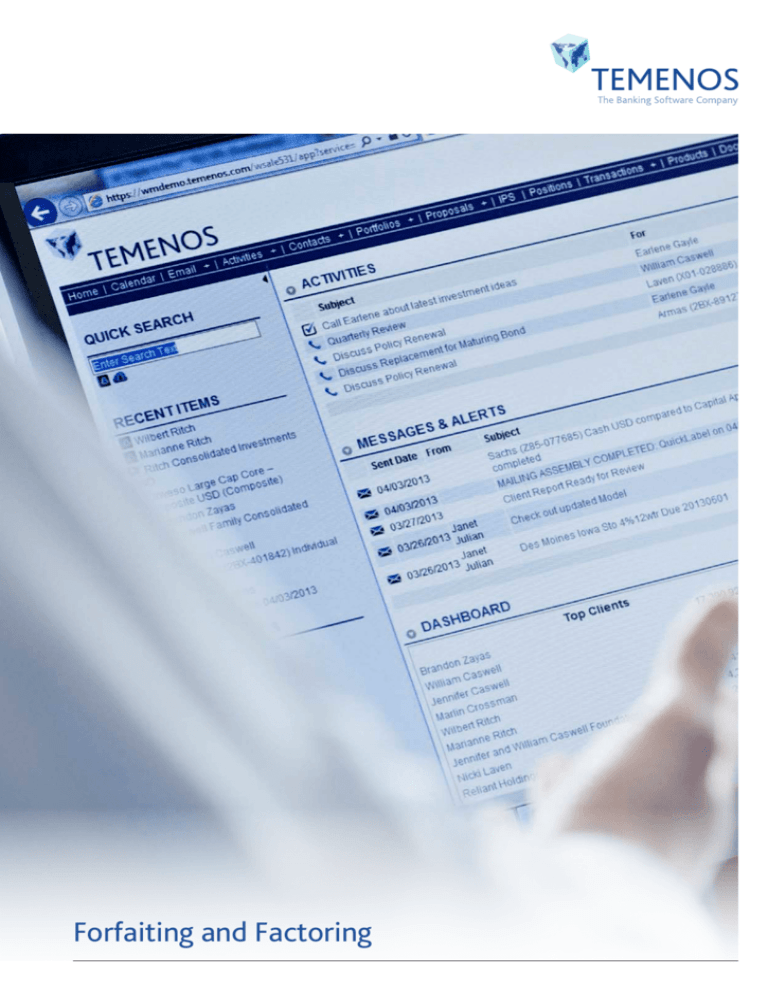

Forfaiting and Factoring

Temenos Product Overview

2

Forfaiting and Factoring

Flexible factoring efficiency for dealer and distributor financing

R

unning a business has never been more challenging for corporates.

To survive corporates must remain liquid, reduce the high cost of

capital and in turn increase profit. The importance in ensuring the

smooth flow of cash and meet working capital needs has never

been greater. To support this corporates expect the right forfaiting and

factoring solution from their bank.

Building upon our award winning core-banking solution T24 for

Corporate Banks, Temenos have now developed a powerful sales

tool for banks to support their corporate clients, which assists in

creating positive cashflows for the corporate and therefore reduces

risk; Forfaiting and Factoring. The advanced rule based solution allows

bank to lend to corporates based on their cashflows – reducing risk

– as well as offers corporates the service of giving accurate status of

their collections. In essence, Our Forfaiting and Factoring solution

allows the Exporter to simultaneously be fully protected against

interest and/or currency rates moving unfavorably during the credit

period, however, this new solution offers so much more.

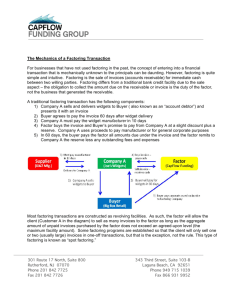

Greater efficiency through automatic upload of invoice

Temenos’ Forfaiting and Factoring solution has been designed to

reduce the previously cumbersome process of manually processing

invoices, sometimes in high volume, to action them. Greatly reducing

time and the associated workload, the solution now allows the

automatic upload of invoices and batching through an enhanced

module in T24.

Analysis can be easily undertaken as the details of the invoices

which are generally available at a corporate in multiple formats,

can be uploaded into a spread sheet or other agreed format and

automatically into T24. The Forfaiting and Factoring application

automates a high proportion of the invoice management with inbuilt

monitoring functionality supporting limit checks and a rich set of

screens and reports for easy management of invoices. This not only

results in greater cost efficiencies but also reduces the chance of

errors occurring at these stages.

Increased control to update records and product type

Forfaiting and Factoring has multi-dimensional risk control which

allows you to define your risk against multiple parties like the buyer,

seller, insurer etc. It allows conditions to be defined for updating the

Product Type based on the default conditions or customer specific

conditions. Whilst, duplicate checks against upload history and status

are also available enabling a full understanding of the invoice to be

established where required. In addition, flexibility is ensured through

conditions that can be defined for updating the Product Type based

on default or customer specific requirements. Also helps corporates

monitor risks against another corporate. This translates into greater

customer service by automating much of the process, from how a

batch is created, what products and services are to your client, to the

detailed processing thereof.

Benefits to banks

• Control through agility: rule based condition and data driven

solution enables robust real-time changes to react instantly

Benefits to corporates

• Up to 100% financing: risk appetite determinable with or

without recourse

• Enhanced STP: automatic invoice and batching upload, product

assignment, margin processing and standard instruction processing

• Improve cash flow: receivables become current cash in-flow,

enabling exporters to improve financial status and liquidation

ability to increase fund raising capability

• Enhanced customer service: an extended product range

enabling corporates to gain 100% finance

• Increased revenue: through fee based income, plus flexible

repayment options and invoices, refinancing or partial discounting

• Greater cost efficiencies: lower credit administration and credit

follow up

• A complete understanding: a full customer view inc. fund

receivables, payable, account statements and limit details, and

all trade related data

• Outstanding customer service: built-in risk control through

duplicate checks

• Access comprehensive features: tool set provides multi

parameter based options to enhance usability of the product

• A true picture: real-time interest pricing at time of invoice acceptance

• Advanced monitoring: allowing corporates to define limits

against each other to understand their exposure

• A tailored approach: allowing your bank to define limits against

a particular buyer or seller

• Reduce administration costs: full management of receivables

for exporters, greatly reducing the relative costs

• Reduce risk: through effective control of forward position

hedging

• Increase trade opportunity: the export is able to grant credit to

his buyers freely, and thus, be more competitive in the market

Temenos Product Overview

3

Temenos Forfaiting and Factoring: efficiency through automation

Customer on boarding:

Limits and authencity

Validate:

Buyer and Seller Limits

Relationship Limits

AML

Relation Limit

Relation Limit

Seller

Limit

Relation Limit

Relation Limit

Buyer

Buyer

/

Seller

Buyer

Limit

Limit

Limit

Relation Limit

Buyer

Limit

Relation Limit

Buyer

Limit

Relation Limit

Buyer

Limit

Temenos Headquarters SA

2 Rue de l’Ecole-de-Chimie

CH-1205 Geneva

Switzerland

Tel: +41 22 708 1150

Fax: +41 22 708 1160

www.temenos.com

TEMENOS™, TEMENOS ™, TEMENOS T24™ and

Temenos Headquarters SA

™ are registered trademarks of

©2014 Temenos Headquarters SA - all rights reserved.

Warning: This document is protected by copyright law and international treaties. Unauthorised reproduction of this document,

or any portion of it, may result in severe and criminal penalties, and will be prosecuted to the maximum extent possible under law.

201410003