Liquidity Coverage Ratio

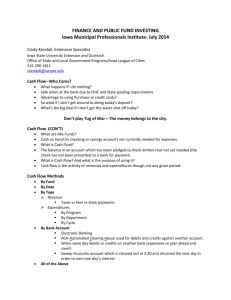

advertisement