11. first nations sales tax (fnst).................................... 22

advertisement

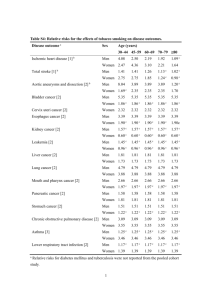

First Nations People and Tobacco Taxation First Nations and Inuit Peoples of Canada and Tobacco Taxation: A Discussion Document Prepared for: the First Nation and Inuit Health Branch of Health Canada and the National Cancer Institute of Canada April 29, 2006 1 First Nations People and Tobacco Taxation Rob VanWynsberghe PhD 2 First Nations People and Tobacco Taxation Executive Summary Despite declining smoking rates amongst the general population in Canada, tobacco consumption by First Nations and Inuit people remains alarmingly high. Smoking-attributable mortality among First Nations people is very similar to the general population due to nonsmoking cause of mortality (i.e., injuries). This paper explores the potential for using on-reserve tobacco taxation as a means of promoting smoking cessation in Aboriginal communities in Canada. Most of the evidence suggests that increased price of tobacco products brought about by taxation can be an effective deterrent to the onset of smoking and an incentive for smoking cessation. As well, revenue generated from tax increases can be used in smoking cessation programs and for health care. This paper also examines some of the impediments in implementing on-reserve tobacco taxation, such as perceptions of Aboriginal tax immunity and tobacco smuggling. Although further research is needed, in particular on tobacco taxation strategies already in use in Aboriginal communities in Canada, the evidence suggests that tobacco taxation can be an effect component of comprehensive anti-smoking campaigns. Acknowledgements I would like to thank the following people for their generous time and aid in producing this document. Dr. Dennis Wardman, Community Medicine Specialist with the First Nations and Inuit Health Branch conceptualized thisresearch. Ken Medd, Senior Tax Policy Officer with Finance Canada provided encyclopaedic knowledge of First Nation taxation. Scott Uzelman, Ph.D Candidate, in York University’s Graduate Program in Communication and Culture provided important editorial help and Aileen Penner MA, was instrumental to early circumscribing this complex that made this scoping paper possible. Finally, my partner, Samia Khan, PhD, read several drafts and asked all the right questions. 3 First Nations People and Tobacco Taxation Table of Contents Executive Summary……………………………………………………………………….. ii Table of Contents………………………………………………………………............ iii Preamble …………….…………………………………………………………………….….. 1 Objectives……………………………………………………..……………………………….. 2 Scope and Delimitations of the Paper…………………….…………………….. 2 1. A CANADIAN PROFILE OF TOBACCO CONSUMPTION AND ASSOCIATED HEALTH RISKS……….……………………………………………….. 4 2. ABORIGINAL SMOKING RATES AND HEALTH IMPACTS…………….6 SUMMARY OF ABORIGINAL SMOKING RATES AND HEALTH IMPACTS…………………………………..…..……………………………………………….. 8 3. FACTORS RESPONSIBLE FOR HIGH RATES OF TOBACCO CONSUMPTION……………………………………………………………………………….. 9 4. TAXATION AND TOBACCO CONSUMPTION AMONG ABORIGINAL GROUPS AND THE GENERAL POPULATION…………………………………………………………………………….……..10 5. YOUTH SENSITIVITY TO PRICE…………………………………………………. 13 6. IMPACT OF TOBACCO USE ON MORTALITY………………………………. 14 7. TAXATION AND TOBACCO CONSUMPTION: EVIDENCE TO THE CONTRARY………………………………………………………..……………………………. 15 SUMMARY OF TAXATION AND TOBACCO CONSUMPTION AMONG ABORIGINAL GROUPS AND THE GENERAL POPULATION……………… 17 8. TAXATION: IMMUNITY, ARRANGEMENTS, and ISSUES.......... 18 9. INDIAN ACT AND PERCEPTIONS OF TAX IMMUNITY……………… 18 SUMMARY OF INDIAN ACT AND PERCEPTIONS OF TAX IMMUNITY…………………………………..…..…………………………………………….. 21 10. SPECIFICS OF TAXATION AGREEMENTS………………………………… 21 11. FIRST NATIONS SALES TAX (FNST).................................... 22 12. FIRST NATIONS GOODS AND SERVICES TAX (FNGST)…………. 24 SUMMARY OF FNST AND FNGST……………………………………………… 25 4 First Nations People and Tobacco Taxation 13. SMUGGLING AND DOWN THE ROAD SALES…………………………… 26 14. REVENUE GENERATION…..………………………………………………………. 27 SUMMARY OF ISSUES REGARDING TAXATION AS A SMOKING CESSATION STRATEGY…………………………………………………………………… 28 RECOMMENDATIONS FOR FURTHER RESEARCH, POLICY, and COMMUNITY…………………….……………………………………………………………… 29 15. IMPORTANCE OF COMPREHENSIVE APPROACH……………………… 29 16. CASE STUDY RESEARCH ON THE HEALTH IMPACTS OF IMPLEMENTING TAXATION AGREEMENTS, RAISING REVENUES, AND ESTABLISHING TOBACCO MISUSE IN ABORIGINAL COMMUNITIES ……….………………………………………………………………………………………………. 31 17. INTERCOMMUNITY COLLABORATION……………………………………… 32 18. CANADIAN ABORIGINAL COMMUNITIES AS ROLE MODEL……. 33 OVERALL SUMMARY OF THE WHOLE REPORT………………………………..33 REFERENCES…………………………………………………………………………………… 36 List of Tables Table 1. Section 87 of the Indian Act…………………………………………….19 Table 2. What the Native Leaders Say……………………………………………20 INTRODUCTION PREAMBLE If on-reserve tobacco products were taxed by 7%, the number of aboriginal smokers who will quit will be approximately 39,000 and the revenue generated could potentially be over 75 million per year.1 This report discusses the use of tobacco taxation as a method to reduce the consumption of tobacco products (cigarettes, snuff, pipes, chew, and cigars) in First Nations and Inuit communities. In doing so, the 5 First Nations People and Tobacco Taxation possibilities and problems associated with taxation of tobacco products are reviewed. The report will also address the following questions: What is the extent of the Aboriginal and Inuit tobacco-related health problems and can taxation help? What evidence supports tobacco taxation as a mechanism for reducing smoking among First Nation and Inuit populations and fostering healthier communities? How will taxation impact the growing and complicated problem of aboriginal smoking, especially among aboriginal youth? What are the issues and conflicts that can be anticipated in First Nation and Inuit communities’ using taxation to stop the misuse of tobacco? Given both the positive outcomes and potential conflicts, what are some ways that taxation could be implemented? 6 First Nations People and Tobacco Taxation OBJECTIVES The objectives of this paper are: 1. To delineate factors relevant to considering taxation as a smoking cessation strategy among First Nations and Inuit populations in Canada. 2. To review studies on tobacco use in Canada and research on smoking cessation through taxation among First Nation and Inuit populations in Canada. 3. To sketch existing First Nation-government arrangements for introducing taxation as a smoking cessation strategy. 4. To synthesize the existing evidence on the above and to provide broad recommendations for community members, health practitioners, policymakers, and funders. SCOPE AND DELIMITATIONS OF THE PAPER It is acknowledged that making any conclusions about the impact of tobacco use is complicated by the general health status of First Nations and Inuit people in Canada, which is negatively impacted by relatively poor socio-economic status, lack of access to quality health care, and poor physical infrastructure and environmental factors. 7 First Nations People and Tobacco Taxation It is acknowledged that tobacco use by many Aboriginal peoples is rooted in traditional religious and medicinal practices.2 It is acknowledged that the addition of chemicals to tobacco and high rates of consumption mean that contemporary tobacco consumption is different and more dangerous than traditional uses. It is acknowledged that Western medicine and traditional Aboriginal medicine are based on radically different worldviews about what causes addictions and illness, and what good health means. It is acknowledged that this report is mainly situated in the peer-reviewed world of research articles and government documents. These reports largely assume that First Nations and Inuit people are unique sub-populations. We recognize that it is incorrect to assume that all people who share a First Nations or Inuit identity also share the same culture. However, for the purposes of this paper we do so. No disrespect is intended. It is acknowledged that to the extent that tobacco use itself is a choice, we see it as a product and a practice that is linked to a particular culture. We take an expansive view of health promotion, which argues that a new cultural context of sovereignty, built capacity, and infrastructure will alter behaviour, attitudes, beliefs, and customs associated with tobacco use. 8 First Nations People and Tobacco Taxation 1. A CANADIAN PROFILE OF TOBACCO CONSUMPTION AND ASSOCIATED HEALTH RISKS Over the past forty years, tobacco use has declined significantly amongst the general population in North America (Reading, 1996, p.97). More recently, a national Canadian survey by Health Canada in 2000 indicates that the smoking rate declined by 7% nationwide, from 30% to 23% in the period between 1990 and 2000 (Health Canada, 2000, p.52). A 2003 Health Canada survey found that the rate of tobacco consumption has fallen again to approximately 21% since 2000. However, approximately 5 million Canadians (aged 15 years and older) still smoke and, according to the 2003 Canadian Tobacco Use Monitoring Survey (CTUMS) survey (see Reference List for url), the most recent profile of the average smoker is as follows: Smokers consume about 16 cigarettes on a daily basis (down from 20.6 in 1985). Men continue to smoke more cigarettes than women (17.3 cigarettes per day for males as compared to 14.0 for females). 23% of Canadian men were current smokers and approximately 18% of women smoked in 2003. 58% of Canadian smokers reported consuming "light" or "mild" cigarettes compared to 42% who smoke a "regular" type of cigarette. In short, the average Canadian smoker is part of a decreasing minority, somewhat more likely to be male than female, who smokes about a pack a day of light or mild cigarettes (Health Canada, 2003).. 9 First Nations People and Tobacco Taxation Despite a reduction in numbers of smokers and cigarettes smoked per day the health problems associated with tobacco consumption persist. A 2002 foreword to a report by the Federal Tobacco Control Strategy (see Reference List for url), presented some startling statistics about the effects of smoking in Canada: Tobacco use is the single most preventable cause of premature death and disease. Tobacco use costs in excess of $3.5 billion in health care annually. Non-medical costs (e.g. worker absenteeism, residential fires and lost future income from smokers’ premature deaths) raise the annual economic burden of tobacco use to at least $15 billion. Every ten minutes, two Canadian teenagers start smoking cigarettes. Every 11 minutes, a person in Canada dies from tobacco use. Each year, more than 1000 Canadians die from second-hand tobacco smoke. Every year, more than 45,000 Canadians die because of tobacco use, more than five times the number of Canadians who die from traffic injuries, alcohol abuse, murder and suicide combined. The Aboriginal Non-Smoker’s Rights lists a host of health risks of regular tobacco use including: Pneumonia, cold, and flu Chronic bronchitis, emphysema and asthma Cancers, including the lung, throat, cervix, pancreas, kidney, High cholesterol (LDL) High blood pressure 10 First Nations People and Tobacco Taxation Coronary heart disease (e.g., heart attacks) Clearly, tobacco use is related to a number of health risks. In fact, it is responsible for 45,000 deaths a year. In addition, the costs to the public are enormous, nearly $20 billion a year in medical and nonmedical costs. 2. ABORIGINAL SMOKING RATES AND HEALTH IMPACTS As daunting as the above statistics are, they are not reflective of the Aboriginal situation in this country, where the statistics are worse. In addition, the average Aboriginal smoker has a different profile and this is important because it bears on whether taxation is more or less potentially useful. The Canadian Tobacco Use Monitoring Survey (Health Canada, 2003), showed that tobacco use by First Nations and Labrador Inuit is very high (see endnote 1 for Aboriginal population and smoking rate calculations). Approximately two-thirds of Aboriginal adults reported smoking in 2002 (Health Canada, 2003). Numerous studies, going as far back as 1980, have been cited by Reading et al (2002, p. 98) in linking Aboriginal people to higher rates of smoking than nonAboriginal populations.3 This means that the smoking rate sits somewhere between 60 and 70 percent for Aboriginal people. This rate has been consistent for 25 years or more even in the face of massive public health efforts, such as media campaigns, to control tobacco consumption in Canada. 11 First Nations People and Tobacco Taxation First Nations and Inuit populations appear to have magnified health impacts from tobacco use that are exacerbated by socio-economic factors. Health Canada notes that First Nations people living on reserve have much higher rates of stroke (40% higher) and heart disease (60%) in comparison with the general Canadian population. As well, Inuit women have some of the highest rates of cancer in the world (Health Canada, 2000, p.52). These health risks are linked to high rates of tobacco use puts by Aboriginal people. Amongst First Nations people in BC, smoking-attributable mortality was similar to to the rest of British Columbians. The lower than expected smokingattributable mortality most likely reflects a higher rate of non-smoking related mortality, such as injuries (Wardman & Khan, 2004a). Most seriously, in an Australian study, Unwin et al. show that tobacco smoking was responsible for 15.4% of deaths in the general population and 13.9% of Aboriginal deaths. The study also found that of those who died as a result of tobacco use, 49% of Aboriginal males and 48% of Aboriginal females died before 55 years of age, compared with 11% and 10%, respectively, in non-Aboriginals (Unwin et al. 1995). Plainly, the high rate of tobacco consumption by Aboriginal people is linked to serious and widespread health risks. Tobacco use may have some indirect health consequences as well. Evidence suggests that the use of tobacco may lead to drug and alcohol experimentation, gambling and other unhealthy behaviours. The Nechi Institute, an Aboriginal education, research and health promotion centre, reports that graduates of their alcohol and drug treatment programs began smoking at an early age with some 80% of Aboriginal female adult smokers and 60% of Aboriginal male smokers beginning to smoke between the ages of 11 and 15 (Nechi Institute, 12 First Nations People and Tobacco Taxation 1992 as cited in Reading et al, 2002, p.105). Thus, tobacco use also has serious indirect health impacts for Aboriginal people, seemingly connected to drug and alcohol use as well as gambling. Aboriginal youth are a susceptible sub-category of the Aboriginal population whose average age and rates of tobacco consumption is significant and noteworthy. In Canada, the First Nations Youth Inquiry into Tobacco Use (Wunska, 1997, p.116) confirms that tobacco smoking is a serious public health problem among youth and suggests that cessation and prevention efforts should begin at 10 years of age. The implication is that Aboriginal people are consuming tobacco products at a young age, which in turn magnifies negative health outcomes by increasing the lifetime exposure to the harmful substances in tobacco. This concern is shared in findings of research about Australian Aboriginal youth. Sweet (2002) conducted focus groups where the adult Aboriginal respondents explained that Australian Aboriginal children typically started smoking at age 9 or 10, and sometimes as young as 6. The evidence suggests that Aboriginal youth are at risk generally for long-term tobacco use and addiction. SUMMARY OF ABORIGINAL SMOKING RATES AND HEALTH IMPACTS Although smoking rates among the general Canadian population are steadily declining, the negative impact on health, productivity and well-being of smokers is still high. Despite public health efforts, 13 First Nations People and Tobacco Taxation Aboriginal rates of tobacco consumption remain disproportionately high. This continues to render Aboriginal adults and youth susceptible to a host of health impacts such as stroke, heart disease and cancer leading to death. 3. FACTORS RESPONSIBLE FOR HIGH RATES OF TOBACCO CONSUMPTION Unique factors or combinations of factors may contribute to the disproportionately and sustained rates of tobacco use amongst First Nations and Inuit people, and especially youth. Social acceptance of smoking in Aboriginal communities, whether out of habit or for recreational purposes, and the widespread availability of tobacco could account in part for high rates of tobacco use (Reading et al, 2002, p.97). It is important to note that tobacco has a cultural history among First Nations people, likely increasing its acceptance (see endnote two). In addition, for those without a lot of money, consuming tobacco products might be considered an affordable indulgence. For youth especially, social inclusion, peer group practices, role models, and agerelated experimentation might be relevant factors in initiating tobacco use. As well, studies have shown that North American smoking rates are highest among lower-income groups (Chen, 1993) and groups with lower levels of education (Government of Yukon, 1994). It appears that smoking tends to be more prevalent in minority populations who, in turn are more likely to suffer from low socio-economic status (Bartecchi et. al., 1994). A study of the general population in the Yukon compared several factors – employment pattern, level of education, income level and ethnicity – among tobacco users 14 First Nations People and Tobacco Taxation (Government of Yukon, 1994). The study found that Aboriginal people had the highest rates of smoking and that socioeconomic status is likely the primary factor in whether or not a person uses tobacco (Reading et al, 2002, p.106). Socio-economic status, social acceptance and inclusion, peer pressure, and low levels of education are all factors in making tobacco use more prevalent for Aboriginal peoples. 4. TAXATION AND TOBACCO CONSUMPTION AMONG ABORIGINAL GROUPS AND THE GENERAL POPULATION There are very few studies that examine the effectiveness of smoking cessation techniques among Aboriginal populations. In Australia, Ivers (2004) looked at the effectiveness of advice by heath professionals as well as the use of nicotine replacement therapy in lowering tobacco consumption among Australian Aboriginals. He noted that little is known about whether such interventions are appropriate and effective for Aboriginal Australians. Because evidence from systematic reviews in other populations may not be directly transferable to Aboriginal people, Ivers concludes that further research is required to assess the effectiveness of tobacco cessation strategies for Aboriginal people (Ivers, 2004). In the current state of research on this topic, there is a need for specific studies assessing the effectiveness of specific Aboriginal smoking cessation strategies. Additionally, the available evidence suggests that significant differences among Aboriginal communities exist with respect to tobacco consumption and this makes research in particular, unique communities important. 15 First Nations People and Tobacco Taxation There are also only a few studies exploring the impact of increased pricing on Aboriginal rates of tobacco use, but what the research tells us about the impact of taxation on tobacco use in the general population is illuminating. Numerous studies indicate that higher tobacco prices are associated with lower tobacco consumption (Levy et al., 2000; Sweanor et. al, 2000). Consumer demand for tobacco, like all commodities, tends to fall as price rises. This empirical evidence suggests that higher tobacco taxes can be an effective means of reducing smoking and tobacco consumption, and as a result, tobaccorelated deaths and illness. Evidence of the relation between price, taxation and tobacco consumption has been particularly compelling in Canada over the past twenty years. Sweanor et. al. (2000, p.168) present a graph that shows the relationship between cigarette consumption and price in Canada. The 1980s saw a rapid increase in the price of cigarettes due to several large tax increases. Between 1982 and 1991, the price of a pack of cigarettes (adjusted for inflation) rose on average from approximately $2.10 to about $5.40 (Sweanor et al., 2000, p.169). The rapid increase in price brought about by tax increases was accompanied by significant declines in the rate of smoking. During the same time period, tobacco consumption declined by about 40% among adults and approximately 60% among youth aged 15 to 19 (Sweanor et al, 2000, p.169). By comparison, the decrease of tobacco consumption among Canadians was much more rapid than the US – per capita cigarette consumption by those aged 15 and older fell by 42% in Canada versus 26% in the US from 1982 to 1992 (Sweanor et al, 2000, p.168). These declines in Canada have translated into an overall increase in cessation, moving the smoking rate from 16 First Nations People and Tobacco Taxation approximately 40% in 1981 to 31% in 1991. The decline in the youth smoking rate (15 to 19 year-olds) was even more pronounced, from 44% to 22% (Sweanor et al, 2000, p.169). Overall, this data suggests a clear relationship between tobacco price and smoking rates in Canada. Although the influence of tax increases on cigarette use is complex (Levy et al., 2000), there is clear evidence of a trend towards lower rates of tobacco consumption as price increases. For example, a study in California examined the relative effectiveness of a $0.25 per pack increase and an anti-smoking media campaign. Hu et al. (1995) concluded that a tax (tax or price) increase reduced cigarette sales by 819 million packs over a two year period. By contrast, the antismoking media campaign reduced sales by 232 million packs over the same period (Hu et al, 1995). Similarly, Green (1997) noted that when “real disposable income is held constant, per capita cigarette consumption tends to fall by 0.5% for every 1% price” (p.2). Moreover, these effects tend to increase over time. Using similar figures, Sweanor et. al (2000) suggest that a 10% increase in the cost of cigarettes would result in a 4% decrease in consumption in the short term and a 8% decrease in the long term (p.166).4 Theoretically, one could extrapolate from the above and suggest that significant price increases would lead to a stop in tobacco product consumption. The evidence data below suggests that other factors must be accounted for. At the same time, it should be emphasized that the effect of a tax increase on cigarette use depends on a number of related factors, including the reaction of manufacturers, how long the tax is in effect, 17 First Nations People and Tobacco Taxation and the inflation rate. Manufacturers have successfully lobbied against tax increases, arguing that higher tobacco taxes could, over time, lose their impact on consumer behaviour. Moreover, they argue that if the tax is implemented in inflationary times, smokers could have less discretionary income to begin with and thus smoking rates would decline “naturally.” Furthermore, others have noted that the effects of a tax may vary over time because of different smoking rates by different social segments and because of greater responses to price changes by youth. Evidence suggests that the effects of price increases on smoking rates for lower income groups will be more pronounced (Gruber et al., 2003; Colman & Remler, 2004). Thus there are a number of factors complicating the relationship between taxation and tobacco use. A general lack of studies on smoking cessation via taxation in Aboriginal groups exists. Non-Aboriginal evidence suggests that age, disposable income, manufacturer responses to tax, duration of taxation, and the inflation rate are relevant determining factors in tobacco use. Yet there is evidence that suggests that cost is positively associated with reducing tobacco consumption. 5. YOUTH SENSITIVITY TO PRICE Significant evidence suggests that young people are particularly price sensitive with respect to smoking given that they tend to have lower levels of disposable income than adults (Grossman & Chaloupka, 1997). Ding (2003), for example, shows that a 10 percent increase in price resulted in a 14 percent decrease in smoking among youth. 18 First Nations People and Tobacco Taxation Based on a review of the empirical evidence regarding the effectiveness of economic tobacco control measures, Liang et al. (2001) conclude that the most consistent finding in the literature suggests that higher cigarette prices discourage youth smoking. Nonetheless, it is important to recognize that the effects of policy changes are not always uniform within a population. Gruber and Zinman (2000), for example, argue that youth smoking in the US is affected by taxation rates but has different impacts on different age groups within this category. Specifically, price is a powerful determinant on smoking rates for high school seniors but not as important for younger teens. Nevertheless, the authors conclude that the cigarette taxes teens face significantly reduce smoking in later life. This evidence is important given that numerous studies indicate that approximately 90% of smokers begin smoking during their teenage years, suggesting that price increases through taxes could have a lasting and cumulative effect on rates of tobacco consumption (Grossman & Chaloupka, 1997, p.292). Taxation increases the price of tobacco use and it appears that price is a significant factor in the onset and cessation of youth smoking. 6. IMPACT OF TOBACCO USE ON MORTALITY A number of studies suggest that increases in tobacco taxes can result in a decrease in smoking-related mortality. Moore (1996) found that a significant decrease in smoking mortality rates accompanies increases in tobacco excise taxes. The author concludes that a 10% increase in tobacco excise taxes could save over 6,000 lives a year in the U.S. Similarly, Levy et al. (2000), using a computer simulation model, 19 First Nations People and Tobacco Taxation suggest that sustained tax increases have the potential to substantially reduce the smoking rate and the number of premature smokingrelated deaths. Specifically, the authors looked at the effects of a 20 cent tax hike on a pack of cigarettes. They noted that the increase would result in an immediate 2.5% reduction in the general smoking rate and a 6% reduction amongst youth. As well, smoking-related deaths would decline by 0.9%. Moreover, the effects of the tax increase would accumulate over time such that the 20 cent tax increase indexed to inflation would, in 40 years, result in a 12.4% decrease in smoking and a 5.4% decrease in smoking-related mortality.5 Studies such as these suggest that tobacco taxation can save lives by introducing a price increases. These price increases are especially positive for younger people who reduce their consumption throughout their lifetime. 7. TAXATION AND TOBACCO CONSUMPTION: EVIDENCE TO THE CONTRARY It should be noted that despite the overwhelming evidence that infers that taxation is a factor in lowering tobacco consumption, there are a number of studies that suggest that taxes have little impact on smoking rates. Significantly, it should be noted that smoking rates for the Aboriginal youth population were remarkably consistent over a 20 year period, which might indicate less responsiveness to price (Levy et al., 2000, p.279). It is necessary to turn briefly to three studies on youth and the general population for some possible explanation. 20 First Nations People and Tobacco Taxation Glied’s 2002 longitudinal study suggests that the effects of taxes can diminish over time. She found that tobacco taxes did reduce smoking rates for teens but the effect of taxes tended to have only limited effects on the adult smoking rate. In other words, tobacco taxation had much greater short-term than long-term effects. However, it should be noted that Glied relied on a small sample size and thus her results should be taken as indicative rather than definitive. In another longitudinal study of youth smoking in the United States, DeCicca et al. (2002) argue that cigarette taxes and the onset of youth smoking between grades 8 to 12 are not strongly related. The authors suggest that when other variables are removed there is little evidence that youth are sensitive to tax increases. They argue that the influence of peers may be the most significant determinant of youth smoking and this overrides the effect of price increases. However, the authors note that their data included only small tax increases and so cannot tell us what the effects of very large tobacco tax increases on youth smoking would be. Sissoko (2002) argues that because demand for cigarettes is relatively inelastic (i.e. price has relatively little effect on demand), the main impact of tobacco taxation on tobacco usage is likely to be modest. He argues that smoking rates may depend on whether increased state revenue through tobacco taxation is channelled into smoking cessation programs or not. Sissoko’s starting assumption (i.e., price does not matter) makes it impossible to compare other programs to taxation. Such a comparison would be useful. 21 First Nations People and Tobacco Taxation These studies should not be taken as conclusive arguments against using taxation as a strategy for reducing smoking rates. Rather they point to the difficulty in isolating any one variable as the key determinant of tobacco consumption. They also remind us of the danger of aggregating all smokers into one category. For example youth are motivated by different values than adults and, moreover, young people, like all “subpopulations”, differ by region, gender, ethnicity, income, education and so on. More conjecturally, perhaps youth may tend to be more influenced by peers and media than strictly "rational" economic calculation. It also seems that the three studies of youth smoking were based on longitudinal data rather than cross sectional data and so it is easier to follow the relationship between tax rates and the onset of youth smoking. Above all, and as will be argued below, this and other evidence suggests that there is no “magic bullet” for reducing youth smoking rates but rather that tobacco taxation can be an effective component of comprehensive anti-smoking programs which have been shown to demonstrate the best results. SUMMARY OF TAXATION AND TOBACCO CONSUMPTION AMONG ABORIGINAL GROUPS AND THE GENERAL POPULATION Tobacco use is a massive health risk and social problem that is responsible for 50,000 deaths a year. In addition, the costs to the public are enormous, costing nearly $20 billion annually. Although smoking rates among the general Canadian population are steadily declining, the negative impact on health, productivity and well being of smokers is still high. Despite some public health efforts, but little research on the matter, Aboriginal rates of tobacco consumption 22 First Nations People and Tobacco Taxation remain disproportionately high. This continues to render Aboriginal adults and youth susceptible to a host of health impacts such as stroke, heart disease and cancer leading to death. While there is no “magic bullet” for reducing smoking rates, tobacco taxation can be effective, especially if other factors such as age, government resolve, and the inflation rate are favourable to effecting one’s disposable income. Certainly there is enough evidence presented above on the relationship between smoking rates and taxes to make a strong argument for assessing the effectiveness of taxation as a tool for use by Inuit and First Nations people to reduce tobacco use. 8. TAXATION: IMMUNITY, ARRANGEMENTS, and ISSUES The next section of the report addresses the overarching question of what issues can be anticipated that challenge or potentially facilitate the implementation of taxation as a tobacco cessation strategy. Here, we indicate what taxation potentially means to an Aboriginal community and why it may or may not be suitable for implementation. The issues addressed below are Aboriginal people’s perceptions of the Indian Act and tax immunity, taxation arrangements, smuggling, revenues, and unintended benefits of new revenue streams created by on-reserve taxation. 9. INDIAN ACT AND PERCEPTIONS OF TAX IMMUNITY The key challenge to implementing taxation might be what the Canadian Report of the Royal Commission on Aboriginal People states 23 First Nations People and Tobacco Taxation is a perceived history among Aboriginal people of having an “immunity from taxation” (Indian and Northern Affairs Canada). This perception is not lived experience as virtually all Aboriginal adults in Canada pay some taxes and many cannot take advantage of the tax exemption (section 87 of the Indian Act – see below), either because they are not registered (i.e., Metis or Inuit) or because transactions occur offreserve. In Canada, there is a federal legal exemption (via Section 87 of the Indian Act) from GST, provincial retail sales taxes, and tobacco taxes for status persons (i.e., registered First Nations) who can demonstrate close links between personal property (including income) and a reserve (see Table 1). Employment income, if acquired on reserve or in conducting band activity, is generally included (Canada Revenue Agency) from this tax exemption. Métis and Inuit people - on and off reserve - do not benefit from this limited exemption from tax. Table 1 provides the essential conditions for Section 87 of the Indian Act to apply. Table 1. Section 87 of the Indian Act In order for the section 87 exemption to apply, the following requirements must be met: 1) the government levy from which exemption is sought must be a tax; 2) the person claiming the exemption must be an Indian or a band member, and; 3) the tax must be levied in respect of an Indian’s or a band’s interest in either: a) reserve or surrendered land, or b)personal property situated on a reserve (Maclagan, 2000: 1504) 24 First Nations People and Tobacco Taxation Ken Medd (2004, p. 147-148) has written a document containing recent excerpts from Native leaders’ statements about tax immunity. Two examples are provided below (Table 2). Table 2. What Native Leaders are Saying Ovide Mercredi, the National Chief of the Assembly of First Nations, in an address to a First Nation taxation conference in 1991: “[T]axes like the GST, income tax, provincial sales tax and road taxes are being imposed illegally against our First Nations and their citizens.” The Confederacy of First Nations resolution in a 2001 resolution: “WHEREAS the government of Canada, forgetful of history, indifferent to its fiduciary obligations, disrespectful of our inherent right to selfgovernment and sovereign status, caring only to assimilate us and extinguish our historic rights, has adopted a policy to eliminate the historic taxation exemption that has been a corner stone of the relationship between First Nations and the Crown...” Native leaders represent a view of taxation, which is not conducive to its widespread implementation of on-reserve tobacco taxation. Moreover, a strong belief in tax immunity exists in the wider Aboriginal community. At the same time as immunity is being claimed, many First Nations are exercising municipal-type property tax powers. They are doing so according to Section 83 of the Indian Act. Admittedly, the original thinking was to allow bands to levy property taxes on their own members who held interests in real property on reserve (Ken Medd, 25 First Nations People and Tobacco Taxation personal communication). However, the Kamloops amendment made it possible for the First Nations property taxes to apply (some say in a discriminatory manner) to non-members’ holdings in or on reserve land. Since the Kamloops amendment, more than 100 First Nations now impose property taxes under the Indian Act. SUMMARY OF INDIAN ACT AND PERCEPTIONS OF TAX IMMUNITY Clearly perceptions of tax immunity are a powerful sentiment, with an extensive history and continued resonance. This history and the emotions it invokes does not incline Band residents to consider taxation as the mechanism for increasing prices in order to reduce smoking rates. Others mistrust taxation as a step towards government abdication of historical responsibilities. At the same time, many First Nations are choosing to impose property taxes in their communities. 10. SPECIFICS OF TAXATION AGREEMENTS The implications of using taxation as a smoking cessation strategy in First Nation and Inuit communities include the need to emphasize the positive elements of tax powers, such as creating a revenue stream for the Band. The arrangements that enable such tax powers are the topic of the next segment of this section. They include the First Nations Sales Tax and the First Nations Goods and Services Tax. Much of what is written in the following sections was acquired in personal communications with Ken Mead in the Government of Canada’s 26 First Nations People and Tobacco Taxation Department of Finance. Information was supplied via Email, a phone interview and one face-to-face meeting between January and April 2005. Since 1997, the Government has expressed its willingness to enter into taxation arrangements with interested First Nations and Inuit communities. In 1997, the federal Budget Implementation Act (BIA) permitted Bands to pass a bylaw that placed a 7% tax on the supply of listed products on their lands. So far, the Federal Government has entered into taxation arrangements with ten First Nations communities. Currently, another 15-20 communities have expressed interest (Ken Medd, personal communication, 2005). The following discussion outlines two types of tax arrangements that have been created, the First Nations Sales Tax and the First Nations Goods and Services Tax. The idea is that implementing these taxes activates a revenue stream that increases the prices of cigarettes, which, in turn, deters smoking while supporting other community-based health promotion programs that can have positive impacts on communities by creating revenues for local government. 11. FIRST NATIONS SALES TAX (FNST) In 1997, the federal Budget Implementation Act (BIA) contained a provision that provided a tax power for the Cowichan Tribes to enact a law imposing a tax similar to the provincial (BC) commodity tax on tobacco. In this First Nation tax, called the Cowichan Tobacco Tax, the Province of British Columbia collects and administers the tobacco tax for the Cowichan Tribes and gives the First Nation’s residents revenue 27 First Nations People and Tobacco Taxation back, while retaining the tobacco tax that is paid on reserve by nonNatives. Subsequent BIAs for 1998 and 1999 provided other individual First Nations with a power to tax sales of tobacco, fuels or alcohol products. Specific federal legislation for each participating First Nation has led to BIA 2000, which is the current legislative basis for what is called the First Nations Sales Tax. BIA 2000 contained generic provisions allowing any First Nation to enact a law imposing a sales tax, like the GST, on sales of any or all of fuel, alcohol, and tobacco sold on the First Nation lands. The First Nation Sales Tax (FNST) permits First Nations to pass a bylaw that places a 7% tax on the supply of listed products. This tax is applied to purchases made by residents and non-residents alike. “Listed products” refers to alcoholic beverages, fuel, or tobacco products. Currently about twelve First Nations apply this tax. The FNST is considered to be a good option for communities with a location that generates a large amount of consumer traffic flowing through the community. The Federal Government agreed to administer the tax at no cost to the First Nation because it is harmonized with and operates like the GST. The method for estimating FNST revenues can be based, in part, on actual tax collected at the businesses selling the specified products on First Nation lands. The FNST is a very straightforward tax on certain products that permits First Nations with an advantageous location to limit tobacco use and create a revenue stream. 28 First Nations People and Tobacco Taxation 12. FIRST NATIONS GOODS AND SERVICES TAX The 2003 BIA included legislation that allows a First Nations Goods and Services Tax (FNGST). The FNGST replaces the GST and is a tax on consumption that is levied by a First Nation government with revenues going to the First Nation. The FNGST is a tax that applies to all goods and services sold on First Nation’s land. In this, it is similar to the federal GST which applies to transactions off reserve. However, on reserve, both band members and other persons are liable for paying the tax. The difference between the FNST and FNGST is that the FNGST involves a greater number of goods and services and it is a tax on consumption that is made regardless of place of sales. The implication is that a particular community does not need a commercial base to create a revenue stream; all that is needed is a consumption base (i.e., residents). There are two methods for calculating the FNGST, the simplified revenue estimation method (SRM) and the detailed revenue estimation method (DRM). The SRM attributes consumption to residents by calculating the net GST for the province or territory in which the community is located. This total is then multiplied by the percentage of the population that the individual First Nations community represents. Finally a number representing the relative income of the community is entered into the equation. This factor is important because the relative incomes of First Nation residents are often lower than the Canadian average. The detailed revenue estimation method (DRM) tackles the question of what proportion of industry is related to either residential or immediate 29 First Nations People and Tobacco Taxation consumption. It does so when consumption on the lands of the taxing First Nation is attributable to non-residents as well as to residents. The overall purpose is to create a formula, which equitably determines the revenues that flow back to the First Nation community under the FNGST. These complex calculations are important because it helps to establish a FNGST as a tax arrangement that respects Section 87 of the Indian Act and could therefore be included in tobacco cessation strategy.6 The FNST and FNGST offer central strategies for creating tax arrangements that could become an obvious revenue stream for comprehensive health promotion strategies. The fact that FNST and FNGST are tax arrangements that result in higher tobacco prices suggests that they could be also deployed as smoking cessation strategies SUMMARY OF FNST AND FNGST The difference between the FNST and the FNGST is that the FNGST involves a greater number of goods and services and it is a tax on consumption that is made regardless of the location of purchase. Exemptions exist for some goods and services (e.g., milk) and for small businesses, governments (including First Nations), and not-forprofit organizations. These properties of the FNGST means that a particular community does not need a commercial base (i.e., residents) to increase the price of goods in order to lower smoking rates and create revenue. Both of these tax arrangements are also partnerships with either the federal or provincial governments. This means that the negative perception of taxes by First Nation people 30 First Nations People and Tobacco Taxation may remain because of the association with the Federal government and a historical perception of tax immunity. 13. SMUGGLING AND DOWN THE ROAD SALES As discussed earlier, in the 1980s Canada raised taxes to combat some of the highest smoking rates in the world. The tax increases led to a drop in smoking rates among teens from 43% in 1981 to 23% in the early ‘90s as well as increased tax revenues (Banthin, 2004). However, high prices brought about by increased taxation encouraged an increase in the prevalence of smuggling in Canada (The Economist, 1994). Consequently, large tobacco tax reductions were introduced by the federal government and several provincial governments in early 1994 to combat the underground market. As a result, the average price of a pack of cigarettes fell to $3.20 (Sweanor et al, 2000, p.169) and cost Canadian governments almost $4.8 billion in tobacco tax revenues (Banthin, 2004). One estimate suggested that 30% of all cigarettes sold in Canada were contraband (Thatcher, 2003, p.22). Using complex formulas, Fougere (2000) calculates that in 1993 the demand for cash associated with tobacco contraband represented up to 2.6% of the total currency demand in Canada.7 A related phenomenon to smuggling is “down the road” sales of onreserve tobacco products, where tobacco products are purchased in communities without taxes and sold to residents from communities with taxes. Down the road sales challenge taxation initiatives because they allow residents to avoid taxes, access cheap cigarettes, and continue smoking. The potential source of the problem is neighbouring 31 First Nations People and Tobacco Taxation First Nations who, in the absence of a tax agreement, have a significant pricing advantage for their customers. First Nations residents can continue to purchase tobacco products at lower prices “just down the road.” Down the road sales are not the same as smuggling because they are not illegal and we are talking about smallscale purchases for individual consumption. However, as the illicit sales suggest, tobacco users, like anyone, will take advantage of lower prices and such sales will lessen the impact of on-reserve taxes and consequently lower tax revenues. 14. REVENUE GENERATION The most recent Canadian federal budget (Department of Finance Canada, 2005, p.408; p.412) stated that taxation arrangements with First Nation and Inuit communities are important. The same document also pointed to taxation in general as an important element of the Government's health strategy to discourage smoking among Canadians. One implication might be that Federal tax powers are going to be used to run health promotion programs. Are sufficient revenues being generated for communities to run these programs? Some research suggests the answer is no, finding that even those First Nations who are using taxes are not generating enough revenue (Fiscal Realities Economists, 2003) to sustainably manage their health promotion programs. These researchers conclude that First Nations governments have federally-recognized authority over only about 14% of their potential tax base through property, fuel, alcohol, and tobacco tax. Further, only some (~100) First Nation governments are taxing property and only two have legislation enabling them to tax tobacco. 32 First Nations People and Tobacco Taxation The Fiscal Realities Economists stress that increased revenue is imperative because First Nation governments are facing: (i) Rapidly growing populations will drive up the expenditures needed to maintain current levels of service. (ii) Communities will have to compete for federal funds against political pressure for tax cuts, increased spending on social programs, and the cost increases associated with an aging society. (iii) Self government and economic aspirations require funds over and above those needed to maintain existing service levels. If these communities implement new taxes on their people, it is uncertain if adequate revenues will be generated and health promotion strategies may be overshadowed by other priorities in First Nations communities. SUMMARY OF ISSUES REGARDING TAXATION AS A SMOKING CESSATION STRATEGY The federal government has expressed its willingness to enter into taxation arrangements with First Nations interested in exercising taxation powers through the FNST and FNGST. There is a strong sentiment among First Nations leaders that taxation is counter to previously established legal and treaty rights that are perceived to be a source of tax immunity. There is also some mistrust that is generated out of a very real fear that federal taxation powers are one part of a larger federal effort to reduce their responsibilities to First Nations and Inuit communities while maintaining control over 33 First Nations People and Tobacco Taxation expenditures. The fact that the tax arrangements with communities, municipalities, and individuals are consistent with the overall Canadian tax system may do little to alleviate that fear. However, the move by the Federal Government to give individual First Nations the power to decide whether or not to exercise tax powers should provide grounds for trust. First Nations tax powers are not unsubstantial in terms of revenues, but the revenues they generate may be insufficient to support tobacco cessation programs. Smuggling and down-the-road sales would be serious threats to revenue generation efforts. Still, the goal of creating a revenue stream for health promotion purposes is promising for smoking cessation efforts and consistent with newly emerging tax powers for First Nations. These revenues can support health promotion efforts in the communities. RECOMMENDATIONS FOR FURTHER RESEARCH, POLICY AND COMMUNITY We conclude this paper with several recommendations for further research by policymakers and community members. They are intended to provide future directions in the continuing dialogue on tobacco use in Aboriginal communities in Canada. 15. IMPORTANCE OF COMPREHENSIVE APPROACH It is important not to overstate the case for tobacco taxes as the only tool in reducing tobacco consumption. Evidence from the US suggests that the most successful cessation strategies employ a range of tactics 34 First Nations People and Tobacco Taxation to alter the social and economic environment of smokers. Although many of the studies cited in this document strongly suggest that taxation can be an effective strategy in reducing tobacco consumption, it is difficult to demonstrate the effectiveness of any one strategy. This may mean that the best strategy involves combining approaches such as media campaigns, taxation and efforts to make smoking socially unacceptable (Burns, 1992; Levy et. al., 2003). Similarly, Wardman and Khan (2004b) assert that meeting the challenge of stopping adolescent smoking is best met by developing a comprehensive approach that focuses on taxation but also includes education, the elimination of all forms of tobacco advertising and sponsorship, industry “de-glamorization” strategies, and marketing controls, such as warnings on packages. A comprehensive Canadian national strategy to address tobacco use in Aboriginal communities would identify prevention, cessation and protection measures. Tobacco use must be seen as a high public health priority and a call to action for the community, health professionals and government leadership. Thus a comprehensive strategy would not rely solely on the federal and provincial governments but would crucially involve consultation with and implementation by First Nations communities. 35 First Nations People and Tobacco Taxation 16. CASE STUDY RESEARCH ON THE HEALTH IMPACTS OF IMPLEMENTING TAXATION AGREEMENTS, RAISING REVENUES, AND ESTABLISHING TOBACCO MISUSE IN ABORIGINAL COMMUNITIES Access considerations precluded gathering primary data on First Nations and Inuit communities that have employed taxation as a smoking cessation strategy. National and international examples of how Aboriginal communities have discussed and implemented taxation policies can inform future research on this topic. Particular areas of future study would explore the health impacts of implementing taxation agreements and establishing tobacco misuse in aboriginal communities: 1. The health impacts of community-based strategies for smoking cessation (especially those paid for using taxation). 2. Attitudes and perception of residents to financing health promotion strategies through on-reserve tax revenues. 3. Attitudes and perception of residents to the use of taxes to create revenue. 4. Relevant legal interpretations of Native self government, sovereignty and autonomy over taxation revenues 5. Issues in delivering culturally appropriate smoking cessation programs to indigenous people that take into consideration traditional uses of tobacco. Case studies are detailed examinations of complex topics and they typically involve a number of data collection strategies. In Canada, a fifty million dollar Tobacco Control Strategy is currently being implemented to address the high rates of smoking and tobacco use in 36 First Nations People and Tobacco Taxation First Nations and Inuit communities. Part of these funds could be allocated to implementing and allocating a cross-case analysis of tobacco taxation in Aboriginal communities. 17. INTER-COMMUNITY COLLABORATION To address the problem of “down the road” sales, it is recommended that a cluster of neighbouring Bands enter into an arrangement to tax the sales of tobacco products. As the term suggests, neighbouring communities are the source of down the road sales and therefore, regional adoption of tobacco taxes could mitigate the potential for down the road sales. This collaboration could lead to the collective administration offices implementing the taxes and reporting to their membership. The Bands could establish a common tax administration that could be a check and balance for one another as well as a source of dialogue and comparison on health promotion strategies. This initiative could be supported by the recently established First Nations Tax Commission (FNTC). The FNTC is responsible for the development and regulation of the First Nations property tax system, ensuring that tax powers are equitably arranged. Inter-community collaboration among neighbouring bands can potentially support the successful implementation of taxation agreements by the Federal Government within a number of communities. 37 First Nations People and Tobacco Taxation 18. CANADIAN ABORIGINAL COMMUNITIES AS ROLE MODEL The Framework Convention on Tobacco Control (FCTC) has been signed. It is the first modern public health treaty and Canada was a leader in its development. Among other things The FCTC recognizes that tobacco misuse has become a global problem, rivaling HIV/AIDS as the fastest growing cause of death in the developing world. Taxation is one of the measures put forward to assist in tobacco control of these developing countries. The First Nations Tax Commission and the Framework Convention on Tobacco Control could be coupled to enable First Nations and Inuit communities in this country to take the lead in utilizing taxation to reduce health risks while contributing economic revenue to the community at the same time. With respect to health risks, taxation has been identified by the major health and medical organizations in the US as well as the World Health Organization as critically important to reducing tobacco consumption (Sweanor, et al., 2000). Regarding tax revenue, First Nations and Inuit communities in Canada could, under the auspices of the Tobacco Control Strategy, generate much needed revenue for health care services and promotion. In doing so, they could serve as a model for similar initiatives elsewhere in Canada and in developing nations around the world. OVERALL SUMMARY OF THE WHOLE REPORT Although smoking rates among the general Canadian population are steadily declining, Aboriginal rates of tobacco consumption remain as high as ever. Aboriginal people are susceptible to a host of health 38 First Nations People and Tobacco Taxation impacts, some of which are more prevalent in Aboriginal people, such as stroke, heart disease and cancer. Taxation has the potential to decrease tobacco consumption through increased pricing and there is a strong argument for assessing the effectiveness of taxation as a tool for use by Inuit and First Nation people to reduce tobacco consumption. The FNST and FNGST offers tax arrangements with the federal government that present First Nation and Inuit communities with a revenue stream. However, the association of these taxes with the federal government could provoke resistance to implementation due to commonly held negative perceptions of taxes among First Nations people. “Down the road” sales and smuggling also pose serious threats to revenue generation from on-reserve tobacco taxation; if they become widespread they will undermine the effectiveness of increased tobacco price as a deterrent to smoking and as well community revenues from tobacco sales will not be adequate and sustainable. Although further research is needed, in particular on tobacco taxation strategies already in use in Aboriginal communities in Canada, the evidence suggests that tobacco taxation can be an effect component of comprehensive anti-smoking campaigns. Although smoking rates among the general Canadian population are steadily declining, Aboriginal rates of tobacco consumption remain as high as ever. Aboriginal people are susceptible to a host of health impacts, some of which are more prevalent in Aboriginal people, such as stroke, heart disease and cancer. Taxation has the potential to decrease tobacco consumption through increased pricing and there is a strong argument for assessing the effectiveness of taxation as a tool for use by Inuit and First Nation people to reduce tobacco 39 First Nations People and Tobacco Taxation consumption. The FNST and FNGST offers tax arrangements with the federal government that present First Nation and Inuit communities with a revenue stream. However, the association of these taxes with the federal government could provoke resistance to implementation due to commonly held negative perceptions of taxes among First Nations people. “Down the road” sales and smuggling also pose serious threats to revenue generation from on-reserve tobacco taxation; if they become widespread they will undermine the effectiveness of increased tobacco price as a deterrent to smoking and as well community revenues from tobacco sales will not be adequate and sustainable. Although further research is needed, in particular on tobacco taxation strategies already in use in Aboriginal communities in Canada, the evidence suggests that tobacco taxation can be an effect component of comprehensive anti-smoking campaigns. 40 First Nations People and Tobacco Taxation References Banthin, Christopher. Cheap smokes: State and federal responses to tobacco tax evasion over the Internet. Health Matrix: Journal of Law Medicine 2004; Summer, 14(2): 325-356 Bartecchi CE, MacKenzie T, Schrier R. The human costs of tobacco use. New England Journal of Medicine 1994; 330(13): 907-912 Burns DM. Positive evidence on effectiveness of selected smoking prevention programs in the United States. Journal of the National Cancer Institute; 1992; 12:17-20 Indian and Northern Affairs Canada. Canadian Report of the Royal Commission on Aboriginal People No Date. Available on line at http://www.ainc-inac.gc.ca/ch/rcap/rpt/index_e.html (Accessed on April 28, 2005). Canada Revenue Agency. Available on line at http://www.craarc.gc.ca/Aboriginals/guidelines-.html (Accessed on March 12, 2005). Chen, VW. Smoking and the health gap in minorities Ann Epidemiol. 1993; 3(2):159-64 Colman, G., Remler, D. K. Vertical Equity Consequences of Very High Cigarette Tax Increases: If the Poor are the Ones Smoking, How Could Cigarette Tax Increases be Progressive?, 2004; NBER Working Papers 10906, National Bureau of Economic Research, Inc DeCicca P, Kenkel D, Mathios A. Putting out the fires: Will higher taxes reduce the onset of youth smoking? Journal of Political Economy 2002; February 110(1):144-69 Department of Finance Canada. The Budget Plan, 2005. Distribution Centre Department of Finance Canada: Ottawa. Available on line at 41 First Nations People and Tobacco Taxation www.fin.gc.ca/budget05/pdf/bp2005e.pdf (Accessed February 23, 2005). Ding A. Youth are more sensitive to price changes in cigarettes than adults. The Yale Journal of Biology and Medicine May 2003; 76(3):115124(10). First Nations Tax Commission. Available on line at http://www.fntc.ca/main.phtml (Accessed March 25, 2005). Fiscal Realities Economists. First nation taxation and new fiscal relationships. Kamloops and Vancouver, BC, 2003. Available on-line at http://www.fiscalrealities.com/recentwork.htm (Accessed Feb 15, 2005). Fougere M. Tobacco smuggling in Canada, the demand for "nico" dollars, and the size of the underground economy. Canadian Tax Journal 2000; 48(6): 1793-1814. Framework Convention on Tobacco Control. Available on line at http://www.who.int/tobacco/framework/en/ (Accessed April 15, 2005). Glied S. Youth tobacco control: Reconciling theory and empirical evidence. Journal of Health Economics 2002; January 21(1): 117-35 Gohdes D, Harwell TS, Cummings S, Moore KR, Smilie JG, Helgerson SD. Smoking cessation and prevention: an urgent public health priority for American Indians in the Northern Plains. Public Health Reports. 2002; 117(3): 281-90. Government of Yukon, Bureau of Statistics. An Accounting of Health: What the numbers say (A review of the methodology and the results of the 1993 Yukon Health Promotion Survey). March, 1994 Green LW. Taxes and the tobacco wars. Canadian Medial Association Journal. 1997; 156: 205-06. 42 First Nations People and Tobacco Taxation Grossman, M., Chaloupka, F.J. Cigarette Taxes: The Straw to Break the Camel's Back, Public Health Reports 1997; 112(4):290–297, Gruber J, Sen A, Stabile M. Estimating price elasticities when there is smuggling: The sensitivity of smoking to price in Canada. Journal of Health Economics. 2003; 22(5): 821-42 Gruber J, Zinman J. Youth smoking in the U.S.: Evidence and implications. National Bureau of Economic Research Working Paper: 7780. 2000. Available on-line at http://www.nber.org/papers/W7780 (Accessed Feb 15, 2005). Health Canada. A statistical profile on the health crisis of First Nations in Canada. Health Canada, 2000. Available on-line at http://www.hcsc.gc.ca/fnihb-dgspni/fnihb/sppa/hia/publications/statistical_profile.pdf (Accessed April 1, 2005) Health Canada. Canadian Tobacco Use Monitoring Survey 2003. Available on-line at: http://www.hc-sc.gc.ca/hecssesc/tobacco/research/ctums/2003/summary_annual_2003.html (Accessed April 28, 2005) Hu TW, Sung HY, Keeler TE. Reducing cigarette consumption in California: tobacco taxes vs an anti-smoking media campaign. American Journal of Public Health. 1995; 85 (9), pp. 1218-22. Ivers RG. An evidence-based approach to planning tobacco interventions for Aboriginal people. Drug and Alcohol Review. 2004; 23 (1): 5-9. Lazar, F. Comments regarding: First Nations Fiscal and Statistical Institutions Initiative. Union of British Columbia Indian Chiefs, 2002. Available on-line at http://www.ubcic.bc.ca/docs/LazarFinancial_Institutions_Sept2002.pdf (Accessed April 1, 2005). 43 First Nations People and Tobacco Taxation Levy DT, Cummings KM, Hyland A. Increasing taxes as a strategy to reduce cigarette use and deaths: Results of a simulation model. Preventive Medicine. 2000 31(3): 279-86 Levy DT, Mumford EA, Pesin B. Tobacco control policies and reductions in smoking rates and smoking-related deaths. Expert Review of Pharmacoeconomics and Outcomes Research. 2003 3(4): 457-68 Liang L, Chaloupka F, Nichter M, Clayton R. Prices, policies and youth smoking, May 2001. Addiction. 2003; 98(Suppl 1): 105-22. Maclagan B, Section 87 of the Indian Act: Recent Developments in the Taxation of Investment Income. Canadian Tax Journal. 2004; 48(5): 1503-1524. Medd K. First Nations and Taxation in Canada. Working Paper. Department of Finance, Government of Canada 2004. Medd K. Personal Communications (e-mail, phone calls, face-to-face interview), January – April 2005. Moore MJ. Death and tobacco taxes. RAND Journal of Economics. 1996; 27(2): 415-28. Reading J. Eating Smoke: A Review of Non-Traditional Use of Tobacco Among Aboriginal People. Ottawa, ON: Health Canada, 1996 Reading J, Allard Y. Chapter 4: The Tobacco Report. In Final Report of the First Nations and Inuit Regional Health Survey (FNIRHS). Health Canada, 2002: 86-135. Available on-line at http://www.hcsc.gc.ca/fnihbdgspni/fnihb/aboriginalhealth/reports_summaries/regional_survey.htm (Accessed Feb 23, 2005. 44 First Nations People and Tobacco Taxation Sissoko M. Cigarette consumption in different U.S. states, 1955–1998: An empirical analysis of the potential use of excise taxation to reduce smoking. Journal of Consumer Policy 2002; 25(1): 89-106. Sweanor D, Burns DM, Major JM, Anderson CM. Effect of Cost on Cessation. in Population Based Smoking Cessation: Proceedings of a Conference on What Works to Influence Cessation in the General Population. Smoking and Tobacco Control Monograph No. 12. Bethesda, MD: U.S. Department of Health and Human Services, National Institutes of Health, National Cancer Institute, NIH Publication No. 00-4892, November 2000. Available on-line at http://www.dccps.cancer.gov/tcrb/monographs/12/Chapter_6.pdf (Accessed April 4, 2005) Sweet, M. High smoking rates among Aboriginal community cause financial hardship. British Medical Journal 2002; 324(7349): 1296. Thatcher R. A good day for big tobacco: A bad day for world health Canadian Dimension 2003; 37(2):22. The Economist. Smoke smuggling: Contraband cigarettes hurt Canada's cigarette makers. 1994; 330: 68 Von Gernet, A. North American Indigenous Nicoltiana Use and Tobacco Shamanism: The Early Documentary Record, pp. 59-80 in J.C. Winter (ed.) Tobacco Use by Native Americans: sacred smoke and silent killer. 2000. Norman, Ok: University of Oklahoma Press. Unwin CE, Gracey MS, Thomson NJ. The impact of tobacco smoking and alcohol consumption on Aboriginal mortality in Western Australia, 1989-1991. Medical Journal of Australia 1995; 162 (9): 475-78. Wardman D, Khan N. (2004a) Smoking-attributable mortality among british columbia’s first nations populations. International Journal of Circumpolar Health. 63(1):81-92. 45 First Nations People and Tobacco Taxation Wardman AED, Khan NA. Tobacco Cessation Pharmacotherapy Use Among First Nations Persons Residing Within British Columbia. Nicotine & Tobacco Research 2004b; August 6(4): 689-692 Winter, J.C. Traditional Uses of Tobacco by Native Americans, pp. 9-58 in J.C. Winter (ed.) Tobacco Use by Native Americans: sacred smoke and silent killer. 2000. Norman, Ok: University of Oklahoma Press. Wunska. First Nations Youth Enquiry into Tobacco Use. Final Comprehensive Report to Health Canada. The First Nations Social Research Institute, Saskatchewan Indian Federated College. Saskatoon, Saskatchewan. April. 1997 Works Consulted: Brady M. Historical and cultural roots of tobacco use among Aboriginal and Torres Strait Islander people. Australian and New Zealand Journal of Public Health 2002; 26(2): 120(5). First Nations Chiefs’ Health Committee. Chiefs’ Health Examiner: Special Edition. 2001; 2. Available on-line at www.fnchc.ca/_pdf/Special_Edition_April.pdf (Accessed April 1, 2005). Hajek P, Stead LF, West R, Jarvis M. Relapse prevention interventions for smoking cessation. The Cochrane Database of Systematic Reviews 2005; 1. Available on-line at http://www.cochrane.org/cochrane/revabstr/ab003999.htm (Accessed April 1, 2005). Jenkins CN, McPhee SJ, Le A, Pham GQ, Ha NT, Stewart S. The effectiveness of a media-led intervention to reduce smoking among Vietnamese-American men. American Journal of Public Health 1997; 87 (6): 1031-34. Lancaster T, Stead LF. Self-help interventions for smoking cessation. The Cochrane Database of Systematic Reviews 2002; 3. Available on- 46 First Nations People and Tobacco Taxation line at http://www.cochrane.org/cochrane/revabstr/ab001118.htm (Accessed April 1, 2005). Marin G, Marin BV, Pérez-Stable EJ, Sabogal F, Otereo-Sabogal R. Changes in information as a function of a culturally appropriate smoking cessation community intervention for Hispanics. American Journal of Community Psychology 1990; 18 (6): 847-64. Marin BV, Pérez-Stable EJ, Marin G, Hauck WW. Effects of a community intervention to change smoking behavior among Hispanics. American Journal of Preventive Medicine. 1994; 10 (6): 340-47. McPhee SJ, Jenkins CN, Wong C, Fordham D, Lai KQ, Bird JA, Moskowitz JM. Smoking cessation intervention among Vietnamese Americans: A controlled trial. Tobacco Control 1995; 4 (suppl1): S1624. Millar WJ. Place of birth and ethnic status: factors associated with smoking prevalence among Canadians. Health Reports. 1992; 4(1): 724. Rice VH, Stead LF. Nursing interventions for smoking cessation. The Cochrane Database of Systematic Reviews 2004; 1. Available on-line at http://www.cochrane.org/cochrane/revabstr/ab001188.htm (Accessed April 1, 2005). Sandoval VA. Smoking and Hispanics: Issues of identity, culture, economics, prevalence, and prevention. Health Values 1994; 18(1): 44-53. Studlar DT. The mouse that roared? Lesson drawing on tobacco regulation across the Canada-United States border. Canadian American Public Policy 1999; 38: 1-56. 47 First Nations People and Tobacco Taxation Tillgren P, Rosén M, Haglund BJ, Ainetdin T, Lindholm L, Holm LE. Cost-effectiveness of a tobacco ‘Quit and Win’ contest in Sweden. Health Policy 1993; 26: 43-53. Tillgren P, Haglund BJ, Ainetdin T, Thörnqvist E, Uhrbom E, Holm L. Effects of different intervention strategies in the implementation of a nationwide tobacco “Quit and Win” contest in Sweden. Tobacco Control, 1995; 4: 344-50. Unger JB, Cruz T, Baezconde-Garbanati L, Shakib S, Palmer P, Anderson Johnson C, Shields A, Cruz J, Mock J, Edsall E, Glynn T, Gritz E. Exploring the cultural context of tobacco use: A transdisciplinary framework. Nicotine & Tobacco Research 2003; 5 (suppl 1): S101S107 Ussher M, West R, Taylor A, McEwen A. Exercise interventions for smoking cessation. The Cochrane Database of Systematic Reviews 2005; 1. Available on-line at http://www.cochrane.org/cochrane/revabstr/ab002295.htm (Accessed April 1, 2005) World Health Organization. Ministerial round tables on risks to health, 55th World Health Assembly, May 11-16, 2002. Zhu SH, Pierce JP. Telephone counselling for smoking cessation: A randomized trial. Paper presented at the Fourteenth Annual Scientific Sessions of the Society of Behavioral Medicine, San Francisco, 1993. ENDNOTES 1 This claim is based on some intriguing “back of the envelope” calculations regarding the absolute number of fewer smokers and larger revenues, which might result from increasing the cost of cigarettes by 7%. Here is the formula that answers these two questions. 48 First Nations People and Tobacco Taxation Number of smokers who are Aboriginal. Since the Aboriginal smoking rate is approximately 60%; 1.3 million people identified as Aboriginal according to Statistics Canada (www12.statcan.ca/english/census01/products/analytic/companion/abor/cana da.cfm). Thus, there are approximately 780,000 Aboriginal smokers. We slightly amend the increase/reduction formula that comes from the Physicians for A Smoke-Free Canada (www.smoke-free.ca). They state that a 10% increase in price may reduce prevalence of smoking by 4%. We can therefore conservatively suggest something like a 7% increase will lead to 3% reductions. Assuming 1.3 million aboriginals, and a 57% instead of a 60% smoking rate (60% - 3%), we are talking about 39,000 quitters. The money potentially available for a community that receives the revenue is based on the average smoker, who consumes 16 cigarettes per day (Public Health Agency of Canada (www.phac-aspc.gc.ca/publicat/prcccrelccc/chap_3_e.html). Assuming 20 cigarettes per pack, 16 cigarettes per day is approximately 292 packs per year. Conservatively assuming a cost of $5 per pack, we are talking about the average individual spending $1460 per year on cigarettes. A 7% tax on $1460 would net 102.20 per smoker per year (this of course would be somewhat lower as consumption declined). 1.3 million x .57 (number of smokers after price increase) = 741,000 741,000 X 102.20 = $75,730,000 per year across the country meaning approximately $75,000 per community of 1300 people. 2 Tobacco has traditionally held a prominent place in many Aboriginal ceremonies, rituals, spirituality, trading patterns and medicinal use (Gohdes et.al, 2002, p.288). Winter (2000) encapsulates the use of tobacco by Indigenous groups. Native Americans still use tobacco, and although many of them smoke, chew, and otherwise ingest it in the manner as most non-Indians [sic] – that is, as a dangerous recreational drug – a large number of Indian revere tobacco as a sacred plant, a life-affirming force, a food of the spirits, a god itself. From northern Canada to Panama, native North American use Nicotiana tacacum, N. rustica, and other species of a narcostimulant – a psychotropic, mind-altering 49 First Nations People and Tobacco Taxation substance that serves as a medium between the ordinary world of humans and the superordinary world of the spirits. Tobacco leaves were and are smoked in pipes, cigars, and cigarettes. Leaves are often chewed (often with lime) and sometimes eaten. Resin and concentrates are licked. An infusion is drunk, occasionally with datura (jimsonweed) or other drugs. Tobacco powder is snuffed. Tobacco smoke is blown on the body and into the air. Tobacco juice is painted on the body and used medically as a poultice. Tobacco incense is burned. Tobacco offerings are buried and are cast onto the ground, into the air, onto the water (p.3). Tobacco use has an extensive history and geographical reach. Traditionally, it was generally used in small amounts in spiritual and ceremonial situations. The mindaltering properties of tobacco were used to induce visions and trances to bring about direct communication with the supernatural world. Some believed that it was food for gods and others considered tobacco itself to be a god. It also figured in indigenous creation stories and was prized for its healing properties. The lengthy quotation misses a point that is particularly relevant for understanding the relationship between tobacco use and health among the Aboriginal peoples in what is now Canada. Tobacco was economically important to trade among Indigenous bands and for fur traders, like the Hudson’s Bay Company. In fact, the Aztecs, in what is now Brazil, grew tobacco that was highly favoured by the Hudson’s Bay Company, which, in turn, gave it as a gift when engaging in trade. von Gernet (2000) states that nomadic peoples, such as the Algonkians (Canadian Shield), Micmac (Nova Scotia and New Brunswick) and Montagnais (Labrador) may have even cultivated their own tobacco after having been introduced to it. The Haida and Tlingit grew and exported tobacco from their homes in Northwestern British Columbia (Winter, 2002, p.26-27). Winter (2002, p.16-17) champions the Petun and Neutral peoples as the largest cultivators and traders of tobacco in what is now Canada. The Petun grew tobacco in Southern Ontario (between Lakes Ontario and Huron). Petun was the name given to this nation from the French, who borrowed the word from Indigenous people in Brazil. It means tobacco nation. The point is that the cultivation of tobacco is at least a marker (if not a factor) in the colonization of Aboriginal people in North America; colonization itself might be the most important sociocultural determinant of health. 50 First Nations People and Tobacco Taxation (Longclaws et al 1980; Young 1982; McIntyre and Shah 1986; Warren 1988; Millar 1990; Stevens 1991; Rode and Shephard 1992; Clarkson et al 1992; Young et al 1993; Mills et. al., 1993; Erickson 1996; Health Canada: Advisory Committee on Aboriginals and Tobacco Use, 1993; The Tobacco Demand Reduction Program, 1994; Reading 1996; Wunska 1997) 4 However, it should be noted that these decreases are aggregate measures of 3 tobacco consumption and not cessation as such. That is to say, these figures measure a decrease in the number of cigarettes purchased as a result of a combination of cessation and reduced per day consumption (Sweanor et al, 2000, 166). In general, studies have found that approximately one-half of the decrease is due to reductions of tobacco use (Levy, Cummings and Hyland, 2000, 280). 5 Levy, Mumford and Pesin (2003) make a similar assertion. Using a computer simulation model, they compared six anti-smoking policies and their effectiveness in reducing premature mortality. Their results suggest that a comprehensive package of taxes, clean air laws, mass media campaigns, advertising, cessation programs and curtailing youth access showed the best outcomes compared with individual initiatives/interventions. They do note, however, that taxes and clean air laws by themselves would have a significant impact in lowering smoking. 6 Here is a further explanation of the DRM. The starting point for the DRM is the SRM but it also breaks the tax base into housing (~13%), exempt (~17%), and consumer expenditure (~70%) categories. The consumer expenditure portion is further categorized into residence-based consumption (~42%) and immediate consumption (~27%). Immediate consumption reflects activities such as eating at a restaurant, going to a theatre to watch a movie, purchasing tobacco, etc. The DRM formula therefore combines a value for residence-based consumption by the residents on First Nation’s lands (e.g., a washer or a hockey stick) with a value for immediate consumption by both residents and other persons that occurs at the business premises on First Nations lands (representing tax on hotel stays, golf green fees, theatre admissions, restaurant meals, etc.). Doing so involves gathering data on what industrial sector firms are located in, classifying whether the firm’s outputs are for residential or immediate consumption, and determining the amount of input tax credits. 51 First Nations People and Tobacco Taxation 7 Interestingly, this research postulates that a 1% rise in the relative price of Canadian tobacco would stimulate the consumption of contraband tobacco by about 2.6%. 52