NAB Annual Review 2015

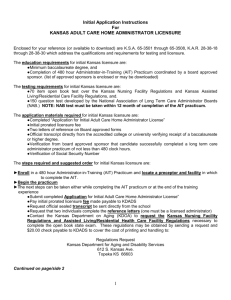

advertisement