Board Paper No - Bank of Tanzania

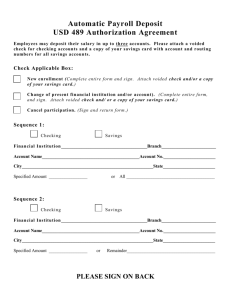

advertisement