The Treasurer`s Perspective - Part 11: Cash Management

advertisement

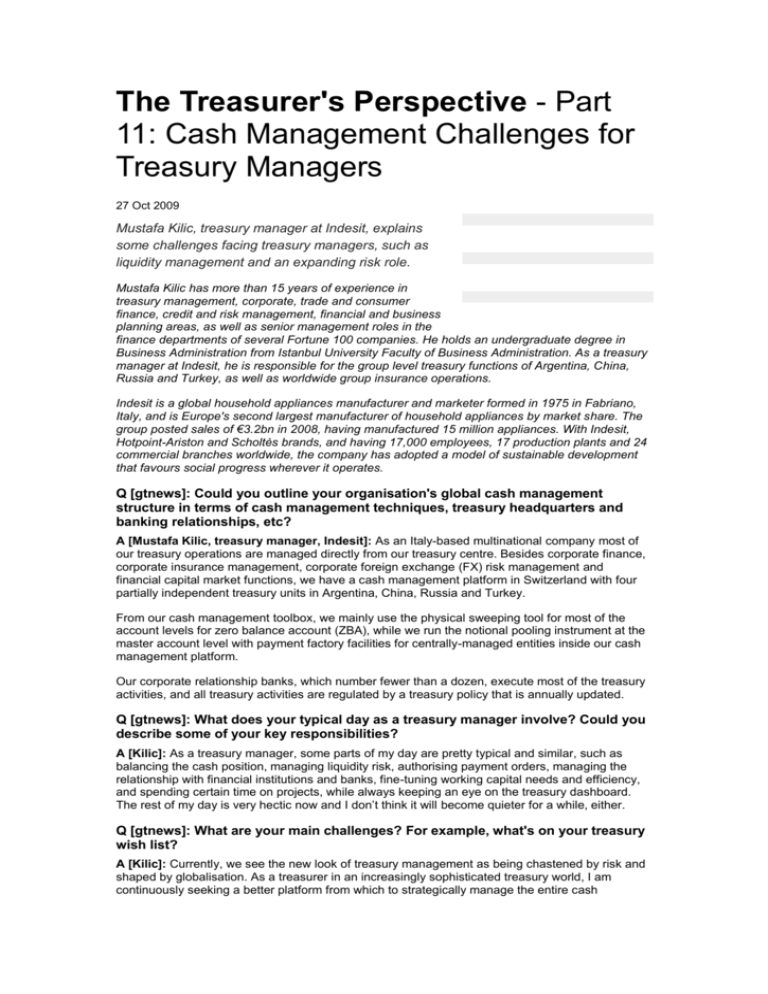

The Treasurer's Perspective - Part 11: Cash Management Challenges for Treasury Managers 27 Oct 2009 Mustafa Kilic, treasury manager at Indesit, explains some challenges facing treasury managers, such as liquidity management and an expanding risk role. Mustafa Kilic has more than 15 years of experience in treasury management, corporate, trade and consumer finance, credit and risk management, financial and business planning areas, as well as senior management roles in the finance departments of several Fortune 100 companies. He holds an undergraduate degree in Business Administration from Istanbul University Faculty of Business Administration. As a treasury manager at Indesit, he is responsible for the group level treasury functions of Argentina, China, Russia and Turkey, as well as worldwide group insurance operations. Indesit is a global household appliances manufacturer and marketer formed in 1975 in Fabriano, Italy, and is Europe's second largest manufacturer of household appliances by market share. The group posted sales of €3.2bn in 2008, having manufactured 15 million appliances. With Indesit, Hotpoint-Ariston and Scholtès brands, and having 17,000 employees, 17 production plants and 24 commercial branches worldwide, the company has adopted a model of sustainable development that favours social progress wherever it operates. Q [gtnews]: Could you outline your organisation's global cash management structure in terms of cash management techniques, treasury headquarters and banking relationships, etc? A [Mustafa Kilic, treasury manager, Indesit]: As an Italy-based multinational company most of our treasury operations are managed directly from our treasury centre. Besides corporate finance, corporate insurance management, corporate foreign exchange (FX) risk management and financial capital market functions, we have a cash management platform in Switzerland with four partially independent treasury units in Argentina, China, Russia and Turkey. From our cash management toolbox, we mainly use the physical sweeping tool for most of the account levels for zero balance account (ZBA), while we run the notional pooling instrument at the master account level with payment factory facilities for centrally-managed entities inside our cash management platform. Our corporate relationship banks, which number fewer than a dozen, execute most of the treasury activities, and all treasury activities are regulated by a treasury policy that is annually updated. Q [gtnews]: What does your typical day as a treasury manager involve? Could you describe some of your key responsibilities? A [Kilic]: As a treasury manager, some parts of my day are pretty typical and similar, such as balancing the cash position, managing liquidity risk, authorising payment orders, managing the relationship with financial institutions and banks, fine-tuning working capital needs and efficiency, and spending certain time on projects, while always keeping an eye on the treasury dashboard. The rest of my day is very hectic now and I don’t think it will become quieter for a while, either. Q [gtnews]: What are your main challenges? For example, what's on your treasury wish list? A [Kilic]: Currently, we see the new look of treasury management as being chastened by risk and shaped by globalisation. As a treasurer in an increasingly sophisticated treasury world, I am continuously seeking a better platform from which to strategically manage the entire cash management process to improve our financial performance, while knowing that it is not feasible to have one approach for all countries. I face many challenges these days: the need to stay focused on liquidity management in tight credit market conditions and an expanding risk role. It is important to retain treasury compliance under difficult economic conditions and heightened regulatory oversight, with the changing character of liquidity dynamics. For a long time, the first thing I had on my treasury wish list was the concept of ' iTreasuryDashboard' - my customised treasury dashboard that would allow me to control overall treasury performance in real time. The second wish is a fully-integrated mobile digital signature for all types of transactions and activities. Q [gtnews]: As a Swiss-based treasury for an Italian company and operating in the home appliance industry in 24 countries, are there are any tax, legal or regulatory issues that you need to be particularly mindful of when it comes to the company's cash management? A [Kilic]: Of course. In each country there are dozens of limitations and regulatory issues, but if I have to emphasise specific issues I would like to underline the increased tax implications for shortterm funding activities and the higher withholding taxes for inter-company loans in Turkey, as well as cash pooling limitations in eastern European countries - and the number of the entity limitations for a cash pooling structure in Switzerland. Q [gtnews]: What steps will you be taking in 2010 to make your treasury more efficient? A [Kilic]: Since we know there is no single solution that can be implemented in each country to improve the efficiency of cash and liquidity management, we decided to focus on hybrid solutions in treasury management. Therefore, we started to build new hybrid cash pooling solutions at the corporate level. Also, we are focused on increasing the sharpness of our cash forecasting and boosting our order-to-cash (O2C) speed by implementing innovative collection and payment tools in emerging markets. Q [gtnews]: If you weren't a treasurer, what would you be? A [Kilic]: I would have balanced the money with more sport. I think I would have been a professional golfer. From GTNEWS.COM 28-10-09