Shedding Light on the Business Model of Italian

advertisement

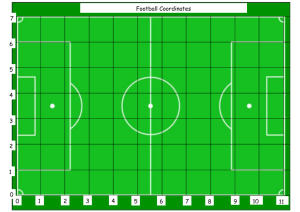

Shedding Light on the Business Model of Italian Professional Football Clubs: A Critical Perspective Over the ‘Dogma’ of Football Clubs as Mere Entertainment Providers Abstract Several research contributions have investigated the operations of professional football clubs (PFCs). These studies identify the economic essence of PFCs in the production of entertainment. The aim of this study is to provide evidence that the business model developed in these previous researches does not hold for all PFCs in the Italian “Serie A” league. The paper first identifies the potential drivers of profitability of PFCs in the “Serie A” in terms of financial and governance related variables. Secondly, the paper tests the association – via the application of an OLS multivariate model – of these factors with the actual profitability of clubs over a seven-year period, from 2006 to 2012. The paper shows that the business model that best explains the profitability of PFCs is one where: (i) the core activity is not merely the provision of entertainment; and (ii) as a consequence, it pursues objectives of profit maximization. The main limitation of this study lies in its focus on the Italian domestic professional football market. Further research may provide evidence of the validity of our conclusions to a wider set of clubs at an international level. The business model of Italian PFCs, as resulting from our findings, may drive a revision of the annual reports of these entities to better reflect their economic and financial position. Ultimately, the paper tries overcoming the ‘dogma’ of PFCs being looked at as mere entertainment producers by showing that they perform other (more profitable) operating activities which characterize a different business model. Introduction A recent market research (Deloitte 2012) on the European football industry has highlighted that this sector has reached a total turnover over almost EUR 17 bn in 2012 with the English “Premier League” leading the ranking with total revenues of approximately EUR 2.5 bn followed by the German “Bundesliga” (EUR 1.75 bn), the Spanish “Liga” (EUR 1.72 bn), the Italian “Serie A” (EUR 1.55 bn) and the French “Ligue 1” (EUR 1.04 bn). While the Italian football market only ranks fourth in terms of revenues, it presents the highest cost-to-revenue ratio signalling that containing the costs associated to football players is a key factor to improve the economic and financial performance of Italian clubs. At the same time, according to this research, the level of revenues is still concentrated around the “traditional” ticket sale and “show-related” activities and therefore the search for new strategies to increase revenues will become a pivotal factor of future economic viability of football clubs in Europe. While showing the status quo of the European football market, this evidence raises a question for academic researchers: what is revenue for football teams? From a normative perspective, in the IFRS Conceptual Framework revenue “arises in the course of the ordinary activities of an entity and is referred to by a variety of 1 different names including sales, fees, interest, dividends, royalties and rent” (IASB 2012). Considering that most EU football clubs file their financial statements according to IFRSs, from this perspective, the notion of revenues proposed in the Conceptual Framework could be accepted as describing the “operating” top line of football entities. What is then “ordinary” or “operating” activity for football clubs? This question further links to the issue of business model in the context of football clubs. In fact, today, while football clubs are subject to the strict conditions imposed by the UEFA financial fair play (2012) which pushes in the direction of requiring clubs to secure – by almost any means – their financial break-even, it is still to understand what features make football a business which is still worth investing in for many private entrepreneurs. Understanding the business model of football clubs can therefore help assessing the areas where it is worth investing to balance the two conditions of existence of these peculiar entities: (a) the economic viability of clubs; and (ii) their sporting performance. If those revenues which are traditionally regarded as being the “operating” ones for football clubs – that is revenues from sporting events and related ones – no longer explain the profitability and market persistence of certain football clubs, other sources of income need investigation in order to identify elsewhere in the financial statements the drivers of profitability of these entities and, by this means, better defining their business model. Furthermore, professional sport clubs are subject to significant stakeholder pressure, especially where clubs’ supporters are particularly attached to local teams. The stakeholder management approach (see ex multis Freeman 1984) is quite familiar to for-profit firms, especially in Western countries, where internal and external stakeholders have gained increasing importance and power so to influence the way in which firms try reaching their business objectives. Even more important, in the specific field of football clubs, seems the approach provided by the legitimacy theory (Suchman 1995) to depict the peculiar importance of the social contract that exists between football firms and their reference environment (especially supporters) and to explain that these firms, at each point in time, “fluctuate” between at least two orders of objectives: (i) maintaining their economic equilibrium; and (ii) meeting foreseeable and reachable sport results. In fact, in professional sport business, possibly these issues are even stronger because directors may find it quite difficult to choose strategic plans if these result in poor sport results and they make supporters unhappy, even when such plans are deemed necessary for the firm’s survival. Therefore, the governance model of professional sport clubs is an important factor when defining the clubs’ approach to achieving business objectives. In the paper, the Italian “Serie A” league is observed on a time frame considering the last 7 years (2005-2012). Particularly: the latest financial statements (2012-2013 season) of “Serie A” teams are analysed, in order to find evidence regarding the business model of those teams which have achieved positive financial results over this timeframe. The business model of any firm “at a minimum, […] would indicate: what activities it undertakes within the firm and how these are organised; what it buys and sells in market transactions, which markets it operates in (i.e. who it buys from and who it sells to), and the nature of its relationships with these parties” (ICAEW 2010, p.10); therefore, in broad terms, a firm’s business model can be identified by considering both performance-related and governance structure-related features. In fact, corporate governance characteristics1, such as Board of Directors’ size, are an integral part of a firm’s business model as they indicate – from the lowest operational level to the highest strategic level in an entity – how the production is organised. 2 By looking at financial and governance factors, we tested the existence of any statistical association between those aspects (explanatory variables) and football clubs’ profitability (dependent variable) as expressed in terms of yearly net earnings. We believe that the relevance of this contribution is two-fold: (i) in the recently published new UEFA’s Financial Fair Play Regulation (2012) no reference is made to the concept of a business model, therefore football clubs are looked at only from the perspective of their cash flows, to ensure their ‘financial’ viability. However, in this paper we show that there are some economic – rather than merely financial – determinants of clubs’ performance that should be looked at, in order to better understand their economic model; and (ii) this work may help overcoming the usual ‘dogma’ of football clubs as being mainly entertainment producers, by highlighting the economic factors that show a significant degree of association between the operating performance of Italian professional teams in the “Serie A” league and the business activities they perform. The paper is structured as follows: (i) in the first section, the general context of the paper is set by providing a theoretical perspective (literature review) which helps us shaping our research questions; further, a snapshot of the Italian Serie A market (economic context) is sketched out in order to allow for the definition of research hypotheses consistent with the status quo and the pre-defined research questions; this section concludes with the indication of the expected relevance of this paper as a contribution to existing research; (ii) the second section concerns the identification of the methodology used to verify the research hypotheses; (iii) the following section presents the empirical results showing the extent to which research hypotheses have been verified and the cases in which this has not occurred; (iv) the last section addresses comments on the empirical results, offers possible explanations to them in line with the theoretical reference framework and answers the research questions proposing some considerations for further research. 1. Literature Review, Economic Context and Research Hypotheses 1.1 Existing Literature and problem setting For the last thirty years, football championships have attracted significant interest not only by club supporters, but also by accounting academics. Many studies have tried to investigate from an accounting perspective this particular business, shedding light on several features of the income statement or the balance sheet (e.g. depreciation of players’ registration rights and the related recognition and measurement of intangible assets; see ex multis Trussel, 1977; Morrow 1992, 1995, 1996a, 1996b, 1999; Michie and Verma 1999; Rowbottom 2002; Amir and Livne 2005; Forker 20052). Regarding these studies, we noted that the debate around the option between expensing or capitalising and, in general, regarding the methodology to evaluate players’ intangible assets in the balance sheet sometimes reopens: Morrow 1996a and 1996b concluded that “there are convincing arguments for the conceptualisation of the services provided by 3 football players as accounting assets, and recommends a system of valuation in which players are valued at their realisable value by independent experts”; Amir and Livne 2005 argued that players rights should be expensed because of the weak evidence of future cash inflows (before 1998, the British FRS 10 gave the expensing option), whilst, according to Forker 2005, capitalization should remain the right way for accounting for these intangibles3. A peculiar view on the determinants of the transfer value of these rights is discussed in several papers, with interesting results (Carmichael, Forrest and Simmons 1999; Dobson, Gerrard and Howe 2000; Tunaru, Clark and Viney 2005)4. However, only a few researchers have tried to find evidence regarding one aspect of deeper concern when looking at football club activities, that is the determinants that are able to explain their economic durability in their ‘market’. In addition, we found that most studies have only considered either (i) major teams and/or listed teams (in the Italian context, see Risaliti and Verona 2013), or (ii) aggregated and often by country data (Lago, Simmons and Szymanski, 2006; Buraimo, Simmons and Szymanski, 2006; Lago and Baroncelli, 2006; Gouguet and Primault 2006; Frick and Prinz, 2006; Ascari and Gagnepain, 2006; Morrow, 2006; Barros 2006; Dejonghe and Vandeweghe, 2006; UEFA, 2010; Deloitte 2003, 2004, 2005, 2006a, 2006b, 2007, 2008, 2009, 2010). However, none of the Italian studies (see footnote 1) considered the whole “Serie A” league, as it has been done for other countries with their respective major leagues, although from a more limited perspective (for example, Hall, Szymanski and Zimbalist (2002) test the existence of an association between clubs’ performance and level of payroll expense). Regarding the former, as a matter of fact, we notice that the conditions of economic durability of those clubs largely depend on robust equity injections by their main shareholders. Also, a pure ‘surplus-maximization’ approach similar to those applicable to proper businesses is difficult to apply to those teams, as their strategic and managerial choices are seldom comparable to those of firms (in this respect, we recall that Guzman and Morrow 2007 refer to football clubs as “unusual businesses”, p. 309)5. For what concerns the second group of studies, instead, the co-existence of a few large teams together with many small ones generates some distortions in the market: for example, if one club alone loses EUR 100 mln and eight other smaller teams in the same league gain EUR 10 mln each, then the balance of the whole sector indicates a situation of economic tension, whilst a deeper look into the specific economic conditions and business model6 could let us conclude differently. For these reasons, most studies focusing on football clubs have restricted their analyses to the description of the ‘status quo’ rather than providing the ‘economic rationale’ that is able to explain the business model of football clubs and their performance patterns. One common misconception about professional football clubs is, in fact, that their existence would be largely explained by their efforts in winning competitions and championships. We believe that this is where the difficulty in trying considering professional football clubs as proper businesses is rooted. Of course, we do not necessarily hold that professional football clubs are ‘profit maximisers’ tout court, but we note that even ‘proper’ businesses seldom operate as pure profit maximisers. Therefore, a focus solely on the economic and governance determinants of football clubs’ operations may shed light on the drivers of their performance and better explain their activities in terms that differ from their claimed nature of ‘sui generis’, mere sport result-maximiser entities. 4 Particularly, we noted that for Szymanski e Kuypers (1999) revenues depend on sporting results (see also Hoehn e Szymanski 1999) which in their turn depend on the average level of football player wages in the long term. Therefore, those clubs which are relatively wealthier than others are more likely to rank in higher positions (Murphy 1999a and Murphy 1999b), and relegation causes several financial problems (Gerrard 2002). Nevertheless the link between sporting results and revenues remains unclear when measuring revenues (also “sporting revenues” for Barajas et al. 2005) as the sum of “the income from match tickets and the pools (combined as the TAP variable), television rights (TV) and advertising/sponsorship (ADV)” (Barajas et al. 2005, p. 12), excluding the results of, for example, the trading activity of players’ registration rights. Moreover, only these latter consider a different hypothesis: do economic results (not only revenues, but all other sources of income) depend on sporting results? The answer to this question shows that when profitability is considered in association with sporting results, as opposed to considering the mere dependence between sporting results and the level of revenues, the degree of significance of the association tested becomes much weaker (Barajas et al. 2005, par. 5, pp. 14-17; Bollen 2010). As previous literature contributions have rarely addressed the issue of the determinants of football teams’ economic results, we try entering this research field by proposing an alternative model to the ordinary one that looks at the performance of these clubs by underlying any association between their sport results and their economic performance. In fact, football clubs are generally regarded as entities which are unable to translate their operational objectives in profitable targets. Instead, we believe that: (i) football teams pursue different patterns of profitability which differ from the mere production of revenues by means of ticket sale or brand merchandising; and (ii)sporting results are far from being the unique or the ordinary focus of these entities when it comes to setting their profitability targets. In fact, when looking at professional football leagues in their entirety, and particularly when focusing on the Italian case, it is clear that: (i) most teams - generally the small and medium ones - do not necessarily compete with the realistic expectation to win the championship or to rank in the first few top positions of any tournament; and (ii) their choices in terms of best players’ retention and players’ trading policies do not necessarily seem consistent with the objective of increasing a team’s potential to win competitions. If “the mission of professional football clubs can be described as to offer entertainment to their spectators through the game of football” (Cincimino et al. 2012, p. 116) and therefore the only ‘customers’ of football clubs were theirs fans, then probably none of the Italian professional teams would reach the economic equilibrium. At the same time, we noted that in the Italian premier league, the “Serie A”, most small and medium sized teams are generally profit-makers as opposed to some of the major clubs which are loss-makers. The existence of those clubs that, on one hand, are not the best performers in their league in terms of the number of competitions won, but that, on the other hand, are profit-makers raises the question of why this happens and what are the determinants of such state of things or, in other words, what their business model is. We agree with Lago and Baroncelli (2006, p. 22) that “if for the leading clubs, sporting results can be expressed in terms of victories (in the championship, European Champions League, UEFA Cup, etc.), for the provincial teams, they can be expressed in terms of them having managed to remain in Serie A and their promotion from Serie B”, however we believe that there are 5 also other factors of the operations of Italian professional football clubs that need to be investigated in order to identify the proper determinants of the economic durability of those clubs. In fact, the ‘ordinary’ lenses through which football clubs are usually analysed, that is looking at them as mainly show-business providers, appear to be unsatisfactory. We note that this may be a relevant and even sustainable business driver if: (i) the club is renowned as being a competitive one (and, as such, it relies on strong and generally expensive players); and/or (ii) the club has a quite large fanbase either locally or in even remote regions which, however, are reachable via satellite television. Again, this is not the case for small and medium clubs which do not always meet either conditions and we agree that, “the provincial teams are forced to replace a large number of their players every year. Teams that easily retain their position in Serie A let two, three, or even more talented players go each year, whom they replace with young players whose performance at the start of a season is uncertain […] although paradoxical, […] have more clearly defined economic objectives. These are clubs that are often linked to entrepreneurs who have no desire or cannot afford to run a business at a loss, and they must thus make a profit from invested capital” (Ibidem, p. 23 emphasis added). Nevertheless, as opposed to what stated by these authors, we believe that this way of performing is not a constrained choice, but it is rather a sought-after model. Furthermore, even for major clubs, which the ‘business model’ of show providers seems to best fit, the mere sale of TV rights and tickets proves not to be economically sustainable (as shown in Risaliti and Verona 2013 and also noted in Lago, Baroncelli and Szymanski 2006; Dobson and Goddard 2001; Antonioni and Cubbin 2000). Therefore the question of what factors are able to explain the existence and the economic durability of football clubs still remains unanswered7 also for those teams. In sum, when looking at both small/medium sized clubs and major football teams their respective conditions of existence seem not to be explained by the ordinary paradigm which indicates that they are businesses whose core characteristic is the subordination of profitability targets to sporting targets. Therefore it is worth investigating the specific economic and governance-related conditions which may explain the performance of these entities. Based on the considerations developed above, we identify a threefold research question: RQ.1 What are the determinants of football clubs’ performance for the Italian “Serie A” league? RQ.2 What is their economic raison d’être? RQ.3 What are the conditions of their durability as economic entities? To answer these questions, we considered the whole population of Italian football teams focusing, at a first stage, on small and medium clubs and then including in the sample also the major teams. We notice that, by not limiting the analysis to the ‘top-tier’ clubs, we look for the key features of football activities which are able to explain their performance over a fairly long (seven-year) period in terms that differ from the usual show-provider model. The search for the conditions of the economic viability of football clubs (in the first place, small and medium sized ones) suggests that we look more in depth into their financial statements. In analysing the financial statements, our search for a business model for professional Italian football clubs belonging to the Serie A league will not simply consider the accounting model as a given (in the Italian context many studies follow this approach; see ex multis Cesarini 1985; Committeri and Melidoni 2003; De Vita 1998; Manni 1990; Rusconi 1990; Teodori 1995; Bianchi and Di Siena 2000; Bianchi and Corrado 2004; Melidoni and Committeri 2004; Regoliosi 2006; Pezzoli 2007; Valeri 2008; Mancin 2009; Gravina 2012), that is we will not merely rely on the 6 representation that statutory accounts give of the business model of the reporting entity. Also, as mentioned earlier, the identification of the business model of professional football clubs will rely on a review of their governance structures. 1.2 The Italian “Serie A” Aggregated data from PwC (2013) seem to be very useful in providing a snapshot of the Italian professional football industry. In this report, several measures have been observed, such as total sales (broken down by revenues from competitions, revenues from TV rights, merchandising, etc.), and asset and liability key factors (including players’ registration rights and net financial position) for each of the following groups: “Serie A” league, “Serie B” league (Italian second division) and “Lega Pro” league (Italian third division) during the period from season 2007-2008 to season 2011-2012. Data relating to Serie A are given more emphasis and space in the document and, looking at the associated graphs and tables (pp. 84-95), it is possible to note some interesting factors which are useful in describing the economic status of Italian professional football teams: 1) the increasing weight of income from the sale of players’ registration rights on total revenues (from 12% in season 2007-2008 to 20% in season 2011-2012); 2) the decreasing weight of TV rights sales (in absolute terms the relative weight is quite high at 43% in season 2011-2012, but it was far higher four seasons before, at 53%); 3) the relative growth of players’ wages (from EUR 949 M in season 2007-2008, to EUR 1,182 M in the latest season); and, eventually 4) the trend of the cumulated net income (from a cumulated loss of EUR 150 M during season 2007-2008 to a cumulated loss of EUR 282 M in latest season). The following graphs help summarising the situation of the Italian professional football industry in recent years (Serie A only). Graph 1 – Total Sales 7 Graph 2 – Gains from Players Trading Graph 3 – Annual Total Players Wages Graph 4 – Annual Net Income The teams of the Italian “Serie A” league which we refer to in this paper are listed in table 1 here below (in alphabetical order)8 (these teams differ from those considered in the PwC report, as we have considered teams playing in the Serie A as of beginning of season 2012-2013): 8 Table 1 – Italian “Serie A” 2012-2013 teams Atalanta Bologna Cagliari Catania Chievo Fiorentina Genoa Inter Juventus Lazio Milan Napoli Palermo Parma Pescara Roma Sampdoria Siena Torino Udinese For each of the listed teams, we analysed the annual reports of last 7 years (annual reports relating to fiscal years 2006-2012), disregarding the league they belonged to in the seasons preceding season 2012-20139. First of all, we have to underline that in the Italian Civil Code and according to Federal accounting rules, even if the percentage of income from players trading on Total Revenues is increasingly important, not all football teams include these gains in the “Total Revenues” section (“Valore della produzione” according to art. 2425 Civil Code). If we sum the “ordinary” revenues (i.e. sporting-related revenues, such as TV right sales, ticketing and merchandising revenues) to the line item relating to revenues arising from players’ transfer (which are often regarded as being “residual” ones) ) for the 20 teams listed above, we have the results listed in tables 2, 3 and 4 below (please note that Pescara did not exist during years 2006-2009; fiscal year 2012 financial statements of Atalanta, Fiorentina, Genoa, Milan and Torino have not yet been issued at the date this paper is published): Table 2 – Italian “Serie A” 2012-2013 teams aggregated Revenues and Other Income (R&I) EUR Atalanta Bologna Cagliari Catania Chievo Fiorentina Genoa Inter Juventus Lazio Milan Napoli Palermo Parma Pescara Roma Sampdoria Siena Torino Udinese Total R&G 2012 Not available71,126.131 67,164.706 54,629.468 53,631.425 Not available Not available 235,686.916 213,786.231 95,509.291 329,307.000 155,929.550 96,517.284 101,486.232 15,636.259 115,973.000 32,427.358 52,340.285 Not available 120,968;790 R&G 2011 35,152.303 58,124.124 46,782.669 55,289.005 41,429.533 67,076.954 118,807.748 268,827.275 172,066.450 93,670.372 266,811.000 131,476.940 98,197.944 83,108.964 11,356.899 143,878.000 54,339.968 30,355.276 19,510.578 96,356;473 R&G 2010 20,154.633 49,128.409 42,256.935 45,407.893 40,956.843 79,854.927 95,890.719 323,516.329 219,731.837 98,501.843 253,196.000 110,849.458 68,483.430 78,349.512 4,624.832 137,044.000 59,387.396 52,823.316 31,892.917 73,544;066 R&G 2009 51,886.904 41,554.004 47,851.946 50,488.682 36,006.384 140,040.713 99,682.839 232,642.570 240,434.141 92,001.361 307,349.000 108,211.134 113,225.649 36,377.569 Not available 160,929.000 52,655.231 46,584.991 49,288.688 88,547;290 R&G 2008 45,508.797 26,303.628 56,444.771 42,547.815 28,672.482 108,521.983 61,131.833 203,421.845 203,731.662 102,482.031 218,663.548 88,428.490 74,834.928 45,425.434 Not available 189,313.000 58,196.009 39,567.454 59,201.027 78,536;548 R&G 2007 42,104.786 19,695.483 29,234.177 38,030.157 42,127.752 88,627.385 29,372.647 221,217.652 186,685.844 76,271.330 257,813.388 41,411.837 84,290.942 35,545.234 Not available 157,589.000 39,974.488 15,521.588 47,536.017 45,725;304 R&G 2006 34,224.167 13,621.792 27,384.987 16,586.538 32,894.241 60,961.502 17,446.927 215,731.889 252,727.083 81,197.194 293,106.971 12,068.630 53,911.752 51,833.339 Not available 128,542.000 38,115.264 29,280.006 33,149.605 84,982;606 1,482,812;926 1,892,618;475 1,885,595;295 1,995,758;096 1,730,933;285 1,498,775;011 1,477,766;493 9 Table 3 – Italian “Serie A” 2012-2013 teams Cumulated Net Profit (CNP) - EUR EUR Atalanta Bologna Cagliari Catania Chievo Fiorentina Genoa Inter Juventus Lazio Milan Napoli Palermo Parma Pescara Roma Sampdoria Siena Torino Udinese CNP 2012 Not available -48,960.95 23,721.75 29,685.37 -16,586.94 Not available Not available -773,678.32 -206,649.29 41,870.26 -240,427.000 34,436.03 573.64 -14,768.11 1.59 -82,408.00 -90,630.45 -44,941.24 Not available 19,731.29 CNP 2011 -8,194.71 -42,771.42 21,213.49 25,392.76 -17,203.32 -70,039.86 -31,324.49 -696,530.39 -157,994.74 37,648.70 -233,570.00 19,715.27 4,585.34 -12,300.40 -6,531.28 -24,155.00 -52,501.70 -46,758.49 -45,913.17 10,949.13 CNP 2010 2,723.51 -38,605.00 23,020.87 18,943.25 -16,945.66 -37,565.78 -31,256.99 -609,716.61 -62,580.72 27,666.29 -166,236.00 15,517.44 -3,184.48 -12,958.52 -5,873.83 6,379.00 -36,859.68 -26,309.78 -31,178.21 8,051.97 CNP 2009 2,620.38 -30,332.47 26,690.75 16,395.85 -15,407.17 -27,961.42 -14,292.29 -540,670.80 -51,612.78 29,359.04 -96,485.00 15,173.76 14,041.42 -10,530.32 CNP 2008 -1,364.63 -17,308.97 26,007.97 5,490.23 -9,298.84 -32,404.23 -13,694.08 -386,247.33 -58,195.27 17,308.06 -86,649.00 4,239.24 -3,934.15 -614.65 CNP 2007 -4,565.85 -16,749.39 23,292.39 3,011.56 -5,999.22 -23,224.74 -15,198.83 -237,976.07 -37,407.80 3,546.19 -19,811.00 -7,671.81 257.97 -226.58 CNP 2006 -6,554.19 -9,322.21 -3,302.61 17.88 384.87 -19,519.79 -11,478.15 -31,143.74 -36,480.23 2,078.71 11,904.00 -9,088.78 -540.72 3,008.80 28,143.00 -24,750.22 -20,818.12 -20,042.04 14,973.08 29,432.00 -8,360.25 -12,966.74 -11,631.85 8,047.03 9,960.00 -3,175.42 -8,417.63 -7,731.28 171.00 -4,051.00 114.51 -8,109.31 -3,836.12 6,490.84 Total -1,517,645.60 1,326,284.28 -976,968.93 -705,505.35 -552,145.46 -347,916.51 -119,427.24 Table 4 – Italian “Serie A” 2012-2013 teams Cumulated Adjusted Ebit (CAdjEBIT)* EUR Atalanta Bologna Cagliari Catania Chievo Fiorentina Genoa Inter Juventus Lazio Milan Napoli Palermo Parma Pescara Roma Sampdoria Siena Torino Udinese Total CAdjEBIT 2012 Not available -48,236.25 5,329.51 42,519.50 8,424.15 Not available Not available -904,536.42 -153,691.85 101,749.55 -179,022.00 77,443.73 6,523.44 7,219.76 -4,178.75 -43,492.00 -146,172.82 -80,101.07 Not available 47,110.49 CAdjEBIT CAdjEBIT CAdjEBIT CAdjEBIT CAdjEBIT CAdjEBIT 2011 2010 2009 2008 2007 2006 34.06 18,071.71 17,212.58 8,490.72 3,805.57 -3,424.56 -46,544.53 -44,823.79 -30,925.34 -18,783.55 -15,333.03 -8,964.04 -9,301.92 -7,134.50 -4,676.79 -6,151.28 -12,395.30 -6,857.39 34,184.41 23,971.12 19,795.74 11,365.70 6,715.39 457.34 4,853.40 4,555.91 4,588.65 8,459.73 7,120.25 3,430.21 -118,127.96 -68,355.49 -33,438.29 -42,284.91 -33,089.29 -29,062.64 -40,775.04 -32,674.50 -16,940.57 -18,768.52 -21,846.95 -11,381.43 -819,988.89 -734,276.36 -650,156.08 -500,489.88 -361,416.76 -173,378.57 -112,503.48 -20,348.68 -22,434.20 -36,475.36 -27,478.70 -33,948.37 102,471.09 80,929.52 73,263.36 50,448.04 16,575.53 18.64 -184,016.00 -109,766.00 -32,590.00 -37,152.00 35,874.00 47,751.00 51,198.15 35,486.05 32,264.45 12,122.06 -5,093.63 -8,280.90 9,713.18 -3,351.24 11,721.77 -10,747.82 -8,044.41 -11,311.04 -6,464.84 -5,191.85 -10,986.43 -3,030.67 -60.17 4,106.08 -5,456.11 -6,109.27 4,206.00 25,746.00 46,335.00 44,144.00 15,571.00 -6,740.00 -90,879.97 -66,252.48 -48,009.02 -28,287.94 -26,431.11 -14,388.09 -60,000.43 -31,474.65 -26,788.95 -20,329.67 -13,112.11 -7,579.10 -63,548.26 -41,932.35 -25,834.81 -14,735.35 -9,941.02 -5,913.50 24,629.31 11,904.42 14,457.37 906.66 -4,747.03 6,113.23 -1,490,522.24 1,326,317.81 -971,026.44 -683,141.56 -601,300.04 -453,327.74 -259,353.13 * For Adjusted ROI; we consider the (EBIT plus Gains from players trading when presented as Extraordinary Items less Losses from players trading when presented as Extraordinary Items) 10 As we can easily observe in Table 2; during the analysed time period R&I results are very different among Italian “Serie A” teams. Only two firms have to be considered large-sized firms; because their R&S are above EUR 150 M; almost in each observed year. Therefore rest; the majority of clubs in the “Serie A” league; is small-tomedium sized and in some cases we have very small entities (e.g. Pescara). Partly; R&I results are impacted by sporting results; as it has been argued by several Authors (cfr. previous section 1.1.); and many of the most significant effects on the R&I aggregates are due to relegations or promotions. Furthermore; we note that most part of R&Is for Italian professional football clubs stems from the following two main sources: 1. TV rights whose allocation among 2012-2013 “Serie A” league clubs is shown below in Table 5; and 2. income from Trading of Players’ Rights (IFPRT); whose distribution is shown in Table 6. The rest of R&Is comes from merchandising and; for Juventus only; from own stadium related business activities (Vendemiale 2013). Table 5 – Italian “Serie A” 2012-2013 teams Allocation of TV rights EUR M Juventus Milan Inter Napoli Roma Lazio Fiorentina Udinese Palermo Sampdoria Cagliari Torino Genoa Atalanta Bologna Catania Parma Chievo Siena Pescara Total Equal part 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 17.31 346.14 Fans 51.19 35.04 35.98 21.33 16.22 8.40 6.18 3.77 5.35 3.09 5.26 4.64 3.09 2.81 3.50 3.32 2.11 2.09 1.39 1.57 216.33 Citizens Previous season 3.11 4.12 4.28 3.71 4.28 2.47 4.15 3.92 5.69 3.09 5.69 2.89 1.35 3.50 0.73 3.30 1.68 0.62 1.19 1.44 0.76 2.06 3.11 1.03 1.19 0.82 1.49 1.24 1.34 1.65 1.47 2.68 0.60 2.27 0.37 1.85 0.37 0.41 0.44 0.21 43.29 43.28 Last 5 Historical years Results 11.13 8.24 11.74 7.83 12.36 7.42 9.89 4.94 10.51 7.00 8.04 5.77 8.65 6.59 9.27 3.30 7.42 2.47 6.18 5.36 5.56 2.88 1.24 6.18 6.80 3.71 4.33 4.12 2.47 4.53 3.71 1.65 4.94 2.06 3.09 0.41 1.85 0.82 0.62 1.24 129.80 Total 86.52 95.10 79.91 79.82 61.54 59.82 48.10 43.58 37.68 34.85 34.57 33.83 33.51 32.92 31.30 30.80 30.14 29.29 25.12 22.15 21.39 865.36 Table 6 – Italian “Serie A” 2012-2013 teams Income From Players Rights Trading (IFRPRT) EUR M Palermo Sampdoria Udinese Torino Napoli Parma IFPRT 2012 35;452.33 783.00 57;533.08 5;016.97 53;448.45 IFPRT 2011 25;408.12 19;052.00 41;879.02 5;103.00 9;137.52 37;184.23 IFPRT 2010 1;200.00 2;701.00 24;274.33 11;156.00 6;618.36 34;727.70 IFPRT 2009 49;653.73 7;942.03 36;967.94 9;600.00 10;046.57 25;666.81 IFPRT 2008 12;422.43 9;648.03 33;652.92 7;573.00 440.49 5;410.92 IFPRT 2007 22;848.16 1;004.04 13;869.07 704.00 4;921.44 IFPRT 2006 12;866.25 16;281.60 38;086.96 59.23 21;946.92 11 Genoa Pescara Catania Cagliari Bologna Atalanta Fiorentina Siena Chievo Lazio Juventus Inter Milan Roma Total 62;162.04 38;880.71 42;184.03 21;782.41 6;136.61 5;256.11 4;758.96 3;243.14 606.50 10;529.22 15;746.70 5;614.50 11;600.90 5;234.00 2;626.75 2;950.00 23;795.47 998.31 1.54 6;171.98 17;369.39 2;316.80 326.17 21;729.51 12;444.20 9;926.29 5.33 10;563.43 2;130.40 1;702.54 2;773.99 8;333.78 8;483.93 9;142.24 11;078.07 18;724.13 392.41 3;913.84 33;631.49 3;499.23 14;827.39 971.16 11;938.03 9;656.24 9;707.87 12;055.43 6;715.10 2;307.74 1;100.60 14;431.27 5;456.82 5;211.80 4;030.72 13;357.83 11;142.63 3;389.46 10;183.84 18;507.47 8;159.90 9;759.25 1.00 10;613.96 3.00 18;433.50 18;239.44 14;664.72 17;270.84 17;129.73 41;531.10 4;444.84 44;369.20 51;458.25 72;876.00 11;111.07 8;045.77 23;974.01 7;495.19 53;436.73 23;566.92 25;533.24 74;024.45 20;453.44 15;661.90 44;807.11 18;405.00 7;821.00 21;406.00 16;601.00 15;274.00 8;530.00 3;527.00 384;244.556 370;230.815 305;514.061 386;807.504 217;715.367 196;224.069 183;938.246 A closer look at Table 3 and Table 4 shows some interesting elements that highlights the importance of the research questions described above. Particularly; we can see in these tables that some clubs constantly produce net profits as well as positive levels of Adjusted EBIT (EBIT plus Gains from players’ rights when presented as Extraordinary Items less Losses from players’ rights when presented as Extraordinary Items). Therefore; the purpose of this paper is to try identifying the determinants of the positive earnings of those clubs. As mentioned; these factors have been considered in previous studies; in light of the hypothesised main goal of producing sporting results. However; in this paper we try proposing a different – though not necessarily contrasting – reading of these factors by looking at the following two aspects: 1. the economic determinants of football teams’ net profits or adjusted operating profits; which we investigate by splitting the total of Revenues and Income in their elementary parts; i.e. ordinary sales (according to mainstream literature and common practice) and revenues from players’ trading. 2. Furthermore; we cannot avoid appreciating the importance of stakeholder pressure; as mentioned above. To address this aspect; we considered governance related elements; especially those which corporate governance literature has detected as connected to the objective of achieving profitable objectives; notwithstanding strong external pressures. 1.3 Research hypotheses In order for us to investigate the conditions of existence of those clubs in the terms stated above; we test the following hypotheses: HP1. The operating performance of football clubs is a direct function of the relative weight of revenues from players trading as a share of football clubs’ total revenues HP2. The operating performance of football clubs is a direct function of the degree of concentration in the boards of directors. The first hypothesis builds on the evidence that markets10 where football players’ rights are traded; represent a relevant source of revenues for Italian football teams. Particularly; these markets can be looked at as a source of valuable reserves for football teams which; in the course of their ‘ordinary activities’ – that is; in providing sport 12 shows – can rely on these resources when economic and/or financial difficulties arise as a result of excessively onerous operating costs or investments. However; by looking at the financials of Italian professional clubs a different picture emerges. In fact; these markets are seldom a source of revenues of “last-resort”; while especially small and medium sized clubs rely on those markets as their primary source of earnings. We believe that; if verified; the proposed test under HP 1 will support the idea that the core business of football clubs is significantly oriented on players’ trading and much less on providing entertainment. In other words; far from relying on a “business-to-customer” model; football teams rely on a “business-to-business” model whereas producing entertainment via sport events is a means for increasing the “tradability” of individual players. The second hypothesis focuses on the need; especially for small and medium sized clubs; to maximise their operating ‘room of manoeuvre’ that is their ability to take decisions which are in the best interest of the club’s economic performance. Some corporate governance literature attributes the ability to take more rapid and sharper actions to relatively smaller boards as opposed to largely democratic structures. Klein 2002 recalls that “Lipton and Lorsch (1992); Jensen (1993); and Yermack (1996) argue that the board's decision-making quality decreases with board size because the more people in the group; the lower the group's coordination and processing skills (see Steiner 1972; Hackman 1990). Yermack (1996) finds evidence consistent with this argument” (p. 438). Consistently with these studies; we argue that when governance structures of football clubs; ie BoDs; increase their degree of democracy; the operating performance gets proportionally deteriorated because – as noted by Eisenberg; Sundgren and Wells (1998) – “increased problems of communication and coordination as group size increases; and decreased ability of the board to control management; thereby leading to agency problems stemming from the separation of management and control” (p. 37) (see also Bhagat and Black; 1996; Hermalin and Weisbach 2000)11. We believe that; if verified; this test shows how a lean governance structure may ‘protect’ the economic viability of football clubs from social and emotional pressures which may lead to anti-economic operating decisions. In sum; we believe that the combination of the two hypothesis; if verified; can shape a business model of football clubs whereas: (a) Football clubs pursue proper business objectives; that is guaranteeing their economic durability by means of establishing and maintaining a concentrated governance structure; and (b) Football clubs rely on players’ trading as their main driver of operating performance; so that the relative volume of revenues from ticket sales; merchandising activities and TV rights – ie those revenues relating to the football clubs in their capacity of show providers – are merely accessory activities to explain the operating performance of football teams. 2. Methodology In order to test HP 1; we analyse the determinants of operating profitability in terms of the main sources of revenues for fiscal years 2006-2012. In order to test HP 2; we analyse the association between size of the Boards of Directors and the operating profitability (Yermack 1996; Bhagat and Black 1996) of each Italian football team during fiscal periods 2006-2012. To verify the existence of any association between different drivers of business model and governance related variables and the operating profitability of football clubs; as expressed in terms of the Adjusted Return on 13 Investments (as shown earlier in Table 4 we largely deal with below in section 2.2); we estimated an OLS model where the Adjusted ROI is an interactive function of economic and financial related variables; discussed below in section 2.3.1 and a set of governance variables; discussed in section 2.3.2. Some of the former variables are control variables; as one of the latter is a control element too. 2.1 The sample The observed clubs are all those involved in Serie A league during season 2012-2013. We considered their consolidated (if any) or separate financial statements for the seven-year period between 2006 and 2012 (a total of 132 reports have been analysed). For most clubs; the reporting period ends on June 30th each year; however for a few clubs the reporting period ends on December 31st and therefore financial reports 2012 for these clubs were not available. For one club in the sample; financial statements for years 2006 through 2008 were not available as the legal entity it belonged to during that period defaulted in 2009. The complete list of clubs is reported above in Table 1. Most clubs report their financial statements under Italian GAAP; only three clubs report under IFRSs as they are listed in Italian Stock Exchange. We believe that this fact does not impact on our results nor it requires specific adjustments to the methodology applied as the share of publicly exchanged stocks is very limited and the significant equity injections which these clubs have requested to their main shareholders over the years have significantly diluted the interests of minority investors. 2.2 The dependent variable In order to verify the existence of any association between the determinants of the business model and the operating performance we considered an adjusted version of the Return on Investments ratio (“Adj ROI”) as a proxy of the profitability as our dependent variable. To reach a logical configuration of this ratio; we followed a two-step process. Firstly; we considered; for both listed and non-listed companies; the line items included in the Income Statement as required under Italian GAAP (“ITA GAAP”) and which total up to the “Risultato della Produzione”; also referred to as Operating profit balance (“OPER”). We acknowledge that the line items included in the IFRS income statement (rectius statement of profit or loss) differ in name from the items included in OPER under Italian GAAP. However; we made sure that consistency was achieved through the appropriate review of the notes referring to each single line item so that; regardless for the ‘taxonomy’ adopted in each set of statements (ITA GAAP and IFRSs respectively); line items were fully comparable content-wise. In order to ensure that the operating profitability includes revenues; gains; costs and losses from both the provision of sport entertainment and the activities of players’ trading; the OPER balance has been adjusted to include items classified under ITA GAAP as extraordinary items12. This adjusted balance (“OPERplus”) is therefore the sum of OPER and some extraordinary items. OPERplus is the numerator of the Adjusted ROI; we considered this figure as a proxy for the gross operating profit. The denominator of the Adj ROI is the sum of total assets. The resulting Adjusted ROI; therefore represents the ratio between OPERplus and Total Assets. 14 2.3 Selection of the independent variables In our research hypotheses there are two profiles to be tested in order to highlight the features of a potential business model of football clubs: (a) a purely economic aspect; that is the existence of any association between (i) the provision of sportshows and (ii) the activity of trading in players with the operating performance of football clubs; and (b) a governance-related aspect. 2.3.1 Economic variables The test involving economic variables highlights two potentially different business models; as described in section 1.1. We considered as total revenues the sum of revenues from the sport-event related activities and income from players’ trading activities; this is named after “Total Sales”. Because associativity applies to the elements which sum up to Total Sales; we test the nature of the business model from the economic perspective by reference to income from the sale of football players registration rights (“Trading Income”). Therefore our independent variable for the purpose of testing the business model from the economic viewpoint is the ratio between Trading Income and Total Sales which we refer to as “BUS_MOD”. We also considered four control variables to ensure that our results are not distorted by (i) the size of the football club (“SIZE”); (ii) the degree of its financial leverage (“LEV”); (iii) the value of its players’ expressed in terms of its intangible assets (“INTANG”) and (iv) the relative weight of depreciation charges for the intangible assets (represented by the players in the team) and the total personnel cost (“DEP&PERS”). 2.3.2 Corporate governance variables We considered the size of the Board of Directors (“BoD SIZE”) expressed in terms of the total number of directors (Klein 2002) in each of the 20 teams for 7 years considered (as noted above; one club defaulted in 2009 and 4 teams have not reported 2012 financial statement yet; as they close their fiscal year on December 31st); we only have 132 observations in our sample. We used control variables to ensure that the association between BoD SIZE and profitability is not distorted by (i) the nature of the entity in charge of performing external audit activities (“AUDIT”); this is expressed by means of a dummy variable to indicate the use of external auditors or the Board of Statutory Auditors. 3. Empirical results 3.1 Descriptive Statistics Table 7 here below shows the mean; median; minimum; maximum and first and third quartiles of the untransformed variables used in the regression analysis. 15 Table 7 - Descriptive Statistics for Untransformed Variables Used in Analysis of profitability of Italian Football Teams for a sample of 132 annual reports Hypothesis Variable Number Mean Minimum Q1 Median Q3 Maximum Adj ROI -0.0798 -1.1424 -0.1872 -0.0274 0.0503 0.2672 BUS_MOD 1 0.1885 0 0.0701 0.1535 0.2814 0.7056 LEV 2 -1.00 -123.13 -1.09 -0.15 0.35 24.865 INTANG 3 58.080 2499 21.140 47.841 78.948 209.495 DEP&PERS 4 0.4264 0.1071 0.2539 0.3799 0.5335 1.1275 SIZE 5 11.123 8.439 10.631 11.018 11.637 12.705 BoD SIZE 6 7.160 2 4 7 10 16 AUDIT 7 0.8015 0 1 1 1 1 Variable definitions: Adj ROI = Ratio between Operating Profit adjusted for Gains from Player Rights’ trading and Total Operating Assets. BUS_MOD = Ratio between Gains from Players Rights’ trading and Total Sales LEV = Ratio between Net Financial Position and Equity INTANG = Total Intangible Assets DEP&INT = Ratio between Depreciation of Intangible Assets and personnel cost SIZE = Logarithm of Total Sales BoD SIZE = the number of board members AUDIT (Dummy variable) = 1 if the auditors are from an external team; 0 otherwise. 3.2 Correlations Table 8 presents Pearson correlations between the transformed dependent and independent variables. Table 8 - Pearson correlation (and p-values) among the Dependent and Explanatory variables Adj ROI BUS_MOD NFP/E INTANG DEP&PERS BUS_MOD 0.153 0.079 LEV -0.024 0.053 0.817 0.549 INTANG -0.005 -0.054 0.128 0.952 0.573 0.144 DEP&PERS 0.165 0.245 -0.111 0.208 0.059 0.005 0.206 0.017 SIZE 0.337 -0.135 0.240 0.802 0.085 0.000 0.124 0.006 0.000 0.331 BoD SIZE -0.217 -0.169 0.183 0.571 -0.178 0.013 0.053 0.036 0.000 0.041 AUDIT -0.180 0.101 0.212 0.379 0.118 0.038 0.249 0.015 0.000 0.177 LN Sales BoD SIZE 0.543 0.000 0.372 0.000 0.188 0.031 Table 8 also shows that many explanatory variables are significantly correlated with each other. The tests of the formal hypothesis are based on multiple regression analysis. 3.3 Multiple Regression Results Equation 1 is the regression equation; the related empirical results are presented in Table here below. 16 Equation 1 Adj ROI = – 3.02 + 0.294 BUS_MOD – 0.00149 LEV – 0.000003 INTANG + 0.0856 DEP&PERS + 0.296 SIZE – 0.0231 BoD SIZE – 0.166 AUDIT Table 9- Explanatory variables of Adjusted ROI Based on Regressions for a Pooled Sample of 132 Annual reports (Years 2006-2012) Predictor Coefficient p-value BUS_MOD 0.32223 0.0000 -0.001668 0.1190 -0.00000045 0.0000 DEP&PERS 0.09431 0.1230 SIZE 0.30585 0.0000 *** -0.022233 0.0000 *** -0.17374 0.0000 *** LEV INTANG BoD SIZE AUDIT Adjusted R-square *** *** 0.593 ***; **; * Significant at the 0.01; 0.05; and 0.10 levels; respectively As shown in Table 9, the Adjusted R² is 0.593 which is fairly high compared to regression models applied in previous similar studies. We also tested the Durbin-Watsons statistics and do not reject the null hypothesis for autocorrelation. Adj ROI is significantly positively associated with BUS_MOD (p < 0.01) and negatively associated with Board Size (p < 0.01). Regarding our control variables; Adj ROI is significantly negatively associated with INTANG (p < 0.01); and AUDIT (p < 0.01); while it is positively associated with SIZE (p < 0.01). The positive association between Adj ROI and BUS_MOD is consistent with our initial hypothesis and with the theoretical framework which we referred to (Baroncelli and Lago 2004). These results indicate that the business model of Italian professional football clubs in the Serie A league would be better described with reference to the main determinant of its operating activities; that is the trading of players’ registration rights; rather than the provision of entertainment services through sporting events. The negative association between Adj ROI and Board Size is also consistent with our initial hypothesis and with part of the literature. This association could be explained by highlighting that a close board concentration allows for more profit-oriented activities and partly ‘immunises’ the club from social pressures on improving competitive sporting results at the expense of economic performance. This evidence also suggests that further research may confirm whether our understanding of the governance structure of football firms is correct in terms of the ownership structure of the club. In fact; the combination of the two factors; (i) negative correlation between operating performance and board size and (ii) positive correlation between ownership concentration 17 and operating performance; would indicate that clubs with a closer ownership oversight and with a direct involvement in the management of the club’s operating activities are key factors to explain football clubs profitability. On the other hand; larger boards may suffer from social pressures more significantly than smaller ones; this may be particularly true in the Italian case as football is certainly regarded as being the “national sport” and; especially in local communities; a right balance between profitability and reasonable competitive results may be difficult to achieve. Furthermore; the positive and negative associations concerning control variables are; in our opinion; consistent with previous literature. Particularly; the negative association between Adjusted ROI and the presence of an external (single person or firm) auditor can be explained with the fact that in Italy; especially individual entrepreneurs may be more willing to perceive external auditors as a burden to their ‘entrepreneurial freedom’ due to their lack of information with respect to the importance of having strong external monitoring bodies (such as an external auditor). In fact; the preference on appointing the Board of Statutory Auditors as external auditor adds a supplementary task that may reduce the level of oversight; leading to weaker attention in guaranteeing that reliable and faithfully representational financial statements are issued. By this means; clubs could more easily implement earnings management practices by reducing the degree of oversight (even if this could also increase the level of risks in operating and financial activities the club is exposed to). 4. Conclusions and suggestions for future research In this paper; we tried providing some evidence that football clubs; and particularly Italian professional clubs in the “Serie A” league; can be investigated with the lenses of ordinary business and that there exist profitability and governance patterns that are worth investigating to better understand the conditions of economic durability of football clubs. The importance of understanding the economic determinants of football clubs is two-fold: (i) expressing more informed judgements regarding the economic viability of football clubs; in order to put into effect any reward mechanisms for those teams which show a certain ability to remain fairly competitive and; at the same time; maintain a reasonable level of profitability; (ii) gaining a deeper understanding of the business model of football clubs; allows for better economic planning and for sharper actions in case of any restructuring plans. We also note from our analysis that the core activity driving the operating performance of football clubs identified in this paper; is poorly described in the accounting model provided by both groups of clubs; ie listed and not listed ones. We believe that the income statement should at least highlight the balance of the two main activities performed by Italian football clubs: (i) the result of the provision of sporting events to the public; and (ii) the result of players’ registration rights trading. Finally; this research may represent a seminal work for future contributions in the area of business and accounting research on football clubs; at least in two respects: (i) on one hand; it would be interesting to investigate whether the general business model identified in this paper can be equally applied to all football clubs regardless for their dimension; popularity; ownership structure and nationality. We believe that this is not necessarily the case. Particularly; our findings suggest 18 that within the general business model identified in this work; future research may look at identifying at least two possible clusters of football clubs in the Italian “Serie A” league (and possibly in other national or international leagues as well): (i) the “providers” of players; and the (ii) “consumers” of players. (ii) On the other hand; our identification of the business model of Italian professional football clubs may suggest a revision of the existing accounting schemes (or models) under which; at present; financial information of football clubs are reported in Italy. For example; an accounting model consistent with our findings would be one that shows; in terms of presentation of the income statement; at least a distinction between the balance of “sport shows-related activities” and “players’ trading activities”13. Furthermore; in light of our conclusions; also the measurement aspects of the “available for sale” or “held for trading” players may need to be revised in order to present their current values; rather than their historical cost information; in this respect we believe that for football clubs could apply the following: “Where the firm’s business model is not to transform its inputs; but to buy and sell assets in the same market with the intention of profiting from changes in market prices; we would expect that fair value would generally be the most useful basis of measurement” (ICAEW 2010; p. 42). In this respect; a relevant question arises about the correct classification of players’ rights in the financial statements and also the annual impairment assessment of these assets. These issues may be considered for further analysis (possibly by broadening the scope of the study to other European football teams) not only by academics; but also by accounting standard setters which will be increasingly interested in the next future in assessing the “real” value of the intangible assets embedded in entities’ financial statements (IASB December 2012). 19 Reference List Amir E. e Livne G.; Accounting; Valuation and Duration of Football Player Contracts; in Journal of Business Finance & Accounting; Vol. 32; n. 3-4; April/May 2005 Antitrust; Indagine conoscitiva 27: Settore del calcio professionistico;2008 Antitrust; Segnalazione 1773; 2013 Antonioni P.; Cubbin J.; The Bosman Ruling and the Emergence of a Single Market in Soccer Talent; in European Journal of Law and Economics; Vol. 9; Iss. 2; 2000 Ascari G.; Gagnepain P.; Spanish Football; in Journal of Sports Economics; Vol. 7 Iss. 1; February 2006 Barajas A.; Fernández-Jardón C. and Crolley L.; Does sports performance influence revenues and economic results in Spanish football? MPRA Paper No.3234; 2005 Barros C.P.; Portuguese Football; in Journal of Sports Economics; Vol. 7 Iss. 1; February 2006 Bauer R.; Aree critiche di revisione delle società di calcio; in Revisione Contabile; n. 41; 2001 Bhagat; S.; Black; B.; Do independent directors matter? (March 1996 paper presented at the American Law and Economics Association Meeting; Chicago; May 10-11; 1996) Bianchi L.A.; Corrado D.; I bilanci delle società di calcio. Le ragioni di una crisi; Milano; Egea; 2004 Bianchi M; I mali del calcio si leggono nei bilanci; in Contabilità; finanza e controllo; vol. 10; 2002. Bianchi M.T.; Di Siena M.; Il bilancio delle società di calcio: gli effetti della sentenza Bosman; in “Auditing”; n. 37; gennaioaprile 2000 Bollen P.; Influence of sports performance on financial performance in Dutch football; Master thesis study Financial Management; Tilburg School of Economics and Management; 2010 Boughes S.; Downward P.; The Economics of Professional Sports Leagues: some insights of the reform of transfer market; in Journal of Sports Economics; Vol. 2; 2003 Buraimo B.;Simmons R.; Szymanski S.; English Football; in Journal of Sports Economics; n. 7; 2006 Busardò P. ; Il bilancio delle società di calcio professionistiche: trattamento contabile del «parco giocatori»; in Rivista dei Dottori Commercialisti; n. 6; 2004 C. Zott; R. Amit; L. Massa – The business model: theoretical roots; recent developments; and future research – Working Paper IESE Business School; 2010 Cairns J.A.; Jennet N.; Sloane P.J.; The Economics of Professional Team Sports: A Survey of Theory and Evidence; in Journal of Economics Studies; Vol. 1; 1986. Carmichael F.; Forrest D.; Simmons R.; The labour market in Association Football: Who gets transferred and for how much?; in Bulletin of Economic Research; Vol. 51; Iss. 2; 1999 Catturi G.; La contabilizzazione dell’indennità di preparazione e di promozione nelle società di calcio; “Rivista Italiana di Ragioneria ed Economia Aziendale”; n. 9-10; 1984 Cesarini G.; Aspetti particolari del bilancio d’esercizio delle società di calcio; in Rivista Italiana di Ragioneria ed Economia Aziendale; Vol. 12; 1985 Cincimino S.; La valutazione e la rappresentazione della risorsa calciatore nei bilanci delle società di calcio professionistiche; Gulotta; Palermo; 2008 Cincimino S.; Tomaselli S.; Carini F.; The model of governance of the professional football sector in Italy: a critical analysis; in Journal of Sport Sciences and Law; vol. V; fasc. 3-4; sez. 1; 2012 Committeri G.M. and Melidoni F.; Bilanci nel pallone: vecchi problemi e nuovi scenari; in Amm. e Finanza; vol. 20; 2003 De Vita G.; Il bilancio di esercizio nelle società di calcio professionistiche; Lega Calcio serie C; 1998 Dejonghe T.; Vandeweghe H.; Belgian Football; in Journal of Sports Economics; Vol. 7; Iss. 1; February 2006 Dello Strologo A. and Celenza D.; L’esposizione in bilancio dei diritti alle prestazioni sportive dei giocatori professionisti nel paradigma IAS-IFRS; in Rass. Diritto e Economia dello sport; Vol. 2; 2008 Deloitte; Annual Review of Football Finance; 2003 Deloitte ; Annual Review of Football Finance; 2004 Deloitte; Annual Review of Football Finance. A Changing Landscape; 2005 Deloitte; Money League Changing of the guard; Febbraio 2006 Deloitte; Annual Review of Football Finance. All Eyes on Europe; 2006 Deloitte; Annual Review of Football Finance 2007. Taking New Direction; 2007 Deloitte ; Annual Review of Football Finance; 2008 Deloitte ; Annual Review of Football Finance; 2009 Deloitte; Annual Review of Football Finance; 2010 Dobson S.; Gerrard B.; Howe S.; The determination of transfer fees in English nonleague football; in Applied Economics; Vol. 32; 2000 Dobson S. and Goddard J.; Economics of Football; Cambridge University Press; 2001 20 Eisenberg; T.; S. Sundgren; M. Wells; ‘Larger Board Size and Decreasing Firm Value in Small Firms’; Journal of Financial Economics; Vol. 48; 1998 Fiori G.; La valutazione dei diritti pluriennali alle prestazioni degli sportivi professionisti: una possibile metodologia; in Rivista Italiana di Ragioneria ed Economia Aziendale; n. 7-8; 2003 Forker J.; Discussion of Accounting; Valuation and Duration of Football Player Contracts; in Journal of Business Finance & Accounting; Vol. 32; n. 3-4; 2005 Frau A.; Le svalutazioni dei diritti pluriennali alle prestazioni degli sportivi professionisti; in Rivista Italiana di Ragioneria ed Economia Aziendale; n. 5-6; 2004 Frau A.; Prima adozione degli Ias-Ifrs nelle società di calcio quotate in borsa; in Rivista Italiana di Ragioneria ed Economia Aziendale; n. 7-8; 2007 Freeman; R. E.; Strategic management: A stakeholder approach; Boston; Pitman; 1984. Frick B.; Prinz J.; Crisis? What Crisis? Football in Germany; in Journal of Sports Economics; Vol. 7; Iss. 1; February 2006 Gerrard B.; Going down; going down; going down: the economics of relegation; Comunicacion al 10th EASM Congress. Jyvaskyla; 4-7 September; 2002. Gouguet J.J.; Primault D.; The French Exception; in Journal of Sports Economics; Vol. 7; Iss. 1; February 2006 Gravina G.; Il bilancio d’esercizio e l’analisi delle performance nelle società di calcio professionistiche. Esperienza nazionale ed internazionale; Milano; FrancoAngeli; 2012 Groot L.; De-commercializzare il Calcio Europeo e Salvaguardarne l'Equilibrio Competitivo: Una Proposta Welfarista; in Rivista di diritto ed Economia dello Sport (Journal of Law and Economics of Sport); Vol. 1; n. 2; 2005. Hall S.; Szymanski S.; Zimbalist A. S.. Testing causality between team performance and payroll: The cases of major league baseball and English soccer; in Journal of Sports Economics; Vol. 3; Iss. 2; 2002. Hermalin and Weisbach; Boards of Directors as an Endogenously Determined Institution: A Survey of the Economic Literature; Working Paper (University of California; Berkeley); 2000. Hoehn T. and Szymanski S.; The Americanization of European football; Economic Policy; Vol. 14; n. 28; 1999. IASB – International Accounting Standards Board; Bound Volume 2012; IFRS Foundation; 2012 IASB – International Accounting Standards Board; Feedback Statement: Agenda Consultation 2011; IFRS Foundation; December 2012 ICAEW – Institute of Chartered Accountants of England and Wales; Business models in accounting: the theory of the firm and financial reporting; 2010 Jensen M.; The Modern Industrial Revolution; Exit; and the Failure of Internal Control Systems’ in Journal of Finance; Vol. 48; 1993. Lacchini M. and Trequattrini R.; La stima del valore economico dei diritti pluriennali alle prestazioni sportive dei calciatori professionisti: un approccio innovativo; in Rassegna di Diritto e Economia dello sport; Vol. 1; 2008 Lago U.; Baroncelli A.; Szymanski S.; Il Business del Calcio. Successi sportivi e rovesci finanziari; Milano; EGEA; 2004 Lago U.; Baroncelli A.; Italian Football; in Journal of Sports Economics; Vol. 7; Iss. 1; 2006 Lago U.; Simmons R.; Szymanski S.; The Financial Crisis in European Football. An Introduction; in Journal of Sports Economics; Vol. 7 Iss. 1; February 2006 Lipton; M. and J. Lorsch; A Modest Proposal for Improved Corporate Governance; in Business Lawyer; Vol. 48; 1992 Mancin M.; ; Il bilancio delle società sportive professionistiche. Normativa civilistica; principi contabili nazionali e internazionali (Ias/Ifrs); Padova; CEDAM; 2009 Manni F.; Calciatori professionisti: valori in bilancio in caso di trasferimento; in Contabilità; Finanza e Controllo; Anno XXIII; 2000 Manni F.; Le società calcistiche. Problemi economici; finanziari e di bilancio; Giappichelli; Torino; 1990 Melidoni F.; Committeri G.M.; Il bilancio delle società di calcio; Ipsoa; Milano; 2004 Michie J.; Verma S.; Corporate Governance and Accounting Issues for Football Clubs; Birkbeck College Football Governance Research Centre; London; 1999 Morrow S.; Putting people on the balance sheet: HRA applied to professional football clubs; Royal Bank of Scotland Review; Vol. 174; 1992 Morrow S.; Recording the human resource of football players as accounting assets: establishing a methodology; Irish Accounting Review; Vol. 2; n. 1; 1995 Morrow S.; Football Players as Human Assets. Measurement as the Critical Factor in Asset Recognition: A Case Study Investigation; in Journal of Human Resource Costing & Accounting; Vol. 1 Iss. 1; 1996 Morrow S.; Football players as human assets. Measurement as the critical factor in asset recognition: a case study investigation; in Journal of Human Resource Costing & Accounting; Vol. 1; n. 1; 1996 Morrow S.; The New Business of Football; MacMillan Business; 1999 Morrow S.; Scottish Football: It's a Funny Old Business; in Journal of Sports Economics; Vol. 7 Iss. 1; February 2006 21 Murphy P.; Banking on Success: examining the links between performance and the increasing concentration of wealth in English elite football; Singer &Friedlander; 1999a; Review 1998-99 Season. Murphy P.; For richer; for poorer north of the border: examining the link between resources and performance in Scottish elite football; Singer & Friedlander; 1999b; Review 1998-99 Season. Neale W.C.; The Peculiar Economics Of Professional Sports. A Contribution To The Theory Of The Firm In Sporting Competition and in Market Competition; in The Quarterly Journal of Economics; Vol. LXXVIII February; No. 1; 1964 Nicoliello M.; La valutazione dei diritti pluriennali alle prestazioni dei calciatori nei club italiani quotati dopo la transizione ai principi contabili internazionali; Rivista dei Dottori Commercialisti; n. 3; 2011 Onesti T. e Romano M.; La valutazione dei diritti pluriennali alla prestazioni sportive nelle società di calcio; in Rivista dei Dottori Commercialisti; n. 2; 2004 Page M.; Business models as a basis for regulation of financial reporting; in Journal of Management and Governance; October 2012 Pezzoli S.; Capitale e reddito delle società sportive con particolare riferimento alle società di calcio; in Rivista Italiana di Ragioneria e di Economia Aziendale; Vol. 5-6; 2007 Price Waterhouse Coopers (PwC); Report Calcio 2013; (with Arel) 2013 Regoliosi C.; Alcune riflessioni aggiuntive sul valore in bilancio dei Diritti Patrimoniali relativi alle prestazioni dei calciatori professionisti alla luce delle novità del Regolamento FIFA; in Rivista Italiana di Ragioneria ed Economia Aziendale; 2010 Regoliosi C.; Gli effetti degli Ias/Ifrs sui bilanci delle società calcistiche quotate; in Rivista dei Dottori Commercialisti; n. 5; 2006 Risaliti G.; Verona R.; Players’ registration rights in the financial statements of the leading Italian clubs; in Accounting; Auditing and Accountability Journal; Vol. 26; n.1; 2013 Rottenberg S.; The baseball player’s labor market; in Journal of Political Economy; Vol. 64; Iss. 3; 1956 Rowbottom N.; The application of intangible asset accounting and discretionary policy choices in the UK football industry; in British Accounting Review; Vol. 34; 2002 Rusconi G.; Il bilancio d’esercizio nell’economia delle società di calcio ; Cacucci; Bari; 1990 Sloane P. J.; The Economics of Professional Football: The Football Club as a Utility Maximiser; Scottish Journal of Political Economy; 1971 Sloane; P. J.; The Labour Market in Professional Football; British Journal of Industrial Relations; 1969 Suchman M.C.; Managing Legitimacy: Strategic and Institutional Approaches; Academy of Management Journal; 1995; Vol. 20; Iss. 3; pp. 571 - 610 T. W. Malone; P.Weill; R.K. Lai; V.T. D’Urso; G. Herman; T. G. Apel; and S. L. Woerner - Do Some Business Models Perform Better than Others? - Working Paper MIT Sloan School of Management; 2006 Tanzi A.; La gestione economica delle società sportive tra esigenze di bilancio e aspettative della tifoseria; in Rassegna Diritto Economia dello sport; Vol. 1-2; 2006 Tanzi A.; Le società calcistiche. Implicazioni economiche di un “gioco”; Torino; Giappichelli; 1999 Teodori C. L’economia ed il bilancio delle società sportive. Il caso delle società di calcio; Giappichelli; Torino; 1995 Trussel; 1977; Trussel P.; Human resources accounting and the football league; in Management Decision; Vol. 1; 1977 Tunaru R; Clark E.; Viney H.; An option pricing framework for valuation of football players; in Review of Financial Economics; Volume 14; Issues 3–4; 2005 UEFA; The UEFA Club Licensing Benchmarking Report Financial Year 2010; 2010 UEFA; The UEFA Club Licensing System and Financial Fair Play Regulations; 2012Valeri M.; Standard IAS/IFRS e nuove esigenze di disclosure nei bilanci delle società di calcio; Torino; Giappichelli; 2008 Vendemiale L.; L’Udinese come la Juve: al via i lavori per lo stadio di proprietà; in Il Fatto Quotidiano online; www.ilfattoquotidiano.it; 14 maggio 2013. Yermack D.; Higher market valuation of companies with a small board of directors; in Journal of Financial Economics; Vol. 40; 1996 We note that in the particular context of professional football clubs –at least in Italy – the traditional Agency (Jensen and Meckling 1976) and Managerial Capitalism (Berle and Means 1932) theories do not necessarily explain the nature of the relationship that exists between clubs’ owners and managers. This is because the degree of control that the former exercise on the latter, with respect to the core business decisions (such as buying/selling key players or hiring/firing a team’s coach), 1 22 is so pervasive that there is a low level of information asymmetry. Furthermore, at present, most chairmen or CEOs of Italian football clubs are the owners themselves. This may suggest that governance-related features need to be interpreted in a way that considers this peculiarity of football teams, so that for example, a small number of members of the BoD does not necessarily signal a situation of lack of transparency or a reduced degree of collegial decision making, but it reflects the fact that majority owners are also directly involved in the clubs top management. 2 In the Italian context see Catturi 1984; Manni 2000; Bauer 2001; Fiori 2003; Busardò 2004; Onesti and Romano 2004; Frau 2004, 2007; Lacchini and Trequattrini 2008; Dello Strologo and Celenza 2008; Regoliosi 2010; Cincimino 2008; Nicoliello 2011; Risaliti and Verona 2013. 3 Regoliosi 2010, eventually, proposed an alternative model to fair value and historical cost for the measurement of players’ registration rights. 4 Lucifora and Simmons 2003 tested the existence of determinants of superstar wages in Italian context, even if with reference to a short period. 5 From a purely economic perspective, football clubs are very peculiar entities as the competitive conditions of the market they operate in are different from the ordinary competitive conditions of firms which do not operate either in monopolistic or oligopolistic conditions. In fact, as opposed to ordinary businesses, football (as any other sport) clubs benefit the most when there is a perfect degree in competition with the other teams in the same league. The existence of a team that is far more competitive than the others in the same league (a sort of monopoly situation) pushes its earnings close to zero, and even in the case of a few strong competitors (a second-best hypothesis in main stream economic theories) the reasonable expected returns are lower than those arising from a market with a situation of perfect competition. See Neal 1964. From this perspective, in fact, it has also been noted that “sports fan interest is greatest when sporting competition is at its most intense” (Boughes and Downward 2003, p. 88) and that sports fans are football teams customers. See also Rottenberg 1956, Cairns, Jennet, Sloane 1986 and Dobson and Goddard 2001. From a different perspective, El Hodiri and Quirk (1971) contributed to better understanding the peculiarities of the football business environment according to antitrust rules (for the Italian antitrust regulation, see Autorità Garante della Concorrenza e del Mercato 2008; 2013). 6 We acknowledge that the notion of ‘business model’ has assumed several meanings and that no shared definition exists among different disciplines where this term is most frequently adopted (for example, Zott, Amit and Massa 2010 considered the concept of business model in the following areas: e-business, information technology in organizations, strategy, innovation and technology management), also Page 2012 provided an overview of the term business model in the context of financial regulation. Throughout this paper we will consider the notion of business model by referring, in general, to those factors that are able to explain the operating performance of football clubs. 7 This seems to be a key issue for the owners of professional football teams; in fact, we noticed the growing tendency to select different managers to cover different positions in football teams, by separating, for example, those who are in charge of technical-sport issues (attributed to a general manager or to an operating one) from those involved in economic, financial and commercial issues (whose responsibilities are attributed to internal sector specialists or to external professionals). The importance of effectively managing business-related aspects is particularly important nowadays due to the growing pressure that the strategic option to build club-owned stadiums has gained as a means for increasing volume and nature of revenues by expanding the portfolio of business activities (e.g. hospitality, food services, shopping center, etc. also by means of selected agreements with travel agencies and tour operators, schools and universities, etc.). 8 Fiscal year aggregated results are the sum of results of the same 20 teams, even if some of them had undergone relegation in past seasons, or have classified in different tournaments. 9 The different timeframe considered also explains the differences in our balances for each measure compared to those from PwC (2013). 10 The reference to the term “market” is not intended in the sense of “active market” as defined in IAS 38 Intangible Assets as the market for players’ rights does not qualify as an active one according to the requirements of this standard. 11 “We do not argue that good corporate governance produces good corporate performance. Some of the most successful companies are managed by entrepreneurs who disdain what we view as good corporate governance” (Lipton and Lorsch 1992, p. 64). 12 In NOIF accounts (the Italian football federation accounting and organizational rules), any club may choose to recognize gains and losses from trading either as extraordinary or operating items. 13 Recently, according to the NOIF regulation, Italian teams have to disclose in a specific section (in tabular form) of their annual reports, the result from players trading, however this additional information have not attracted significant interest so far. 23