Discussion Paper No

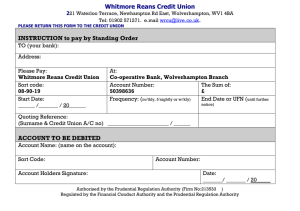

advertisement