

2

Developing an integrated customer and market

insights dashboard to support decision-making

Ensuring research insights are actionable and

included in stakeholders’ decision‑making

3

Ensuring research insights are actionable and

included in stakeholders’ decision‑making

Creating an insight generation process that yields

high-quality outputs

4

Demonstrating the ROI of market research

Integrating global, regional, and local customer/

market information to generate insights

5

Identifying and prioritizing future trends/

Mega Trends

Demonstrating the ROI of market research

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

11

INTRO

SECTION

1

SECTION

2

Market Research Resource Trends

SECTION

3

SECTION

4

SECTION

5

SECTION

6

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

12

2013 survey results

Section 2

B-to-C market research departments have larger budgets than those in B-to-B companies

2013 Market Research Budgets (By Business Model)

percentage of revenue dedicated to

department budget (by business model)

50%

The median percentage of company revenue dedicated to the

market research budget is:

•• All companies = 1%

•• B-to-B companies = 1%

•• B-to-C companies = 0.9%

Median = $374,999

41%

Average = $374,999

40%

35%

Survey Question: What is your 2013 total market research budget

as a percentage of your company’s total 2012 revenue?

31%

29%

30%

26%

22%

21%

20%

14%

16%

15%

13%

9%

10%

7%

2%

0%

Below $250,000

$250,000 to

$499,999

$500,000 to

$999,999

$1 Million to

$2.99 Million

All Companies

SURVEY QUESTION:

3%

0%

$3 Million to

$4.99 Million

B-to-B Companies

2%

3%

0%

$5 Million to

$9.99 Million

2%

7%

2%

0%

$10 Million to

$19.99 Million

0%

$20 Million

or more

B-to-C Companies

hich of the above ranges (in $USD) best describes your 2013 total market research budget (all expenditures on market research

W

activities and general & administrative—including staff)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 2

13

B-to-C respondents put more emphasis on branding, pricing,

and customer satisfaction research than their peers in B-to-B companies

Market Research Portfolio Composition (By Business Model)

market research’s budget allocated

to vendors (by business model)

20%

The median percentage of budget allocated to vendors is:

•• All companies = 45%

•• B-to-B companies = 27.5%

•• B-to-C companies = 60%

18%

15%

Survey Question: What percent of your 2013 budget is

allocated to vendors/suppliers?

13%

10%

10%

18% 18%

10%

10%

10%

10%

10%

9%

8%

8%

8%

5%

5%

2%

1%

0%

0%

Market Size/Structure

Product/Service

Development and

Testing

Branding, Messaging,

Customer/

and Market

Consumer Behavior

Communications

(segmentation,

attitudes, usage

studies, etc.)

All Companies

SURVEY QUESTION:

B-to-B Companies

Pricing Research

0%

Customer

Business/Competitive

Satisfaction/Market

Intelligence

Tracking

B-to-C Companies

How have you allocated your market research project portfolio across the above research categories?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 2

14

The majority of respondents expect staffing levels to remain constant in 2013

Market Research Staffing Changes (By Business Model)

2011 Average Rating = 3.21

2012 Average Rating = 3.11

2013 Average Rating = 3.23

70%

67%

70%

RESPONDENTS’ expectations

for additional staff has recovered

after a sharp decline in 2012.

60%

54%

50%

market research staff

(by business model)

38%

40%

The median number of staff is: All companies = 3

employees, B-to-B companies = 3 employees, B-to-C

companies = 4.5 employees.

30%

25%

21%

Survey Question: Approximately how many full-time

employees are in your market research department?

20%

10%

2%

0%

6%

3%

8%

0%

5

Increase Substantially

0%

4

Increase Moderately

All Companies

SURVEY QUESTION:

6%

3

Stay the Same

B-to-B Companies

2

Decrease Moderately

0%

0%

1

Decrease Substantially

B-to-C Companies

In comparison to 2012, your 2013 market research staffing will…

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 2

15

Most respondents expect budgets to remain static in 2013

Market Research Budget Changes (By Business Model)

2011 Average Rating = 3.14

2012 Average Rating = 3.06

2013 Average Rating = 3.23

49%

50%

47%

46%

EXPECTATIONS for

additional funding have

increased.

39%

40%

32%

31%

30%

20%

13%

13%

15%

10%

4%

0%

6%

2%

0%

5

Increase Substantially

4

Increase Moderately

All Companies

SURVEY QUESTION:

3

Stay the Same

B-to-B Companies

2

Decrease Moderately

3%

0%

1

Decrease Substantially

B-to-C Companies

In comparison to 2012, your 2013 market research budget will…

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 2

16

Most respondents rate their departments’ effectiveness as “Average”

Market Research Effectiveness (By Business Model)

2012 Average Rating = 3.31

2013 Average Rating = 2.74

69%

70%

60%

50%

48%

41%

40%

37%

33%

30%

20%

15%

11%

10%

13%

8%

4%

0%

8%

4%

3%

0%

5

Exceptional

4

Above Average

All Companies

SURVEY QUESTION:

6%

3

Average

B-to-B Companies

2

Below Average

1

Poor

B-to-C Companies

How would you rate the performance or effectiveness of your function compared to others within your industry?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

17

INTRO

SECTION

1

SECTION

2

SECTION

3

Key Competitive Intelligence Challenges

SECTION

4

SECTION

5

SECTION

6

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 3

18

Top Five Key Competitive Intelligence Challenges

CHALLENGE

SURVEY QUESTION:

1

Developing, implementing, and monitoring

counter-intelligence tactics

2

Packaging and communicating competitive data and

insights to drive stakeholder decision-making

3

Capturing the competitive information held by

your company’s employees

4

Developing an integrated competitive insights

dashboard to support decision-making

5

Conducting actionable win/loss analysis

FOR the previous two

years, the top challenge was

“Aligning Key Intelligence

Topics (KITs) to the company’s

strategic priorities.”

What are the top five functional challenges shaping your competitive intelligence strategy?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 3

19

Respondents’ challenges are attributed to staff and process limitations

Top Five Competitive Intelligence Challenges

Root Cause of Top Five Competitive Intelligence Challenges

CHALLENGE

1

Developing, implementing, and monitoring

counter-intelligence tactics

Staff: Inadequate skills

2

Packaging and communicating competitive

data and insights to drive stakeholder

decision-making

Process: Lack of process

3

Capturing the competitive information held

by your company’s employees

Process: Lack of process

4

Developing an integrated competitive

insights dashboard to support

decision‑making

Technology/Systems: Inadequate/outdated

technology

5

Conducting actionable win/loss analysis

Staff: Lack of experience

SURVEY QUESTION:

P lease indicate the root cause—staff, process, technology/systems, or strategic alignment—of your top five competitive

intelligence challenges.

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 3

20

B-to-B respondents focus on dashboards and counter-intelligence tactics,

while their B-to-C peers prioritize stakeholder needs and competitive alerts

Top Five Competitive Intelligence Challenges (By Business Model)

CHALLENGE

B-to-B

B-to-C

1

Developing, implementing, and monitoring

counter-intelligence tactics

Packaging and communicating competitive data and

insights to drive stakeholder decision-making

2

Capturing the competitive information held by

your company’s employees

Diagnosing stakeholders’ specific intelligence needs

3

Packaging and communicating competitive data and

insights to drive stakeholder decision-making

Capturing the competitive information held by

your company’s employees

4

Developing an integrated competitive insights

dashboard to support decision-making

Creating effective and timely competitive alerts

5

Conducting actionable win/loss analysis

Conducting actionable win/loss analysis

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

21

INTRO

SECTION

1

SECTION

2

SECTION

3

SECTION

4

Competitive Intelligence (CI) Resource Trends

SECTION

5

SECTION

6

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 4

22

The majority of CI departments have budgets that do not exceed $250,000

2013 Competitive Intelligence Budgets (By Business Model)

percentage of revenue dedicated

to budget (by business model)

Median = $125,000

70%

61%

60%

63%

Average = $191,500

The median percentage of company revenue dedicated to the CI budget is:

All companies = 1%, B-to-B companies = 1%, B-to-C companies = 1%.

60%

Survey Question: What is your 2013 total competitive intelligence budget as

a percentage of your company’s total 2012 revenue?

percentage of budget allocated

to vendors (by business model)

50%

The median percentage of budget allocated to vendors is: All companies

= 10%, B-to-B companies = 10%, B-to-C companies = 3%.

40%

Survey Question: What percentage of your 2013 budget is allocated to

vendors/suppliers?

30%

22%

20%

20%

15%

11%

10%

0%

9%

11%

Below $250,000

$250,000 to

$499,999

7%

6%

2%

0%

All Companies

SURVEY QUESTION:

13%

$500,000 to

$999,999

B-to-B Companies

$1 Million to

$2.99 Million

0%

$3 Million

or more

B-to-C Companies

hich of the above ranges (in $USD) best describes your 2013 total competitive intelligence budget (all expenditures on competitive

W

intelligence activities and general & administrative—including staff)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 4

23

The majority of respondents expect staffing levels to remain static

Competitive Intelligence Staffing Changes (By Business Model)

2013 Average Rating = 3.12

2012 Average Rating = 3.21

2011 Average Rating = 3.25

EXPECTATIONS for additional

70%

65%

65%

staff have declined over the

past three years.

64%

60%

competitive intelligence staff

(by business model)

50%

The median number of employees in 2013 is:

•• All companies = 2 employees

•• B-to-B companies = 1.5 employees

•• B-to-C companies = 2.5 employees

40%

30%

19%

20%

Survey Question: Approximately how many full-time

employees are in your competitive intelligence department?

22%

18%

14%

10%

10%

4%

0%

6%

8%

2%

0%

5

Increase Substantially

4

Increase Moderately

All Companies

SURVEY QUESTION:

3

Stay the Same

B-to-B Companies

2

Decrease Moderately

3%

0%

1

Decrease Substantially

B-to-C Companies

In comparison to 2012, your 2013 competitive intelligence staffing will…

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 4

24

The majority of respondents expect little to no budget increase for 2013

Competitive Intelligence Budget Changes

2013 Average Rating = 3.08

2012 Average Rating = 3.18

2011 Average Rating = 3.25

69%

70%

60%

58%

RESPONDENTS’ forecasts for

52%

additional funding have declined

over the past three years.

50%

40%

30%

27%

22%

18%

20%

18%

19%

12%

10%

2%

0%

3%

0%

5

Increase Substantially

0%

4

Increase Moderately

All Companies

SURVEY QUESTION:

3

Stay the Same

B-to-B Companies

2

Decrease Moderately

0%

0%

1

Decrease Substantially

B-to-C Companies

In comparison to 2012, your 2013 competitive intelligence budget will…

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 4

25

B-to-C respondents are twice as likely to rate their

departments’ effectiveness as “Average” than their B-to-B peers

Competitive Intelligence Effectiveness (By Business Model)

2013 Average Rating = 3.12

2012 Average Rating = 3.22

60%

56%

50%

40%

37%

33%

30%

28%

30%

29%

25%

21%

20%

13%

10%

8%

9%

6%

2%

0%

5

Exceptional

4

Above Average

All Companies

SURVEY QUESTION:

3

Average

B-to-B Companies

2

Below Average

3%

0%

1

Poor

B-to-C Companies

How would you rate the performance or effectiveness of your function compared to others within your industry?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 4

26

Most CI departments report into Marketing

Direct Line Report of Competitive Intelligence (By Business Model)

50%

46%

SINCE 2012, the percentage of

CI departments reporting into

Marketing has decreased by 10%,

and the percentage reporting into

Executive Management has doubled.

40%

32%

30%

26%

20% 20% 20%

20%

21%

20%

16%

12%

14%

10%

10%

6%

0%

6%

7%

12%

7%

2%

0%

Marketing

Market Research

Corporate

Strategy/Planning

All Companies

SURVEY QUESTION:

Sales/Business

Development

B-to-B Companies

R&D/Innovation

and Product

Development

Executive

Management

(CEO/President/

General Manager)

3%

0%

Other

B-to-C Companies

To which department does your competitive intelligence function directly report?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

27

INTRO

SECTION

1

SECTION

2

SECTION

3

SECTION

4

SECTION

5

Special Interest Topic: Supporting Stakeholder

Decision‑Making

SECTION

6

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

28

Sales/Business Development accounts for most of the B-to-B respondents’ research

portfolio, while Marketing is the primary client for B-to-C respondents

Top Three Clients (By Business Model)

All Companies

B-to-B Companies

Sales/Business Development

Sales/Business Development

(67%)

(78%)

Marketing (66%)

Corporate Strategy/Planning

(65%)

SURVEY QUESTION:

B-to-C Companies

Marketing (74%)

Corporate Strategy/Planning

Corporate Strategy/Planning

(50%)

(50%)

Marketing (63%)

Sales/Business Development

(47%)

Please identify your top three internal clients (in terms of the percentage of your research portfolio they account for).

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

29

Market assessments are a critical activity conducted for Marketing

Activities to Support Marketing (By Business Model)

67%

61%

Market Assessments

78%

Pricing Research

Currently

Conducting

50%

(55%)

61%

(59%)

(58%)

measuring success

Branding, Messaging, and Marketing

Communications

(61%)

(60%)

(68%)

The primary method used to measure impact on

Marketing is:

•• All companies = Customer Satisfaction or Net

Promoter Scores (33%)

•• B-to-B companies = Customer Satisfaction or

Net Promoter Scores (44%)

•• B-to-C companies = Key Intelligence

Topics (34%)

Customer/Consumer Research

56%

Not

Conducting *

(60%)

(61%)

Customer Satisfaction and Loyalty

Research

(61%)

(67%)

(68%)

Survey Question: What metric(s) do you use to

measure the impact of your department’s work

for Marketing?

Voice of the Customer

(67%)

(100%)

(80%)

(60%)

(40%)

All Companies

(20%)

0%

20%

B-to-B Companies

40%

60%

80%

100%

B-to-C Companies

*Percentages indicate the number of people not using this activity.

SURVEY QUESTION:

Which of the above activities does your department perform to support Marketing’s decision-making (please check all that apply)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

30

The majority of respondents do not conduct win/loss analysis for Sales

Activities to Support Sales (By Business Model)

70%

69%

Customer/Consumer Research

69%

Currently

Conducting

60%

Tools that Position Sales Against Specific

Competitors (e.g., Battle Cards)

63%

57%

(57%)

measuring success

(59%)

Sales Forecasts and Pipeline Analytics

54%

(62%)

Not

Conducting *

(59%)

Win/Loss Analysis

(69%)

Survey Question: What metric(s) do you use to

measure the impact of your department’s work

for Sales?

(79%)

(75%)

The primary method used to measure impact on

Sales is:

•• All companies = Sales or Win/Loss

Ratio (46%)

•• B-to-B companies = Sales or Win/Loss

Ratio (50%)

•• B-to-C companies = Forecast Accuracy (40%)

War-gaming

(85%)

(100%)

(80%)

(60%)

(40%)

All Companies

(20%)

0%

20%

B-to-B Companies

40%

60%

80%

100%

B-to-C Companies

*Percentages indicate the number of people not using this activity.

SURVEY QUESTION:

Which of the above activities does your department perform to support Sales’ decision-making (please check all that apply)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

31

SWOT analysis is the primary activity conducted for Executive Management

Activities to Support Executive Management (By Business Model)

80%

82%

SWOT Analysis

80%

53%

Currently

Conducting

50%

Customer/consumer segmentation

60%

(62%)

(61%)

measuring success

Scenario planning

The primary method used to measure impact on

Executive Management is:

•• All companies = Verbal feedback (39%)

•• B-to-B companies = Key Intelligence

Topics (38%)

•• B-to-C companies = Verbal feedback (60%)

(60%)

Not

Conducting *

(80%)

(76%)

Strategic Early Warning (SEW)

(87%)

Survey Question: What metric(s) do you use to

measure the impact of your department’s work

for Executive Management?

(84%)

(82%)

War-gaming

(87%)

(100%)

(80%)

(60%)

(40%)

All Companies

(20%)

0%

20%

B-to-B Companies

40%

60%

80%

100%

B-to-C Companies

*Percentages indicate the number of people not using this activity.

SURVEY QUESTION:

Which of the above tools/methods do you use to support Executive Management’s decision-making (please check all that apply)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

32

SWOT analysis is the primary activity conducted for Corporate Strategy

Activities to Support Corporate Strategy (By Business Model)

74%

78%

SWOT Analysis

64%

Currently

Conducting

52%

Customer/Consumer Segmentation

(56%)

64%

(63%)

(58%)

measuring success

Scenario Planning

The primary method used to measure impact on

Corporate Strategy is:

•• All companies = Sales (40%)

•• B-to-B companies = Sales (50%)

•• B-to-C companies = Key Intelligence

Topics (50%)

(71%)

(84%)

Not

Conducting *

(78%)

Strategic Early Warning (SEW)

(100%)

Survey Question: What metric(s) do you use to

measure the impact of your department’s work

for Corporate Strategy?

(87%)

(86%)

War-gaming

(86%)

(100%)

(80%)

(60%)

(40%)

All Companies

(20%)

0%

20%

B-to-B Companies

40%

60%

80%

100%

B-to-C Companies

*Percentages indicate the number of people not using this activity.

SURVEY QUESTION:

Which of the above tools/methods do you use to support Corporate Strategy’s decision-making (please check all that apply)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 5

33

Most respondents provide front-end inputs (needs analysis and brand positioning) for Product Development

Activities to Support Product Development (By Business Model)

86%

86%

Customer Needs Analysis

83%

Currently

Conducting

57%

50%

Brand Positioning

67%

(51%)

(55%)

Product Concept and Packaging Testing

50%

(54%)

Not

Conducting *

Post-launch Evaluations

(68%)

67%

(66%)

(73%)

Product Testing

(58%)

(100%)

(80%)

(60%)

(40%)

All Companies

(20%)

0%

20%

B-to-B Companies

40%

60%

80%

100%

B-to-C Companies

*Percentages indicate the number of people not using this activity.

Note:The number of respondents who measure their support for product development, was not statistically significant enough for analysis.

SURVEY QUESTION:

Which of the above activities do you conduct to contribute to Product Development’s decision-making (please check all that apply)?

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

34

INTRO

SECTION

1

SECTION

2

SECTION

3

SECTION

4

SECTION

5

SECTION

6

Respondent Demographics

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

35

2013 survey results

Section 6

Respondent Demographics

Enterprise Type

Not for Profit

Government/Public Sector

4% 6%

Venture Capital 1%

Hybrid 2%

Business Model

B-to-C

Company

(Indirect)

Most respondents are

from Public companies.

The majority of the

respondents come from

B-to-B companies.

25%

46%

Public

8%

B-to-C

Company

(Direct)

41%

Private

67%

B-to-B

Company

N = 91

N = 87

Company Revenue

40%

20%

19%

SURVEY QUESTION:

Below

$50 Million

25%

$1 Billion to

$11 Billion

More than

$11 Billion

17%

9%

6%

0%

24%

$50 Million to

$99.99 Million

$100 Million to

$499.99 Million

$500 Million to

$999.99 Million

N = 88

Please indicate the type of enterprise, business model, and revenue that best represents your company.

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.

growth team m e m b e r s h i p ™

2013 survey results

Section 6

36

Respondent Demographics: Top Five Participating Industries

40%

37%

31%

30%

20%

20%

19%

18%

10%

0%

Information and

Communication

Technologies

Healthcare and Life

Sciences

Automotive and

Transportation

Chemicals, Materials,

and Food

Energy and Power

Systems

N = 85

SURVEY QUESTION:

Please indicate which industry categories best describe your company (check all that apply).

The contents of these pages are copyright © 2013 Frost & Sullivan. All rights reserved.

Growth Team Membership™ research.