the basics of factoring

advertisement

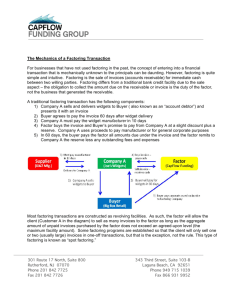

THE BASICS OF FACTORING A Guide to Understanding Accounts Receivable Financing The Basics of Factoring Table of Contents What is Factoring? ……………………………………….. 1 Benefits of Factoring ………………………………………4 What Types of Businesses Utilize Factoring?…………….5 What does it cost and how is it calculated?.………………6 Timing: When does the Seller get funded?.………………7 Debtor’s perception of Factoring…………………………..8 What is Factoring? Factoring is a financial transaction whereby a business sells its accounts receivable (invoices) to a third party called a Factor at a discount. The purpose of this transaction is to facilitate the immediate payment of an invoice(s) in order to allow a business to accelerate cash flow and to enhance business growth. A Factor provides funds to the Seller of the invoice(s) in the form of a cash advance, normally between 70-90% of the face amount of the invoice(s). The balance of the purchase price of the invoice(s) known as the Reserve is paid to the Seller, less the Factor's discount fee (commission) and other charges upon collection of invoice from the Seller’s client also known as the Debtor. Factoring differs from bank loans in several ways. In Factoring, the Factor is much more concerned with the creditworthiness of the Seller’s client known as the Debtor, whereas a bank focuses more on the value of the Seller's total assets. Factoring is not a loan. It is the purchase of a financial asset (a receivable) by the Factor from the Seller. 1 There are three parties directly involved in Factoring. 1. The Seller. The one who provides goods or services to the Debtor and who then sells that receivable to the Factor. 2. The Debtor. The customer that buys the goods or services from the Seller. 3. The Factor. The one who buys the receivable from the Seller. A receivable is a financial asset associated with the Debtor's liability to pay money owed to the Seller for work performed or for goods sold. The Seller sells one or more of its invoices (receivables) at a discount to the Factor in order to obtain cash. The sale of a receivable transfer’s ownership of the receivable from the Seller to the Factor. The Factor in return obtains all of the rights associated with the receivable sold. The account Debtor is notified of the sale of the receivable and pays the Factor directly for the invoice. 2 There are three principal parts to a factoring transaction; (a) The Advance is a percentage (70-90%) of the face amount of the invoice that is paid to the Seller at the time of sale. (b) The Reserve is the remaining balance of the purchase price held by the Factor. When the payment by the account Debtor is made the remaining balance of the reserve is rebated back to the Seller less the Factor’s fees. (c) The Discount Fee is the cost associated with the transaction including the commission that is deducted from monies due the Seller from the Reserve. 3 Benefits of Factoring A Factor makes its credit decisions primarily on the strength of the Seller’s customer not the Seller’s financial strength. Factoring companies provide free credit reporting and AR management as part of their due diligence process. Factoring may be a less costly option than traditional bank financing in the long term. Factoring as a financial tool increases the velocity of cash flow, effectively increasing working capital and helps avoid problems that slow paying customers can create. Factoring allows you to take advantage of profitable opportunities requiring additional cash. Factoring turns your unpaid invoices into immediate cash instead of having to wait 30 days to 60 days or more. Factoring obtains working capital without dilution of ownership and control. Factoring secures operating cash on a flexible and controllable basis. Factoring protects and improves credit ratings. Factoring avoids the burden of long term debt, which can ultimately destroy a company. 4 What Types of Business can Utilize Factoring? There are a variety of industries that benefit from Factoring some included are: Transportation Manufacturing Distribution Wholesalers Communications Janitorial Food Suppliers Staffing Agencies Companies that provide “business to business” goods or services and offer terms can benefit from the use of Factoring. Businesses that CAN NOT utilize factoring are companies that provide services to the public and receive immediate payment by means of cash or credit card. Typically retail establishments such as restaurants, stores and gas stations do not qualify for the benefit of factoring. 5 What does Factoring cost and how is it calculated? The cost to the Seller for factoring is generally a percentage of the gross amount of the invoice calculated on a monthly basis. That percentage is generally between 1.5% to 3.0%, depending on the creditworthiness of the Debtor and the amount of the invoice. Example: A Seller provides a good or service for $50,000. The following are the cost associated with the transaction. Seller generates invoice to Debtor Factor advances 80% to Seller Reserve held by Factor $50,000 Factor receives payment from Debtor* Factor rebates back to Seller $50,000 Total Cost to Seller for 30 days @ 2.0% Total Cost to Seller for 60 days @ 2.0% $ 1,000 $40,000 $10,000 $ 9,000 $ 2,000 *In the event that the Debtor does not pay the invoice in full there will be adjustments made reducing the amount of the Rebate made by the Factor to the Seller. 6 Timing: When does the Seller get Funded? The Factor advances the initial funding: A. Once the Factor receives acceptance from the Debtor of the assignment or transfer of rights. This transfer known as the “Notification of Assignment” is simply a form letter written on the Seller’s letterhead notifying the Debtor that a UCC-1 (Uniform Commercial Code securing rights to assets.)has been filed and the all rights have been transferred to the Factor B. Factor verifies the validity of the invoice sold by Seller with the Debtor. The Factor returns the Reserve in a form of a Rebate to Seller when: A. Payment is received by Debtor and has cleared the bank. B. It is customary for the Factor to Rebate to the Seller within a week of receiving payment from Debtor. . 7 Debtor’s perception of Factoring Factoring has become an accepted means of business financing. Many large commercial buyers encourage Sellers to enlist a Factor to support their business growth. Many large firms (Debtors) have developed departments that specialize in facilitating the process of dealing with redirection of payment to the Factor. 8 to ne our websites. http://transfac.com/sandiego/ http://transfac.com/sanfrancisco/ http://transfac.com/northdakota/ http://transfac.com/portland/ http://transfac.com/ohio/ http://transfacreferrals.com/ http://transfac.com/louisiana/ http://transfac.com/texas/ http://truckingbusinessfinancing.com/