Land speculation as a cause of deforestation

advertisement

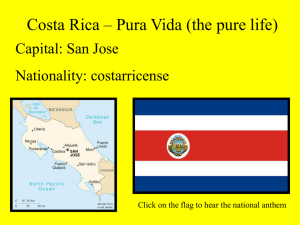

Deforestation due to uncertainty in land and capital prices: The case of cattle

ranching in the humid tropics of Costa Rica

P.C. Roebeling1, E. Hendrix2 and R. Ruben1

1)

2)

Development Economics Group, Department of Social Sciences, Wageningen University

Operations Research & Logistics Group, Department of Social Sciences, Wageningen University

Information regarding corresponding author:

Name

P.C. Roebeling

Title

Ph.D. researcher

Organization / Affiliation

Wageningen University / Development Economics Group

Mailing address

P.C. Roebeling

Development Economics Group

Department of Social Sciences

Hollandseweg 1

6706 KN Wageningen

The Netherlands

Telephone

+31-317-482972

Fax

+31-317-484037

E-mail

Peter.Roebeling@ALG.OE.WAU.NL

Paper title

Deforestation due to uncertainty in land and capital prices:

The case of cattle ranching in the humid tropics of Costa Rica

JEL Codes

Q15 / Q18

Abstract

This paper examines the effect of land speculation on investment decisions by cattle ranchers in

Latin America, and the subsequent consequences for deforestation under varying levels of land

price uncertainty and interest rate subsidy. Based on the Neoclassical investment theory, a

stochastic reversible investment model with adjustment costs is developed in which land prices

are modeled as a geometric Brownian motion. Analytical results indicate that: i) the optimal rate

of investment is dependent on the price of land at a specific moment in time, ii) the value of the

farm increases with the variance in land prices due to speculative returns from land, and iii) the

maximum farm size attained over time will be larger, the larger the variance in land prices. For

the numerical example of an average cattle rancher in the Atlantic Zone of Costa Rica, it is

shown that not correcting the development in land prices for fluctuations in interest rates leads to

overestimated resource use levels and overestimated speculative returns from land. Policy

simulations show that lower fluctuations in land prices lead to a reduction in these speculative

returns, as well as a reduction in the maximum farm size attained over time. This effect is further

reinforced in combination with lower interest rate subsidies. Consequently, it can be concluded

that variability in land prices alone is a sufficient condition for land speculation and subsequent

inflated levels of deforestation of agrarian frontier areas by cattle ranchers in the Atlantic Zone of

Costa Rica, and that this deforestation is further promoted by subsidized livestock credit.

Key words: dynamic optimization, land speculation, deforestation, cattle ranching

1

1

Introduction

This paper examines the effect of land speculation on investment decisions by cattle ranchers in

Latin America, and the subsequent consequences for deforestation under varying levels of land

price uncertainty and interest rate subsidy. A stochastic reversible investment model with

adjustment costs for cattle ranchers is developed, in which uncertainty in land prices is modeled

as a geometric Brownian motion. In the numerical example, the development in land prices is

corrected for fluctuations in interest rates.

Over the period 1980 to 1990, global deforestation in the tropics amounted up to 15.4*106

ha yr-1 or about 0.8% of the tropical forest area (Hecht, 1992; Faminow, 1998). Almost 50% of

global deforestation took place in Latin America, where pasture for cattle ranching has been the

principal replacement for cleared primary forest (van Hijfte, 1989; Hecht, 1992; Kaimowitz,

1996; Smith et al, 1997). Forest clearing and subsequent conversion to pasture for cattle ranching

has important environmental effects, like the loss of bio-diversity, resource degradation (Bouman

et al, 1998b; Kaimowitz, 1996), and elevated levels of CO2, N2O and NO emission (Hecht,

1992; Veldkamp, 1993, Plant & Bouman, 1999).

Cattle ranching in Latin America is mostly pasture-based, oriented towards beef

production for the market, and takes place on large land holdings (Seré & Jarvis, 1992; Squires

& Vera, 1992). Consequently, cattle ranching plays a predominant role in terms of land use.

Over the last century the total pasture area about tripled, and by 1985 the total pasture area

accounted for 75% of the total agricultural area (Faminow, 1998). The expansion of the livestock

sector in Latin America is generally explained by (Hecht, 1992; Kaimowitz, 1996; Faminow,

1998): 1) the characteristics of livestock production, 2) the increased demand for beef and dairy

products, 3) government policies, and 4) land speculation.

Land speculation by cattle ranchers is often considered the principal cause of deforestation

in Latin America, especially in combination with interest rate subsidies that were widely

provided to cattle ranchers in the 1980’s and 1990’s (van Hijfte, 1989; Hecht, 1992; Kaimowitz,

1996; Smith et al, 1997; Faminow, 1998). Cattle ranching is viewed as the easiest vehicle to

securing the land while waiting for land prices to rise, while at the same time it also provides

economic returns in the form of beef production (Hecht, 1992; Faminow, 1998). Consequently, it

is argued, cattle ranchers hold more pasture land for beef production than what would be optimal

from a productive point of view (Kaimowitz, 1996; Jansen et al, 1997; Smith et al, 1997).

Proof for the hypothesis that land speculation causes deforestation, is relatively limited and

contradicting. Fearnside (1990), Diegues (1992) and Kaimowitz (1996) claim that real land

prices have risen considerably over the last couple of decades due to infrastructure development,

favorable livestock product prices during the 1960’s and 1970’s, population growth and

urbanization, while Kaimowitz also claims that deforested lands sell at a higher price than

forested lands. Faminow (1998), however, states that the empirical evidence is limited, and

shows that annual rates of returns to land speculation in the Brazilian Amazon exceed the

opportunity cost of capital to a limited extent and in a small number of cases.

Based on the Neoclassical investment theory (Eisner & Strotz, 1963; Gould, 1968;

Treadway, 1969; Mussa, 1977; Abel, 1990), a stochastic reversible investment model with

adjustment costs is developed in which land prices are modeled as a geometric Brownian motion.

The model is solved analytically and a numerical example of the model will be given for cattle

ranchers in the Atlantic Zone of Costa Rica. Model base run results are generated on the basis of

1995 data, while correcting the development in land prices for fluctuations in interest rates.

Model simulations are performed for varying levels of uncertainty in land prices and varying

levels of interest rate subsidy.

The paper is structured as follows. Section 2 provides a discussion on the development in

real land prices and interest rates in Costa Rica over the last couple of decades, and is followed

2

by an empirical determination of the stochastic process underlying the development in land

prices as well as an empirical determination of the magnitude of interest rate subsidy targeted

towards the livestock sector. In Section 3, the deterministic and stochastic reversible investment

model with adjustment costs for cattle ranchers is developed. Land prices are modeled as a

geometric Brownian motion in the stochastic version of the model. Section 4 provides a

numerical application of the model with uncertainty in land prices to the case of Costa Rica. Base

run results in which the development in land prices is corrected for fluctuations in interest rates,

are compared to base run results in which the development in land prices is not corrected for

fluctuations in interest rates, as well as the to actual situation in 1986 and 1996. Subsequently, a

comparative static sensitivity analysis with respect to uncertainty in land prices and interest rate

subsidies is performed, and results are analyzed. Finally, Section 5 offers concluding remarks

and observations.

2

Land prices and interest rates in Costa Rica

The first Subsection starts with an overview of the debate on the development of land prices in

Latin American agrarian frontier areas, and is followed by the empirical determination of the

stochastic process underlying the development in real land prices in the Atlantic Zone of Costa

Rica over the period 1965 to 1991. The development in land prices is modeled as a geometric

Brownian motion, and parameter values are used in the numerical application of the model in

Section 4. The second Subsection gives an overview of the development in real interest rates in

Costa Rica over the period 1982 to 1997, while giving special attention to interest rates subsidies

that are targeted towards specific sectors in the economy. The magnitude of interest rate subsidy

that is targeted towards the livestock sector, is used in the numerical application of the model in

Section 4. The last Subsection provides a discussion on the relation between land prices and

interest rates in Costa Rica over the period 1984 to 1991. The development in land prices is

corrected for fluctuations in real interest rates, and parameter values are used in the numerical

application of the model in Section 4.

2.1

Land prices

The development in land prices in Latin American agrarian frontier areas, is an important issue

of debate in literature. Kaimowitz (1996) argues that real land prices in Central America have

risen considerably over the last couple of decades, for a number of reasons. First, real land prices

have risen at a rate greater or equal to the opportunity cost of capital due to infrastructure

development, favorable livestock product prices during the 1960’s and 1970’s, as well as

population growth and urbanization. Second, he states that deforested lands usually sell at a

much higher price than forested lands. Faminow (1998), however, states that real land prices

have not risen at all. He shows that annual rates of returns to land speculation in the Brazilian

Amazon are greater than the opportunity cost of capital in only 32% of the cases and even

negative in 34% of the cases. For some years, however, he found annual rates of return that

highly exceeded the opportunity costs of capital.

The estimation of trend and standard deviation in land prices requires time series data of

land prices over the largest period possible. However, there do not exist published data on land

transactions and land prices in Costa Rica. Annual land price data over the period 1965 to 1991

are obtained from the Institute of Agricultural Development (IDA), an institute that was

concerned with the registration, distribution and sale of land and that maintained a database of

land transactions over the earlier mentioned period. Real land prices are calculated using the

1995 consumer price index (World Bank, 1999).

Figure 1 shows real annual land prices together with the change in real land prices over

the period 1965 to 1991. Real land prices vary considerably over time, while there is no visually

3

evident general trend in land prices. There are, however, two distinct periods in which real land

prices have risen considerably. As of 1976 land prices are elevated to a higher plane. This is the

period in which the government started to play an active role in the protection of natural

resources through the establishment of natural parks and a more strict control on deforestation in

agrarian frontier forest areas (Salas, et al., 1983). Over the period 1986 to 1988 land prices have

risen temporarily, due to the following causes. First, this is the period in which the “FODEA”

law was passed, which cancelled certain debts, provided longer pay-back periods, and lowered

interest rates on past debts provided to, especially, cattle ranchers (Hijfte, 1989). Second, this is

the period in which a major highway is constructed that connects the capital (San José) with the

major export harbor (Limón) and that passes right through the middle of the Atlantic Zone.

Figure 1. Real land prices in the Atlantic Zone of Costa Rica: levels and percentage changes

over the period 1965 – 1991.

Source: Instituto de Desarrollo Agrícola (IDA).

Data regarding percentage changes in real land prices dpI,t / pI,t are important for the stochastic

model developed in Section 3, which is a continuous time model of a competitive farm that buys

land at an exogenously given land price pI,t. It is assumed that land prices evolve according to a

geometric Brownian motion,1 which is given by

dpI ,t / pI ,t dt dz

(1)

where is the instantaneous drift, is the instantaneous standard deviation, where dz is a Wiener

process with mean zero and unit variance, and where – ½2 is the expected rate of growth in

land prices (Dixit & Pindyck, 1994). This specification is used to determine the constants and

, while using the data presented in Figure 1.

Over the period 1965 to 1991, the Chow breakpoint test indicates three distinct periods of

changes in real land prices at the 5% level of significance. Parameter values for these three

periods are given in Table 1. During the period 1965 to 1975, the expected rate of growth in land

prices was negative, about – 8.1% yr-1. The period 1976 to 1979 can be considered as a transition

period, in which the rate of growth in land prices was no less than 50.3% yr-1. Finally, as of 1980

the rate of growth in land prices was about 0.8% yr-1. For the numerical example provided in

Section 4, we will use the parameter values of and for this latter period.

Table 1. Drift and standard deviation in real land prices over the period 1965 – 1991.1

Coefficients:

Drift

Standard deviation

Number of observations

Notes:

1

1

1965 – 1975

Period

1976 – 1979

1980 – 1991

-0.045

0.277

10

0.745

0.695

4

0.131

0.496

12

Dependent variable is the percentage change in land price.

Geometric Brownian motion is generally used to model economic and financial variables (Dixit and Pindyck,

1994). Given the occurrence of a jump in real land prices over the period 1976 – 1979, it might have been

more realistic to model land prices as a Poisson process. The available data on real land prices, however, do

not permit an accurate estimation of the mean arrival time and size of the jump in real land prices.

4

2.2

Interest rates

The development in real interest rates in Costa Rica over the period 1982 to 1997, is shown in

Figure 2. Large fluctuations in real interest rates can be observed, while real interest rates were

even negative at the beginning of the 1980’s. Economic growth in Costa Rica, which was mainly

agricultural driven, slowed at the end of the 1970’s due to a decrease in the growth of agricultural

production (Nieuwenhuyse et al., 2000). This resulted in an economic crisis at the beginning of

the 1980’s, with subsequent high levels of inflation (up to 90% in 1982) and currency

depreciation (up to 130% in 1981, as compared to the US$). Consequently, structural adjustment

programs were developed which aimed at the lowering of inflation, the balancing of fiscal and

external accounts, the lowering of trade barriers, as well as the reform of the financial and state

sector (Nieuwenhuyse et al., 2000).

Figure 2. Real interest rates in Costa Rica over the period 1982 – 1997.

Source: World Bank development indicators (1999).

The gradual implementation of structural adjustment programs lead to a relative stabilization of

real interest rates, with a geometric mean of about 6.9% per year since 1984. Fluctuations in real

interest rates remained, however, relatively large. From 1993 to 1995, for example, the real

interest rate was about 8% points above the average since 1984, leading to a reduction in

investment combined with a contraction in consumption. This recession was (at least partially)

caused by a government bail-out of depositors associated to a major bank that collapsed in 1994

(Nieuwenhuyse et al., 2000).

Political support for the livestock industry in Latin America in the 1970’s has been

reflected in the terms and availability of livestock credit (Kaimowitz, 1996; Faminow, 1998).

Livestock credit provided in this period was heavily subsidized, it went mostly to cattle ranchers,

and it was allocated to a relatively small group of cattle ranchers. Figure 3 shows the percentage

difference in real interest rates charged on livestock and agricultural credit, as compared to the

national average credit interest rate over the period 1984 to 1996.2 These data confirm the belief

that real interest rates for livestock credit were subsidized in the past. Especially before 1992,

interest rates on livestock and, to a minor extent, agricultural credit were well below the national

average. Interest rates charged on livestock and agricultural credit were, respectively, 0.7% and

0.3% below the national average, with a peak in 1985 when the livestock and agricultural interest

rate were, respectively, 2.7% and 1.4% below the national average. Comparison of the livestock

and agricultural interest rates shows that the interest rates charged on livestock credit was about

0.4% below the agricultural interest rate, with a peak of 1.3% difference in 1985 and 1995.

Figure 3. Percentage difference in real interest rates for livestock and agricultural credit

compared to the national average over the period 1984 – 1996.

Source: Banco Nacional de Costa Rica (BNCR).

Over the decade before the economic crisis at the beginning of the 1980’s, livestock credit

subsidies were even larger than those reported in Figure 3. Kaimowitz (1996), who refers to an

unpublished report by Aguilar & Solís (1988), shows that real interest rates for livestock credit

2

The national average real interest rate includes the agricultural, livestock, construction, housing, and other

sectors.

5

were even negative between 1970 and 1983. After the economic crisis at the beginning of the

1980’s, the gradual implementation of structural adjustment programs lead to a reduction in the

deviation of livestock and agricultural interest rates from the national average (see Figure 3). Put

differently, public livestock credit has become less available and less subsidized since the second

halve of the 1980’s.

Subsidized livestock credit promoted cattle ranching in a number of ways (Kaimowitz,

1996). First, credit helped cattle ranchers to overcome credit constraints which otherwise would

have limited pasture and herd expansion. Second, credit subsidies made cattle ranching a

relatively attractive investment option compared to alternative investment options. Finally, credit

facilitated the transfer of cattle between ranchers. As a consequence, credit subsidies lead to an

allocation of scarce capital away from investments with higher returns, thereby reducing the

national income (Faminow, 1998).

The role of subsidized livestock credit in the conversion of forest to pasture should,

however, not be overstated. In his study on the impact of livestock credit on deforestation in

Panama, Ledec (1992) shows that less than 10% of deforestation could be attributed to livestock

credit, that most of this deforestation took place in small forested areas outside the agricultural

frontier, and that banks preferred to provide credit to large established cattle ranchers rather than

to relatively small colonist cattle ranchers. Hence, livestock credit subsidies explain only part of

the expansion of cattle ranching and subsequent deforestation in Latin America.

2.3

Relation between land prices and interest rates

Real land prices as well as real interest rates fluctuate strongly over time, as can be observed

from Figure 1 and 2, respectively. According to the macroeconomic IS-LM theory, an increase in

prices leads to a decrease in the interest rate, and vice versa (Branson, 1989). When real prices

increase, real money supply decreases, an excess demand in the money market is created, and,

for the money market to clear, the interest rate must increase given a certain income level. In this

section the development in real land prices is corrected for fluctuations in real interest rates

In Section 3, a stochastic reversible investment model with adjustment costs is developed

in which land prices are modeled as a geometric Brownian motion. Given that land prices

fluctuate over time while all other prices are held constant, the development in real land prices

needs to be adjusted for fluctuations in interest rates. If not, fluctuations in land prices and,

subsequent, speculative returns from land will be overestimated.

The development of real land prices and livestock interest rates in Costa Rica over the

period 1984 to 1991 (the longest period for which land prices and livestock interest rates were

found for the case of Costa Rica) are shown in Figure 4. It is clear from the figure that high land

prices are accompanied with low interest rates, and vice versa. Over this same period,

fluctuations in beef and, especially, input prices were relatively low and mostly determined on

the world market,3 while labor costs for cattle and pasture maintenance are relatively low

compared to other costs given the labor extensive character of cattle ranching (Kaimowitz,

1996). Consequently, it is sufficient to correct the development in real land prices for fluctuations

in real interest rates.

Figure 4. Real land prices and livestock interest rates in Costa Rica over the period 1984 – 1991

Source: Real land prices from the Instituto de Desarrollo Agrícola (IDA), and real interest rates from the Banco

Nacional de Costa Rica (BNCR).

3

Trend and standard deviation in real beef prices are –1.3% and 15.2% per year, respectively, over the period

1980 to 1998.

6

In order to determine the development in real land prices while correcting for fluctuations in real

interest rates, fixed capital costs (i.e. interest payments on the value of land) are calculated for the

concerned period. Percentage changes in fixed capital costs are calculated, and drift and standard

deviation in fixed capital costs are determined ( = 0.124 and = 0.476), equivalent to the

calculation of drift and standard deviation in real land prices in Section 2.1. For the numerical

example given in Section 4, we will use the parameter values for drift and standard deviation in

fixed capital costs, as these reflect the drift and standard deviation in real land prices in case

interest rates are held constant.

3

Model specification

3.1

The deterministic model

Based on the dynamic Neoclassical investment theory with adjustment costs (Eisner & Strotz,

1963; Gould, 1968; Treadway, 1969; Mussa, 1977; Abel, 1990), a model for cattle ranchers in

Latin America is developed. In the model it is assumed that: 1) the production function employs

one variable and one fixed factor of production, produces one single output, is twice

differentiable and reflects constant returns to scale, 2) the variable input can be adjusted

costlessly and instantaneously, 3) the fixed capital input can be adjusted and is subject to an

investment cost function that is convex in the rate of investment, 4) the fixed capital input is

subject to depreciation, 5) all factor, output and capital markets function perfectly, and 6) there is

perfect certainty concerning the present and future.

The cattle rancher uses cattle St and land At to produce beef according to a production

function Q(St, At) that is quadratic in the stocking rate S/A, while assuming constant returns to

scale (c.r.s.). The rancher undertakes gross investment It, while facing convex increasing

investment costs C(It). The annual net income stream tis

( S t , At , I t ) pQ ( S t , At ) p S S t p A At C ( I t )

with

Q(S t , At ) aSt bSt2 At1

(3)

where n/(n-1) and n {2, 4, 6, …}

C ( I t ) p I ,t I t c3 I t

(2)

(4)

and where p represents the beef price, pS is the price of cattle and cattle maintenance, pA is the

price of pasture maintenance, pI is the price of land, c3 is the adjustment cost scale parameter, and

where is the adjustment cost elasticity.4 The farm maximizes the present value of net income

streams over time, subject to the equation of motion for land. The optimization problem is

formulated as follows

Maximize

V At max s e rs ds

I s ,Ss

t

(5)

subject to

A t I t At

(equation of motion for At)

and

A0 > 0 and I0 = 0

At 0 and St 0

(initial conditions)

4

Abel & Ebely (1997) show that the adjustment cost function is real-valued and convex for negative and

positive It in case = n/(n-1), with n an even positive integer.

7

where r is the time discount rate, and where a dot over a variable denotes the derivative of that

variable with respect to time t. The equation of motion for land is determined by gross

investments It in land as well as depreciation of land. The value function in Eq. (5) satisfies the

Hamilton-Jacobi-Bellman equation

rV At max pQ( S t , At ) p S S t p A At C ( I t ) ( I t At )V A

(6)

I t , St

where VA is the derivative of V(At) with respect to A. This optimality condition requires that, over

an infinitely small time interval, the instantaneous net income equals the required return rV(At).

Using Eq. (3) and (4), maximization of Eq. (6) with respect to I and S, respectively, yields the

first order conditions (f.o.c.’s)

1 /( 1)

1

V A p I c3 I t

pS p a 2bSt At1

or

or

V pI

I t A

c

3

( p S pa) At

St

2 pb

(7)

(8)

Eq. (7) states that the optimal rate of investment is such that marginal valuation of land VA is

equal to the marginal cost of investment in land, i.e. the sum of purchase and adjustment costs.

Eq. (8) states that the farm employs cattle up to the point where marginal costs equal marginal

returns. Substitution of It and St into Eq. (6) yields

rV At (h V A ) At V A p I

where h

/( 1)

(9)

2 p S pa p 2 a 2 p S2 4 p A pb

4 pb

1 /( 1)

1

c3

c3 1

c3

/( 1)

Note that VA is the marginal valuation or shadow value of installed land, in correspondence with

Tobin’s marginal q (Tobin, 1969). To find an analytical solution of Eq. (9), we take V(At) to be a

linear function of the land stock At, thus

V At qAt C

(10)

where C and q = VA are constants to be determined. Substitution of Eq. (10) into Eq. (9) yields

rqAt rC (h q) At q p I

/( 1)

(11)

which holds for all values of At. Consequently, the term multiplying At on the lhs must equal the

term multiplying At on the rhs, and, similarly, the term not involving At on the lhs must equal the

term not involving At on the rhs. This yields, while solving for q and C, respectively

q

2 p S pa p 2 a 2 p S2 4 p A pb

h

r

4 pb(r )

(12)

8

C r 1 q p I

/( 1)

r 1 q p I

/( 1)

1 /( 1)

1 c

3

c3 1

c

3

/( 1)

(13)

Consequently, taking V(At) to be a linear function of At leads to a solution of Eq. (9). This means

that q is independent of the land stock At, in line with the assumption that the farm faces a

constant returns to scale production function and exogenous prices.5 Substitution of q and C back

into Eq. (10) and (7), respectively, yields the fundamental value of the farm V(At) and the

optimal rate of investment It, which are given by

V At qAt r 1 q p I

I t*

q pI

c3

1 /( 1)

/( 1)

1 /( 1)

1 c

3

c3 1

c

3

/( 1)

(14)

2 p pa p 2 a 2 p S2 4 p A pb 4 p I pb(r )

S

4 pb(r )c3

1 /( 1)

(15)

As assumed in Eq. (10), it is also clear from Eq. (14) that the fundamental value of the farm is a

linear function of the land stock At, given that q is independent of the land stock. The value of the

farm will increase for positive and negative differences between the shadow price of land q and

the purchase price of land pI, as land can be bought for future productive returns and sold for

immediate sales returns.6 Eq. (15) states that the optimal rate of investment is an increasing

function of q, and independent of A and t. When the shadow price of land q is greater (smaller)

than the purchase price of land pI, the farm buys (sells) land and gross investment is positive

(negative).7

Using the equation of motion, the land stock path At is obtained by solving the differential

equation At / t At I t . It can be verified through direct substitution that the specific solution

to this nonhomogeneous linear differential equation is given by

I

I

At A0 t e t t

(16)

where A0 is the initial land stock. Eq. (16) shows that the steady state land stock A* equals It/,

and that the land stock grows (falls) in an exponential fashion towards this equilibrium level

given the initial land stock below (above) this equilibrium.

3.2

The stochastic model with uncertainty in land prices

Based on the deterministic model presented in the previous Subsection, a stochastic reversible

investment model for cattle ranchers is developed in which uncertainty in land prices is modelled

as a geometric Brownian motion. Consequently, the description of the model will be brief.

Again, cattle St and land At are used to produce beef according to the c.r.s. production function

Q(St, At), gross investment It is subject to convex investment costs C(It, pI,t), and the annual net

income stream t is given by

(St , At , I t ) pQ(St , At ) pS St p A At C(I t , pI ,t )

5

6

7

(17)

Abel (1983) shows that q equals the present value of marginal revenue products of land.

Note that / (– 1) is even for n {2, 4, 6, …}, so that q p I

/( 1)

> 0 for all q – pI.

Note that 1 / (– 1) is odd for n {2, 4, 6, …}, so that I > 0 for q > pI and I < 0 for q < pI.

9

Q(St , At ) aSt bSt2 At1

with

C ( I t , p I ,t ) p I ,t I t c3 I t

(18)

where n/(n-1) and n {2, 4, 6, …}

(19)

where p is the beef price, pS is the price of cattle and cattle maintenance, pA is the price of pasture

maintenance, pI,t is the price of land at a specific moment in time t, c3 is the adjustment cost scale

parameter, and is the adjustment cost elasticity. The farm maximizes the present value of net

income streams over time, subject to the equation of motion for land and the land price process.

The optimization problem becomes

V At , p I ,t max Et s e rs ds

I s ,Ss

t

Maximize

(20)

subject to

A t I t At

dpI ,t / pI ,t dt dzt

(equation of motion for At)

(land price process pI,t)

and

A0 > 0 and I0 = 0

At 0 and St 0

(initial conditions)

where r is the time discount rate. The equation of motion for land is determined by gross

investments It and depreciation . The land price is modeled as a geometric Brownian motion,

where is the instantaneous drift parameter, is the instantaneous standard deviation, and dzt is

an increment to the standard Wiener process with mean zero and unit variance. The value

function in Eq. (20) satisfies the Bellman equation

rV At , p I ,t max pQ( S t , At ) p S S t p A At C ( I t , p I ,t ) Et {dV } / dt

I t , St

(21)

This optimality condition requires that, over an infinitely small time interval, the instantaneous

net income plus the expected capital gain Et{dV}/dt equals the required return rV(At, pI,t). The

expected capital gain Et{dV} is calculated using Ito’s lemma and the constraints in Eq. (20) that

describe the evolution of At and pI,t, so that

Et {dV} / dt ( I t At )VA pI ,tV pI 12 2 pI2,tV pI pI

(22)

Substitution of Eq. (22) into Eq. (21) yields the basic condition for the stochastic optimal control

problem in Eq. (20)

rV At , p I ,t max pQ( S t , At ) p S S t p A At C ( I t , p I ,t ) ( I t At )V A p I ,tV pI 12 2 p I2,tV pI pI (23)

I t , St

Using Eq. (18) and (19), maximization of Eq. (23) with respect to I and S yields the f.o.c.’s

1 /( 1)

V A p I ,t c3 I t 1

pS p a 2bSt At1

or

or

V A p I ,t

I t

c3

( p pa) At

St S

2 pb

(24)

(25)

10

which are similar to the first order conditions in the deterministic case, though now the rate of

investment It is a stochastic process. Substitution of Eq. (24) and Eq. (25) into Eq. (23) yields

rV At , p I ,t hAt VA p I ,t

/( 1)

where h

AtVA p I ,tV pI 12 2 p I2,tV pI pI

(26)

2 p S pa p 2 a 2 p S2 4 p A pb

4 pb

1 /( 1)

1

c3

c3 1

c3

/( 1)

To find an analytical solution of Eq. (26), we take V(At) to be a linear function of the land stock

At. So

V At , pI ,t qAt g

with

q q( pI ,t ) and g g ( p I ,t )

(27)

where q and g are functions to be determined. Substitution of Eq. (27) into Eq. (26) yields

rqAt rg hAt q p I ,t

/( 1)

At q

(28)

p I ,t q pI At p I ,t g pI 12 2 p I2,t q pI pI At 12 2 p I2,t g pI pI

which should hold for all values of At. Consequently, the term multiplying At on the lhs must

equal the sum of terms multiplying At on the rhs, and, similarly, the term not involving At on the

lhs must equal the sum of terms not involving At on the rhs. This yields

q pI pI

2 2

2(r ) 2

q pI

q

p I ,t

p I2,t

1

2

2 2 q p I ,t

2 2

2r 2

g pI

g

p I ,t

p I2,t

p I2,t

/( 1)

g pI pI

p 1b 1 2 2 p S pa p 2 a 2 p S2 4 p A pb

p I2,t

(29)

(30)

It can be verified that the particular solution to Eq. (29) is given by

q

2 p S pa p 2 a 2 p S2 4 p A pb

4 pb(r )

(31)

This expression for q is identical to the q in the deterministic setting, and does not involve any of

the parameters of the adjustment cost function. Abel & Eberly (1997) note that q is the present

value of expected marginal revenue products, which is exogenous for a competitive firm with

constant returns to scale. The q is independent of the specification of the adjustment cost

function, as the path of marginal revenue products is independent of the farm’s investment.

Similarly, it can be verified that the particular solution to Eq. (30), for = 2, is given by

g ( p I ,t )

1

q

q2

2

p

p

I

,

t

I

,

t

2c3 (r )

4c3 r

4c3 r 2 2

(32)

which equals the present value of the expected rents accruing to the adjustment technology, as

represented by the adjustment cost function (Abel and Eberly, 1997).

11

The fundamental value of the farm V(At, pI,t) is obtained through substitution of q and

g(pI,t) into Eq. (27), which yields

V ( At , p I ,t ) q( p I ,t ) At g ( p I ,t ) qAt

1

q

q2

2

p

p

I

,

t

I

,

t

2c3 (r )

4c3 r

4c3 r 2 2

(33)

The value function is comprised of two additive parts (Abel and Eberly, 1997). The first part,

q(pI,t)At, represents the value of existing land, and equals the expected present value of the

returns to the existing land stock. The second part, g(pI,t), represents the value of the adjustment

technology, and equals the present value of the expected rents accruing to the adjustment

technology as represented by the investment cost function C(It, pI,t) in Eq. (19).

Looking at uncertainty in land prices while assuming = 0, we see that the value of the

farm is higher for 0 < 2 < r and lower for 2 > r, as compared to the deterministic case (i.e. the

case with constant land prices). In both cases, expected land prices decrease in a negative

exponential fashion towards zero over time. For 0 < 2 < r , the value of the farm increases with

the variance in land prices as the costs of adjusting the land stock will be below the expected

discounted returns obtained from this adjustment. For 2 > r, the value of the farm has the

asymptotic value V ( At , p I ,t ) qAt qp I ,t / 2c3 r q 2 / 4c3 r as 2 , which is p I2,t / 4c3 r below

the value of the farm in the deterministic case.

Looking at the trend in land prices , while assuming = 0, it can be verified that the

value of the farm is higher for < 0, 0 < < ½ r and > r, and lower for ½ r < < r, as

compared to the deterministic case (i.e. the case with constant land prices). For < 0, expected

land prices decrease in a negative exponential fashion towards zero over time. The value of the

farm has the asymptotic value V ( At , p I ,t ) qAt q 2 / 4c3 r as , which is

p I2,t / 4c3 r qp I ,t / 2c3 r below the value of the farm in the deterministic case. As land prices fall

more rapidly over time, investment costs will decrease, land is purchased for beef production,

and, consequently, the value of the farm will increase. Similarly, for > r, expected land prices

increase in an exponential fashion towards infinity over time. The value of the farm has the

asymptotic value V ( At , p I ,t ) qAt q 2 / 4c3 r as , which is p I2,t / 4c3 r qp I ,t / 2c3 r below

the value of the farm in the deterministic case. As land prices increase more rapidly over time,

investment costs will increase, available land is sold at the current (increasing) land price pI,t,

and, consequently, the value of the farm will increase. Finally, for 0 < < r the behavior of the

value function is complex, due to asymptotic values of the value function for = ½ r and = r.

Similarly, the rate of investment It is obtained through substitution of q (which is equal to

VA) into Eq. (24), so that

I ( p I ,t )

q p I ,t

2c3

2 p S pa p 2 a 2 p S2 4 p A pb 4 p I ,t pb(r )

8 pb(r )c3

(34)

which only differs from the rate of investment in the deterministic setting, in the sense that the

rate of investment is dependent on the price of land pI,t at a specific moment in time t.

Consequently, the rate of investment fluctuates over time according to the land price process

depicted in Eq. (20), and gross investment I(pI,t) is positive (negative) when the shadow price of

land q is greater (smaller) than the purchase price of land pI,t.

Finally, looking at the expected land price E(pI,t) we know that the land price process in

Eq. (20) has the following solution (Dixit & Pindyck, 1996)

12

E( p I ,t ) p I ,0 e (

2

/ 2) dt

(35)

where pI,0 is the land price in t = 0, and where – 2/2 is the expected rate of growth in land

prices. In case – 2/2 < 0, land prices are expected to decrease in a negative exponential

fashion towards zero over time. The rate of investment has the asymptotic level I ( pI ,t ) q / 2c3

as pI ,t 0 , and the corresponding asymptotic land stock equals At q /( 2c3 ) . In case –

2/2 > 0, land prices are expected to increase in an exponential fashion towards infinity over

time. The rate of investment is decreasing as p I ,t , and the corresponding land stock first

increases, reaches a maximum in case A0 < Amax, and then decreases until the farm is closed.8

4

Model results

This Section provides a numerical application of the model with uncertainty in land prices to the

case of Costa Rica, for the reference year 1995. Base run situations are generated for the case in

which the development in land prices is either or not corrected for fluctuations in interest rates.

The base run in which the development in land prices is corrected for fluctuations in interest rates

(corrected base run, where = 0.124 and = 0.476) is generated, and compared to the base run

in which the development in land prices is not corrected for fluctuations in interest rates

(uncorrected base run, where = 0.131 and = 0.496), as well as the to actual situation in 1986

and 1996. Subsequently, a comparative static sensitivity analysis with respect to uncertainty in

land prices and interest rate subsidies is performed on the basis of the corrected base run, and

results are analyzed.

Base run results are obtained for the year 1995. The price of beef (p = 1.41 US$ kg-1),

cattle and cattle maintenance (pS = 213.2 US$ AU-1), and pasture maintenance (pA = 55.0 US$

ha-1) are obtained from the PASTOR system, which is calibrated for the Atlantic Zone of Costa

Rica for the year 1995 (Bouman et al., 1998a). The base price of land with road access, poor soil

drainage and no further facilities for an average beef cattle farm in the Atlantic Zone (pI = 630.0

US$ ha-1) is obtained from the Dirección de Tributación Directa of the Ministry of Housing.

Trend and standard deviation in real land prices over the period 1980 – 1991 are determined in

Section 2.1 ( = 0.131 and = 0.496), and trend and standard deviation in real land prices over

the period 1984 – 1991 that are corrected for fluctuations in real interest rates are determined in

Section 2.3 ( = 0.124 and = 0.476). The constant rate of land depreciation is set at = 0.10, in

line with Faminow (1998) who states that the carrying capacity of pasture land falls rapidly in

case it is used for cattle ranching. In about 7-10 years after pasture establishment the field is

abandoned or recuperated. Quadratic adjustment costs related to investment in land are

determined on the basis of secondary data regarding labor supply, costs and requirements,

thereby assuming that 25% of all beef cattle farms invest simultaneously (c3 = 3.432 and = 2).

The time discount rate (r = 6.9% yr-1) is obtained from the World Development Indicators

(World Bank, 1999), and is calculated as the geometric mean of the real interest rates over the

period 1984 to 1997. The official 1995 exchange rate (179.73 Colones US$-1) is, also, obtained

from the World Development Indicators (World Bank, 1999). Production function parameter

estimates for pasture based beef production on poorly drained soil types in the Atlantic Zone of

Costa Rica, are determined on the basis of technical input-output coefficients generated by the

PASTOR system (a = 354.3 and b = - 70.9).

8

The rate of investment will be positive until the point in time t where the shadow price of land q equals the

purchase price of land pI,t.

13

4.1

Base run results

In the previous Section it is shown that the rate of investment in the stochastic setting fluctuates

over time according to the land price process, the latter being modeled as a geometric Brownian

motion. As such, this finding does not provide information on the effect of uncertainty in land

prices on investment decisions by cattle ranchers in Costa Rica. Cattle ranchers do, however,

anticipate on the expected development in land prices over time. In Section 3 it is shown that the

2

expected land price E(pI,t) equals pI ,0 e ( / 2) dt . Given the parameter values for and in the

corrected base run as determined in Section 2.3 ( = 0.124 and = 0.476), it can be verified that

the expected growth in land prices is 1.0% yr-1. As land prices are expected to grow over time,

land will first be bought, a maximum farm size will be attained, and then the land will be sold

until the farm is closed (i.e. when At = 0). The value of the farm is determined over the period in

time where At > 0.

The uncorrected and corrected base run as well as the actual situation in 1984 and 1996 for

an average beef cattle ranch in the Atlantic Zone of Costa Rica, are given in Table 2. The

uncorrected base run ( = 0.131 and = 0.496) and the corrected base run ( = 0.124 and =

0.476) are generated for the year 1995, and refer to the situation in which the maximum farm

size is attained at a specific moment in time t as the cattle rancher anticipates on the expected

development in land prices over time.9 The actual situation refers to the situation in 1984

(DGEC, 1987) and to the situation in 1996 (Roebeling et al., 1998).10

Table 2. (Un-)corrected base run and actual situation in 1984 and 1996 for an average beef

cattle ranch in the Atlantic Zone of Costa Rica.

Unit

Value of the farm

Resource use

Land

Cattle

Labor

Beef production

Resource use intensity

Stocking rate

Labor intensity

Notes:

106 US$

Ha yr-1

AU yr-1

LD yr-1

Tons yr-1

AU ha-1 yr-1

LD ha-1 yr-1

Base run

Uncorrected Corrected

1.94

1.93

Actual situation

19841

19962

-

199.6

285.5

574.7

33.2

173.1

247.7

498.6

28.8

214.5

232.0

566.0

-

170.4

228.9

570.0

-

1.4

2.9

1.4

2.9

1.1

2.6

1.3

3.3

1

Actual situation 1984 obtained from DGEC (1987).

2

Actual situation 1996 obtained from Roebeling et al. (1998).

Comparison of the uncorrected and corrected base run shows that the value of the farm is about

0.6% overestimated when the development in land prices is not corrected for fluctuations in

interest rates. Resource use, on the other hand, is overestimated with no less than 15% in case the

development in land prices is not corrected for fluctuations in interest rates. Resource use

intensity indicators are equal for the uncorrected and corrected base run, as the same constant

returns to scale production function is used in both base runs.

The corrected base run indicates that an average cattle ranch in the AZ of Costa Rica

encompasses about 173 ha of pasture land and 248 animal units (AU) of 400 kg live weight,

which implies a stocking rate of about 1.4 AU ha-1 yr-1. Annual labor requirements for cattle and

9

We consider a ‘starting’ cattle rancher with an initial land stock A0 of 1 ha of poorly drained land.

In both cases, beef cattle ranches are defined to have more than 50 ha of pasture and more than 50 animal units

of beef cattle of 400 kg live weight.

10

14

pasture maintenance are about 500 labor days (LD), which implies a labor use intensity of 2.9

LD ha-1 yr-1. Annual beef production is almost 30 tons yr-1, which implies an average beef

production of 116 kg AU-1 yr-1. Finally, over the concerned infinite time horizon the value of the

farm is 1.93*106 US$.

Comparison of the corrected base run and the actual situation shows that land use is in

between the 1986 and 1996 situation, while cattle and labor use are up to 25% overestimated.

This deviation can be explained by differences in beef, input and land prices, as well as interest

rates for the concerned base run and reference years. Resource use intensity indicators in the

corrected base run situation are 5% to 30% overestimated compared to the actual situation in

1996 and, especially, 1986. This overestimation can be explained by the production function

parameter estimates that are based on 1995 data of the top ten best cattle ranches in the Atlantic

Zone as well as experimental field data (Hengsdijk et al., 2000). This is confirmed by the fact

that differences are larger between 1985 and 1995 than between 1996 and 1995 as a result of

technological progress.

4.2

Policy simulations: Uncertainty in land prices and interest rate subsidies

In this Section the stochastic reversible investment model, as presented in Section 3, is used to

evaluate the effect of varying levels of interest rate subsidy and uncertainty in land prices on the

maximum farm size and value of the farm of an average beef cattle ranch in the Atlantic Zone of

Costa Rica. This analysis is performed on the basis of the corrected base run.

Table 3 shows the maximum farm size and value of the farm for various levels of interest

rate r and standard deviation in land prices . The corrected base run situation is given in the

shaded upper left corner of Table 3, where r = 6.9% yr-1 and = 0.476. Simulations include a

gradual reduction of the interest rate subsidy (on average the interest rate subsidy on livestock

credit was about 0.7% yr-1 over the period 1985 – 1996) as well as a gradual reduction of the

standard deviation in land prices ( will be reduced by 20%). Numerical solutions of a

discretisized version of the model for a large number of stochastic land price paths, leads to

similar results and response reactions. Moreover, numerical exercises with a constant rate of

growth in land prices (i.e. with constant – 2/2) show that the (average) value of the farm and

maximum farm size attained over time is reduced for lower levels of .

Table 3. Farm size and value of the farm for various levels of interest rate (r) and standard

deviation in land price ().

r \

6.9

7.1

7.3

7.5

0.48

173

163

153

143

Farm size (in ha)

0.45 0.43 0.40

111

82

66

103

77

62

96

71

57

90

66

53

0.38

56

52

49

45

Value of the farm (in 106 US$)

0.48

0.45

0.43

0.40

0.38

1.931 1.275 0.875 0.628 0.464

1.924 1.268 0.870 0.624 0.462

1.921 1.263 0.866 0.622 0.460

1.920 1.260 0.864 0.620 0.458

The maximum farm size attained over time is relatively sensitive with respect to interest rate

subsidies and, especially, fluctuations in land prices. Abolition of the interest rate subsidy would

lead to a 17% reduction in farm size, as investments are reduced due to a decrease in the

marginal production value of land. This effect is even stronger for lower values of . Reduction

of the standard deviation in land prices by one fifth would lead to a 68% reduction in farm size,

15

as investments are reduced due to more rapidly increasing land prices over time.11 This effect is

stronger for higher values of r.

The value of the farm is relatively insensitive with respect to interest rate subsidies, and

relatively sensitive with respect to fluctuations in land prices. Eradication of the interest rate

subsidy would lead to a 0.6% reduction in the value of the farm, due to a decrease in the

marginal production value of land as well as a decrease in the present value of expected rents

accruing to the adjustment technology. This effect is stronger for lower values of . Reduction of

the standard deviation in land prices by one fifth would lead to a 76% reduction in the value of

the farm, due to increased capital costs related to the ownership of land as well as a decrease in

the present value of expected rents accruing to the adjustment technology.12 This effect stronger

for higher values of r.

5

Conclusions

Analytical results indicate that the optimal rate of investment is dependent on the price of land at

a specific moment in time. Consequently, at each point in time the optimal rate of investment is

determined through comparison of the marginal value of an extra unit of land, and the marginal

investment costs of this extra unit of land. Furthermore, analytical results indicate that the value

of the farm increases with the variance in land prices. Fluctuations in land prices give rise to

speculative returns from land, in the form of rents accruing to the adjustment technology. Finally,

analytical results indicate that the maximum farm size attained over time will be larger, the larger

the variance in land prices. A smaller variance in land prices leads to an increased exponential

growth in expected land prices over time (given that land prices are modeled as a geometric

Brownian motion), and the farmer starts selling his land earlier in time.

Land price data for the Atlantic Zone of Costa Rica indicate that there is limited evidence

for Kaimowitz’s (1996) statement that land prices in Central America have risen considerably

over the last couple of decades. Over the period 1980 to 1991, expected land prices in the

Atlantic Zone have risen with less than 0.8% yr-1. Fluctuations in real land prices are relatively

large. Relative changes in land prices show a standard deviation of no less than 50% yr-1 when

the development in land prices is not corrected for fluctuations in interest rates, and about 48%

yr-1 when the development in land prices is corrected for fluctuations in interest rates. This result

is in line with Faminow (1998), who shows that real land prices in the Brazilian Amazon have

not risen over the last couple of decades, although fluctuations in land prices were large. Interest

rate data for Costa Rica confirm that interest rate subsidies have been supplied to agricultural

credit in general, and livestock credit in particular. Over the period 1984 to 1996, interest rates

charged on agricultural and livestock credit were, respectively, 0.3% and 0.7% below the

national average.

Numerical results for an average cattle rancher in the Atlantic Zone of Costa Rica indicate

that the value of the farm and resource are, respectively, 0.6% and 15% overestimated in case the

development in land prices is not corrected for fluctuations in interest rates. Policy simulations

show that interest rate subsidies and, especially fluctuations in land prices, determine to a large

extent the maximum farm size that is attained over time, as the cattle rancher anticipates on the

expected development in land prices over time.

Abolition of the interest rate subsidy would lead to a 17% reduction in farm size, while a

one fifth reduction in the standard deviation in land prices would lead to a 68% reduction in farm

size. Consequences for the value of the farm are relatively small with respect to interest rate

subsidies and relatively large with respect to fluctuations in land prices. Abolition of the interest

In case 2 smaller, then increases in pI,t are bigger than decreases in pI,t, and therefore pI,t rises more rapidly

over time. Consequently, the hacienda owner starts selling his land earlier in time.

12

Investment costs increase with the expected increase in land prices.

11

16

rate subsidy would lead to a 0.6% reduction in the value of the farm, while a one fifth reduction

in the standard deviation in land prices would lead to a 76% reduction in the value of the farm.

In this study it is shown that uncertainty in land prices is a sufficient condition for land

speculation, as it gives rise to speculative returns from land in the form of rents accruing to the

adjustment technology. For the numerical example of an average cattle rancher in the Atlantic

Zone of Costa Rica, it is shown that results are overestimated when the development in land

prices is not corrected for fluctuations in interest rates. Moreover, it is shown that lower

fluctuations in land prices lead to a reduction in speculative returns from land, as well as a

reduction in the maximum farm size attained over time. This effect is further reinforced in

combination with lower interest rate subsidies. Consequently, it can be concluded that variability

in land prices alone is a sufficient condition for land speculation and subsequent inflated levels of

deforestation of agrarian frontier areas by cattle ranchers in the Atlantic Zone of Costa Rica. This

deforestation is further promoted by subsidized livestock credit. While the role of subsidized

livestock credit in deforestation has been widely acknowledged (Ledec, 1992; Kaimowitz, 1996),

the role of land speculation has, so far, only be related to deforestation in case it was proven that

land prices tended to rise over time (Kaimowitz, 1996; Faminow, 1998).

Future research needs to address a number of topics that were not dealt with in this study.

First, the partial equilibrium approach implies that prices are not determined by aggregate supply

and demand. Second, it might be interesting to model real land prices as a mixed geometric

Brownian and Poisson jump process, given the occurrence of a jump in real land prices in the

Atlantic Zone of Costa Rica around the year 1978.

References

Abel, A.B., 1990. Consumption and investment. Pages 726-778 in: Friedman, B. and F. Hahn (Eds)

Handbook of Monetary Economics. Elsevier Science Publishers, New York: North-Holland.

Abel, A.B. & J.C. Eberly, 1997. An exact solution for the investment and value of a firm facing

uncertainty, adjustment costs, and irreversibility. Journal of Economic Dynamics and Control

21: 831-852.

Aguilar, I. & M. Solís, 1988. La elite ganadera en Costa Rica. Editorial de la UCR, San José, Costa

Rica.

Bouman, B.A.M., A. Nieuwenhuyse & H. Hengsdijk, 1998a. PASTOR: a technical coefficient

generator for pasture and livestock systems in the humid tropics, version 2.0. Quantitative

Approaches in Systems Analysis No. 18. AB-DLO/C.T. de Wit Graduate school for Production

Ecology. Wageningen, The Netherlands. 59 pp., plus appendixes.

Bouman, B.A.M., R.A. Schipper, A. Nieuwenhuyse, H. Hengsdijk & H.G.P. Jansen, 1998b.

Quantifying economic and biophysical sustainability trade-offs in land use exploration at the

regional level: a case study for the Northern Atlantic Zone of Costa Rica. Ecological Modelling

114: 95-109.

Branson, W.H., 1989. Macroeconomic theory and policy. Harper & Row Publishers, New York, USA.

656 pp.

DGEC [Dirección General de Estadística y Censos], 1987. Censo agropecuario 1984. Ministerio de

Economía, Industria y Comercio, San José, Costa Rica.

Diegues, A.C., 1992. The social dynamics of deforestation in the Brazilian Amazon: An overview.

United Nations research institute for social development, Department Publication 36, Geneva.

Dixit, A.K. & R.S. Pindyck, 1994. Investment under Uncertainty. Princeton, NJ: Princeton University

Press, New Jersey, USA. 468 pp.

Eisner, R. & R.H. Strotz, 1963. Determinants of business investment. Pages 59-337 in: Commission

on money and credit impacts of monetary policy. Engelwood Cliffs, New Jersey: Prentice-Hall.

Faminow, M.D., 1998. Cattle, deforestation and development in the Amazon: An economic,

agronomic and environmental perspective. CAB International, New York, USA. 253 pp.

17

Fearnside, P.M., 1990. Predominant land uses in Brazilian Amazonia. Pages 233-251 in: Anderson,

A.B. (ed.) Alternatives to deforestation: Steps toward sustainable uses of the Amazon rain

forest. Oxford University Press, New York, USA. 281 pp.

Gould, J.P., 1968. Adjustment costs in the theory of investment of the firm. Review of Economic

Studies 35: 47-55.

Hecht, S.B., 1992. Logics of livestock and deforestation: The case of Amazonia. Pages 7-25 in:

Downing, T.E., S.B. Hecht, H.A. Pearson & C. Garcia-Downing (Eds.) Development or

destruction: The conversion of tropical forest to pasture in Latin America. Boulder, CO:

Westview, 405 pp.

Hengsdijk, H., B.A.M. Bouman, A. Nieuwenhuyse, R.A. Schipper & J. Bessembinder, 2000.

Technical coefficient genrators for quantifying land use systems. Pages 97-114 in: Bouman,

B.A.M., H.G.P. Jansen, R.A. Schipper, H. Hengsdijk & A. Nieuwenhuyse (Eds.) Tools for land

use analysis on differrent scales: With case studies for Costa Rica. Kluwer Academic

Publishers, Dordrecht, The Netherlands. 274 pp.

Hijfte, P.A. van., 1989. La Ganaderia de Carne en el Norte de la Zona Atlantica de Costa Rica.

CATIE/Wageningen/MAG, field report No.31.

Jansen, H.G.P, M.A. Ibrahim., A. Nieuwenhuyse, L. ‘t Mannetje, M. Joenje & S. Abarca, 1997. The

economics of improved pasture and sylvipastoral technologies in the Atlantic Zone of Costa

Rica. Tropical Grasslands 32: 34-44.

Kaimowitz, D., 1996. Livestock and deforestation in Central America in the 1980s and 1990s: a policy

perspective. Center for International Forestry Research, Jakarta, Indonesia. 88 pp.

Ledec, G., 1992. The Role of Bank Credit for Cattle Raising in Financing Tropical Deforestation: An

Economic Case Study from Panama. Ph.D. dissertation, University of California, Berkely.

Mussa, M., 1977. External and internal adjustment costs and the theory of aggregate and firm

investment. Economica, 47: 163-178.

Nieuwenhuyse, A., B.A.M. Bouman, H.G.P. Jansen, R.A. Schipper & R. Alfaro, 2000. The physical

and socio-economic setting: The northern Atlantic Zone of Costa Rica. Pages 9-34 in: Bouman,

B.A.M., H.G.P. Jansen, R.A. Schipper, H. Hengsdijk & A. Nieuwenhuyse (Eds.) Tools for land

use analysis on differrent scales: With case studies for Costa Rica. Kluwer Academic

Publishers, Dordrecht, The Netherlands. 274 pp.

Plant, R.A.J. & B.A.M. Bouman, 1999. Modeling nitrogen oxide emissions from current and

alternative pastures in Costa Rica. Journal of Environmental Quality 28(3): 866-872.

Roebeling, P.C., R. Ruben & F. Sáenz, 1998. Politicas agrarias para la intensificación sostenible del

sector ganadero: una aplicación en la Zona Atlántica de Costa Rica. Pages 156-174 in: Castro,

E. & R.Ruben (Eds.) (1998) Políticas agrarias para el uso sostenible de la tierra y la seguridad

alimentaria en Costa Rica. UNA-CINPE / WAU-DLV, Costa Rica.

Salas, W.U., J.S. León, J. Aguilar & C.V. Barboza, 1983. El sector agropecuario Costaricense: Un

analisi dinamico 1950-1980. UCR-Escuela de economía agrícola, San José, Costa Rica. 198 pp.

Seré, C. & L.S. Jarvis, 1992. Livestock economy and destruction. Pages 95-113 in: Downing, T.E.,

S.B. Hecht, H.A. Pearson and C. Garcia-Downing (Eds.) Development or destruction: The

conversion of tropical forest to pasture in Latin America. Boulder, CO: Westview, 405 pp.

Smith. J., J.V. Cadavid, A. Rincon & R. Vera, 1997. Land Speculation at the Frontier: a Seeming

paradox in the Colombian Savana. Agricultural Systems 54, 501-520.

Squires, V.R. & R.R. Vera, 1992. Commercial beef ranching in tropical and semi-arid zones. Pages

437-454 in: Jarrige, R. & C. Beranger (Eds.) Beef cattle production. Elsevier, Amsterdam, The

Netherlands, 487 pp.

Tobin, J., 1969. A general equilibrium approach to monetary theory. Journal of Money and Credit

Banking 1: 15-29.

Treadway, A.B., 1969. On rational entrepreneurial behavior and the demand for investment. Review

of Economic Studies, 36: 227-239.

Veldkamp, E., 1993. Soil organic carbon dynamics in pastures established after deforestation in the

humid tropics of Costa Rica. Ph.D. thesis, Wageningen Agricultural University, Wageningen,

The Netherlands. 117 pp.

World Bank, 1999. World development indicators. CD-ROM.

18