AP Economics: Economic Measurements FRQs

advertisement

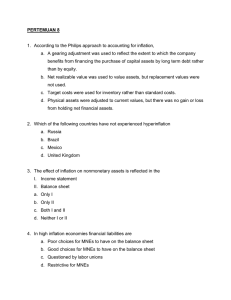

AP Economics: Economic Measurements FRQs January 2016 Economic Measurement FRQs 1. 2009 Quantity _______ Food 6 Clothes 5 Entertainment 2 2009 Price (base year) $2.50 $6 $4 2010 Quantity _______ 8 10 5 2010 Price _____ $2.50 $10 $5 a) The outputs and prices of goods and services in Country X are shown in the table above. Assuming that 2009 is the base year, calculate each of the following. i) The nominal gross domestic product (GDP) in 2010 $145 ii) The real GDP in 2010 $100 b) If in one year the price index is 50 and in the next year the price index is 55, what is the rate of inflation from one year to the next? 10% c) Assume that next year’s wage rate will be 3 percent higher than this year’s because of inflationary expectations. The actual inflation rate is 4 percent. At the beginning of next year, will the real wage be higher, lower, or the same as today? Lower d) Assume that Sara gets a fixed-rate loan from a bank when the expected inflation rate is 3 percent. If the actual inflation rate turns out to be 4 percent, who benefits from the unexpected inflation: Sara, the bank, neither, or both? Explain. Sara benefits. She will be paying back dollars 4% less purchasing power, but the interest rate she paid only accounted for 3% reduction in purchasing power. 2. Explain how some individuals are helped and others harmed by unanticipated inflation as they participate in each of the following markets: a) Credit markets Borrowers are helped and lenders hurt. The dollars used to repay loans have less purchasing power than the interest rate paid assumed. b) Labor markets Workers are hurt and firms helped. Real wages will decline, reducing purchasing power for workers but reducing real costs and increasing profits for the firm c) Product markets Consumers are hurt and firms benefit. Consumers have less purchasing power than expected. Firms benefit as profits grow when sales revenues grow faster than the resource (input) costs.