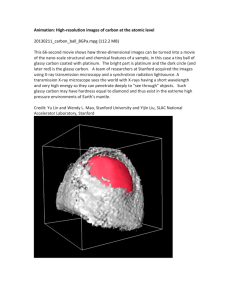

Interim results booklet (PDF - 648KB)

advertisement