Araby.com Business Plan - BestPracticesGuide.com

advertisement

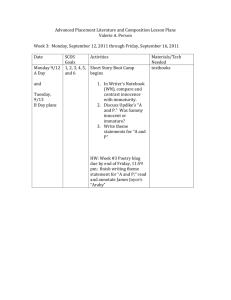

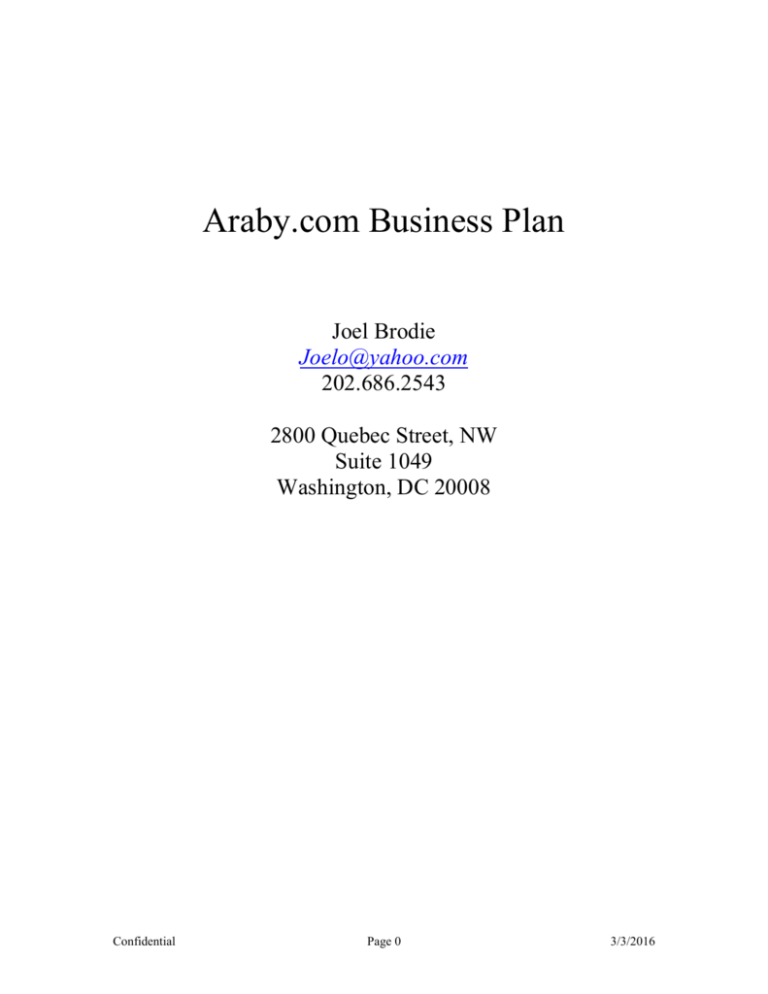

Araby.com Business Plan Joel Brodie Joelo@yahoo.com 202.686.2543 2800 Quebec Street, NW Suite 1049 Washington, DC 20008 Confidential Page 0 3/3/2016 Table of Contents 1. EXECUTIVE SUMMARY ............................................................................................ 2 2. MARKET OPPORTUNITY ........................................................................................... 4 3. THE SERVICE ............................................................................................................... 7 4. BUSINESS MODEL ..................................................................................................... 9 5. MARKETING STRATEGY........................................................................................ 10 6. OPERATIONS & TECHNOLOGY ............................................................................ 12 7. COMPETITION .......................................................................................................... 13 8. CRITICAL ISSUES ..................................................................................................... 14 9. MANAGEMENT ......................................................................................................... 15 10. FINANCIALS ............................................................................................................. 16 11. APPENDICES ............................................................................................................ 19 Confidential Page 1 3/3/2016 1. Executive Summary 1.1 Overview Araby (“Araby”) is developing the world’s first centralized online barter (“e-barter”) trading community on the Internet. Imagine a Web site where you can trade anything, music, books, timeshares, and gifts you’ve received without receipts, directly for millions of tradable items with people around the world. What eBay did for auctions, Araby will do for barter. 1.2 Market Opportunity The Company plans to transform and exploit two major market opportunities: The multi-billion e-barter market Araby believes that the Internet transforms e-barter from a niche to mass-market activity. In the offline world, barter markets are inefficient because they are local, finite, fragmented, and expensive. The Internet solves these problems and creates huge economies of scale by being global, infinite, centralized, and inexpensive. Among the items that people may be interested to trade include: Trading cards (sports, Pokemon) Vacation timeshares Collectibles Books Used clothing Computer software & hardware Entertainment (DVDs & CDs) Games (Sony PlayStation, Nintendo, & PC) Small business services To reach critical mass, Araby will pass on cost savings to its members, charging a small transaction fee ($2 per trade) only after a trade has been completed. The $162 billion a year direct marketing industry Every time members initiate or accept a trade online, they voluntarily tell Araby valuable data regarding their consumer preferences. Araby will use its database of members’ previous purchase and trading history to sign lead distribution deals with e-commerce Web sites for access to these targeted audiences. Since this data is based on goods and services members own and want, instead of online polls, surfing habits, or contests, Araby’s database will be among the most valuable on the Internet. Araby’s multiple “zero-gravity” models are attractive. With no warehousing or fulfillment costs, the Company is pure Internet play. Though the Company faces intense potential competition from newsgroups, portals, online auctions, and offline barter exchanges, no credible direct competitor currently exists in the person-to-person (“c2c”) ebarter space. By being first to market, Araby has the opportunity to build its brand synonymous with ebarter and dominate the market for years to come. 1.3 Management Joel Brodie (CEO & Founder) is Director, Business Development at Simutronics Corporation, the leading developer of Internet games and one of the fastest growing companies in the Washington DC area. Mr. Brodie launched two major online products and developed distribution relationships with high-profile Web partners, including Microsoft, Lycos, Excite, Mplayer, AT&T WorldNet, and theglobe.com. In 1996, Mr. Brodie worked at FreeLoader, Inc., the first Internet start-up success story to be launched and sold for $38 million within a six-month period of existence. Araby has firm commitments to work with Cooley Godward LLP, PricewaterhouseCoopers, and Silicon Valley Bank in the future. Confidential Page 2 3/3/2016 1.4 Products & Strategy Araby will create a proprietary and centralized e-barter platform to facilitate active trading and foster online community. The site and service will be user-friendly, entertaining, customizable, community-oriented, scalable, reliable (open 24/7), and frequently updated (every half-hour). Araby’s strategy is to immediately develop the e-barter market online and establish its brand as the number one place to trade goods and services over the Internet. Once the Company establishes itself as the leading c2c e-barter community, it will leverage its brand to develop the business-to-business (“b2b”) e-barter market. Araby will launch its site during 4Q 99 Holiday season through promoting “The World’s Largest Gift Exchange” special event. In addition, the Company will aggressively pursue Web distribution deals, encourage word-of-mouth viral marketing, and hire a public relations firm. 1.5 Summary of Five-Year Financial Projections Within a five-year period, the Company forecasts that net revenues will increase from $750,000 to $45,000,000 and operating expenses will rise from $3,000,000 to $29,250,000. Revenues will grow 700% between year one and year two and stabilize at 200% by year five. Operating margins are expected to reach 35% by the end of the forecast, which is compatible with equity analysts future expectations for typical online auction and direct marketing Web sites. By year three, the Company will reach profitability. 1.6 Funds Requested and Uses Araby requests a first-round of venture capital of $3,000,000 to develop the proprietary trading and database system, create a first-class, user-friendly Web site, hire a strong management team, and launch the service during 4Q 99 with the “Gift Exchange” special promotion. Confidential Page 3 3/3/2016 2. Market Opportunity 2.1 Overview The Internet is among the fastest, exciting, and most lucrative sectors of the global economy. Unlike passive mediums like television and radio before, the Internet is entertaining, communicative, inter-active, and, commerce-oriented. And it is growing faster than any other medium before. In 1998, the total number of worldwide Internet users was 150 million; by the year 2000, this number will rocket to 500 million worldwide.1 More people and businesses are buying and selling goods and services online (“e-commerce”). Total ecommerce revenues surpassed $13 billion during 1998 and are currently growing at an annual rate of 200%.2 Forrester Research predicts that the total value of goods and services purchased over the Web will grow to over $1.3 trillion by the year 2003. 2.2 E-barter There are currently four major ways to trade goods and services online through the Internet: Online classifieds (Classifieds 2000) Traditional e-commerce (Amazon.com) Online auctions (eBay) Reverse auctions (Priceline.com).3 The last remaining offline market activity not yet adapted to the Internet is barter, whereby goods and services are traded with one another without the use of money. Like auctions, the Internet presents unique opportunity to transform e-barter from a niche to a mass-market activity. The Problem In the offline world, barter markets are inefficient for the following reasons: Barter markets are local. People are limited to trade for items and participants by regions. Barter markets are finite. People are forced to make non-optimal trades before the market closes. Barter markets are fragmented. The barter market is highly segmented by region and exchange. No dominant players exist. In the US, there are officially 1248 barter exchanges servicing 380,000 member companies, the largest exchange with only 3500 member companies. 4 Barter markets are expensive. Due to lack of perfect information and a limited supply of available goods to trade for, intermediaries charge a huge participation fee. The average barter exchange charges members $200 to $300 to join and takes 10 to 15% off of every completed transaction. For these reasons, it is extremely difficult for members to exchange items that completely satisfy their individual needs. 1 International Data Corporation The State of Online Retailing, A Shop.org Study by Boston Consulting Group, November 1998. 3 List does not include newly created Internet market activities not yet accepted by the mass market, such as herd marketing (Accompany.com). 4 International Reciprocal Trade Association 2 Confidential Page 4 3/3/2016 The Solution The Internet has the potential to solve these problems in the following ways: The Internet is global. The Internet expands the online trading floor to the entire world’s population of online households. The Internet is infinite. Open 7 days a week, 24 hours a day, people are not pressured to make nonoptimal trades before the market closes. The Internet is centralized. The Internet offers one single destination on a massive scale to conduct all barter transactions. The Internet is inexpensive. Due to the above, the Internet and devalues the role of intermediaries and offers huge economies of scale. Araby plans to transform barter from a niche to a mass-market activity through developing the world’s first and largest c2c e-barter trading community on the Internet. The Company will reach a critical mass quickly through leveraging economies of scales provided by the Internet and passing the cost-savings onto member traders. In turn, this will fuel growth even further (see table 1). Once the Company establishes itself as the leading c2c e-barter community, it will leverage its brand to develop the b2b e-barter market. The Upside The upside is huge. According to the International Reciprocal Trade Association, “official” domestic barter grew in 1996 to $9.6 billion at an annual growth rate of 15%.5 Business-to-business (“b2b”) barter, which includes corporate barter (“barter between large domestic corporations) and counter-trade (“barter between U.S exporters and developing country governments) is estimated to be a $600 billion annual industry on a global scale.6 These figures do not account for the tremendous amount of barter that occur “unofficially” through the underground economy nor the economies of scale generated through a global, Internet-based barter market. The best gauge to measure the potential opportunity of the e-barter market is the explosive growth of online e-commerce and auctions. During the first six months of 1998, online auctions generated $898 million and were the third most successful e-commerce sites, behind computer goods and financial services. 7 eBay, the largest online auction site, generated net revenues of $34 million for 1Q99 alone, for a 469% increase over revenues reported for the same period the previous fiscal year. Forrester Research estimates that gross merchandise sales in the online auction space will grow from $1.4 billion in 1998 to $19 billion in 2003. Like auctions, the Internet has the potential to turn e-barter in a multi-billion dollar opportunity and Araby will be the first Company to market. 2.3 Direct Marketing Araby will leverage its massive database of member trading activity to exploit the $162 billion direct marketing opportunity.8 Every time members initiate or accept a trade online, they voluntarily tell Araby valuable data regarding their consumer preferences. Collection and analysis of this data provides Araby an ideal platform for direct marketing. 5 International Reciprocal Trade Association (IRTA) White Paper, 1996, http://www.irta.net Gershman, Michael, Smarter Barter, Viking Penguin, NY, 1. 7 Jupiter Communications 8 Direct Marketing Association 6 Confidential Page 5 3/3/2016 By examining customer purchasing patterns and demographic data, Araby will segment its membership bases across several different targeted areas. Araby then will be able to sign lead generation deals with other e-commerce Web sites or terrestrial-based businesses that wish to reach these targeted audiences. For example, members who have traded books or traded for books will be sent an email from Araby on behalf of Amazon.com. The targeted audiences will result in high CPMs for advertisers. Since this data is based on goods and services members own and want, instead of online polls, surfing habits, or contests, Araby’s database will be among the most valuable on the Internet (see table 2). Table 1: E-barter Value Proposition Araby ebarter Web site & service Economies of scale Greater economics of scale Cost savings (pass to consumers) Critical mass Table 2: Direct Marketing Opportunity Trading members Araby online trading floor Trading members Database of member trading history Add value $$$ Target direct marketing offers for partners Confidential Page 6 3/3/2016 3. The Service Araby will develop proprietary and centralized e-barter platform and Web site to facilitate active trading and to foster vertical trading communities. The service will be: User-friendly Simple-to-navigate Customizable Sticky Entertaining Community-oriented Scalable (for thousands of simultaneous users at one time) Reliable (open 24 hours a day, 7 days a week) Frequently updated (at least every half-hour). 3.1 How it works Registration (see Appendix 1) For people to trade a good or service, they must first sign up as a registered member. To limit fraud, all members are required to enter their contact information, as well as a valid email address and credit card number. Though optional, members are further encouraged to include their driver’s license and social security number through a third-party vendor. The more verifiable information the site has on its members, the easier to limit fraud. Members must also review and accept the site’s Terms and Conditions, explaining the Company’s policies and procedures. Adding Items to the Trading Floor (see Appendix 2) To add goods and services on the trading floor, members click ADD ITEM and enter the following information about their item: 9 Category & sub-categories (in the case of a music CD, entertainment>music>CD) Product description Estimated value amount Product condition (new, excellent, good, fair, used) Graphic (optional). After entering this information, the item is given an item number and placed on the trading floor under the appropriate category. Searching for items/Making an Offer (see Appendix 2) There are four ways to find items to trade for through the service: Conduct a keyword search Browse by category Set up a personalized agent that notifies members when requested item is online Request items through “items wanted” message boards. Once members find an item, they click on the item profile to learn more about the item, as well as view a list of all other offers for this item. To make an offer, members click MAKE OFFER and the site automatically adds their offer to the item list. 9 Items on the trading floor are further classified and searchable by location. Araby derives this information from the zip code number that members enter during registration. Confidential Page 7 3/3/2016 Completing a Trade (see Appendix 3) If the owner of the requested item decides s/he wants to make a trade, s/he clicks ACCEPT OFFER. Araby places both items off the trading floor, automatically bills both member accounts (see Section 4, Business Model), and sends a message to each member with the other’s email address. Members also have the option to send back a counter-offer by clicking the HAGGLE button. Offers and counter-offers are published on the site under trade history in a format similar to threaded messages. Members are responsible for shipping the items to one another and are encouraged to use the feedback forum to rate each other’s roles in the trade. Ratings are published next to the member’s profile and members earn reputations on the site based on their trade activity, similar to eBay. 3.2 Personalization (see Appendix 4) When members initially sign up, they have the option to accept a cookie to remember their user name and password and to personalize their front page. The personalized front page (“My Araby”) includes information regarding the member’s trading history (offers made, trades pending), reputation, and hot links to favorite trading communities. 3.3 Notification Members may set up a personal agent to search the site for items of interest and notify them via email when a requested item is on the trading floor. Members may also install an ActiveX agent component placed on the desktop to notify them when new offers have been made or when requested items have been placed on the trading floor. Members have the further option to list requested items within “items wanted” message boards throughout trade categories. 3.4 Goods & Services Araby will accept all goods and services through the online trading floor, except for items that are illegal, fraudulent, and/or items that may lead to legal action against the Company (hand guns). Each item is grouped and indexed within a set of main categories and additional sub-categories. To maximize trading activity and revenues, Araby will focus on developing trading forums for goods and services that are most (a) suitable to e-barter, and/or (b) highly valuable to potential direct marketing partners. These include: Collectibles – Premium goods that people may desire to have as a part of a greater collection of similar goods. Zero-sum products – Goods and services that depreciate over time for the owner but appreciate back to full value for those interested in trading for the item. These include books, music CDs, movies (DVDs), and entertainment game software. Traditional barter products – Goods and services traditionally bartered in the offline world. These include vacation timeshares, small business services, and gifts without receipts. For a complete list of the goods and services that people may be interested in bartering online, see Appendix 5. Confidential Page 8 3/3/2016 3.5 Community Services Fostering online trading communities is a key component to the Company’s success. Araby will develop active online communities for each of its trading categories featuring: Items-wanted message boards Chat rooms Monthly newsletters Syndicated content & articles Trading tips. To develop and maintain communities, Araby will hire a remote staff of part-time community leaders and compensate them with a revenue share and/or stock options. 3.6 Customer Support Araby will be designed from the ground-up to offer members excellent and responsive customer service. Such actions are necessary to limit fraud and develop trust among member traders. There are four levels of customer support: Web Site – Publish prominently on the Web site the Company policies, FAQs, instructions to report abuses, and ways to contact the Company through e-mail. Online Assistance – Outsource with LivePerson.com (http://www.liveperson.com) so that a customer-service representative is online 24/7 to answer general questions. Contact Information – Offer numerous e-mail addresses for people to seek information and report fraudulent claims, and respond within a 24 – 48 hour period. Customer Service Staff – Develop a full-time customer service department to personally handle billing, fraud, and customer service issues. 3.7 New User Experience To encourage new users, Araby will offer the first trade free of charge. In addition, Araby will publish a comprehensive “New Trader’s Online Tutorial to E-barter” on the Web site and organize “New Trader Nights,” whereby online staff will be available within the chat rooms to offer barter tips, answer questions, and give away prizes. 4. Business Model Araby will generate revenue in three ways: 4.1 Transactions Araby will charge for providing the trading forum. Unlike offline barter exchanges, it is free to join the community and to offer items on the trading floor. Once a trade is accepted, however, members will be charged a flat fee of $2 once a trade. This means that for every successful trade on the site, Araby will collect at least $4 since both members are charged equally. In addition, Araby will charge members for special promotional listing within the site for their wares, replicating eBay’s model. 4.2 Direct Marketing Araby will use its database of members’ previous purchase and trading history to determine direct marketing opportunities. Araby can then sign lead distribution deals with other e-commerce Web sites for access to these targeted audiences. For example, members who have traded books or traded for books will be sent an email from Araby on behalf of Amazon.com. These deals can be signed either on a CPM or revenue share basis. Confidential Page 9 3/3/2016 4.3 Advertising & Sponsorships Araby will generate revenues from targeted advertising and sponsorships. Advertising/sponsorships can be sold on the various categories within the site. Furthermore, email newsletters can be made available to members which also offers an advertising opportunity. Araby’s multiple, “zero-gravity” business models are attractive because the long-term overhead costs are low. With no warehousing or shipping costs, or any other brick and mortar constraints, the Company is a pure Internet play. 5. Marketing Strategy Araby’s strategy is to immediately develop the e-barter market online and establish its brand as the number one destination to trade goods and services over the Internet. The key is to establish first-mover advantage and reach critical mass as soon as possible. This means that in the short term, the Company will sacrifice revenues for high growth, profits for market share. The key elements to Araby’s sales and marketing strategy are: 5.1 World’s Largest Gift Exchange Promotion To officially launch the site, Araby will promote “The World’s Largest Gift Exchange” during the 4Q 99 Holiday season. Retail studies reveal at least 10% of the billions of dollars worth of gifts purchased during the 1998 Holiday season were returned or exchanged. 10 This does not include the amount of gifts that were unwanted yet not returned due to lack of receipt. The “World’s Largest Gift Exchange” will create an influx of items immediately on the trading floor and generate a massive amount of free publicity. Araby will promote the event through public relations and partnerships with portal and/or e-commerce sites. By cross promoting the “Gift Exchange” with their shopping areas, e-commerce partners offer customers an additional incentive to purchase additional goods through their Web site, thereby increasing transactions during the critical Holiday shopping season. Araby may also offer a portion of transaction revenues to charity during this event to promote holiday goods will and build market share. 5.2 Web Distribution Deals Araby will develop co-branded trade exchanges with destination, e-commerce, and portal sites. Co-branded partners will earn a continuous revenue share for money generated from the co-branded site, but Araby will co-own all member information. These deals are based on the affiliate model, whereby neither partner pays the other up-front cash. There are two types of partnerships: 10 General audience partnerships – Araby will develop entire co-branded e-barter trade exchanges for Web partners with attractive audiences. Partners include: portal sites (AOL, Yahoo!, Lycos); online communities (ICQ, Xoom.com/NBCi); and group-oriented newsgroup/mailing list sites (Deja.com, Topica.com, egroups.com, OneList.com). Targeted audience partnerships – Araby will develop co-branded e-barter trade exchanges for portal, community, and e-commerce sites targeting their unique audiences. Examples of “targeted audience” trading communities include a: National Retail Association Confidential Page 10 3/3/2016 Gift exchange of unwanted gifts with wedding sites (i.e., Weddingconnect.com) Book swap with book sites (i.e., Barnesandnoble.com) Sport card trading floor with sport sites (i.e., CBS Sportsline) Time-share exchange with travel sites (i.e., Travelocity). These partnerships are win-win for both parties. Partners benefit by increasing site stickiness, adding value to membership, and developing a new revenue stream. Araby builds its brand, develops multiple distribution channels, and lowers its customer acquisition costs to acceptable levels. Araby further gains by improving its cash flow, since revenues are paid to the partner only after transactions are completed. 5.3 Viral Marketing Viral marketing is a no cost way to promote a product online through encouraging users to spread the word about the Company through e-mail. It is viral because if successful, word-of-mouth on the product spreads quickly to millions globally on the Internet. Examples of successful viral marketing stories are ICQ, a free instant message service and Hotmail, a free Web-based email service. Both companies grew their usage levels into the millions within a year entirely through viral marketing. The Company will expose its e-barter trading service to millions of Internet users online through an aggressive viral marketing campaign. To encourage word-of-mouth, Araby will: Develop a Friends & Family promotion - Offer members prizes for inviting their friends and family to participate in the online trading community. Create an evangelical group of hard-core users Start a Link-to-Us program – Provide the Web graphic tools for people to directly link to Araby’s Web site. Offer an Affiliate program – Pay Webmasters a revenue share for all traffic and customers they send to Araby. Initiate a frequent trader program - Reward repeat traders with prizes such as frequent flyer miles. As mentioned before, Araby will encourage people unfamiliar with barter the opportunity to try out the service by offering the first trade free of charge. Araby will also offer a prize giveaway (such as a monthly drawing to win a computer) as a further incentive to register and try out the service. 5.4 Public Relations The Company believes that Araby is a great press story. The business model is unique, the service is simple to explain, and the venture is egalitarian in nature. It may also be positioned as the Internet’s next eBay. One of Araby’s priorities is to hire a top-notch public relations agency to pitch the Company’s story to the online, financial, and traditional press, as well as to raise awareness among the mass media about the “Gift Exchange” promotion. 5.5 B2B Market Araby believes that the b2b e-barter market is prohibitively too expensive to enter in the short term because corporations will be reticent to barter on a public Web site. Corporations conduct barter as a result of excess inventory and cash flow problems. Since corporate barter is a public admission of a mistake, and could have a negative impact on stock value, corporations prefer to barter in secret. Nonetheless, the b2b market is too huge an opportunity to ignore. Araby’s plan is to reach critical mass within the c2c e-barter space and then to leverage its brand to exploit the b2b and b2c e-barter markets. In the meantime, Araby will target companies that are more traditionally receptive to barter practices, such as small businesses and cash-poor start-up companies. To reach them, Confidential Page 11 3/3/2016 Araby will develop partnerships with small business portals (Office.com, Inc. Online) and vertical industry Web sites (VerticalNet, Chemdex, MetalSite.com). In addition, Araby will create e-barter trading communities for the hospitality (hotels) and advertising media (radio, television, online) industries. The online advertising market is particular interesting since a majority of advertising banners on the Web are sold below rate-card or bartered away. By trading ad banners directly through Araby’s e-barter site, instead of through existing ad barter networks, Web sites avoid the middleman and gain a better value for their excess inventory. 6. Operations & Technology Araby plans to build a robust, scalable user interface, user database, and transaction processing system based on a combination of internally developed proprietary software, open standard off-the-shelf software, and outsourced information management services. This system mix will enable Araby to more effectively utilize research and development capital and employ world-class standards and practices to reduce time-tomarket. The system will handle all aspects of the e-barter process: Searching through the database Registration User login and authentication Personalization Notification of new items by active search agent Adding of items to the electronic bartering floor Making a barter offer Haggling and trade completion Transaction billing The system will maintain user registration information, billing and receivable information, current barter items, and history barter listings. The system will employ a data warehouse to maintain, track, and correlate user activities, preferences, online experience feedback, and impression response to advertisements and partner links. The system will also support community bulletin boards and chat areas where users may interact and build community. The system will seek to employ a natural language-based search engine (through a partnership with Ask.com or Inference Corp.) to enable users to search for items and barter bids without resorting to use of complex Boolean expressions. Araby’s architecture will be based on a “best of breed” e-commerce support model. The system will be designed not only to minimize the occurrence of outage but also to minimize the effect of outages on the service, thereby maximizing 24-hour-a-day, 365-day-a-year core trading service availability to trading members. Araby’s system will consist of a suite Sun Solaris database servers running Oracle relational database management systems interacting with a suite of Sun NetDynamics application servers. Oracle provides the most scalable, reliable database solutions in the industry while NetDynamics provides scalable, fault-tolerant application support and easy integration with heterogeneous technologies through use of CORBA and stateless Enterprise Java Beans. Araby’s databases will be horizontally partitioned by goods and services and/or users. In the event of a database server failure, this will enable Araby to still serve a large fraction of its registered users and barter among a majority of goods and services categories. Also, Araby’s data architecture will employ active, read-only replicants instead of passive, read-write replicants, enabling the system to enhance scalability and availability by employing replicated databases for read-based functions such as item searches. This provides three major benefits: faster performance, more cost-effective use of data infrastructure, and lowerrisk system recovery in the event of a system failure. Araby is also examining the use of the Lightweight Directory Access Protocol (LDAP) to organize barter items in a manner that ensures future support of massive item data “inventory” growth. Confidential Page 12 3/3/2016 Araby’s application servers will be vertically partitioned by function classification. Mission critical functions (login, item search, barter offer, and trade completion) will be supported by a static, extremely fault tolerant server complex to ensure users can continue basic bartering (albeit with increased latency) in the event of server failure. Meanwhile, user support functions (haggle, chat, bulletin boards, and notification) will be supported by a less costly, but more adaptable, dynamic server complex. Although this user support complex will be less fault tolerant than the static complex, it will be more easily adaptable to accommodate changing user needs and barter market demographics. Araby is considering use of domain name server (DNS) routing for availability-based load balancing across application servers within a given complex. Araby may configure and implement these application server complexes internally or outsource work to a local NetDynamics-certified application partner (such as Litton Enterprises). Araby’s architecture and transaction support engine will be designed to support the highly bursty transaction loading associated with seasonal peaks and special promotions (i.e., “The World’s Largest Gift Exchange” promotion). This design will execute transactions quickly during loading periods in excess of twenty-five times the average expected Araby site load. Such a design is critical to support the hypergrowth (exponential growth at a increasing degree over time) typically associated with other e-commerce success stories such as AOL, Yahoo, and eBay. 7. Competition Currently, Araby faces no credible direct competition. However, due to low barriers of entry and the potential size of the market opportunity, the Company expects to face intense competition in the future. Direct and potential competition may be separated into the following categories: 7.1 Offline Barter Exchanges Numerous offline barter exchanges are interested in expanding their bricks-and-mortar barter exchanges onto the Web, including ubarter.com barter.com, and ebarter.com. These companies, however, face numerous obstacles migrating to the Internet, such as lack of Web expertise and the existence of legacy barter systems. Equally significant, none of these companies have the market power to leverage their customer base to immediately become the dominant player on the Web. As stated before, the barter industry is highly fragmented with an estimated 1248 barter exchanges servicing 380,000 trading members. The largest exchange is BarterCorp. of Chicago, IL, boasting only 3500 trading members. Finally, offline barter exchanges are generally more interested in using the Web to compete in the existing offline b2b barter market, leaving the c2c market all to Araby to own. 7.2 Newsgroups & Mailing Lists E-barter activity occurs informally through newsgroups and mailing lists. For example, game players use games-related newsgroups to trade computer games with one another. Though free-of-charge, newsgroups and mailing lists are inefficient because they are designed to facilitate communications instead of ecommerce activities among users. They do not provide a user-friendly trading interface nor allow for trading across different vertical markets. In addition, most newsgroups and mailing lists are too complex for the average Internet user to participate in. Recently, numerous ventures have been launched to make newsgroups and mailing lists simple enough for the mass market to join and participate in, including deja.com, onelist.com, topica.com, egroups.com, and remarq.com. The Company believes these groups-related community sites share a common audience and present a unique distribution partnership opportunity (see Section 5, Marketing Strategy). Confidential Page 13 3/3/2016 7.3 Portals & Online Auctions Araby competes indirectly with c2c online auction sites in regards to marketing and audience. Someone who wants to trade a used book will have two options. They may either trade the book directly for other goods and services through Araby’s e-barter site, or attempt to sell the book through an online auction. There are thousands of competitors in the online auction space, most notably eBay, Amazon.com, Excite Auctions, City Auction, Auction Universe and Yahoo! Auctions. Though the competition is fierce, the Company believes the market is large enough to support both types of e-commerce markets. In the same way that the market is large enough for e-commerce, classifieds, and auction sites to exist, there is room for an e-barter site such as Araby to grow and prosper. Moreover, online auction and trade exchanges appeal to vastly different audiences. The online auction community is driven more by competition and the entertainment value of the “Final Bell.” The e-barter audience, on the other hand, comprises more of bargain hunters. Whereas auction participants like the stock market, e-barter members are more apt to enjoy a flea market. 8. Critical Issues Araby faces numerous critical issues, all surmountable, in developing its Web site and service. 8.1 Low Barriers of Entry Similar to online auctions, developing an online trading environment is not prohibitively difficult. Once Araby becomes popular, portals, e-commerce, and auction sites may be encouraged to create their own online trade exchanges. To increase stickiness, portals may offer the service for free, similar to Yahoo! Auctions. While developing an e-commerce site is not complex, creating an online trading experience that is fun, simple and valuable is. Araby will discourage potential competitors in the e-barter space by creating a best-in-class e-barter trading platform and developing a critical mass of loyal customers quickly. Araby will continuously raise barriers to entry, adding new features and services to the site to ensure that the value of its paid service is greater than that of free services. It should be noted that potential competition offers the Company a major business opportunity. Entry of major Internet companies legitimizes the Company’s unique business models and market opportunities. In addition, major Internet companies may strike deals with Araby to provide the back-end to their trading floor or acquire Araby completely. 8.2 The Trust Factor A major weakness to Araby’s model is the same weakness as eBay, that the user experience is partially dependent on its members’ behavior. If a member is dishonest and lies about an item, or reneges on the trade, the other member will have a bad experience and not return to the site. Since trades do not involve any changing of money, enforcement of trades may be extremely difficult. There is no way for Araby to guarantee a positive trading experience. However, Araby will enact policies to develop a level of confidence in the service and to minimize fraud. Araby will: Initiate random spot-checks Offer a feedback forum feature whereby users publicly rate their trading partners Provide incentives for members to submit verifiable information through a third-party vendor Offer escrow service through a third-party vendor Establish an active and responsive customer service department Enforce a zero-tolerance policy for fraud on the Web site. Confidential Page 14 3/3/2016 Araby will also actively kick out abusers of the system and press criminal charges in fraudulent cases to set precedence. 8.3 Lack of Precedence Araby is risky because no one has ever successfully built a global, massive-scale, c2c e-barter exchange in either the online or offline world. No model exists to base the future success of the Company, aside for the extreme success of all other market types adapted to the Web. It should be noted, however, that no precedence existed when Jeff Bezos decided to pack his bags, move to Seattle, and launch a start-up called Amazon.com. Before Amazon.com, no one was selling books online. Before eBay, no one was buying or selling goods via auctions online. Within three years, both companies have market capitalizations worth billions of dollars. So far, every market activity that has been adapted online has been successful, if not improved upon. As a case study, one must only compare the market valuation of Amazon.com with the market valuation of its bricks and mortar competitor, Barnes & Noble. There are numerous reasons to suggest that Araby and e-barter will succeed tremendously online, following in the pioneer footsteps of Amazon.com and eBay. If successful, Araby has the unique opportunity to dominate the online trade exchange market as AOL dominates online services, Microsoft dominates operating systems, and Amazon.com dominates e-commerce. 9. Management 9.1 Joel Brodie, Founder & CEO Araby’s founder and CEO, Joel Brodie, brings over four years Internet start-up experience successfully formulating marketing strategies, developing business relationships, and growing brands online. In 1996, Mr. Brodie developed grassroots marketing programs at FreeLoader, Inc., the first Internet start-up success story to develop a product and be acquired for $38 million within a six-month period. As Director, Business Development at Simutronics, the leading developer of Internet games, Mr. Brodie was responsible for developing a Web distribution strategy to replace AOL as the primary distribution channel. With no marketing budget, he negotiated and implemented multi-year, revenue-share deals with portal and games destination sites, including Microsoft (MSN Game Zone), Lycos, Excite, Mplayer, AT&T WorldNet, and theglobe.com. As a result, Simutronics was placed on Washington Technology’s Fast 50 list for the past two consecutive years. 9.2 Future Partners Araby has a firm commitment from the following partners to work with the Company in the future: Cooley Godward, LLP (law firm) PricewaterhouseCooopers (audit firm) Silicon Valley Bank (commercial bank) 9.3 Future Management Hires Upon raising a first round of venture capital, the Company plans to hire numerous key players to round out its management team, including: Vice President, Product Development Chief Financial Officer Director, Customer Service & Quality Control Director, Community Development Confidential Page 15 3/3/2016 Director, E-commerce & Advertising Sales Director, Marketing (focus on viral marketing) The Company also plans to develop an in-house development and system administrative team. 9.4 Board of Advisors/Board of Directors The Company is currently in discussions with numerous key players within the Internet industry for placement on its Board of Advisors and Board of Directors. 10. Financials 10.1 Pro Forma Income Statement The Company’s pro forma income statement for the first five years of operations contains certain forwardlooking statements involving risk and uncertainties (see Appendix 7). Main Points The Company’s operating margins are expected to reach 35% by the end of the forecast, which is compatible with equity analysts future expectations for typical online auction and direct marketing sites.11 The Company’s long-term operating model is consistent with the long-term operating model of eBay as projected by BT Alex. Brown.12 Due to its attractive zero-gravity revenue models, the Company expects to reach profitability within a three-year period. Revenues Net revenues are gross revenues minus the cost of net revenues. Gross revenues consists of four revenue streams: transactions (cost per trade, pegged at $4 per transaction), direct marketing, advertising (ad banners), and sponsorships. During year one, transactions will account for 75% of revenues, followed by direct marketing (15%), sponsorships (5%), and ad banners (5%). As the site reaches critical mass, the percentage of revenues accounted by direct marketing and sponsorships will increase to 20% and 10%, respectively. Cost of net revenues include commissions to Web distribution partners, costs associated with customer support, and to a lesser extend, credit card fees, and ISP connectivity charges. The Company expects that costs of net revenues will consist of 25% of gross revenues. The annual growth rate is based on the percentage change of net revenues on a yearly basis. The Company expects the rate to increase to 700% within the first year of existence, as the Company aggressively grows its service through higher marketing expenses. This rate will stabilize at 200% within a five-year period, consistent with the growth rates of eBay and similar Internet sites. The Company expects that net revenues will grow from $750,000 in year one to $5,250,000 in year two, $11,250,000 in year three, $22,500,000 in year four, and $45,000,000 in year five. 11 12 BT Alex. Brown, eBay Equity Media Report, October, 27, 1998. BT Alex. Brown, eBay Equity Media Report, October, 27, 1998. Confidential Page 16 3/3/2016 Operating expenses Sales and marketing consists of expenses for sales and marketing personal, public relations, and the creative design of the Web site. Araby will invest heavily in sales and marketing in order to gain market share and build its brand within the first two years of operation. As the Company reaches critical mass and becomes the number one player within the e-barter market, sales and marketing expenses will decrease to 35% of the total operating model, consistent with the long term operating model of eBay and similar Internet companies. Research and development (R&D) includes compensation for internal development staff and payments to outside contractors. Within the first year of operation, R&D will account for the highest percentage of expenses as the Company develops its proprietary e-barter trading service and Web site. The initial architecture deployment (excluding internal staff compensation) will be approximately $1.5 million (for specific details, see Appendix 6). Since the technology will be scalable, the Company expects R&D to decrease over a five-year period to 20% of total revenues, accounting upgrading and maintaining the system. General and administrative (G&A) includes compensation for personal and fees to professional services, including legal counsel and overhead costs. The Company anticipates that G&A costs will start at 13% but stabilize at 10% of total revenues within a five-year period, consistent with eBay. The Company expects that total expenses will grow from $3,000,000 in year one to $5,250,000 in year two, $9,000,000 in year three, $16,875,000 in year four, and $29,290,000 in year five. Income During year one, the Company anticipates that operating expenses will be greater than revenues. However, the Company expects to break even by year two and reach profitability by year three. This will occur as sales and marketing and R&D costs decrease and revenues (as a result of Araby reaching critical mass) grow at 200% a year. Operating margins (“earnings before income tax divided by net revenues”) and net margins (“net income divided by net revenues”) will be 20% and 12% respectively by year three. By year five, operating margins will stabilize at 35%, consistent with the margins of similar Internet sites. 10.2 Funding Araby requests a first-round investment of venture capital of $3,000,000 to: Develop the proprietary trading and database system Create a first-class, user-friendly Web site Hire a strong management team Launch the service during 4Q 99 with the “Gift Exchange” promotion 10.3 Exit Strategy Araby presents investors with numerous opportunities to gain extremely high returns on their initial investment. E-barter is a revolutionary new concept in e-commerce. It is so simple, it will touch everyone online – from consumers to small businesses to huge corporations on a global scale. Araby’s centralized, proprietary, Internet solution transforms barter from an inefficient, fragmented, expensive and marginalized economic activity into an efficient, universal, inexpensive, and popular way to exchange goods and services online. By being first to market, Araby has the opportunity to build its brand synonymous with e-barter and dominate the market for years to come. Confidential Page 17 3/3/2016 The direct marketing opportunity is just as huge. The data Araby will collect on its members will be among the most highly valued on the Internet, since it is collected voluntarily and based on member preferences as determined by their trading activity through the Web site. Unlike other Internet ventures, Araby not only will make money, but also it will reach profitability once it hits critical mass. This is guaranteed by its attractive, multiple “zero-gravity” models, whereby long-term overhead costs are extremely low. Within a one to two year period, Araby faces two likely scenarios: First, Araby will position itself as an attractive IPO candidate. This will bring in a large influx of capital to ensure continual dominance within the marketplace, grow membership, and discourage credible competition. Secondly, a partner interested in exploiting and entering the e-barter and/or direct-marketing markets may acquire Araby. The number of potential acquisition partners is limitless due to Araby’s dual, attractive business opportunities: Online auctions – eBay, USA Networks (City Auction) E-commerce sites – Amazon.com Portals – Yahoo!, Lycos, Excite/@Home Online Services – AOL Broadband Cable Companies – Paul Allen’s Vulcan Ventures, AT&T Online Direct Marketers – Xoom.com/NBCi Offline Direct Marketers – Federated/Fingerhut Traditional Retail – Wal-Mart Other – Microsoft In both scenarios, Araby will be valued at a high premium, due to its lucrative “zero-gravity” business models, unique e-barter market opportunity, valuable direct marketing database, proprietary technology, massive online community, and tremendous upside. Confidential Page 18 3/3/2016 11. Appendices Appendix 1: Registration Home Page New? Trade Now Member User: Password: Save Password: Personal Info Email Credit Card Demo (optional) Terms of Service More Info (optional) Drivers SS # 3rd Party Verification Verification email with Password & user name Appendix 2: Adding Items to the Trading Floor Jack’s Page Add item Add Item Select category Product Description Value Add graphic Sample Yes Approve? Y or N Celine Dion CD Category: DVD Description: xxx Pix… Create Item Number - 01 No Modify Add to trading floor under entertainment> Music>CD Example 2 Traders, Jack & Jill Jack wants to trade his Celine Dion CD for Jill’s Titanic DVD. Confidential Page 19 3/3/2016 Appendix 3: Searching for items/Making an offer/Completing a trade My Araby (Jack) Search by: Product Keyword Value Categories Trading cards Households Entertainment Etc… Personal Agent Entertainment>Movies> DVD User Item ID Value More Jill Titanic 01 $10 click Xxx xxx xxx xxx Item 02 Member: Jill Description: Titanic Value Days on Floor Pix Offer History Member Offer ID Bob Marley CD 05 Xxx xxxx xx xx Make Offer? Automatically adds Jack’s item as offer Email to Jack verifying trade Automatically bill account Jill accepts Make Trade Email to Jill verifying trade Item 01 Member: Jill Description Value Days on Floor Pix Offer History Member Offer ID Accept Bob Marley CD 05 Jack Dion CD 02 Automatically bill account Appendix 4: Personalization New? Home Page Trade Member Page Member User: Password: Save Password: Agent Trading History Reputation Hot Links Cookie Confidential Page 20 3/3/2016 Appendix 5: Goods and Services Trading cards (sports, Pokemon) Vacation timeshares Collectibles Books Used clothing Computer software & hardware Movies (DVDs) Music (CDs) Games (Sony PlayStation, Nintendo, & PC) Small business services Appendix 6: Initial Architecture Deployment (Costs & Equipment) $650,000 for NetDynamics servers and consulting support $125,000 for Oracle licensing $25,000 for Oracle Consulting Support $175,000 for Sun Solaris data servers $75,000 for data storage and replication technology $300,000 for consultation support and application development $50,000 for data communications and power $100,000 for systems integration (with advertising, shipping, and other partners) Confidential Page 21 3/3/2016 Appendix 7: Pro Forma Income Statement Year 1 Revenues Transactions Direct Marketing Advertising Sponsorship Gross Revenues Cost of Net Revenues Net Revenues Annual Growth Rate Operating Expenses Sales and Marketing Research and Development General and Administrative Total Expenses Year 2 750,000 150,000 50,000 50,000 $ 1,000,000 250,000 $ 750,000 $ Year 3 5,250,000 1,050,000 350,000 350,000 $ 7,000,000 1,750,000 $5,250,000 700% 1,200,000 $ 3,150,000 1,700,000 1,575,000 100,000 525,000 $ 3,000,000 $ 5,250,000 EBIT EBIT Margin $ (2,000,000) NA Income Tax (39%) Net Income Net Margin NA $ (2,000,000) NA $ 9,750,000 3,000,000 750,000 1,500,000 $ 15,000,000 3,750,000 $11,250,000 214% $ - $ - $ NA Year 5 19,500,000 6,000,000 1,500,000 3,000,000 $ 30,000,000 7,500,000 $22,500,000 200% 5,625,000 $ 10,125,000 2,250,000 4,500,000 1,125,000 2,250,000 $ 9,000,000 $ 16,875,000 NA $ Year 4 2,250,000 20% 877,500 1,372,500 12% $ $ 39,000,000 12,000,000 3,000,000 6,000,000 $ 60,000,000 15,000,000 $45,000,000 200% $ 15,750,000 9,000,000 4,500,000 $ 29,250,000 5,625,000 25% $ 15,750,000 35% 2,193,750 3,431,250 15% $ 6,142,500 9,607,500 21% ASSUMPTIONS: Operating Model (Expenses as a % of Revenues) Sales and Marketing Research and Development General and Administrative Operating Margin Net Margin Confidential 160% 227% 13% NA NA 60% 30% 10% NA NA Page 22 50% 20% 10% 20% 12% 45% 20% 10% 25% 15% 3/3/2016 35% 20% 10% 35% 21%