CEBR - Economic Impact Report

advertisement

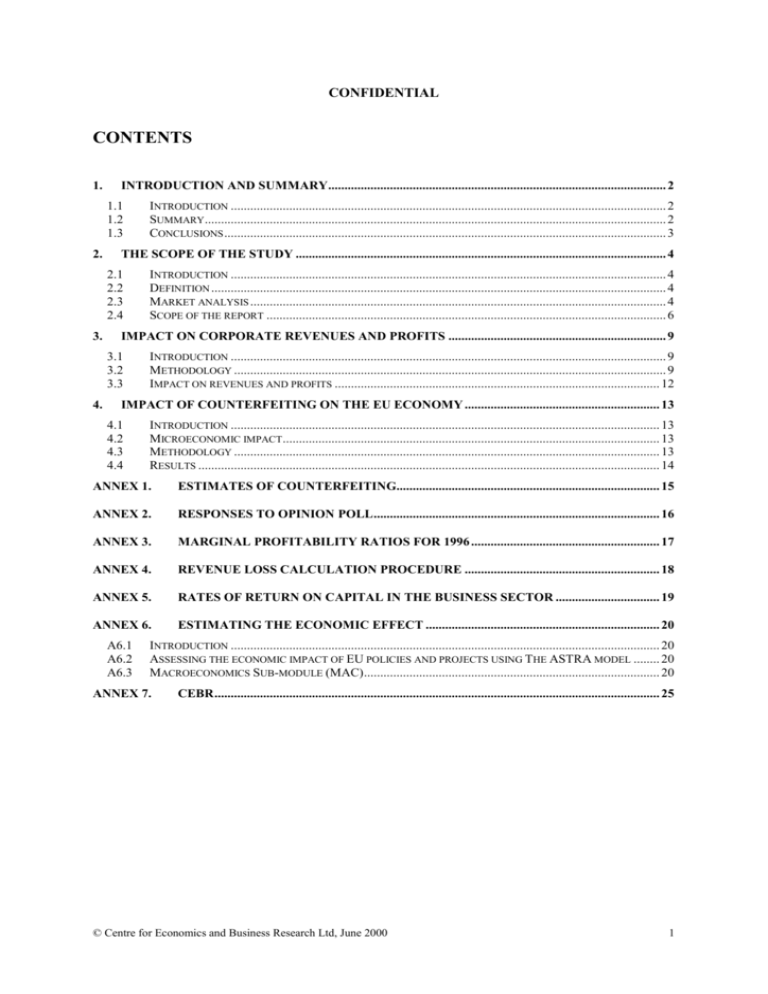

CONFIDENTIAL CONTENTS 1. INTRODUCTION AND SUMMARY ........................................................................................................ 2 1.1 1.2 1.3 2. THE SCOPE OF THE STUDY .................................................................................................................. 4 2.1 2.2 2.3 2.4 3. INTRODUCTION ...................................................................................................................................... 4 DEFINITION ............................................................................................................................................ 4 MARKET ANALYSIS ................................................................................................................................ 4 SCOPE OF THE REPORT ........................................................................................................................... 6 IMPACT ON CORPORATE REVENUES AND PROFITS ................................................................... 9 3.1 3.2 3.3 4. INTRODUCTION ...................................................................................................................................... 2 SUMMARY.............................................................................................................................................. 2 CONCLUSIONS ........................................................................................................................................ 3 INTRODUCTION ...................................................................................................................................... 9 METHODOLOGY ..................................................................................................................................... 9 IMPACT ON REVENUES AND PROFITS .................................................................................................... 12 IMPACT OF COUNTERFEITING ON THE EU ECONOMY ............................................................ 13 4.1 4.2 4.3 4.4 INTRODUCTION .................................................................................................................................... 13 MICROECONOMIC IMPACT .................................................................................................................... 13 METHODOLOGY ................................................................................................................................... 13 RESULTS .............................................................................................................................................. 14 ANNEX 1. ESTIMATES OF COUNTERFEITING................................................................................. 15 ANNEX 2. RESPONSES TO OPINION POLL ........................................................................................ 16 ANNEX 3. MARGINAL PROFITABILITY RATIOS FOR 1996 .......................................................... 17 ANNEX 4. REVENUE LOSS CALCULATION PROCEDURE ............................................................ 18 ANNEX 5. RATES OF RETURN ON CAPITAL IN THE BUSINESS SECTOR ................................ 19 ANNEX 6. ESTIMATING THE ECONOMIC EFFECT ........................................................................ 20 A6.1 A6.2 A6.3 INTRODUCTION .................................................................................................................................... 20 ASSESSING THE ECONOMIC IMPACT OF EU POLICIES AND PROJECTS USING THE ASTRA MODEL ........ 20 MACROECONOMICS SUB-MODULE (MAC) ........................................................................................... 20 ANNEX 7. CEBR ......................................................................................................................................... 25 © Centre for Economics and Business Research Ltd, June 2000 1 CONFIDENTIAL 1. INTRODUCTION AND SUMMARY 1.1 INTRODUCTION This report describes a study, carried out by the Centre for Economics and Business Research (CEBR) for the Global Anti-Counterfeiting Group (GACG), of the impact of counterfeiting on four key sectors in the European Union (EU) and on the EU economies. It is an extension of a similar study focusing on the UK, which CEBR completed on behalf of GACG. This study aims to model the impact of counterfeiting within an economic methodology and to quantify the economic impact of counterfeiting in 4 key sectors and on the economies of the EU. By describing and quantifying the economic effects of counterfeiting on the EU, the report addresses some of the questions raised in the European Commission’s Green Paper on Combating Counterfeiting and Piracy in the Single Market. Section 2 outlines the scope of the study, describing the term ‘counterfeiting’, giving a brief summary of the four industries analysed, and providing an overview of the economic and social impact of counterfeiting. Section 3 describes the model and methodology that has been used within this report to quantify the loss to the affected industries due to counterfeiting. The section then quantifies the cost from counterfeiting to the clothing and footwear, pharmaceutical, toys and sports equipment, and perfume and cosmetic industries, measured as loss of revenues and loss of profits. Section 4 uses these estimates of the effects on these industries as the inputs to the CEBR model of the EU economies to calculate the overall loss to the EU economy in terms of employment and GDP. 1.2 SUMMARY The study shows that counterfeiting has a serious impact on the revenues, profits and investment levels of the four sectors studied. Counterfeiting reduces company revenues, stifles investment and innovation, and retards economic growth. Its final effects on the general economy are observed directly through job losses and reduced GDP. 1.2.1 Impact on revenues It shows that counterfeiting in the EU reduces revenues substantially in the affected industries: i) by €7,581 million annually in clothing and footwear; ii) by €3,017 million annually in perfumes and cosmetics; iii) by €3,731 million annually in toys and sports equipment; and iv) by €1,554 million annually in pharmaceuticals. © Centre for Economics and Business Research Ltd, June 2000 2 CONFIDENTIAL 1.2.2 Impact on profits In this study, estimates of profit loss were obtained by applying marginal profitability ratios to estimates of revenue loss in each sector. This approach differs from that adopted in the UK study where we applied average profitability ratios. The main costs from counterfeiting are at the margin (i.e. losses to legitimate producers for every extra counterfeit unit sold). This means that the marginal profitability of producing counterfeit goods is a substantial multiple of the average profitability. In addition the study shows that profits are reduced by significant amounts: 1.2.3 i) by €1,266 million annually in clothing and footwear; ii) by €555 million annually in perfumes and cosmetics; iii) by €627 million annually in toys and sports equipment; and iv) by €292 million annually in pharmaceuticals. Impact on the EU economy The study also shows that counterfeiting has a significant impact on the EU economy because of the impact on profitability and investment. This negative technology shock acts to reduce GDP and employment. Our analysis indicates that the macroeconomic impact on the EU economy of counterfeiting in these 4 industries is to: 1.3 i) reduce GDP by €8,042 million (at 1995 prices) per annum; and ii) reduce EU employment by 17,120 jobs. CONCLUSIONS Counterfeiting leads to lost revenue and profits for the sectors concerned. These sectors also make a significant contribution to the EU economies, through generating jobs and tax revenues. The study indicates that counterfeiting not only harms these 4 industries substantially, but also reduces GDP growth and employment in the EU economy. © Centre for Economics and Business Research Ltd, June 2000 3 CONFIDENTIAL 2. THE SCOPE OF THE STUDY 2.1 INTRODUCTION This section outlines the scope of the study, describing the term ‘counterfeiting’, giving a brief summary of the four industries analysed, and providing an overview of the impact of counterfeiting. 2.2 DEFINITION Counterfeit goods are defined as: “goods, including the packaging thereof being without authorisation a trade mark which is identical to the trade mark validly registered in respect of the same type of goods, or which cannot be distinguished in its essential aspects from such trade mark, and which thereby infringes the rights of the holder of the trade mark in question under Community law or the law of the Member State in which the application for action by the customs authorities is made any trade mark symbol (logo, label, sticker, brochure, instructions for use or guarantee document) whether presented separately or not, in the same circumstances as the goods referred to in the first indent packaging materials bearing the trademarks of counterfeit goods, presented separately in the same circumstances as the goods referred to in the first indent1.” 2.3 MARKET ANALYSIS Counterfeiting is a growing problem across the world. Counterfeiters no longer target luxury goods with developed brands but have also moved into other wider sectors. However, its impact still remains greatest in these high-end markets. Its prevalence in certain sectors such as pharmaceutical and toys poses an additional threat to public health and safety. Less well documented but no less of a problem is counterfeiting within other industries. This report investigates four other industries where counterfeiting is a particular problem: 2.3.1 i) clothing and footwear; ii) the pharmaceutical industry; iii) toys and sports equipment; and iv) the perfume and toiletries industries. Clothing and footwear Counterfeiting is a major problem within the clothing and footwear industry. It occurs especially within the “designer label” market, and the highly lucrative market of high 1 European Commission Council regulation (EC) No 3295/94. © Centre for Economics and Business Research Ltd, June 2000 4 CONFIDENTIAL street fashion. This sector is especially prone to counterfeiting because these products are relatively easy to emulate. This acts as a strong disincentive for designers to innovate with the knowledge that within a month a factory in South East Asia is able to copy both the design and the label and ship the counterfeited goods to markets in the EU. Clothing and footwear is different from the other industries considered in this study, because within this market normally the consumer knows that they are buying a fake item. We estimate that EU clothing and footwear industry generated approximately €238 billion of sales in 1998. 2.3.2 Perfume and toiletries The EU perfume and toiletries market in 1998 was worth €42 billion. A few large companies with carefully built up brand names and images dominate the market. Economies of scale are large, with most of the costs within the industry being the fixed costs of marketing, design and research and development. These characteristics, similar to those of the clothing industry, makes the industry susceptible to counterfeiters who can take advantage of the brand name to sell at premium prices without the fixed costs faced by legitimate businesses. 2.3.3 Toys and sports equipment This market is worth approximately €35.5 billion, with the level of counterfeiting in the industry, it constitutes a significant economic problem. The toy market is not characterised by company brand names in the classical sense but by TV and film brands. This strong brand awareness and the intense advertising in the run-up to Christmas create ideal conditions for profitably counterfeiting branded products. Moreover, much of the counterfeit toy trade is produced in the same areas as the legitimate toy trade (South East Asia and China), thus facilitating the production of counterfeit products. 2.3.4 Pharmaceuticals The market size is estimated at €26.9 billion in the EU. Counterfeiting of pharmaceutical products is not only a serious problem for the legitimate pharmaceutical companies in the form of lost revenues but also for consumers in that the counterfeit products are likely not to have the medicinal value of the genuine products and may indeed be positively dangerous. This problem is becoming endemic in developing countries and Eastern Europe where within these countries there are well-documented cases of deaths and serious illnesses from the consumption of fake medicine. Although some of the counterfeit pharmaceuticals have the same active ingredients as branded products, others contain no active ingredients and in worse cases may contain harmful, or incorrectly mixed active ingredients. A study carried out in 1988 concluded that 51% of counterfeit drugs originated from the European Community and 46% were sold in developing countries. However for most countries within the Western Europe and the US, national governments believe that the level of pharmaceutical counterfeiting is insignificant, presumably because domestic © Centre for Economics and Business Research Ltd, June 2000 5 CONFIDENTIAL sales of counterfeit products are low. Only Italy has reported domestic manufacturing of counterfeit medicines. 2.4 SCOPE OF THE REPORT In this study, the main costs of counterfeiting that are considered are set out below. There are clear costs to: i) the companies whose products are counterfeited; and ii) those to the economy of the country where the genuine products would otherwise have been developed and manufactured. There are other areas where the impact of counterfeiting is more mixed: i) the impact to the economies of the countries where the counterfeit products are manufactured; and ii) the costs to consumers of counterfeit products. In addition to these costs, there are also potential consumer gains from counterfeiting. 2.4.1 Costs to companies whose goods are counterfeited While there are obvious costs to companies in terms of reduced sales and profits as they are forced to compete directly against counterfeiters for market share. Other hidden costs exist which impact on the firm in different ways. There is a loss of future sales from customer who have been deceived into buying the inferior counterfeit believing it to be the original. Companies incur significant expense protecting their products, conducting investigations and litigation. 2.4.2 Costs to the country where legitimate goods would otherwise have been manufactured With many counterfeits manufactured outside of the EU and imported, those genuine articles manufactured in the EU are in direct competition with their counterfeit imports. The EU as a whole will experience a loss in output and jobs with the loss in demand from EU consumers of genuine goods. Exports are also affected directly, as companies have to compete with counterfeit goods at home and abroad. Counterfeiting leads to reduced tax revenues as corporate tax, indirect and income tax revenues are reduced. Since very few manufacturers of counterfeit goods will pay any company/income taxes, this will result in lower tax receipts and hence either a direct loss in spending or indirect loss through higher taxes for legitimate businesses. The negative multiplier effect on this lower government spending will result in substantial losses. The effects of counterfeiting on employment are more pervasive than it might first appear. There are three main effects on employment. The primary effect is the reduction in employment as a direct result of a fall in sales and profits. A secondary effect occurs when firms who supply or service these sectors also reduce employment as demand for their services declines. And the third effect occurs when induced-demand falls as a © Centre for Economics and Business Research Ltd, June 2000 6 CONFIDENTIAL consequence of the reduction in expenditure by the employees directly employed in the sector. Lastly like companies, governments in countries where counterfeits are sold have to spend increasing amounts of their budgets funding enforcement procedures by the police and costly judicial cases by the law courts. In the cases where convictions are made counterfeiting becomes a cost for the prison service. However attempting to assign time series monetary values to the qualitative statistics is not possible and consequently lies out of the scope of this document. 2.4.3 Costs to third countries where counterfeit goods are manufactured If a country manufactures counterfeit products, there is likely to be some gain to the extent that these counterfeit products replace sales of products made in other countries. But this potential impact is partly offset by the fact that counterfeiters rarely pay taxes and often break other laws and regulations in a way that is detrimental to society. Moreover, if a country gains a reputation for higher than average counterfeit levels, foreign manufacturers may become reluctant to produce in that country and it may lose on foreign direct investment. In developing countries this is particularly relevant as they will lose out on the manufacturing knowledge that is often brought with production. Where economies such as China and Thailand obtain a reputation for counterfeit goods, exports of genuine goods may suffer from this slight. 2.4.4 Possible gains from counterfeiting Whilst clearly there are many losses from counterfeiting there are potentially some gains that should also be considered. Consumers unable to buy the genuine goods at the full price may gain utility from buying counterfeit goods at a lower cost, assuming that quality is sufficiently high. This benefit may potentially be significant, but the difficulty of calculating a demand curve for the counterfeit industry solely places this calculation out of the scope of this report. 2.4.5 Social Costs The impact of counterfeiting on consumers operates through a series of mechanisms: i) if the consumer purchases a counterfeit product unwittingly, they are likely to obtain a product that is of lower quality and perceived value than expected; ii) some counterfeit products (eg pharmaceuticals, toys, car and airplane spares) pose serious health or safety risks; iii) ultimately the consumer suffers from the impact of reduced profits for the legitimate producers through the producers cutting back on new product research and development and hence the consumer has available a less advanced product range; iv) counterfeiting is likely to have links to organised crime attracted by the large profits in this illicit trade; and © Centre for Economics and Business Research Ltd, June 2000 7 CONFIDENTIAL v) however, there are some minor offsetting consumer gains in some areas (eg fake clothing in those circumstances where the consumer knows that the product is counterfeit) where part of the producers’ loss is a gain to the consumer. Although these mechanisms operate in different directions, it is likely that the negative impacts, which are costs to the consumer and society, outweigh the positive impact where there are consumer gains from counterfeiting. This study does not consider the impact of counterfeiting on consumers as such although the macroeconomic assessment in Section 4 picks up some of the impacts of the reduced expenditure on research and development. © Centre for Economics and Business Research Ltd, June 2000 8 CONFIDENTIAL 3. IMPACT ON CORPORATE REVENUES AND PROFITS 3.1 INTRODUCTION This section measures the impact of counterfeiting on the revenues and profits of the companies producing the genuine products. It first describes the methodology used for the calculation and then sets out the results of the calculation. 3.2 METHODOLOGY The description of the methodology for estimating revenue and profit losses due to counterfeiting begins with a simple diagrammatic exposition to fix ideas and then moves on to a more technical discussion of the estimation procedure. 3.2.1 A Simple Diagrammatic Illustration The methodology adopted to measure the revenue and profit loss that occurs due to counterfeiting can be illustrated using a simple industry demand and supply diagram, as shown in Figure 3.1 below. The existing situation, where firms in the industry face unfair competition from counterfeiters, is described by the equilibrium p* and q*. Figure 3.1 Price Supply P** P* Q* Q** Quantity Demand D` To calculate the industry’s revenue loss, an estimate of industry equilibrium is required under the alternative situation where no counterfeiting occurs. Clearly the industry demand curve in such a situation will lie further to the right, in a position such as D` in Figure 3.1. © Centre for Economics and Business Research Ltd, June 2000 9 CONFIDENTIAL The industry’s revenue loss due to counterfeiting is then given by the difference between total revenue when no counterfeiting occurs, p**q**, and total revenue at present, p*q*. In practical terms, the estimation of revenue and profit loss for each industry due to counterfeiting can be done using a five-step procedure. 3.2.2 Estimation of Demand and Supply Slopes The first step in this procedure concerns the estimation of demand and supply slopes. To achieve this, we used an econometric model, which was developed as part of the UK study. The model has the following general specification: Demand qt 0 1 pt 2 yt 3 ptA error Supply qt 0 1 pt 2 ct error where: qt = sales volume in each industry at time t pt = industry retail price index at time t yt = total personal disposable income at time t ptA = overall retail price index at time t ct = index of costs for each industry at time t The s and s in each equation are coefficients to be estimated. Of particular interest are 1 and 1 as these represent the model’s estimates of the demand and supply slopes, respectively. These estimates play a major role in the actual revenue and profit loss estimation. 3.2.3 Calibration Given these estimates of the demand and supply slopes, the constants in each equation are estimated indirectly by calibrating the model to fit the equilibrium values of price and quantity in each industry for the period 1995-98. This completes the estimation of supply and demand. 3.2.4 Estimating the “full transfer” size of the demand shift Using data obtained on the likely scale of counterfeiting in each industry from the ACG for the UK and Association des Industries de Marque (AIM)2 for the remainder of the EU, the model was used to estimate directly how much higher total revenue would be under the alternative scenario where all current counterfeit goods purchases are transferred to the legitimate sector. 2 See Annex 1 for this data. © Centre for Economics and Business Research Ltd, June 2000 10 CONFIDENTIAL The model, which we employed is data intensive and requires detailed sectoral data. In the majority of cases the application of the first two stages of this procedure was not practicable due to lack of data. For these cases we developed an alternative methodology, which involved calculating the full effect of counterfeiting by applying the estimates of the size of counterfeiting to the total revenue for each sector. We used the results from our previous UK study as a guide to the reliability of these results. Of course, these estimates of the effects of counterfeiting on total revenue represent a large overestimate in most cases, as counterfeit and non-counterfeit goods are not perfect substitutes. Put differently, not all individuals who currently purchase counterfeit goods will transfer their expenditure to non-counterfeit items. 3.2.5 Using survey data to estimate revenue loss The fourth step of this procedure attempts to take account of any overestimation by using data from opinion polls3 to scale these total revenue estimates. Respondents were asked whether they would knowingly purchase a range of counterfeit goods; a high positive response rate for a good indicates a low degree of substitution between the counterfeit and non-counterfeit goods. Consequently, the estimated total revenue increase due to the elimination of counterfeiting would be adjusted downwards to reflect the low degree of substitution between these goods. Unfortunately, only two countries conducted this type of survey: Italy and the UK. For the rest of the EU, we used the UK results to scale back the revenue loss estimates. 3.2.6 Estimating profit loss The main costs from counterfeiting are at the margin (i.e. losses to legitimate producers for every extra counterfeit unit sold). This means that the marginal profitability of producing counterfeit goods is a substantial multiple of the average profitability. For this study we applied the UK marginal profitability ratios across the EU aggregates to translate revenue loss directly into estimates of profit loss.4 This measure excludes fixed costs such as advertising, research and development, and design, which are high in these sectors. We opted to apply the UK marginal profitability ratios to the estimated turnover loss for each EU country because we would expect that the cost structure would be similar across these industries. Large internationally companies tend to dominate these sectors and their manufacturing plants have similar economies of scale and cost. We would expect that there is minimal cost variation across country and it seems a reasonable assumption that the cost structures are similar across countries. 3 4 See Annex 2 for the results of these polls. See Annex 3 for the data. © Centre for Economics and Business Research Ltd, June 2000 11 CONFIDENTIAL 3.3 IMPACT ON REVENUES AND PROFITS This section describes the estimated impact on revenues and profits for each of the industries under consideration using the methodology set out above. 3.3.1 Revenue impact Table 3.1 provides the estimates of revenue loss due to counterfeiting in the four selected industries5. As explained above when this procedure was not applicable due to lack of data we applied an alternative method. The estimation of the loss of revenue involved calculating the full effect of an elimination of counterfeiting in these industries and then adjusting these estimates to allow for the fact that counterfeit and non-counterfeit goods are not perfect substitutes for one another. It is unlikely that the elimination of counterfeiting will see the full transfer of consumer demand from this market to the authentic market. The full effect has been adjusted to reflect this and we use national survey results where appropriate, if not available we use the results from other surveys. Table 3.1 Estimates of Revenue Loss Due to Counterfeiting Sector Percentage of Total Revenue Total Loss of Revenue at 1998 Levels (€ millions) 3.2 7,581 7.2 3,017 11.5 3,731 5.8 1,554 Clothing and Footwear Perfume and Toiletries Toys and Sports Pharmaceuticals In monetary terms, revenues in the clothing and footwear sector experience the largest loss from counterfeiting. Proportionately, revenues in the toy and sports industry suffer the greatest impact. 3.3.2 Impact on profits Estimates of profit loss each year due to counterfeiting are presented in Table 3.2 below. As explained above these were calculated from total revenue loss using marginal profitability ratios. Table 3.2 Estimates of Profit Loss Due to Counterfeiting Sector Total Loss of Profit at 1998 Levels (€ millions) Clothing and Footwear Perfume and Toiletries Toys and Sports Pharmaceuticals 5 1,266 555 627 292 The procedure for calculating these revenue loss estimates is presented in Annex 4. © Centre for Economics and Business Research Ltd, June 2000 12 CONFIDENTIAL 4. IMPACT OF COUNTERFEITING ON THE EU ECONOMY 4.1 INTRODUCTION This section extends the analysis of the impact of counterfeiting on companies to consider the macroeconomic impact on the EU economy. The section provides estimates of the impact of counterfeiting on investment, GDP and employment. 4.2 MICROECONOMIC IMPACT The estimates of the microeconomic impact of counterfeiting consider the four industries detailed in earlier sections. We estimated a total loss of profits from counterfeiting at €2,740 million annually in 1998 prices. To calculate the impact on investment, we used the average rate of return on capital invested in countries across the EU.6 For the companies to achieve the same rate of return with the reduced rate of profits, they would have to scale back their investment. The cumulative impact on capital is €19,558 million. For the purpose of this macro simulation it is assumed that the impact on investment has taken place over 5 years. This implies a negative shock of €978 million a quarter over 20 periods. 4.3 METHODOLOGY The starting point for our macroeconomic analysis is the CEBR’s model of European economy (EUROMOD2). CEBR has been commissioned by the European Union to build a macroeconomic model of the European economy for transport policy applications within the European Union. The model is formulated for each of the 15 EU member states. Adding together the relevant aggregates for each Member state forms the EU aggregates. The model produces a wide range of results of which two are of particular relevance. These are: 1. The net impact on the economies of the EU – measured by its Gross Domestic Product – this is the key result for the economic prosperity of EU as a whole; 2. The impact on employment in terms of jobs. The impact of counterfeiting on the four industries is treated as a negative technology shock on the EU economies. In the model this operates through investment expenditure – to simulate this, investment is reduced by €978 million a quarter. 6 See Annex 5 for average rate of return on capital by country. © Centre for Economics and Business Research Ltd, June 2000 13 CONFIDENTIAL 4.4 RESULTS The results summarised in the tables below are shown as the difference between the base forecasts for the EU economy and the simulated impact of counterfeiting in the 4 industries studied. Counterfeiting reduces firms’ total revenues and restricts profit. This has implications for firms’ investment decisions. EUROMOD2 allows us to estimate these effects in terms of GDP and employment for the European Union.7 Our analysis indicates that the macroeconomic impact on the EU economy of counterfeiting in these 4 industries is to: i) reduce GDP by €8,042 million (at 1995 prices) per annum; and ii) reduce EU employment by 17,120 jobs. EUROMOD2 estimates of the effects of counterfeiting are divided into smaller geographical zones and by sector.8 Table 4.4.1 Estimates of the Impact on Employment and GDP of Counterfeiting by Zone Zone Employment GDP (€ 1995 prices) 3,850 2,483 3,940 1,973 3,950 1,589 5,380 1,997 17,120 8,042 Area 1 Area 2 Area 3 Area 4 Total Table 4.4.2 Estimates of the Impact on Employment and GDP of Counterfeiting by Sector9 Sector Employment GDP (€ 1995 prices) 7,280 3,462 3,520 1,637 4,370 2,001 1,960 937 17,130 8,037 Clothing and Footwear Perfume and Toiletries Toys and Sports Goods Pharmaceuticals Total 7 Annex 6 provides a greater explanation of the ASTRA model. Zone 1 includes Germany and Austria; Zone 2 includes France and the Benelux countries; Zone 3 includes Greece, Italy, Portugal and Spain; and Zone 4 includes Denmark, Finland, Ireland, Sweden and the United Kingdom. 9 In order to produce estimates of the impact of counterfeiting for individual sectors, it was necessary to model each sector separately. This gives rise to a small discrepancy between total employment and GDP by sector and zone. 8 © Centre for Economics and Business Research Ltd, June 2000 14 CONFIDENTIAL ANNEX 1. ESTIMATES OF COUNTERFEITING Table A1.1 below gives ACG and AIM estimates of the proportion of counterfeit goods in each of the industries analysed. These estimates are notoriously difficult to calculate due to the unobserved nature of the problem, and due to their source, they should be regarded as upper estimates. Table A1.1 ACG and AIM Estimates of the Proportion of Counterfeit Goods Sector ACG/AIM Clothing and Footwear Perfume and Toiletries Toys and Sports 11 Pharmaceuticals 6 © Centre for Economics and Business Research Ltd, June 2000 10 12 15 CONFIDENTIAL ANNEX 2. RESPONSES TO OPINION POLL Table A2.1 below contains responses to opinion polls asking the question below or a variant. “Which, if any, of the following goods would you knowingly purchase as counterfeit, assuming you thought the price and quality of the goods was acceptable?” Table A2.1 Responses to the opinion poll Product Proportion of Interviewees Responding Positively - UK (%) Proportion of Interviewees Responding Positively - Italy (%) Clothing and Footwear Perfume and Fragrance Toys and Sports 52 76 16 38 5 12 Pharmaceutical 5 5 © Centre for Economics and Business Research Ltd, June 2000 16 CONFIDENTIAL ANNEX 3. MARGINAL PROFITABILITY RATIOS FOR 1996 Table A3.1 below contains the marginal profitability ratio for the 4 sectors. Table A3.1 Marginal Profitability Ratios for 1996 Sector Marginal Profitability Ratios (%) Clothing and Footwear Perfume and Fragrance Toys and Sports 16.7 Pharmaceutical 18.8 © Centre for Economics and Business Research Ltd, June 2000 18.4 16.8 17 CONFIDENTIAL ANNEX 4. REVENUE LOSS CALCULATION PROCEDURE Demand: q D a bp Supply: q S c dp Equilibrium requires: q D q S q * a bp * c dp * p* ac bd and ad bc bd q* To model the revenue lost due to counterfeiting, we take the alternative scenario where there is no counterfeiting and the firm’s demand curve is further to the right. New demand: q ND a bp Equilibrium now occurs where: q ND q S q * * a bp * * c dp * * p** ac bd bd and q ** ad bc d bd bd The effect on total revenue is then found by comparing revenue levels before and after the change, as follows. Before: a c ad bc TR * p *q * b d b d After: ad bc d ac TR * * p * *q * * bd b d b d b d Change in revenue: TR * * TR * In percentage terms: TR * * TR * TR * 1 b d 2 a c d ad bc d d2 ad bc a c a c ad bc © Centre for Economics and Business Research Ltd, June 2000 18 CONFIDENTIAL ANNEX 5. RATES OF RETURN ON CAPITAL IN THE BUSINESS SECTOR The rates of return in the business sector reported in table A5.1 below were extracted from Table 25 OECD Economic Outlook December 1998. Table A5.1 Rates of Return on Capital by Country Country Rate of Return on Capital (%) Austria 15.7 Belgium 14.4 Denmark 8.9 Finland 12.9 France 16.4 Germany 15.3 Greece 24.3 Ireland 17.0 Italy 14.6 Luxembourg 14.4 Netherlands 18.9 Portugal 18.2 Spain 18.2 Sweden 11.8 United Kingdom 11.1 © Centre for Economics and Business Research Ltd, June 2000 19 CONFIDENTIAL ANNEX 6. A6.1 ESTIMATING THE ECONOMIC EFFECT INTRODUCTION This annex describes the macroeconomic simulation using the ASTRA macroeconomic model developed for Directorate General VII of the European Commission. A6.2 ASSESSING THE ECONOMIC IMPACT OF EU POLICIES AND PROJECTS USING THE ASTRA MODEL The evaluation of the overall economic impact of counterfeiting has been carried out using a stand-alone version of the Macroeconomic sub module that the CEBR has developed for the European Union ASTRA project. The ASTRA model has been designed as an output of a 4th Framework Research Project to devise an evaluation and assessment tool for assessing policies and projects10. The ASTRA model has been developed by CEBR along with the following partners: IWW, Institut für Wirtschaftspolitik und Wirtschaftsforschung, Universität Karlsruhe (GER) TRT, Trasporti e Territorio Srl, Milano (I) ME&P, Marcial Echenique & Partners Ltd, Cambridge (UK). ASTRA comprises four key sub-modules. Driving the model is the macroeconomics submodule (MAC) that the CEBR has produced11. This is interlinked with a regional economics sub-module (REM)12, a transport sub-module (TRA)13 and an environmental sub-module (ENV)14. The stand-alone version of the macroeconomic sub-module allows simulations to be made of shocks to the EU economy. The model’s key relationship is the interaction between the supply side and the demand side of the economy and the resultant effect that this generates through inflation and interest rates. A6.3 MACROECONOMICS SUB-MODULE (MAC)15 This section outlines the CEBR's macro-modelling methodology for the MAC, the model of the EU macro economy. The objectives of the model are described in ASTRA Deliverable 1 ‘Review of existing tools’ Chapter 1, Wolfgang Schade (ed) IWW, 1998. 11 The underlying philosophy of the MAC and a comparison with the macroeconomic models of other evaluation tools is set out in Chapter 6 of ASTRA Deliverable 1 ‘Review of existing tools’ Wolfgang Schade (ed) IWW, 1998. 12 Developed by ME&P, Marcial Echenique and Partners Ltd, Cambridge (UK). 13 TRT, Trasporti e Territorio Srl, Milano (I). 14 IWW, Institut für Wirtschaftspolitik und Wirtschaftsforschung, Universität Karlsruhe (GER). 15 This section is an extract from ASTRA Deliverable 3A ‘The ASTRA Systems Dynamics Model Platform’ Wolfgang Schade (ed) IWW, 1999. 10 © Centre for Economics and Business Research Ltd, June 2000 20 CONFIDENTIAL A6.3.1 Introduction The sub-module is based upon the familiar macroeconomic national accounting framework. It uses national data on the European System of Accounts 1979 basis (ESA 79)16. The sub-module is formulated on the basis of 5 macro regions: Germany and Austria France, Belgium, Netherlands and Luxembourg Italy, Spain, Portugal and Greece UK, Ireland, Sweden, Denmark and Finland Rest of the World. Each of the first 4 macro regions, which include all EU member states, has the equation structure set out in the equations described in section A6.3.2. A6.3.2 Internal Structure of the MAC Inflation and interest rates: The core identity for the model is real gross domestic product for each region (GDP): GDP C + I + G + X – M (eq. 1) Where: C = government and household consumption I = fixed investment plus inventories X = Exports M = Imports This identity therefore gives the aggregate Regional demand for goods and services. The supply of goods and services in a particular Region is represented by the Potential Output, modelled by equation [2] below. YP = YPt-1 . (K/Kt-1)α . (E.Q/Et-1.Qt-1)β . γ Where: (eq. 2) YP = potential output K = Capital stock E = Employment Q = Labour productivity benefits of the policy change to be analysed α, β, γ = fixed coefficients 16 See European System of Accounts (1995) available from SOEC in Luxembourg or from national statistical offices. © Centre for Economics and Business Research Ltd, June 2000 21 CONFIDENTIAL Potential output depends on the capital stock and the size of the current labour force taking into account any changes in productivity over time. One such change might result from the policy changes being analysed (eg business and commuter time savings, if transport policies are being evaluated). This is treated as increasing labour productivity. By comparing the supply of goods and services in the form of Potential Output with the demand for goods and services in the form of GDP expenditure, the rate of inflation in the Region’s economy can be modelled. Supply Demand Labour Force Capital Stock Consumption Investment Exports Imports Inflation The rate of inflation is therefore directly dependent upon Potential Output, GDP and the rate of inflation in the previous period. P = f (YP, P t-1) (eq. 3) where: P = change in prices YP = potential output P t-1= changes in prices in the previous period If demand is outstripping supply then price increases will gradually filter into the economy and vice-versa. Inflation is calculated separately for each Region. However in order to take into account the effects of European Monetary Union a single interest rate is used for the entire EU area. This reasonably assumes convergence amongst countries outside of the Euro-Zone. The interest rate is dependent upon the change in inflation, the interest rate in the previous period and the target rate of inflation. Int = f (P t-1 , Int t-1, T) (eq. 4) © Centre for Economics and Business Research Ltd, June 2000 22 CONFIDENTIAL Where Int = rate of interest P t-1 = changes in prices in the previous period T = target rate of inflation Components of GDP: Imports grow as a proportion of GDP growth. In other words spending on foreign goods and services is in line with the general domestic spending trend. The total value of imports is then split according the source Region using fixed coefficients. M = f (∆GDP t-4, M t-1) (eq. 5) Mi = Ki M (eq. 5a) Where M = Imports M i = the imports by region i from the region under consideration. K = a constant The total value of a Region’s exports can then be derived from the import figures. For example Region 1’s exports are the sum of Region 2,3,4 and 5s’ imports from Region 1. X M I (eq. 6) Where X= exports M i = the imports by region (i) from the region under consideration. Investment is a function of the lagged change in GDP. It is also sensitive to the level and rate of change of interest rates. This reflects the investment decisions of firms based upon the level of demand and the rate of return. Inv = f(Invt-1 , ∆GDPt-4 , Int, ∆Intt-1 ) (eq. 7) Consumption is dependent upon the growth in personal disposable incomes, interest rate and inflation. Higher interest rates will encourage saving and higher prices will discourage consumption. Any investment expenditure due to policy changes is incorporated into the investment equation. Government consumption including the effects of policy changes is aggregated into the consumption variable. This takes account of transport taxes, which are calculated through the environmental submodule. C = f (∆PI, Int, ∆Int, P, ∆P) (eq. 8) Aggregate personal disposable income grows according to growth in employment and wage levels. PDI = f(PDIt-1, ∆Emp, ∆W) (eq. 9) Where Emp = Employment © Centre for Economics and Business Research Ltd, June 2000 23 CONFIDENTIAL W = Wage level Changes in the wage level depend on changes in prices in the previous period, unemployment, changes in unemployment levels and consumer benefits from the policy changes. Wi = f (P t-1, U, U, CB ) (eq. 10) where: Wi = change in wages P t-1 = changes in prices in the previous period U = unemployment U = changes in unemployment CB = Consumer benefits from policy changes Employment grows relative to the growth in spending in the Region’s economy. It increases as a proportion of GDP growth and a productivity trend. The model assumes a 2% annual increase in labour productivity. E = f (GDPt-1, Prod) Where: (eq. 11) E= Employment Prod = Productivity trend The unemployment level used in the calculation of the wage level is determined by size of the labour force – supplied by the REM – minus the employment figure. Components of Potential Output: Potential Output is determined by the employment level and capital stock through a production function. The calculation of Employment has been covered above. The capital stock grows according to the level of investment taking into account depreciation. It also takes into account savings in freight costs that are recapitalised and added back into the capital stock. K = f (Kt-1, Invt, Z) (eq. 12) Where K t-1 = Capital stock in the previous period Inv t = Investment Z = External influence on productivity Region 5 – the rest of the world Region 5 exists purely in terms of exports and imports. These are derived using the system of import/export equations described earlier. © Centre for Economics and Business Research Ltd, June 2000 24 CONFIDENTIAL ANNEX 7. CEBR This report has been prepared for the Global Anti-Counterfeiting Group by the Centre for Economics and Business Research (CEBR). The London-based CEBR is one of Europe’s leading specialist economic consultancies. Founded in 1993 by Douglas McWilliams, former Chief Economic Adviser to the Confederation of British Industry, the CEBR has a wide range of clients in the business and public sector in Europe. The CEBR maintains and runs models of the World, European, UK and London economies and is renowned as a leading expert in carrying out economic impact studies. © Centre for Economics and Business Research Ltd, June 2000 25