CPM Group

advertisement

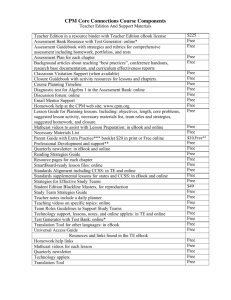

Cotton Price Risk Management Jeffrey M. Christian February 2002 CPM Group Today’s Presentation 1. Introduction: History 2. Introduction: What can be done in cotton hedging 3. CFC Program 4. How Field Tests Could Work 5. Commodity Market Mechanics 6. Real World Examples 7. A Proposed Field Demonstration Program for Commodity Price Risk Management 8. Cotton Hedging, in detail 9. CFC Program, continued CPM Group Introduction: History • • • • • • 1997: EU started the process of seeking new commodity risk management regimes. 1998: World Bank published paper, Effective Commodity Price Risk Management (Akiyama, Christian), and organized the first commodity risk management roundtable. 1999: World Bank International Task Force on commodity price risk management formed. 1999: CPM delivers proposals for field tests of hedging programs to International Coffee and Cocoa Organizations 2001: World Bank ITF refocuses on possible field tests. 2001: CFC commissions feasibility studies on coffee, cocoa, and cotton hedging field tests. CPM Group Introduction: History • The World Bank and the Common Fund for Commodities have been seeking to implement programs to assist in commodity price risk management – hedging – since 1998 and 1999. • The CFC and World Bank are moving toward field tests of a program CPM Group outlined in 1998, using existing market instruments, dealers, and relationships. • CPM Group currently is conducting a feasibility study for the CFC’s program to hedge cotton price risk in Tanzania, Uganda, and Zimbabwe. CPM Group Introduction: What can be done • The next two slides will illustrate what can be done, now, using existing market instruments and facilities, to hedge cotton. • The key is not to build a new market facility, but to provide a bridge between agricultural producers in these countries and international markets, to bring existing price hedging mechanisms to remote producers. CPM Group One example of a cotton hedge Participatory Option -- 17 December 2001 for July 2002 Sales Price 80 70 Spot Sales 60 50 40 CPM Group 30 Participatory Option 20 10 0 0 6 12 18 24 30 36 42 48 54 60 66 72 78 Market Price CPM Group Another example of a cotton hedge Participatory Option -- 17 December 2001 for July 2002 Sales Price 80 70 Spot Sales 60 50 40 CPM Group 30 Participatory Option 20 10 0 0 5 11 17 23 29 35 41 47 53 59 65 71 77 Market Price CPM Group Examples of cotton hedges • These instruments may be structured to provide some flexibility to producers. • In these two examples, a producer could have hedged this year’s crop at a minimum price of 36 cents per pound, and given up 3 cents of any increase over that level… • Or, the producer could have accepted a slightly lower minimum price, at 35 cents per pound, and given up 2 cents of any increase. • These prices are for deliverable cotton: Producers prices for seed cotton would be discounted accordingly. CPM Group Examples of cotton hedges • These two examples are real-life cases, structured by CPM Group in December, 2001. • These hedges can be executed today, using existing market instruments, existing market intermediaries, and existing market relationships. • There is no intention of building new market instruments or markets, but simply an effort to build an efficient, intelligent bridge between producers and international providers of cotton price hedging services. CPM Group CFC Program Analysing the Potential for Introducing Market Based Price Risk Management to Cotton Farmers and/or their Co-operatives CPM Group CFC Program • The Common Fund for Commodities wishes to develop a program to bridge the gap between developing nation commodity market entities and market-center financial institutions providing hedging facilities. • The CFC wishes to undertake a series of field tests on commodities price risk management for such bridge building. • First, the CFC wishes to study the potential structure and mechanics of these field tests. CPM Group CFC Program • The present study is an investigation of the ability, and potential constraints, to launch field tests of commodity hedging programs for cotton growers and others in Tanzania, Uganda, and Zimbabwe. • The study is to be completed by late May 2002. A second field research trip by CPM Group will occur in April. • Other studies on coffee and cocoa are underway simultaneously. • A Regional Workshop will be scheduled, probably in June at some point in Africa, to outline study results and discuss the program. CPM Group How the Field Tests Could Work CPM Group CFC Field Tests -- Needs of System For this program to work, various conditions need to exist in the domestic cotton markets: 1. Key buyers of services 2. Domestic intermediaries 3. Legal and regulatory framework 4. Telecommunications infrastructure 5. Providers of hedging services CPM Group 1. Key buyers of services • This program depends on finding cotton market entities large enough to purchase price hedging instruments, and then distribute them to smaller farmers. • Such entities can be farmers, co-operatives, gin mills, dealers, exporters. • One key aspect of the program will be to develop a method of assuring that the benefits of the price protection program are distributed to small farmers. CPM Group 2. Domestic intermediaries • Most likely, domestic banks and other financial intermediaries will play a role in helping to establish the bridge between the international market and domestic producers. • By providing price insurance, the banks actually also would be improving the credit worthiness of their small farming clients. • These hedges can be tied into input credits. • These hedges improve the credit worthiness of farmers seeking micro-finance and other input credits. • Joint programs with international providers of such hedging instruments and domestic banks already exist, and can be used to provide these instruments and services to producers. CPM Group 3. Legal and regulatory framework The legal regime must be structured to allow such transactions to occur. • Companies must be legally allowed, and able, to buy and sell commodity options for hedging purposes overseas. • Financial market regulations must allow for such transactions. • Foreign exchange laws must allow them as well. • Its both the regulatory regime and the rules by which it is applied that matter. CPM Group 4. Telecommunications infrastructure • Effective communications networks will need to be developed to handle cotton price risk management on an on-going basis. • Reliable telephone, telefax, and e-mail are needed. • For the field tests, the flow of pricing information and hedging structures might be rather minimal. CPM Group 5. Providers of hedging services • The study is designed to identify as many providers of hedging services, options, and cotton related financial services as possible. • On identification, these financial counterparties will be invited to participate in field tests. – Introduced to program – Review of strategies, systems, networks, operations CPM Group CFC Program • The study over the next three months will examine and analyze each set of requirements and assess what obstacles exist to the field test, and whether the field tests can be conducted in these three national markets. CPM Group An Intelligent Bridge The need is to build a bridge between local growers and international markets. • It needs to be an intelligent bridge. • Technical assistance is needed to make sure the hedges are optimally structured, and in the best interest of local, domestic producers and others. • An honest broker is needed to make sure the program is optimally run. CPM Group An Intelligent Bridge • Concerns that these complex and powerful financial instruments could back-fire on producers are correct and well placed. Attention is needed to risk management steps. • There have been numerous examples of how managers not fully understanding the power – good and bad – of options have suffered large losses. These examples mostly involve large, presumably financially sophisticated corporations in Europe, Japan, and the United States. • So, it is important to build assurances into the cotton program to protect smaller companies in the three countries chosen for field tests, and to provide them with adequate financial advisory services to protect them from such potentially devastating mistakes. CPM Group CFC Program • The program would use existing marketing instruments, trading counterparts, and relationships. • An international organization would provide technical assistance and serve as the honest broker. • The international organization would not have any credit exposure. • CPM Group-like companies can provide technical assistance in pricing, placing, and managing hedges. CPM Group What Hedging Cannot Do • It cannot stabilize prices. • It cannot raise market prices. • It cannot offer above-market prices. CPM Group What Hedging Can Do • It can raise revenue, both in a given crop year and in the long-term. • It can stabilize revenue. • It can offer above-market revenues in the long run. • It can provide predictability to revenue, which means…. • It can enhance producers’ credit-worthiness and ability to borrow. CPM Group Mechanics of hedging • Dealer or over-the-counter options. • Zero cost options programs, that provide protection from lower prices and exposure to higher prices. • Rarely if ever use futures or exchange traded options. The futures markets are for the dealers to hedge their exposure. CPM Group Why these services are not provided now • • • • • Credit risks Profitability issues for hedge providers Small size of producers Non-performance Gap exists CPM Group Input credit finance & microfinance • Ultimately, hedging provides a minimum price assurance for farmers, co-ops, and others. This should help them in securing or enlarging their credit facilities with domestic financial institutions that provide input credits, financing, and micro-financing. • There may well be a role in some countries for these local financial institutions to serve as local distributing mechanisms for the price risk management services. They can provide the hedging facilities as part of their overall lending facility. CPM Group Commodity Market Mechanics The Structure and Function of Commodity Markets • Structure a. Dealer Markets b. Exchanges c. Instruments CPM Group Instruments • Spot Sales • Futures • Forwards • Spot Deferred Contracts • Simple Options • Compound Options Fences, Min-Maxes, Participatory Options Programs CPM Group • Synthetic Put vs. Participatory Options • Commodity Swaps • Commodity Loans • Short, Medium, and Long Term Trades Instruments Any time CPM Group advises a client on hedging strategies, it presents a range of instruments, structures, and possible hedges to it. It assists the client in understanding the risks, costs, benefits, and rewards of each possible hedge, and in choosing the most efficacious and suitable hedge. It does not dictate only one type of instrument to any client. Dealers invariably offer only one or two options most suitable to them. CPM Group Instruments The following schematics portray revenue streams for commodities producers using different sales and hedging instruments. Similar comparisons may be done for commodities consumers. CPM Group Spot Sales Producers selling on a spot basis are fully exposed to rising and falling commodity prices. 35 Price Received 30 25 20 15 10 5 0 0 3 6 9 12 15 18 21 24 27 30 Market Price CPM Group Spot Sales and Forwards 35 Price Received 30 25 20 Forward sales protect producers from falling prices, but remove exposure to beneficial price developments. Beneficial Price Developments Spot Sales Forwards 15 10 Adverse Price Developments 5 Spot sales leave producers fully exposed to price variations, good and bad. 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 Market Price CPM Group Simple Options: Put 35 Price Received 30 25 20 15 Spot Sales Simple Put 10 5 0 0 3 6 9 12 15 18 21 24 27 30 Market Price CPM Group Using puts preserves exposure to beneficial price developments and removes exposure to adverse price developments, but puts cost money up front and can be expensive. Compound Options: Collars Producers lock in a minimum price received, and benefit only from a small portion of any price increase... 30 Price Received 25 20 Minimum Price Received Spot Sales Collar 15 10 …while giving up this exposure to beneficial price developments if prices rise. 5 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 Market Price CPM Group Compound Options: Collars 1. With collars -- which is what banks like to sell -producers get a little slice of beneficial price developments; the banks get most of it. 2. CPM Group rarely advises clients to use collars – only at times of historically high prices when prices seem overwhelmingly likely to decline. 3. The credit risks inherent in collars and forfeiture of upside price exposure simply make these inappropriate hedges, even if they are the hedges banks most commonly offer. CPM Group Participatory Options With Participatory Options Programs, producers reverse the field on banks. The producers get to keep most of the beneficial price developments, giving the banks only the thin slice. CPM Group Participatory Options Programs 30 Price Received 25 20 …while protecting against falling prices, With POPS, the producer keeps all of this if prices rise... 15 and giving away only a small amount of any price rise. 10 5 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 Market Price CPM Group Spot Sales POPS Participatory Options Programs Producers using these options strategies are able to: • Receive above-market prices for their commodity over time. • Protect their operations from sharp decreases in prices. • Preserve the ability to receive higher prices, if prices rise. • Avoid unlimited and unnecessary credit risks. CPM Group Participatory Options Programs Additionally, hedging with Participatory Options strategies provides producers and consumers with far better credit exposure than other hedging strategies. • The credit risk is reduced to a minimum -- typically 2% 10% of the total value of the hedge -- compared to unlimited risk with most hedge strategies. • The credit risk and other risks are known at the time the hedge is initiated. There are no credit risk surprises possible later. • It really is more performance risk than credit risk. CPM Group Participatory Options Programs Additional Benefits • Properly constructed Participatory Options have no premium, fee, brokerage commission, or other transaction cost to hedgers, either at inception or later. • Since the hedger is paying nothing for this hedge, and only foregoes a small portion of any price increase, should prices rise, the risks of non-compliance on the part of small farmers and others is greatly reduced compared to other hedges. CPM Group Commodity Price Risk Management • Banks and dealers rarely advise clients to use participatory options or other structures favorable to the clients. They are too beneficial to clients and do not offer dealers the extra profit potential they desire. • It is inappropriate, with a large conflict of interest, for banks and dealers to advise and structure hedges for their counterparts. • Most counterparts rely on their banks and dealers for strategies. • Banks and dealers by definition will not advise their clients to use optimally structured hedges. CPM Group Commodity Price Risk Management Hedging is an on-going process. It is not a one-time event. CPM Group Synthetic Put vs. Participatory Options Banks try to counter the move to Participatory Options by selling producers "Synthetic Puts." But these programs cost a lot to initiate. Participatory Options are better -- with no premiums and reduced credit risk. CPM Group Synthetic Put vs. Participatory Options 110 Prices Collar POPS Synthetic Put 100 90 80 70 60 60 CPM Group 70 80 90 100 110 Revenue Profile of Participatory Options for Crude Oil Producer These are the results in a hypothetical study CPM Group did on oil sales for the World Bank. 40 35 30 $/bbl. 25 20 15 Market Price Program Revenue 10 5 0 89 90 CPM Group 91 92 93 94 95 96 97 98 Revenue of Participatory Options Program Relative to Market The oil producer capped its loss (red) relative to the market, but had exposure to "all" of the gains (green) relative to the market if prices fell. 10 8 $/bbl. 6 4 2 0 -2 89 CPM Group 90 91 92 93 94 95 96 97 98 Real World Examples Real World Examples These are actual hedges. These hedges show what client companies of CPM Group have done, and what other groups could have done over the past few years, had the bridge been built between the private sector providers of these services, and developing country commodity producers and exports. CPM Group Mechanics • CPM Group advises companies on commodities hedging programs. • Some clients ask CPM Group to structure hedges, which they execute and manage themselves. • CPM also will execute and manage hedge positions for clients as their agents. • Typically, more than one alternative hedge strategy will be presented at a time, allowing the client to see and compare the relative costs and benefits of various strategies, approaches, and instruments. CPM Group Coffee Hedge 1 February 1997 for December 1998 Sales Price 400 350 Spot Sales 300 250 200 CPM Group 150 Participatory Option 100 50 0 0 35 70 105 140 175 210 245 280 315 350 385 Market Price CPM Group Coffee Prices: January 1996 - December 1999 Cents/Lb Cents/Lb 320 300 280 260 240 220 200 180 160 140 120 100 80 60 Jan- Apr- Aug- Dec- Apr- Aug- Dec- Apr- Jul- Nov- Mar- Jul- Nov96 96 96 96 97 97 97 98 98 98 99 99 99 CPM Group 320 300 280 260 240 220 200 180 160 140 120 100 80 60 Coffee Hedge 2 April 2000 for January 2001 Sales Price 180 165 150 Spot Sales 135 120 105 90 CPM Group 75 Participatory Option 60 45 30 15 0 0 15 30 45 60 75 90 105 120 135 150 165 180 Market Price CPM Group Coffee Prices: January 1999 - June 2001 Cents/Lb Cents/Lb 150 140 130 120 110 100 90 80 70 60 50 40 Jan- Mar- May- Aug- Oct- Jan- Mar- May- Aug- Oct- Jan- Mar- May99 99 99 99 99 00 00 00 00 00 01 01 01 CPM Group 150 140 130 120 110 100 90 80 70 60 50 40 Cocoa Hedge 1 March 2000 for July 2000 Sales Price 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 700 600 600 Spot Sales CPM Group Participatory Option 750 900 1,050 1,200 1,350 1,500 Market Price CPM Group Cocoa Prices: January 1999 - June 2001 $/metric ton 1,500 $/metric ton 1,500 1,400 1,400 1,300 1,300 1,200 1,200 1,100 1,100 1,000 1,000 900 900 800 800 700 700 600 Jan- Mar- Jun- Aug- Nov- Feb- Apr99 99 99 99 99 00 00 600 CPM Group Jul- Oct- Dec- Mar- Jun00 00 00 01 01 Cocoa Hedge 2 May 2001 for December 2001 Sales Price 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 700 600 600 Spot Sales CPM Group Participatory Option 750 900 1,050 1,200 1,350 1,500 Market Price CPM Group Cocoa Prices: January 2001 - June 2001 $/metric ton 1,250 1,200 1,150 1,100 1,050 1,000 950 900 850 800 750 700 650 2-Jan 24-Jan 14-Feb 8-Mar 29-Mar 20-Apr 11-May 4-Jun CPM Group $/metric ton 1,250 1,200 1,150 1,100 1,050 1,000 950 900 850 800 750 700 650 25-Jun Key advantages ♦Immediate development, implementation, and operation. ♦Uses existing market instruments and institutions. ♦No government subsidies. ♦Superior price returns compared to non-hedging and currently typical hedging. ♦Known maximum credit risk at outset. ♦Protection against market shocks. ♦Self-funding beyond start-up, self-insuring, selfsustaining. ♦Low costs to implement, with no operational costs for governments or users beyond start-up. CPM Group Commodity Price Risk Management The ugly truth of the matter is there are few companies with the technical expertise, market knowledge, market experience, and options understanding to effectively operate such programs. Banks and dealers simply will not offer such efficient hedges. Traders trained in banks and dealers do not understand hedgers’ needs and operations sufficiently to structure suitable hedges. Many consulting companies that claim knowledge of options trading in fact never have managed any trades and lack the technical experience and expertise. CPM Group Cotton Hedges, in detail This section revisits the two examples of cotton hedges from the beginning of this presentation, showing how they were constructed in explicit detail, and comparing how the revenues that can be earned with these hedges in place compare to alternative sales methods. CPM Group One example of a cotton hedge Participatory Option -- 17 December 2001 for July 2002 Sales Price 80 70 Spot Sales 60 50 40 CPM Group 30 Participatory Option 20 10 0 0 6 12 18 24 30 36 42 48 54 60 66 72 78 Market Price CPM Group Another example of a cotton hedge Participatory Option -- 17 December 2001 for July 2002 Sales Price 80 70 Spot Sales 60 50 40 CPM Group 30 Participatory Option 20 10 0 0 5 11 17 23 29 35 41 47 53 59 65 71 77 Market Price CPM Group Construction of Participatory Option Participatory Options are constructed by combining three options. 1. A producer wants to protect against lower prices, so he purchases a put option. 2. Not wanting to pay cash for the put, the producer instead pays for it by selling a call option. 3. By choosing the right put to buy and call to sell, the producer generates a net profit on these two transactions, which it uses to purchase another put above these levels, giving it renewed exposure to rising prices. CPM Group Construction of Participatory Option The first Participatory Option in this presentation was constructed from three components. 1. The producer bought a put option at 36 cents. It paid 1.68 cents per pound for that option. 2. The producer paid for that put option by selling a call option at 36 cents, earning it 5.79 cents. The net of these two transactions was 4.11 cents. 3. The producer used this net premium to purchase a call option at 39 cents, paying 4.09 cents for it. The result is a zero-premium option. CPM Group Construction of Participatory Option Participatory Option with 36 cent floor, calculations 1. 2. 3. Producer buys 36 cent put Producer sells 36 cent call Net profit from these two actions Producer buys a 39 cent call Net premium is effectively zero CPM Group -1.68 cents +5.79 cents +4.11 cents -4.08 cents +0.03 cents Construction of Participatory Option The second Participatory Option in this presentation was constructed from three components. 1. The producer bought a put option at 35 cents. It paid 1.36 cents per pound for that option. 2. The producer paid for that put option by selling a call option at 35 cents, earning it 6.45 cents. The net of these two transactions was 5.09 cents. 3. The producer used this net premium to purchase a call option at 37 cents, paying 5.17 cents for it. The result is a zero-premium option. (-0.08 net cost.) CPM Group Construction of Participatory Option Participatory Option with 35 cent floor, calculations 1. 2. 3. Producer buys 35 cent put Producer sells 35 cent call Net profit from these two actions Producer buys a 37 cent call Net premium is effectively zero CPM Group -1.36 cents +6.45 cents +5.09 cents -5.17 cents -0.08 cents Cotton Hedges, Revenue Performance The next two slides illustrate how the potential revenue performance of various sales and hedging policies compare under varying price scenarios. CPM Group Cotton Hedges, Revenue Performance Cotton Hedges -- Competetitve Analysis December 17, 2001 for July 2002 US cents per pound Market Price 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 Spot Sales Forward Sales Collar (37-43) Participatory Option 35 Participatory Option 36 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 40 40 40 40 40 40 40 40 40 40 40 40 40 40 40 40 40 37 37 37 37 37 37 37 37 40 43 43 43 43 43 43 43 43 35 35 35 35 35 35 35 35 38 43 48 53 58 63 68 73 78 36 36 36 36 36 36 36 36 37 42 47 52 57 62 67 72 77 Notes: Details of the structures of these positions may be found elsewhere in this presentation, or are available from CPM Group. CPM Group Cotton Hedges, Revenue Performance Revenue 90 80 Market Price Spot Sale 70 60 Participatory Option (37) 50 Participatory Option (35) 40 Forward Collar 30 20 10 0 0 5 10 15 20 25 30 35 40 45 Market Price CPM Group 50 55 60 65 70 75 80 Cotton Hedges, Revenue Performance Benefits of participatory options outweigh those of competing methods of sales and hedging. • The participatory options offer superior returns in the long run. Producers using them retain exposure to rising prices, while gaining a minimum price for their product. • Reduced credit risks. Reduced costs. • Losses relative to the market are limited on each transaction; gains relative to the market are unlimited. CPM Group CFC Program CPM Group CFC Program • CPM Group provided template proposals and assistance to the Internation Cocoa Organization and the International Coffee Organization in November 1999, outlining commodity hedging field demonstrations. • CFC in July 2001 issued a request for proposals for comprehensive studies of the potential for field tests of commodities hedging programs in three countries each for three commodities each: coffee, cocoa, and cotton. CPM Group CFC Program 1. The CFC has contracted comprehensive studies of the target country and commodities markets. These studies will outline in detail the potential program participants in each country and other aspects of potential programs. 2. The CFC seeks to launch field demonstrations, to demonstrate the ability of market participants in these countries to undertake these hedging programs themselves directly and immediately. CPM Group CFC Program: Comprehensive Study Many issues to be explored and delineated: 1. Institutional framework and capacity to initiate and management such financial trades in target countries. 2. Legal and regulatory framework necessary to allow and accommodate options trades. 3. Information transmission and distribution. 4. Management of hedging positions during any field test. CPM Group CFC Program: Comprehensive Study Issues to be delineated: • What is the potential for introducing commodity hedging programs into these three countries’ cotton industries. • What services, instruments, and strategies would work best for these producers, coops, etc. • What are the most efficient and effective transmission mechanisms, market intermediaries to use. • What actions are needed to develop a program to provide these services to producers. CPM Group CFC Program: Comprehensive Study Issues to be delineated (continued): • What is the institutional, legal, and regulatory framework in each country. Can commodity options be used in these countries in cotton. What laws and regulations may need modification or introduction. • What safeguards against risks and hazards need to be implemented to protect these operations from problems. • How can these field tests be conducted. • What will these field tests cost in full. CPM Group CFC Program: Comprehensive Study Actions: • Identify and develop comprehensive list of potential hedgers. Contact them and introduce them to program concepts and structures. • Identify and develop comprehensive list of potential service providers. Contact them and introduce them to concepts of program structure. • Develop operation for effecting and managing these programs. • Develop program to collect information on program performance. CPM Group 30 Broad Street, 37th Floor New York, N.Y. 10004 Telephone: (212) 785-8320 Telefax: (212) 785-8325 E-mail: investmentbanking@cpmgroup.com Website: www.cpmgroup.com