End of Chapter 18 Questions and Answers

advertisement

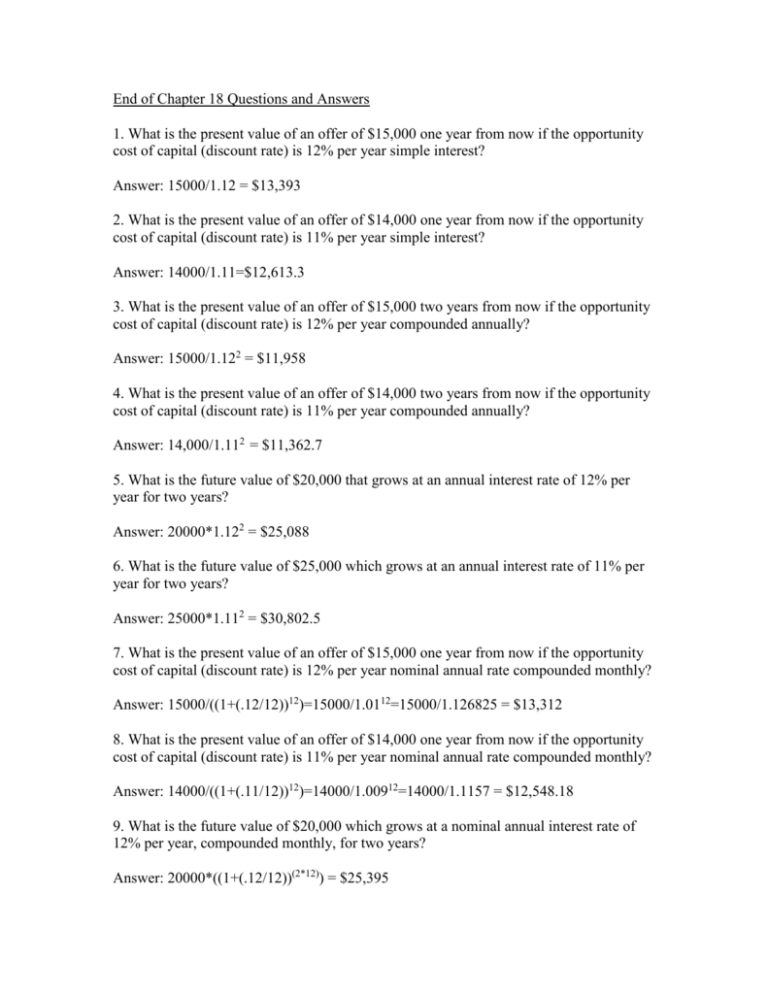

End of Chapter 18 Questions and Answers 1. What is the present value of an offer of $15,000 one year from now if the opportunity cost of capital (discount rate) is 12% per year simple interest? Answer: 15000/1.12 = $13,393 2. What is the present value of an offer of $14,000 one year from now if the opportunity cost of capital (discount rate) is 11% per year simple interest? Answer: 14000/1.11=$12,613.3 3. What is the present value of an offer of $15,000 two years from now if the opportunity cost of capital (discount rate) is 12% per year compounded annually? Answer: 15000/1.122 = $11,958 4. What is the present value of an offer of $14,000 two years from now if the opportunity cost of capital (discount rate) is 11% per year compounded annually? Answer: 14,000/1.112 = $11,362.7 5. What is the future value of $20,000 that grows at an annual interest rate of 12% per year for two years? Answer: 20000*1.122 = $25,088 6. What is the future value of $25,000 which grows at an annual interest rate of 11% per year for two years? Answer: 25000*1.112 = $30,802.5 7. What is the present value of an offer of $15,000 one year from now if the opportunity cost of capital (discount rate) is 12% per year nominal annual rate compounded monthly? Answer: 15000/((1+(.12/12))12)=15000/1.0112=15000/1.126825 = $13,312 8. What is the present value of an offer of $14,000 one year from now if the opportunity cost of capital (discount rate) is 11% per year nominal annual rate compounded monthly? Answer: 14000/((1+(.11/12))12)=14000/1.00912=14000/1.1157 = $12,548.18 9. What is the future value of $20,000 which grows at a nominal annual interest rate of 12% per year, compounded monthly, for two years? Answer: 20000*((1+(.12/12))(2*12)) = $25,395 10. What is the future value of $25,000 which grows at a nominal annual interest rate of 11% per year, compounded monthly, for two years? Answer: 25000*((1+(.11/12))(2*12)) = $31,120.7 11. What is the effective annual rate (EAR) of 8% simple nominal annual rate when compounded monthly? Answer: (1+(.08/12))12 - 1 = .0830 = 8.30% 12. What is the effective annual rate (EAR) of 6.5% simple nominal annual rate compounded monthly? Answer: (1+(.065/12))12 - 1 = 6.697% 13. What is the monthly loan constant for a 10%, 25-year mortgage? Answer: MMC = .009087008 14. What is the annualized mortgage constant in Problem #13 above? Answer: Annualized Mortgage Constant = .109044096 15. If you invested $15,000 at one point in time and received back $30,000 five years later, what annual interest (or growth) rate (compounded annually) would you have obtained? Answer: (30000/15000)(1/5) - 1 = 14.87% 16. If you invested $40,000 at one point in time and received back $100,000 seven years later, what annual interest (or growth) rate (compounded annually) would you have obtained? Answer: (100000/40000) (1/7) – 1 = 13.98% 17. In question 15, what nominal annual rate compounded monthly would you have obtained? Answer: 12*((30000/15000)(1/(5*12) - 1) = 13.94% 18. In question 16, what nominal annual rate compounded monthly would you have obtained? Answer: 12*((100000/40000)(1/(7*12) - 1) = 13.156% 19. What is the mortgage balance on a $75,000 loan after 5 years with an original term of 30 years a 10% contract rate, and monthly payments? Answer: $72,430.73 20. How much interest would be paid on problem #19 if paid over the full term? Answer: $161,944.80 = $681.52 times 360 less $75,000 21. Use the "Rule of 72" to estimate how long it will take $15,000 to grow to $30,000 at an annual growth rate of 10%. Answer: DT = 72/(100*.10) = 72/10 = 7.2 years 22. A real estate investor feels that the cash flow from a property will enable her to pay a lender $15,000 per year, at the end of every year, for 10 years. How much should the lender be willing to loan her if he requires a 9% annual interest rate (annually compounded, assuming the first of the 10 equal payments arrives one year from the date the loan is disbursed)? Answer: 15000*(1 - (1/1.09)10) / .09 = $96,265 23. You are borrowing $80,000 for 25 years at 10% nominal annual interest compounded monthly. How much must your monthly payments be if you will completely retire the loan over the 25-year period (i.e., what is the level payment annuity with a present value of $80,000)? Answer: 80000*(.10/12) / (1 - (1+(.10/12)))(25*12)) = $726.96 24. A tenant offers to sign a lease paying a rent of $1,000 per month, in advance (i.e., the rent will be paid at the beginning of each month), for five years. At 10% nominal annual interest compounded monthly, what is the present value of this lease? Answer: 1000*(1+. 10/12)*(1-(1/(1+(.10/12)))(5*12))/(.10/12) = $47,458 25. A lender makes a $30,000 loan at 9.0% for 31 years with monthly payments of $239.89. To bring the APR up to 9.5% how many points must be charged? Assume no prepayment. Answer: 4.369 points based on $1,310.64 over $30,000 26. What is the mortgage balance after 10 years on a 30-year loan at 6.0% with the original loan at $400,000 and monthly payments assumed? Answer: PMTs will be $2,398.20 and the PV of the remaining PMTs will be $334,774.90 after 10 years with 240 months left. 27. What is the present value of a 30-year mortgage at a contract rate of 9.0% with monthly payments. The original loan is $90,000 and prepayment is assumed at the end of the 12th year. The market yield required by the lender is 12.0%. Answer: $73,588.84 based on the balance of $77,330.81 and the PMTs of $724.16 all discounted over 12 years at 12%. 28. How much loan can a household afford if their gross income is $66,000 with current mortgage rates at 8.125% over 30 years, monthly payments, ignoring the loan to value constraint? Hint: Use 25% of household income as the limit for payments. Answer: $185,185.88 29. How much loan could a commercial property support with NOI of $50,000 a debt coverage ratio requirement of 1.25 and current rates at 9.0% for 25 years, with monthly payments? Ignore loan to value constraints. Answer: $50,000/1.25/12 is the payment. The PV is $397,205.41 based on 9.0% for 25 years.