®

R E T I R E M E N T

I N C O M E

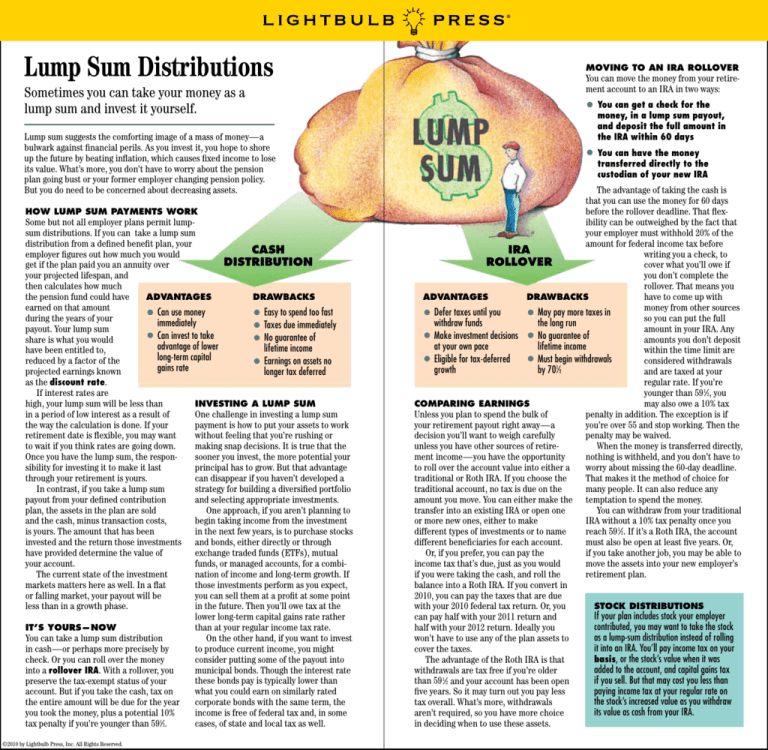

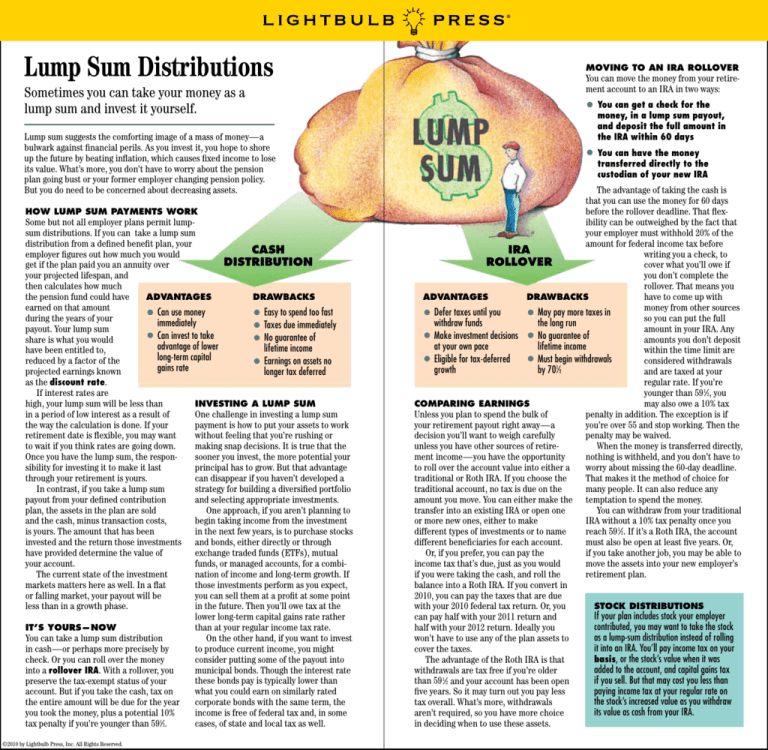

Lump Sum Distributions

MOVING TO AN IRA ROLLOVER

Sometimes you can take your money as a

lump sum and invest it yourself.

s You can get a check for the

Lump sum suggests the comforting image of a mass of money—a

bulwark against financial perils. As you invest it, you hope to shore

up the future by beating inflation, which causes fixed income to lose

its value. What’s more, you don’t have to worry about the pension

plan going bust or your former employer changing pension policy.

But you do need to be concerned about decreasing assets.

HOW LUMP SUM PAYMENTS WORK

Some but not all employer plans permit lumpsum distributions. If you can take a lump sum

distribution from a defined benefit plan, your

CASH

employer figures out how much you would

DISTRIBUTION

get if the plan paid you an annuity over

your projected lifespan, and

then calculates how much

ADVANTAGES

DRAWBACKS

the pension fund could have

earned on that amount

Can use money

Easy to spend too fast

during the years of your

immediately

Taxes due immediately

payout. Your lump sum

Can

invest

to

take

No guarantee of

share is what you would

advantage of lower

lifetime income

have been entitled to,

long-term capital

reduced by a factor of the

Earnings on assets no

gains rate

projected earnings known

longer tax deferred

as the discount rate.

If interest rates are

high, your lump sum will be less than

INVESTING A LUMP SUM

in a period of low interest as a result of

One challenge in investing a lump sum

the way the calculation is done. If your

payment is how to put your assets to work

retirement date is flexible, you may want

without feeling that you’re rushing or

to wait if you think rates are going down.

making snap decisions. It is true that the

Once you have the lump sum, the responsooner you invest, the more potential your

sibility for investing it to make it last

principal has to grow. But that advantage

through your retirement is yours.

can disappear if you haven’t developed a

In contrast, if you take a lump sum

strategy for building a diversified portfolio

payout from your defined contribution

and selecting appropriate investments.

plan, the assets in the plan are sold

One approach, if you aren’t planning to

and the cash, minus transaction costs,

begin taking income from the investment

is yours. The amount that has been

in the next few years, is to purchase stocks

invested and the return those investments and bonds, either directly or through

have provided determine the value of

exchange traded funds (ETFs), mutual

your account.

funds, or managed accounts, for a combiThe current state of the investment

nation of income and long-term growth. If

markets matters here as well. In a flat

those investments perform as you expect,

or falling market, your payout will be

you can sell them at a profit at some point

less than in a growth phase.

in the future. Then you’ll owe tax at the

lower long-term capital gains rate rather

than at your regular income tax rate.

IT’S YOURS—NOW

On the other hand, if you want to invest

You can take a lump sum distribution

to produce current income, you might

in cash—or perhaps more precisely by

consider putting some of the payout into

check. Or you can roll over the money

municipal bonds. Though the interest rate

into a rollover IRA. With a rollover, you

these bonds pay is typically lower than

preserve the tax-exempt status of your

what you could earn on similarly rated

account. But if you take the cash, tax on

corporate bonds with the same term, the

the entire amount will be due for the year

income is free of federal tax and, in some

you took the money, plus a potential 10%

cases, of state and local tax as well.

tax penalty if you’re younger than 591⁄2.

s

s

©2010 by Lightbulb Press, Inc. All Rights Reserved.

s

s

s

s

You can move the money from your retirement account to an IRA in two ways:

money, in a lump sum payout,

and deposit the full amount in

the IRA within 60 days

s You can have the money

transferred directly to the

custodian of your new IRA

The advantage of taking the cash is

that you can use the money for 60 days

before the rollover deadline. That flexibility can be outweighed by the fact that

your employer must withhold 20% of the

amount for federal income tax before

IRA

writing you a check, to

ROLLOVER

cover what you’ll owe if

you don’t complete the

rollover. That means you

ADVANTAGES

DRAWBACKS

have to come up with

money from other sources

Defer taxes until you

May pay more taxes in

so you can put the full

withdraw funds

the long run

amount in your IRA. Any

Make investment decisions

No guarantee of

amounts you don’t deposit

at your own pace

lifetime income

within the time limit are

Eligible for tax-deferred

Must begin withdrawals

considered withdrawals

growth

by 701⁄2

and are taxed at your

regular rate. If you’re

younger than 59 1⁄2, you

may also owe a 10% tax

COMPARING EARNINGS

penalty in addition. The exception is if

Unless you plan to spend the bulk of

you’re over 55 and stop working. Then the

your retirement payout right away—a

penalty may be waived.

decision you’ll want to weigh carefully

When the money is transferred directly,

unless you have other sources of retirenothing is withheld, and you don’t have to

ment income—you have the opportunity

worry about missing the 60-day deadline.

to roll over the account value into either a

That makes it the method of choice for

traditional or Roth IRA. If you choose the

many people. It can also reduce any

traditional account, no tax is due on the

amount you move. You can either make the temptation to spend the money.

You can withdraw from your traditional

transfer into an existing IRA or open one

IRA without a 10% tax penalty once you

or more new ones, either to make

reach 59 1⁄2. If it’s a Roth IRA, the account

different types of investments or to name

different beneficiaries for each account.

must also be open at least five years. Or,

Or, if you prefer, you can pay the

if you take another job, you may be able to

income tax that’s due, just as you would

move the assets into your new employer’s

if you were taking the cash, and roll the

retirement plan.

balance into a Roth IRA. If you convert in

2010, you can pay the taxes that are due

STOCK DISTRIBUTIONS

with your 2010 federal tax return. Or, you

If your plan includes stock your employer

can pay half with your 2011 return and

contributed, you may want to take the stock

half with your 2012 return. Ideally you

as a lump-sum distribution instead of rolling

won’t have to use any of the plan assets to

it into an IRA. You’ll pay income tax on your

cover the taxes.

basis, or the stock’s value when it was

The advantage of the Roth IRA is that

added to the account, and capital gains tax

withdrawals are tax free if you’re older

if you sell. But that may cost you less than

than 59 1⁄2 and your account has been open

paying income tax at your regular rate on

five years. So it may turn out you pay less

the stock’s increased value as you withdraw

tax overall. What’s more, withdrawals

its value as cash from your IRA.

aren’t required, so you have more choice

in deciding when to use these assets.

s

s

s

s

s

s