CHAPTER 2

advertisement

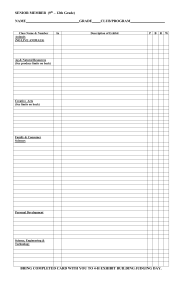

CHAPTER 4 … Completing the Accounting Cycle Objective 1: Prepare an accounting work sheet A. The accounting cycle, the process by which a company prepares its financial statements, consists of a number of steps. Exhibit 4-1 illustrates those steps, from the beginning of the period through the work sheet and preparation of the financial statements. 1. For a new business, begin by setting up ledger accounts; for an existing business, begin with account balances carried over from the previous period. 2. During the period: 3. B. a. Analyze and journalize transactions (based on various source documents) for the current period. b. Post transactions from the journal to the ledger. End of the period: a. Calculate the balance of each account in the ledger. b. Enter the trial balance on the work sheet and complete the work sheet (optional). c. Using the adjusted trial balance, prepare financial statements. d. Adjust and close the accounts, including journalizing and posting. e. Prepare the postclosing trial balance. Exhibits 4-2 through 4-6 illustrate the following steps in preparing the work sheet. It is an optional tool that may be used for the convenience of the accountant in the adjusting and closing process. Note that each pair of columns must be in balance (total debits must equal total credits). 1. Begin by listing the account titles, and then enter the trial balance directly into the first two columns of the work sheet. Total the columns. 2. Enter adjusting entries in the next two columns. Total the columns. 4-1 3. Combine the amounts in the Trial Balance columns with the amounts in the Adjustments columns; write the total of each account in the Adjusted Trial Balance columns. Total the columns. 4. Extend (that is, copy) these adjusted balances to the Income Statement or Balance Sheet columns. Debits on the Adjusted Trial Balance columns remain as debits, while credits remain as credits. 5. The amount required to balance the Income Statement and Balance Sheet columns represents net income or net loss. a. Net income is entered in the debit column of the Income Statement and in the credit column of the Balance Sheet. b. Net loss is entered in the credit column of the Income Statement and in the debit column of the Balance Sheet. Objective 2: Use the work sheet to complete the accounting cycle A. After the work sheet is completed, it may be used to prepare the financial statements, adjusting entries, and closing entries. Preparation of the postclosing trial balance completes the accounting cycle. B. From the data on the work sheet, prepare financial statements, always in this order as illustrated in Exhibit 4-7: income statement, statement of owner’s equity, and balance sheet. C. Copy adjusting entries from the work sheet into the journal and post to the ledger. (Refer to Exhibit 4-8.) Objective 3: Close the revenue, expense, and withdrawal accounts A. Closing the accounts is the process that prepares the accounts for the next period. Note that closing entries may be prepared directly from the work sheet. B. Closing entries transfer the temporary accounts (revenues, expenses, and withdrawals) to the Capital account. 1. These accounts relate to a particular accounting period and must be closed at the end of the period. 4-2 2. C. The closing process also zeroes out all the revenues and expenses in order to measure each period’s income separately. The closing process is pictured in Exhibit 4-9. 1. Revenue and expense accounts are closed to Income Summary, a temporary account used only at closing. This is the entry to close revenue accounts: Revenue XX Income Summary 2. This is the entry to close expense accounts: Income Summary Expense 3. 4. XX XX After the previous entries, the balance of Income Summary equals net income or net loss and must be transferred to the capital account. One of these two entries is required to close Income Summary: Income Summary XX Capital To close net income. XX Or, Capital XX Income Summary To close net loss. XX Close Withdrawals directly to Capital. Withdrawals are not closed to Income Summary because Withdrawals is not an expense account. Capital XX Withdrawals 5. D. XX XX Exhibit 4-10 illustrates the journalizing and posting of closing entries. After the closing entries are posted, all temporary accounts will have a zero balance. Never close permanent accounts. 1. Permanent accounts include assets, liabilities, and capital accounts. 2. Balances of permanent accounts carry over to the next period. 4-3 E. F. A postclosing trial balance (Exhibit 4-11) proves the accuracy of the journalizing and posting of closing entries. It lists the account balances after closing entries. 1. The postclosing trial balance is similar to the balance sheet in that it only contains the balances of permanent accounts. 2. If any temporary accounts appear on the postclosing trial balance, one or more errors have been made. Revenues, expenses, withdrawals, and income summary should never be among the accounts listed. Reversing entries ease the accounting of the next period and are optional; they are discussed in the Appendix to Chapter 4. Objective 4: Classify assets and liabilities as current or long-term A. Assets and liabilities are classified as either current or long-term based on their liquidity. Liquidity is the measure of how quickly the item may be converted to cash. B. Assets include: 1. 2. C. Current assets – cash or other assets that will be converted to cash, sold, or used up, in one year or one operating cycle, whichever is longer. a. The operating cycle is the length of time during which (1) cash is used to acquire goods or services; (2) these goods or services are sold to customers, who (3) pay for their goods or services with cash. b. Current assets include cash, accounts and notes receivable due in less than one year, prepaid expenses, and inventory. Long-term assets – all other assets used in the business, such as property, plant, and equipment (also called fixed assets) and long-term investments. Liabilities include: 1. Current liabilities – debts or obligations due within one year or one operating cycle, whichever is longer. a. Current liabilities must be paid with cash or with goods and services. b. Included are accounts and notes payable due in less than one year, salary and other accrued payables, and unearned revenue. 4-4 2. D. Long-term liabilities – all other debts due in longer than one year. Many notes payable and bonds payable are long-term. The detailed or classified balance sheet groups assets and liabilities as current and longterm, as illustrated in Exhibits 4-12 and 4-13. The statement may be in one of these formats: 1. The report format of the balance sheet lists assets first, then liabilities, and finally owner’s equity. (Dell Computer Corporation is presented in Exhibit 4-13.) The report format is more popular. 2. The account format reports assets on the left side and liabilities and owner’s equity on the right, similar to the accounting equation, A + L + O/E. (See Exhibit 4-7 and Exhibit 4-12.) Objective 5: Use the current ratio and the debt ratio to evaluate a company A. Accounting ratios are useful in financial statement analysis and decision making. B. The current ratio compares current assets to current liabilities. It helps the financial statement user assess the company’s ability to pay current liabilities with current assets. Current ratio = Total current assets Total current liabilities C. The debt ratio compares total liabilities to total assets. 1. 2. It shows how much of the company’s assets are financed with debt. The debt ratio helps the financial statement user assess the company’s long-term and short-term debt-paying ability. Debt ratio = Total liabilities Total assets D. Generally, a high current ratio is preferable to a low current ratio. A low debt ratio is preferable to a high debt ratio. E. Financial ratio analysis is most helpful when performed for a series of periods and when many different ratios are included. F. Decision Guidelines summarize the steps in completing the accounting cycle and analyzing financial statement data. 4-5 Appendix to Chapter 4: Reversing Entries: An Optional Step A. Reversing entries are special journal entries that ease the burden of accounting in later periods; they are the exact opposite of certain adjusting entries. B. Reversing entries are not required by GAAP, but are merely for the convenience of the accountant. C. As presented in the body of the chapter, an adjusting entry at year-end for an accrued expense such as $500 of salary expense would be recorded as: Salary Expense Salary Payable D. Then, as presented, on the day the salary is actually paid (in the following accounting period), the entry would be: Salary Expense Salary Payable Cash E. 500 500 1,500 500 2,000 However, if reversing entries are made, the exact opposite entry is prepared on the first day of the new period. Thus, using the above adjusting entry (in C), on the first day of the new year, this reversing entry would be made: Salary Payable 500 Salary Expense F. 500 Finally, on the day the salary is actually paid (in the following accounting period), the entry would be: Salary Expense Cash 2,000 2,000 4-6