Lump sum nominations & pensions for dependants

advertisement

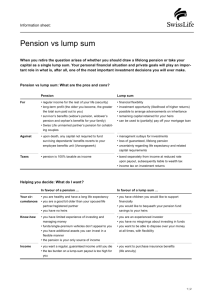

Lump sum nominations & pensions for dependants SE 201PT 4 online factsheet P13 version14 GREATER MANCHESTER PENSION FUND Introduction From the moment you join, right up to the time you retire, and even beyond, you have valuable life cover as a member of the Local Government Pension Scheme (LGPS for short). This can include a one off lump sum payment, and also pensions for your loved ones. So we have put this factsheet together to give you an introduction to these various benefits, and details of who we can pay them to. And in the case of the lump sum life cover, there’s a form you can fill in if you like, to let us know your wishes. You don’t have to fill in the form, but if you do, it will give us a better understanding of your wishes if you die. Page 1 Lump sum life cover The amount lump life cover you have depends on which typeyou of member youdie... are when The amount of of lump sumsum life cover you have depends on which class of member are when you you die... Before you retire If you die in service, and you are only a member of the LGPS with us, we will pay out a lump sum of three times your assumed pay. So for example, if you’ve been on reduced pay on long term sick, assumed pay is the pay you would have normally been on. If you have deferred benefits If you have left ‘benefits on hold’ in the LGPS these are known as deferred benefits. If you only have deferred benefits with us, we will pay the following lump sum if you die: l If you left 1 April 2008 onwards: five times your deferred pension l If you left 1 April 2008 onwards: the lump sum will be ten times your pension less any pension already paid and the amount of retirement tax-free lump sum you chose to take l If you left between 1 April 1998 and 31 March 2008: the lump sum will be five times your pension less any We pension already paid. can’t a lum pay p Warning: if you have multiple memberships if you ar sum when e 75+ there may only be one lump sum life cover you payment. Here are some examples... die. You pay into the LGPS for 2 jobs, Two lump sums either with ourselves or a different local authority fund You pay into LGPS with ourselves One lump sum but also have deferred benefits with - whichever is greatest ourselves or any LGPS fund from before 1 April 2014 l If you left before 1 April 2008: three times your deferred pension. Once you’ve retired You pay into LGPS with ourselves and also started drawing an LGPS pension before 1 April 2014 If you only draw an LGPS pension from ourselves, and retired on or after 1 April 1998, we may pay a lump sum when you die, depending on how long you have been on pension... One lump sum - whichever is greatest Making a nomination The amount of lump sum cover you haveindepends on which type of member you are when It’s possible to make a lump sumlife nomination, by filling It’s easy to change your mind you die... the nomination form which is at the back of this factsheet. You can change your mind at any time by filling in a new nomination form. This is something you should think about if your circumstances change, for example someone you’ve named dies first, or you get divorced. You can also cancel your nomination at any time simply by writing in, or using the contact us form on our website (www.gmpf.org.uk). You can nominate whoever you like - friends, family, partners, even an organisation such as your favourite charity. Someone you name is known as a beneficiary. All we ask is that if you want to name more than one beneficiary, you spell out what share each should get (making sure the shares add up to 100%!) If you pay AVCs If you prefer, you can ask us to pay the lump sum to your personal representatives, for them to pay out in line with the rest of your estate. There is a section on the form for this. If you are also paying AVCs for extra lump sum life cover through our in house arrangement, your nomination will cover this too. If you are paying AVCs to top up your own benefits, our policy is: Do I need to make a nomination? No you don’t, but please think about it seriously, as it’s the best way of letting us know your wishes. or AVCs set up 1 April 2014 onwards: the cash value lF will normally be paid in line with your nomination too lF or AVCs set up before 1 April 2014: these are paid to your estate Page 2 Who will you pay the lump sum life cover to? Under the Scheme rules the final decision will always rest with us. But we haveamount agreed guidelines to how wecover will useyou thishave discretion... The of lumpassum life depends on which type of member you are when you die... If you do nominate We will always give great weight to your nomination, and will generally follow it unless this isn’t possible, or we feel there are exceptional circumstances. An example of when we can’t follow your nomination is if a beneficiary has died, or we can’t trace them within two years. Also we may choose not to follow your nomination if your circumstances have changed, for example you had nominated a spouse or partner, but you have now separated. If you don’t nominate, or we don’t follow your nomination If you don’t nominate, or we don’t follow your nomination, we will normally pay the lump sum to your spouse, civil partner, or eligible cohabiting partner. And if you don’t leave any of these dependants, to your children if you have any. If you don’t leave any of the above, we will normally pay it to your personal representatives. The lump sum is normally free from inheritance tax And there will always be a short delay to allow for any claims from family or dependants who wouldn’t benefit if we followed your nomination. But they would have to put forward a good case for us to pay them instead. How to make a nomination The Step 1 Fill in your details on the form. Tips for getting it right first time l Use black ink & UPPER CASE so your form is clear. amount of lump sum life cover you have depends on which ofon member are when l If you make a mistake, don’t cross it out! Instead ask There type is space the back,you in case Step 2 for a new form or we will reject it. you die... you want to add any extra information giving weight to your nomination. For example, you might be divorced from your spouse, but still want them to benefit. Or you might have deliberately nominated a charity, even though you have a spouse or partner. Step 3 Step 4 S ign the form and get it witnessed by someone who is not a beneficiary, their husband, wife, civil partner, or cohabiting partner. The witness must be over 18. l If you are nominating a child, just put their own details, rather than parents, guardians, etc. l You cannot name an alternative in case one of your beneficiaries dies l If naming more than one beneficiary, please spell out the percentage share for each, making sure it adds up to 100%. We will treat your nomination confidentially, and it will be valid as soon as we receive it. We will add the details to your pension records (which we hold on computer) and return your original to you. Check all your details, before returning your form to us. Page 3 Pensions for dependants The let’s amount of to lump sum life cover Now move on look at pensions for you have depends on which type of member dependants. These benefits are totally separate to you are when you die... the lump sum life cover - they are worked out in a different way, and can be paid to different people. With this type of benefit, we have no discretion - the scheme rules spell out who we should pay a pension to. This is either your spouse, eligible cohabiting partner, or your civil partner, plus any dependent children... Spouse - this means someone you are married to. Eligible cohabiting partner - this means someone you are living with - see later for terms & conditions. Civil partnership - where two people of the same sex have registered their partnership through a civil ceremony. Dependent children - normally under 18 - see later for terms & conditions. How much pension will my dependants get? The amountfor ofyour lumpspouse, sum lifeeligible cover you have depends on which type of civil member you are when A pension cohabiting partner, or same sex partner... you die... Working out the value of the pension for a dependant if you die in service is not straightforward. But to give you a rough idea, the pension for your spouse, civil partner or eligible cohabiting partner is 160th of your pay for the period from the date you joined right up to your normal pension age. In other words: Years to normal pension age x Current pay ÷ 160 A pension for dependent children By a dependent child, we mean your natural child, adopted child, or a step child or child you have accepted into your family. The child needs to be: l Under 18, l Or aged 18 or over, but is under 23 and is in full time education or vocational training, for example an apprenticeship l Or aged 18 or over but is unable to engage in gainful employment* because of a disability. In the case of a child aged 23 or over, the disability is likely to be permanent and the child was dependent on the member at the date of death because of that disability. Gainful employment means paid employment for not less than 30 hours in each week for a period of not less than 12 months. If you die in service, again we base the value of your children’s pensions on the period from the date you joined right up to your normal pension age, and your current pay at the point you die. But this time we use one of the following fractions: l One child: 320th. l Two or more children: Equal share of pension based on160th If we pay children’s pensions but no spouse or partner’s pensions: l One child: 240th. l Two or more children: Equal share of pension based on120th For example, for one child, where there is also a spouse or partner’s pension it would be: For example, for one child, where there is also a spouse or partner’s pension it would be: Years to normal pension age x Current pay ÷ 320 Page 4 Please see important notes on page 5 More about dependants’ pensions Normal pension age As explained, in many cases benefit enhancements are based on the years you would have built up to your normal pension age. This is 65, or your State pension age if later. l Where a man marries a woman after he leaves, we will base the widow’s pension on his membership from 5 April 1978. Deferred members l If you left before 1 April 2014, and form a same sex civil partnership after this date, your civil partner’s pension will be based on all your membership. If you no longer pay into GMPF and have deferred benefits, the dependants’ pensions are only based on the actual time you had been in the scheme, with no enhancement. Transfers Dependent children We can only pay a pension to a natural child born within 12 months of your death. Dependants’ pensions generally include a value to reflect any transfers into the scheme which you have had. An example of a child accepted into your family would be where you are bringing up your grandchild, but haven’t formally adopted him or her. A child you are sponsoring through a charity is not classed as dependent. Cohabiting partners A cohabiting partner is only eligible for a pension if you were paying into the scheme on or after 1 April 2008, and we can normally only count membership from 6 April 1988, unless you have paid extra to make it count. Once you have left If you get married, form a cohabiting partnership or form a same sex civil partnership after you leave then in most cases the pension for your other half will be based on your membership from 5 April 1988. But... Where a child aged 18 or over is dependent because of a disability, an approved doctor may be asked to confirm that the child is permanently incapable of gainful employment. What do my dependants need to do if I die? We don’t currently need you to register your dependants’ details with us. But we will naturally need them to provide certificates or other documents at the point you die... If you are married or in a in a same sex civil partnership we will need to see a copy of the marriage certificate/civil partnership certificate. A cohabiting partner is only eligible for a pension if at the point you die, your partner has met ALL the following conditions for at least two years continuously: l You and your partner have lived together as a couple in the same way as a married couple or civil partners would live together, and l You and your partner were free to marry or form a civil partnership with each other, and l Neither you or your partner have been married, in a civil partnership, or living with someone else in the last two years, and l Your partner has depended on you financially (in other words, you had the highest income), or you have depended on each other financially (in other words you relied on your joint finances to support your standard of living). Your partner will need to provide proof that you meet all these conditions, by showing documents such as utility bills or joint bank statements. Dependent children - we will ask to see the full birth certificate showing parents, place of birth etc. Page 5 Can we help? Here are the ways you can find out more or get in touch with us. If you do contact us, please quote your National Insurance number. Please remember to keep us up to date if you move house... Visit our website to find out more or to contact us: www.gmpf.org.uk Or call our friendly helpline on: 0161 301 7000 Or call in at our offices:F Guardsman Tony Downes House 5 Manchester Road, Droylsden, M43 6SF P13 Lump sum nomination form Version 14 1. MEMBER DETAILS Your name: Title InitialsSurname Employer or former employer: (for example Bury MBC) Address: National Insurance or Pension number: Your daytime phone number: Postcode: 2. WHO YOU WOULD LIKE TO NOMINATE If you want your personal representatives to pay out any lump sum in line with the rest of your estate, tick here: OR... if you want to name individual beneficiaries yourself, please fill in the boxes below: Beneficiary 1 Title: Percentage share % First name(s): I wish my personal representatives to pay out any lump sum in line with the rest of my estate Beneficiary 2 Title: Surname: Surname: Address: Address: Postcode: Postcode: Date of birth: DD MMYYYY Beneficiary 3 Title: Relationship to you: Percentage share First name(s): DD MMYYYY Surname: Surname: Address: Address: Postcode: Postcode: Date of birth: DD MMYYYY Relationship to you: Relationship to you: Beneficiary 4 Title: % First name(s): Date of birth: % Percentage share Percentage share % First name(s): Date of birth: DD MMYYYY Relationship to you: 3. DECLARATION If I die, I wish you to pay any lump sum to whoever I have named above. However I understand that for legal reasons the Fund has the discretion to decide who to pay. I also consent to you storing the information I have given. Your signature: DD MMYYYY Today’s Date: 4. WITNESSED BY (NOT SOMEONE YOU HAVE NOMINATED OR THEIR SPOUSE, CIVIL PARTNER OR COHABITING PARTNER) Witness’s full name: Address: Postcode: Witness’s signature: DD MMYYYY Date witnessed: P E N S I O N S O F F I C E S TA M P 5. EXTRA INFORMATION (only fill in if you want to) Please return to: Greater Manchester Pension Fund Guardsman Tony Downes House 5 Manchester Rd, Droylsden, M43 6SF.