project on wcm of shree dayal tours & travel pvt ltd.doc

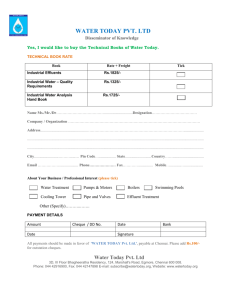

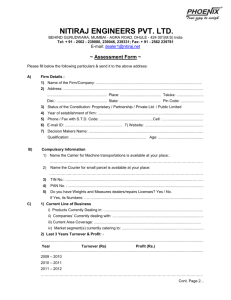

advertisement