Online Course Management Platform

advertisement

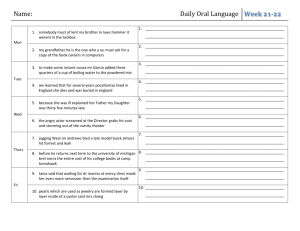

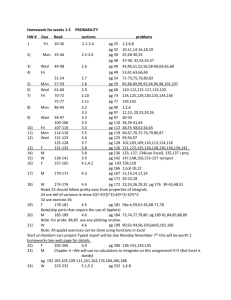

University of Puget Sound School of Business and Leadership BUS 315B Principles of Financial Management Professor Alva Wright Butcher McIntyre 103 MWF 10:00-10:50 Fall Semester 2003 Office: McIntyre 111 I Phone: 253-879-3349 FAX: 253-879-3156 Office Hours: Mon-Wed-Fri 2:00-3:30 Tuesday 10:00-12:00 Note that I am always willing to schedule additional office hours by appointment. I check email frequently, so that is also a good way to communicate. Do not hesitate to call me at home. If you cannot reach me, please leave a number so that I can get back to you. Email: butcher@ups.edu Home: 206-285-3990 or 360-779-4706 Required Course Materials: 1. Ross, Westerfield, and Jordan, Essentials of Corporate Finance, Fourth Edition, McGraw-Hill Irwin, 2004 2. Harvard Business School cases available in course packet in bookstore Assessing a Firm’s Future Financial Health Note on Financial Forecasting Clarkson Lumber Recommended: Subscription to the Wall Street Journal We will be working with the Wall Street Journal during several class sessions. As a business student, you should read this publication regularly. References and Support Materials: 1. Self-Study Software that accompanies the textbook. After you have downloaded this on your computer, it provides multiple choice quizzes for all chapters. The software immediately grades your response to a question and provides hints if your answer is not correct. 2. Self-test problems and solutions at the end of each chapter provide excellent review material. Note that in general, solutions to odd numbered end-of-chapter problems are available in the back of the textbook. 3. Website supported by the publisher. http://highered.mcgraw-hill.com/sites/0072510765/student_view0/index.html The site provides access to many sources of financial information as well as material specific to each chapter in the text. This includes: a brief chapter summary, online multiple choice quizzes, Web links Bibliography (access to web links noted in the chapter), BUS 315B Fall 2003 Professor Alva Butcher 1 What’s on the Web?(access to web links noted in these questions at the end of each chapter), Excel templates for selected problems at the end of the chapter. 4. Thomas Eyssell, Student Problem Manual, Fourth Edition, McGraw-Hill Irwin, 2004. For each chapter, this provides a summary of key concepts, a concept quiz, and problems with detailed solutions. 5. Please contact me for sources that provide other explanations of the material. Calculator: A financial calculator is required. The calculator must have functions for bond valuation, net present valuation (NPV), internal rate of return (IRR), present value (PV), and future value (FV). One suitable calculator is the HP10-B. It is available in the bookstore for around $30. Course Objectives: The key objective of this course is to develop a conceptual and pragmatic understanding of corporate finance. The topics and assignments are designed to prepare you to apply both theory and techniques in the “real world” of corporate finance. Note that some of these topics, such as the time value of money, are ones that you will also find invaluable in handling your own personal finance. Assignments include end of chapter questions and case analyses. You will create spreadsheets to model financial problems and will prepare professional reports of your analyses. The course builds upon concepts covered in Elements of Applied Statistics (Math 271) and in Principles of Financial and Managerial Accounting (BUS 205). It is assumed that you are proficient in the use of financial data as reported in financial statements. If you are not comfortable with these concepts, please see me for some review problems. Since the application of financial concepts also requires proficiency in basic algebra and geometry, we will frequently address basic mathematical concepts and techniques. After you have successfully completed this course, you will be able to: Work with financial statements to evaluate financial ratios and their implications regarding the financial strengths of weakness of a firm. Use historical financial statements and assumptions about future growth to prepare pro-forma financial statements and estimate additional financing needed to support that growth. Determine the value today of cash flows to be received later. Evaluate the cost-benefit trade-off of costs incurred today with cash inflows expected in the future. Understand the effect of compounding periods on interest rates. (What interest rate are you really paying on that loan?) Understand the basic features of bonds and how they are priced. Estimate the fundamental price of a common stock, using the two-stage discount model. BUS 315B Fall 2003 Professor Alva Butcher 2 Identify the relevant cash flows for a proposed investment, and evaluate a complex proposed investment using Net Present Value, Internal Rate of Return, and Payback Period. Recognize the impact of diversification, and use the Capital Asset Pricing Model to quantify the risk-return tradeoff. Use financial information to estimate the required rate of return on a proposed investment. This is known as the firm’s weighted average cost of capital. Have a basic understanding of the Efficient Market Hypothesis and its implications when you are presented with a “hot tip”. Read financial data as reported in the Wall Street Journal and have a basic understanding of primary versus secondary markets. Evaluate your “stock pick” and reflect on your “virtual” gains or losses. Class Preparation and Participation: Preparation for class is extremely important. Prior to class, you are expected to have read the assigned reading material. You are also expected to have analyzed any assigned discussion problems and to be prepared to participate in the class discussion. If for some reason you are not prepared to participate in the discussion please let me know prior to class. Your presence and contribution to class discussion are important. There are three categories: present, absent with leave, and AWOL. Online Course Management Platform – Blackboard We will be using an online course management platform this semester. The key benefit is that it provides an excellent means of communication. You will be able to download the syllabus, homework assignments, homework solutions, sample exam problems etc. from the internet at any time. It also provides a platform for threaded discussion. Another feature allows discussion among group members on their group project; access is restricted to members of the group. You can access this at blackboard.ups.edu. Click on “Course Catalogue.” Find the course, Principles of Financial Management, and click on “Enroll.” You will need a password in order to enroll. I will provide this in class. If this is your first course on Blackboard, you will need to create an account and specify your user-id and password. (Click on “Create Account.”) During this process, you will be asked for additional information, such as your name, email address etc. Please begin both your first and last name with a capital letter, and enter the other letters in lower case. If you have other courses on Blackboard, I would suggest that you use the same user-id and password for all classes. Once you have enrolled in Blackboard, subsequent contacts only require that you open blackboard.ups.edu and click on “Login”. You will be asked for your id and password. BUS 315B Fall 2003 Professor Alva Butcher 3 Homework: Homework assignments are listed on the course outline, and are due on the class date indicated on the outline. These assignments are designed to reinforce your familiarity with the material, to train you in the use of your financial calculator and computer spreadsheets, to identify areas in which you may be having difficulty, and to serve as a basis for classroom discussion. The end of each chapter includes Critical Thinking and Concepts Review and Questions and Problems. Most homework questions are from the end-of-chapter Questions and Problems. A critical thinking question will have the notation CT3, i.e. question 3 under Critical Thinking and Concepts Review. The course outline notes two categories of homework: discussion and written. Written homework assignments will be collected at the beginning of class, and a subset of these problems will be selected on a random basis for grading. Solutions to homework assignments will be available after class on the online course management platform, blackboard.ups.edu (under Assignments). Late homework assignments will not be accepted. Case Analyses and Projects: Several case studies and projects will be assigned during the term. These are utilized to enable you to: 1) practice effective communication techniques, both written and oral; 2) engage in an active learning situation; 3) perform data interpretation and analysis; 4) gain experience in decision making under uncertainty. They are also designed to give you an opportunity to use an essential tool in real world business finance - the application of computer models in financial analyses. Each case study will require a written report. Some of these reports will be short memos; others will require more lengthy exposition. Reports must be typed, with exhibits inserted in the narrative where appropriate, or at the end of the report. One of these assignments, the Stock Project, will be a team project. Additional details will be available on Blackboard, the online course platform. (blackboard.ups.edu Check under Assignments) The cases will be discussed in detail during a regular class session. You should be prepared to respond to specific questions, and to the comments of other students. Grades for both written reports and class discussions will be based on content, exposition, and clarity. Late written reports will not be accepted. Reports are due at the beginning of the class period. Please make an extra copy for your use during the class discussion. Exams: There will be three midterm exams and a comprehensive final. Exams will be problem oriented, but will also include short essay questions. Exams are closed book, but you may use one side of an 8 by 11 paper for notes and formulae. As a general policy, makeup exams will not be given. Extra Credit Quizzes: During the term, there will be unannounced pop quizzes. These will consist of a few multiple choice or true false questions, and will cover material presented in the prior one or two class sessions. As with homework problems, these are designed to reinforce the material, and to identify problem areas. By keeping current with the material, these quizzes also provide you with a means of earning extra credit points. BUS 315B Fall 2003 Professor Alva Butcher 4 Grades: Grades will be based on the following weights: Three Midterm Exams 44% Comprehensive Final Exam 25% Projects and Case Analyses Stock Project (7%) 21% Financial Forecasting Case (7%) Clarkson Lumber Capital Budgeting Case (7%) Homework and Class Discussion 10% Total 100% Unannounced Quizzes 5% (extra credit) BUS 315B Fall 2003 Professor Alva Butcher 5 Course Outline Wed. 9/3 Introduction to Course Chapter 1: Overview of Financial Management Establish the Dartboard Portfolio Fri 9/5 Chapter 2: Financial Statements, Taxes, and Cash Flow Homework Register on Blackboard, the online course platform. Discussion Chapter 2: 1, 2, 3 Chapter 2: What’s on the Web? 2.2 Note: Please bring your financial calculator to class. Mon 9/8 Chapter 3: Working with Financial Statements Math Concept: Review of Algebraic Manipulation Homework Discussion Chapter 3: CT3.1, CT3.4, CT3.5,1,3,9 Written Chapter 2: 6,7 Stock Project Submit names of 3 potential firms for your stock project. Please list firms in order of preference. You are encouraged to pick a company in which you have some interest. This could be a firm that employs someone in your family, one in which you would like to own stock, one with products or services you admire or use often. The firm must be publicly traded and in an identifiable industry. Financial institutions, such as banks, are not allowed. Wed 9/10 Harvard Business School Case Discussion Assessing a Firm’s Future Financial Health Homework Written Chapter 3: 2, 4,6, and 34 (a,b,d,e,f,g,j,l,m,n) In problem 34, calculate ratios for 2003. Use the year end information.) Discussion of Harvard Case 1. Read the discussion of the essence of long-term financial health 2. Work through the programmed text on financial ratios. Answer each of the questions and be sure you understand the calculation and meaning of each of the ratios. Be prepared to discuss your results in class. This does not need to be handed in. 3. Using any approach you find helpful, identify three of the five unidentified industries (pages 14, 15 and 17 of the case). The case is designed to help you recognize the range of distinctive patterns in financial statements for different industries. For example, different industries will have different inventory turnover rates, different asset structures (high versus low levels of plant property and equipment), different inventory turnover ratios, different collection periods for accounts receivable etc. You are asked to play the BUS 315B Fall 2003 Professor Alva Butcher 6 financial detective here, and to use selected financial data to identify companies in 5 industries. Note that the balance sheets shown in Exhibit 3 are common size balance sheets. That is all items are calculated as a percentage of total assets. Be prepared to discuss your results in class. This does not need to be handed in. What were the key screening devices or key clues that you used to identify a particular industry? Briefly explain your rationale. Fri 9/12 Excel tutorial Room to be announced Mon 9/15 Harvard Business School Case Discussion Note on Financial Forecasting You may skip the section on Cash Budgets, pp 6-8. The assumptions used to prepare the Pro Forma Operating Statement (Table A) and the Pro Forma Balance Sheet (Table B) are provided in the Note. Be prepared to discuss the details behind some of these pro-forma forecasts. In particular, can you explain the calculations behind the Pro Forma numbers for Inventories, Accounts payable, Accrued liabilities, Earned surplus, and Additional financing needs in Table B? Wed 9/17 Financial Forecasting Case Discussion - AWOL You have been asked to analyze whether an expected increase in AWOL sales will require additional financing. The analysis of this case will provide a good background for your preparation of the Clarkson Lumber case that is due on 9/22. Under Assignments on Blackboard you will find a folder named AWOL. This folder contains the following: Instructions for the case An Excel file that contains the most recent financial statements for fiscal year 2002 and the assumptions. Use this Excel file to prepare your forecasts for 2002 and to calculate the specified financial ratios. Please bring a hard copy of your Excel solution to class for class discussion. Fri 9/19 Chapter 7: The Stock Markets (Sections 7.2 and 7.3) Working with the Wall Street Journal Please bring a copy of the Thursday edition, 9/18/03, or today’s edition Homework Discussion BUS 315B Chapter 7 :19 Fall 2003 Professor Alva Butcher 7 Mon 9/22 Harvard Business School Case: Written Report and Case Discussion Clarkson Lumber You will find the instructions for this financial forecasting case under Assignments on Blackboard. Please submit your Excel file for this case via the Blackboard Drop Box. Your excel file should be named “your name CLARKSON”. A file with a virus will not be accepted, and the grade for this project will be discounted depending on the length of the delay Wed 9/24 Chapter 4: Introduction to Valuation: The Time Value of Money Homework Stock Project: Part One -A Profile of Your Firm See Part 1 of the Stock Project for details. Discussion Chapter 4: CT1, CT2, CT3, CT4, CT8, CT9 Chapter 4: 1,2,3,4 Note that problems 2,3,and 4 each have four parts. You only need to be prepared to discuss the first part. Please bring your financial calculators to class. Fri 9/26 Exam 1: Chapters 2, 3, and Financial Forecasting Mon 9/29 Chapter 4: continued Homework Discussion Chapter 4: 8,11, 18, 24 Written Chapter 4: 6, 12, 14 Chapter 5: Discounted Cash Flow Valuation Homework Discussion Chapter 5: 1,4,5 Wed 10/1 Discounted Cash Flow Valuation continued Math Concept: Continuous Compounding Homework Discussion Chapter 5: 12, 17 Written Chapter 5: 2, 6, 8 Fri 10/3 Discounted Cash Flow Valuation continued Homework Discussion Chapter 5: 24, 25 Written Chapter 5: 14,16,18 Mon 10/6 Discounted Cash Flow Valuation continued Homework Discussion Chapter 5: 35, 53 Written Chapter 5: 20, 55 Wed 10/8 Chapter 6: Interest Rates and Bond Valuation Homework Discussion Chapter 6: CT6, 2, 3 BUS 315B Fall 2003 Professor Alva Butcher 8 Fri 10/10 Interest Rates and Bond Valuation continued Homework Written Chapter 6: 6, 7, 8 Mon 10/13 Interest Rates and Bond Valuation continued Working with the Wall Street Journal Please bring a copy of the Friday edition, 10/10/03, or today’s edition Wed 10/15 General review of time value of money Homework Discussion Chapter 6: 21 (a, b) Written Chapter 6: 19, 25 Fri 10/17 Exam 2: Chapters 4, 5, and 6 Mon 10/20 Fall Break Day Wed 10/22 Chapter 7: Stock Valuation Homework Discussion Chapter 7: CT1, CT2, CT3, 4 Fri 10/24 Stock Valuation continued Homework Discussion Chapter 7: CT7.6, 5 Written Chapter 7: 7, 12, 15, 16 Mon 10/27 Chapter 8: Net Present Value and Other Investment Criteria (Skip sections 8.3 and 8.5) Homework Stock Project: Part 2- Examine Historical Daily Returns See Part 2 of the Stock Project for details. Wed 10/29 Chapter 8: Net Present Value and Other Investment Criteria continued Homework Discussion Chapter 8: CT8.5, CT8.6 Written Chapter 8: 10, 22 Fri 10/31 Chapter 9: Making Capital Investment Decisions Mon 11/3 Making Capital Investment Decisions continued Homework Written Chapter 9: 5, 6, 20 Wed 11/5 Chapter 10: Some Lessons from Capital Market History (Skip section 10.5) Math Concept: Sample Mean and Standard Deviation Homework Discussion: Chapter 10: 1, 2, 7 BUS 315B Fall 2003 Professor Alva Butcher 9 Capital Budget Case – Written Report and Case Discussion Additional details are available on Blackboard under Assignments. Please submit your Excel file for this case via the Blackboard Drop Box. Your file should be named “your name Budget”. Files with a virus will not be accepted; the grade for this project will be discounted depending on the length of the delay Fri 11/7 Mon 11/10 Review Homework Written Chapter 10: 9, 10, 17 Wed 11/12 Exam 3: Chapters 7, 8, 9, 10 (Not including section 10.5) Fri 11/14 Chapter 11: Risk and Return Homework Discussion Chapter 11: CT 11.3, CT 11.3 Mon 11/17 Math Concept: Linear Regression and Basic Inferential Statistics Homework Written Chapter 11: 7(Stock B only), 16, 19(Assume that CAPM is true), 31 Wed 11/19 Risk and Return continued Homework Stock Project: Part 3 – How Risky is Your Firm? See Part 3 of the Stock Project for details. Fri 11/21 Chapter 12: Cost of Capital Mon 11/24 Cost of Capital continued Homework Discussion Chapter 12: CT 8 Written Chapter 12: 3, 6, 15 Wed 11/26 Video: Changing Values: What is a Company Worth? Thanksgiving Holiday Mon 12/1 Chapter 10: Capital Market Efficiency (Section 10.5) Homework Discussion Chapter 10: CT 10.5, CT 10.9, CT 10.10 Wed 12/3 Chapter 15: Raising Capital Fri 12/5 Guest Speaker Mon 12/8 and Wed 12/10 Bulls and Bears Ball Stock Project: Report 4 – Present Your Virtual Profit or Loss See Part 4 of the Stock Project for details. Wed 12/10 Integration and Review Comprehensive Final Exam Tuesday December 16th, 8:00-10:00 BUS 315B Fall 2003 Professor Alva Butcher 10 BUS 315B Fall 2003 Professor Alva Butcher 11