![6211 course outline - Index of [jallen.cox.smu.edu]](//s3.studylib.net/store/data/008060911_1-a2aa6b8448495a0defcb6394c6a74a88-768x994.png)

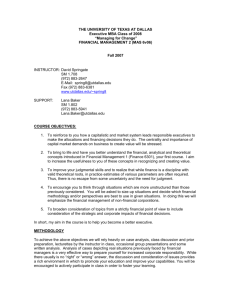

Valuation and Analysis

FINA 6211

Fall 2010

Prof. Jeffrey Allen

214-768-2627, 118F

jwallen@cox.smu.edu

In FINA 6211, we examine tools and applications in the valuation of assets and securities. The material is

relevant for individuals in investment management, investment banking, securities analysis, financial

consulting, M&A, and corporate finance. The primary areas covered in the course are performance

analysis, cost of capital estimation, capital investment analysis, and foundational concepts in asset and

corporate valuation.

Learning objectives for the course are:

1)

2)

3)

4)

Understand how to analyze and critique cash flow projections,

Gain a working knowledge of commonly-used valuation methods,

Understand the circumstances under which each method is appropriately used, and

Execute the chosen valuation techniques in the correct way.

Required Textbooks (use Brealey, et al or Berk et al from your FINA 6205 class)

Tim Koller, Marc Goedhart and David Wessels, Valuation: Measuring and Managing the Value of

Companies, (5th ed.) McKinsey & Company, 2010.

Richard Brealey, Stewart Myers and Franklin Allen, Principles of Corporate Finance, (8th ed.) Irwin

McGraw-Hill, 2007.

OR

Jonathan Berk and Peter DeMarzo, Corporate Finance, (1st ed.) Pearson / Addison Wesley, 2007.

Course packet available at www.study.net (registration required to receive a grade)

Recommended Texts (not required)

Robert Higgins, Analysis for Financial Management, (9th ed.) Irwin McGraw-Hill, 2008.

Craig W. Holden, Excel Modeling and Estimation in Corporate Finance, (3rd ed.) Prentice Hall,

2008.

Grading:

Your final grade will be calculated as follows:

20%

80%

+/-

Company financial analysis report (due 9/10)

Final examination

Possible adjustment to final grade up or down a notch (e.g. B+ to A-) for

exceptional class participation

The university grading scale (A: 93.0+, A-: 90.0-92.99, B+: 87.0-89.99, etc) is used as the basis for assigning

grades. Additional assignments or work for extra credit purposes will not be offered.

Final exam: You will have five contiguous hours to complete the take-home exam prior to the due date

given in class.

Course Prerequisite: FINA 6205

Participation: My expectation is that every student will thoroughly analyze each case and be prepared to

discuss their insights in class. The format of the class is an open discussion of the case studies. I often call

on those who don’t voluntarily participate. In the past I’ve found a positive correlation between class

participation and exam performance.

Case preparation: A common complaint about cases is that they do not contain enough relevant

information to “solve” the case and obtain the “right answer”. This is exactly why cases studies offer a rich

learning environment. In comparing case studies to the actual decision situations you will encounter in

your career, cases are extremely well defined and rich in available information. Most practical decisions

hinge on several assumptions made by individuals and often must be based on incomplete information.

Part of the financial decision-making process is generating appropriate forecasts and being able to defend

your choices. Case analyses should sharpen your abilities in generating key assumptions, insights and

conclusions.

Case analysis can be a painful process, especially in the early stages. Arriving at one or more solutions

requires intensive study of the case followed by group discussion and further analysis. This process is very

similar to decision processes of any significance in business. You should set aside 5-7 hours per case for

review, group discussion and analysis work. Suggested study questions for each case are listed in this

document. An important objective of the case method is for you identify important issues that may not be

obvious in the case handout.

**You must prepare and understand the case studies in detail in order to pass the final exam**

Honor Code: The honor code of the university and the Cox School strictly applies to this course. Case

assignments are generally prepared in learning groups where free collaboration is encouraged.

Collaboration between groups, however, should not occur. Electronic transmission of case solutions

between students across study groups is a violation of the honor code.

The use of material directly related to a particular case from previous classes at Cox, classes at other

schools, or posted on the internet is a violation of the Honor Code. Your performance on the final

exam will be greatly enhanced if you work through the details of the cases rather than consult case

solutions.

Religious Observance: Religiously observant students wishing to be absent on holidays that require

missing class should notify their professors in writing at the beginning of the semester, and should

discuss with them, in advance, acceptable ways of making up any work missed because of the absence.

(See University Policy No. 1.9.)

Disabilities: Students who need academic accommodations for a disability must first contact Ms. Rebecca

Marin, Coordinator, Services for Students with Disabilities (214-768-4557) to verify the disability and

establish eligibility for accommodations. These students should then schedule an appointment with the

professor to make appropriate arrangements (See University Policy No. 2.4.).

Extracurricular Activities: Students participating in an officially sanctioned, scheduled University

extracurricular activity should be given the opportunity to make up class assignments or other graded

assignments missed as a result of their participation. It is the responsibility of the student to make

arrangements with the instructor prior to any missed scheduled examination or other missed assignment

for making up the work.

Attendance Policy: Students are expected to attend every class. In cases where the class must be missed,

students should independently prepare the cases studies, if any, and obtain the class notes. You will be

responsible for all material presented in the class sessions. Grading is not directly based on attendance in

my class, but it will affect your performance on graded assignments, projects or examinations.

Electronic Distractions: Unless you enjoy being called upon to answer difficult questions, please refrain

from browsing the Internet or e-mail during class.

Valuation and Analysis

Fall 2010

Class Date

Topic

Cases

8/23

Introduction to Valuation and

Financial Analysis

Lecture

Note on Adjusted Present Value (HBS 9-293-092)

Free Cash Flow Valuation Methods (HBS 9-201-094)

8/30

Performance Analysis and

Forecasting

Advanced Technologies (HBS 9-299-042)

Cost of Capital Applications

PepsiCo., Inc. (Darden F-0981)

Marriott Corporation (HBS 9-289-047)

** Company Analysis Due **

9/13

Investment Analysis

Whirlpool Europe (HBS 9-202-017)

9/20

Basic Corporate Valuation

Mercury Athletic Footwear (HBS 4050)

White Hen Pantry (pdf on class website)

9/27

Valuation in the Capital Markets

Jet Blue IPO Valuation (Darden F-1415)

United Parcel Service IPO (HBS 9-103-015)

10/4

Valuation of Privately-Owned

Assets

Kohler Inc. (HBS 9-205-034)

Brinker Intl: Acquisition of NERCO Assets (distributed

during class session)

9/10

(Friday, 6:30

pm – note

change)

Exam Review & Distribution

Class 2

Topic:

Case:

Analysis of Financial Performance

Advanced Technologies (HBS 9-299-042)

Study Questions

Use the three study questions on page 1 of the case. What is ATI’s sustainable growth rate? Prepare a

“stress scenario” (a scenario that strains the balance sheet) in a spreadsheet model.

Assignment: Select a public company of your choice and conduct an analysis on the financial health

of the organization using the metrics presented in the first class session. From the available historical

information, estimate the values you would expect to see in the income statement and balance sheet in

the subsequent year.

Class 3

Topic:

Case:

Cost of Capital

PepsiCo., Inc. (UVA F-0981)

Study Questions

1. How has PepsiCo performed over the past 10 years? How did you measure performance to answer

this question? Has the company created value for its shareholders as claimed in the annual report?

2. What are the costs of capital for the individual business segments? What is the overall WACC for

PepsiCo?

3. Do your business segments add up to 11 percent as an overall cost of capital? Why or why not?

** Do not follow the recommendation to ignore asset betas given in the case **

Case:

Marriott Corporation (HBS 9-289-047)

Study Questions

1. How does Marriott use its cost of capital estimate?

2. What is your estimate of the WACC for Marriott Corporation? Assume a marginal tax rate of 34%

3. If Marriott used a single corporate hurdle rate for evaluating investment opportunities in each of its

lines of business, what would happen to the company over time?

4. Calculate the cost of capital for the lodging and restaurant divisions.

Class 4

Topic:

Case:

Capital Investment Analysis

Whirlpool Europe (HBS 9-202-017)

Study Questions

1. Do the benefits and costs of the ERP investment seem reasonable? What assumptions would you

question further?

2. What are the after-tax cash flows for the proposed ERP investment from 1999 through 2007?

What is the present value of those cash flows?

3. When valuing the proposed investment, should value be included for possible cash flows that occur

beyond 2007?

4. Would you recommend the ERP investment?

Class 5

Topic:

Case:

Basic Valuation Techniques

Mercury Athletic Footwear (HBS 4050)

Study Questions (spreadsheet available on class website):

1. Is Mercury an appropriate target for AGI?

2. Review the projections formulated by Liedtke for reasonableness. How would you recommend

modifying the forecast?

3. Estimate the value of Mercury using a discounted cash flow approach and Liedtke’s base case

projections. Conduct a sensitivity analysis on key assumptions in the valuation model. What is

your recommendation regarding Mercury’s equity value?

4. How would you analyze possible synergies or other sources of value not reflected in Liedtke’s base

case assumptions?

Case:

White Hen Pantry

Study Question

1. Use the adjusted present value technique to value WHP. How do differences in the underlying

assumptions between the management group and PruCapital affect the results? Assume the

unlevered required return is 20 percent, a marginal tax rate of 40 percent, that debt will be repaid as

scheduled, and that the $21mm revolver will not be paid down or retired.

Class 6

Topic:

Case:

Valuation in the Capital Markets

JetBlue IPO Valuation

Study Questions

1. What valuation approaches can be used to price JetBlue’s shares?

2. At what price would you recommend that JetBlue offer their shares?

3. What are the advantages and disadvantages of going public?

Case:

United Parcel Service IPO

Study Questions

1. Compare the financial performance of both UPS and FedEx. Are the current levels of performance

likely to be sustained? What are the key factors that will affect the value of UPS stock?

2. Why does FedEx have a lower debt rating than UPS? What is your estimate of the present value of

each company’s operating leases?

3. What are the pros and cons for UPS in deciding whether to carry out an IPO?

4. What is your estimate of the value of UPS stock? How do your valuation multiples compare to the

comparable companies in Exhibit 13?

Class 7

Topic:

Case:

Valuation of Privately-Owned Assets

Kohler Co. (HBS 9-205-034)

Study Questions (spreadsheet available on class website):

Using different valuation approaches and methods, what is your estimate of the per share value of

Kohler? What would you recommend as a settlement price?

Case: Brinker Intl.: Acquisition of NERCO Assets (distributed and discussed in class)

Background Reading

Brealey and Myers, chapter 21 on real options

![6211 course outline - Index of [jallen.cox.smu.edu]](http://s3.studylib.net/store/data/008060911_1-a2aa6b8448495a0defcb6394c6a74a88-768x994.png)