459sony.doc - Initial Set Up

advertisement

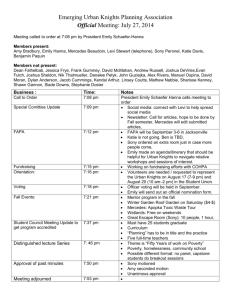

Marketing Channel Analysis Sony was founded on May 7, 1946 in Tokyo Japan. Corporate headquarters is located in Tokyo Japan along with all major research centers. Sony operates globally and had operating revenue of 7,496,400 million yen in 2004. 1 Sony manufactures and sells multiple products under the categories of audio, television, video, information, communication, semiconductors and electronic components. Sony currently has a dual distribution structure in place consisting of a “bricks and mortar” outlet, the Sony Store, and an on-line ordering site, Sony Style. The success of each of these channels complements the other and has increased Sony sales. Sony also sells its products to independent retailers including Future Shop, Radio Shack and Best Buy. the Sony Store The first Sony Store was introduced to the Canadian market in 2003 and approximately 70 additional stores have been opened across Canada since then. 2 The Sony Store displays the company’s latest products in a hands-on environment, complete with sales staff to answer any questions consumers may have. The stores are tailored to primarily target the female market with a tendency to be located in up-market shopping centers. These locations were chosen “based on a widely held belief that conventional electronics stores do a lousy job with women”.2 Each Sony Store also includes a “concierge desk” to greet shoppers as they enter the store with the idea females would respond to this feature.2 The stores also act as an alternative for consumers who are uncomfortable with purchasing items online; “The latest…Sony Stores are designed to display products, in the full expectation that many people will buy online”.2 This idea of allowing consumers to observe products in a “showroom” before they purchase the item online might suggest, to an extent, a merge of online and offline markets. (For additional information see SWOT analysis: Appendix A) On-line Operations Sony’s Canadian corporate website, www.sony.ca, offers the consumer information on all available Sony products. The website also provides customer support and lists locations of Sony’s authorized dealers. The Sony website contains links to the 1 Marketing Channel Analysis global corporate website, Sony Style Canada and the Sony Store website. The Sony Store website lists locations of stores across Canada as well as service and warranty information. The purpose of the Sony Store website is not to showcase all of the products available at the store but instead to offer the customer a number of factors to consider before making a decision to purchase a product. On-line purchases are not available through the Sony Store website. Consumers wishing to peruse the complete library of Sony products or make an online purchase will be transferred via the Sony Store website to the Sony Style website.3 The Sony Style Canada website is the online shopping homepage for all of Sony’s products. The site provides the consumer with product and pricing information along with financing, delivery and warranty options. Orders can be shipped directly to the customer’s home or can be picked up at the nearest Sony Store location. Order status can also be checked on the Sony Style website. (For additional information see SWOT analysis: Appendix B) Target Market Sonystyle.ca is primarily targeted to consumers who value convenience. Geographical and temporal constraints are a major attraction for consumers to the website. It also targets people who are familiar with Sony products and are not in need of sales personnel to answer questions. Marketing activities are performed through this site providing on-line consumers with the same promotions as those available at the Sony Store locations. Marketing campaigns which advertise new products and promotions available to the website’s target market is achieved by collecting customer email addresses when consumers register for online purchasing. Channel Structures The Sony Store’s current marketing channel consists of four major players: manufacturers, warehouses, Sony Store and end consumers. The web based channel currently used by Sony performs all of the same flows but has changed the channel members who perform them. The on-line channel consists of: manufacturers, warehouses, Sony Style and the end-consumer. (A comparison of the channel structures can be viewed in Appendix C and D). 2 Marketing Channel Analysis Channel Flows Payment and Financing Credit card and financing are the two options online consumers have when paying for orders. Sony Style accepts payment on any Canadian-issued VISA, MasterCard, American Express or Sony Citi MasterCard. The Sony Citi MasterCard allows Sony customers to earn points with every purchase in order to obtain Sony Rewards such as Sony branded electronics. The financing option is available to those customers who spend more than $499.99 on their purchase. This option requires the user to apply for a “Sony Store Card” which will be used to finance their payments over a three, six, or twelve month period.4 Customers who purchase products at the bricks and mortar locations have the same payment and financing options along with the added convenience of debit and cash. The same financing alternative is available to the consumers who wish to delay payments. Risk Each channel member in the online channel assumes risk when they receive a Sony product. Sony will take on the majority of the risk except when the product is in the hands of a courier, who then assumes the majority of the risk. Even after the end-consumer receives the product, Sony will still be at risk because of warranties, repair, and after-sale service costs. The credit card companies involved in the online ordering process also assume risk when dealing with the end consumer and possible non-payment. The bricks and mortar risk flow is very similar to that of the online ordering risk flow. Ordering Online users can order their products to either be shipped directly to their home or to the nearest Sony Store location to be picked up. When ordering through Sonystyle.ca, consumers can also place “pre-orders” and “next-in-line orders”. 5 Pre-orders refer to opportunities for the customer to order products not yet introduced into the Canadian market. Once the product in question is available, it 3 Marketing Channel Analysis will be shipped to the end consumer immediately.6 Next-in-line orders are made when Sony is sold out of a specific product. The customer is then added to a waiting list and as soon as the product becomes available again, it will be shipped. 7 The ordering flow of the Sony Store includes merchandise being purchased and subsequently replaced. The Sony Store orders products from Sony wholesalers as inventory replacement becomes necessary. 8 This flow is one that might become more efficient with the addition of an electronic data interchange system to keep track of inventory and notify suppliers instantaneously of any products that need to be shipped. Physical Possession and Ownership The physical possession flow follows the logical order from manufacturer to consumer. Costs associated with the physical possession flow include storage and delivery costs of the Sony products. 9 Most channel members are part of the physical possession flow, more so when dealing with online ordering since most products will have to be shipped by a courier, adding another member to the channel. The ownership flow involves the Sony warehouses and the Sony Store retailers. Costs associated with this flow include inventory carrying costs for both the warehouses and Sony Stores.9 Promotion The promotional flows for the bricks and mortar locations and online shopping are interrelated. The store acts as a hands-on advertisement for the available online purchases. Advertising is relayed through both the store and website. All Sony customers have access to the same promotions and sales. Demand Side Factors On-line ordering provides the consumer with facilitation of search. Customers can search the on-line ordering site and purchase products without having to visit a traditional bricks and mortar outlet. The search process is convenient since the consumer can access the site from their home. 4 This process is fast, convenient Marketing Channel Analysis and easy. The on-line ordering process satisfies the need for assortment. With the majority of Sony products being offered on-line, the consumer’s need for variety of products is provided. The Sony store does not offer as many products as the online store and therefore, the on-line method of ordering satisfies this need to a greater degree. Supply Side Factors The internet has provided Sony with the opportunity and ability to sell products online to end users directly. The consumer has the option of picking up their order at the nearest Sony Store or having their order shipped to their home.10 Choosing the former deletes the Sony Store from the channel. Service outputs The service outputs provided by the on-line store include bulk-breaking, spatial convenience, waiting and delivery time and assortment and variety. Bulk-Breaking Customers will typically only purchase one of each item offered by Sony. It is unlikely that large numbers of each product will be sought by consumers. Both the Sony Store and Sonystyle.ca allow customers to purchase single units. Spatial Convenience (Ordering) The Sony Store and Sonystyle.ca address spatial convenience in distinctive ways. The Sony Store allows customers to physically obtain the product whereas the website makes ordering the product convenient regardless of geographic location. Waiting and delivery time The Sony Store reduces or eliminates the consumer’s waiting time provided the product is available in store. When the consumer orders a product on-line, depending on the size and number of products and the desired shipping method, waiting time can range from one to seven days. Sonystyle.ca offers a feature on 5 Marketing Channel Analysis the website allowing customers to check the status of their order, tracking its progress from the warehouse to the destination. Assortment and Variety Thirty percent more products are available at Sonystyle.ca than the Sony store.8 There are some products that are sold exclusively through each channel. For example, Sony Playstation and Playstation2 consoles and accessories are not available for purchase through the Sonystyle.ca website but are available at the Sony Store. Playstation accessories can be purchased through the playstation.com site. Also, there are certain laptops which are exclusively available through the Sonystyle website. On-line Support System Many consumers are hesitant to order products on-line because they prefer the touch and feel aspect of traditional shopping. Sony has developed an extensive online support system for its product offerings. The site offers tutorials and emulators which allow the consumer to explore features and functions of Sony products over the internet. This on-line support system acts as an additional after-sales service offering. When the consumer has an operational problem or is in need of information, the website can be accessed to solve these issues. Each product model has a frequently asked questions page which helps the consumers in solving problems that may occur. The consumer receives correct and timely information from this site which may not be provided consistently from sales personnel. Conflict Both the Sony Store and Sonystyle.ca may face resistance from retailers who currently carry Sony products. These retailers may believe that sales of Sony products will decrease because consumers will be able to access the entire Sony product line, both on-line and in a retail setting directly from the manufacturer. Due to the fact that Sony sells its product line in its own stores as well as conventional electronic retailers, Sony may face cannibalization of sales revenue as 6 Marketing Channel Analysis consumers move to purchasing their Sony products online or at the Sony Store instead of existing retailers. Gap Analysis In the traditional Bricks & Mortar system, there is a demand and supply gap evident (Refer to Appendix E). On the demand side, consumers must travel to major urban centers in order to buy Sony products from the Sony Store. Furthermore, the Sony Store only stocks seventy percent of all Sony products. Having only seventy percent of Sony products available in retail outlets increases the chances of consumers not being able to purchase the desired item which leads to stock-out costs, creating a supply-side gap. Due to restricted inventory space, stock-outs are more likely to occur than with on-line ordering. Since going on-line, Sony has addressed the spatial convenience deficiency of their stores. Customers are able to order a greater assortment and variety of products from any computer with access to the internet. However, purchasing online presents a demand-side gap by increasing delivery times from the wholesaler to the end user (Refer to Appendix F). In order to reduce this gap, a second distribution center should be established in Western Canada. The end result is delivery of Sony products to consumers within four days, as well as reduced variable costs due to less frequency of shipping from one warehouse. Recommendations and Conclusions Sony’s existing dual distribution channel structure is a benchmark for global businesses desiring to increase sales by going on-line. By having both channel structures complementing one another, Sony has experienced synergies within its business model. They have made a greater connection with the consumer which has increased brand recognition and equity. Sony’s bricks and mortar store exists to address consumer’s needs to physically observe products and to reassure them of their choices. The Sonystyle.ca site addresses consumers’ need for convenience, support and eliminates many barriers such as geographical constraints. 7 Marketing Channel Analysis In order to increase efficiencies and operational effectiveness, Sony could implement the following: Establishing a distribution warehouse in Western Canada to reduce shipping times and costs. Fixed costs will be a large capital outlay but the increased capacity and decreased variable costs will offset this in the long-term. Increasing the product offerings at the Sony Store locations to be consistent with product offerings on the website. This will provide for consistency between the two channels. Implementing the use of EDI systems within Sony Stores. This will ensure adequate inventory is available when it is needed and will provide for timely delivery of products. Increasing the capacity of floor space in stores and inventory storage to accommodate additional product offerings and to reduce potential stock-outs. 8 Marketing Channel Analysis Bibliography Sony . 2005. 12 Mar. 2005 <http://www.sony.net/SonyInfo/CorporateInfo/index.html>. 1 Spagatt, Elliot. "Sony makes big changes with small stores." Marketing News . 15 Nov. 2004: 12. Proquest . University of Saskatchewan Library, Saskatoon. 13 Mar. 2005 <http://proquest.umi.com/pqdweb?did=742080241&sid=1&Fmt=2&clientId= 12306&RQT=309&VName=PQD>. 2 Sony Style Canada Sony Style Canada. 2005. 12 Mar. 2005 <http://www.sonystyle.ca/commerce/servlet/HomepageView?storeId=1000 1&langId=-1&catalogId=10001>. 3 On-line Financing Sony Style Canada . 2005. 12 Mar. 2005 <http://www.sonystyle.ca/view/ShoppingCart/Financing/main.shtml > 4 Sony Style Customer Care. 2005. Sony Canada. 1 Apr. 2005 <http://www.sonystyle.ca/view/ShopConfidence/swccustomer.shtml?tid= conf_swccustomer_tab>. 5 Placing a Pre-Order. 2005. Sony Style Canada. 31 Mar. 2005 <http://www.sonystyle.ca/view/ShopConfidence/swccustomer_book_in_ad vance.shtml?tid=conf_swccustomer_tab>. 6 Placing a Next-in-line Order . 2005. Sony Style Canada. 31 Mar. 2005 <http://www.sonystyle.ca/view/ShopConfidence/swccustomer_next_in_line.shtml?t id=conf_swccustomer_tab>. 7 8 Keller, Dean. Personal interview. 30 Mar. 2005. Lane, Brian. Channel Flows and Efficiency. University of Saskatchewan, Saskatoon, SK. Jan. 2005. 9 Delivery Sony Style Canada . 2005. 12 Mar. 2005 <http://www.sonystyl...sc_pickup_home.html>. 10 9