International division of functions and its determinants (PDF file

advertisement

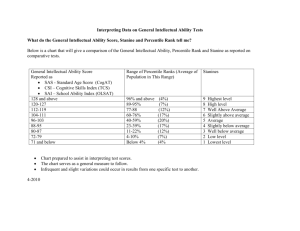

Section 2 International division of functions and its determinants <Key points> 1. Division of functions by Japanese companies operating in China – A case study A study was undertaken to identify the specific division of functions between Japan and China employed by Japanese companies operating in China. Four Japanese companies were examined and the study found that the companies continued to maintain and enhance domestically (i) production functions for high value-added products; and (ii) innovation functions such as product design, R&D and system design. It was also found that these companies were actively developing their Chinese operations as production and sales bases by utilizing and realizing domestically-created technology and systems with some adaptation to China. Regardless of business type or scale, each company is making efforts to divide functions flexibly and strategically between domestic and overseas operations, taking account of characteristics of intellectual assets in the domestic and overseas operation bases. It is therefore assumed that companies are trying to enhance their core competencies and ensure their competitive advantage by constantly pursuing value creation through these efforts. 2. Patterns in division of functions and intellectual assets No particular methods have been established for the evaluation of intellectual assets on a country basis, nor is it always possible to acquire sufficient data samples. However, where two provisional evaluation indices, namely skill intensity and intellectual intensity are employed, Japan scores highly alongside Europe and the United States (US), and, at this stage, considerably higher than the rest of East Asia. 3. Japan’s export competitiveness from the standpoints of intellectual assets Using a trade specialization coefficient adjusted by skill intensity and intellectual intensity to look at Japan’s competitive advantage in trade, Japan’s figures are improving compared with simple calculations. Although the evaluation methods for skill intensity and intellectual intensity are still in development, given that the quality of human capital and intellectual assets of a country are unlikely to undergo any major changes in the short-term, Japan should seek to boost its competitiveness on the basis of its human capital and intellectual assets. The previous section examined by utilizing trade statistics, that in East Asia, parts trade and division of the production process are progressing mainly in the machinery sector. Progress in division of the production process would imply that the functions, such as planning, R&D, production and sales, are divided internationally into each function in accordance with its characteristics. As already discussed in Chapters 1 and 2, the competition environment changes dramatically through economic globalization, and it is necessary for Japan to sustain its competitiveness and economic prosperity by constant value creation for which appropriate functions should be incubated domestically. In particular, as will be discussed later, if the Japanese economy is -223- more liberalized by the progress of East Asian economic integration through the conclusion of EPAs, these value creation functions will need to be incubated and strengthened domestically, regardless of business type or scale. In that event, the role of intellectual assets, such as human capital and innovation skills will be important, as discussed in Chapter 2. In this section, first, we look at specific cases of Japanese companies which are developing international production networks in the East Asian region, then see the actual situations of division of functions and analyze the relation between division of functions and intellectual assets, finally discussing challenges for Japan in the progress of international division of functions. 1. Division of functions by Japanese companies operating in China – A case study In analyzing the division of functions within the East Asian region, there is a limit to grasping specific situations using only macroeconomic data, such as trade statistics. For this reason, this section covers the actual situation of the division of functions by introducing some cases of Japanese companies whose operations are partially transferred to China, which is one of the most important production bases and markets in East Asia. In particular, we take a specific look at the production process and components profile of “digital cameras” and “mobile phones” of large firms, whose production networks in East Asia are expanding most in electrical industries. In addition, we also look at the actual situation of the international division of functions for small and medium-sized enterprises (SMEs) and the service industry.1 (1) Case study of digital camera product A (a) Background of starting operations in China Company A, a famous Japanese camera manufacturer, established a plant in Guangdong Province in China at the beginning of the 1990s, from the viewpoint of possibility for developing effective business, given improvements in infrastructure, abundant labor, and advantages of transportation bases. Initially, the plant specialized in processing and assembly functions, but gradually its operations were expanded in scope and scale to include lens components, plastic molding, painting and packaging. By the end of the 1990s, an independent production process was established for standard film cameras, and based on this process, full-scale production of digital cameras was initiated at the beginning of the 2000s. (b) System of division of the production process Shown below is the current production process for digital camera A at Company A’s affiliates in China (Fig. 3.2.1),2 indicating that the headquarters is basically in charge of the process from product planning to development. Components are supplied by Company A’s group affiliates, other Japanese companies in China, 1 This section’s case studies of “digital cameras,” “mobile phones” and the service industry are based on the results of interviews by METI. 2 The production process chart was taken as reference from the Japan Finance Corporation for Small Business (2003). -224- and local manufacturers. Product assembly is operated exclusively in China, and finished products are distributed to each sales base. As such, China is functioning as the main production base of Company A. Company A’s concept on the division of roles between home and overseas (China) operations is clear, with the former operations specializing in technology development (development of added value), and the latter serving as production platforms (production of added value). However, it is essential to maintain domestically a certain level of production functions besides R&D; otherwise, manufacturing skills and know-how would be lost. Therefore, in addition to R&D, the production functions of prototypes and key components as well as high-tech and small-lot products, such as single-lens reflex digital cameras, are maintained in Japan. Figure 3.2.1 System of division of the production process for the digital camera product A In-house division of labor Japan (home country) Marketing/product planning Product development Component production Headquarters (Planning/development) Headquarters (Product development/ design) Affiliated companies in Japan Overseas market (China) Sales Sales headquarters (reimport) Sup ply Affiliated companies in China and distribution in China Affiliated companies in China Affiliated companies in China Affiliated companies Europe and US Third country Product assembly Sup ply in Worldwide (Europe, the US, etc.) Supp ly Japanese components manufacturers in China Chinese local components manufacturers Taiwanese components manufacturers in China Original design manufacturing companies of Asian regions other than China Other companies Source: METI based on the interview with company A. (c) Composition of component supply for digital cameras The chart below shows the location of suppliers for each major component group and its cost shares for the digital cameras produced by the above process (Fig. 3.2.2). In the case of product A, most of major components are supplied by Japanese companies, the main reason for which is the reliability of their quality. In addition, the components supplied by Japanese companies gain an advantage over those of other countries in their technology, and given the high value-added nature of digital cameras, at this point, only Japanese companies can assure supply of precision components while maintaining its quality. Figure 3.2.2 Composition of component costs for digital camera product A Location of Share of component supplier costs (%) Imaging operation function/exterior Japan 13 (e.g., TFT, metal cladding, etc.) Optical system unit China Japan 1 13 Component group Component costs (e.g., filters, image pickup devices, lenses, etc.) Circuit board (e.g., custom IC, electrical components, etc.) Other components China 6 Thailand 2 Japan Switzerland 17 4 Japan 6 China 1 Subtotal: 63 (Breakdown: Japan, 49; China, 8; Switzerland, 4; Thailand, 2) Others 37 Total 100 Not e: Japan in "Location of supplier" means that a component is supplied by a Japanese company (excluding Japanese companies in China). It does not always mean that its product ion processes were all operat ed in Japan. Source: MET I, based on interview with Company A. -225- Although it cannot be seen from the chart, the division of the production process for a component itself is expanding worldwide. For example, in the case of CCD (charge-coupled devices for picking up images), the initial production process is operated in East Asian countries other than China, and the final process is completed in Japan. As for camera lenses, approximately five to seven lenses are mounted for one digital camera, so that suppliers’ countries tend to diversify depending on the lens function. In addition, in view of promoting fair competition among suppliers and to reduce the risk of relying on a single supplier, even lenses for the same function are supplied from various countries, such as from Chinese or domestic production bases, and Thai component manufacturers. Furthermore, given the undeveloped infrastructure at Chinese plants, the metal cladding, which is a part of the imaging operation functions, is also supplied by many Japanese component manufacturers, depending on their know-how and production skills, such as the capability to process small or designed components. In this way, it can be said that the components of digital cameras produced in China are supplied by a variety of countries through the division of the production process and most of the high value-added components are supplied by Japanese companies. (d) Concepts for key components in digital camera products and their future division of labor Company A regards “technology and know-how” as the most important driving force for competitiveness in its business activities. In the case of above-examined digital camera product A, the key unit is “the tube unit of the optical device;” specifically, “the lens, tube component and metal mold production technologies” used for the tube unit of the camera are considered as their core competencies. In order to maintain and enhance the competitiveness of these key components in the future, it is fundamental for Company A to manufacture these components on their own (and supply them to other companies), and it is also important to enhance the technology for high-precision assembly and evaluation, and the production capacity and manufacturing technology for optical elements, metal mold designs for optical frames and molding. On the other hand, the manufacturing technology for key components is not a technology that anyone can achieve, so that there are differences in technology levels even for the same unit, and the lens precision is completely different by product class. For example, Taiwanese companies can manufacture lower technology components; however, for those that require a certain level of technology and design, Japan still keeps its competitiveness and therefore needs to make every effort to develop and protect a leading technology. Company A’s future vision for the desirable role of China in the division of the production process is: (i) strengthening and expanding mass production function; (ii) enhancing technological functions by transferring part of unit design technologies excluding the latest ones and developing new products for standard film cameras, etc.; and (iii) expanding local procurement (however, electronic key devices will be supplied mainly by Japan). As for the role of Japan, it is in maintaining development functions for manufacturing technology from the viewpoint of preventing its outflow and keeping competitiveness while enhancing technologies for manufacturing key components and functions, such as deciding mass production, small-middle lot production -226- of highly complex products, and quality control. In addition, Company A’s production bases have been concentrated in China for reasons of establishing the operation system. From now on, Company A is planning to situate them in other countries to reduce the risk of relying on a single base. In this way, Company A has a clear concept for the division of roles between China and Japan in its international production process, whereby Japan is a base for “development of added value (developing technology),” and China is one for “production of added value (producing to make profits).” It can be assumed that Company A is trying to ensure its competitive advantage by concentrating management resources in its core competencies (Fig. 3.2.3). Figure 3.2.3 The image of Company A's division of functions between Japan and China Japan (R&D base) China (production base ) Research & Development Production (Technology cre ation) (Production to create profit) Source: METI, based on interview with Company A. (2) Case study of mobile phone B (a) Background of starting operations in China Company B is one of the famous mobile communications equipment manufacturers in Japan. At the beginning of the 1990s, it established a joint venture company with a Chinese company in Beijing, aiming at enhancing global competitiveness through utilizing their human resources and cost competitiveness in China. Initially, it started as a production base for beepers, and at the end of the 1990s, it started the production of GSM mobile phone handsets. In the 2000s, it stopped the production of beepers and shifted all production lines to mobile phone handsets. At the same time, the Japanese headquarters endowed this Chinese affiliated company with independent procurement functions, and now it is playing an important role as the major plant for GSM mobile phones, produced by consecutive operations from the initial process to the finished product. At present, in addition to the production base in Beijing, R&D bases are located in Shanghai and Beijing. (b) System of division of the production process Shown below is the current production process for camera phone B, which is being produced by Company B’s affiliates in China (Fig. 3.2.4). Similar to the case of Company A, the headquarters is basically in charge of the process from product planning to development, and components are supplied by other Japanese-affiliates or US and European-affiliates in China besides Company B’s group companies. In addition, product assembly is operated by its Chinese affiliates and these assembled products are distributed to sales bases in China (part of the semi-finished products are exported to overseas affiliates). The Beijing production base does not have any R&D function, so that product development and planning are provided by Company B’s group company in Japan. -227- In-house division of labor Figure 3.2.4 System of division of the production process for the camera phone B Marketing/product planning Product development Component production Japan (home country) Headquarters (planning/development) Headquarters (product development/design) Affiliated companies in Japan Overseas market (China) Affiliated companies in China (marketing) Product assembly Supply Affiliated companies in China Third country (Europe, US) Sales Affiliated companies in China Affiliated companies overseas (exports of semi-finished products) Supply Japanese components manufacturers European and US components manufacturers Local components manufacturers Other companies Source: METI, based on interview with Company B. (c) Composition of component supply for camera phones The chart below shows the location of suppliers for each major component group and its cost shares for the camera phones produced by the above process (Fig. 3.2.5). Although suppliers’ countries and cost shares of components change accordingly by mobile phone model, the case of product B demonstrates that currently high value-added components, such as liquid crystal screens, cameras and memory chips, are mainly supplied by Japanese companies. In addition, although the number of components supplied locally in China is gradually increasing, most of them are still supplied by Japanese-affiliated manufacturers and a little by Chinese local companies due to their quality problems. As a characteristic of mobile phones, their future key component will be software to realize value-added functions, such as operations, picture processing and ring tones. Moreover, it should be noted that in addition to component costs, expenses concerning royalty payments are relatively high. Figure 3.2.5 Composition of component costs for camera phone B Component group Component costs Location of supplier Share of component costs (%) Japan 17 China 2 Camera feature Japan 10 Embedded memory Japan 12 Semi-conductor Japan 7 Battery China 4 Other components China 20 Liquid crystal (examples: circuit boards, surface mounting, call-related Japan components, etc.) Subtotal: 82 (Breakdown: Japan, 56; China, 26) 10 Others 18 Total 100 Note: Japan in "Location of supplier" means that a component is supplied by a Japanese company (excluding Japanese companies in China). It does not always mean that its production processes were all operated in Japan. Source: METI, based on interview with Company B. -228- (d) Concepts for key components in mobile phones and their future division of labor The mobile phone market in China is growing remarkably and is the world’s largest. As consumer preference is quite unique compared to the other regions, there is sometimes a difference between production cost and market price. For example, some models are traded at a premium for their design or value-added functions; others are traded at a discount, lower than their production costs. For this reason, it is necessary to develop products taking account of regional characteristics based on elaborate market research. In this development, the following are pointed out to be Company B’s key components: technology for developing hardware to realize high added value and functionality, such as large color liquid crystal displays, cameras, and unique design packages; and development of application software to realize operations for high functional services. As such, Company B considers it necessary not only to enhance R&D functions for developing both hardware and software technologies to support these product developments, but also to take measures for preventing the outflow of such technologies (protection of intellectual property rights, etc.). Company B’s future vision for the division of labor with China is quite clear. In Japan, 3G and 3.5G communications technologies are overwhelmingly advanced, and also the technologies for developing application software to support operations for such advanced communications technologies. Even though Japanese technology is at least a year ahead of East Asia’s, including China’s, it is still necessary to keep on developing leading technologies by utilizing its technological accumulation and know-how before the rest of Asia catches up. Moreover, Japan also has an advantage in advanced technologies such as miniaturization and high-density packaging techniques so that R&D functions for such technologies need to remain in Japan. On the other hand, the role of China is expected to strengthen mass production and R&D functions, given the growing importance of developing mobile phone handsets, the potential of the world’s largest market in China, the necessity for quick responses to market needs, and an abundance in low-wage yet capable labor. To this end, Company B recognizes it as necessary to establish a clear division of roles with China in R&D, in which the role of China is development of customizing functions in response to market needs, such as Chinese original designs and planning in view of the domestic market and more contents in Chinese, while Japan maintains and enhances core technologies such as production technologies for high value-added components, communications and application software technologies. Furthermore, it is also pointed out as necessary to enable overseas bases to manufacture prototypes for mass production of exports for overseas markets. Prototypes used to be manufactured in Japan until a few years ago, but differences in production lines require local plants in China to reorganize their production systems to enable manufacturing prototypes for mass production (Fig. 3.2.6).3 3 Company B divides product development and plant technology. Plant technology is the process of trial manufacture which ascertains whether a prototype is suitable for mass production. Company B considers plant technology as a part of manufacture, and plans to manufacture prototypes for mass production in China, while those for developing products are manufactured at the R&D base in Japan. -229- Figure 3.2.6 The image of Company B's division of functions between Japan and China China (production/sales base) Japan (R&D base) Research & Development Plant technology Production (Prototype manufacture for (For mass mass production) production, sales) (Up to prototype manufacture for developing products) Source: METI, based on interview with Company B. As described above, Company B is trying to form an appropriate division of the production process in Asia, regarding Japan as its R&D base for developing core technologies, with China as its production base taking account of its domestic market. (3) Case study of division of functions by SMEs As large Japanese electronics manufacturers are shifting their production bases to China, many small and medium Japanese component manufacturers are transferring their production bases to China as well. Here we introduce the case of a small and medium enterprise Company C, which was reported by Matsushima (2003)4 to produce electric components in China under a desirable division of the production process with a Taiwanese company. (a) Background of starting operations in China Company C is a manufacturer of electronic components for mobile phones running operations from design to production of prototypes for mass production. Company C started to operate in China in the mid-1990s, as a large Japanese office machinery company planned to start the mass production of low-priced facsimile machines with a Taiwanese company group (Group D), which had already operated the production of optical machinery components in the South China region. The core component of facsimile machines is a print circuit board mounted with electronic components, but at the time, Taiwanese Group D did not possess the surface mounting technology (SMT) required to produce it on their own. In order to establish the mass production system for facsimile machines in the South China region, the Japanese office machinery company considered that SMT of a stable quality would be indispensable for a variety of components provided by Taiwanese Group D. Therefore the Japanese office machinery company introduced Group D to Company C, which was not only its outsourcer for processing the mounting units for electronic components in Japan, but also already had a high reputation in SMT. At that time, the assembly divisions of large Japanese electronics and electrical companies became positive about starting operations in China, so that Company C had to face the prospect of decline in domestic demand on mounting units for electronic components in the long run. However, it was difficult for Company C to start operations in China all by itself due to its business scale. Under such circumstances, it was the golden opportunity to start a joint venture with Group D, which already had 4 Matsushima, S. (2003), “NIHON NO CHUUSHOUKIGYOU NO CHUUGOKUTENKAI TO FUTATSU NO RINKEEJI.” -230- operated in component production in the South China region and would ensure a stable demand. As for Taiwanese Group D, it was considered a good chance to enhance their competitiveness by complementing the mounting division of electronic components, whose importance was expected to increase in the future, under situations of progress in the digitization of optical equipments incorporating lenses—in which Taiwanese Group D was an expert— and increases in products whose core components were electronic components, such as SMT and chip on board (COB) components. In this way, in the mid-1990s, Company C and Group D agreed to establish a joint venture company (registered in Hong Kong) and a production base for electrical components in Guangdong Province (joint venture Company E). (b) System of division of electronic component production Now take a look at Company C’s system of division of the electronic component production process with its joint venture Company E in Guangdong Province. The chart below shows an image of the division of the production process between Company C, joint venture Company E and Group D (Fig. 3.2.7). Although specific patterns for division of the production process are different for each electronic component and unit, at present, there are cases where design, prototype manufacture and mass production for components, such as small LCD circuit boards, are operated in Japan. However, there is an increasing tendency to operate the design or prototype manufacture processes domestically and the mass production process locally at the joint venture company. The processes for print circuit boards for mobile phones and electronic components for digital cameras are typical cases of such a production process. While the design and prototype manufacture processes continue to remain to be based in Japan, the mass production process is gradually shifted to the joint venture company in Guangdong, with the following reasons in the background: First, the gradual shift in the mass production function to the Chinese joint venture company can be explained by the fact that Company C’s main customers—large electrical and camera companies—have shifted their assembly processes to China. In particular, the cycle of digital products such as digital cameras is short, so that it is increasingly necessary to shorten the time from development to production as much as possible. In order to do so, the mass production process of mounting units for electronic components needs to be located close to the product assembly process. In addition, similar to the product assembly process, the inspection process in mass production is labor-intensive, so it goes without saying that the South China region, where there is certain to be low-wage and abundant labor, was an attractive location for Company C. Second, the reason for maintaining the design and prototype manufacture processes domestically is the necessity of locating nearby clients. A large electronics manufacturer, one of Company C’s clients, is shifting its product assembly processes to China, while maintaining its product planning and design processes in Japan. When Company C receives an order from a client, its development division visits the client’s design division frequently to discuss the details. By doing so, Company C can always grasp its client’s requests and respond to them optimally and swiftly with its own development and design. In addition, for components that require high precision, it is indispensable to check not only whether they are exactly as their designs, but also whether they are fitted into products, so that it -231- is favorable for Company C to locate its clients nearby in view of receiving orders. Furthermore, it is easier in Japan to acquire inspection equipment and tools needed for prototype manufacture for mass production. Even in the case that such equipment and tools are insufficient, Company C’s headquarters locates nearby a cluster of small manufacturers that possess high precision processing technology for small-lot and short-term products. It should be noted that Company C’s design and prototype manufacture are supported by such industrial clusters. Through the above design and prototype manufacture processes in Japan, electronic components are mass-produced at Company C’s joint venture company with Group D, after which they are provided to the assembly plants of each of Group D’s companies and incorporated into a variety of products such as cameras and copiers. Furthermore, Company C is recently expanding its business by making efforts to get orders from other Japanese companies in China besides supplying its components to Group D companies. Figure 3.2.7 The image of Company C's division of functions between Japan and China Japan China Electrical component design / prototype manufacture Product assembly Mass production of components (Joint venture company) ( Headquarters, main plants) (Companies in Business Group D) Source: METI, based on Matsushima (2003). As described above, Company C’s case shows that there can be international division of production processes for a component. With the cooperation of Taiwanese Group D, Company C could realize “mutual complementarity in functional cooperation,” securing a stable demand for its electronic components by Group D, while providing them with its surface mounting technology required for the production of optical equipment. In this way, Company C’s case gives a useful suggestion to understanding the current system of division of functions in East Asia, by forming an “appropriate division of labor among bases” by dividing between design, prototype manufacture and mass production processes taking account of environmental conditions in Japan and China. (4) Case study of the division of functions in service industry Not only in the manufacturing industry as described above, but also in the non-manufacturing industry, there are companies expanding their business overseas through the active utilization of their intellectual assets (business models, know-how, etc.). The following is a case study of Company F. (a) Company F’s comprehensive information network system Based on a franchise system, Company F forms the following comprehensive information network system, which enables meeting customers’ needs swiftly by sharing information among Company F headquarters (hereafter “headquarters”), manufacturers, the joint distribution center and stores (Fig. 3.2.8). -232- Figure 3.2.8 The image of company F’s division of functions between Japan and China Distribution Manufacturer s, busine ss partners Joint delivery center Japan (Formation and refinement of the system) China (Introduction of the system) Distribution Orders, sales, accounting data Stores Comprehensive information network system Orders, sales, accounting data Company F headquarters Expansion of sales base in China Comprehensive information network system Source: METI based on company F’s pamphlet. In other words, (i) the POS5 information accumulated on each POS register (computer terminal) is immediately transmitted to store computers (SC) which are provided to every store, so that each store is able to access sales information in real time. In addition, by analyzing this information with the advice of an Operation Field Counselor (OFC) in Company F, each store is able to hypothesize and place orders for each product. Also, (ii) ordering by each store is operated through an ordering terminal known as a Graphic Order Terminal (GOT). Once the order data is collected at the headquarters, it is swiftly transmitted to manufacturers (production plants) and joint distribution centers. Therefore, manufacturers are able to plan their production at the peak time of demand for each product, and the products can be distributed in a timely fashion to each store from the joint distribution center by a product’s temperature range. Furthermore, (iii) each store settles its payment with manufacturers based on the data used in the above-mentioned transaction. In settling its account, Company F pays in a lump for each of their stores, so that manufacturers can avoid the burden and risk of collecting bills. In this way, utilizing the above comprehensive information network system, which is intellectual assets combining hardware (SC, POS sales data, joint distribution center, etc.) with software (product orders based on hypotheses, etc.), in the entire process of ordering, production, distribution and settlement, Company F becomes the largest domestic convenience store chain with over 10,000 stores nationwide (as of the end of March 2004). (b) Overseas introduction of the comprehensive information network system Company F is actively developing its business overseas as well as domestically, and including its group affiliates, it now has a network of over 25,000 stores in 18 different countries and regions around the world (as of the end of March 2004). In China, where dramatic development has been showing in recent years, many problems remain to be 5 POS is an abbreviation of “Point of Sale.” POS systems are defined as “systems whereby sales information on each product at each store is recorded and totaled, with results being used for inventory management and marketing.” -233- solved, particularly in the distribution sector, including (i) regulatory issues such as the prohibition of daytime transportation of products using large trucks (over 2 tons) in central Beijing; and (ii) business customs issues such as an undeveloped joint distribution system of high-frequency and low-volume transportation under the dominant opening method (intensive development of many stores), which was originally developed by Company F. Under such regulations and business customs, Company F considered it difficult to operate its distribution system which is essential for the development of convenience store chains. For this reason, despite request by the Chinese government, Company F did not open stores in China by that time.6 However, in view of the rapid economic growth and progresses in infrastructure and deregulations of distribution, in January 2004, Company F started a joint venture (Beijing private limited Company F) as the first ever Japanese-owned convenience store chain in Beijing (the first store was opened in April 2004). This was the first time for Company F’s overseas business to modify its original comprehensive information network system suitable for the Chinese market in order to win in the intense competition among convenience stores in China. Specifically, Company F planned to form a system similar to Japan’s, with the Beijing private limited Company F functioning as the headquarters, the center for managing information concerning orders, sales and accounting between manufacturers, distributors and individual stores7 by utilizing POS and SC. In this way, Company F is trying to differentiate itself from competitors to win in the intense competition in China through the development of a comprehensive information network system, namely intellectual assets. As described above, the four specific cases of Japanese companies’ divisions of functions in China indicate the following: Companies continued to maintain and enhance domestically (i) production functions for high value-added production; and (ii) innovation functions such as product planning, R&D and system design. It was also found that these companies were actively developing their Chinese operations as production and sales bases by utilizing and realizing domestically-created technology and systems with some adaptation to China. In this way, regardless of business type or scale, each company is making efforts to divide its functions flexibly and strategically between domestic and overseas operations taking account of characteristics of intellectual assets in domestic and foreign regions. Through such efforts, companies are pursuing continuous value creation and enhancing their own core competencies in order to secure their competitive advantage (Fig. 3.2.9). Figure 3.2.9 The system of Japanese companies’ division of functions between Japan and China Japan China Value application/ realization functions Value creation functions (product planning, R&D, system design, etc.) (mass production, sales, etc.) Source: METI. 6 Although a store was opened in Hong Kong in 1992, it was managed by a third party (a UK company), which obtained the area license from the master licensee of Company F. Therefore, Company F is not involved in this business. 7 In China, given that the franchise system will not be allowed until December 2004, all stores are under the direct management of Beijing private limited Company F. -234- 2. Patterns in division of functions and intellectual assets As explained above, Japanese companies operating in China are maintaining innovation functions such as R&D and system design, as well as production functions for high value-added components in Japan, and developing production and sales bases in China while utilizing domestically-created technologies and systems. In that sense, it can be assumed that companies’ concepts for division of labor is based on a broad sense of potential of innovation, rather than differences in technological levels merely applied for production, etc. This demonstrates that even while enhancing the protection of intellectual property rights, it becomes difficult to fix differences in technology levels at a certain degree, so that continuous innovation is necessary as the driving force of competitiveness. In this section, we will take a look at some statistics suggesting that Japanese companies are maintaining the production of high value-added components and R&D functions in Japan through their international division of labor. (1) Patterns in the division of functions from statistics (a) High value-added ratio in Japan First of all, with regard to maintaining production functions for high value-added components in Japan, we look at trends in the domestic and overseas value-added ratio (proportion of added value to sales) in the Japanese manufacturing industry. In viewing the recent value-added ratio8 for domestic industries from METI’s Basic Survey of Japanese Business Structure and Activities, and for Japanese overseas affiliates from the Basic Survey of Overseas Business Activities, it could be seen that the value-added ratio of companies in Japan was comparatively higher than that of overseas affiliates, supporting the above-mentioned patterns for the division of functions. However, looking by overseas area, the value-added ratio of East Asia was comparatively lower than that of the US, but higher than that of the EU, which would suggest that there was no difference in the value-added ratios between developed and developing countries as far as Japanese overseas affiliates (Fig. 3.2.10) were concerned. Figure 3.2.10 Value-added ratio of Japanese companies (manufacturing industry) 25% 20% (Breakdown of East Asia 15% 10% 5% 0% Japan Overseas US EU East Asia NIEs ASEAN4 China (Breakdown of overseas) Notes: 1. Value-added production ratio = Amount of added value / Sales. Amount of added value = Operating profit (sales - cost of sales - selling, general and administrative expenses) + payment for salary + rental costs + depreciation costs. However, taxes and public dues are included for Japan. 2. Sales, cost of sales, selling, general and administrative expenses, payment for salary, rental costs, and depreciation costs were total of available data from respondent companies in operation. 3. Overseas companies whose investment share of Japanese companies is over 10% (overseas Japanese affiliates) or those whose investment share of overseas Japanese affiliates is over 50% were used for the calculation of "overseas." 4. The figures are the average of years from 1999 to 2001. Sources: Computations based on Basic Survey of Overseas Business Activities, Basic Survey of Japanese Business Structure and Activities (METI). 8 The ratio is calculated as the average of corporate accounts for three fiscal years: 1999, 2000 and 2001. -235- In addition, according to the recent survey by Japan Bank for International Cooperation (JBIC), when domestic production items are shifted to overseas production, more than 80 percent of respondent companies answered that they will domestically specialize in more high value-added products or services in place of those items (Fig. 3.2.11). Figure 3.2.11 Impact of overseas production on domestic business operations Details of "Efforts in other products and product areas" in domestic production (multiple responses) Stance on domestic business operations over the mid-term (next 3 years or so) 80.8 84.3 40.3 While the production of product lines that used to be produced domestically is shifting to overseas, domestic production will focus on other products and product areas, filling in the resulting gap. Specializing in higher value-added products or services 36.3 48.1 9.8 13.4 4.7 6 0.5 1.4 0 Moving to new production areas 33.1 Since overseas investment aims at maintaining and expanding the market share of sales from (and/or exports and imports from) overseas production bases, there will be no effect on domestic business operations. 15.6 Currently considering specific measures Expanding production of standard products Others 20 40 8.2 2003 2002 80 (%) 60 2.8 0 100 Domestic business operations will decrease because overseas production will replace domestic production. Since products produced overseas differ from domestically-produced products, there will be no effect on domestic operations. Others 10 20 30 40 (%) 50 Source: Survey Report on Overseas Business Operations by Japanese Manufacturing Companies (Japan Bank for International Cooperation) (2004). (b) High ratio of R&D expenses in sales in Japan Previously introduced case studies demonstrated that new technology development was operated in Japan, so we now compare the R&D level of Japan’s manufacturing industry with that overseas in the same way as we did for the value-added ratio. When looking at the ratio of recent R&D expenses in sales from the Basic Survey of Japanese Business Structure and Activities and the Basic Survey of Overseas Business Activities,9 the R&D expenses ratio is high domestically and relatively low in overseas affiliates, which indicates that R&D is more active in Japan. In addition, it is clear that among overseas affiliates, those located in the US and EU have relatively higher R&D cost ratios (Fig. 3.2.12). Figure 3.2.12 The ratio of R&D expenses in sales of Japanese companies (manufacturing companies) 5% 4% 3% 2% (Breakdown of East Asia) 1% 0% Japan Overseas US EU East Asia NIEs ASEAN4 China (Breakdown of overseas) Notes: 1. Ratio of R&D expenses in sales = R&D expenses / Sales. 2. Sales and R&D expenses were total of available data from respondent companies in operation. 3. Overseas companies whose investment share of Japanese companies is over 10% (overseas Japanese affiliates) or those whose investment share of overseas affiliates is over 50% were used for the calculation of "overseas." 4. The figures are the average of years from 1999 to 2001. Sources: Computations based on Basic Survey of Overseas Business Activities, Basic Survey of Japanese Business Structure and Activities (METI). 9 Data for the same years as Footnote 8 were used. -236- (c) Motivations of Japanese companies for overseas expansion Looking at the motivations of Japanese affiliates for their location, whereas the main motivations for the US and EU are market factors such as sales to local markets and third countries in the same region, ASEAN4, NIEs3 and China are attached importance in terms of cost as well as market factors with strong expectations of serving as production bases. At the same time, motivations from market factors such as sales to local markets and third countries within the regions also occupy a large proportion in ASEAN4, NIEs3, and China. In particular, motivations from the expansion of intra-regional sales for ASEAN4 and NIEs3 show an almost equivalent proportion to the total of motivations from the expansion of exports to third countries outside the region and those from re-import to Japan. Although this survey does not distinguish between business types and components or products, it can be assumed that Japanese companies are creating the division of functions taking advantage of cost factors in the East Asian region, and also selling their final products within the region (Fig 3.2.13). Figure 3.2.13 Motivations of local Japanese affiliates for overseas expansion (multiple responses) US EU Asia All regions ASEAN4 Because overseas production is more profitable from cost perspective Because price competitiveness could not be maintained by production in Japan, the price had to be reduced by overseas production T o maintain and expand sales in the location for overseas operations T o maintain and expand sales in third countries within the same region T o maintain and expand sales in third countries in other regions T o reimport the products t o Japan T o conduct R&D at the locat ion for operations T otal of answers NIEs3 China 5.7% 3.8% 16.3% 18.4% 11.8% 17.3% 12.1% 4.5% 2.4% 11.8% 13.0% 7.5% 13.7% 8.6% 34.6% 34.0% 25.3% 22.5% 30.3% 24.2% 28.4% 10.5% 23.1% 11.2% 10.3% 15.6% 9.2% 13.0% 6.1% 11.6% 6.2% 5.5% 7.8% 5.8% 7.2% 3.7% 1.9% 6.3% 5.9% 4.6% 8.1% 5.1% 5.3% 2.6% 0.8% 0.6% 1.1% 1.0% 3,464 2,809 11,683 4,156 2,945 4,105 1.9% 19,961 Notes: 1. Survey allows multiple answers (3 choices) out of 12 choices. Here, only mot ivations related to this section were extracted. 2. Hong Kong is included in China, but not in NIEs3. Source: Basic Survey of Overseas Business Activities 2002 (MET I). (2) Effect of intellectual assets on company’s location Although there are no statistics that examine precisely the effect of each country’s intellectual assets on the international division of functions, let us introduce here the results of an analysis which examined the effect of intellectual assets on a company’s location in Japan. In Tomiura (2003), a regression analysis was used to project the decisive factors in employment for each prefecture of Japan. According to the results, comparing the period 1990 to 2000 with the period 1985 to 1990, the advantages of clustering suppliers of intermediates (explaining variable INP) were lost, which was assumed to be related to the increasing foreign procurement. In contrast, the effects of knowledge and human resources (explaining variables DIV and SIM) increased during the same period (Fig. 3.2.14). The explanatory variable DIV is the index that demonstrates a variety of industries in a region, and a higher value of DIV means more various intellectual stimulations from different industries. Although the DIV value was negative over 1985 to 1990, it turned positive over 1990 to 2000. The -237- increase in DIV can be explained as the increasing importance for Japanese industries to exchange their knowledge and ideas; therefore, as these exchanges become more active in a region where the industrial structure is diversified, it can be observed that that region’s growth in employment will be more accelerated than others. Furthermore, the explanatory variable SIM is an index demonstrating similarities among required types of human resources for industries within the region. The increase in SIM indicates the cohesion of industries that are strongly related and required for similar human resources. In regions with a high SIM value, plentiful human resources that match companies’ needs are considered to be nearby, demonstrating a favorable situation for companies. From the fact that the SIM value was positive throughout the 1990s, it could be assumed that the accumulation of specialized labor adapting to companies’ needs functioned well. Figure 3.2.14 Decisive factors of employment in the Japanese manufacturing industry by prefecture Explaining Variables (1) 1985-90 (2) 1990-2000 INP 0.0274 -0.0104 (0.0120) (0.0123) OUT -0.0234 -0.0295 (0.0132) (0.0129) INP Ratio of the regional supply of goods necessary for concerned industry in that region WAGE -0.2459 -0.0647 OUT Ratio of the regional demand for goods produced by concerned industry in that region (0.0639) (0.0690) WAGE -0.0556 -0.1175 IIA (0.0144) (0.0167) SCL Scale of economy for concerned industry in that region Diversity of other industries in that region Similarity in demand for human resources between concerned industry and other industries in that region IIA SCL DIV SIM R2 Explaining Variables 0.0193 0.0023 DIV (0.0268) (0.0225) SIM -0.0778 0.0582 (0.0288) (0.0345) 0.0011 0.0277 (0.0094) (0.0138) 0.1738 0.2670 Contents Wage of concerned industry in that region Clusters of concerned industry in that region Notes: 1. All the variables are relative value to the national figures of concerned industry (logarithm values) . 2. There are dummy variables by industry. 3. Values inside ( ) represent standard error. Source: Eiichi Tomiura (2003). These results would imply that in recent years, intellectual exchange beyond various business types and functionally-specialized human resources adapting to regional industrial needs have had an increasingly significant effect on regional growth. As overseas business is rapidly expanding, the importance of geographical proximity in product transactions has declined. However, human resources and knowledge are hard to transfer beyond geographic distance, so that it can be said that the importance of accumulating intellectual assets in regions is increasing relatively from the viewpoint of providing skilled human resources and intellectual stimulation. -238- (3) Comparisons of intellectual asset level in each country The above-mentioned case studies and statistics showed that Japanese companies were accelerating their international division of functions by maintaining production functions for high value-added products and innovation functions in Japan. As discussed in Chapter 2, the decisive factor which leads to such value creation functions is not the size of tangible assets, but a diversity of intellectual assets, including human and organizational capital. At this point, it is difficult to evaluate accurately the scale of intellectual assets on a national or regional level, but it can be assumed that the level of “intellectual assets” in a country or region is related to companies’ choices of where and what type of function they locate, and it also has a kind of effect on industrial clusters (innovation function is located in regions with a high level of intellectual assets, which further raises the level of their intellectual assets). In this section, although the following evaluations are still in development, we make a comparison between the level of “intellectual assets” in Japan and that in other regions taking a look at various data. (a) Skill intensity Skill intensity is the ratio of the added value of a country’s workers engaged in jobs that require expert knowledge and those that are engaged in production activities. Higher figures imply a larger proportion of intellectual workers in a country, and such figures can be used as a primary approach to evaluate the level of human capital by country and region. When looking by region, the US shows the highest skill intensity, followed by the EU, Japan and East Asia (excluding Japan). Furthermore, among East Asia, NIEs has the highest level, while ASEAN4 has roughly the same level as China10 (Fig. 3.2.15). Figure 3.2.15 Skill intensity by country and region 0.8 0.6 0.4 0.2 0.0 US EU Japan East Asia (Excluding Japan) NIEs ASEAN4 China (East Asia breakdown) Notes: 1. “Skill intensity” is defined as: (total of value-added production by skilled labor) / (total of value-added production by unskilled labor). 2. The distinction here between skilled and unskilled labor follows the ILO definitions for skilled labor (professional workers and other occupations requiring specialized knowledge) and unskilled labor (production workers and other manual laborers). 3. The figures are based on the GTAP Version 5 data for skill intensity (1997 basis), which were estimated using the above definitions. Source: GTAP Version 5 Data Base (GTAP). (b) Provisional intellectual asset evaluation indices A by country and region In Chapter 2, as a way to evaluate intellectual assets provisionally, corporate reform capacity, efficiency and technological skills, etc. were indicated by adjusted standard deviation scores of representative indices, 10 Data was compiled from the latest Global Trade Analysis Project’s (hereafter “GTAP”) “GTAP Version5 Data Base.” However, it should be remembered that skill intensity data was relatively old, as of 1997. -239- including improvements in operating profit ratio, ratio of fixed asset turnover and R&D expenses. In this section, we make a comparison considering the average scores for listed companies in each country and region (limited to the countries and regions where headquarters are located) as provisional evaluation indices of intellectual assets for that country and region. Although the indices are still at the trial stage and there are certain biases, such as the differences in initial listing requirements in each country and region, generally the indices for Europe, the US and Japan are high, while those for East Asia (excluding Japan) are low. In order to explain another index for evaluation of intellectual assets by country and region briefly, the indices here will hereafter be called “provisional intellectual asset evaluation indices A by country and region” (Figs. 3.2.16 and 3.2.17). Figure 3.2.16 Provisional intellectual asset evaluation indices A by country and region (composite of 5 items) 56 Figure 3.2.17 Provisional intellectual asset evaluation indices A by country and region in machinery industry (technology level) 52 54 51 52 50 50 49 48 48 46 47 44 North America 46 North America Europe Japan East Asia Europe Japan East Asia (excluding Jap Notes: 1. Refer to Chapter 2 for details on the methodology . 2. The indices were calculated for the manufacturing industries of electrical machinery, transport machinery, general machinery, and precision machinery. 3. The number of companies whose data are available for calculating "technology level" are limited: North America 888 companies; Europe 114 companies; Japan 51 companies; East Asia 9 companies. 4. The year of the data is the latest business accounting year for which data is available (mostly the year 2002). 5. "North America" here refers to US and Canada. "Europe" here refers to UK, Germany, France, Italy, Sweden, Norway, Finland, Denmark and Netherlands. "East Asia" here refers to NIEs, ASEAN4, China. Source: Intellectual Assets Study Group. (Excluding Jap Notes: 1. Refer to Chapter 2 for details of the methodology. The calculation for the five items is a simple average of the deviation value of each item. 2. The indices were calculated for the manufacturing industry. 3. The year of the data is the latest business accounting year for which data is available (mostly the year 2002). 4. “North America” here refers to US and Canada. “Europe” refers to UK, Germany, France, Italy, Sweden, Norway, Finland, Denmark, and Netherlands. “East Asia” refers to NIEs, ASEAN4, and China. Source: Intellectual Assets Study Group. (c) Provisional intellectual asset evaluation indices B by country and region Next, as a second index for provisionally evaluating the level of intellectual assets by country and region, the adjusted standard deviation scores of products, which were obtained by multiplying per capita sales by the ratio of tangible fixed asset turnover for each country and region. This index is based on the concept that if a company’s sales exceed the average sales which are estimated from its capital and labor inputs, this difference will be caused by the contribution of the intellectual assets owned by that company. Although this is a rough evaluation method compared to the one above, it has an advantage in that smaller numbers of indices are required for its calculation and data can be obtained internationally from many companies. Specifically, first, by multiplying per capita sales by the ratio of tangible fixed asset turnover for each company, adjusted standard deviation scores are obtained for all companies in the same industry. Next, the average obtained by country and region in a unit of country or region where headquarters is located is defined as the “provisional intellectual asset evaluation indices B by country and region.” Looking at the indices for 1999 and 2002, similar trends can be seen, and the results show hardly any difference among the US, EU and Japan. In contrast, although data samples for East Asia (excluding Japan) were relatively small, its value is about 20 percent lower than other regions (Fig. 3.2.18). -240- Figure 3.2.18 Provisional intellectual asset evaluation indices B by country and region 55 1999 2002 50 45 40 35 30 US Europe Japan East Asia (Excluding Japa Notes: 1. The indices were calculated for all industries. 2. The data was compiled from the publicly listed companies for which both the latest business accounting year (mostly the year 2002) and the year three years before that (mostly 1999) were available. 3. “Europe” here refers to UK, Germany, France, Italy, Sweden, Norway, Finland, Denmark, Netherlands, Ireland, Belgium, Austria, and Sweden. “East Asia” here refers to Malaysia, Thailand, and Singapore, due to the limitations of data. Source: Intellectual Assets Study Group. No particular methods have been established for the evaluation of intellectual assets on a country or region basis, nor is it always possible to acquire sufficient data samples. However, as can be seen from the above, where two provisional evaluation indices, namely skill intensity and intellectual intensity, are employed, Japan scores highly alongside Europe and the US, and, at this stage, considerably higher than the rest of East Asia. 3. Japan’s export competitiveness from the standpoint of intellectual assets As discussed in Section 1 of this chapter, a country’s exports could be considered as exporting production factors used in the export goods. If it were possible to measure intellectual assets accurately besides capital and labor and to grasp the situation of factor endowment for each country, it would become possible to analyze relations between trade patterns and the situation of factor endowment, including intellectual assets, and it could be used for the analysis of each country’s competitiveness. The following are the results of analysis, which first divided Japan’s export and import goods into a factor of production labor (production process workers and laborers) and that of non-production labor (professional and technical workers, managers and officials, clerical and related workers, sales workers, and service workers, etc.),11 and then included other production factors. 11 In Ito and Fukao (2004), “production labor” and “non-production labor” were classified based on the occupational classification in the Population Census of Japan (Ministry of Public Management, Home Affairs, Posts and Telecommunications). In the Population Census of Japan, “Production labor” is defined as “production process workers and laborers”, and “non-production labor” is a broad definition that includes all other types of occupations. Specifically, this includes “professional and technical workers,” “managers and officials,” “clerical and related workers,” “sales workers,” “service workers,” “protective service workers,” “agricultural, forestry and fisheries workers,” and “workers in transport and communications occupations.” -241- (1) Division of production factors in Japan’s trade goods Here we introduce Ito and Fukao (2004) as the analysis of production factors for trade goods. This analysis classified production factors for trade goods into the following factors: production labor (production process workers and laborers), non-production labor (professional and technical workers, managers and officials, clerical and related workers, sales workers, and service workers, etc.), land, and tangible fixed assets. Then it analyzed how each input of these production factors was reflected in Japan’s trade goods.12 In classifying Japan’s import goods into the above production factors, this analysis used a profile of production factors in Japan’s industries that were producing those import goods, in that sense, this would analyze how Japan’s production factors are substituted through imports. In this analysis, given the lack of appropriate statistics which demonstrate the level of human capital through its skill differential, the changes in time series data of the share of production labor and that of non-production labor in labor input were observed as representative indices. The results of this analysis can be seen in Figure 3.2.19. Looking at the changes in the share of non-production labor in labor input for Japan’s exports, it can be seen that the share increased from 30.66 percent in 1980 to 32.73 percent in 1990, moving upward to 33.68 percent in 2000. In addition, it can be seen that the share of non-production labor is almost the same across the regions, and this implies that Japan’s level of human capital, which is reflected in export goods, are at the same level on average regardless of their destination.13 On the other hand, looking at Japan’s imports, on the whole it has substitution effects on goods whose ratio of non-production labor input in imports is lower than that in exports. Moreover, looking by region, it can be seen that the ratios of non-production labor input in imports from ASEAN4 and NIEs3 rose rapidly over last 20 years as such substitution effects. As far as looking at these statistics, they show an increasing proportion of import goods whose ratio of non-production labor input is high, and it implies that the level of human capital in imports is almost reaching that in exports. Next, we take a look at the balance. In 1980, Japan recorded “net exports” of about 620,000 in production labor, and that of about 290,000 in non-production labor. By 2000, these figures changed to about 360,000 in production labor and 380,000 in non-production labor, respectively. Therefore, when look at the profile of net exports by production factors, it can be said that the proportion of non-production labor is rapidly rising. 12 In addition to the direct input of production factors in an industry, the intermediate input of production factors, which was used to produce intermediate goods in that industry, was calculated from inter-industry relations tables. 13 For all trading partners, the same ratio of production factor input (the profile of production factor input for a good in Japan) was used for the same good, differences in the ratio of non-production labor input by region are caused by those in the ratio of goods composition in each region. -242- Figure 3.2.19 Changes in the factor contents in goods trade Production labor (unit: people) All regions China + Hong Kong NIEs3 ASEAN4 US EU Others Exports 1990 1,388,633 97,278 198,831 103,502 440,972 286,382 261,667 2000 1,941,421 242,423 353,213 189,007 583,364 324,457 248,957 1980 306,751 22,976 54,302 10,060 90,578 61,872 66,963 Imports 1990 761,507 87,209 138,387 51,945 178,069 174,314 131,583 2000 1,578,368 513,402 218,617 177,053 273,127 208,738 187,430 1980 616,723 50,341 44,830 51,877 132,801 71,554 265,318 Net exports 1990 627,125 10,070 60,444 51,557 262,903 112,068 130,084 2000 363,053 -270,979 134,596 11,953 310,237 115,719 61,527 1980 408,313 31,756 46,089 28,616 96,813 60,203 144,836 Exports 1990 675,630 44,161 100,185 50,583 215,813 141,939 122,948 2000 985,796 119,781 186,061 96,495 294,537 169,484 119,439 1980 118,829 5,861 15,805 3,679 42,276 26,359 24,850 Imports 1990 291,902 21,364 44,569 16,693 87,408 70,748 51,119 2000 607,572 127,705 106,804 79,591 136,926 90,007 66,540 1980 289,484 25,895 30,285 24,937 54,537 33,844 119,986 Net exports 1990 383,728 22,797 55,617 33,890 128,405 71,191 71,829 2000 378,224 -7,924 79,257 16,904 157,610 79,477 52,900 1980 2,367,285 Exports 1990 3,154,935 2000 4,251,546 1980 782,374 Imports 1990 1,777,449 2000 2,895,281 1980 1,584,911 Net exports 1990 1,377,486 2000 1,356,265 2000 21,701,611 1980 3,068,328 Imports 1990 7,169,480 2000 12,586,585 1980 8,019,274 Net exports 1990 8,209,024 2000 9,115,026 1980 31.94 33.97 40.32 32.46 29.11 32.11 31.14 Net exports 1990 37.96 69.36 47.92 39.66 32.81 38.85 35.57 2000 51.02 2.84 37.06 58.58 33.69 40.72 46.23 1980 923,474 73,317 99,132 61,937 223,380 133,426 332,281 Non-production labor (unit: people) All regions China + Hong Kong NIEs3 ASEAN4 US EU Others Land (unit: million yen) All regions Tangible fixed assets excluding land (unit: million yen) All regions 1980 11,087,602 Exports 1990 15,378,504 Ratio of non-production labor Exports Imports 1980 1990 2000 1980 1990 2000 All regions 30.66 32.73 33.68 27.92 27.71 27.79 China + Hong Kong 30.22 31.22 33.07 20.32 19.68 19.92 NIEs3 31.74 33.50 34.50 22.54 24.36 32.82 ASEAN4 31.60 32.83 33.80 26.78 24.32 31.01 US 30.24 32.86 33.55 31.82 32.92 33.39 EU 31.09 33.14 34.31 29.87 28.87 30.13 Others 30.36 31.97 32.42 27.07 27.98 26.20 Note: Ratio of non-production labor is a proportion of non-production labor to all labor (production labor + non-production labor). Source: Ito and Fukao (2004). (2) Skill intensity, intellectual intensity and competitiveness In the above analysis, goods were first decomposed into production factors, including labor, land and tangible fixed assets, and labor was then divided into production labor and non-production labor. While that may be a detailed analysis in terms of production factors, there are problems in analysis of trade patterns in terms of production factors of trading partners because we assumed the compositions of production factors in partners’ exports to be the same as those of Japan. Although the following analysis does not decompose production factors in detail, we will examine Japan’s trade pattern by looking at skill intensity, because data is available for both Japan and trading partners with a breakdown by individual industry. -243- (a) Trade specialization coefficient We used the simple “trade specialization coefficient”14 to evaluate the competitive advantage of Japan’s exports by item, as a first stage when intellectual assets factors were not considered. All items were distributed into five ranges15 according to the trade specialization coefficient calculated for each item: 1 to 0.6: most comparatively advantageous (strongest export competitiveness); 0.6 to 0.2: comparatively advantageous; 0.2 to -0.2: balanced export-import; -0.2 to -0.6: comparatively disadvantageous; and -0.6 to -1: most comparatively disadvantageous (weakest export competitiveness). In contrast, given the amount of Japan’s trade surplus, this analysis showed that there were a large number of items with most comparative disadvantage (items with weak export competitiveness) in exports to the world. In addition, as already seen in the trends in East Asian intra-regional trade, items with a high trade specialization coefficient were concentrated in the machinery sector, such as the electrical machinery sector (the proportion of items in machinery sector accounted for 33.7 percent in the most advantageous items). When taking a look by destination, in exports to the US and EU, the number of items within the range of “weakest export competitiveness (import specialization)” is the biggest among the five ranges, while in exports to East Asia that of “strongest export competitiveness (specialization in exports)” is almost the same as “weakest export competitiveness (specialization in imports)”. In the case of Japan’s trade with East Asia, while machinery and chemical industrial products were specialized in exporting, light industrial goods and other products were specialized in importing. Furthermore, in export to China, although it showed a similar trend to East Asia, the number of items with “weakest export competitiveness (specialization in imports)” was higher than that with “strongest export competitiveness (specialization in exports)” (Fig. 3.2.20 (1)). (b) Trade specialization coefficient adjusted by skill intensity Given these circumstances, Roland-Holst (2003) 16 employed a method to recalculate the trade specialization coefficient, adjusted by the ratio of skilled labor (professional and technical work, management work, etc.) to unskilled labor (clerical work, sales, plant operation, driver, etc.) for each country on an industry basis.17 Similar to the previous ratio of non-production labor input, the ratio of skilled labor (hereafter called “skill intensity”) can be considered to indicate the level of human capital in production factor input. Even in the case where the same item is traded bilaterally, if one country’s item embodies higher skill intensity, that item can be considered as a higher quality good with strong competitiveness. As the data of skill intensity can be acquired by industry for Japan and Japan’s trading partners as of 1997, Japan’s competitive advantage could be 14 The trade specialization coefficient is calculated as follows: (value of exports – value of imports) / (value of exports + value of imports). Figures are always within the range between -1 and 1, -1 indicating a specialization in imports, 1 indicating a specialization in exports, and 0 indicating a balanced export-import. 15 Yoshitomi (2003), p.269-273. 16 Roland-Holst (2003), p.10-18. 17 Roland-Holst defines skill intensity as the ratio of added value of skilled labors to that of unskilled labors in terms of production factors. In our analysis, however, skill intensity was defined as the share of added value of skilled labor out of that of all labor. -244- examined with the trade specialization coefficient adjusted by this skill intensity. First of all, here we examined the number of items whose competitive advantage would be improved (items whose trade specialization coefficient increase) when skill intensity was taken into account. The results can be seen in Figure 3.2.21 (1). These results indicate that over 80 percent of items would improve in their competitive advantage in exports to the world, and looking at destination, it can be seen that a large number of items would improve in their competitive advantage in exports to East Asia. Next, we take a look at the degree of changes also, not only whether there is an increase or decrease in competitive advantage. However, it should be noted here that we simplify the method by considering only labor input as production factors, not using various production factor inputs, such as land and tangible fixed assets as introduced above for Ito and Fukao (2004). The adjusted trade specialization coefficient was calculated by multiplying the total imports and exports by skill intensity, and then changes in the competitive advantage were examined in terms of the five-stage distribution as explained above. The results can be seen in Figure 3.2.20 (2). Looking at these results, while the proportion of the number of items within the range of strongest comparatively disadvantageous (-1 to -0.6) declined by 3.5 percent, that within the range of strongest comparatively advantageous (0.6 to 1) increased by 2.5 percent compared to the unadjusted case. -245- Figure 3.2.20 Composition of comparitive advantages and disadvantages in Japan’s trade commodities (2003) Chemical industrial products Iron and steel industry General machinery (1) Trade specialization coefficient Electrical machinery Transport machinery Precision machinery (2)Trade specialization coefficient adjusted by skill intensity Others All types (2)Trade specialization coefficient adjusted by intellectual intensity (1) World 50 (%) 50 (%) 50 40 40 40 30 30 30 20 20 20 10 10 10 0 0 Most disadvantageous (%) Neutral Most advantageous 0 Most disadvantageous Neutral Most advantageous Most disadvantageous Neutral Most advantageous Neutral Most advantageous Neutral Most advantageous Neutral Most advantageous (2) US (%) (%) (%) 40 40 40 30 30 30 20 20 20 10 10 10 0 0 Most disadvantageous Neutral Most advantageous 0 Most disadvantageous Neutral Most advantageous Most disadvantageous (3) EU (%) (%) (%) 60 60 60 50 50 50 40 40 40 30 30 30 20 20 20 10 10 10 0 0 Most disadvantageous Neutral Most advantageous 0 Most disadvantageous Neutral Most advantageous Most disadvantageous (4) East Asia (%) (%) (%) 50 50 50 40 40 40 30 30 30 20 20 20 10 10 10 0 0 Most disadvantageous Neutral Most advantageous 0 Most disadvantageous Neutral Most advantageous Neutral Most advantageous Most disadvantageous (5) China (%) (%) 50 50 40 40 30 30 20 20 10 10 0 0 Most disadvantageous Neutral Most advantageous Most disadvantageous Notes: 1. The trade specialization coefficient was calculated at the HS 4-digit level. The coefficient was classified into the following ranges (most disadvantageous: under -0.6, disadvantageous: -0.6 to under -0.2, neutral: -0.2 to under 0.2, advantageous: 0.2 to under 0.6, most advantageous: 0.6 or above) and the relative composition of the number of included items was calculated. China is excluded in (3) since the intellectual intensity could not be calculated due to lack of data availability. 2. Refer to the note in Figure 3.2.15 for skill intensity, and the note in Figure 3.2.18 for intellectual intensity (provisional intellectual asset evaluation indices B by country and region). 3. The trade specialization coefficients were calculated as follows: (1) Trade specialization coefficient = (value of exports - value of imports) / (value of exports + value of imports). (2) Trade specialization coefficient adjusted by skill intensity = (skill intensity × value of exports of the exporting country - skill intensity × value of imports of the importing country) / (skill intensity ×value of exports of the exporting country + skill intensity × value of imports of the importing country). (3) Trade specialization coefficient adjusted by intellectual intensity = (intellectual intensity × value of exports of the exporting country - intellectual intensity × value of imports of the importing country) / (intellectual intensity × value of exports of the exporting country + intellectual intensity × value of imports of the importing country). Sources: Computations based on Trade Statistics (Ministry of Finance), GTAP Version 5 Data Base (GTAP), Intellectual Assets Study Group. (c) Trade specialization coefficient adjusted by intellectual intensity In addition, using the provisional intellectual asset evaluation indices B by country and region (hereafter “intellectual intensity”), which are calculated in this section, we look at the changes in competitive advantage -246- with the trade specialization coefficient in the same way as (b). Intellectual intensity has the advantage of reflecting the sufficiency of broad types of intellectual assets not limited to human capital, but given the limited size of statistical samples, it is inevitable that the analysis can not be detailed. Figure 3.2.21 (2) shows the proportion of items whose competitive advantage was improved when intellectual intensity was taken into account. Looking at Japan’s exports to the world, similar to the results of the adjustment by skill intensity, about 80 percent of items showed improvements in competitive advantage. In addition, taking a view by destination, it shows the same trend as a large number of items with improved competitive advantage in exports to East Asia. However, the number of items with improvements was relatively smaller in exports to the EU, whereas it was larger in exports to the US than figures in the case of skill intensity. Next, in the same way as skill intensity, the degree of improvements in competitive advantage was looked at by calculating the adjusted trade specialization coefficient taking account of intellectual intensity. The results can be seen in Figure 3.2.20 (3). Looking at these results, in exports to the world, the proportion of the number of items within the range of strongest comparatively disadvantageous (-1 to -0.6) declined by 0.2 percent. However, the proportion within the range of strongest comparatively advantageous (0.6 to 1) also declined by 0.3 percent, which contradicts the result of the adjustment by skill intensity. While skill intensity tends to show a larger degree of improvement since it only considers labor inputs as production inputs, intellectual intensity tends to show a smaller degree of improvement since it is adjusted to deviation scores. As described above, looking at the competitive advantage of Japan’s trade using a trade specialization coefficient adjusted by skill intensity and intellectual intensity, it is evident that Japan’s figures are improving in comparison with cases in which the two factors are not taken into account. Although the evaluation methods for skill intensity and intellectual intensity are still in development, given that the quality of human capital and intellectual assets of a country will not change greatly in the short term, Japan should seek to boost its competitiveness on the basis of its human capital and intellectual assets. Figure 3.2.21 Proportion of number of export items improved by adjustment of trade specialization coefficient (Japan) Chemical industrial products Electrical machinery Others Iron and steel Transport machinery (1) Adjusted by skill intensity General machinery Precision machinery (2) Adjusted by intellectual intensity (%) 0 0 20 40 60 80 40 60 100 World World East Asia 20 East Asia China EU EU US US Note: See the note in Figure 3.2.15 for skill intensity, and the note in Figure 3.2.18 for intellectual intensity (provisional intellectual asset evaluation indices B by country and region). Sources: Computations based on Trade Statistics (Ministry of Finance); GTAP Version 5 Data Base (GTAP); Intellectual Assets Study Group. -247- 80 (%) 100