4430.01 syl s11.doc - University of Lethbridge

advertisement

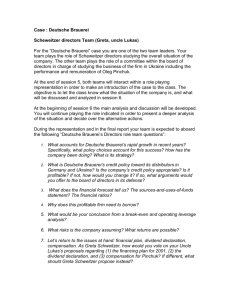

The University of Lethbridge Calgary Campus Faculty of Management Management 4430Y Financial Management Spring 2011 A.P. Palasvirta Office: Markin 4132, Lethbridge Phone: (403) 332-4582 e-mail: oz.palasvirta@uleth.ca Goal of Course Management 4430 is the capstone course in finance and will incorporate concepts you have learned in through your study of corporate, investments, and international. We will utilize the case methodology to focus our analysis. Cases describe a context in which a particular problem is found. Regardless of the particular characteristics of the problem, problem solving follows a general methodology: identification of the problem, describing the context of the problem, analysis of potential alternative solutions, the identification of the best solution, implementation of the best solution , and the creation of controls and contingency plans, if applicable. Text and Other Sources: E-book based on Case Studies in Finance, 6th ed., 2010, McGraw Hill, Toronto, ISBN Prerequisites Management 3412, Fundamentals of Investments Investments, Analysis & Management, 2nd Canadian Ed., 2005, Cleary & Jones, John Wiley & Sons Canada Ltd., Mississauga ISBN 0-470-83542-7 Management 3460, Corporate Finance Fundamentals of Corporate Finance, 6th Canadian Ed., 2007, Ross, Westerfield, Jordan, & Roberts, McGraw-Hill Ryerson, Toronto ISBN 13: 978-0-07-095910-1 A list of topics for which you should have working knowledge follows: 1. 3. 5. 7. 9. Time value of money Valuation, risk, and return Cost of capital Capital structure Portfolio theory 2. 4. 6. 8. 10. Market Efficiency Capital budgeting Pro-forma financial statements Dividend policy Foreign exchange This course is designed not only to deepen your knowledge of concepts already covered in other courses, but also to broaden the application of these concepts. I sincerely hope that you have kept the books that you used in previous finance courses. It is certain that you will need to refresh your understanding of many of the concepts listed above by revisiting these books from time to time. Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 1 Administration of the Course The grading in the course will be proportioned as follows: Three spreadsheet assignments: 25% There are two required spreadsheet assignments and two that can be chosen from four cases. Spreadsheets must be printed and fit on one sheet (neatness and ease of reading are important). These assignments are to be handed in before class and will be used to ask questions of the author with respect to how they got some of their numbers. You can complete all the spreadsheets if you wish and the best four will be chosen to count toward your grade. Four quizzes: 25% Thirteen cases are marked as written analysis. The analysis must be between 250 and 300 words (one page, either double-spaced or 1.5 spacing); please print word count on the paper. You must complete ten analyses or you can choose to do all and the best ten will be counted toward you grade. In-class participation 20% Participation is important to the process of understanding. Participation means that each individual takes an active role in the discussion or the case materials. Learning is a process of inquiry. In order to have an orderly process of inquiry, each student must be prepared prior to class. The discussion questions related to that class highlight the important concepts that are to be discussed. In order to be prepared, you must read the case and/or supporting material; think about it in the context of an analytical framework. You will put together your own analytical framework for the purpose of solving problems. The framework that I find best suited to achieve a solution to a problem may not be the framework that you will find best suited to your needs, although there will be components in common. How much you learn will be a function of the effort you put in. I have little control over the effort you put into your learning process; I can only direct the flow of the discussion. Effective participation will include contributions such as the following: 1. 2. 3. 4. Relevancy to the discussion; Critical argument (critical implies analytical thought) about relevancy; Discussion leading to further interaction of class; Willingness to explore solutions that are not safe (meaning obvious) based on good analysis. Final case analysis 30% Please note that there is no numerical scale attached to the letter grades assigned at the end of the Semester. The following number ranges will approximately translate to letter grades: 80 to 100 70 to 79 60 to 69 50 to 59 0 to 49 Syllabus 4430Y A- and above B- to B+ C- to C+ D to D+ F Spring 2011 a.p. palasvirta, ph.d. 2 Plagiarism is defined in the Academic Regulations (Part 4.2.2.a.1, page 70 of the 2007-2008 Calendar): “No student shall represent the words, ideas, images, or data of another person as his or her own. This regulation will affect any academic assignment or other component of any course or program of study, whether the plagiarized material constitutes a part of the entirety of the work submitted.” This includes work that may have been done by someone else but purchased. When any specific material is used to help in the analysis of the case it must be cited. Any text used verbatim must be in quotes and cited (much as I have done with the Calendar quote above). Failure to cite appropriately is plagiarism. Any proven act of plagiarism is punishable by penalties ranging from zero on the specific work to expulsion from the University. If you have any questions about how to cite a source refer to any writing guide. If you have any questions about the appropriateness of any practice in preparing your written assignment, e-mail me. It is important to understand that there is no “right” or “correct” solution to any case or problem. In fact, in some of the cases that we examine in this class, the solution that was ultimately implemented was not very successful in terms of its stated objectives. Successful management is more art than science and part of the art of management is finding optimal solutions more frequently than not. You examine the biographies of many wellknown entrepreneurs and you will find that the good ones do not succeed at everything they try, but that the successes outnumber the failures. Case List 1. 3. 4. 5. 6. 8. 10. 11. 13. 14. 15. 16. 17. 19. 20. 22. 23. 24. 26. 27. 31. 32. 34. 35. 38. 41. Warren E. Buffet Ben & Jerry’s Homemade, Inc. The Battle for Value, 2004; FedEx Corp vs. United Parcel Service Inc. A Thoughtful Forecaster The Financial Detective The Body Shop International Plc 2001: An Introduction to Financial Modeling Kota Fibres Ltd. Deutsche Brauerei Best Practices in Estimating the Cost of Capital: Survey & Synthesis Nike, Inc.: Cost of Capital Teletech Corporation, 2005 The Boeing 7E7 The Investment Detective Target Corporation Compass Records Victoria Chemicals pls (A): The Merseyside Project Victoria Chemicals plc(B): The Merseyside and Rotterdam Projects Eurolands Foods, S.A. Gainesboro Machine Tools Corporation EMI Group plc An Introduction to Debt Policy and Value Structuring Corporate Financial Policy: Diagnosis of Problems and Evaluation of Strategies The William Wrigley Jr. Company Deluxe Corporation Carrefour, S.A Methods of Valuation for Mergers and Acquisitions Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 3 Course Outline Week One Learning Objectives: We will preview what our objectives are in this class over the term. This class will be conducted as a seminar, which means that everyone talks. To be able to talk, I expect you to be prepared for class by having studied the materials to be covered in that class. We will also take a quick look at problem solving in general and the case methodology in particular. Financial analysis is all about risk and return. We will do a general examination of how various category components of the financial statements contribute to the risk for the firm. 1. January 15A: Discussion of course objectives, grading, etc 4430.01 Introduction to the case method 2. January 15B: Risk in financial analysis Week Two Learning Objectives: Warren E. Buffett has been, arguably, one of the most successful businessmen of the modern age. He has made his fortune by investing in real assets and financial assets. Berkshire Hathaway, Buffett’s holding company, holds sufficient holdings in many companies to be able to direct them. In others companies he makes an investment in preferred stock with a high yield. He delineates eight rules that he follows in making investment decisions. What is the difference between strategy and tactics? Ben & Jerry’s represents a situation in which the management broke all the rules with respect to a good business plan; how did they succeed. Can it be possible to be profitable, yet “ethical” and “green”. In the Battle for Value, we see two companies in the same industry with different strategies for success yet both are successful. 2. January 22A: Warren E. Buffet (U.S.A.) 4430.02 tutorial portfolio.ppt Case 01 3. January 22B: Ben & Jerry’s Homemade (R&D) Case 03 Week Three Learning Objectives: The Battle for Value illustrates how competition, technology, and innovation interact to bring about new products and new ways of solving old problems. Financial accounting and financial management both deal with the use of financial statements such as the income statement, balance sheet, and cash flow statement. From these financial statements we generate ratios that we use to examine the risk structure, the financial viability, and the operating practices of the firm. All together we use these data to extrapolate the health of the firm. 4. January 29A: The Battle for Value, 2004; FedEx Corp vs. UPS (R&D) Case 04 5. January 29B: A Thoughtful Forecaster 4430.05 tutorial fin state.ppt Case 05 Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 4 Week Four Learning Objectives: The Financial Detective examines the characteristics of firms through their financial ratios. It is of pair-wise examination firms in the same industry with quite different characteristics. This shows that firms in the same industry can have very different business plans. Body Shop International is our first look at the elements of forecasting. Forecasting uses historical data to try to forecast future cash flows. 6. February 5A: The Financial Detective Case 06 7. February 5B: The Body Shop International 4430.07 tutorial pro formas.ppt Case 08 Week Five Learning Objectives: Often little thought is given to working capital management, but it is one of the most important aspects of properly run firm. Our focus consequently is on working capital management particularly the cash cycle, accounts receivable, and inventories. Kota Fibres is having problems with its inventory management. Deutsche Brauerei has an otherwise good business plan, but it gets caught up with problems with their working capital management, both receivables and inventories, that put them at risk. In addition we must decide whether to expand our production facilities. 8. February 12A: Kota Fibres Ltd. (India) 4430.08 tutorial working cap.ppt Case 10 9. February 12B: Deutsche Brauerei Case 11 Week Six Learning Objectives: Deutsche Brauerei wants to expand in the Ukraine beyond their current sales, but forecasting is necessary to complete reasonable projections for pro-forma financial statements to determine whether their proposed investment project in the Ukraine is viable. The weighted-average cost of capital (WACC) is the discount rate that is used to discount net cash flows in the capital budgeting problem. Too high a WACC risks rejecting profitable projects; too low risks accepting project losses. We will identify the problems associated with the WACC and contrast that to Warren Buffett’s assertion that (and I paraphrase very loosely) there is not such thing as risk, just lack of knowledge and preparation. 10. February 19A: Deutsche Brauerei Case 11 11. February 19B: Best Practices in Estimating the Cost of Capital Case 13 Week Seven Reading Week - February 21 – 26 Week Eight Learning Objectives: With Nike Inc. we will apply the lessons that we learned with the previous assignment, Best Practices in Estimating the Cost of Capital, to calculate the WACC. In this instance a mutual fund is trying to Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 5 determine whether Nike stock is overvalued or undervalued in the market place. Obviously if they determine that it is significantly undervalued, they will buy the stock to put into their portfolio. Teletech Corporation involves an argument about a firm that has two businesses that have different risks and how to integrate those different risks into the calculation of the WACC. 11. March 5A: Nike, Inc.: Cost of Capital (U.S.A.) Case 14 12. March 5B: Teletech Corporation, 2005 Case 15 Week Nine Learning Objectives: With Boeing we calculate a WACC that is specific to the civilian aircraft division of Boeing and discuss whether it adequately captures the risk in discounting project cash flows to determine whether to invest or not. Financial theory does not accept capital rationing in theory, however practice is a different story. In this case we have multiple potential investments identified only by their net cash flows. How do we choose among them? These projects quickly illustrate the problems associated with making capital budgeting decisions, particularly under conditions of limited resources 13. March 12A: The Boeing 7E7 (U.S.A.) Case 16 14. March 12B: The Investment Detective 4430.14 tutorial on investment criteria & rules Case 17 Week Ten Learning Objectives: A discussion of how international trade increases risk. Target Corporation requires a decision to ration capital in not investing in positive net present value projects, but using what decision criteria? In the classroom, we will act as if we the board of directors and argue which projects we favor and for what reasons. Victoria Chemicals involves a choice between two mutually exclusive projects Eurolands is also in a situation in which it has to choose among competing projects. Criteria for making choices should be explicit and have a sound economic rational; these criteria may be difficult to asses. In the classroom, we will again act as if we the board of directors and argue which projects we favor and for what reasons. 15. March 19A: Target Corporation Case 19 16. March 19B: Euroland Foods, S.A. Case 24 Week Eleven Learning Objectives: We have a successful firm, now what do we do with the profits assuming we do not have positive NPV projects in which to invest. How best to create value for the firm; can we pay out dividends or buy back stock. 17. March 26A: Gainesboro Machine Tools Corp Case 26 18. March 26B: EMI Group plc Case 27 Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 6 Week Twelve Learning Objectives: We have learned through theory that the firm maximizes value by optimally leveraging the firm. The firm takes advantage of the government subsidizing debt financing over equity financing by allowing interest costs to be deducted before taxes. How does this impact the value of the firm and are there lessons to be learned from the financial market implosion about the optimum level of debt financing (back to Buffet)? 19. April 2A: An Introduction to Debt Policy and Value Case 31 20. April 2B: Structuring Corporate Financial Policy Chapter 16 & 17, Ross et.al. Case 32 Week Thirteen Learning Objectives: With these two cases we look at the application of theory and whether it delivers as promised. Wrigley is an example of an investment bank trying to convince stock holders on the benefits of leverage. Deluxe Corporation examines the benefits of retaining financial flexibility. 21. April 9A: General discussion on risk 22. April 9B: William Wrigley Jr. Company (U.S.A.) Case 34 Week Fourteen Learning Objectives: Since most of the world’s economies operate under a floating exchange rate regime, exchange rates convert domestic currency values into foreign currency values and change affecting the ultimate value received when involving a firm into foreign trade, foreign borrowing, or foreign direct investment. Foreign exchange risk is classified under three different ways as transaction, translation, and operating exposure. 25. April 16: 4430.25 tutorial on foreign exchange Chapter 10 & 11, Ross et. al 26. April 16B: Methods of Valuation for Mergers etc. Case 41 Carrefour S.A. Case 38 Week Fifteen Final Case Analysis: Syllabus 4430Y Spring 2011 a.p. palasvirta, ph.d. 7