Chapter 13: Corporations: Paid-in Capital and the Balance Sheet

advertisement

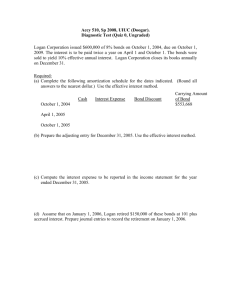

Chapter 13: Corporations: Paid-in Capital and the Balance Sheet True or False A corporation is a separate legal entity formed under the laws of a particular state. Stock sold for amounts in excess of par value results in a gain reported on the income statement. When a corporation sells 10,000 shares of $10 par value common stock for $12,000, the common stock account is credited for $100,000. Profitable operations result in net income, which increases retained earnings. Every corporation issues preferred stock. When a company has issued both preferred and common stock, the preferred stockholders are allocated their dividends first. Book value is the amount of owner's equity on the company's books for each share of its stock. Which of the following is a characteristic of a corporation? A) The owners of a corporation have co-ownership of the property of the corporation. B) A corporation is not taxed on the corporation's business income. C) A corporation has a limited life. D) The owners of a corporation have limited liability for the corporation's debts. Which of the following characteristics of a corporation limits a stockholder's losses to the amount of his or her investment in the stock of the corporation? A) Transferability of ownership C) Separate legal entity B) Limited liability D) Separation of ownership and management Which of the following corporate characteristics is a disadvantage of the corporate form of business? A) Limited liability C) No mutual agency B) Double taxation D) Transferability of ownership Which of the following is TRUE of retained earnings? A) Retained earnings do not appear on any financial statement. B) Retained earnings represent investments by the stockholders of a corporation. C) Retained earnings represent capital earned through profitable operations. D) Retained earnings are a liability on the corporate balance sheet. Which of the following are included in paid-in capital? A) Investments by the stockholders of a corporation are included in paid-in capital. B) Capital earned through profitable operations are included in paid-in capital. C) Investments by the creditors of a corporation are included in paid-in capital. D) All of the above are included in paid-in capital. Which of the following occurs when a shareholder invests cash in a corporation? A) Both liabilities and stockholders' equity are increased. B) Both assets and stockholders' equity are increased. C) One asset is increased and another asset is decreased. D) Both assets and liabilities are increased. Which of the following would occur if 35,000 shares of $10 par common stock are issued at $16. 50 per share? A) Total paid-in capital increases by $350,000. B) Total paid-in capital increases by $277,500. C) Total paid-in capital decreases by $577,500. D) Total paid-in capital increases by $577,500. Which of the following would occur if a corporation issues stock at a price above par value? A) Common stock would be debited. B) Retained earnings would be credited. C) Paid-in capital in excess of par ∙ common would be credited. D) Gain on sale of stock would be credited. A corporation declares a dividend of $. 75 per share on 12,500 shares of common stock. Which of the following would be included in the entry to record the declaration? A) Retained earnings would be debited for $9,375. B) Paid-in capital in excess of par ∙ common would be credited for $9,375. C) Retained earnings would be credited for $9,375. D) Dividends payable would be debited for $9,375. On which of the following dates do dividends become a liability of a corporation? A) on the declaration date. B) on the date of record. C) at the end of the accounting period when the adjusting entry is prepared. D) on the payment date. Which of the following is the price for which a person can buy or sell a share of stock? A) Book value C) Cumulative equity B) Market value D) Average shareholders' equity If a company has only common stock, which of the following is the result of dividing total stockholders' equity by the number of shares outstanding? A) The result is liquidation value per share of common stock. B) The result is par value per share of common stock. C) The result is book value per share of common stock. D) The result is market value per share of common stock. Chapter 14: Corporations: Retained Earnings and the Income Statement True or False Stock dividends have no effect on assets or liabilities. Stock dividends are distributed to stockholders in proportion to the number of shares each stockholder already owns. Treasury stock is a corporation's own stock that it has issued and later reacquired. One of the reasons for acquiring treasury stock is to avoid a takeover by an outside party. The entry to record an appropriation of retained earnings requires a debit to retained earnings and a credit to cash. A company originally issued 40,000 shares of $5 common stock at $8. The company has now issued a 5% stock dividend when the market price of the stock is $10 a share. What is the amount to be credited to the common stock account when the shares are distributed? A) $45,000 B) $16,000 C) $10,000 D) $20,000 How is treasury stock reported on the balance sheet? A) as a contra stockholders' equity account. B) as a contra asset account. C) as a liability account. D) as a contra liability account. Which of the following statements is TRUE? A) Restrictions on retained earnings reduce total assets on the balance sheet. B) Restrictions on retained earnings are usually reported in the notes to the financial statements. C) Restrictions on retained earnings are disclosed on the income statement. D) None of these statements are true. How would a gain on the sale of machinery be reported on an income statement? A) as an extraordinary gain. B) as a component of net sales. C) as a component of income from discontinued operations. D) as a component of income from continuing operations. A corporation has $40,000 of retained earnings at the beginning of the period. The company has net income of $5,000 and pays dividends of $30,000 during the period. What is the balance in retained earnings at the end of the period? A) $35,000 B) $15,000 C) $25,000 D) $ 5,000 __________ is a distribution by a corporation of its own stock to its stockholders. A) Stock Dividend B) Retained Earnings C) Unrealized gains or losses on certain investments D) All of these items are found on a statement of comprehensive income. Chapter 15: Long-Term Liabilities True or False Bonds payable are groups of notes payable issued to multiple lenders called bondholders. Debentures are unsecured bonds backed only by the good faith of the borrower. A bond issued at par has no discount or premium. Callable bonds are bonds that the issuer may call or pay off at a specified price whenever the issuer wants. Serial bonds are bonds that may be converted into the common stock of the issuing company at the option of the investing company. The entry to record a call of bonds payable generally includes a gain or loss on the retirement of bonds payable. A discount on a bond payable is the excess of the bond's issue price over its maturity value. The stated interest rate is the interest rate that determines the amount of cash the borrower pays and the investor receives each year. Which of the following is a characteristic of a bond? A) Each bondholder is an owner of the corporation. B) A bond represents the ownership of a corporation. C) The corporation must repay a bond. D) The corporation may or may not pay interest on the bond. Which of the following is the definition of secured bonds? A) Unsecured bonds backed only by the good faith of the borrower. B) Bonds that mature in installments over a period of time. C) Borrower's promises to transfer the legal title to certain assets to the lender if the debt is not paid on schedule. D) Bonds that all mature at the same time for a particular issue. Which of the following is the amount the borrower must pay back to the bondholders? A) Maturity date C) Stated interest rate B) Present value D) Principal amount A company issues bonds with a stated rate of 8% when the market interest rate is 7%. How will the bonds be issued? A) The bonds will be issued at par. B) The bonds will be issued at a discount. C) The bonds will be issued at a premium. D) None of the above. A company issues bonds with a stated rate of 6% when the market interest rate is 7%. How will the bonds be issued? A) The bonds will be issued at a premium. B) The bonds will be issued at a discount. C) The bonds will be issued at par. D) None of the above. How much cash will be received if a corporation issues $6,000,000 of 10% bonds at 102? A) $6,120,000 B) $6,000,000 C) $6,012,000 D) $5,880,000 How much cash will be received if a corporation issues $6,000,000 of 10% bonds at 98? A) $6,120,000 C) $6,012,000 B) $6,000,000 D) $5,880,000 A corporation issues $400,000 of 10%, 5-year bonds at face value. What will be the total interest expense over the life of the bonds? A) $8,000 B) $200,000 C) $40,000 D) $400,000 A company issues two thousand $1,000 bonds at 102. Which of the following is the entry to record this transaction? A) Cash 2,040,000 Premium on bonds payable 40,000 Bonds Payable 2,000,000 B) Cash 2,000,000 Premium on bonds payable 40,000 Bonds Payable 2,040,000 C) Cash 2,040,000 Discount on bonds payable 40,000 Bonds Payable 2,000,000 D) Cash 2,040,000 Bonds Payable 2,040,000 A company issues two thousand $1,000 bonds at 98. Which of the following is the entry to record this transaction? A) Cash 1,960,000 Bonds Payable B) Cash 2,000,000 Premium on bonds payable Bonds Payable C) Cash 1,960,000 Discount on bonds payable Bonds Payable D) Cash 1,960,000 Premium on bonds payable Bonds Payable 1,960,000 40,000 1,960,000 40,000 2,000,000 40,000 2,000,000 A company issues two thousand $1,000 bonds at face amount. Which of the following is the entry to record this transaction? A) Cash 2,000,000 Bonds Payable 2,000,000 Premium on bonds payable Bonds Payable C) Cash 2,000,000 Premium on bonds payable Bonds Payable D) Cash 2,040,000 Discount on bonds payable Bonds Payable 2,000,000 B) Cash 40,000 2,040,000 40,000 1,960,000 40,000 2,000,000 Which of the following would be a reason that the stockholders of a company would issue bonds rather than stock to finance expansion? A) Leveraged debt is always more advantageous than additional stock. B) The value of their stock will inevitably decrease. C) Dividends must be paid each year even if the company is not profitable. D) Additional shares of stock might decrease earnings per share. Which of the following is an advantage of issuing stock rather than issuing bonds? A) Issuing stock creates interest expense that must be paid. B) Issuing stock is more risky to the issuing corporation. C) Issuing stock creates no liabilities. D) Issuing stock generally results in higher earnings per share. Which of the following is a characteristic of stock? A) The corporation must pay dividends on stock. B) The corporation must repay stock. C) Stock represents a liability of a corporation. D) Each stockholder is an owner of the corporation. Chapter 16: The Statement of Cash Flows True or False The statement of cash flows reports why cash increased or decreased during the period. Cash equivalents include highly liquid short-term investments that can be readily converted into cash. When a company uses the indirect method to present the statement of cash flows, depreciation expense must be added to net income to reconcile to net cash provided by operating activities. Which of the following is TRUE of the statement of cash flows? A) It reports why cash increased or decreased during the period. B) It covers a span of time and is dated "Year Ended Month Day, Year". C) It shows where cash came from and how cash was spent. D) All of these are true of the statement of cash flows. Which of the following are created by operating activities? A) Revenues and expenses are created by operating activities. B) An increase in common stock is created by operating activities. C) An increase in long-term debt is created by operating activities. D) Both A and B are created by operating activities. Which of the following is true about a statement of cash flows? A) It is prepared at the option of management. B) It is required by generally accepted accounting principles. C) It may be combined with the income statement. D) It does not have to be completed if an income statement is prepared. Which of the following is true if a corporation shows a net loss on its income statement? A) They may still have a net increase in cash. B) They will not be able to sell stock. C) They will not be able to pay dividends. D) They may still have an increase in retained earnings. Which of the following descriptions do apply to cash equivalents? A) Cash equivalents' values change because of interest rate changes. B) Cash equivalents are invested in fixed assets. C) Cash equivalents are long-term. D) Cash equivalents are highly liquid. Which of the following is the correct order of the sections on a statement of cash flows? A) The correct order is operating, financing, investing. B) The correct order is financing, investing, operating. C) The correct order is investing, operating, financing. D) The correct order is operating, investing, financing. Which of the following are the three major categories included on the statement of cash flows? A) They are investing, operating and financing activities. B) They are investing, capital and financing activities. C) They are investing, operating and capital activities. D) They are financial, operating and capital activities. Which of the following are the activities that are included in the operating activities section of the statement of cash flows? A) Activities that obtain the cash needed to launch and sustain the business. B) Activities that create revenue or expenses in the entity's major line of business. C) Activities that increase or decrease long-term assets. D) None of these is an accurate description of the activities included. Which of the following sections from the statement of cash flows is the most important section because this section reflects the day-to-day operations that determine the future of an organization? A) The financing section is the most important. B) The operating section is the most important. C) The investing section is the most important. D) The most important section is not included in the above-mentioned sections. Which of the following sections from the statement of cash flows includes activities that increase and decrease long-term assets? “Activities that increase and decrease long-term assets ______________” A) are included in the financing section. B) are included in the operating section. C) are included in the investing section. D) are not included in any of the above-mentioned sections. Which of these sections from the statement of cash flows includes the issuance of stock and payment of dividends? “The issuance of stock and the payment of dividends _____________________________ “ A) are included in the investing section. B) are included in the financing section. C) are included in the operating section. D) are not included in any of the above-mentioned sections. Which of the following sections from the statement of cash flows includes borrowing money and paying off loans? “Borrowing money and paying off loans _______________________________________” A) are included in the investing section. B) are included in the operating section. C) are included in the financing section. D) are not included in any of the above-mentioned sections. A company sold equipment with a book value of $9,000 at a gain of $2,500. How much will be reported in the investing activities section of the statement of cash flows as cash received upon the sale of the equipment? “The cash received upon the sale of the equipment was ____________” A) $ 11,500. C) $ 6,500. B) $ 2,500. D) $ 13,000. Chapter 17: Financial Statement Analysis True or False Most financial statement analysis covers trends of more than one year. Vertical analysis is the study of percentage changes in comparative financial statements. Trend percentages are a form of horizontal analysis. Horizontal analysis and vertical analysis are used to analyze the performance of a single company. A common size statement reports only percentages, no dollar amounts. Common size statements allow the comparison of two or more companies with different amounts of net sales and net assets. The current ratio is the most widely used ratio to measure a company's ability to pay current liabilities. The inventory turnover ratio indicates how rapidly inventory is sold. Days' sales in receivables is a measure of a company's ability to collect receivables. Rate of return on net sales is a measure of a company's profitability. Which of the following types of analysis makes the following statement true? “ _________________ would include the comparison of 2008 operating expenses with 2007 operating expenses. “ A) Horizontal analysis C) Profitability analysis. B) Vertical analysis. D) Capital analysis. Which of the following ratios is a measure of a company's ability to pay liabilities with current assets? A) The inventory turnover ratio. B) The day's sales in receivables. C) The current ratio. D) The acid-test ratio. Which of the following is the formula to compute the current ratio? A) (cash + short-term investments + net current receivables) / current liabilities. B) (current liabilities + short-term investments + net current receivables) / current assets. C) (current assets / current liabilities) D) (cash + short-term investments + net current receivables) / current assets.