Intermediate Macroeconomics 311 (Professor Gordon)

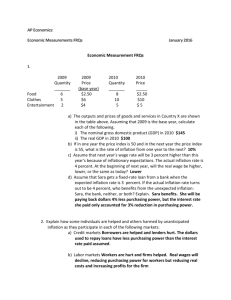

advertisement

Intermediate Macroeconomics 311 (Professor Gordon) Final Examination Fall, 2007 YOUR NAME: INSTRUCTIONS 1. The exam lasts 2 hours. 2. The exam is worth 120 points in total: 35 points for the multiple choice questions, 55 points for the analytical questions, and 30 points for the essays. 3. Write your answers to Part A (the multiple choice section) in the blanks on page 1. You won’t get credit for circled answers in the multiple choice section. 4. Place all of your answers for part B in the space provided 5. You must show your work for part B questions 6. Write your essays with a pen. Write clearly! 7. Good Luck and Happy Holidays! PART A Choose the ONE alternative that BEST completes the statement or answers the question. Your answers must be in the space provided below. USE CAPITAL LETTERS. 1. ____ 7. ____ 13. ____ 19. ____ 25. ____ 31. ____ 2. ____ 8. ____ 14. ____ 20. ____ 26. ____ 32. ____ 3. ____ 9. ____ 15. ____ 21. ____ 27. ____ 33. ____ 4. ____ 10. ____ 16. ____ 22. ____ 28. ____ 34. ____ 5. ____ 11. ____ 17. ____ 23. ____ 29. ____ 35. ____ 6. ____ 12. ____ 18. ____ 24. ____ 30. ____ 1 1. A neutral policy maintains _________ constant. (a) inflation rate (b) log-output ratio (c) nominal GDP growth (d) real GDP growth 2. The “trilemma problem” implies that countries that opt for (a) fixed exchange rates lose control of domestic monetary policy. (b) flexible exchange rates lose control of domestic monetary policy. (c) fixed exchange rates may experience exchange rates that “overshoot” when there are large capital inflows. (d) flexible exchange rates may experience exchange rates that “overshoot” when there are large capital inflows. 3. The AD curve will shift to the (a) right if the price level falls and the quantity of money is held constant. (b) right if the price level rises and the quantity of money is held constant. (c) right if the price level is held constant and the quantity of money rises. (d) right if the price level is held constant and the quantity of money falls 4. In the formula for calculating the growth rate of multifactor productivity, the growth rate of labor productivity is represented by (a) y–n (b) b(k – n) (c) bk/n (d) b–n 5. Successful activist stabilization policy presumes that (a) the timing of policy impact on nominal GNP is known. (b) the magnitude and size of impact are known. (c) the timing and magnitude of the impact of AD disturbances are known, forecasted with precision. (d) All of the above 6. If inflation is greater in Mexico by 10% than it is in the rest of the world then the purchasing power parity theory predicts that the (a) Mexican peso would appreciate. (b) Mexican peso would depreciate. (c) Mexican peso would remain stable. (d) U.S. dollar would weaken. 7. Which of the following factors will NOT cause the AD curve to shift? (a) tax rates. (b) autonomous exports. (c) changes in the marginal product of labor. (d) consumer confidence. 2 8. The inflation differential is (a) always zero. (b) foreign inflation plus domestic inflation (c) domestic inflation minus foreign inflation (d) never negative. 9. Probably the best measure of a country’s economic growth is the growth of (a) real domestic investment. (b) real GDP. (c) real GDP per person. (d) real consumption expenditures 10. The Phillips Curve was first discovered in the (a) 1930s (b) 1950s (c) 1970s (d) 1990s 11. The economic consensus was to favor ___________ policy in the decade of the _________ and favor _____________ policy in the decade of the ___________. (a) monetary; 1930s; fiscal; 1990s (b) fiscal; 1930s; monetary; 1960s (c) fiscal; 1960s; monetary; 1930s (d) monetary; 1990s; fiscal; 1960s 12. In the late 1960s, the Friedman-Phelps “natural rate hypothesis” predicted from the microeconomic structure of the labor market that the long-run Phillips curve is __________, while macroeconomic events caused a very ________ acceptance of this change in aggregate supply theory. (a) horizontal, rapid (b) horizontal, gradual (c) vertical, rapid (d) vertical, gradual 13. The aggregate demand curve may be derived from the IS-LM analysis by shifting (a) the IS curve as the price changes. (b) the real money supply and thus LM curve for each new price level. (c) both the LM and IS curves since the real money supply and real expenditures change when P changes. (d) the LM rightward when P increases to define Y. 3 14. After a period of sustained unexpected inflation, it is likely that the renegotiation of nominal wages will (a) shift the SAS curve downward thereby increasing output. (b) shift the SAS curve upward thereby increasing output. (c) shift the SAS curve upward thereby decreasing output. (d) shift the AD curve downward thereby increasing output. 15. If the inflation rate is 10% and nominal GDP growth is 8% then real GDP must have (a) increased by 2%. (b) decreased by 18%. (c) decreased by 2%. (d) increased by 18%. 16. The output-capital ratio (Y/K) depends on the following four determinants. Which determinant of these four is most likely to be affected by government growth policy? (a) the nature of the production function (b) the depreciation rate (c) the growth rate of labor input (d) the growth of capital per person 17. Suppose that the nominal exchange rate between the dollar and the English pound was 1 pound per $2 and that the English price level was twice that of the U.S., then the real exchange rate is (a) 1 pound/$1. (b) 2 pounds/$1. (c) 1 pound/$2. (d) 1 pound/$4. 18. The theory of economic growth divides the causes of growth into (a) elements affecting the output ratio and factors affecting population growth. (b) elements affecting the output ratio and factors affecting inflation. (c) elements affecting the amount of factor inputs available and the productivity of those inputs. (d) None of the above 19. Let the government increase autonomous taxes. The aggregate demand curve will (a) shift leftward and the IS curve will shift leftward. (b) shift rightward and the IS curve will shift rightward. (c) remain unaffected but the IS curve will shift leftward. (d) become positively sloped but the IS curve will remain negatively sloped. 20. Unanticipated inflation will hurt _______ and help _______. (a) pensioners; borrowers (b) borrowers; pensioners (c) the government; tax payers (d) homeowners; banks 4 21. An acceleration of nominal GDP growth from, say 4% to 6% will (a) permanently raise the rate of inflation. (b) temporarily lower the rate of inflation. (c) leave real GDP unaffected in the long run. (d) Both (a) and (c). 22. Which of the following events will tend to increase net exports of the U.S.? (a) a fall in the real interest rate in several western European countries (b) an increase in the U.S. real interest rate (c) a depreciation of the dollar (d) none of the above 23. The Taylor Rule suggests that (a) Interest rates were too high during 2001-04 (b) Interest rates were too low during 2001-04 (c) Weights changed over the 1980-2004 period (d) (a) and (c) (e) (b) and (c) 24. During ____ productivity growth grew ______ and during _____ productivity growth grew ______ (a) late 1990s; slower; early 2000s; faster (b) late 1990s; faster; early 2000s; slower (c) 2005-2007; slower; early 2000s; faster (d) 2005-2007; faster; early 2000s; slower 25. If the productivity of labor were suddenly to increase, we would expect to observe (a) a short-run rise in output and fall in prices. (b) an increase in the natural level of real GDP. (c) a downward shift in the aggregate supply curve. (d) All of the above are correct. 26. When the actual inflation rate is equal to the expected inflation rate the economy will be ____________ and the SP curve will ____________. (a) in long-run equilibrium; shift upward (b) in disequilibrium, at an output level less than the natural rate of output; shift upward (c) in short-run equilibrium; shift upward (d) in short- and long-run equilibrium; be stable 5 27. Given that all countries have the same Cobb-Douglas production function, i.e. Y/N=(K/N)b, a ten-fold difference in per capita income requires a difference in capital per capita by a factor of (a) 10. (b) 10b. (c) 101/b. (d) b. 28. “Okun’s Law” refers to (a) the trade-off between inflation and unemployment. (b) the relationship between real and nominal output growth. (c) minimum wage laws and the impact of price controls. (d) the relationship between the unemployment rate and the ratio of actual to natural output. 29. If the economy is characterized by diminishing or decreasing returns to scale, then (a) a doubling of inputs will lead to a three-fold increase in output. (b) a doubling of inputs will lead to a constant output. (c) a doubling of inputs will lead to a two-fold increase in output. (d) a doubling of inputs will lead to a less than two-fold increase in output. 30. In equilibrium, rate of growth of capital in a simple closed economy (i.e. NX=0) is determined primarily by (a) the growth rate of savings. (b) the level of saving less expenditures for replacement capital. (c) per capita well being. (d) the growth rate of replacement capital. 31. Which of the following policies would NOT affect the natural unemployment rate? (a) a reduction in minimum wages (b) an increase in public-service employment (c) an increase in subsidized private employment (d) a reduction in sales taxes 32. Monetarists believe that the major source of macroeconomic instability lies in (a) the private investment sector and the government sector. (b) the government sector. (c) private corporations and the government sector. (d) export and import sector. 33. Before the Great Depression, macroeconomic theory was dominated by the __________ approach that presumed the essential ________ of the private economy. (a) Keynesian, stability (b) Keynesian, instability (c) old classical, stability (d) old classical, instability 6 34. Myths discussed by the Economist about the Great Depression include that Hooverera government policy was ___________ and that Roosevelt New Deal policy was _______ (a) passive; passive (b) perversely active; passive (c) passive; perversely active (d) perversely active; perversely active 35. The Okun’s Law line in Chapter 8 lies above the actual values for 1995-2004 because (a) Supply shocks were beneficial in this period (b) The natural rate of unemployment fell (c) The natural rate of unemployment rose (d) Supply shocks were adverse in this period 7 PART B (55 points) QUESTION 1 (25 points) Consider an economy characterized by the following production function Y AK 1 / 3 H 1 / 6 N 1 / 2 , where K represents physical capital, H is human capital and N is labor. Assume that the growth rate of labor n 0.05 , the depreciation rate d 0.05 (both physical and human capital depreciate at the same rate) and A=1. Investment I is the sum of two components, investment in physical capital I K and investment in human capital I H . The fraction of GDP that goes to physical capital investment is s K 0.2 and the fraction of GDP that goes to human capital investment is s H 0.2 1) Derive an expression for the marginal product of physical capital ( MPK ) and the marginal product of human capital ( MPH ) (4 points) 1 MPK K 2 / 3 H 1 / 6 N 1 / 2 3 and 1 MPH K 1 / 3 H 5 / 6 N 1 / 2 6 2) Show that the share of physical capital in output is 1/3 and the share of human capital in output is 1/6. (Assume that each factor is paid its marginal product) (4 points) 1 2 / 3 1 / 6 1 / 2 K H N K MPK K 3 1/ 3 The share of physical capital in output is Y K 1/ 3 H 1/ 6 N 1/ 2 1 1 / 3 5 / 6 1 / 2 K H N H MPH H 6 1/ 6 Similarly, the share of human capital in output is Y K 1/ 3 H 1/ 6 N 1/ 2 Y K H to both and . Write N N N K down the equations characterizing the steady state physical capital - labor ratio ( ) and N H the steady state human capital – labor ratio ( ). (5 points) N 3) Convert the production function to a function relating Y K H ( )1 / 3 ( )1 / 6 N N N 8 Steady state physical capital-labor ratio is characterized by s K Steady state human capital-labor ratio is characterized by s H Y K (n d ) N N Y H (n d ) N N 4) Using the equations from part 3, find the steady-state physical capital-labor ratio ( and the steady-state human capital-labor ratio ( H ) (8 points) N Combining the equations from previous part, we have K H K s K ( )1 / 3 ( )1 / 6 ( n d ) N N N K 1/ 3 H 1/ 6 H s H ( ) ( ) (n d ) N N N Substituting for s , n and d we get: K H K 0.2( )1 / 3 ( )1 / 6 0.1 N N N K 1/ 3 H 1/ 6 H ) ( ) 0.1 N N N K H K H 4 Solving for and we get: N N N N 0.2( 5) Find the steady state output per person ( Y ). (4 points) N 9 K ) N QUESTION 2 (15 points) Suppose that natural real GDP ( Y N ) equals 1,000, the Fed’s desired real federal funds rate ( r FF * ) equals 3% and its desired inflation rate ( p * ) equals 2%. Suppose you are given the following combinations of actual inflation and real GDP: Year 2000 2001 2002 2003 Actual inflation 2% 3% 3% 4% Real GDP 900 1,000 1,100 1,200 1) For each level of GDP, compute the log output ratio Yˆ . (3 points) 2000: Yˆ 10.53 2001: Yˆ 0 2002: Yˆ 9.53 2003: Yˆ 18.23 ˆ Y 2) Write down the equation for the Taylor Rule, leaving unspecified the parameters a and b. (2 points) Equation for the Taylor Rule: r FF r FF* a( p p * ) bYˆ or r FF 3 a ( p 2) bYˆ 3) Using the Taylor Rule, calculate the real federal funds rate for the given combinations of inflation and real GDP when a b 1. (5 points) In this case, Taylor Rule is r FF 3 ( p 2) Yˆ Real federal funds rate is: 2000: r FF 7.53 2001: r FF 4 2002: r FF 13.53 2003: r FF 23.23 4) Using the Taylor rule, calculate the real federal funds rate for the given combinations of inflation and real GDP when the Fed is targeting inflation, that is, a 1 and b 0 . (5 points) In this case, Taylor Rule is r FF 3 ( p 2) p 1 Real federal funds rate is: 10 2000: 2001: 2002: 2003: r FF 3 r FF 4 r FF 4 r FF 5 QUESTION 3 (15 points) Let the following represent the structure of a large open economy with a fixed exchange rate: C = CA + 0.6(Y-T) CA = 500-5r T = 1000 (M/P)D = 0.2Y-10r MS/P = 1000 IP = 1000-20r G = 1000 NX = 1000-0.1Y-100e (A) Initially let foreign and domestic interest rates be equal so that r = rf and let the foreign exchange rate e=2. Find the IS and LM equations. (5 points) k = 1/[(1-0.6)(1-0)+0+0.1] = 2 AP = 500-5r-0.6(1000)+1000-20r+1000+800 = 2700-25r IS: Y=k*AP = 2(2700-25r) = 5400-50r LM: MS/P=(M/P)D => 1000 = 0.2Y-10r => Y = 5000+50r (B) Find the equilibrium domestic and foreign interest rates and the equilibrium output. (2 points) Solve IS and LM simultaneously r=4 Y = 5200 (C) Suppose the balance of payments (BOP) is zero if Y and r satisfy: r=-101+0.02*Y. Calculate the new level of equilibrium output, the interest rate, and the money supply after an increase of autonomous consumption by 100. (so that now CA = 600-5r) (Hint: Use the new IS curve and the BOP equation to determine the new level of output and interest rate. Then determine the money supply that makes the LM curve pass through the new equilibrium) (8 points) New IS : Y = 5600-50r BOP : r=-101+0.02Y. 11 Solving for r and Y: Y=5325 and r=5.5 New money supply: MS/P=0.2(5325)-10(5.5)=1010 12 PART C (30 points) WRITE YOUR NAME AND ID NUMBER ON YOUR BLUE BOOK. YOU MUST ANSWER THE ESSAY QUESTIONS IN PEN NOT PENCIL. YOU RECEIVED AN E-MAIL ON DECEMBER 11 REMINDING YOU TO BRING A PEN, OR BETTER YET, 2 PENS. This year there are two 15 minute essay questions. Write answers to BOTH questions 1 and 2 in your blue book. 1. Write a 15-minute essay on what has happened to the U. S. economy in the period since the textbook was sent to the printer in March, 2005. Use as sources any reading items dated after mid-2005 and especially the comments in the lectures and the updated Powerpoint slides which in lectures displayed data through mid-2007. Divide your essay into two parts. a) How has the DEMAND side of the U. S. economy evolved since early 2005? Can you explain the major aspects of this evolution by any theory learned in this course, or have there been unique developments not covered by any theory? b) How has the SUPPLY side of the U. S. economy evolved since early 2005? Can you explain the major aspects of this evolution by any theory learned in this course, or have there been unique developments not covered by any theory? 2. A major theme of this course has been the economic interactions between China and the U. S. a) Do imports from China inevitably imply a permanently higher rate of unemployment in the U. S. Why so or why not? b) Trace in a short but well-organized essay the effects of the China-US interaction on the following macro variables in the US: the current account, the capital account, productivity growth, the inflation rate, the 10-year treasury bond rate, and the tradeweighted exchange rate of the dollar (against all currencies, not against the Chinese currency) 13