The evolving role of the financial function: a framework for best

advertisement

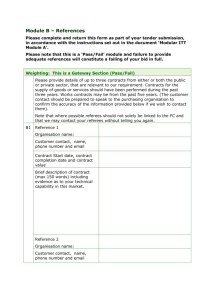

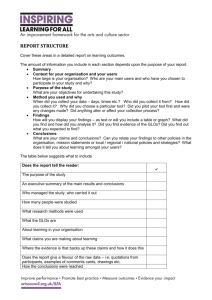

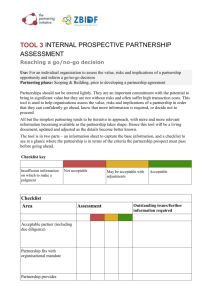

The evolving role of the financial function: a framework for best practice BY IAN HERBERT, WILLIAM MURPHY AND RICHARD MS WILSON The previous article in this series considered the role of the financial function in terms of scorekeeping or score making activities and the potential for role conflict in achieving a balanced position. This article responds to a frequent question that we hear from FDs and that is ‘Given all the research and advice that is available, how do we as a financial function rationalise our activities and explain our purpose clearly to senior management? In other words, where are we now? Where do we want to be? And how do we get there? In our recent survey of a sample of ACCA Members, 26% of those working for organisations said their financial function had already had to justify its existence formally. When asked about outsourcing of transaction processing accounting functions 63% thought that this would be a significant issue for their organisations in the next five years and 47% thought that outsourcing might also apply to higher level accounting functions such as analytical work. Against this background of change and challenge to the role of the financial function we suggest that these emerging issues are best addressed in three stages. Consider how good quality financial information (the output) gets produced and how, through better decision making, organisational effectiveness is achieved. Moreover, who should do the accounting processes and where might these people be situated; within a separate financial function or embedded within operational teams? Take stock of the present and future situation within a coherent analytical framework and then develop an agenda for change. Communicate the vision both within the financial team and to management. Taking these in turn. 1. How does good quality financial information (the output) get produced. Who needs to do it and where? The terms accounting and accountants tend to be used interchangeably but, of course, have distinct meanings. Firstly, accounting is made up of a number of processes. The lower three levels of exhibit 1 depict the routines, systems and techniques which allow us to capture, record, process and report economic data. with modern computing power and software we can now view much of the activity involved in preparing routine accounting information at this level as ‘mechanistic’ in that it can be done on what is often called a ‘lights-out’ basis (May 2000). Secondly, in the upper three levels people, principally but not exclusively accountants, are required to design the contributory processes of accounting and then to make sense of the outputs (products) that support accountability and decision making. This sense making has three basic levels; analysis of data; seeing connections between sets of data and situations (synthesising); and finally… evaluating the information produced and weighting its importance within a problemsolving framework (Huber 1956) so that management can be advised about alternatives. External environment organisational situation Significant situational knowledge required - people centred - visible - intangible roles evalulation synthesis Role of accountants - decision support - scoremaking - ethics & judgement analysis Little situational knowledge required - systems centred - invisible - tangible Report presentation & communication Report compilation Transaction processing Role of accounting - scorekeeping - attention directing - problem solving Exhibit 1 : Processes, roles and organisational situation of the financial function The pyramid depicts the activities of accounting as a successive progression from more mechanistic processes building into more cognitive skills and sets these in the context of two continuums of design choice. Firstly, what is the role dimension and secondly where should the role be situated; embedded within operational teams or at arm’s length in a central financial function. 2. Analysis of the present situation and an agenda for change The basic purposes of accounting information and advice in supporting organisations are: enabling - through financing activities and providing accountability to stakeholders; sustaining – through keeping the score and ensuring control* and enhancing – through providing decision support and facilitating effectiveness through organisational learning (adding-value). * Control being a wide ranging concept including the attainment of planned objectives and at a more basic level stewardship of assets. The extent to which these are pertinent to a particular situation at a particular time and place will depend on a wide range of environmental and organisational factors. The following framework of analysis can be explained to all members of the finance team through the use of the simple but compelling propeller metaphor. In addition, it can form the basis for sense making discourses with the users of financial information and advice. Exhibit 2 seeks to represent the attributes of an effective and integrated financial function supporting a wider set of organisational activities. The positive analogy is of a propeller driving a ship forward, a negative view of a dysfunctional department might be of a windmill spinning aimlessly at the mercy of the wind! People personal outlooks/needs, skills & qualities Organisation context ideas, outlooks & experience Role of financial function Professional Discipline expertise, ethics & techniques Communication with the organisation Business specific - objectives, structures, processes, products & activities Exhibit 2 Framework for analysing a financial function This scheme is designed to assist a financial function in thinking about where the team is now, what it wants to achieve, how to do it and what new skills/outlooks are required to change. It can also provide a framework to set targets, develop detailed plans (with clear responsibilities) and finally, ensure that progress is monitored and plans achieved. Taking each aspect in turn. 1. Professional discipline expertise By this we mean expert knowledge of the techniques, methods and conventions of accounting and finance. Does the financial team have the requisite skills in appropriate fields from the base disciplines of accounting and finance; financial accounting, management accounting, finance, auditing, taxation, etc.? Is there sufficient expertise and experience in professional ethics and corporate governance? What about supporting knowledge in information technology, systems design, knowledge management, risk management? How relevant is the knowledge and experience? Are there any gaps? Are individuals keeping up to date? Are the members of the financial function learning as a team? Could certain activities be sourced outside of the team – in shared service centres orto third parties? 2. People Everything that you need as a person to function in a world full of other people! This includes the personal skills to do your job effectively and the interpersonal skills to work in a team within the financial function as well as interfacing with the rest of the organisation and outside the immediate organisation – negotiator/communicator/educator. How outward looking are they? Do they have a strategic focus? How are they keeping skills updated? How well is the team working together? What ‘life’ skills do individuals possess? What qualities are needed to make-sense of complex business events? How well do the members of the financial function understand the business? How involved are they? How proactive/ creative are they? 3. Organisation context - ideas, outlooks and experience How does the organisation as a collection of people work? How does the financial function fit in with the common culture and ideas? Is the organisation financially driven or market driven? Is it task or function focussed? Is responsibility centralised or dispersed? What role do accountants play? Are accountants involved as business partners helping to make the score or more as independent keepers of the score? How are they perceived by other departments? What are the characteristics of the organisation? What parts operate as open or closed systems? Is information valued? Does the organisation learn/adapt? What role do accountants play in organisational learning? What role do accountants play in knowledge management? 4. Business specific context What does the business actually do? How does it achieve its objectives and who does it serve? What processes and products are involved? How does it perform its operations? How does it structure its operations? What is the systems architecture? Does it work? What distinguishes success from mediocrity or failure? What are the key performance indicators? How does the organisation make decisions and solve problems? How does it fit in with the external environment? What forces are driving change? What resources and opportunities are available? Do the managers perceive the financial function as being the occupational territory of the professional accountant? How is the independence of the professional accountant used? 5. Role of the financial function i. How is the financial function seeking to help the business? Drawing on the work of Simon et al.(1954) a good function will: - Provide informational services of high quality (products). - Perform these services at minimal cost (processes). - Facilitate the long range development of competent accounting and operating executives (people). - ii Given the skills available within the financial function and the situational context of the organisation, what should it be doing? What accounting and financial activities are necessary to enable, sustain and enhance the organisation? What do managers/users need? External - statutory information Internal - scorecard questions - how well are we doing? - attention-directing - what should we be looking into? - problem-solving - of several ways of doing the job, which way is best? For internal information, what is required on a routine basis and what should be subject to special studies. iii How should the activities of the financial function be structured? This may include consideration of: - structure of accounts and reports - geographic location of accounting personnel – centralised or decentralised? onsite or outside? in country or offshore? - loyalties – the extent to which accounting units regard themselves as members of the operating team - formal authority relations (issues of reporting lines) - channels of communication (and the nature and language within that communication). iv How will we know that we have achieved best practice? - set objectives together with milestones and performance measures (in conjunction with users). - develop and share best practice between unit accounts teams - benchmarking against best industry standards - regular, objective, assessment of progress. Communication To complete the analogy the propeller shaft can be seen as the communication with the ‘ship’ of the organisation. The information produced and advice given needs to be explained in ways that are relevant, understandable and clear to users. Moreover, communication needs to work both ways to operate successfully. How should financial teams best communicate with the users of accounting information? The following questions provide a starting point. Do users understand existing outputs? Are these relevant? What else might they need? In what form do they need information? Need to consider response times and trade-offs between time, completeness, accuracy and cost v. benefit: also, recognising the level of financial literacy across the organisation. And finally, where next for the project? Our enquiry into the role of the financial function has produced three themes that we intend to take forward into future projects. 1. To explore the contemporary relevance of Simon et al. (1954) to the organisation of the management accounting function within contemporary organisations. 2. To explore the issue of communication between compilers and users of financial information. 3. To understand how the processes of continuing professional development can be harnessed to the co-ordinated progress of the financial function. 4. To understand how financial directors and executive managers make sense of the nature, and processes of accounting and finance functions in terms of factors that facilitate and inhibit their ability to support organisational effectiveness. If you would like to take part in these or add to our analysis, then please contact us through the project website at www.role-of-finance.com. References. Simon, H. A., Kozmetsky, G., Guetzkow, H. and Tyndall, G. (1954) ‘Centralization vs Decentralization in Organizing the Controller’s Department’, New York: Controllership Foundation, Inc. Huber, G.P. (1980) Managerial Decision-Making. Scott, Foresman, Glenview. Ian Herbert is a lecturer at the Loughborough University Business School. William Murphy is the Research Manager and principal lecturer in managerial accounting, organization theory and research methods at the Derbyshire Business School, University of Derby. Richard MS Wilson is professor of business administration and financial management at Loughborough University Business School.